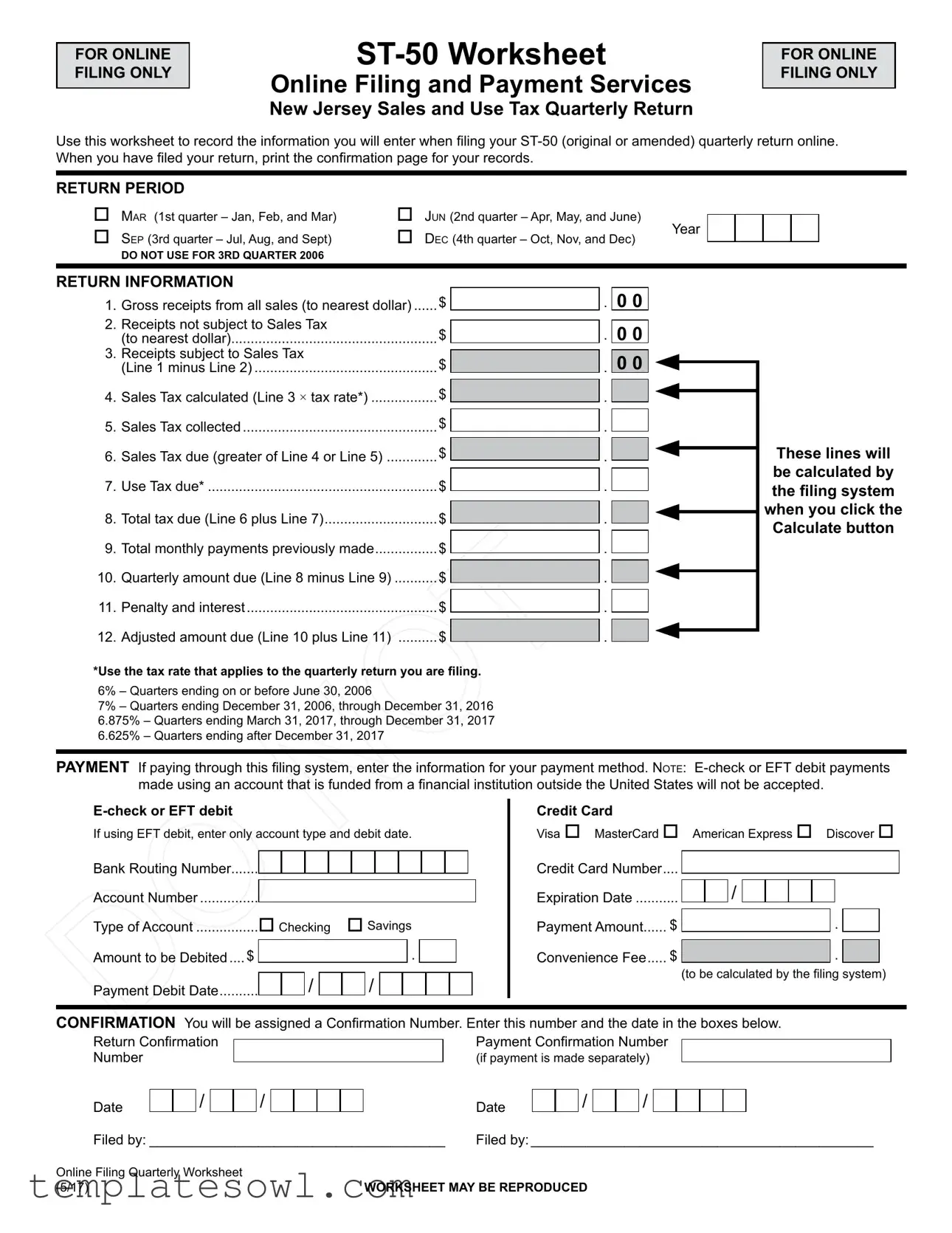

Fill Out Your Nj Sales Tax St 50 Form

The New Jersey Sales Tax ST-50 form is an essential document for businesses engaged in the collection of sales tax. Primarily utilized for filing quarterly returns, this form aids in the accurate reporting and payment of sales and use taxes owed to the state. Businesses must complete various sections, including gross receipts from all sales, which helps determine the tax base. Additionally, the form distinguishes between receipts subject to sales tax and those exempt, allowing for a clearer calculation of the sales tax owed. Tax rates may vary depending on the specific quarter; thus, understanding the applicable rate is crucial for compliance. Key figures such as total tax due, use tax due, and any penalties or interest accrued also appear prominently, ensuring that businesses can ascertain their financial obligations effectively. For convenience, the ST-50 offers an online filing option, which streamlines the process and requires users to print a confirmation page as a record of submission. Understanding each component of the ST-50 allows businesses to maintain compliance with New Jersey tax regulations while minimizing errors in their financial reporting.

Nj Sales Tax St 50 Example

FOR ONLINE FILING ONLY

Online Filing and Payment Services

New Jersey Sales and Use Tax Quarterly Return

FOR ONLINE FILING ONLY

Use this worksheet to record the information you will enter when filing your

RETURN PERIOD

|

Mar (1st quarter – Jan, Feb, and Mar) |

|

Sep (3rd quarter – Jul, Aug, and Sept) |

|

|

|

DO NOT USE FOR 3RD QUARTER 2006 |

|

Jun (2nd quarter – Apr, May, and June) |

Year |

|

Dec (4th quarter – Oct, Nov, and Dec) |

||

|

RETURN INFORMATION

1. |

Gross receipts from all sales (to nearest dollar) |

$ |

2. |

Receipts not subject to Sales Tax |

$ |

|

(to nearest dollar) |

|

3. |

