Fill Out Your Non Erisa Loan Application Form

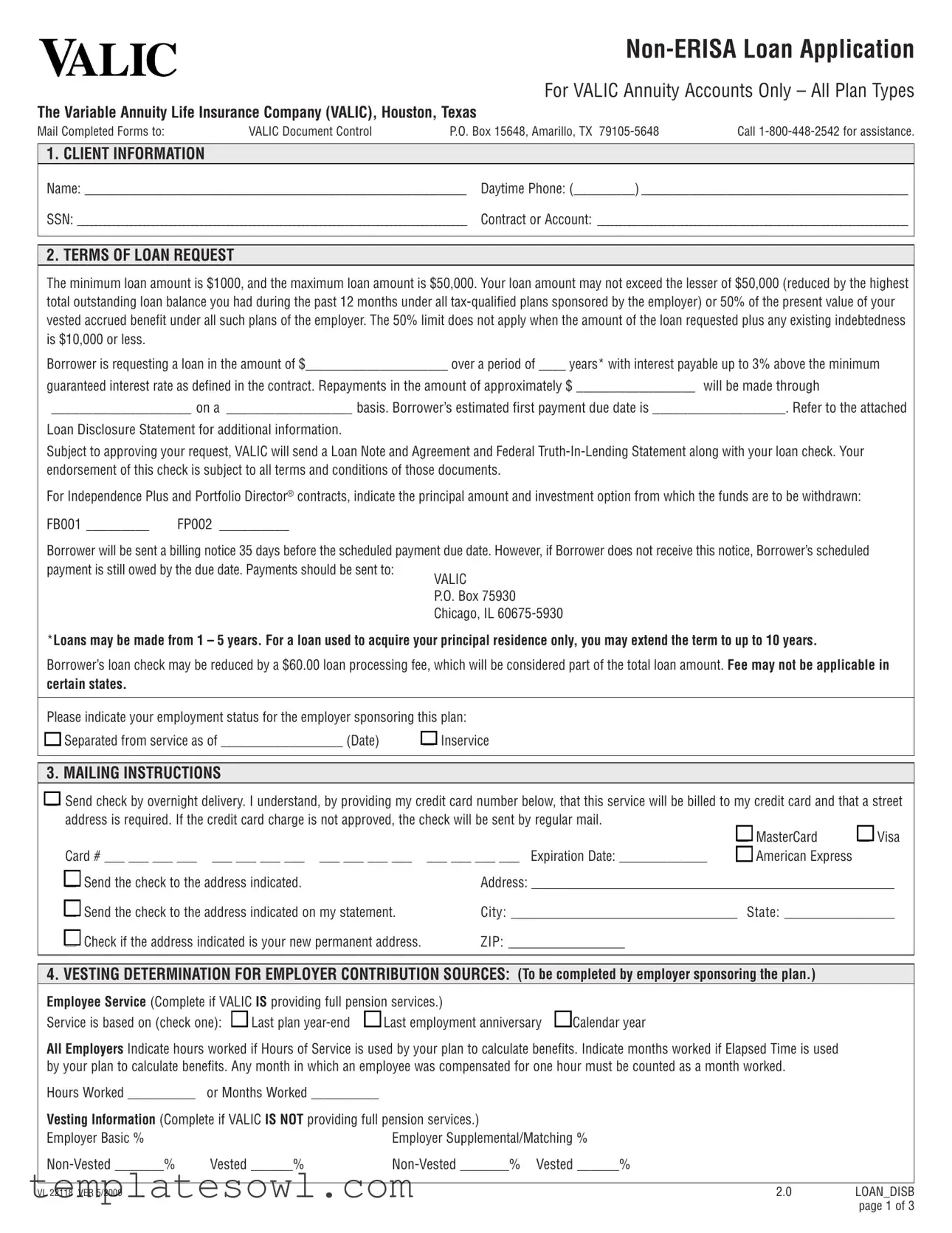

When considering a loan from your VALIC annuity accounts, the Non-ERISA Loan Application form is essential. This form serves a variety of purposes. First, it collects important client information, including your name, contact number, and Social Security number. Next, it outlines the terms of your loan request, detailing the allowable minimum and maximum amounts, repayment terms, and interest rates. An applicant may borrow as little as $1,000 or as much as $50,000, depending on their vested benefits and outstanding loan balances. It is important to pay attention to the regulations surrounding loans, which stipulate that the total amount requested cannot exceed certain limits based on your plan and contributions. For those seeking loans for home purchases, there’s an option to extend the repayment period to 10 years. The form also contains critical sections regarding security and approval for the loan, requiring signatures from both the borrower and the plan administrator. Additionally, it informs borrowers about the implications for their IncomeLOCK option, if applicable, and provides mailing instructions for submitting the form. By completing this application, individuals take an important step toward accessing the funds necessary for their financial needs while adhering to the company's policies and regulations.

