Fill Out Your Nj L 8 Form

The NJ L-8 form, known as the Affidavit for Non-Real Estate Investments for Resident Decedents, is a crucial document designed for the streamlined release of specific financial assets following the passing of a loved one. This form allows the executor, administrator, or certain surviving beneficiaries, such as a spouse or child, to access New Jersey bank accounts, stocks in New Jersey corporations, brokerage accounts, and New Jersey investment bonds without the complexities often associated with estate handling. However, it’s important to note that this form is not applicable for real estate assets; instead, individuals must use the NJ L-9 form for those purposes. The process begins by confirming the eligibility of the beneficiaries, which must fall under a defined group referred to as Class A beneficiaries. This ensures that the assets are transferred appropriately without causing issues later on. Additionally, the form requires a clear declaration of how the deceased's assets will be passed on, whether by operation of law or via specific bequests outlined in a will. Should any assets be tied to a trust or disclaimers, the L-8 cannot be utilized. The estate tax implications play a significant role; depending on when the decedent passed away, various tax thresholds will apply to determine qualification for using this form. Completing the NJ L-8 accurately is vital, as it details the specific financial accounts involved, lists eligible beneficiaries, and requires notarization to confirm the truthfulness of the information presented. Ultimately, the NJ L-8 form serves as an essential tool in ensuring the smooth and efficient transfer of non-real estate investments to the rightful parties.

Nj L 8 Example

Form

Use this form for release of:

New Jersey bank accounts;

Stock in New Jersey corporations;

Brokerage accounts; and

New Jersey investment bonds.

This form cannot be used for real estate.

For real estate investments, use Form

This form can be completed by:

The executor;

Administrator;

The surviving Class A joint tenant (often a spouse or civil union partner); or

Class A Payable On Death (POD) beneficiary of the assets for which release is sought.

PART I – ELIGIBLE BENEFICIARIES: Check the box or boxes corresponding to the type of beneficiary who is receiving the assets that will be listed in Part V. If at least one of the boxes does not apply, the

document their status.

The following are considered Class A beneficiaries:

Surviving spouse;

|

Surviving civil union partner when a decedent’s death is on or after February |

, |

; |

|

Surviving domestic partner when a decedent’s death is on or after July , |

4; |

|

Child, stepchild, legally adopted child, or issue of any child or legally adopted child (includes a grandchild and a great grandchild but not a

Parent and /or grandparent.

Note: You cannot use this form to release any asset passing to a beneficiary other than the Class A beneficiaries specifically listed in Part I.

For example, the following people cannot use this form (and must file a return to receive waivers):

Sisters and brothers of the decedent;

Nieces and nephews, aunts and uncles;

Mutually acknowledged children;

(02/18)

PART II – SUCCESSION: Check the box that shows how the assets pass to the beneficiary.

Check Box a if the assets on the form pass directly to the beneficiary by operation of law. This means they were jointly held, POD, or Transfer on Death (TOD). (A copy of the will is not needed);

Check Box b if the will states that these specific assets reported on the

Check Box c if there was no will (intestate) and all the beneficiaries in the entire estate are Class A beneficiaries as listed in Part I; or

Check Box c if there was a will (testate), but there were no specific bequests and all the beneficiaries in the entire estate are one of the Class A beneficiaries listed in Part I (attach a copy of the will).

Note: If at least one of the boxes does not apply, the

PART III – TRUSTS/DISCLAIMERS: If any of the assets you wish to release pass into or through a trust, where the

trust decides how the assets are distributed, you cannot use the

cases, a full return must be filed with the Inheritance Tax Branch, even if the assets all appear to be passing to Class A beneficiaries.

NOTE: Assets that are owned by or in the name of a trust do not require a waiver or

PART IV – ESTATE TAX: This section determines whether the estate may be required to pay New Jersey Estate Tax. You must be able to answer YES to either a , b , or c) to qualify to use this form. If the decedent died on or after

January 1, 2017, but before January 1, 2018, his/her entire taxable estate must be under $2 million. If the date of death was before January 1, 2017, the entire taxable estate must be under $675,000. Even if you qualify to use this form, a return is still required if the gross estate is over $675,000. If the decedent died on or after January 1, 2018, then there is no Estate Tax.