Receipts subject to Sales Tax |

$ |

|

(Line 1 minus Line 2) |

|

4. |

Sales Tax calculated (Line 3 × tax rate*) |

$ |

5. |

Sales Tax collected |

$ |

6. |

Sales Tax due (greater of Line 4 or Line 5) |

$ |

7. |

Use Tax due* |

$ |

8. |

Total tax due (Line 6 plus Line 7) |

$ |

9. |

Total monthly payments previously made |

$ |

10. |

Quarterly amount due (Line 8 minus Line 9) |

$ |

11. |

Penalty and interest |

$ |

12. |

Adjusted amount due (Line 10 plus Line 11) |

$ |

. 0 0

. 0 0

. 0 0

. 0 0

.

.

.

.

.

.

.

.

.

.

.

.

.

.

These lines will be calculated by the filing system when you click the Calculate button

*Use the tax rate that applies to the quarterly return you are filing.

6% – Quarters ending on or before June 30, 2006

7% – Quarters ending December 31, 2006, through December 31, 2016 6.875% – Quarters ending March 31, 2017, through December 31, 2017 6.625% – Quarters ending after December 31, 2017

PAYMENT If paying through this filing system, enter the information for your payment method. Note:

If using EFT debit, enter only account type and debit date.

Bank Routing Number.......

Account Number................

Type of Account |

Checking |

Savings |

||||||||||||

Amount to be Debited..... $ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

Payment Debit Date |

|

/ |

|

|

/ |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Credit Card

Visa MasterCard American Express Discover

Credit Card Number.... |

|

|

|

|

|

|

|

|

|

|

|

|

|

/ |

|

|

|

|

|

|

|

|

|

Expiration Date |

|

|

|

|

|

|

|

|

|

|

|

Payment Amount...... $ |

|

|

|

|

|||||||

|

. |

|

|

||||||||

Convenience Fee..... $ |

|

|

|

||||||||

|

|

|

|

|

|

|

. |

|

|

||

|

(to be calculated by the filing system) |

||||||||||

CONFIRMATION You will be assigned a Confirmation Number. Enter this number and the date in the boxes below.

