Fill Out Your Notice Of Right To Cure Auto Loan Letter Form

The Notice of Right to Cure Auto Loan Letter is an essential document that helps borrowers understand their options when facing a default on an auto loan. This letter is issued when a borrower has not made a payment for at least ten days. It outlines the specifics of the default, as well as the required payment amount to remedy the situation. The borrower is given a 20-day window to make a payment and rectify the default. Additionally, the letter highlights the implications of failing to cure the default, such as potential cancellation of credit insurance. It is a critical notice that not only informs about the current status of the loan but also serves as a reminder of the responsibilities that come with borrowing. Should further issues arise, the lender retains the right to proceed without sending another notice. Clarity is key, as borrowers are encouraged to reach out with any questions they may have regarding this important matter.

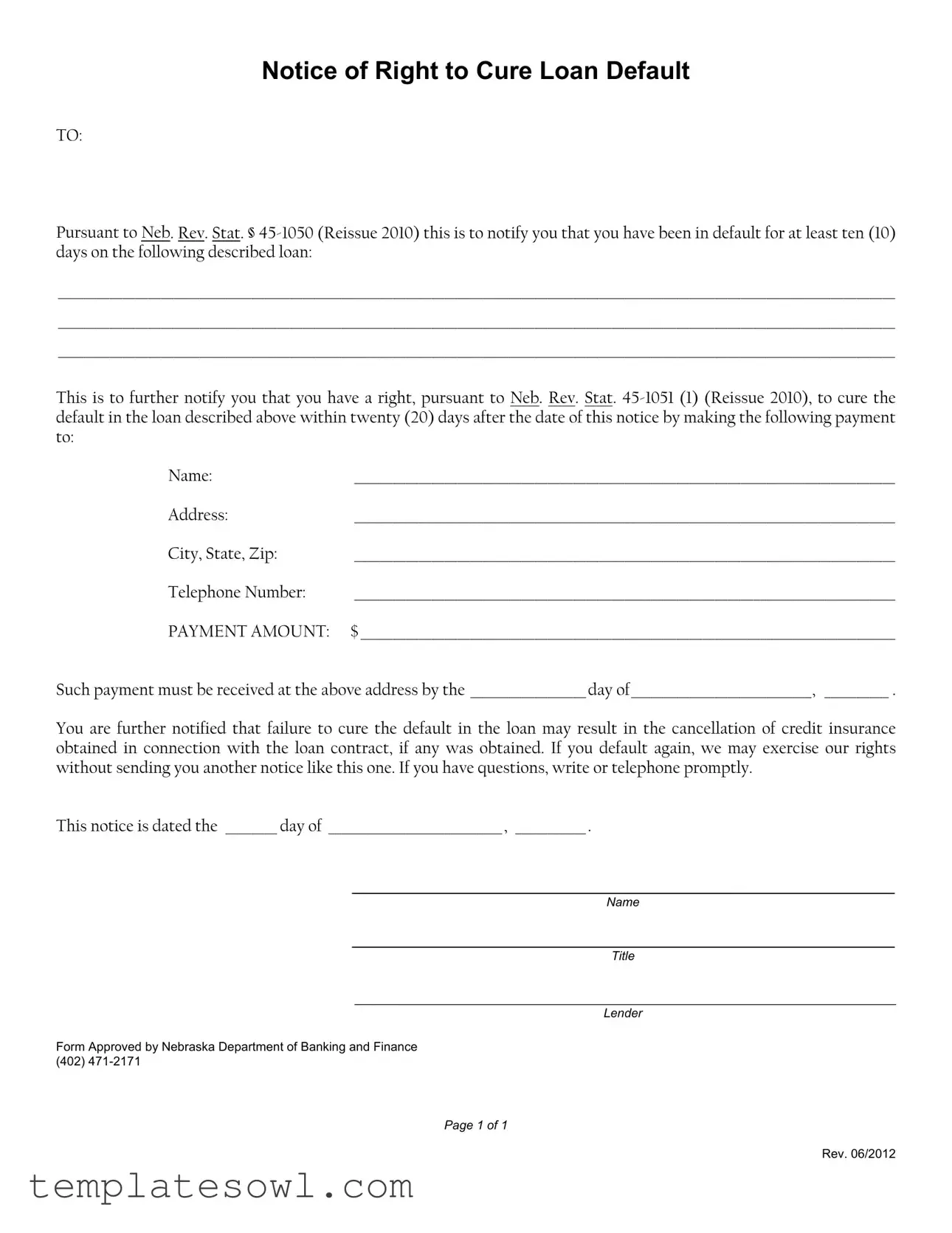

Notice Of Right To Cure Auto Loan Letter Example

Notice of Right to Cure Loan Default

TO:

Pursuant to Neb. Rev. Stat. §

__________________________________________________________________________________________________________________________________

__________________________________________________________________________________________________________________________________

__________________________________________________________________________________________________________________________________

This is to further notify you that you have a right, pursuant to Neb. Rev. Stat.