Non Erisa Loan Application Example

For VALIC Annuity Accounts Only – All Plan Types

The Variable Annuity Life Insurance Company (VALIC), Houston, Texas

Mail Completed Forms to: |

VALIC Document Control |

P.O. Box 15648, Amarillo, TX |

Call |

|

|

|

|

|

|

1. CLIENT INFORMATION |

|

|

|

|

Name: ________________________________________________________________________________ |

Daytime Phone: (_________) ____________________________________________________________ |

|||

SSN: ________________________________________________________________________________________ |

Contract or Account: ______________________________________________________________________ |

|||

|

|

|

|

|

2. TERMs OF LOAN REquEsT

The minimum loan amount is $1000, and the maximum loan amount is $50,000. Your loan amount may not exceed the lesser of $50,000 (reduced by the highest total outstanding loan balance you had during the past 12 months under all

Borrower is requesting a loan in the amount of $_____________________ over a period of ____ years* with interest payable up to 3% above the minimum

guaranteed interest rate as defined in the contract. Repayments in the amount of approximately $ _________________ will be made through

____________________ on a __________________ basis. Borrower’s estimated first payment due date is ___________________. Refer to the attached

Loan Disclosure Statement for additional information.

Subject to approving your request, VALIC will send a Loan Note and Agreement and Federal

For Independence Plus and Portfolio Director® contracts, indicate the principal amount and investment option from which the funds are to be withdrawn:

FB001 _________ |

FP002 __________ |

Borrower will be sent a billing notice 35 days before the scheduled payment due date. However, if Borrower does not receive this notice, Borrower’s scheduled payment is still owed by the due date. Payments should be sent to:

*Loans may be made from 1 – 5 years. For a loan used to acquire your principal residence only, you may extend the term to up to 10 years.

Borrower’s loan check may be reduced by a $60.00 loan processing fee, which will be considered part of the total loan amount. Fee may not be applicable in

certain states.

Please indicate your employment status for the employer sponsoring this plan:

|

Separated from service as of __________________ (Date) |

l |

Inservice |

l |

3. MAILINg INsTRuCTIONs |

|

|

|

|

|

|

l Send check by overnight delivery. I understand, by providing my credit card number below, that this service will be billed to my credit card and that a street |

||||||

address is required. If the credit card charge is not approved, the check will be sent by regular mail. |

l MasterCard |

l Visa |

||||

|

|

|

|

|

||

Card # ___ ___ ___ ___ |

___ ___ ___ ___ |

___ ___ ___ ___ |

___ ___ ___ ___ |

Expiration Date: _____________ |

l American Express |

|

l Send the check to the address indicated. |

|

Address: ____________________________________________________________ |

||||

l Send the check to the address indicated on my statement. |

City: _____________________________________ State: __________________ |

|||||

l Check if the address indicated is your new permanent address. |

ZIP: ___________________ |

|

|

|||

4. VEsTINg DETERMINATION FOR EMPLOYER CONTRIBuTION sOuRCEs: (To be completed by employer sponsoring the plan.)

Employee service (Complete if VALIC Is providing full pension services.) |

||

Service is based on (check one): |

l Last plan |

l Last employment anniversary |

l

Calendar year

All Employers Indicate hours worked if Hours of Service is used by your plan to calculate benefits. Indicate months worked if Elapsed Time is used by your plan to calculate benefits. Any month in which an employee was compensated for one hour must be counted as a month worked.

Hours Worked __________ |

or Months Worked __________ |

|

|

Vesting Information (Complete if VALIC Is NOT providing full pension services.) |

|

||

Employer Basic % |

|

Employer Supplemental/Matching % |

|

Vested ______% |

|

||

|

|

|

|

VL 22118 VER 5/2009 |

|

2.0 |

LOAN_DISB |

|

|

|

page 1 of 3 |

5. PLAN ADMINIsTRATOR APPROVAL

To be completed where required under your employer’s plan.

•I approve this loan in accordance with current plan provisions and all applicable laws and regulations.

•I verify that the information provided on this form for purposes of this distribution is correct to the best of my knowledge.