Return Confirmation Number

Date/

/

Payment Confirmation Number

(if payment is made separately)

Date |

|

|

/ |

|

|

/ |

Filed by:_______________________________________ Filed by:_____________________________________________

Online Filing Quarterly Worksheet |

WORKSHEET MAY BE REPRODUCED |

(5/17) |

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The NJ Sales Tax ST-50 form is used for online filing of the New Jersey Sales and Use Tax Quarterly Return. |

| Eligibility | This form is for businesses that need to report sales tax collected and calculate their total tax due for a specific quarter. |

| Governing Law | The form is governed by New Jersey Statutes Annotated (N.J.S.A.) 54:32B, which deals with sales and use tax. |

| Payment Method | Payments can be made via E-check, EFT debit, or credit card, but accounts outside the U.S. are not accepted for E-check or EFT transactions. |

Guidelines on Utilizing Nj Sales Tax St 50

Filing the NJ Sales Tax ST-50 form is an important process that requires accurate information about your sales and tax obligations. Once the form is completed, remember to print the confirmation page for your records. You will want to stay organized and ensure every detail is filled in correctly.

- Select the Return Period from the options provided:

- Mar (1st quarter – Jan, Feb, and Mar)

- Jun (2nd quarter – Apr, May, and June)

- Sep (3rd quarter – Jul, Aug, and Sept)

- Dec (4th quarter – Oct, Nov, and Dec)

- Fill in Gross Receipts from all Sales on Line 1. Round to the nearest dollar.

- Enter Receipts not Subject to Sales Tax on Line 2. Round to the nearest dollar.

- Calculate Receipts Subject to Sales Tax for Line 3 by subtracting Line 2 from Line 1.

- For Line 4, calculate Sales Tax Collected by multiplying Line 3 by the applicable tax rate.

- Enter the Sales Tax Collected on Line 5.

- On Line 6, determine the Sales Tax Due; this should be the greater of Line 4 or Line 5.

- If applicable, enter the Use Tax Due on Line 7.

- Add Line 6 and Line 7 to find the Total Tax Due on Line 8.

- Record any Total Monthly Payments Previously Made on Line 9.

- Calculate the Quarterly Amount Due for Line 10 by subtracting Line 9 from Line 8.

- Enter any Penalty and Interest on Line 11.

- Calculate your Adjusted Amount Due on Line 12 by adding Line 10 and Line 11.

If you are paying through the filing system, follow the prompts to enter your payment information. Whether using an e-check, EFT debit, or credit card, ensure all fields are completed correctly.

Don't forget to note your Confirmation Number and Payment Confirmation Number once you have submitted your form. This will serve as important proof of your submission.

What You Should Know About This Form

What is the ST-50 form used for?

The ST-50 form is a quarterly return required for reporting New Jersey sales and use tax. Businesses must complete this form to report gross receipts from sales, calculate sales tax owed, and make necessary payments. It is specifically designed for online filing, making it easier for businesses to complete their tax obligations efficiently.

How do I determine the sales tax rate to use on the ST-50?

The sales tax rate depends on the time period for which you are filing. For quarters ending on or before June 30, 2006, the rate is 6%. For dates ranging from December 31, 2006, to December 31, 2016, the rate is 7%. From March 31, 2017, to December 31, 2017, the tax rate is 6.875%. For any quarters after December 31, 2017, you should use the rate of 6.625%. Always verify the applicable rate before finalizing your return.

What if I need to amend my ST-50 submission?

If you need to amend your ST-50 form, you will use the same worksheet. Be sure to select the option for an amended return during the filing process. You will need to enter the correct information and ensure that all calculations reflect the changes. Once you've completed the amended form, file it online and print the confirmation page for your records.

How do I make payment after filling out the ST-50?

You can make your payment directly through the online filing system by selecting either an e-check or credit card option. If you choose e-check, have your bank routing number and account number ready. For credit card payments, provide the card number, expiration date, and the type of card. Remember that payments made using an account funded from outside the U.S. will not be accepted. Confirmation of your payment will be provided, so keep that for your records.