PART V – PROPERTY: List all the assets in this institution for which you are requesting a release. If this is a bank, list each account in this bank separately. Follow the column headings for each asset. Under How held/Registered, you may enter NOD Name of Decedent if the account was in the name of the decedent alone. If it was Paid on Death POD to a person, enter POD to and the person or persons’ names (e.g., POD Jane Doe and John Doe). If it was jointly held, enter NOD and/or the beneficiary’s name.

PART VI – BENEFICIARIES: List the name of each beneficiary and his/her relationship to the decedent. The relationship must be one of the Class A beneficiaries listed in Part I of the

NOTE: Executor, Estate, and |

Beneficiary are not correct relations to the decedent in this column. You must use |

terms such as Child, Spouse, |

or Grandchild. |

SIGNATURE: This form is an affidavit and must be signed by the executor, administrator, or beneficiary, and the signature must be notarized.

PART VII – RELEASING INSTITUTION: A representative of the institution releasing the funds must verify that all questions have been answered and that the beneficiaries reported are allowed per Part I, before signing the form and releasing any assets. If you have any question as to whether you are permitted to release assets, please call the Inheritance Tax general information number at (609)

(02/18)

Form

Take or send the completed form directly to the bank or other financial institution holding the funds.

Do not mail this form to the Division of Taxation. You will not receive a waiver.

Decedent’s Name ________________________________________________________ Decedent’s SSN: _____________________________________________________

(Last) |

(First) |

(Middle) |

Date of Death (mm/dd/yy) |

/ |

/ |

County of Residence ____________________________Testate (Will) |

You must answer the following questions:

I.ELIGIBLE BENEFICIARIES: Who is receiving the assets listed on the reverse side? Check all that apply:

Intestate (No Will)

a. |

Surviving spouse; |

b. |

Surviving civil union partner when a decedent’s death is on or after February , 2007; |

c. |

Surviving domestic partner when a decedent’s death is on or after July , 2004; |

d.Child, stepchild, legally adopted child, or issue of any child or legally adopted child (includes a grandchild and a great grandchild but not a

e. Parent and /or grandparent.

e. Parent and /or grandparent.

Were you able to check at least one of the boxes above?

|

Yes |

|

No If No, this form may not be used and an Inheritance Tax return must be filed. If Yes, continue to Part II. |

II.SUCCESSION: How were the assets received? Check any that apply:

a. The beneficiary succeeded to the assets by survivorship or contract; or

b.The property was specifically devised to the beneficiary; or

c.The property was not specifically devised, but all beneficiaries under the decedent’s will or intestate

Were you able to check at least one of the boxes above?

|

Yes |

|

No If No, this form may not be used. |

NOTE: If there are any assets passing to any beneficiary other than a member of the groups listed above, a complete Transfer Inheritance Tax Return must be filed in the normal manner. It must list all assets in the estate, including any which were acquired by means of this form.

III.TRUSTS/DISCLAIMERS: Do any portion of the assets listed on the reverse side pass into a trust or pass to the beneficiary as a result of a disclaimer?

Yes |

|

No If Yes, this form may not be used. |

IV. ESTATE TAX:

a.Was the decedent’s date of death on or after January 1, 2018; or

b.Was the decedent’s date of death on or after January 1, 2017, but before January 1, 2018, and his/her taxable estate less than $2 million as determined pursuant to Section 2051 of the Internal Revenue Code (I.R.C. § 2051)*; or

c.Was the decedent’s date of death before January 1, 2017, and is his/her taxable estate plus adjusted taxable gifts $675,000 or less as determined pursuant to the provisions of the Internal Revenue Code in effect on

December 31, 2001, (Line 3 plus Line 4 on 2001 Federal Estate Tax Form 706)?

|

|

|

|

Check Yes or No based on whether a, b, or c applies. |

|

|

|

Yes |

|

No If No, this form may not be used. |

|

|

|

|

|

||

*While this form may be used if the decedent died on or after January 1, 2017 but before January , |

if the decedent’s |

||||

taxable estate is under $2 million pursuant to Section 2051 of the Internal Revenue Code, a return must still be filed if the gross estate is over $2 million.