Name: |

____________________________________________________________________________________ |

Address: |

____________________________________________________________________________________ |

City, State, Zip: |

____________________________________________________________________________________ |

Telephone Number: |

____________________________________________________________________________________ |

PAYMENT AMOUNT: |

$ ___________________________________________________________________________________ |

Such payment must be received at the above address by the __________________ day of____________________________, __________ .

You are further notified that failure to cure the default in the loan may result in the cancellation of credit insurance obtained in connection with the loan contract, if any was obtained. If you default again, we may exercise our rights without sending you another notice like this one. If you have questions, write or telephone promptly.

This notice is dated the ________ day of ___________________________, ___________ .

_________________________________________________________

Name

_________________________________________________________

Title

__________________________________________________________

Lender

Form Approved by Nebraska Department of Banking and Finance (402)

Page 1 of 1

Rev. 06/2012

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | This form notifies a borrower of a loan default and their right to cure it. |

| Legal Basis | The form is governed by Neb. Rev. Stat. § 45-1050 and § 45-1051 (Reissue 2010). |

| Time Frame | Borrowers have 20 days to cure the default after receiving the notice. |

| Payment Requirement | A specific payment amount must be made to avoid further action. |

| Consequences of Default | If the default is not cured, credit insurance may be canceled and rights may be exercised without another notice. |

| Contact Information | Borrowers are encouraged to reach out with questions via writing or telephone. |

Guidelines on Utilizing Notice Of Right To Cure Auto Loan Letter

Once you have the Notice Of Right To Cure Auto Loan Letter form ready, it's time to fill it out accurately. Completing this form correctly will ensure that all necessary details are included, facilitating the process of curing your loan default. Follow the steps below to ensure you fill out the form correctly.

- At the top of the form, denote the recipient by entering the name of the individual or entity you are notifying.

- In the subsequent section, describe the loan that is in default. Be specific. Include details such as the loan number and any relevant identifiers.

- Indicate the lender's name by filling in the designated line for the lender’s name.

- Next, provide the address of the lender. This should include street address, city, state, and zip code.

- Fill in the lender's telephone number for any potential follow-up questions.

- Specify the payment amount required to cure the default. This should be clearly stated in a dollar amount.

- Indicate the exact date by which the payment must be received. Ensure it is a 20-day deadline from the notice's date.

- Complete the date section at the bottom of the notice, providing the exact day, month, and year when you are filling out the form.

- Finally, sign the document where indicated. Include your name and title, verifying your authority to send this notice.

What You Should Know About This Form

What is the Notice of Right to Cure Auto Loan Letter?

The Notice of Right to Cure Auto Loan Letter is a formal notification to borrowers that they have fallen behind on their auto loan payments. This letter informs the borrower of their right to rectify the default within a specific period. It outlines the necessary steps to make the payment and avoid further consequences, such as potential cancellation of credit insurance.

How long do I have to cure my loan default?

You have a total of twenty (20) days to cure your loan default once you receive this notice. It is crucial to ensure that your payment arrives at the specified address by the deadline indicated in the notice. Prompt action can prevent additional negative impacts on your credit and financial standing.

What happens if I do not cure the default within the given time?

If you fail to cure the default within the specified twenty days, there may be significant consequences. These could include the cancellation of any credit insurance associated with your loan. Additionally, if you default again in the future, the lender may take further actions without issuing another notice, which could lead to increased financial complications.

What should I do if I have questions about the notice?

If you have questions about the Notice of Right to Cure, it is advisable to contact the lender promptly. You can either write a letter or call the telephone number provided in the notice. Addressing your concerns quickly can help clarify your options and guide you on the best course of action.

Is this notice mandatory for all loan defaults?

This notice is required under Nebraska state law and is meant to inform borrowers of their rights specifically in the event of a loan default. If you have received this notice, it indicates that you are eligible to rectify the situation and are being made aware of your options within a legal framework.

What information do I need to include in my payment to cure the default?

