Fill Out Your Non Borrower Credit Authorization Form

When seeking a loan modification, one of the essential components for borrowers is the Non Borrower Credit Authorization form, particularly when household income is bolstered by a member who isn’t listed on the mortgage note. This form becomes crucial if a borrower or co-borrower discloses income that stems from a non-borrower residing in the household. A non-borrower, as defined in this context, is any individual living in the home who contributes financially but does not hold any legal obligation towards the mortgage. For effective evaluation, each non-borrower must complete and sign this credit authorization, granting permission for the lender or its designated representatives to access their consumer credit reports. Such access allows for an accurate appraisal of the household’s financial situation, which is vital for processing a loan modification request. It’s also important to note that if a household has multiple non-borrowers contributing to the income, additional copies of this form are necessary. The steps outlined within the form not only serve as a means of compliance with necessary legal standards but also work to safeguard the lender’s interests by ensuring that all relevant financial information has been disclosed and authorized.

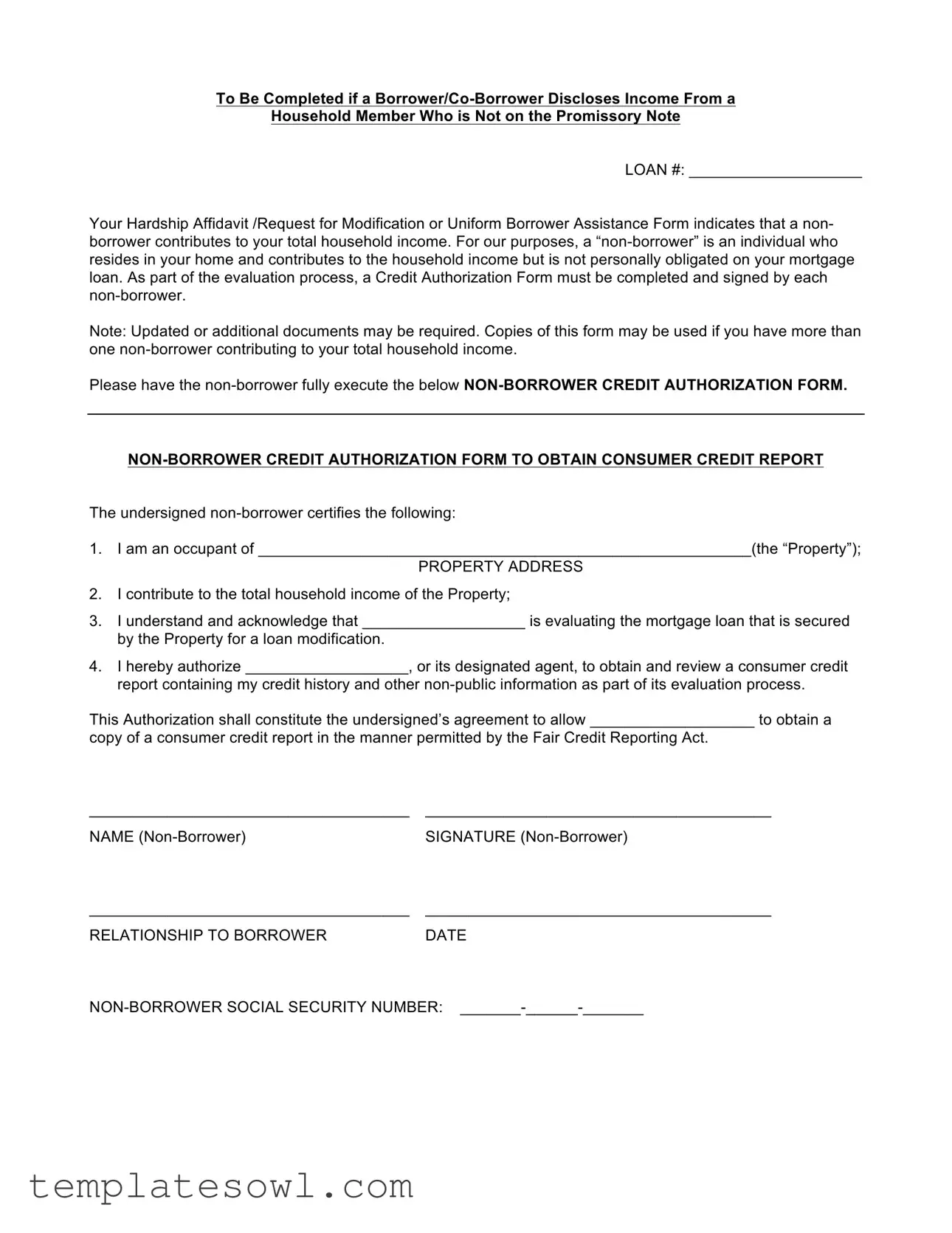

Non Borrower Credit Authorization Example

To Be Completed if a

Household Member Who is Not on the Promissory Note

LOAN #: ____________________

Your Hardship Affidavit /Request for Modification or Uniform Borrower Assistance Form indicates that a non- borrower contributes to your total household income. For our purposes, a

