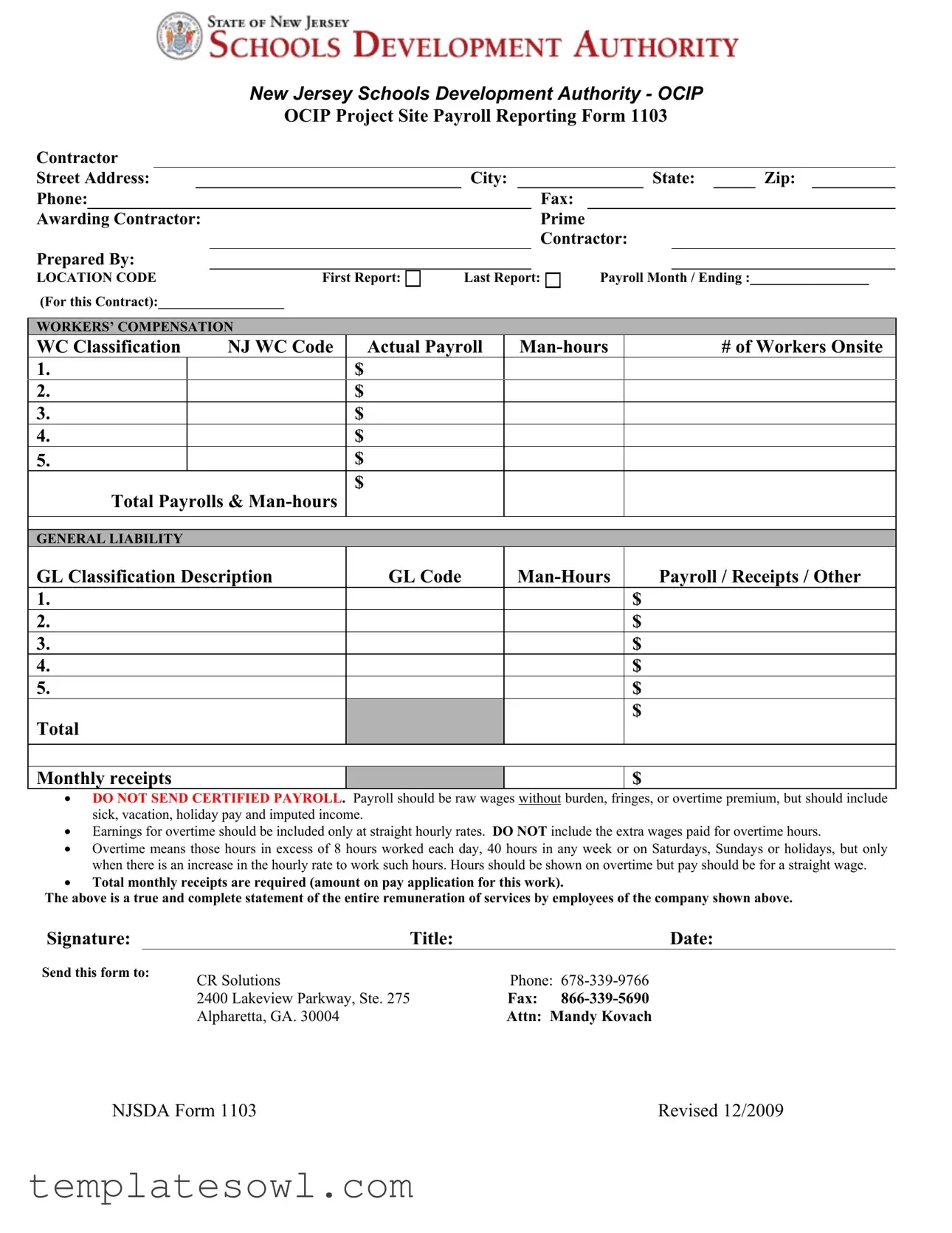

Fill Out Your Njsda 1103 Form

The NJSDA 1103 form plays a crucial role in managing payroll reporting for contractors affiliated with the New Jersey Schools Development Authority's insurance program. This form is specifically designed for contractors operating under the Owner Controlled Insurance Program (OCIP) in New Jersey, ensuring compliance with safety and financial regulations on construction sites. Each contractor must complete the form monthly, detailing essential information such as the contractor’s address, contact details, payroll month, and various classifications related to workers' compensation and general liability insurance. The form requires a snapshot of actual payroll figures and man-hours, inviting contractors to account for their workforce accurately. It emphasizes clarity by mandating that reported figures exclude overtime, fringes, and burdens, while also ensuring that total monthly receipts are disclosed in line with project applications. Adhering to the instructions is vital, as it not only supports proper financial tracking but also safeguards against misreporting that could affect insurance audits and compliance with state regulations.

