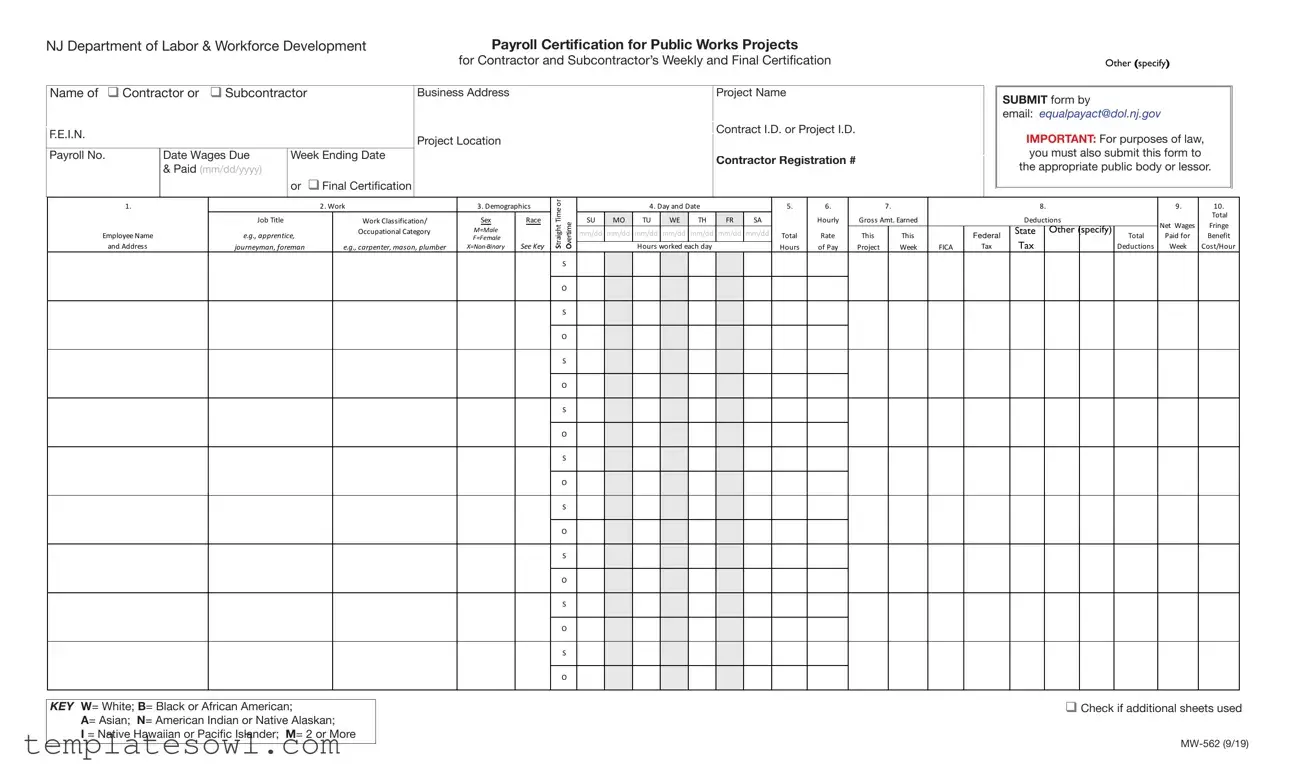

Fill Out Your Nj Payroll Certification Form

The NJ Payroll Certification form serves as a crucial document for contractors and subcontractors engaged in public works projects within New Jersey. This form is required weekly and upon project completion to ensure compliance with state wage regulations. It collects essential information, including project name, contractor details, and worker demographics such as gender and race. Contractors must report wages, hours worked, and job classifications for each employee on site. Compliance verification is also necessary, ensuring that all workers have been paid their rightful earnings without any unauthorized deductions. Additionally, the form stipulates conditions related to fringe benefits and the necessity of submitting accurate payroll records within designated timeframes. Failure to adhere to these regulations can result in civil or criminal penalties. The completion of the form includes an electronic signature option, which simplifies the submission process while preserving the legal integrity of the certification. Submission must occur not only to the Department of Labor but also to the appropriate public body overseeing the project.