__________________________________________________________________________

Plan Administrator or Authorized Representative Name (Print) |

|

__________________________________________________________________________ |

_____________________ |

Plan Administrator or Authrorized Representative Signature |

Date |

sPECIAL NOTICE FOR INCOMELOCK OPTION

special note to IncomeLOCK participants: If a loan is taken on an account with the IncomeLOCK option, the IncomeLOCK option will be terminated and all benefits will cease. Once terminated, the IncomeLOCK option can not be added back to the contract.

6. ACCOuNT VERIFICATION (skip this section if your plan has only one provider or you are not in a 403(b) Plan.) |

||

Plan type of my account: |

l 403(b) |

l 401(a) or 401(k) (If 401(a) or 401(k), skip to Section 7) |

This section is applicable only to a loan from a 403(b) plan: If you are requesting a loan from a 403(b) plan and Plan Administrator or

I have funds under this or any other plan sponsored by this Employer with other investment providers: lYes lNo (If no, skip to Section 7.) If you answered “Yes” to the question above, the Loan Supplement for Investment Providers (on page 3) will be required.

List all other investment providers and account number(s) under this Plan where contributions have been made at any time:

Investment Provider

Customer service Phone Number

Account Number

Use a separate sheet for additional accounts and/or loans.

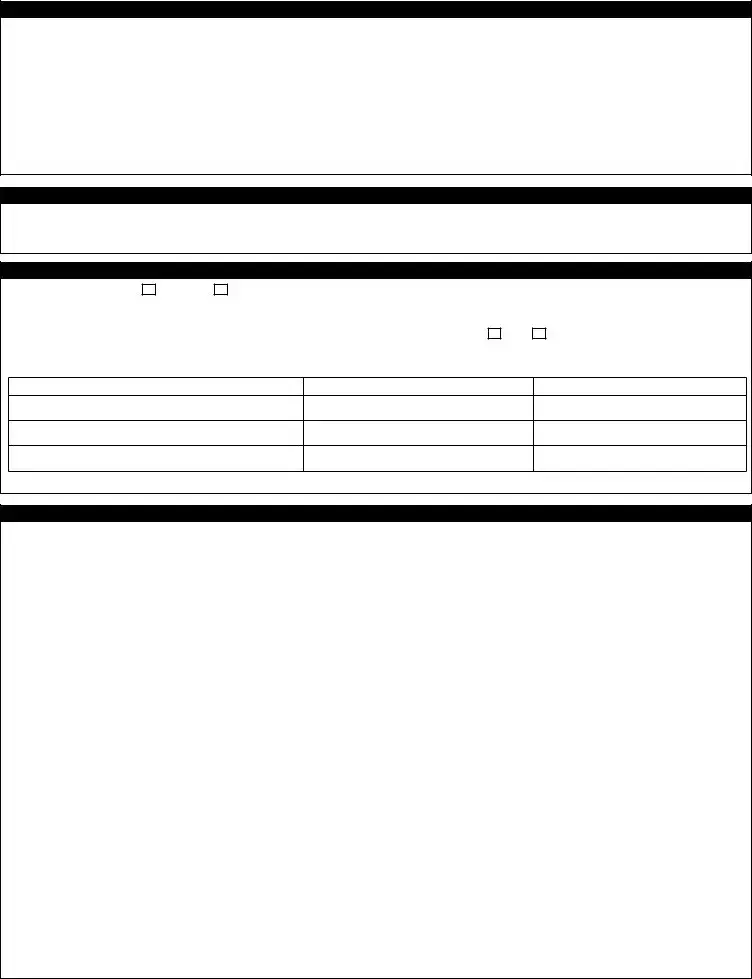

7. sECuRITY AND APPROVAL FOR LOAN

•Borrower understands that Borrower will be pledging to VALIC as security for the loan the following amounts (1) the cash surrender value of the contract or account in an amount equal to the value of the loan; (2) the portion of the loan interest due with a quarterly loan payment; (3) any applicable surrender charge; and (4) all interest credited on (1), (2), and (3) held in reserve until the loan is repaid or foreclosed upon. Any applicable surrender charge is calculated as if I partially surrendered an amount equal to the loan balance as of the beginning of the loan term. The reserve is not subject to withdrawal, surrender, reallocation, transfer, assignment, or pledge to anyone other than VALIC.

•Borrower certifies that Borrower does not have any loans under this or any other plan sponsored by this employer (or under a plan sponsored by any other employer related to the employer sponsoring this plan) that would cause any amount of this loan to be in excess of the applicable loan limits described under Section 2 of the attached Loan Disclosure Statement.