Note: Updated or additional documents may be required. Copies of this form may be used if you have more than one

Please have the

The undersigned

1.I am an occupant of _________________________________________________________(the “Property”);

PROPERTY ADDRESS

2.I contribute to the total household income of the Property;

3.I understand and acknowledge that ___________________ is evaluating the mortgage loan that is secured by the Property for a loan modification.

4.I hereby authorize ___________________, or its designated agent, to obtain and review a consumer credit report containing my credit history and other

This Authorization shall constitute the undersigned’s agreement to allow ___________________ to obtain a

copy of a consumer credit report in the manner permitted by the Fair Credit Reporting Act.

_____________________________________ |

________________________________________ |

NAME |

SIGNATURE |

_____________________________________ |

________________________________________ |

RELATIONSHIP TO BORROWER |

DATE |

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The Non Borrower Credit Authorization Form is intended to evaluate income contributions from household members who are not on the mortgage note. |

| Loan Number | A loan number must be included for identification purposes on the form. |

| Definition of Non-Borrower | A non-borrower is defined as an individual living in the borrower’s home who contributes to household income, but is not responsible for the mortgage. |

| Signature Requirement | The form must be signed by each non-borrower to authorize the evaluation of their credit report. |

| Documentation | Additional documents may be required for the evaluation process beyond the Credit Authorization Form. |

| Credit Report Authorization | Non-borrowers grant permission for the lender to obtain their consumer credit report as part of the assessment process. |

| Fair Credit Reporting Act | The form operates under the stipulations of the Fair Credit Reporting Act, ensuring proper handling of personal information. |

| Multiple Non-Borrowers | If more than one non-borrower contributes to family income, additional copies of the form may be used. |

| State-Specific Governance | For certain states, specific laws may govern the use and handling of credit authorization forms; it is essential to check local regulations. |

Guidelines on Utilizing Non Borrower Credit Authorization

Completing the Non Borrower Credit Authorization form is a vital step in the process of evaluating your request for loan modification. Once you have filled out the form, it will be submitted by the appropriate party to facilitate the review of the non-borrower's contribution to household income.

- Start by locating the section titled LOAN # at the top of the form and write your loan number in the space provided.

- In the section labeled PROPERTY ADDRESS, provide the full address of the property related to your loan.

- Have the non-borrower complete the following items:

- Write their full name where it states NAME (Non-Borrower).

- Sign the form in the area marked SIGNATURE (Non-Borrower).

- Indicate their relationship to the borrower in the section labeled RELATIONSHIP TO BORROWER.

- Enter the date in the section labeled DATE.

- Fill in the non-borrower's Social Security Number in the format: XXX-XX-XXXX.

- Ensure that the form is fully completed and legible to prevent any delays in processing.

- Make a copy of the completed form for your records.

After filling out the form, it should be fully executed and ready to be submitted. This ensures that the necessary information is available for the review process, helping to streamline your request for assistance.

What You Should Know About This Form

What is the Non Borrower Credit Authorization form?

The Non Borrower Credit Authorization form is required when a borrower discloses income from a household member who is not listed on the mortgage's promissory note. It authorizes the lender to obtain a credit report from the non-borrower, who contributes to the household income but is not legally obligated on the loan.

Who needs to complete this form?

This form must be filled out by each non-borrower who resides in the home and contributes to the total household income. If there are multiple non-borrowers, each one must complete a separate form.

What information is required on the form?

The form requires the property address, details about the non-borrower’s contribution to household income, the relationship to the borrower, their signature, and their Social Security number. This information is essential for the verification process.

Why is a credit report needed from non-borrowers?

The credit report is necessary for the lender to evaluate the financial situation of all household members contributing to the income. This evaluation helps determine eligibility for loan modifications or assistance programs.

What is the purpose of this authorization?

The authorization allows the lender or its designated agent to access the non-borrower's credit history and other relevant information. This information is used to assist in determining the approval for any alterations to the mortgage agreement.

Is there a deadline for submitting this form?

