Fill Out Your Njar Real Estate Contract Form

The Njar Real Estate Contract form is a crucial document in New Jersey's residential real estate transactions, specifically designed for sales involving one to four family homes or vacant lots. It establishes key components such as the purchase agreement, property description, and the roles of buyers and sellers. This form outlines the purchase price and manner of payment, often requiring a deposit that is held in escrow until closing. Buyers must also demonstrate financial capability, whether by securing a mortgage or providing proof of sufficient cash resources. Additionally, the contract incorporates important contingencies, including those for attorney review and satisfaction of conditions prior to closing. It addresses zoning laws, maintenance responsibilities, and the quality of title, ensuring both parties are informed about easements or restrictions affecting the property. Various clauses detail items included in the sale and clarify the conditions regarding lead-based paint for homes built before 1978. Understanding this contract is essential for a smooth and legal transaction, ensuring that all parties' rights and obligations are clear from the outset.

Njar Real Estate Contract Example

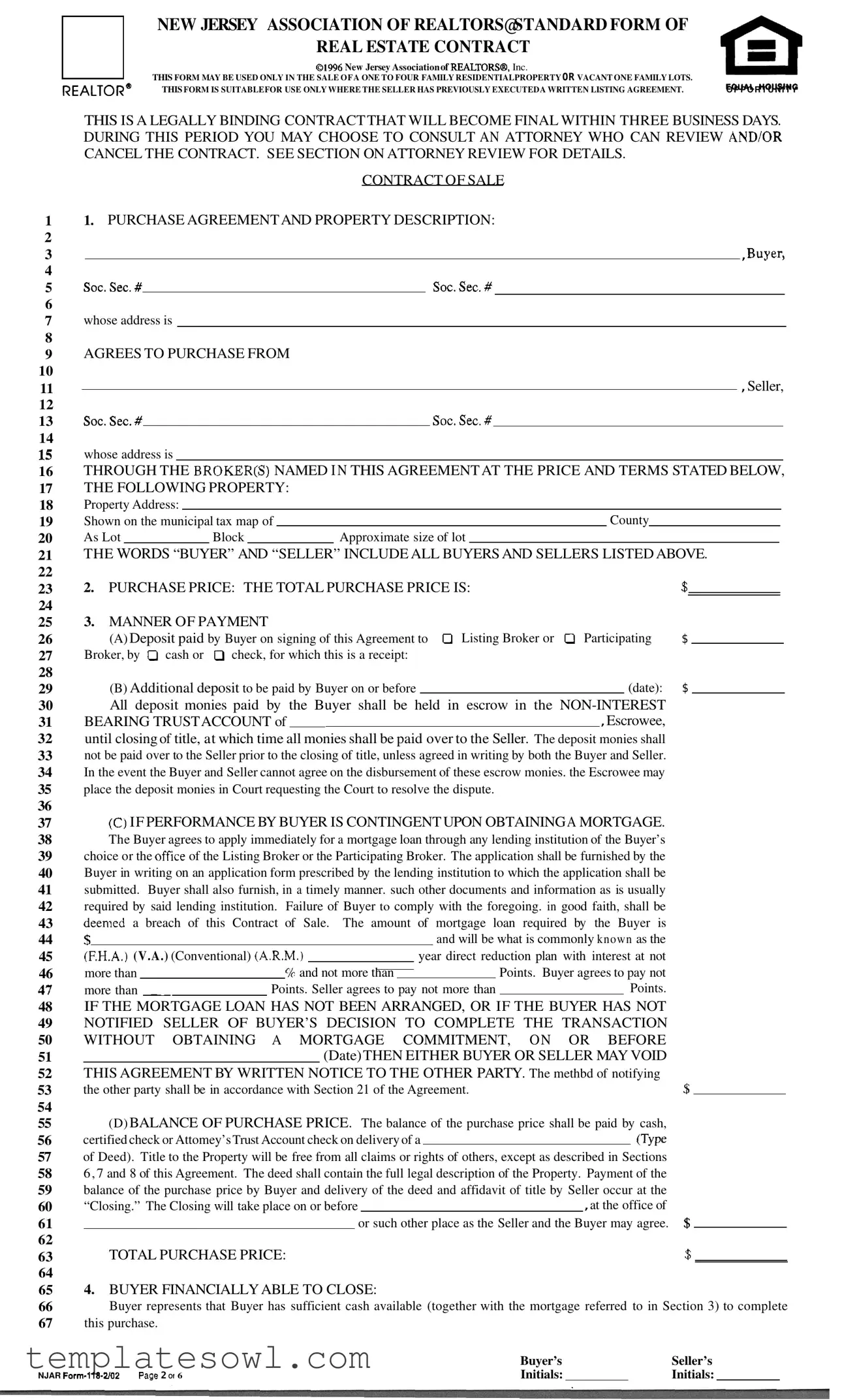

NEW JERSEY ASSOCIATION OF REALTORS@STANDARD FORM OF |

|

|

REAL ESTATE CONTRACT |

|

|

01996 New Jersey Association of REALTORS@,Inc. |

|

|

THIS FORM MAY BE USED ONLY IN THE SALE OFA ONE TO FOUR FAMILY RESIDENTIALPROPERTY OR VACANT ONE FAMILY LOTS. |

EQUAL HOUS,NG |

|

REALTOR@THIS FORM IS SUITABLEFOR USE ONLY WHERE THE SELLER HAS PREVIOUSLY EXECUTEDA WRITTEN LISTING AGREEMENT. |

||

O P P O R T U N I T Y |

THIS IS A LEGALLY BINDING CONTRACT THAT WILL BECOME FINAL WITHIN THREE BUSINESS DAYS. DURING THIS PERIOD YOU MAY CHOOSE TO CONSULT AN ATTORNEY WHO CAN REVIEW AND/OR CANCEL THE CONTRACT. SEE SECTION ON ATTORNEY REVIEW FOR DETAILS.