To Be Valid, This Form Must Be Fully Completed On Both Sides

(02/18)

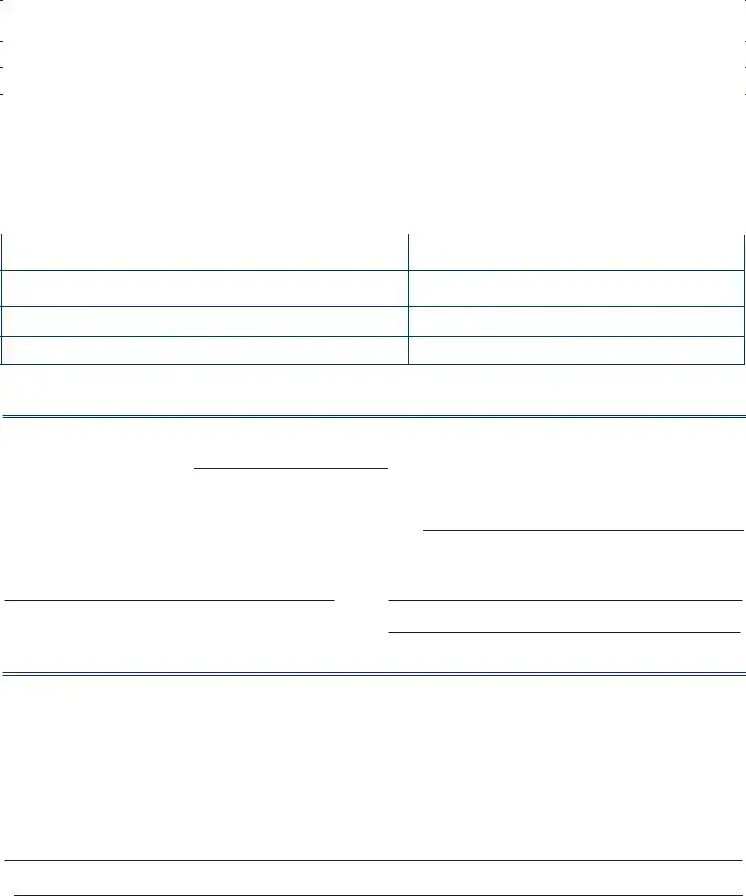

Description of Asset |

How held/Registered |

Date of Death Value* |

(Checking, Savings, CD, IRA, # of Shares, etc.) |

(Joint, POD, TOD, Individual, etc.) |

(Full Value) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Relation to Decedent (Must be checked in Part I)

Town/CityState Zip

This Form Must Be Signed by the Releasing Institution Before Mailing to the Division of Taxation

VII. To Be Completed by Releasing Institution

A bank, trust company, association, other depository, transfer agent, or organization may release the assets herein set forth only if the first, second, and fourth boxes (Parts I, II and IV) on the front of this form are checked YES, the third box (Part III) is checked NO and Part VI includes only those relationships permitted in Part I, items 1 through 5. Also, if the decedent died testate and the assets do not pass by contract or survivorship, a complete copy of the will, separate writing, and all codicils must be attached.

The original of this affidavit must be filed by the releasing institution within five business days of execution with the Division of Taxation, Transfer Inheritance and Estate Tax Branch, 50 Barrack Street, PO Box 249, Trenton, NJ

Name of Institution Accepting AffidavitAddress

By__________________________________________________________________________________________________________________________________________________

Name |

Phone Number |

|

Riders May be Attached – This Form May Be Reproduced |

|

To Be Valid, This Form Must Be Fully Completed on Both Sides |

(02/18)