Common mistakes

Filing the New Jersey Sales Tax ST-50 form can be daunting, and mistakes are not uncommon. One of the most frequent errors occurs when individuals forget to select the correct return period. Each quarter has specific months associated with it, and selecting the wrong one can lead to issues with reporting and payment deadlines. Always double-check the period you are filing for to ensure accuracy.

Another common mistake is miscalculating the gross receipts from all sales. It's essential to record all sales to the nearest dollar correctly. This figure must be accurate, as it forms the basis for calculating the sales tax owed. Inaccurate reporting of gross receipts can lead to discrepancies in tax calculations and potentially trigger audits by tax authorities.

Many filers also fail to separate receipts not subject to sales tax correctly. It is vital to identify which receipts fall into this category to avoid underreporting the sales tax owed. If receipts that should be counted are incorrectly labeled as exempt, it may result in a lower tax liability than required, leading to penalties down the road.

Another area where mistakes can arise is in the calculation of sales tax. The calculation involves multiplying the receipts subject to sales tax by the appropriate tax rate. Errors in either the amount or the tax rate, which can vary by quarter, can cause misleading figures. Always refer to the latest tax rate specified for the corresponding quarter.

Additionally, filers often overlook the importance of monthly payments that have been made previously. Adjusting the total tax due by subtracting any prior payments is crucial to arriving at the correct amount owed for the current quarter. Ignoring this step can result in overpayment or unnecessary penalties.

Finally, failing to properly record confirmation numbers can lead to more confusion. After filing, it is essential to document both the return confirmation number and payment confirmation number if applicable. This information is necessary for tracking and referencing the submission in case any issues arise later.

Documents used along the form

The New Jersey Sales Tax ST 50 form is essential for businesses that collect sales tax in New Jersey. However, several other forms often accompany it in the sales tax reporting and payment process. Below is a list of commonly used forms and documents that may be relevant.

- ST-51: This form is a Sales Tax Exempt Use Certificate. It is utilized by purchasers to assert that their purchases are exempt from sales tax. Proper completion helps streamline transactions for exempt entities.

- ST-4: This form serves as the Sales Tax Exempt Certificate for specific types of sales. Valid for certain goods, it ensures that qualifying purchases are not taxed.

- ST-7: A Resale Certificate, the ST-7 form allows a buyer to purchase goods without paying sales tax, provided that these items will be resold. It’s crucial for retailers to have this documentation on file.

- ST-3: This form is used for exempt organizations to claim exemption from sales tax. It provides proof of their status and justifies tax-free purchases.

- Form 1040: This form might be used for income tax purposes for business owners. It can include information about sales tax collected and paid during the year.

- Form T-2: This is the application form for a New Jersey Sales Tax permit, necessary for any business intending to collect sales tax. Filling this out begins the process of compliance with state tax laws.

- Sales Tax Return Transmittal: This is a cover sheet used when submitting returns or other documentation to the Division of Taxation. It ensures proper routing and handling of your documents.

- Vendor Registration: Vendors must complete this registration form to operate legally in New Jersey. It identifies businesses that are authorized to collect sales tax.

- Record Keeping Documentation: Organizations should maintain relevant sales records, including invoices and receipts, to support the information included on the ST 50 and for any potential audits.

- Confirmation Receipts: After payment is made, businesses should retain these receipts, as they serve as proof of payment and submission of the sales tax returns.

Understanding these forms can make compliance with New Jersey sales tax regulations simpler and more efficient. Collecting and organizing the necessary documentation helps ensure a smooth filing process and minimizes potential issues with the state's tax authorities.

Similar forms

The New Jersey Sales Tax ST-50 form serves as a vital document for businesses filing their sales and use tax returns. Its structure and purpose resemble several other tax-related documents. Below are five documents similar to the ST-50 form, along with explanations of their similarities:

- NJ Sales Tax ST-51 Form: Like the ST-50, the ST-51 is another form used for sales tax purposes but specifically for filing an annual return. Both forms require businesses to report gross receipts and calculate tax due, making them essential for compliance with New Jersey tax laws.