CONTRACT OF SALE

11. PURCHASE AGREEMENT AND PROPERTY DESCRIPTION:

3 |

|

,Buyer, |

|

4

5 SOC.Sec. #SOC.Sec. #

6

7whose address is

8

9AGREES TO PURCHASE FROM

10 |

|

|

|

|

,Seller, |

11 |

|

|

|

|

|

|

|

|

|

||

12 |

|

|

|

|

|

13 |

Soc.Sec. # |

|

SOCSec. . # |

|

|

14 |

|

|

|

|

|

15whose address is

16THROUGH THE BROKER(S) NAMED I N THIS AGREEMENT AT THE PRICE AND TERMS STATED BELOW,

17THE FOLLOWING PROPERTY:

18Property Address:

19 |

Shown on the municipal tax map of |

|

|

|

County |

|

|

|||

|

|

|

|

|

||||||

20 |

As Lot |

|

Block |

|

|

Approximate size of lot |

|

|

||

|

|

|

|

|||||||

21THE WORDS “BUYER” AND “SELLER” INCLUDE ALL BUYERS AND SELLERS LISTED ABOVE.

22

23 2. PURCHASE PRICE: THE TOTAL PURCHASE PRICE IS:$

24

253. MANNER OF PAYMENT

26 |

(A) Deposit paid by Buyer on signing of this Agreement to 0 Listing Broker or 0 Participating |

$ |

27Broker, by 0 cash or 0 check, for which this is a receipt:

28

29 |

(B) Additional deposit to be paid by Buyer on or before |

|

(date): $ |

|

30All deposit monies paid by the Buyer shall be held in escrow in the

31 |

BEARING TRUST ACCOUNT of |

|

,Escrowee, |

32until closing of title, at which time all monies shall be paid over to the Seller. The deposit monies shall

33not be paid over to the Seller prior to the closing of title, unless agreed in writing by both the Buyer and Seller.

34In the event the Buyer and Seller cannot agree on the disbursement of these escrow monies. the Escrowee may

35place the deposit monies in Court requesting the Court to resolve the dispute.

36

37(C) IF PERFORMANCE BY BUYER IS CONTINGENT UPON OBTAINING A MORTGAGE.

38The Buyer agrees to apply immediately for a mortgage loan through any lending institution of the Buyer’s

39choice or the ofice of the Listing Broker or the Participating Broker. The application shall be furnished by the

40Buyer in writing on an application form prescribed by the lending institution to which the application shall be

41submitted. Buyer shall also furnish, in a timely manner. such other documents and information as is usually

42required by said lending institution. Failure of Buyer to comply with the foregoing. in good faith, shall be

43deemed a breach of this Contract of Sale. The amount of mortgage loan required by the Buyer is

44 |

$ |

|

|

|

|

|

|

|

|

|

and will be what is commonly known as the |

|||

|

|

|

|

|

|

|

|

|

||||||

45 |

(F.H.A.) (V.A.) (Conventional) (A.R.M.) |

|

year direct reduction plan with interest at not |

|||||||||||

46 |

more than |

|

|

|

E/r and not more |

|

|

|

|

|

Points. Buyer agrees to pay not |

|||

than |

|

|

|

|

||||||||||

47 |

more than __ |

|

Points. Seller agrees to pay not more than |

|

Points. |

|||||||||

48IF THE MORTGAGE LOAN HAS NOT BEEN ARRANGED, OR IF THE BUYER HAS NOT

49NOTIFIED SELLER OF BUYER’S DECISION TO COMPLETE THE TRANSACTION

50WITHOUT OBTAINING A MORTGAGE COMMITMENT, ON OR BEFORE

51 |

|

(Date) THEN EITHER BUYER OR SELLER MAY VOID |

52THIS AGREEMENT BY WRITTEN NOTICE TO THE OTHER PARTY. The methbd of notifying

53 |

the other party shall be in accordance with Section 21 of the Agreement. |

$ |

54 |

|

|

55(D) BALANCE OF PURCHASE PRICE. The balance of the purchase price shall be paid by cash,

56 |

certified check or Attomey’s Trust Account check on delivery of a |

|

(Type |

|

57of Deed). Title to the Property will be free from all claims or rights of others, except as described in Sections

586 , 7 and 8 of this Agreement. The deed shall contain the full legal description of the Property. Payment of the

59balance of the purchase price by Buyer and delivery of the deed and affidavit of title by Seller occur at the

60 |

“Closing.” The Closing will take place on or before |

|

|

,at the office of |

|

61 |

|

|

or such other place as the Seller and the Buyer may agree. $ |

||

62 |

|

|

|

|

|

63 |

TOTAL PURCHASE PRICE: |

$ |

|||

64 |

|

|

|

|

|

654. BUYER FINANCIALLY ABLE TO CLOSE:

66Buyer represents that Buyer has sufficient cash available (together with the mortgage referred to in Section 3) to complete

67this purchase.

NJAR

Buyer’sSeller’s

Initials:Initials:

685. ACCURATE DISCLOSURE OF SELLING PRICE:

69The Buyer and Seller certify that this Contract accurately reflects the gross sale price as indicated on line

70Contract. The Buyer and Seller UNDERSTANDAND AGREE that THIS INFORMATION SHALL BE DISCLOSED to the

71Internal Revenue Service as required by law.