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose of Form | Form L-8 is used for releasing non-real estate assets of a resident decedent, such as bank accounts and stocks in New Jersey corporations. |

| Eligible Users | This form can be filled out by the executor, administrator, or specific beneficiaries including Class A joint tenants and Payable On Death (POD) beneficiaries. |

| Non-Applicable Assets | Form L-8 cannot be used for real estate assets. For such assets, the L-9 form should be utilized instead. |

| Class A Beneficiaries | Beneficiaries eligible under this form include spouses, civil union partners, children, and parents, among others. Certain relatives, like siblings and ex-spouses, are excluded. |

| Trust and Disclaimer Restrictions | If assets are controlled by a trust or a disclaimer is involved, the L-8 form cannot be used for their release. In this case, a full return must be filed. |

| Estate Tax Considerations | The form can only be used if specific conditions regarding the estate's taxable value and the date of death are met, particularly the thresholds for New Jersey Estate Tax. |

Guidelines on Utilizing Nj L 8

Filling out the NJ L-8 form is an essential step for those seeking the release of New Jersey bank accounts, stocks, brokerage accounts, and investment bonds belonging to a deceased resident. Once the form is completed, it should be taken directly to the financial institution holding the assets. Following these steps carefully will ensure that the form is filled out correctly and that necessary documentation is included.

- Gather all necessary information, including the decedent's name, social security number (SSN), and date of death.

- Under Part I, check the boxes that correspond to the type of beneficiary receiving the assets.

- In Part II, indicate how the assets pass to the beneficiary by checking the applicable box (a, b, or c).

- For Part III, respond to the question regarding trusts or disclaimers by checking Yes or No.

- In Part IV, determine estate tax eligibility by answering the questions and checking Yes or No.

- List all assets in Part V. Be sure to include each account separately, following the required format for asset descriptions.

- In Part VI, list each beneficiary's name and their relationship to the decedent, ensuring they are Class A beneficiaries.

- Have the form signed by the executor, administrator, or beneficiary, and ensure it is notarized.

- Before submission, have a representative from the financial institution verify and sign the form.

- Finally, take or send the completed form directly to the financial institution, and do not mail it to the Division of Taxation.

What You Should Know About This Form

What is the purpose of the NJ L-8 form?

The NJ L-8 form, also known as the Affidavit for Non-Real Estate Investments, is used to request the release of certain assets belonging to a deceased person. It is specifically designed for New Jersey bank accounts, stock in New Jersey corporations, brokerage accounts, and New Jersey investment bonds. However, it cannot be used for real estate assets; if you need to address real estate, you would have to use Form L-9 instead.

Who can complete the NJ L-8 form?

The NJ L-8 form can be completed by specific individuals associated with the estate of the deceased. These include the executor, administrator, the surviving Class A joint tenant (such as a spouse or civil union partner), or a Class A Payable On Death (POD) beneficiary of the assets for which the release is being sought.

What are Class A beneficiaries?

Class A beneficiaries include the surviving spouse, civil union partner, or domestic partner of the deceased. Additionally, children, stepchildren, legally adopted children, parents, and grandparents also fall under this category. It's important to note that other relatives, such as siblings, sons-in-law, and ex-spouses, do not qualify as Class A beneficiaries and cannot use the L-8 form.

What does Part II of the form deal with?

Part II of the NJ L-8 form relates to how the assets are passed to the beneficiaries. You will need to check the appropriate box that indicates whether the assets were inherited by survivorship, named in a will, or if there was no will. Each option requires different documentation, such as attaching a copy of the will when necessary.

Are there any restrictions involving trusts?

Yes, if any of the assets you are looking to release pass into or through a trust, the NJ L-8 form cannot be used. In such cases, the assets must be managed according to the terms of that trust. If assets are specifically bequeathed to a minor to be held in trust until a certain age, the form can still be used under specific circumstances.

When is an estate subject to New Jersey Estate Tax?

The NJ L-8 form can only be used if the estate qualifies under certain tax criteria. For decedents who passed away on or after January 1, 2018, there is no estate tax. If the date of death falls between January 1, 2017, and January 1, 2018, the entire taxable estate must be under $2 million. For those who passed before January 1, 2017, the estate should be under $675,000. Even if the form can be used, a return is necessary if the gross estate exceeds these limits.

What should be done with the completed L-8 form?

The completed NJ L-8 form needs to be submitted directly to the financial institution holding the assets. It should not be mailed to the Division of Taxation. Ensure that all sections of the form are fully completed and signed, as this verifies the information provided and allows the institution to process the release of funds.