Njsda 1103 Example

New Jersey Schools Development Authority - OCIP

OCIP Project Site Payroll Reporting Form 1103

Contractor

|

Street Address: |

|

|

|

|

City: |

|

|

|

|

|

State: |

|

Zip: |

|

||||

|

Phone: |

|

|

|

|

|

|

|

Fax: |

|

|

|

|

|

|

|

|

||

|

Awarding Contractor: |

|

|

|

|

|

|

Prime |

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Contractor: |

|

|

|

|

|

|

||

|

Prepared By: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

LOCATION CODE |

First Report: |

Last Report: |

Payroll Month / Ending :_________________ |

|||||||||||||||

|

(For this Contract):__________________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

WORKERS’ COMPENSATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

WC Classification |

NJ WC Code |

Actual Payroll |

|

|

|

|

|

# of Workers Onsite |

||||||||||

1. |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5. |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Payrolls & |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

GENERAL LIABILITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

GL Classification Description |

GL Code |

|

|

|

|

Payroll / Receipts / Other |

||||||||||||

1. |

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

2. |

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

3. |

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

4. |

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

5. |

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Monthly receipts |

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|||

•DO NOT SEND CERTIFIED PAYROLL. Payroll should be raw wages without burden, fringes, or overtime premium, but should include sick, vacation, holiday pay and imputed income.

•Earnings for overtime should be included only at straight hourly rates. DO NOT include the extra wages paid for overtime hours.

•Overtime means those hours in excess of 8 hours worked each day, 40 hours in any week or on Saturdays, Sundays or holidays, but only when there is an increase in the hourly rate to work such hours. Hours should be shown on overtime but pay should be for a straight wage.

•Total monthly receipts are required (amount on pay application for this work).

The above is a true and complete statement of the entire remuneration of services by employees of the company shown above.

Signature: |

|

Title: |

Date: |

Send this form to: |

CR Solutions |

Phone: |

|

|

|

||

|

|

2400 Lakeview Parkway, Ste. 275 |

Fax: |

|

|

Alpharetta, GA. 30004 |

Attn: Mandy Kovach |

NJSDA Form 1103 |

Revised 12/2009 |

OCIP Monthly Payroll Reporting Form (1103)

Instructions

-To be completed monthly for all work on a project site.

-A

-Payroll and hours should be totally unburdened and represent raw wages only

-Do not include overtime, fringes or other burdens

-Overtime means those hours in excess of 8 hours worked each day, 40 hours in any week or on Saturdays, Sundays or holidays, but only when there is an increase in the hourly rate

-Earnings for overtime should be included only as straight hourly rates. DO NOT include the extra wages paid for overtime hours.

-Total Monthly Receipts amounts are required – this is the amount on your pay applications for the time period worked

-By contract, it is the responsibility of the General Contractor to ensure that these payroll forms

are submitted each month. The GC shall collect the form from all their subcontractors and forward it to the OCIP Administration NO LATER than the tenth (10th) business day of the following month.

-DO NOT add WC or GL classifications that you are not enrolled for. If you need to add one, you must notify the OCIP Administrator separately and a revised payroll form will be sent to you.

-You MUST include the following:

-Month and year for the report

-Hours worked for each WC and GL class code, even if it is zero

-Payroll for each class code, even if it is zero

-Monthly receipts amount

-Signature and date by an authorized member of your company

-A copy should be kept in your records so your work on this project can be excluded from your own insurance carrier’s audit.

-Payroll reports are forwarded to the New Jersey Compensation Rating & Inspection Bureau and have a direct impact on your experience modifier.

Form Characteristics

| Fact | Description |

|---|---|

| Governing Law | The NJSDA 1103 form is governed by New Jersey law, specifically relating to workers' compensation and general liability for construction projects. |

| Submission Deadline | General Contractors must submit the completed form by the 10th business day of the following month to ensure compliance. |

| Required Information | The form requires details such as payroll month, hours worked, and total monthly receipts. All entries need to reflect raw wages only, without overtime or additional burdens. |

| Pre-filled Forms | Contractors receive a pre-filled form with the enrollment packet. Only these pre-filled forms will be accepted for submission. |

Guidelines on Utilizing Njsda 1103

Filling out the NJSDA 1103 form involves several steps to ensure all required information is accurately reported. Completing this form correctly is essential for compliance with the New Jersey Schools Development Authority's reporting requirements. Once filled out, it must be submitted promptly to the specified address.

- Obtain the pre-filled form sent to you with the enrollment packet, ensuring it includes location codes and classification information.

- Enter the Contractor Street Address, City, State, Zip, Phone, and Fax numbers in the designated fields.

- Fill in the Awarding Contractor and Prime Contractor names.

- Indicate the Prepared By person's name.

- Provide the LOCATION CODE for the project site.