72

736. TENANTS, IFANY:

74This sale is made subject to the following tenancies. The Seller warrants that these tenancies are not in violation of existing

75Municipal, County, State or Federal rules, regulations or laws.

76NAMELOCATIONRENTSECURITY DEPOSITTERM

77

78

79

807. QUALITY OF TITLE:

81This sale will be subject to easements and restrictions of record, if any, and such state of facts as an accurate survey might disclose.

82Generally, an easement is a right of a person other than the owner of Property to use a portion of the Property for a special purpose. A

83restriction is a recorded limitation on the manner in which a Property owner may use his/her/their Property. The Buyer does not have

84to complete the purchase, however, if any easement, restriction, or facts disclosed by an accurate survey would substantially interfere

85with the use of the Property for residential purposes. The sale will also be made subject to applicable zoning ordinances.

86Title to the Property shall be good, marketable and insurable, at regular rates, by any title insurance company licensed to

87d o business in the State of New Jersey, subject only to the claims and rights described in this section and Section 6. Buyer agrees

88to order title insurance commitment (title search) and survey if necessary and to furnish copies to Seller. In the event Seller’s

89title shall contain any exceptions other than as set forth in this paragraph, Buyer shall notify Seller and Seller shall have 30 days

90within which to eliminate those exceptions. If Seller cannot remove those exceptions, Buyer shall have the option to void this

91Contract or to proceed with closing of title without any reduction in the purchase price. If Buyer elects to void this Contract, as

92provided in the preceding sentence, the deposit money shall be returned to Buyer and Seller shall reimburse Buyer for search and

93 |

survey expenses not exceeding |

dollars. |

|||

94 |

|

|

|

|

|

95 |

8. BUILDING AND ZONING LAWS: |

|

|

||

96 |

The Buyer intends to use the Property as a |

|

|

family home. The Seller states, to the best of the |

|

97Seller’s knowledge, that this use does not violate any applicable zoning ordinance, building code or other law. The Seller will pay for

98and obtain Certificate of Occupancy, Certificate of Land Use Compliance or other similar document required by law and will arrange

99and pay for all inspections required to obtain such document. SELLER AGREES TO CORRECT ALL VIOLATIONS, AT

100THE SELLER’S OWN EXPENSE, PRIOR TO THE CLOSING OF TITLE.

101

1029. ITEMS INCLUDED IN SALE:

103Gas and electric fixtures, cooking ranges and ovens, hot water heaters, linoleum, T.V. antenna. screens, storm sash, shades, blinds,

104awnings, radiator covers, heating apparatus and sump pump, if any, except where owned by tenants, are included in this sale. All of

105the appliances shall he in working order as of the closing of title. This provision shall not survive closing of title. This means

106that the Seller DOES NOT GUARANTEE the condition of the appliances AFTER the deed and affidavit of title have been

107delivered to the Buyer at the “Closing”. The following items are also specifically included:

108

109

110

11110. ITEMS EXCLUDED FROM SALE:

11511. ASSESSMENTS:

116All confirmed assessments and all unconfirmed assessments which may be imposed by the municipality for public improvements

117which have been completed as of the date of Closing are to be paid in full by the Seller or credited to the Buyer at the Closing. A

118confirmed assessment is a lien (legal claim) against the Property. An unconfirmed assessment is a potential lien (legal claim) which,

119when approved by the appropriate governmental body, will become a legal claim against the Property.

121 12. FINAL INSPECTION:

122Seller agrees to permit the Buyer or the Buyer’s duly authorized representative to examine the interior and exterior of the Property

123at any reasonable time immediately before Closing.

125 13. NEW JERSEY HOTEL AND MULTIPLE DWELLING HEALTH AND SAFETY ACT

126If the New Jersey Hotel and Multiple Dwelling Health and Safety Act applies to the Property, the Seller represents that the

127 Property complies with the requirzments of the Act.

12914. NO ASSIGNMENT

130This Agreement shall not be assigned without the written consent of the Seller. This means that the Buyer may not transfer to

131anyone else his/her/their rights under this Agreement to buy the Property.

13315. RISK OF LOSS:

134The risk of loss or damage to the Property by fire or otherwise, except ordinary wear and tear, is on the Seller until the Closing.

13616. ADJUSTMENTS AT CLOSING; RIGHTS TO POSSESSION:

137Rents, water charges, sewer charges, real estate taxes, interest on any existing mortgage to be assumed by Buyer, and fuel are to

138be apportioned as of the date of actual closing of title. The Buyer shall be entitled to possession of the Property and any rents or profits

139from the Property, immediately upon the delivery of the deed and closing of title. The Seller shall have the privilege of paying off

140any person with a claim or right affecting the Property from the proceeds of this sale at the time of Closing.

14217. MAINTENANCE AND CONDITION OF PROPERTY

143The Seller agrees to maintain the grounds, buildings and improvements, in good condition, subject to ordinary wear and tear. The

144premises shall be in “broom clean” condition and free of debris on the date of Closing. Seller represents that all electrical, plumbing,

145heating and air conditioning systems (if applicable), together with all fixtures included within the terms of the Agreement now work

Buyer’sSeller’s

NJAR |

Page 3 of 6 |

Initials: |

|

Initials: |

146and shall be in proper working order at the time of Closing. Seller further states, that to the best of Seller’s knowledge, there are

147currently no leaks or seepage in the roof, walls or basement UNLESS OTHERWISE INDICATED IN THE ADDITIONAL

148CONTRACTUAL PROVISIONS SECTION (Section 31) OF THIS AGREEMENT. ALL REPRESENTATIONS

149AND/OR STATEMENTS MADE BY THE SELLER, IN THIS SECTION, SHALL NOT SURVIVE CLOSING OF

150TITLE. This means that the Seller DOES NOT GUARANTEE the condition of the premises AFTER the deed and affidavit of

151title have been delivered to the Buyer at the “Closing”.