To cure the default, you will need to make the payment as specified in the notice. Ensure that the amount and the payment are sent to the address given in the notice. Include all required identification details as per your loan documentation, and make sure the payment is sent well before the deadline to ensure timely processing.

Common mistakes

When completing the Notice Of Right To Cure Auto Loan Letter, people often encounter several common mistakes that can hinder the effectiveness of their submission. One prevalent error is omitting crucial information from the form. Many fail to provide complete details about the loan, such as the loan amount, account number, or specific terms. This omission can lead to delays in processing and confusion for both the lender and the borrower.

Another mistake is incorrectly calculating the payment amount. Individuals sometimes misinterpret the total due and either underpay or overpay. This can complicate matters further, especially if the lender does not have clear instructions on how to rectify the situation. Precision in filling out this section is paramount.

Many borrowers neglect to check the deadlines outlined in the notice. The form specifies a twenty-day period to cure the default. Missing this deadline can result in immediate consequences, including the potential loss of any grace period to address the situation. Time is of the essence, and awareness of the due dates is critical.

Failing to sign and date the notice is a frequent oversight. Some individuals assume an electronic submission suffices without a physical signature. However, a lack of both signature and date may render the document invalid, leading to further complications in the resolution of the loan default.

Inaccurately filling out the lender’s name or address poses another significant problem. Borrowers sometimes confuse their lender’s contact information with another institution. This mistake can result in the notice being sent to the wrong location, contributing to delays in communication and resolution.

People often overlook the importance of providing clear and accurate contact information. If the lender cannot reach the borrower due to incorrect phone numbers or addresses, it may complicate the process of addressing the default. Providing accurate details is essential for seamless communication.

Many individuals fail to keep a copy of the notice for their records. Keeping this documentation is important not only for tracking purposes but also for future reference. A copy serves as evidence that the borrower fulfilled their obligation to notify the lender.

Relying on informal methods of communication can also be problematic. Rather than following the formalities outlined in the notice, some borrowers choose to make phone calls or send emails instead. However, adhering to the structured process delineated in the notice ensures that all actions are documented appropriately.

Finally, borrowers often rush to fill out the notice without fully understanding their rights. It’s crucial to read and comprehend the provisions under applicable statutes to ensure informed actions. Understanding one's rights can significantly impact the outcome and protect their interests.

Documents used along the form

The Notice of Right to Cure Auto Loan Letter is a critical document used when a borrower is in default on an auto loan. Several other forms and documents often accompany this letter to ensure compliance and clarity throughout the process. Below is a list of these documents, along with a brief description of each.

- Loan Agreement: This document outlines the terms and conditions agreed upon by the lender and borrower at the onset of the loan. It includes details such as the loan amount, interest rate, repayment schedule, and collateral information.

- Payment History Statement: This statement provides a detailed account of all payments made on the loan. It helps both parties to see what has been paid and what remains outstanding.

- Default Letter: A default letter formally notifies the borrower that they have missed payments. It typically includes a summary of the missed payments and any potential consequences for continued default.

- Credit Counseling Documentation: Should the borrower seek assistance, this document shows their engagement with credit counseling services. It may include service records or action plans proposed to manage their debts.

- Payment Plan Agreement: If a borrower and lender agree to a new arrangement, this document details the revised payment terms to avoid further default. It may include altered payment amounts, due dates, and duration of the plan.

- Right to Cure Affidavit: This legal declaration affirms that the lender has informed the borrower of their right to cure the loan default, fulfilling the requirements of notice compliance.

- Loan Modification Request Form: In certain situations, borrowers may request changes to their loan terms. This form outlines the specifics of the requested modifications, such as new interest rates or extended repayment periods.

- Cancellation Notice for Credit Insurance: If applicable, this notice informs the borrower of the cancellation of any credit insurance tied to the loan. It specifies why and when the cancellation is effective.

- Collection Agency Notification: If the account is transferred to a collection agency, this document eliminates confusion by notifying the borrower that all communications should now go through the agency.

These documents together support the orderly management of loan defaults and help ensure borrowers are fully informed of their rights and obligations throughout the process.

Similar forms

-

Notice of Default Letter: This document serves as a formal notification that a borrower has failed to meet the terms of the loan agreement. It typically outlines the period of default and provides information on how to remedy the situation, similar to the Notice of Right to Cure Auto Loan Letter.

-

Demand Letter: A demand letter requests payment of a debt or compliance with a contractual obligation. Like the Notice of Right to Cure, it sets a time frame for the debtor to rectify the situation, often warning of potential legal action if ignored.