Nj Payroll Certification Example

NJ Department of Labor & Workforce Development |

Payroll Certification for Public Works Projects |

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

for Contractor and Subcontractor’s Weekly and Final Certification |

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Project Name |

|

|

|

|

|

||

Name of Contractor or Subcontractor |

|

|

Business Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

F.E.I.N. |

|

|

|

|

|

Project Location |

|

|

|

|

|

|

|

|

|

Contract I.D. or Project I.D. |

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Payroll No. |

Date Wages Due |

Week Ending Date |

|

|

|

|

|

|

|

|

|

|

|

Contractor Registration # |

|

|

|

|||||||

|

& Paid (mm/dd/yyyy) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

or |

Final Certification |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

1. |

|

|

|

2. Work |

3. Demographics |

or |

|

|

|

4. Day and Date |

|

|

|

5. |

6. |

|

|

7. |

||||||

|

|

|

traightS Time |

|

|

|

|

|

|

|||||||||||||||

and Address |

|

Job Title |

|

|

Work Classification/ |

Sex |

Race |

vertimeO |

SU |

MO |

TU |

WE |

TH |

|

FR |

SA |

Hours |

Hourly |

|

Gross Amt. Earned |

||||

|

journeyman, foreman |

|

e.g., carpenter, mason, plumber |

See Key |

|

|

Hours |

worked |

each day |

|

|

|

of Pay |

|

Project |

|

Week |

|||||||

|

|

|

|

|

Occupational Category |

M=Male |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employee Name |

|

e.g., apprentice, |

|

F=Female |

|

|

|

mm/dd |

mm/dd |

mm/dd |

mm/dd |

mm/dd |

mm/dd |

mm/dd |

Total |

Rate |

|

This |

|

This |

||||

|

|

|

|

|

|

|

|

|

|

S |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

O |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

S |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

O |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

S |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

O |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

S |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

O |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

S |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

O |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

S |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

O |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

S |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

O |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

S |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

O |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

S |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

O |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other (specify)

SUBMIT form by

email: equalpayact@dol.nj.gov

IMPORTANT: For purposes of law, you must also submit this form to the appropriate public body or lessor.

|

|

8. |

|

|

|

|

|

9. |

10. |

||

|

|

|

Deductions |

|

|

|

Total |

||||

|

|

|

|

|

Net Wages |

Fringe |

|||||

|

Federal |

|

State |

|

Other |

|

(specify) |

|

Total |

||

|

|

|

|

|

|||||||

|

|

|

|

|

Paid for |

Benefit |

|||||

|

|

Tax |

|

|

|

|

|

||||

FICA |

Tax |

|

|

|

|

|

|

Deductions |

Week |

Cost/Hour |

|

|

|

|

|

|

|

|

|

|

|

|

|

KEY W= White; B= Black or African American;

A= Asian; N= American Indian or Native Alaskan;

I = Native Hawaiian or Pacific Islander; M= 2 or More

Check if additional sheets used

I, the undersigned, do hereby state and certify:

(1)That I pay or supervise the payment of the persons employed by

_________________________________________________________

(Contractor or Subcontractor)

on the ___________________________________________________

(Project Name & Location)

that during the payroll period beginning on (date) _____________, and ending on (date) _____________, all persons employed on said project have been paid the full weekly wages earned, that no rebates have been or will be made either directly or indirectly to or on behalf of the aforenamed Contractor or Subcontractor from the full weekly wages earned by any person and that no deductions have been made either directly or indirectly from the full wages earned by any person, other than permissible deductions as defined in the New Jersey Prevailing Wage Act, N.J.S.A.

(2)That any payrolls otherwise under this contract required to be sub- mitted for the above period are correct and complete; that the wage rates for laborers or mechanics contained therein are not less than the applicable wage rates contained in any wage determination in- corporated into the contract; that the classifications set forth therein for each laborer or mechanic conform with the work he performed.

(3)That any apprentices employed in the above period are duly registered with the United States Department of Labor, Bureau of

Apprenticeship and Training and enrolled in a certified apprenticeship program.

(4)That:

(a)WHERE FRINGE BENEFITS ARE PAID TO APPROVED PLANS, FUNDS OR PROGRAMS

q In addition to the basic hourly wage rates paid to each laborer or mechanic listed in the

(b)WHERE FRINGE BENEFITS ARE PAID IN CASH

q Each laborer or mechanic listed in the

(5)N.J.S.A.

(6)By checking this box and typing my name below, I am electronically signing this application. I understand that an electronic signature has the same legal effect as a written signature.

Name _____________________________________________________________

Title ____________________________________ Date (mm/dd/yy) ______________

THE FALSIFICATION OF ANY OF THE ABOVE STATEMENTS MAY SUBJECT THE CONTRACTOR OR SUBCONTRACTOR TO CIVIL OR CRIMINAL PROSECUTION.

— N.J.S.A. 34:11- 56.25 ET SEQ. AND N.J.A.C. 12:60 ET SEQ. AND N.J.S.A.