152

15318.

154Buyer acknowledges receipt of the EPA pamphlet entitled “Protect Your Family From Lead In Your Home.” Moreover, ;I copy of

155a document entitled “Disclosure of Information and Acknowledgment

156fully completed and signed by Buyer. Seller and Broker(s) and is appended to this Agreement as Addendum “A“ and is part of

157this Agreement.

158

15919.

160(This paragraph is applicable to all dwellings built prior to 1978. The law requires that unless the Buyer and Seller

161agree to a longer or shorter period, Seller must allow Buyer a

162and/or risk assessment of the Property. Buyer, however, has the right to waive this clause in its entirety.)

163This Agreement is contingent upon an inspection and/or risk assessment (the “Inspection”) of the Property by a certified

164inspector/risk assessor for the presence of

165obtained by the Buyer at the Buyer’s expense, within ten (10) calendar days after the termination of the Attorney Review period set

166forth in Section 24 of this Agreement (the “Completion Date”). If the Inspection indicates that no

167 hazard is present at the Property, this contingency clause shall be deemed to be null and void. If the Inspection indicates that lead-

168 based paint or

169 unless within (5j days from the Completion Date, the Buyer delivers a copy of the inspection and/or risk assessment report to the

170 Seller and Broker(s) and (a) advises Seller and Broker(s) ,in writing, that Buyer is voiding this Agreement; or (b) delivers to Seller

171 and Broker(s) a written amendment (the “Amendment”) to this Agreement listing the specific existing deficiencies and corrections

172 required by the Buyer. The Amendment shall provide that the Seller agrees to (a) correct the deficiencies; and (b) furnish the Buyer

173with a certification from a certified inspector/risk assessor that the deficiencies have been corrected, before the date of Closing. The

174 |

Seller shall have |

|

days after receipt of the Amendment to sign and return it to Buyer or send a written |

175to Buyer. If Seller does not sign and return the Amendment or fails to offer a

176 |

In the event Seller offers a |

|

days after receipt of the |

177it. If the Buyer fails to accept the

17920. INSPECTION CONTINGENCY CLAUSE:

180(a) Responsibilities of Home Ownership

181The Buyer and Seller acknowledge and agree that because the purchase of a home is one of the most significant investments

182a person can make in a lifetime, all aspects of this transaction require considerable analysis and investigation by Buyer before closing

183title to the Property. While the Broker(s) and Salesperson(s) who are involved in this transaction are trained as licensees under the

184License Law of the State of New Jersey, they readily acknowledge that they have had no special training or experience with respect

185to the complexities pertaining to the multitude of structural, topographical and environmental components of this Property. For

186example, and not by way of limitation, the Broker(s) and Salesperson(s) have no special training, knowledgeor experience with regard

187to discovering and/or evaluating physical defects including structural defects, roof, basement, mechanical equipment such as heating,

188air conditioning, electrical systems, sewage, plumbing, exterior drainage, termite and other types of insect infestation or damage

189caused by such infestation. Moreover, the Broker(s) and Salesperson(s) similarly have no special training, knowledge or experience

190with regard to evaluation of possible environmental conditions which might affect the Property pertaining to the dwelling such as the

191existence of radon gas, formaldehyde gas, airborne asbestos fibers, toxic chemicals, underground storage tanks, lead, mold or other

192pollutants in the soil, air or water.

194(b) Radon Testing and Reports

195If the Property has been tested for radon, Seller agrees to provide the Buyer, at the time this Agreement is entered into, with

196a copy of the results of the radon test and evidence of any subsequent radon mitigation or treatment of the Property. Buyer shall have

197the right to conduct a radon inspection/test as provided in paragraph (c) below.

199(c) Buyer’s Rights To Inspections

200 |

The Buyer acknowledges that the Property is being sold in an “AS I S ’ condition and that this Agreement is entered into based |

201upon the knowledge of the Buyer as to the value of the land and whatever buildings are upon the Property, and not on any

202representation made by the Seller, the named Broker(s) or their agents as to character or quality. Therefore, the Buyer. at the Buyer’s

203sole cost and expense, is granted the right to have the dwelling and all other aspects of the Property, inspected and evaluated by

204“qualified inspectors” (as the term is defined in paragraph (f) below) for the purpose of determining the existence of any physical

205defects or environmental conditions such as outlined above. If Buyer chooses to make the inspections referred to in this paragraph,

206such inspections must be completed. and written reports must be furnished to the Seller listed in Section 1 and Broker(s) listed in

207 |

Section 26 of this Agreement within |

|

calendar days after the end of the Attorney Review Period set forth in Section 24 |

208of this Agreement. If Buyer shall fail to furnish such written reports to the Seller and Brokercs) within the time period specified in

209this paragraph, this contingency clause shall be deemed waived by Buyer, and the Property shall be deemed acceptable by Buyer. The

210time period for furnishing the inspection reports is referred to as the “Inspection Time Period.”

