Fill Out Your Non Profit Lpuna 128 Form

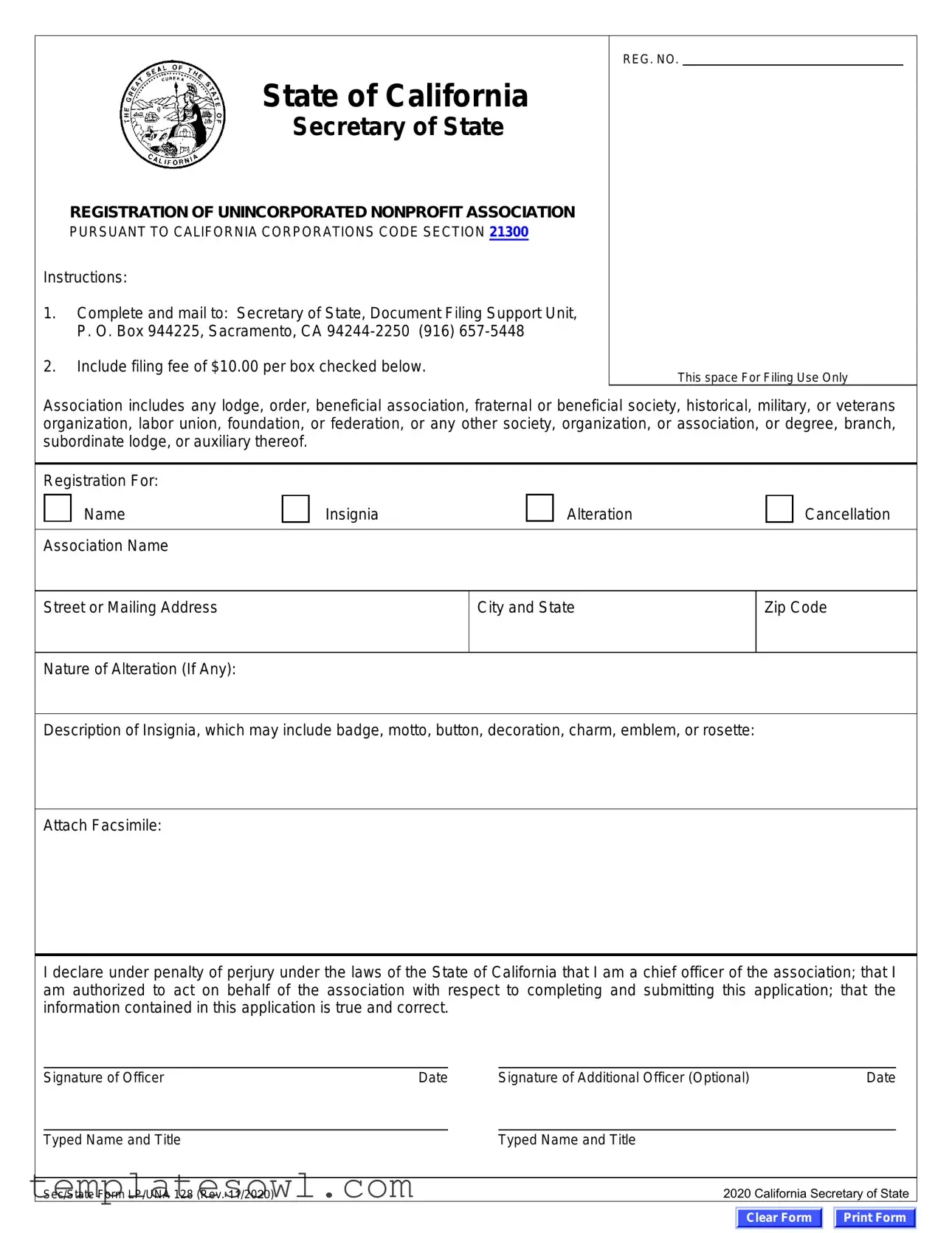

The Non Profit Lpuna 128 form serves as an essential tool for unincorporated nonprofit associations in California seeking to formalize their status. Designed for a range of organizations including lodges, fraternal societies, labor unions, and foundations, this registration process falls under the California Corporations Code Section 21300. The form provides clear instructions for completion, requiring specific details about the organization such as its name, address, and any insignias it may use. Within the application, options for registration include alterations or cancellations, ensuring that each association can maintain accurate records. A filing fee of $10 applies for each item selected, and submissions can be made to the Secretary of State's Document Filing Support Unit. Furthermore, the form necessitates a declaration under penalty of perjury from a chief officer, affirming the authenticity of the information provided. It’s also worth noting that additional fees may apply for optional copy and certification services. By following these outlined procedures, nonprofit associations can effectively navigate their registration, thereby enhancing their credibility and operational capacity within the state.