Program Title, Classification Title,

or Individual Workers

4(c) Benefit Program Information in AMOUNT CONTRIBUTED PER HOUR (Must be completed if 4(a) is checked)

To calculate the cost per hour, divide 2,000 hours into the benefit cost per year per employee.

Health/ |

|

|

Apprenticeship/ |

(e.g., training, |

Fund, Plan, or Program Administrator |

Filing Number/EIN |

&/or Contract Person |

|

|

Vacation/Holiday |

Pension |

||||||

|

Welfare |

Training |

|

Other Benefit Type and Amount |

Name & Address of Fringe Benefit |

USDOL Benefit Plan |

||

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form Characteristics

| Fact Name | Details |

|---|---|

| Governing Laws | The NJ Payroll Certification form is governed by the New Jersey Prevailing Wage Act, N.J.S.A. 34:11-56.25 et seq., and the Payment of Wages Law, N.J.S.A. 34:11-4.1 et seq. |

| Submission Timeline | Contractors and subcontractors must submit this form to the appropriate public body within 10 days after payment of wages for each pay period. |

| Electronic Signature | The form allows for an electronic signature, which carries the same legal effect as a written signature. |

| Employee Information | It requires detailed employee information, including job title, work classification, and demographic data such as sex and race. |

Guidelines on Utilizing Nj Payroll Certification

Completing the New Jersey Payroll Certification Form is an important step in ensuring compliance with wage regulations for public works projects. After filling out this form, you will need to submit it via email to the appropriate address and, simultaneously, provide it to the relevant public body or lessor to fulfill the legal requirements. Below are the step-by-step instructions to assist you in filling out the form effectively.

- Project Identification: Enter the Project Name, choose whether you are the Contractor or Subcontractor, and fill in the Business Address.

- Federal Identification Number: Document your F.E.I.N. (Federal Employer Identification Number).

- Project Information: Provide the Project Location and the Contract I.D. or Project I.D..

- Payroll Numbers: Indicate the Payroll No. and the Date Wages Due, including the Week Ending Date.

- Contractor Registration: Enter your Contractor Registration #.

- Certification Type: Check whether this is a Final Certification or not.

- Employee Information: List each employee’s Name, Job Title, Work Classification, Sex, Race, and total Hours Worked. Reference the race coding key as needed.

- Hours and Earnings: Record the Hours worked each day of the pay period along with the Hourly Rate and Gross Amount Earned.

- Deductions: Detail any Deductions, the Total Paid for Benefits, and any applicable local, state, and federal taxes.

- Fringe Benefit Information: If applicable, include data about fringe benefits in the specified section, especially if payments were made to approved plans.

- Certification Statement: Complete the certification statement, sign it electronically if necessary, and include your Name, Title, and the Date.

After completing these steps, ensure the entire form is accurate. Submit it through email as indicated, while also providing a copy to the necessary public authority. Thorough attention to detail will aid in a smooth submission process.

What You Should Know About This Form

What is the NJ Payroll Certification form used for?

The NJ Payroll Certification form is a requirement for contractors and subcontractors working on public works projects in New Jersey. This form certifies that each worker has been paid the correct wages and that no unauthorized deductions have been made. It serves to ensure compliance with state wage laws and verifies that all laborers or mechanics are compensated fairly according to the prevailing wage rates established for the specific project.

Who is required to submit the NJ Payroll Certification form?

Both contractors and subcontractors involved in public works projects must complete and submit the NJ Payroll Certification form. It is essential for any contractor or subcontractor who pays employees working on a project subject to the New Jersey Prevailing Wage Act. The form should be submitted to the public body overseeing the project and to the New Jersey Department of Labor & Workforce Development.

When must the NJ Payroll Certification form be submitted?

This form must be submitted every pay period within ten days following the payment of wages to employees. If the project has reached its conclusion, a final certification form should be filed. Adhering to this timeline is crucial to avoid potential penalties or legal repercussions.

What information needs to be included in the NJ Payroll Certification form?

The form requires various details, including the project name, contractor or subcontractor information, a payroll number, wage rates for each worker, total earnings, deductions, and fringe benefits. Additionally, the certification will request employment demographics, such as race and sex, along with confirmation of each worker's classification and job title. Accurate information is important for compliance with all applicable laws.

What are the consequences of falsifying information on the NJ Payroll Certification form?

Any false statements or misrepresentations on the NJ Payroll Certification form can lead to serious legal consequences. Contractors or subcontractors found to have falsified information may face civil or criminal prosecution based on New Jersey state law. Compliance and honesty in reporting wages and conditions are vital in upholding labor rights and protecting workers’ interests.