211

212(d) Responsibilities to Cure

21 3If any physical defects, or environmental conditions are reported by the inspectors to the Seller within the Inspection Time

214Period, the Seller shall then have seven (7) calendar days after the receipt of such reports to notify the Buyer in writing that the Seller

215shall correct or cure any of the defects set forth in such reports. If Seller shall fail to notify Buyer of Seller’s agreement to so cure

216and correct, such failure to so notify shall be deemed to be a refusal by Seller to cure or correct such defects. If Seller shall fail to

217agree to cure or correct such defects within said seven (7) day period, or if any part of the dwelling is found to be located within a

218flood hazard area, or if the environmental condition at the Property is incurable and is of such significance as to unreasonably

219endanger the health of the Buyer, the Buyer shall then have the right to void this Contract by notifying the Seller in writing within

220seven (7) calender days thereafter. If Buyer shall fail to void this Contract within the seven (7) day period, the Buyer shall have waived

221his right to cancel this Contract and this Contract shall remain in full force, and Seller shall be under no obligation to correct or cure

222any of the defects set forth in the inspections. If Seller shall agree to correct or cure such defects, all such repair work shall be

223completed by Seller prior to the closing of title.

NJAR

Buyer’sSeller’s

Initials:Initials:

224(e) Flood Hazard Area (delete if not applicable)

225Buyer acknowledges THAT the Property is within a flood hazard area, and Buyer waives Buyer’s right to void this Agreement for

226such reason.

227

228(f)Qualifications of Inspectors

229  Where the term “qualified inspectors” is used in this Contract, it is intended to refer to persons who are licensed by the State of

Where the term “qualified inspectors” is used in this Contract, it is intended to refer to persons who are licensed by the State of

230New Jersey for such purpose or who are regularly engaged in the business of inspecting residential properties for a fee and who

231generally maintain good reputations for skill and integrity in their area of expertise.

232

23321. NOTICES:

234All notices as required in this Contract must be in writing. All notices shall be by certified mail, by telegram, telefax or by

235delivering it personally. The telegram, certified letter or telefax will be effective upon sending. The personal delivery will be effective

236upon delivery to the other party. Notices to the Seller shall be addressed to the address that appears on line fifteen (15) of this

237Contract. Notice to the Buyer shall be addressed to the address that appears on line seven (7) of this Contract.

238

23922. MEGAN’S LAW STATEMENT

240UNDER NEW JERSEY LAW, THE COUNTY PROSECUTOR DETERMINES WHETHER AND HOW TO

241PROVIDE NOTICE OF THE PRESENCE OF CONVICTED SEX OFFENDERS IN AN AREA. IN THEIR

242PROFESSIONAL CAPACITY, REAL ESTATE LICENSEES ARE NOT ENTITLED TO NOTIFICATION BY THE

243COUNTY PROSECUTOR UNDER MEGAN’S LAW AND ARE UNABLE TO OBTAIN SUCH INFORMATION FOR

244YOU. UPON CLOSING, THE COUNTY PROSECUTOR MAY BE CONTACTED FOR SUCH FURTHER

245INFORMATION AS MAY BE DISCLOSABLE TO YOU.

246

24723. NOTICE ON

248PURSUANT TO THE NEW RESIDENTIAL CONSTRUCTION

249P.L. 1995, C. 253, THE CLERKS OF MUNICIPALITIES IN NEW JERSEY MAINTAIN LISTS OF

250CONDITIONS WHICH MAY AFFECT THE VALUE OF RESIDENTIAL PROPERTIES IN THE VICINITY OF THE

251

252INDEPENDENTLY INVESTIGATE THE AREA SURROUNDING THIS PROPERTY IN ORDER TO BECOME

253FAMILIAR WITH ANY

254CASES WHERE A PROPERTY IS LOCATED NEAR THE BORDER OF A MUNICIPALITY, PURCHASERS MAY

255WISH TO ALSO EXAMINE THE LIST MAINTAINED BY THE NEIGHBORING MUNICIPALITY.

256

25724. ATTORNEY REVIEW CLAUSE:

258(1) Study by Attorney

259The Buyer or the Seller may choose to have an attorney study this Contract. If an attorney is consulted, the attorney must

260complete his or her review of the Contract within a

261day period unless an attorney for the Buyer or the Seller reviews and disapproves of the Contract.

262 |

|

263 |

(2) Counting the Time |

264 |

You count the three days from the date of delivery of the signed Contract to the Buyer and Seller. You do not count Saturdays, |

265Sundays or legal holidays. The Buyer and the Seller may agree in writing to extend the

267(3) Notice of Disapproval

268 |

If an attorney for the Buyer or the Seller reviews and disapproves of this Contract, the attorney must notify the REALTOR”(S) |

269and the other party named in this Contract within the

270The attorney must send the notice of disapproval to the REALTOR@(S)by certified mail, by telegram, or by delivering it personally.

271The telegram or certified letter will be effective upon sending. The personal delivery will be effective upon delivery to the

272REALTOR@(S)office. The attorney may also, but need not, inform the REALTOR@(S)of any suggested revision(s) in the Contract

273that would make it satisfactory.

274

27525. ENTIRE AGREEMENT; PARTIES LIABLE:

276This Agreement contains the entire agreement of the parties. No representations have been made by any of the parties, the

277Broker(s) or hishedtheir agents except as set forth in this Agreement. This Agreement is binding upon all parties who sign it and all

278who succeed to their rights and responsibilities.

279

28026. BROKER’S COMMISSION:

281The commission, in accord with the previously executed listing agreement, shall be due and payable at the time of actual closing

282of title and payment by Buyer of the purchase consideration for the Property. The Seller hereby authorizes and instructs the Buyer’s

283attomey, or the Buyer’s title insurance company or whomever is the disbursing agent to pay the full commission as set forth below to

284the below mentioned BrokeR/Brokers out of the proceeds of sale prior to the payment of any such funds to the Seller. Buyer consents

285to the disbursing agent making the said disbursements.