Is notarization required for the NJ L-8 form?

Yes, the NJ L-8 form must be signed by the executor, administrator, or beneficiary, and the signature must be notarized. This affidavit requires the confirmation of identity and the accuracy of the stated information by a notary public.

Common mistakes

Filling out the New Jersey L-8 form can be a complex process, and it is common for individuals to make mistakes that may delay the release of assets. One of the primary errors people make is failing to check the correct boxes in Part I, which determines the eligible beneficiaries. It is crucial to ensure that at least one box applies, as the form cannot be used if none do. Individuals often overlook the importance of including qualified civil union partners and domestic partners, who must provide a legal certificate to document their status.

Another frequent mistake occurs in Part II regarding the succession of assets. Individuals might check the wrong box to indicate how the assets were received. Each box represents a different scenario—those who mistakenly select a box that does not apply to their situation may inadvertently hinder the process. If the assets are jointly held or are payable on death (POD) but the appropriate option is not selected, the form may be deemed invalid.

Furthermore, many people neglect to pay attention to Part III, which deals with trusts. If any of the assets pass into or through a trust, the L-8 form cannot be used. Individuals often assume their assets are simple enough to qualify, but if they are routed through a trust, an entirely different procedure is required. A full inheritance tax return must be filed instead, which can complicate matters considerably.

Lastly, errors in Part VI regarding the identification of beneficiaries can be problematic. Some people mistakenly use titles such as “Executor” or “Estate” instead of specifying the actual relationships, such as "Child" or "Spouse." This oversight can lead to delays as the form may be rejected outright, requiring additional time and effort to correct the problem. By carefully reviewing each section of the L-8 form, individuals can avoid these common pitfalls and streamline the asset release process.

Documents used along the form

The NJ L-8 form is an important document for the release of certain non-real estate investments owned by a resident decedent in New Jersey. It serves as an affidavit that helps facilitate the transfer of assets to qualified beneficiaries without the need for extensive probate proceedings. Other forms and documents often accompany the NJ L-8 to ensure a smooth process in managing the decedent's estate.

- Form L-9: This form is used for the release of real estate assets. When a decedent has real estate holdings, Form L-9 must be filed to properly transfer these assets to beneficiaries.

- Transfer Inheritance Tax Return: Beneficiaries may need to file this return if the NJ L-8 is not applicable. This document outlines all estate assets, including those that do not qualify under the NJ L-8 guidelines.

- Last Will and Testament: A copy of this document is important when specific bequests are made to beneficiaries. It confirms the decedent's intentions regarding the distribution of their assets.

- Affidavit of Executor/Administrator: This affidavit verifies the authority of the executor or administrator handling the estate and is often required to accompany the NJ L-8.

- Notarized Affidavit: The NJ L-8 requires the signature of a notary public. This notarization confirms the authenticity of the signatures and statements made on the form.

- Trust Documents: If any assets are placed in a trust, documentation detailing the trust agreement is required, especially if assets are transferred through that trust.

- Tax ID or Social Security Numbers: The decedent’s and beneficiaries' identification numbers may need to be provided on various forms for tax purposes.

- Proof of Relationships: Documentation that verifies the relationship of the beneficiaries to the decedent may be needed, especially for Class A beneficiaries.

- Court Orders (if applicable): If there are any disputes or unforeseen circumstances related to the estate, court orders regarding asset distribution may must also be submitted.

In conclusion, it is essential to have all necessary documentation prepared when filing the NJ L-8 form. This ensures that the process of asset release is efficient and complies with New Jersey estate laws. For individuals navigating this process, attention to detail and careful preparation of accompanying documents are vital steps toward a successful resolution of the estate's financial matters.

Similar forms

- Form L-9 – Affidavit for Real Estate Investments: This form is specifically used for releasing assets related to real estate, unlike Form L-8, which handles non-real estate assets such as bank accounts and stocks.

- Form L-5 – Affidavit for Small Estates: This form simplifies the process for estates under a specific value threshold, enabling quicker release of assets without the burden of probate.