Common mistakes

Filling out the NJ Payroll Certification form correctly is crucial for compliance with state regulations. However, several common mistakes often lead to difficulties. One major mistake is overlooking the project name and location. This information is essential for accurately matching payroll records to specific public works projects, yet many people fail to include it or provide incomplete details.

Another frequent error is failing to record the correct contractor registration number. This number verifies that the contractor is authorized to work on public projects in New Jersey. Inaccuracies here can raise red flags, leading to delays or rejections of the certification.

People often misclassify employees by not adhering to the specified job titles and work classifications. Each worker's classification should match the labor they performed. This accuracy protects both the workers’ rights and the contractor’s compliance with prevailing wage laws. Misclassifications can result in fines and disputes.

Moreover, many individuals neglect to include all required demographic information like sex and race. These details are critical for ensuring compliance with equal employment and anti-discrimination laws. Omitting this information could be seen as a lack of transparency.

Entering incorrect wage amounts is another common issue. Accurate calculations of gross earnings must reflect the actual hours worked and the agreed-upon rates. Simple arithmetic errors can lead to serious compliance problems.

Additionally, many people do not check the boxes indicating whether fringe benefits are paid in cash or contributions to approved plans. Choosing the correct option impacts overall payroll calculations and employee rights under the law.

It is also essential not to overlook deductions. Some individuals forget to report total deductions accurately. This can misrepresent the net wages received by employees and potentially lead to legal troubles.

Submitting the form without the necessary electronic signature or handwritten certification is yet another common mistake. Failing to sign means the certification is incomplete, and it will not be processed by the relevant authorities.

Finally, individuals should not ignore the submission timeline. The law stipulates that payrolls must be submitted within 10 days of wage payments. Late submissions can incur penalties and hinder future project approvals.

Documents used along the form

The NJ Payroll Certification form is a key document used by contractors and subcontractors in public works projects within New Jersey. It serves to verify that employees have been paid properly according to state prevailing wage laws. Several other forms and documents are often required in conjunction with the NJ Payroll Certification form. Below is a list of some frequently-used documents.

- Employee Classification Form: This document identifies and categorizes workers by job title and classification. It helps ensure compliance with wage laws and appropriate labor classifications.

- Project Wage Determination: Issued by the New Jersey Department of Labor, this form outlines the prevailing wage rates for specific trades within a given locality. It is essential for ensuring accurate wage payments.

- Deductions Authorization Form: This form allows employees to authorize deductions from their paychecks for various reasons, such as benefits, retirement contributions, or other payments.

- Fringe Benefit Certification: This document certifies the payment of fringe benefits to employees. It details the type of benefits provided, ensuring compliance with state regulations.

- Weekly Payroll Summary: A summary that aggregates the hours worked, wages paid, and deductions for each employee over the course of the week. It provides a clear financial overview for payroll processing.

- Affidavit of Compliance: This legal statement asserts that the contractor is complying with all applicable labor laws, including wage and benefit regulations. It may be required at different phases of a project.

- Notice of Intent to Pay Prevailing Wages: A notification submitted to the relevant public authority, indicating the contractor's intention to adhere to prevailing wage laws for a specific project.

- Worker's Compensation Insurance Certificate: This certificate verifies that the contractor or subcontractor holds valid workers' compensation insurance, providing protection for employees in case of injuries on the job site.

- Apprenticeship Program Certification: This document verifies that any apprentices employed on the project are enrolled in a certified program, complying with state and federal regulations.

- Final Pay Affidavit: Submitted at the end of a project, this affidavit confirms that all workers have been paid in full for their services before the release of final payments to contractors.

Each of these documents plays a vital role in ensuring compliance with labor laws and regulations, ultimately protecting the rights of workers and maintaining fair labor practices in the construction industry.

Similar forms

Payroll Form for Contractors: Similar to the NJ Payroll Certification form, this document requires contractors to report wage details for their employees. It includes employee names, hours worked, and rates, ensuring compliance with labor laws, just as the NJ form mandates.

Weekly Certification of Payroll: This certification compiles weekly labor hours and wages for public works projects. Like the NJ form, it necessitates verification that employees received full wages, reinforcing accountability in wage reporting.

Employee Benefit Summary: This summary outlines employee benefits and compensation packages. Both documents ensure that employees’ benefits, including required fringe benefits, are accounted for, akin to the specifics required in the NJ Payroll Certification.