•Borrower certifies that Borrower does not have any outstanding defaulted loans under this or any other plan sponsored by this employer (or under a plan sponsored by any other employer related to the employer sponsoring the plan).

•Borrower understands that this loan will terminate the IncomeLOCK option, if any, and benefits associated with the IncomeLOCK option.

•Once terminated, the IncomeLOCK option can not be added back to the contract.

•Borrower acknowledges that Borrower has read and understands the attached Loan Disclosure Statement.

•Borrower certifies that the information provided above is true and correct to the best of Borrower’s knowledge.

•Borrower authorizes VALIC to confirm the accuracy of information provided with listed providers and authorizes such providers to confirm the information herein, subject to the requirement that the information is used solely for purposes of satisfying the restrictions under the Plan. Borrower understands request will not be processed until confirmed.

_________________________________________________________________________ |

_____________________ |

Borrower’s Signature |

Date |

VL 22118 VER 5/2009 |

2.0 |

LOAN_DISB |

|

|

page 2 of 3 |

|

Loan supplement for Investment Providers |

|

(For use with decentralized |

The Variable Annuity Life Insurance Company (VALIC), Houston, Texas |

(skip this page if your plan has only one provider or |

you are not in a 403(b) Plan.) |

Borrower: Your request for a loan from your 403(b) account and answering “Yes” to the question in Section 6 also requires the submission of this supplemental form to your other investment providers to determine eligibility for a loan distribution from your employer’s plan. You should complete Box A (below) and provide a copy of this form to each of the other investment provider(s) for completion of Box B. Upon full execution of this form, the supplemental form can then be submitted along with the Loan Application form.

Remit this page to each of the investment providers listed in section 6 for completion of required information:

PARTICIPANT INFORMATION

Name: ______________________________________________________ |

Daytime Phone: (________) _____________________________________ |

SSN: _______________________________________________________ |

Contract or Account: ___________________________________________ |

Address: ____________________________________________________ |

City: _______________________ State: _________ ZIP: ___________ |

BOX A:

Name of Investment Provider:

Employer Name:

Plan Name:

Participant’s Name:

Participant’s Address:

Provide Account #:

Provide Account #:

•I certify that the information I have provided is true and correct to the best of my knowledge.

•Borrower authorizes VALIC to confirm the accuracy of information provided with listed providers and authorizes such providers to confirm the information herein, subject to the requirement that the information is used solely for the purposes of satisfying the restrictions under the Plan. Borrower understands request will not be processed until confirmed.

________________________________________________________________________ |

_____________________ |

Participant’s Signature |

Date |

Investment Providers: Client has authorized VALIC to collect the following information. Complete the following table for each 403(b) account where contributions have been made at any time. Do not include accounts only containing transferred amounts transferred prior to 09/25/2007.

Return to Client upon completion. |

|

|

BOX B: |

Account #1 |

Account #2 |

|

|

|

Account Number(s): |

|

|

|

|

|

Account Balance(s): |

|

|

|

|

|

Account Balance(s) On 12/31/1988: |

|

|

|

|

|

Total Amount of Outstanding |

|

|

Loan Balance: |

|

|

|

|

|

Highest Total Outstanding Loan |

|

|

Balance Over Past 12 months: |

|

|

|

|

|

Describe status of Loan: |

|

|

Active, Defaulted, or Fully Repaid |

|

|

|

|

|

________________________________________________________________________ |

____________________________________________ |

|

Signature of Investment Provider |

|

Date |

________________________________________________________________________ |

____________________________________________ |

|

Printed name of Investment Provider |

|

Title of Investment Provider |

VL 22118 VER 5/2009 |

2.0 |

LOAN_DISB |

|

|

page 3 of 3 |

Loan Disclosure statement

THIs LOAN DIsCLOsuRE sTATEMENT gOVERNs YOuR LOAN APPLICATION AND ANY REsuLTINg LOAN.

Additional loans will not be allowed to participants with outstanding defaulted loans under this or any other plan sponsored by this employer (or under a plan sponsored by any other employer related to the employer sponsoring this plan) until these defaulted loans have been repaid with outside funds or can be fully foreclosed.

Payments of principal and interest should be made by check payable to THE VARIABLE ANNUITY LIFE INSURANCE COMPANY.