Non Profit Lpuna 128 Example

State of California

Secretary of State

REGISTRATION OF UNINCORPORATED NONPROFIT ASSOCIATION

PURSUANT TO CALIFORNIA CORPORATIONS CODE SECTION 21300

Instructions:

1.Complete and mail to: Secretary of State, Document Filing Support Unit, P. O. Box 944225, Sacramento, CA

2.Include filing fee of $10.00 per box checked below.

REG. NO.

This space For Filing Use Only

Association includes any lodge, order, beneficial association, fraternal or beneficial society, historical, military, or veterans organization, labor union, foundation, or federation, or any other society, organization, or association, or degree, branch, subordinate lodge, or auxiliary thereof.

Registration For: |

|

|

|

Name |

Insignia |

Alteration |

Cancellation |

|

|

|

|

Association Name |

|

|

|

Street or Mailing Address

City and State

Zip Code

Nature of Alteration (If Any):

Description of Insignia, which may include badge, motto, button, decoration, charm, emblem, or rosette:

Attach Facsimile:

I declare under penalty of perjury under the laws of the State of California that I am a chief officer of the association; that I am authorized to act on behalf of the association with respect to completing and submitting this application; that the information contained in this application is true and correct.

Signature of Officer |

Date |

Typed Name and Title

Signature of Additional Officer (Optional) |

Date |

Typed Name and Title

Sec/State Form LP/UNA 128 (Rev. 11/2020) |

2020 California Secretary of State |

Clear Form

Print Form

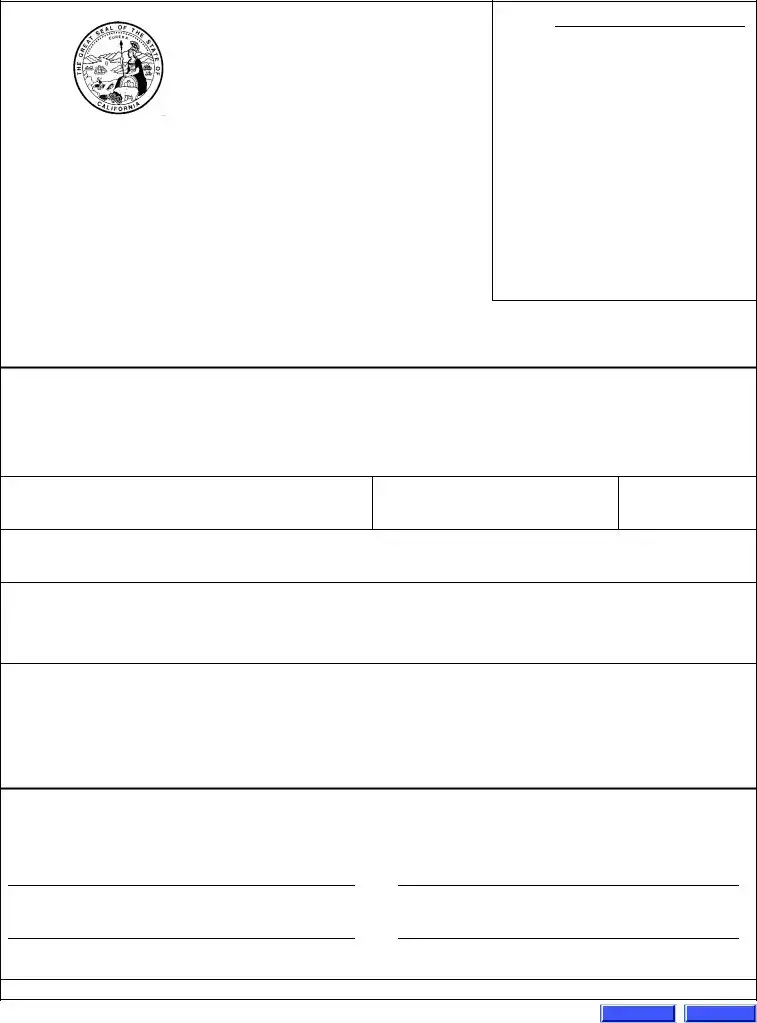

Secretary of State

Business Programs Division

Business Entities

1500 11th Street, Sacramento, CA 95814

P.O. Box 944260, Sacramento, CA

Submission Cover Sheet

Instructions:

•Complete and include this form with your submission. This information only will be used to communicate with you in writing about the submission. This form will be treated as correspondence and will not be made part of the filed document.