Labor Compliance Affidavit: This document ensures that contractors are adhering to labor laws and regulations. Similar to the NJ form, it requires a sworn statement affirming that wage payments comply with the state’s stipulated standards.

Prevailing Wage Record: A record documenting wages that meet state requirements for public projects. The NJ Payroll Certification requires a similar disclosure of wages to validate compliance with prevailing wage laws.

Contractor Registration Form: This form registers contractors on public works projects, necessitating evidence of compliance with local labor laws. The NJ Payroll Certification also verifies registration details as a prerequisite for wage payments.

Subcontractor Agreement: This agreement outlines the duties and compensation for subcontractors. Both agreements and the NJ form emphasize the importance of accurate wage reporting across all project participants to uphold labor standards.

Final Pay Statement: This statement summarizes wages and deductions for an employee upon termination or project completion. The NJ form similarly collects wage data, ensuring all final payments comply with existing labor regulations.

Dos and Don'ts

When filling out the NJ Payroll Certification form, it's important to follow these guidelines to ensure accuracy and compliance. Here’s a helpful list:

- Do: Provide accurate information for all fields, including the project name and address.

- Do: Double-check wages listed against what employees actually earned during the pay period.

- Do: Submit the form promptly to ensure it is received within the designated timeframe.

- Do: Keep records of all payroll submissions for future reference or audits.

- Do: Use the correct codes for race and work classification as specified in the instructions.

- Don't: Leave any mandatory fields blank; this could lead to delays in processing.

- Don't: Alter the form or use incorrect versions; always use the most current form available.

- Don't: Forget to include supporting documentation if required.

- Don't: Submit the form without reviewing it for errors; mistakes can result in compliance issues.

- Don't: Ignore the requirements for electronic signatures if filing online; it must be done correctly.

Misconceptions

The NJ Payroll Certification form is a critical document for contractors and subcontractors participating in public works projects. However, several misconceptions can lead to misunderstandings about its requirements and proper use. Below are nine common misconceptions explained.

- Misconception 1: The form is only necessary for contractors.

- Misconception 2: Only the final certification needs to be submitted.

- Misconception 3: I can submit the form at any time after completing the payroll period.

- Misconception 4: The form is optional if I pay above the required wage rates.

- Misconception 5: The form is only needed for laborers.

- Misconception 6: Deductions from wages are always prohibited.

- Misconception 7: The form does not need to indicate fringe benefit payments.

- Misconception 8: I can sign the form without stating my name and title.

- Misconception 9: An electronic signature is not legally binding.

This form is also required for subcontractors. Both parties need to ensure compliance with wage laws.

Weekly certifications must be submitted for each pay period, alongside the final certification.

The form must be submitted within ten days after wages are paid. Timely submission is essential for compliance.

Regardless of wage rates, submission of the form is mandatory for all public works projects.

The form is applicable to all employees classified as laborers or mechanics involved in the project, not just laborers.

While certain deductions are disallowed, permissible deductions under the law can still be made. These should be detailed on the form.

Specific information about fringe benefits must be included, as these payments are critical to overall wage compliance.

It is necessary to provide both name and title for validation and accountability purposes when signing.

An electronic signature carries the same legal weight as a traditional signature, as per applicable laws.

Understanding these misconceptions is crucial for maintaining compliance with New Jersey's labor laws. Properly filling out and submitting the NJ Payroll Certification form protects both workers' rights and the contractor's legal standing.

Key takeaways

- Accurate Information: Ensure that all sections of the NJ Payroll Certification form are filled out completely and accurately. This includes project details, contractor or subcontractor information, and employee wages.

- Submission Timeline: Submit the completed form within ten days of paying employees each pay period. Timely submission is crucial for compliance with New Jersey labor laws.

- Electronic Signature: An electronic signature on the form holds the same legal weight as a handwritten one. You may confirm your identity by typing your name in the designated space.

- Permissible Deductions: Familiarize yourself with which deductions are allowed under the New Jersey Prevailing Wage Act. Only permissible deductions can be made from employee wages.

- Fringe Benefits: Clearly indicate whether fringe benefits are paid through approved plans or in cash. Accurate reporting is essential to meet legal requirements.

- Documentation for Apprentices: Ensure that all apprentices listed are properly registered and enrolled in a certified apprenticeship program. This compliance is vital for project integrity.

Browse Other Templates

Risk Management Basic Course - Feedback on training effectiveness is encouraged for continual improvement.

Lpc Counselor - Licensure reflects a commitment to professional standards and ethical practice.

Devry Transcripts - No additional costs will be incurred for your transcript request.