The remittance address will be indicated on the payment coupon. However, payments are due regardless of receipt of payment coupon. For additional information contact our Client Care Center at

1. APPLICABILITY

Loans as described herein are available only from VALIC annuity contracts and accounts issued to

The IncomeLOCK option is not available if there is an outstanding loan on the contract. Prior to adding the IncomeLOCK option to the contract, any outstanding loan must first be paid off. If a loan is taken after the IncomeLOCK option is in effect, the IncomeLOCK option and associated benefits will cease. Once terminated, the IncomeLOCK option can not be added back to the contract.

2. AMOuNT OF LOAN

VALIC processes loans for loan qualification purposes solely on the basis of employer

VALIC assumes no responsibility for the processing of loans other than in accordance with the limits described below as applied to VALIC annuity contracts and accounts issued to such employer

a.The availability and amount of a loan are subject to any applicable restrictions in the plan.

b.Both fixed and variable VALIC accounts are considered for purposes of qualifying a loan, but only the vested portion of a fixed

c.The maximum amount you may borrow may not exceed the lesser of $50,000 [reduced by the highest total outstanding loan balance you had during the past 12 months under all

d.Loans are not made to participants who have begun receiving annuity payments under the contract or account.

e.VALIC may from time to time establish minimum loan amounts. Refer to your VALIC contract for the current minimum.

f.If a participant annuitizes, surrenders the contract or account, or dies before the loan is repaid, the annuity value or death benefit payable under the contract will be reduced by the outstanding loan amount, delinquent quarterly interest payments, prorated portion of quarterly loan interest and any applicable surrender charge.

3.TERMs OF LOAN

a.Amortized equal loan payments of principal and interest are due on the last day of each quarter of the loan year.

b.Quarterly payments are required. Quarterly payment obligations may not be satisfied more than one quarter in advance.

c.Payments received by VALIC will be applied in this order: First, to any outstanding payments due

Second, to the current quarterly payment due Third, to the next quarterly payment Fourth, to the principal balance

d.The loan balance may be repaid in full at any time. Please contact the Client Care Center at

4.sECuRITY FOR LOAN

a.VALIC will place in a security reserve an amount equal to the sum of the loan amount, the contract surrender charge as if the loan amount had been surrendered at the start of the loan term, if applicable, and all interest credited to the foregoing amounts.

b.I pledge the foregoing amount in the security reserve to VALIC as security for this loan. This amount is not subject to withdrawal, surrender, reallocation, transfer, assignment or pledge to anyone other than VALIC.

c.The portion of the reserve equal to the loan balance and interest thereon will accumulate minimum guaranteed interest at the applicable contract rate. The portion of the reserve equal to the amount necessary to satisfy the surrender charge, if applicable, and interest thereon, will earn interest at the applicable minimum guaranteed interest rate or such higher rate declared by VALIC’s Board of Directors but no less than the minimum guaranteed rate under the contract.

d.As loan balance repayments are made,

e.VALIC will foreclose on the security reserve for the foreclosure amount upon default or when any withdrawal or plan restrictions no longer apply. If the loan is foreclosed upon, any amount in the security reserve in excess of the foreclosure amount will be credited to the contract or account.

5.LOAN DEFAuLT

a.If Borrower fails to make any scheduled payment, the loan is considered past due. If the past due payment amount remains unpaid for 90 days or such other time period as defined under the terms of the plan or loan provisions (not to extend longer than permitted under applicable regulations or rulings of the Internal Revenue Service or the Department of Labor), the loan will be

in default and the outstanding loan amount, together with any accrued interest, will be immediately due and payable.

b.The defaulted loan amount will be reported on IRS Form

c.If there are any withdrawal or plan restrictions, then, upon default, VALIC may be unable to immediately foreclose upon the security

VL 22118 VER 5/2009

Loan Disclosure statement

reserve and discharge your loan. VALIC may only foreclose upon the security reserve upon the occurrence of a distributable event under your plan, such as your attainment of age 59½, death, disability

or separation from service. Until such time, VALIC must continue to carry your loan and credit interest to you as described above. At the same time, you will continue to accrue interest equal to the minimum guaranteed interest rate under your current contract until the loan is repaid or foreclosed upon.

d.You may repay the defaulted loan amount plus interest due to VALIC prior to foreclosure. This repayment must be in full. Contact the Client Care Center

6.gENERAL LOAN INFORMATION

a.Can I make payments through payroll deductions?