Can I use copies of the form?

Yes, you may use copies of the Non Borrower Credit Authorization form if there are multiple non-borrowers contributing to the total household income. Each non-borrower will need to sign their respective copy.

What if the non-borrower does not want to authorize a credit check?

If a non-borrower refuses to provide authorization for a credit check, it may impede the evaluation process for loan assistance. It is essential for all contributing household members to comply for a thorough assessment.

What happens after the form is submitted?

After submitting the Non Borrower Credit Authorization form, the lender will review the information provided. They will then obtain the necessary credit report and evaluate the overall household income to make decisions regarding loan modifications or assistance.

What should I do if I have further questions?

If you have additional questions about the Non Borrower Credit Authorization form or the process, it is advisable to contact your lender or a qualified representative who can provide further clarity and guidance.

Common mistakes

Filling out the Non Borrower Credit Authorization form can be a straightforward process, but mistakes often occur. These errors can lead to delays in your application or even denial of the loan modification request. Understanding common pitfalls helps ensure that all necessary information is provided correctly. Here are five typical mistakes people make when completing this important document.

One frequent error is failing to accurately complete the property address section. This information is crucial for identifying the correct mortgage in question. When this detail is incorrect or incomplete, it can confuse the processing team and lead to unnecessary complications. Double-checking the property address against official documents ensures clarity and accuracy.

Another mistake involves omitting or incorrectly filling out personal information, such as the non-borrower's name or Social Security number. Each field must be filled in completely and with precise information. Missing data can halt the evaluation process, meaning that a simple error can cause significant delays in obtaining the assistance you need.

It’s essential that the non-borrower understands their role in this process. A common oversight is when a non-borrower does not fully grasp the implications of what they are authorizing. They should know they are permitting a review of their credit report and potential access to their financial history. Ensuring that the non-borrower is adequately informed about the authorization can prevent misunderstandings and ensure smooth processing.

Moreover, many people forget to sign and date the form. Without a signature, the form is not valid, and the whole application could be dismissed. Organizations require a clear acknowledgment that the non-borrower agrees to the terms laid out in the form. Before submission, it’s always advisable to review the document to confirm that all necessary signatures are present.

Lastly, failing to provide multiple copies of the form when there is more than one non-borrower is a common oversight. If more than one person contributes to the household income and their credits will be assessed, each must complete a separate form. Not doing so can create confusion in the evaluation process and potentially hurt your chances of receiving the loan modification. Always prepare enough copies to simplify the review process.

By being mindful of these common mistakes, applicants can help ensure a smoother application process and work toward securing the necessary support for their mortgage needs.

Documents used along the form

The Non Borrower Credit Authorization form is a vital component when a non-borrower contributes to the household income of a borrower seeking a loan modification or assistance. In addition to this form, several other documents are often required to ensure a comprehensive evaluation of the situation. Understanding these documents can facilitate the process and enhance the chances of a favorable outcome.

- Hardship Affidavit: This document details the circumstances that have led to financial difficulty. It often includes information about job loss, medical emergencies, or other personal challenges impacting the borrower's ability to meet mortgage payments.

- Loan Modification Application: This form provides specific information about the loan, the borrower, and the desired modifications. It is essential for formally requesting adjustments to the loan terms.

- Uniform Borrower Assistance Form: Similar to the Hardship Affidavit, this standard form collects information about the borrower’s financial state, including income, expenses, debts, and any hardships faced.

- W-2 Forms / Pay Stubs: Documentation of income from all household members is often needed. These documents verify employment and income levels, serving as proof of the contributions made by both borrowers and non-borrowers.

- Bank Statements: Recent bank statements may be required to assess the financial stability of the household. They provide a clearer picture of income flow, expenses, and financial habits.

- Tax Returns: Often, lenders ask for copies of tax returns from the previous year to evaluate overall financial health and consistency in reported income.

- Property Appraisal Report: This document is used to establish the current market value of the property, which can affect loan modification decisions. It provides insight into how much the property is worth compared to the outstanding mortgage balance.

Each of these documents serves a unique purpose in the loan modification evaluation process, helping lenders gain a comprehensive understanding of the borrower's financial situation. Preparing these forms and information can simplify the process and support a smoother interaction with your lender.

Similar forms

- Employment Verification Form: This document serves to confirm a household member's employment status and income. Like the Non Borrower Credit Authorization form, it requires a signature and all necessary personal details to facilitate the verification process.

- Income Affidavit: An income affidavit provides a sworn statement regarding an individual’s income. Both forms aim to clarify the financial contributions of non-borrowing members but differ in their legal weight and purpose.