•Make all checks or money orders payable to the Secretary of State.

•In person submissions: $15 handling fee; do not include a $15 handling fee when submitting documents by mail.

•Standard processing time for submissions to this office is approximately 5 business days from receipt. All submissions are reviewed in the date order of receipt. For updated processing time information, visit

Optional Copy and Certification Fees:

•If applicable, include optional copy and certification fees with your submission.

•For applicable copy and certification fee information, refer to the instructions of the specific form you are submitting.

Contact Person: (Please type or print legibly)

First Name: __________________________________________________ Last Name: _______________________________________________

Phone (optional): ______________________________________________

Entity Information: (Please type or print legibly)

Name: __________________________________________________________________________________________________________________

Entity Number (if applicable):_____________________________________

Comments: _____________________________________________________________________________________________________________

_____________________________________________________________________________________________________________

_____________________________________________________________________________________________________________

_____________________________________________________________________________________________________________

Return Address: For written communication from the Secretary of State related to this document, or if purchasing a copy of the filed document enter the name of a person or company and the mailing address.

Name: |

|

|

Company: |

|

|

Address: |

|

|

City/State/Zip: |

|

|

Doc Submission Cover - BE (Rev. 11/2020)

Secretary of State Use Only

T/TR:

AMT REC’D: $

Clear Form

Print Form

Print Form

Form Characteristics

| Fact Name | Detail |

|---|---|

| Document Purpose | The LPUNA 128 form registers unincorporated nonprofit associations in California. |

| Governing Law | California Corporations Code Section 21300 governs this registration process. |

| Filing Fee | A $10.00 filing fee is required for each box checked on the form. |

| Submission Address | Mail the completed form to the Secretary of State, Document Filing Support Unit, P.O. Box 944225, Sacramento, CA 94244-2250. |

| Contact Information | For questions, call (916) 657-5448 for assistance. |

| Required Signature | One officer of the association must sign the form, declaring that the information provided is true. |

| Optional Additional Officer | A second officer may also sign the form, although this is not mandatory. |

| Processing Time | The standard processing time is approximately 5 business days from receipt of the application. |

| In-Person Submissions | An additional $15 handling fee applies for submissions made in person. |

| Copy and Certification Fees | Optional copy and certification fees may apply; refer to the specific form instructions for details. |

Guidelines on Utilizing Non Profit Lpuna 128

Filling out the Non Profit LPUNA 128 form is an important step in registering your unincorporated nonprofit association in California. This process ensures that your organization is recognized and able to operate legally. The following steps will guide you in completing the form correctly and efficiently.

- Begin by downloading the Non Profit LPUNA 128 form from the California Secretary of State's website or obtain a hard copy.

- Fill in your association's name in the designated field at the top of the form.

- Provide the street or mailing address, including city, state, and zip code.

- Indicate the registration purpose by checking the appropriate box: Name, Insignia, Alteration, or Cancellation.

- If applicable, describe any alterations in the space provided.

- Detail the description of the insignia that your association uses, such as a badge or motto.

- Attach a facsimile of the insignia if required.

- Sign the form where indicated, confirming that you are a chief officer of the association and that the information provided is accurate. Make sure to include the date.

- Optionally, another officer can sign the form in the space provided, along with their date and typed name and title.

- Prepare a check or money order for the filing fee of $10, payable to the Secretary of State, for each box checked.

- Mail the completed form and payment to: Secretary of State, Document Filing Support Unit, P.O. Box 944225, Sacramento, CA 94244-2250.

- If desired, include the optional cover sheet with additional contact information and any comments.

Once you have sent in your completed form, the processing time is generally about five business days. For any updates or changes to processing schedules, check the California Secretary of State's website for the latest information.

What You Should Know About This Form

What is the Non Profit Lpuna 128 form?

The Non Profit Lpuna 128 form is a registration document used in California for unincorporated nonprofit associations. This form helps organizations to officially register their name, insignia, and any changes pertaining to their status or details. It is governed by the California Corporations Code Section 21300, ensuring that nonprofits maintain transparency and legitimacy in their operations.