Some employers do have agreements with VALIC to offer their employees the option of payroll deductions for loan repayments. If available to you, it’s a simple process of signing a VALIC agreement indicating how much and how often you want deductions made. We will then coordinate with your employer to begin deductions. Check with your employer to see if they offer this benefit.

b.How often can I send in a loan payment?

Payments are due every 90 days from the effective date of your loan. However, you can send payments as often as you like as long as the amount due each quarter is paid by the scheduled due date. Remember to include your loan account number(s) on your check to ensure proper crediting.

Note: Only one quarterly payment may be paid in advance. When making more than one payment in a quarter, any excess after two payments will be credited to the principal of the loan.

c.Will I receive confirmation of my loan payment?

Yes. Payments will be reflected on your account statement. The statement will reflect the amount of principal paid on your loan and the amount of guaranteed interest credited to your account, both of which are returned to your regular account from your loan security reserve amount.

Can I pay my loan back prior to the final due date without penalties?

Yes. You can contact our Client Care Center for a payoff quote and repay the loan at any time without any prepayment penalties.

Please send completed forms to:

VALIC Document Control

P.O. Box 15648

Amarillo, TX

Call

VL 22118 VER 5/2009

Form Characteristics

| Fact Name | Details |

|---|---|

| Applicability | The Non-ERISA Loan Application is available only for VALIC annuity accounts associated with tax-qualified and governmental 457(b) plans. |

| Loan Amount Limits | The minimum loan amount is $1,000, and the maximum is $50,000. Specific limits apply based on the participant's vested benefits. |

| Interest Rate | Interest on the loan may be up to 3% above the minimum guaranteed interest rate defined in the contract. |

| Payment Terms | Loan repayments are typically made quarterly. The borrower receives a billing notice 35 days before the due date. |

| Special Conditions | If taken with the IncomeLOCK option, the option will terminate and cannot be reinstated once a loan is made. |

| State-Specific Laws | Participants should check state-specific regulations as the loan processing fee may not apply based on state law. |

Guidelines on Utilizing Non Erisa Loan Application

Completing the Non-ERISA Loan Application can be a straightforward process when broken down into manageable steps. Attention to detail is critical to ensure that all required information is accurately filled out. After submission, your application will be processed, and you may receive a Loan Note and Agreement along with your loan check.

- Gather Necessary Information: Collect personal details such as your name, Social Security Number (SSN), and daytime phone number.

- Fill Out Client Information: Enter your name, daytime phone number, SSN, and contract or account number in the designated spaces.

- Specify Loan Terms: Indicate the loan amount you are requesting, the loan period (from 1 to 5 years), and the repayment details, including the expected first payment due date.

- Detail Employment Status: Choose your current employment status: Separated from service, In-service, or other options as applicable.

- Provide Mailing Instructions: Select how you want the check delivered, including credit card details for overnight delivery if applicable.

- Vesting Determination: If necessary, ensure that the section for employer contribution sources is filled out correctly by your plan administrator.

- Obtain Plan Administrator Approval: Forward the form to your plan administrator for approval and signature on the designated line.

- Complete Security and Approval for Loan: Sign and date the bottom of the application, certifying the accuracy of the information provided.

- Submit Application: Mail the completed Non-ERISA Loan Application to VALIC Document Control at the specified address.

What You Should Know About This Form

What is the Non-ERISA Loan Application form used for?

The Non-ERISA Loan Application form is designed for individuals with VALIC annuity accounts who are looking to secure a loan. This application allows you to request a loan from your account under specific terms and conditions set forth by VALIC. It is applicable for all plan types that are not governed under the Employee Retirement Income Security Act (ERISA).

What are the minimum and maximum loan amounts?

You can request a loan with a minimum amount of $1,000 and a maximum of $50,000. However, the actual loan amount you qualify for may be lower, depending on your outstanding loan balance within the past 12 months and the total value of your vested benefits under the plans sponsored by your employer.

What is the repayment structure for the loan?

Loans must be repaid through quarterly installments of principal and interest, which are due at the end of each quarter. The duration of the loan can range from 1 to 5 years, or up to 10 years if the loan is specifically for purchasing your principal residence.

What happens to the IncomeLOCK option if I take a loan?

If you take a loan against your account that includes the IncomeLOCK option, the option will be terminated immediately, and all associated benefits will cease. It's crucial to understand that once the IncomeLOCK option is terminated, it cannot be reinstated.

How will I be billed for my loan payments?

Borrowers will receive a billing notice 35 days prior to the scheduled payment due date. It's important to know that even if you do not receive this notice, you are still responsible for making the scheduled payment by the due date.