- Form L-3 – Affidavit for Transfer of Funds: Similar in its intent, this form allows for the transfer of funds to designated beneficiaries, particularly beneficial for small accounts.

- Form L-2 – Inheritance Tax Return: While primarily for tax purposes, this form can provide necessary information about all inherited assets, ensuring proper tax assessment for the estate.

- Form W-4P – Withholding Certificate for Pension or Annuity Payments: Though focused on income, this form addresses the beneficiaries' tax implications from different assets, much like Form L-8 addresses asset distribution details.

- Form 706 – United States Estate (and Generation-Skipping Transfer) Tax Return: This form is required for larger estates and considers numerous asset types, paralleling Form L-8's focus on asset identification and beneficiary designation.

- Form 1041 – U.S. Income Tax Return for Estates and Trusts: This form is used for reporting income generated by estate assets, providing a comprehensive view of an estate's financial status, in contrast to the L-8's more straightforward asset release process.

Dos and Don'ts

- Do: Ensure all eligible beneficiaries check the correct boxes in Part I. This is crucial for using the form.

- Don't: Forget to attach a copy of the will if the assets pass through specific directives. This is needed for proper processing.

- Do: List all assets in Part V with accurate details. Include account numbers or stock names under the correct headings.

- Don't: Use the L-8 form if there are trusts involved. Instead, a complete Transfer Inheritance Tax Return must be filed.

Misconceptions

- Misconception 1: The L-8 form can be used for real estate investments.

- Misconception 2: Anyone can complete the L-8 form.

- Misconception 3: There is no need to check the boxes in Part I if all beneficiaries are Class A.

- Misconception 4: All family members qualify as Class A beneficiaries.

- Misconception 5: A will isn’t needed to use the L-8 form.

- Misconception 6: Trust assets can be released using the L-8 form.

- Misconception 7: No estate tax return is needed if qualifying for the L-8.

- Misconception 8: The L-8 form can be mailed to the Division of Taxation.

This form is specifically for non-real estate assets. For real estate, the appropriate form is L-9.

The form can only be completed by the executor, administrator, surviving Class A joint tenant, or Class A Payable On Death beneficiary.

You must check at least one box in Part I. If none apply, the L-8 cannot be used.

Only specific relatives qualify, such as a surviving spouse or child. Siblings, ex-spouses, and others do not.

A copy of the will is necessary if the assets are passed to a named beneficiary and a box in Part II is checked.

If assets pass through a trust, you cannot use this form. A full return must be filed instead.

A return is still required if the gross estate exceeds $675,000, even if the L-8 form is eligible.

Completed forms must be submitted directly to the bank or financial institution, not mailed to the Division.

Key takeaways

Understanding the NJ L-8 Form:

- The NJ L-8 form is designed specifically for the release of non-real estate investments associated with a deceased individual.

- Eligible assets include bank accounts, stocks in New Jersey corporations, brokerage accounts, and investment bonds.

- Real estate assets cannot be released using this form; for that purpose, the NJ L-9 form should be used.

- Only certain individuals may complete the form, including the executor, administrator, surviving Class A joint tenants, or designated payable-on-death beneficiaries.

- In Part I, it is essential to check the box(es) that signify the qualifying beneficiary. At least one box must be checked to proceed.

- Class A beneficiaries include the surviving spouse, civil union partner, children, and parents, among others.

- To release assets, the method of succession identified must be clarified in Part II, confirming the legal way in which beneficiaries acquire the assets.

- If the assets transfer into a trust, the NJ L-8 cannot be used. Instead, a full return must be filed.

- Part IV assesses if the estate is subject to New Jersey Estate Tax. Ensure that the appropriate criteria are met to qualify for using the form.

- List all assets accurately in Part V, detailing their type, ownership, and value as of the date of death.

Completing this process correctly ensures a smoother transition of assets to beneficiaries while complying with New Jersey regulations.

Browse Other Templates

Partnership Buyout Agreement - The document streamlines what could be a complex negotiation process into a simple agreement.

Free Backround Check - It collects necessary details about the applicant and their previous employment.

Net Income Tax - It’s important for offerors to be thorough in providing requested information.