- Mark whether this is the First Report or Last Report.

- Enter the Payroll Month / Ending date in the respective space.

- For the WORKERS' COMPENSATION section, list each classification code, along with the Actual Payroll, Man-hours, and # of Workers Onsite for each item.

- Calculate and enter the Total Payrolls & Man-hours. Ensure this total reflects raw wages only, excluding any overhead or additional costs.

- In the GENERAL LIABILITY section, provide details for each classification similar to the workers' compensation section.

- Calculate and include the Total Monthly Receipts.

- Read the instructions carefully to ensure no certified payroll, fringe costs, or overtime premiums are included in the calculations.

- Secure a signature from an authorized member of your company, along with their Title and Date.

- Compile a copy of the completed form for your records for future audits.

- Send the completed form to CR Solutions at the designated address, ensuring it is done no later than the tenth business day of the following month.

What You Should Know About This Form

What is the purpose of the NJSDA 1103 form?

The NJSDA 1103 form is used for reporting monthly payroll for contractors and subcontractors working on projects covered under the New Jersey Schools Development Authority's Owner Controlled Insurance Program (OCIP). It ensures that all payroll records are accurately reported and submitted to the OCIP administration within the specified timeframe, thereby maintaining compliance with program requirements.

What information is required on the NJSDA 1103 form?

The form requires detailed information regarding the contractor's street address, phone number, and the awarding and prime contractor details. Additionally, it demands specifics on payroll for workers' compensation and general liability classifications. Contractors must list actual payroll, man-hours, and the number of workers onsite for each classification, as well as total monthly receipts related to the project.

How should payroll be reported on the NJSDA 1103 form?

Payroll must be reported as raw wages only. Do not include any burdens, fringes, or overtime premiums. While overtime hours are to be indicated, payment should reflect straight hourly rates without the extra wages associated with overtime. The total monthly receipts, which correspond to the amounts on pay applications, are also required on the form.

Who is responsible for submitting the NJSDA 1103 form?

The General Contractor holds the responsibility for ensuring that the NJSDA 1103 form is submitted each month. The General Contractor must collect completed forms from all subcontractors and forward these to the OCIP administration no later than the tenth business day of the following month. This chain of responsibility ensures accurate reporting and compliance with the program.

What should be done if classifications not included in the form need to be added?

If there is a need to add workers' compensation (WC) or general liability (GL) classifications that the contractor is not enrolled for, it is essential to notify the OCIP Administrator separately. Upon notification, a revised payroll form will be issued to accommodate the new classification. It is crucial not to add classifications without the Administrator's input.

Common mistakes

Filling out the NJSDA Form 1103 can be a straightforward process, but several common mistakes can lead to issues down the line. One frequent error is omitting essential details. The form requires specific information, including the contractor's street address, city, state, zip code, and contact details. If any of this information is missing, it could delay the processing of the form or result in a rejection.

Another common mistake involves the misunderstanding of payroll reporting requirements. The instructions clearly state that the payroll reported should be raw wages, without any additional burdens such as fringes or overtime premiums. However, some people mistakenly include these costs, which can lead to inaccuracies in the reported figures. Properly distinguishing between regular and overtime pay is essential. Overtime hours should be listed, but the payroll should reflect only straight-time rates, excluding any extra wages paid for those hours.

Further complications can arise from inaccurately reporting the total monthly receipts. This amount is crucial as it reflects the pay application for the work performed. Leaving this section blank or providing an incorrect figure can interfere with the overall reporting process and could raise questions during audits. It is vital to review this section carefully before submission.

Additionally, some individuals fail to sign the form or neglect to include the date and title of the authorized signatory. An unsigned form is essentially incomplete and can lead to delays as it would need to be returned for proper completion. Ensuring that a qualified person reviews and signs the form is a critical step that should not be overlooked.

Lastly, individuals often overlook the requirement of maintaining a copy of the submitted form for their records. Keeping this documentation is not only a best practice but also essential for future audits by insurance carriers. Without this copy, a contractor may struggle to demonstrate compliance or address any discrepancies that arise later.

Documents used along the form

Understanding the requirements for accurately completing the NJSDA 1103 form is essential for any contractor involved in a construction project under the New Jersey Schools Development Authority. This form is just one part of the paperwork needed to ensure compliance and facilitate smooth operations on-site. Below are other documents that are commonly used alongside the NJSDA 1103. Each plays a critical role in the project management ecosystem.

- Certificate of Insurance (COI): This document proves that a contractor has purchased the necessary insurance coverage for the project. It typically outlines coverage limits and types of insurance held, ensuring that all parties are protected against potential risks.

- Enrollment Packet: This packet is provided to contractors upon entering the project and includes essential forms like the NJSDA 1103, a COI, and an OCIP manual. Familiarity with this packet is crucial for successful compliance.