Can I make extra payments on my loan?

Yes, you can make extra payments on your loan at any time without incurring penalties. When making a payment, it’s essential to include your loan account number to ensure proper credit to your account. Any additional amount paid beyond the required quarterly payment will go towards reducing the principal balance of the loan.

Who should I contact for assistance with the loan application?

If you need help or have questions regarding the Non-ERISA Loan Application form, you can reach out to VALIC's Client Care Center at 1-800-448-2542. They are available to guide you through the process and address any concerns you may have.

Common mistakes

Filling out the Non-ERISA Loan Application form requires attention to detail. One common mistake is omitting vital client information. Missing details such as the client’s full name, Social Security Number, or daytime phone can delay the processing of the loan. It is essential to double-check that all fields are filled out completely before submitting.

Another frequent error is miscalculating the loan amount. Borrowers must remember that loans cannot exceed $50,000 or 50% of the current value of their vested benefits, whichever is lesser. Some people overlook existing loans and submit an application that exceeds these limits, which will be rejected. It is advisable to review all past loan balances carefully to avoid this issue.

Failing to accurately complete the repayment terms is also a widespread problem. Terms must reflect the correct payment schedule and amounts. If someone enters incorrect figures or leaves blank fields, it creates confusion regarding repayment. A clear understanding of the loan's terms can simplify setting expectations for payment due dates and amounts.

Inadequate approval from plan administrators can cause significant setbacks. Some borrowers forget to acquire the necessary signatures from their employers or plan administrators. This approval is often mandatory and must be obtained before submitting the application. A simple oversight in this area may result in delays or denial of the loan.

Not adhering to mailing instructions can also pose challenges. Many individuals submit their applications without ensuring they use the correct address or method of delivery. Whether sending by overnight service or regular mail, verifying that the application arrives at the correct location is crucial for timely processing.

Finally, many applicants neglect to read the loan disclosure statement. This oversight can lead to misunderstandings about the terms and conditions associated with the loan. Borrowers should take the time to review all details to ensure that they fully understand their obligations and the implications of taking out the loan.

Documents used along the form

When considering a loan through the Non-ERISA Loan Application form, it's important to be familiar with additional documents that might be required during the process. Each of these documents serves a specific purpose in ensuring the completeness and accuracy of your loan application, offering clarity to both the borrower and the lender.

- Loan Disclosure Statement: This document provides detailed information about the terms and conditions associated with the loan. It explains the maximum loan amounts, repayment terms, and any potential fees. Understanding this statement is crucial, as it governs the loan agreement and ensures the borrower is informed about the associated responsibilities.

- Loan Note and Agreement: Once a loan is approved, this document outlines the specifics of the loan amount, interest rate, and repayment schedule. It serves as a binding contract between the borrower and VALIC, establishing the legal framework for the borrower's obligations regarding loan repayment.

- Loan Supplement for Investment Providers: This supplementary form is necessary if the borrower has funds in multiple investment accounts. It requires the borrower to provide details to other investment providers, ensuring that all accounts are accounted for and eligibility for the loan can be confirmed. This helps protect both the borrower and the lender from potential errors in half-completed applications.

- Vesting Determination Form: This form requires input from the employer sponsoring the plan and documents the employee's vested interests. It confirms the length of service and details any applicable vesting percentages, helping to ensure that the borrower meets the necessary qualifications for taking a loan against their plan.

In summary, these additional forms and documents not only support the loan application process but also help to safeguard both the borrower's and the lender's interests. By understanding each component, individuals can navigate their loan requests with greater confidence and clarity.

Similar forms

- Loan Application Form for a 401(k) Plan: Similar to the Non-ERISA Loan Application, this document requires personal information and specifies terms for borrowing against a 401(k) account, including loan limits and repayment terms.

- Pension Loan Application: This form serves a similar purpose for pension plans, laying out the necessary borrower details and the specifics regarding how much can be borrowed and the repayment process.

- Personal Loan Application: Much like the Non-ERISA form, this document collects personal information, including income and credit history, and outlines the terms of the loan, such as interest rates and repayment timelines.

- Home Equity Loan Application: This application also requires the homeowner's details and specifies the amount that can be borrowed based on equity, mirroring the eligibility checks seen in the Non-ERISA form.

- Financial Aid Application for Student Loans: This document is designed for students looking to borrow for education expenses, collecting personal, financial, and academic information, akin to the requirements found in the loan application for VALIC.