-

Notice of Intent to Foreclose: This document alerts a borrower that the lender intends to initiate foreclosure proceedings due to default. Both notices communicate the seriousness of the borrower's situation, while providing a final opportunity to address the default.

-

Right to Reinstate Letter: Similar to the Notice of Right to Cure, this letter informs the borrower of their right to reinstate the loan after a default. It outlines what payments need to be made and emphasizes the requirement to act within a specific timeframe.

-

Collection Letter: A collection letter is sent to remind the borrower of their overdue debt. It often provides details on how to resolve the outstanding balance and, like the Notice of Right to Cure, encourages the borrower to act promptly to avoid further consequences.

Dos and Don'ts

When filling out the Notice Of Right To Cure Auto Loan Letter form, it’s important to follow certain guidelines. Here are six things to do and not do to ensure your form is completed correctly:

- Do read the entire form carefully before filling it out.

- Do clearly write any personal and loan-specific information.

- Do make sure to provide an accurate payment amount and deadline.

- Do keep a copy of the completed form for your records.

- Don't rush through the form; take your time to avoid mistakes.

- Don't ignore the notice; respond within the given timeframe to prevent further issues.

Misconceptions

Understanding your rights and responsibilities regarding auto loans can be challenging. One common document that borrowers encounter is the Notice Of Right To Cure Auto Loan Letter. However, several misconceptions about this form exist. Here are some of the most prevalent misunderstandings, followed by clarifications to help you navigate the process.

- This letter is a final notice. Many believe that receiving this notice means that it’s too late to address the default. In reality, it serves as a warning and gives borrowers a chance to rectify the situation.

- You can ignore the letter. Ignoring the letter can lead to severe consequences, including repossession of your vehicle. It is essential to take this notice seriously and respond promptly.

- The right to cure is indefinite. Some people think that the right to cure the default lasts as long as they need. In fact, the law specifies a strict time frame, typically 20 days, to make the required payment.

- Once you cure the default, you're in the clear. While curing the default may halt immediate collection actions, it does not guarantee immunity from future defaults. Maintain diligent payment practices to avoid repeating the situation.

- This notice is only sent if you have received multiple notices. The Notice Of Right To Cure is issued after only one instance of default lasting at least ten days. It doesn't require prior notifications.

- The payment required is negotiable. The amount specified in the notice relates directly to the default and must be paid as stated. It’s not something you can negotiate without the lender’s agreement.

- If you cure the default, you won’t face any repercussions. While curing the default can stabilize your situation, it may not prevent the lender from reporting the delinquent payment to credit agencies, which can impact your credit score.

- This notice is only relevant if you want to keep the car. Even if you are considering surrendering the vehicle, understanding this notice is crucial. It lays out your rights and the obligation regarding the loan, irrespective of your decision.

Being clear about your rights and obligations can help you navigate your loan and avoid unnecessary complications. If you receive a Notice Of Right To Cure Auto Loan Letter, paying attention to its content is vital. Educate yourself, take appropriate action, and consider consulting a financial advisor if needed.

Key takeaways

Understanding the Notice of Right to Cure Auto Loan Letter is crucial for those involved in auto loans. Here are key takeaways to consider when filling out and using this form:

- Timeliness is Key: You must act within the specified time frames. If you have been in default for over ten days, you have a limited window to address the issue.

- Required Information: When filling out the form, ensure you accurately complete all sections, including the loan details and your personal information.

- Know Your Rights: This letter informs you of your legal right to cure a default within twenty days. Use this opportunity wisely to regain control of your loan.

- Payment Details: Clearly state the payment amount needing to be made. This ensures no ambiguity in your effort to rectify the situation.

- Keep Records: Retain copies of this notice and any communications regarding the payment or loan status. Documentation can be vital in future discussions.

- Address Accuracy: Confirm the name and address where payment should be sent to avoid delays that could lead to further issues.

- Understand Consequences: Be aware that failing to cure the default could result in the cancellation of any credit insurance linked to your loan.

- Future Defaults: If a future default occurs, the lender may not be required to send additional notices. Stay vigilant to avoid potential complications.

- Contact Information: Should questions arise, utilize the provided contact information to communicate with your lender promptly.

By keeping these points in mind, borrowers can navigate the complexities of the auto loan ecosystem more effectively.

Browse Other Templates

Record of Employment Bc - It's critical for employers to understand the deadlines for issuing an ROE after an employee leaves.

California Proposition 47 - There are fewer resources needed for lower-level misdemeanor cases in court systems.