- IRS Form 1040: This is the standard individual income tax return form. While primarily for personal income, both the 1040 and the ST-50 involve reporting income and calculating tax owed. Each form also provides a structured way for taxpayers to detail their financial activity over a specific period.

- IRS Schedule C: Used by sole proprietors, Schedule C helps report income or loss from a business. Similar to the ST-50, it requires details about gross receipts, expenses, and net profit. Both are tools for accurate tax submission connected to business activities.

- Form CT-1: This form is filed by certain employers to report railroad retirement taxes. Like the ST-50, it involves detailed calculations of taxes owed based on business activities. Each form ensures compliance with tax laws pertinent to different business sectors.

- State Business License Application: Businesses might need to submit a license application to operate legally, much like they submit the ST-50 for tax purposes. Both documents ensure oversight and compliance with state-specific regulations that govern business operations.

Dos and Don'ts

When filling out the New Jersey Sales Tax ST-50 form, be mindful of the following dos and don’ts to ensure a smooth filing process.

- Do carefully read the instructions before starting the form to understand each requirement.

- Don't attempt to submit the form if you are not filing online; this form is intended for online filing only.

- Do keep accurate records of your gross receipts, including sales that are exempt from sales tax.

- Don't forget to calculate sales tax based on the correct tax rate for the specific quarterly period.

- Do verify that all numeric entries are rounded to the nearest dollar to avoid discrepancies.

- Don't overlook providing your payment method information, especially if you choose to pay electronically.

- Do record your Confirmation Number and the filing date for your records once you submit the form.

- Don't submit any payments from financial institutions outside of the United States, as these will not be accepted.

- Do review the total tax due calculations to ensure that you have accounted for all applicable taxes.

- Don't forget to check for any penalties or interest that may apply to overdue payments.

Misconceptions

Many people have misconceptions about the New Jersey Sales Tax ST-50 form. Understanding these can help individuals and businesses avoid mistakes. Here are five common misconceptions:

- The ST-50 form is only for large businesses. In reality, the ST-50 form is required for all businesses that collect sales tax, regardless of size. Whether you’re a small vendor or a large corporation, filing is essential.

- You don’t need to file if you didn’t collect any sales tax. This is incorrect. Businesses are still required to file the ST-50 form, even if no sales tax was collected during the period. This ensures transparency with the state.

- All sales are subject to sales tax. Not every sale is taxable. Certain items, like some food items and clothing, may be exempt. It’s important to determine what receipts are taxable versus exempt when filling out the form.

- You cannot amend the ST-50 after submission. In fact, if you realize there was an error in your filing, you can submit an amended return. The online system allows for corrections to be made.

- The filing deadline is the same for all quarters. This is a misunderstanding. Each quarter has its own due date. Businesses should keep track of the specific deadlines to avoid late fees.

Being aware of these misconceptions can help ensure that your filing process goes smoothly and avoids unnecessary issues with the New Jersey Division of Taxation.

Key takeaways

Here are some key takeaways to consider when filling out and using the New Jersey Sales Tax ST-50 form:

- Online Filing Only: The ST-50 form must be completed and submitted online. Ensure you have access to the appropriate digital platform to process your return.

- Return Period Selection: Clearly indicate the return period for which you are filing. This could be for the first, second, third, or fourth quarter.

- Accurate Recordkeeping: Gather detailed records of all gross receipts, including amounts exempt from sales tax. Accuracy is essential for the calculations you will perform.

- Tax Rate Awareness: Familiarize yourself with the applicable sales tax rate for your reporting period. The rate can vary between quarters, impacting your total tax calculations.

- Payment Methods: If you choose to pay online, provide valid information for either an e-check or credit card. Be aware that certain payment types may not be accepted based on funding sources.

- Confirmation Importance: After submitting your form, save or print the confirmation page. This serves as proof of your filing and can be crucial for your records.

Browse Other Templates

How to Authenticate Birth Certificate - The DS-4194 form is used to request authentication services from the U.S. Department of State.

California Family Law Forms - Petitioners should review all related legal documents after the dissolution is finalized.