Who needs to file the Non Profit Lpuna 128 form?

Any group or organization that fits the description of an unincorporated nonprofit association in California may need to file this form. This includes but is not limited to fraternal societies, lodges, foundations, and labor unions. If your organization is not formally incorporated but engages in nonprofit activities, you should consider filing this form to register your association with the Secretary of State.

What is the filing fee for the Non Profit Lpuna 128 form?

The filing fee for the Non Profit Lpuna 128 form is $10.00 for each box you check on the application, such as registration of a name, insignia, alteration, or cancellation. Make sure to include a check or money order made payable to the Secretary of State when you submit your form. If you submit documents in person, be aware that a $15 handling fee applies, but this fee does not apply for mailed submissions.

How long does it take for the Non Profit Lpuna 128 form to be processed?

The standard processing time for submissions to the Secretary of State's office is approximately 5 business days from receipt. Documents are processed in the order they are received, so earlier submissions will be reviewed first. For the most current processing time, you can visit the California Secretary of State’s website.

What should I include when submitting the Non Profit Lpuna 128 form?

Your submission should include the completed Non Profit Lpuna 128 form along with the appropriate filing fee. If applicable, attach a facsimile of your insignia and any additional documents that may support your application. Additionally, complete the Submission Cover Sheet to provide your contact information, as this will be used for any correspondence related to your submission. Keep all copies of your documents for your records.

Common mistakes

Filling out the Non Profit Lpuna 128 form can be a straightforward process, but there are common mistakes that applicants often make. One prevalent error is omitting critical information. For instance, forgetting to provide the full name of the unincorporated nonprofit association or leaving the address section incomplete can lead to delays or rejection of the application.

Another mistake is inaccurately stating the purpose of the association. Clarity in the nature of the association is important, and vague descriptions may raise questions. Additional explanations should be concise yet thorough to ensure that the reviewing body fully understands the organization’s mission.

Many applicants also fail to sign the application correctly. The form requires signatures from authorized officers of the association. If the signature is missing or if the officer does not provide their title, the application could be considered invalid.

Inconsistent information can cause confusion. For instance, if the name of the association is listed differently in multiple sections, it may raise red flags. Consistency is key; double-checking entries can help avoid this issue.

Additionally, applicants sometimes neglect to check the appropriate boxes related to registration purposes. The form includes several options, such as for name, insignia, alteration, or cancellation. Ensuring that the correct box is checked is essential to indicate the reason for filing.

Another common oversight involves the filing fee. Applicants must include the correct fee, which is $10. Errors in payment, such as submitting insufficient funds or not including a check at all, can lead to processing delays. It’s wise to confirm that the payment method is appropriate for the submission type.

Lastly, failing to attach necessary documents can hinder the process. If there is an alteration or description of insignia mentioned, the respective documents must accompany the form. Thoroughly reviewing the checklist of required attachments can prevent unnecessary setbacks.

Documents used along the form

When registering a nonprofit association in California, several forms and documents are commonly utilized alongside the Non Profit Lpuna 128 form. Each document serves a specific purpose that facilitates the process of establishing your organization and ensuring compliance with state regulations. Understanding these documents can help streamline your registration and operational activities.

- Bylaws: This document outlines the rules and procedures governing how your nonprofit operates. It typically includes information on governance structure, member roles, and meeting procedures.

- Statement of Information (Form SI-100): Required within 90 days of registering, this form provides updated information about your nonprofit’s address, officers, and agents for service of process.

- IRS Form 1023: If you're seeking federal tax-exempt status, this is the application you'll need to complete. It details your nonprofit's purpose, programs, and finances.

- Fundraising Registration: If your nonprofit plans to solicit donations, this document may be necessary to comply with state laws regarding fundraising activities.

- Conflict of Interest Policy: This policy ensures that board members and officers avoid any actions that may benefit themselves financially. It helps maintain transparency and protects the organization’s integrity.

- Employer Identification Number (EIN): Obtaining an EIN from the IRS is essential for tax purposes. It identifies your nonprofit as a separate legal entity and is often required for opening a bank account.

- Charitable Registration Documents: Depending on your nonprofit’s activities, you may need to file additional documents to register as a charity with the state’s attorney general’s office.

Having a clear understanding of these forms and documents will not only ease the registration process but also lay a strong foundation for your nonprofit's operations. Each plays a vital role in ensuring your organization is compliant, transparent, and prepared for growth.