- Subcontractor Agreements: These contracts outline the responsibilities, expectations, and payment terms between the prime contractor and subcontractors. They help clarify roles and obligations, reducing the risk of miscommunication on the project.

- Pay Applications: These documents allow contractors to invoice for completed work on the project. They often accompany the payroll report and must include monthly receipts, which are crucial for financial tracking.

- Monthly Payroll Reports: Apart from the NJSDA 1103, other payroll reports may be required for different classifications of workers. These ensure comprehensive reporting and compliance with wage laws.

- Workmen's Compensation Reports: These reports track the injuries and claims that occur on the job site. They help maintain safety standards and ensure that adequate coverage is in place for all workers.

Each document plays a unique and important role in maintaining compliance and managing liability during a construction project. Understanding their purposes and ensuring that they are completed correctly will contribute to smoother operations. It ultimately enhances both the safety and financial integrity of the project.

Similar forms

-

Form 940: This is the Employer's Annual Federal Unemployment (FUTA) Tax Return form. Like the NJSDA 1103, it requires detailed payroll information regarding employees. Both forms ensure compliance with regulatory requirements surrounding employee compensation and tax obligations.

-

Form W-2: This form reports wages paid to employees and the taxes withheld. Similar to the NJSDA 1103, it requires accurate reporting of wages, but focuses on the end of the year instead of monthly submissions.

-

Form 1099-MISC: Used for reporting various types of income other than wages. Much like the NJSDA 1103, it requires a clear account of payments made, supporting transparent reporting of finances, although it targets non-employee compensation.

-

OSHA 300 Log: This document records work-related injuries and illnesses. It parallels the NJSDA 1103 in that it is a crucial reporting tool, focusing on the safety aspects of employment on a site while ensuring compliance with occupational safety regulations.

-

State Unemployment Insurance (SUI) Forms: These forms report wages subject to state unemployment tax. Similar to the NJSDA 1103, these forms track employee income but focus specifically on unemployment insurance responsibilities at the state level.

Dos and Don'ts

Filling out the NJSDA Form 1103 correctly is essential for accurate reporting. Below is a list of things to do and avoid when completing the form:

- DO provide the month and year for the report.

- DO include hours worked for each WC and GL class code, even if it is zero.

- DO report payroll for each class code, even if it is zero.

- DO ensure total monthly receipts amounts are included.

- DO obtain a signature and date from an authorized member of your company.

- DO keep a copy of the completed form for your records to facilitate future audits.

- DON'T send certified payroll with the form.

- DON'T include burdens, fringe benefits, or overtime premiums in the payroll amounts.

- DON'T add WC or GL classifications that you are not enrolled for without notifying the OCIP Administrator.

Misconceptions

Misconceptions about the NJSDA 1103 form can lead to confusion and potential compliance issues. Here are five common misconceptions clarified:

- The NJSDA 1103 form requires certified payrolls. In fact, raw wages without burdens, fringes, or overtime premiums should be submitted. Certified payrolls are not required for this form.

- Overtime pay should be included in full. Many believe all overtime earnings must be reported. However, only straight hourly rates are required, excluding the higher wage earned for overtime hours.

- The GC is not responsible for collecting payroll forms from subcontractors. The General Contractor must collect all payroll forms from subcontractors and submit them to the OCIP Administration by the deadline.

- All classifications can be reported on the 1103 form. It's a common misunderstanding that any classification may be added at will. Only the classifications you are enrolled for should be included. If changes are needed, the OCIP Administrator must be notified.

- Payroll reporting is optional. This form is mandatory and needs to be completed monthly for all project work. Failing to submit the form can impact the project and the contractor's experience modifier.

Key takeaways

Here are key takeaways about filling out and using the NJSDA 1103 form:

- The form is designed specifically for monthly payroll reporting on OCIP project sites.

- Only the pre-filled version of the form provided with the enrollment packet will be accepted.

- Do not include any burdens, fringes, or overtime premiums in the payroll figures.

- Document only straight hourly rates for any overtime worked, excluding additional wages for overtime hours.

- Indicate the total monthly receipts accurately; this should reflect the amount on your pay application.

- It is the General Contractor's responsibility to collect these forms from all subcontractors and submit them monthly.

- All required information must be provided, including the report month, hours worked, and payroll for each classification.

- Keep a copy of the submitted form for your records to protect against insurance audits.

- Timely submission is critical; forms must be sent to OCIP Administration by the 10th business day of the following month.

Browse Other Templates

Modifying Child Custody - The Texas Petition To Modify empowers parents to engage with the court constructively.

Application Example - Provide a valid phone number so we can contact you regarding your application.

Can You Collect Unemployment With Severance - Taxable wages for the quarter are calculated by subtracting excess wages from total gross wages.