286 |

COMMISSION IN ACCORD WITH PREVIOUSLY EXECUTED LISTING |

|

287 |

AGREEMENT, LESS PARTICIPATING BROKER’S COMMISSION (IFANY) |

|

|

|

|

288Listing Broker

290Address and Telephone #

292 |

Participating Broker |

Commission |

293 |

|

|

294Address and Telephone #

29627. FAILURE OF BUYER OR SELLER TO SETTLE:

297In the event the Seller willfully fails to close title to the Property in accordance with this Contract, the Buyer may commence any

298legal or equitable action to which the Buyer may be entitled. In the event the Buyer fails to close title in accordance with this Contract,

299the deposit monies paid on account, at the Seller’s option, shall be paid over to the Seller as liquidated damages. In the alternative,

300the Seller may commence an action for damages it has suffered, and, in such case, the deposit monies paid on account of the purchase

Buyer’sSeller’s

NJAR |

Page 5 of 6 |

Initials: |

|

Initials: |

|

|

|

301price shall be applied against such damages. Liquidated damages means the Seller will keep the money paid on account and not

302commence any legal action for the Buyer’s failure to close title. In the event the Seller breaches this Contract, Seller will, nevertheless,

303be liable to the Broker for commissions as otherwise set forth in this Contract.

304

30528. CONSUMER INFORMATION STATEMENTACKNOWLEDGMENT

306By signing below the sellers and purchasers acknowledge they received the Consumer Information Statement on New Jersey Real

307Estate Relationships from the brokerage firms involved in this transaction prior to the first showing of the property.

308 |

|

|

|

|

309 |

29. DECLARATION OF LICENSEE BUSINESS RELATIONSHIP(S): |

|||

310 |

(a) |

|

|

,(name of firm)AND |

|

|

|||

311 |

|

|

|

|

312 |

|

|

(name(s) of licensee(s)), AS ITS AUTHORIZED |

|

313REPRESENTATIVE(S),ARE WORKING IN THIS TRANSACTION AS (choose one) 0 SELLER’S AGENTS

3140 BUYER’S AGENTS a DISCLOSED DUAL AGENTS 0 TRANSACTION BROKERS.

315 |

|

|

|

|

|

316 |

(b) INFORMATION SUPPLIED BY |

|

|

(name of other firm) |

|

317 |

HAS INDICATED THAT IT IS OPERATING IN THIS TRANSACTION AS A (choose one) 0 SELLER’S AGENT |

||||

318 |

0 BUYER’S AGENT |

0 DISCLOSED DUAL AGENT |

0 TRANSACTION BROKER. |

||

319 |

|

|

|

|

|

32030. NEW CONSTRUCTION RIDER:

321If the property being sold consists of a lot and a detached single family home (the “House”) to be constructed upon the lot by

322the Seller, the “Rider To Contract of Sale of Real Estate - New Construction” has been signed by Buyer and Seller and is appended

323to and made a part of this Agreement.

324

32531. ADDITIONAL CONTRACTUAL PROVISIONS (if any):

343

344

345

348

349

350

35832. INDEX:

359 |

I . PURCHASE AGREEMENT & |

13. NI HOTELAND MULTIPLEDWELLING IHEALTH & |

23. |

|

360 |

PROPERTY DESCRIPTION |

SAFETY ACT |

24. AlTORNEY REVIEW CLAUSE |

|

2. PURCHASE PRICE |

14. NO ASSIGNMENT |

25. ENTIRE AGREEMENT: |

||

361 |

3. MANNER OF PAYMENT |

IS.RISK OF LOSS |

PARTIES LIABLE |

|

4. BUYER FINANCIALLY ABLE |

16.ADJUSTMENTS AT CLOSING: |

26. BROKER’S COMMISSION |

||

|

||||

362 |

TO CLOSE |

RIGHTS TO POSSESSION |

27. FAILURE OF BUYER OR SELLER |

|

363 |

S. ACCURATE DISCLOSURE OF |

17. MAINTENANCE & CONDITION |

TO SETTLE |

|

SELLING PRICE |

OF PROPERTY |

28. CONSUMER INFORMATION |

||

364 |

6 TENANTS, IF ANY |

I R . |

STATEMENTACKNOWLEDGMENT |

|

7. QUALITY OF TITLE |

DOCUMENT ACKNOWLEDGMENT |

29. DECLARATION OF LICENSEE BUSINESS |

||

|

||||

365 |

8. BUILDING & ZONING LAWS |

19. |

RELATIONSHIP |

|

366 |

9. ITEMS INCLUDED IN SALE |

CONTINGENCY CLAUSE |

30. NEW CONSTRUCTION RIDER |

|

IO.ITEMS EXCLUDED FROM SALE |

20. INSPECTION CONTINGENCY CLAUSE |

31. ADDITIONAL CONTRACTUAL PROVISIONS (IF ANY) |

||

367 |

1 I.ASSESSMENTS |

2 I . NOTICES |

32. INDEX |

|

12. FINAL INSPECTION |

22. MEGAN’S LAW STATEMENT |

|

||

|

|

|||

368 |

|

|

|

369IN THE PRESENCE OF:

371 |

|

|

|

|

|

(L.S.) |

372 |

|

|

Date |

BUYER |

||

373 |

|

|

|

|

|

(L.S.) |

374 |

|

|

Date |

BUYER |

||

375 |

|

|

|

|

|

(L.S.) |

376 |

|

|

Date |

SELLER |

||

377 |

|

|

|

|

|

(L.S.) |

378 |

|

|

Date |

SELLER |

||

379 |

|

|

|

|

|

|

NJAR

Buyer’sSeller’s

Initials:Initials:

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The Njar Real Estate Contract form is intended for the sale of one to four family residential properties or vacant one-family lots. |

| Binding Agreement | This is a legally binding contract that becomes final within three business days, allowing time for consultation with an attorney. |

| Deposit Terms | All deposit monies from the Buyer must be held in escrow and will be paid to the Seller only upon closing of title. |

| Mortgage Contingency | If the Buyer’s performance is contingent on obtaining a mortgage, a specified process must be followed within designated timeframes. |

| Governing Law | The form follows the laws and regulations set forth by the State of New Jersey, ensuring compliance with local real estate practices. |

| Disclosure of Assessments | Seller must disclose any confirmed assessments and unconfirmed assessments for public improvements completed by the Closing date. |

Guidelines on Utilizing Njar Real Estate Contract

Completing the Njar Real Estate Contract form involves several critical steps to ensure all necessary information is accurately provided. After filling out this form, there will be a period for attorney review, allowing either party to address any concerns prior to finalization. Here are the steps for filling out the form:

- Begin by filling in the buyer's full name and address in the designated fields.

- Enter the seller's full name and address in the corresponding sections.

- Provide the Social Security Numbers for both the buyer(s) and seller(s) where indicated.

- Specify the broker or brokers involved in this transaction.

- Input the property address, including county, lot number, and block number as stated on the municipal tax map.

- Fill in the total purchase price of the property.

- Determine the manner of payment, indicating whether a deposit is made by cash or check.

- List any additional deposits and their due dates as necessary.

- Complete information related to mortgage obligations, specifying amounts and types of loans.

- Indicate the date for closing the transaction.

- Verify that both buyer and seller are financially capable of completing the purchase.

- Provide an accurate sale price that complies with tax reporting requirements.

- Document any existing tenancies or tenants, including name, location, rent, and security deposits.

- Disclose any assessments related to the property and document the responsibility for payment.

- Confirm the quality of title and any known easements or restrictions.

- Sign the contract in the designated areas for both the buyer and seller.

What You Should Know About This Form

What is the Njar Real Estate Contract Form used for?

The Njar Real Estate Contract Form is specifically designed for the sale of one to four family residential properties or vacant lots intended for single-family homes. It's important that both the buyer and the seller have already executed a written listing agreement to use this form.

How long do I have to review the contract?

You have three business days to review the contract. During this review period, it’s advisable to consult an attorney who can help you understand or potentially cancel the contract. This timeframe does not include weekends or legal holidays.

What happens if I want to cancel the contract?

Should you decide to cancel the contract during the attorney review period, you need to notify the REALTOR involved and the other party in writing. After this period, the contract becomes legally binding unless disapproved by an attorney.

Is my deposit safe once I sign the contract?

Your deposit is held in an escrow account and will not be released to the seller before the closing of the sale, unless there is written agreement by both parties. If any disagreements arise over the deposit, the escrow holder may require the matter to be resolved in court.

What disclosures should I expect regarding the property?

The seller is required to disclose certain aspects about the property, such as any tenants currently occupying it and any known defects or zoning issues. Additionally, the contract covers relevant assessments and compliance with zoning laws to ensure the property can be used as intended.

What if property defects are discovered during the inspection?

If defects are found during a home inspection, the seller has a limited time to notify the buyer whether they will address these issues. If they agree to fix the problems, repairs must be completed before closing. If they refuse, the buyer can choose to void the contract.

Are there any provisions regarding lead-based paint?

Yes, if the home was built before 1978, the buyer must receive a lead-based paint disclosure before finalizing the sale. The buyer has the right to conduct an inspection for lead paint hazards within a specified period. Depending on the findings, the buyer can either negotiate repairs or void the contract.

Common mistakes

Filling out the NJAR Real Estate Contract form can be a straightforward process, but individuals often make mistakes that can complicate the transaction later. One common mistake is failing to clearly specify the property address and description. Lack of detail in these sections can lead to confusion about which property is being bought or sold. This can cause delays and may even lead to disputes regarding the ownership of the property.

Another frequent error involves the purchase price and manner of payment. Buyers sometimes overlook entering the correct amounts or fail to check the corresponding boxes regarding how the deposit will be made. If these sections are not filled out accurately, it can cause misunderstandings about the financial obligations involved. Ensuring that these details are clearly stated minimizes the risk of complications during closing.

Buyers and sellers may also neglect the attorney review clause. This section provides a three-business-day period during which either party can consult with an attorney. Some individuals misunderstand its significance, either skipping this step or failing to initiate the review process in time. This oversight can lead to the unintentional acceptance of unfavorable terms, underscoring the importance of understanding and utilizing this provision effectively.

Lastly, individuals sometimes misunderstand the implications of the items included or excluded in the sale. It is essential to specify which items remain with the property and which do not. Failing to do so might result in conflict at closing when either party believes certain appliances or fixtures are included. Listing these items clearly in the contract prevents misunderstandings and ensures that all parties agree on what is and isn’t part of the sale.

Documents used along the form

The Njar Real Estate Contract form is a crucial document in real estate transactions in New Jersey. However, various other forms and documents often accompany it to ensure a smooth and legally compliant process. Understanding these additional documents can help both buyers and sellers navigate their real estate transactions more effectively. Below is a list of commonly used forms that should be considered alongside the Njar Real Estate Contract form:

- Disclosure Statement: This document informs buyers about the property's condition and any known issues, such as plumbing or electrical problems. It helps ensure transparency about the property's state.