Similar forms

The Non Profit Lpuna 128 form serves a specific purpose in California's nonprofit sector. Other documents that share similarities include:

- 501(c)(3) IRS Application: Like the Lpuna 128, this application registers a nonprofit organization and ensures tax-exempt status. Both documents require detailed descriptions of the organization's purpose and structure.

- Articles of Incorporation: This foundational document establishes an organization as a legal entity. Both the Articles and Lpuna 128 necessitate accurate information regarding the organization’s name and purpose.

- State Nonprofit Registration Form: Similar to the Lpuna 128, this form registers an organization with the state and outlines its operational parameters. They both require information on governance and structure.

- Bylaws Document: Bylaws govern the internal workings of an organization, much like the Lpuna 128 which collects information on its structure and operations. Both documents inform stakeholders about governance processes.

- Charitable Trust Registration: This document is for organizations seeking to operate as a charitable trust. Both forms demand clarity about the philanthropic intent and operational structure.

- Annual State Association Report: This form maintains a nonprofit's active status with the state, similar to the registration process outlined in the Lpuna 128. Both require annual updates regarding operational changes.

- LLC Registration Form (for Nonprofits): Some nonprofits operate as limited liability companies. This form shares a similar registration purpose to Lpuna 128, establishing the nonprofit’s legal status.

- Federal Employer Identification Number (EIN) Form: This document is crucial for identifying a nonprofit for tax purposes, just like the Lpuna 128 which registers the organization’s operational identity.

- Statement of Information: Often required for active nonprofits, this document provides updated information to the state, similar to what is collected in the Lpuna 128 form.

Dos and Don'ts

When it comes to filling out the Non Profit Lpuna 128 form, careful attention is necessary. Following best practices can help ensure smooth processing. Here are a few crucial dos and don'ts:

- Do read the instructions thoroughly before starting the form.

- Do ensure that all required fields are completed accurately, including names and addresses.

- Do double-check your signature and title; this is vital for validation.

- Do include the correct filing fee based on the boxes checked, as specified.

- Don't leave any required fields blank, as this may delay processing.

- Don't forget to include optional fees for copies and certifications if needed.

- Don't submit the form without a proper mailing address for correspondence.

- Don't ignore the submission cover sheet instructions; they are essential for effective communication.

Pay attention to these tips. The result could save time and ensure your form is processed without unnecessary hitches.

Misconceptions

Misconceptions about the Non Profit Lpuna 128 form can lead to confusion and delays. Understanding these common myths is crucial for a smooth registration process.

- Misconception #1: The Non Profit Lpuna 128 form is only for large organizations.

- Misconception #2: There is no fee associated with submitting this form.

- Misconception #3: The form requires extensive legal knowledge to complete.

- Misconception #4: Processing takes a long time.

This form is designed for all types of unincorporated nonprofit associations, including small community groups and local charities. Size does not dictate eligibility; any nonprofit can utilize this form.

Each box checked on the form incurs a filing fee of $10. This fee is necessary for processing the application, so be sure to include it when submitting your form.

While legal matters can be complex, the Lpuna 128 form is straightforward. Clear instructions guide users through each section, making it accessible to individuals without legal expertise.

The standard processing time is approximately 5 business days from receipt. For most applicants, this is a relatively quick turnaround. Regular updates on processing times are available on the Secretary of State's website.

Key takeaways

- Understand the Purpose: The Non Profit Lpuna 128 form is essential for registering unincorporated nonprofit associations in California.

- Filing Location: All completed forms must be mailed to the Secretary of State's Document Filing Support Unit in Sacramento.

- Filing Fee: There is a fee of $10.00 for each box checked on the form. Ensure payment accompanies your submission.

- Types of Registration: The form covers different registration types, including name, insignia, alteration, and cancellation.

- Accurate Information: Provide a complete and accurate description of the association and its insignia. This ensures smooth processing.

- Signature Requirement: The form must be signed by a chief officer of the association. An additional officer's signature is optional.

- Submission Timeframe: Expect a processing period of approximately 5 business days from receipt for your submission.

- Optional Fees: If you need copies or certifications of filed documents, include the appropriate fees as indicated in the instructions.

- Contact Information: It’s important to provide accurate contact details for communications regarding your submission.

Browse Other Templates

Pto/sb/16 - It serves as an invitation for the U.S. Patent and Trademark Office to review your application.

The Meeting App - Each meeting attended provides an opportunity for support and recovery within AA.