- Credit Card Application: Similar to the Non-ERISA Loan Application, this form gathers personal data and assesses eligibility for borrowing, including credit history and income verification.

- Business Loan Application: Like its Non-ERISA counterpart, this document requires business owners to provide financial details and outlines loan limits, interest rates, and repayment terms.

- Emergency Loan Request Form: This form, used for urgent financial needs, gathers necessary personal information while detailing the loan amount and repayment conditions, paralleling aspects of the Non-ERISA Loan Application.

- Debt Consolidation Loan Application: This document requests personal financial information and establishes loan criteria, similar to the structured approach of the Non-ERISA Loan Application.

Dos and Don'ts

When filling out the Non-ERISA Loan Application form, it is crucial to ensure that the process goes smoothly. To assist you in this endeavor, the following list outlines key dos and don’ts to remember:

- Do read the entire application thoroughly before starting to fill it out. Understanding all sections helps avoid mistakes.

- Do provide accurate and current information for all required fields, such as your name, contact number, and SSN.

- Do ensure your loan request falls within the minimum and maximum loan limits stated in the application.

- Do review your completed application for any errors or omissions before submitting.

- Don’t rush through the application. Taking your time minimizes the risk of errors that could delay processing.

- Don’t forget to include any required supporting documents or signatures, as these are essential for processing your application.

- Don’t assume that previous applications or information are still applicable. Always provide the most current details.

- Don’t neglect to keep a copy of your completed application for your records and future reference.

By adhering to these dos and don’ts, you enhance the likelihood of a successful application process.

Misconceptions

Understanding the Non-ERISA Loan Application form is important for many borrowers. However, several misconceptions can lead to confusion and potential issues. Below are some common misunderstandings and clarifications:

- Misconception 1: The Non-ERISA Loan Application can be used for any retirement account.

- Misconception 2: Borrowers can request any amount for their loans.

- Misconception 3: Loan repayments are only necessary if a notice is received.

- Misconception 4: A borrower can have multiple outstanding loans without repercussions.

- Misconception 5: The IncomeLOCK option remains unaffected regardless of loans.

- Misconception 6: Loan checks are sent without conditions.

- Misconception 7: Once a loan is approved, it cannot be affected by changes in employment status.

This application is specifically for VALIC annuity accounts under tax-qualified and governmental 457(b) plans, not just any retirement account.

Loans must be between $1,000 and $50,000, and specific limits apply based on the vested benefits and previous loan balances.

It's crucial to note that payments are due by the scheduled date, even if a billing notice is not received.

Borrowers can only take out a new loan if they have no defaulted loans in the same or related plans. This limitation is vital for maintaining eligibility.

Taking a loan will terminate the IncomeLOCK option, and benefits associated with it will cease immediately.

Loan checks will only be issued once the loan note, agreement, and federal financing statement are signed and returned. This is a necessary step in the process.

If a borrower changes employment status, particularly if separated from service, it could impact the loan's terms and repayment obligations.

Key takeaways

Filling out the Non-ERISA Loan Application Form can seem daunting, but understanding its key components will make the process much smoother. Here are some important takeaways to consider:

- Eligibility Requirements: This loan is exclusively available for VALIC annuity accounts associated with tax-qualified and governmental 457(b) plans that are not subject to ERISA.

- Minimum and Maximum Amounts: You can request a loan between $1,000 and $50,000, subject to certain conditions regarding existing loans and vested accrued benefits.

- Repayment Terms: Loan repayment is structured around quarterly payments, typically scheduled at the end of each quarter. It's important to plan your budget accordingly to meet these obligations.

- Payment Method: Payments can be made by check, and some employers may allow payroll deductions. Make sure to check with your employer about available options.

- Loan Default Risks: If payments are not made and become overdue, the loan may go into default. This can lead to taxes being assessed on the unpaid loan amount, and any defaulted amount may count as taxable income.

- IncomeLOCK Termination: If you have the IncomeLOCK option on your account, applying for a loan will cause it to terminate permanently, losing associated benefits in the process.

- Contact Information: Should any questions arise while completing the form, you can contact VALIC at 1-800-448-2542 for personalized assistance.

By keeping these key points in mind while filling out the Non-ERISA Loan Application, you can ensure a more efficient and organized process. Good luck!

Browse Other Templates

Gc-310 - The form addresses whether the proposed conservatee is currently in a state institution.

Branch Hdfc Bank Id Card - Each applicant must sign and date the form to validate the request.

St 5 Form - Complying with the guidelines of Form ST-5 supports lawful purchasing.