- Credit Report Authorization Form: This is closely related, as it permits a lender to access an individual's credit history. Similar to the Non Borrower Credit Authorization, it requires explicit consent and is tied to evaluating financial responsibility.

- Co-Signer Agreement: This agreement outlines the responsibilities of a co-signer on a loan. While it involves creditworthiness, it differs since it binds the co-signer to the mortgage obligations, unlike a non-borrower.

- Household Member Income Disclosure: This document allows borrowers to declare additional income sources from non-borrowers. Both documents share the goal of providing a complete picture of household finances while differing in their usage context.

- Personal Financial Statement: A personal financial statement summarizes an individual's financial position, including income and liabilities. Though both forms seek to outline financial involvement, the personal financial statement presents a broader financial overview.

- Permission to Release Information Form: This form grants permission for specific financial information to be disclosed to a lender. Like the Non Borrower Credit Authorization, it involves consent but focuses on broader financial data rather than income contributions alone.

Dos and Don'ts

When filling out the Non Borrower Credit Authorization form, it's important to get it right. Here’s a handy list of dos and don’ts to ensure your submission is smooth and successful.

- Do provide accurate information about the property and your contribution to the household income.

- Do sign and date the form. An unsigned form can cause delays.

- Do ensure that all sections are filled out completely before submitting.

- Do keep a copy of the completed form for your records.

- Don’t leave any sections blank; incomplete forms may be rejected.

- Don’t forget to double-check your social security number for accuracy.

- Don’t ignore additional document requests that may come after submission.

- Don’t submit multiple forms unless you have more than one non-borrower contributing to the income.

Misconceptions

Understanding the Non Borrower Credit Authorization form can be crucial for those involved in the loan modification process. However, various misconceptions may lead to confusion. Here are ten common misunderstandings, along with clarifications for each.

- It’s only for borrowers. Many believe that the form is relevant only for those directly involved in the mortgage. In reality, it’s essential for any non-borrower contributing to the household income.

- Only one form is needed, regardless of the number of non-borrowers. If there are multiple non-borrowers in a household, separate forms must be completed and signed by each individual contributing income.

- Signing the form creates liability for the non-borrower. This is false; signing the authorization does not obligate non-borrowers for the mortgage. They simply allow their credit to be evaluated.

- The lender does not require any explanation of the relationship. The form requires the non-borrower to disclose their relationship to the borrower. This helps the lender understand the household dynamics.

- Credit reports are only pulled if there are issues. The authorization form allows lenders to access credit reports as part of their standard evaluation process, regardless of whether issues have arisen.

- The non-borrower can refuse to sign. While non-borrowers can choose not to sign, their refusal may hinder the borrower’s attempt to qualify for assistance or modification options.

- Any income can be included. Only income generated by non-borrowers living in the household is considered. Income from individuals who do not reside at the property is not applicable.

- The form has no expiration. The authorization is time-sensitive. If not utilized within a specified timeframe, a new authorization may be necessary.

- Non-borrowers won’t be considered in the loan evaluation. In fact, their credit history and income contributions play a pivotal role in determining the borrower’s eligibility for modification.

- The lender provides a copy of the credit report to the non-borrower. Generally, lenders are not obligated to share the obtained credit report with non-borrowers. They may only disclose the result of the evaluation.

Awareness of these misconceptions can lead to a smoother process during loan modifications. Understanding the roles and responsibilities associated with the Non Borrower Credit Authorization form is vital for all parties involved.

Key takeaways

The Non Borrower Credit Authorization form is an essential document for homeowners seeking assistance with their mortgage loan. Below are key takeaways regarding the form's completion and use.

- The form must be completed if a borrower or co-borrower reports income from a household member not on the loan.

- A "non-borrower" is defined as someone who lives in the household and contributes to its total income but is not liable for the mortgage.

- Each non-borrower must sign the Credit Authorization Form for the evaluation process to proceed.

- If there are multiple non-borrowers, copies of the form can be filled out for each individual.

- Authorization allows the lender or its agent to obtain a consumer credit report of the non-borrower as required by the Fair Credit Reporting Act.

- All information provided, including the non-borrower’s Social Security number, must be accurate and current to avoid delays in processing.

Completing the form accurately is crucial for a timely evaluation of any request for a mortgage modification or assistance.

Browse Other Templates

Physical Form - Specific heart-related questions are included for safety assessments.

How to Fill Out a Rescheck Form - User inputs related to basement configurations are necessary for accurate energy modeling.