- Attorney Review Agreement: This form outlines the period during which either party can seek legal advice on the contract. It typically lasts three days, giving both buyer and seller a chance to consult with an attorney.

- Settlement Statement (HUD-1): This document details all charges and credits related to the transaction. It serves as a final accounting of the monetary aspects, including details of the buyer's loan and seller's proceeds.

- Lead-Based Paint Disclosure: Required for homes built before 1978, this form notifies buyers about potential lead hazards and ensures they receive necessary information regarding lead safety.

- Home Inspection Report: This report is generated after a thorough inspection of the property. It highlights any significant issues that could affect the home’s value or habitability.

- Radon Testing Report: If radon testing has been conducted, this document provides results. It informs the buyer about radon levels in the home, which can impact health and safety.

- Title Insurance Policy: This document proves that the property’s title is clear and insurable. It protects the buyer from any unforeseen claims against the property after the purchase.

- Property Survey: A survey provides a detailed map of the property's boundaries, showing the exact dimensions and any encroachments or easements. It is key for confirming property lines.

- New Jersey Real Estate Consumer Information Statement: This statement informs customers about the types of relationships real estate agents can have with buyers and sellers, ensuring informed decisions throughout the transaction.

These documents work in concert with the Njar Real Estate Contract to create a responsible and informed real estate transaction. Both buyers and sellers should take the time to familiarize themselves with these forms to protect their interests and ensure a successful closing.

Similar forms

- Residential Lease Agreement: Like the Njar Real Estate Contract, a residential lease outlines the essential terms between a landlord and tenant, including property description, rent amount, and obligations of both parties.

- Purchase Agreement: This document shares similarities with the Njar form, as it establishes the terms for buying property, including purchase price, closing date, and conditions for performance.

- Escrow Agreement: Both documents discuss the handling of funds during the transaction process. An escrow agreement specifies how earnest money is held until conditions are met, similar to the Njar's escrow provisions.

- Disclosure Statement: Just like the Njar Contract requires certain property disclosures, a disclosure statement informs buyers of any known issues with the property, ensuring transparency in the transaction.

- Mortgage Commitment Letter: While different in purpose, this letter supports the Njar contract by confirming the buyer's financing arrangement, ensuring that they can proceed with the purchase.

- Home Inspection Agreement: This agreement allows for an inspection before completing the sale and parallels the inspection clauses in the Njar Contract, providing buyers with a chance to address issues before closing.

- Title Insurance Policy: Similar to provisions in the Njar form, a title insurance policy protects against defects in title, ensuring that the buyer receives clear ownership of the property.

Dos and Don'ts

When filling out the NJAR Real Estate Contract form, consider the following dos and don'ts:

- Do: Read the entire contract carefully before signing.

- Do: Fill in all required fields completely and accurately.

- Do: Seek assistance from a qualified attorney during the review period.

- Do: Ensure that all monetary amounts are clearly stated and legible.

- Do: Be aware that the contract is legally binding after three business days.

- Don't: Leave any sections blank or incomplete; this could cause delays or issues later.

- Don't: Sign the contract if you do not fully understand its terms.

Misconceptions

- Misconception 1: The Njar Real Estate Contract form is only for new constructions.

- Misconception 2: You don’t need an attorney to review the contract.

- Misconception 3: The buyer loses their deposit if the deal falls through.

- Misconception 4: The seller guarantees all appliances will work after closing.

- Misconception 5: The contract has no provision for property inspections.

This form can be used for the sale of existing residential properties and vacant lots, not just new constructions. It applies to one to four-family residential properties, making it suitable for a variety of housing situations.

While the contract does include an attorney review clause, it's a good idea to have legal counsel. This review period lasts for three business days, allowing buyers or sellers to consult an attorney before it becomes binding.

This is not always the case. If the buyer fails to fulfill the contract obligations without a valid reason, the seller may keep the deposit as liquidated damages. However, in certain circumstances, such as if the seller fails to meet their obligations, the buyer could receive their deposit back.

Not true. The seller is responsible for ensuring that appliances and fixtures are in working condition at closing, but the guarantee does not extend beyond that point. Buyers should conduct a thorough inspection if they want to ensure everything remains functional.

On the contrary, the Njar Real Estate Contract includes an inspection contingency clause. This allows buyers to have the property inspected, helping ensure they are fully informed about its condition before finalizing the purchase.

Key takeaways

Understanding the Njar Real Estate Contract form is essential for both buyers and sellers in New Jersey. Here are five key takeaways to consider:

- Legally Binding Agreement: This form creates a legally binding contract between buyers and sellers. It becomes final within three business days unless an attorney disapproves it during that time.

- Consultation Period: It is advisable for buyers and sellers to consult with an attorney during the three-day review period. This period enables them to review the contract and ensure all terms are acceptable.

- Escrow Deposits: All deposit money provided by the buyer will be held in a non-interest bearing trust account until the closing of the transaction. This ensures financial security for both parties.

- Contingencies: Buyers have specific rights related to obtaining financing and conducting property inspections. These contingencies are critical for protecting buyer interests and ensuring funds are not lost without satisfactory outcomes.

- Disclosure Requirements: Both parties certify that the contract accurately reflects the agreed-upon sale price. Additionally, sellers must disclose any known issues with the property, ensuring transparency throughout the transaction.

Browse Other Templates

Konami Deck List - Indicate the quantity for each card for accuracy.

Howard Gpa Requirements - Previous Howard University students must specify the last semester they attended.

137-1 Army - Users may need to install Adobe Reader to properly view the document.