Fill Out Your Notice Owner Florida Form

In the realm of construction and property management in Florida, communication between the property owner and contractors is crucial to preventing disputes and financial liabilities. A vital document in this process is the Notice to Owner / Notice to Contractor form. This form serves as a formal notification from claimants to various involved parties, such as property owners, contractors, and construction lenders, detailing the services provided at a specific property. Importantly, it highlights the financial obligations tied to construction projects, stressing the potential for liens against the property if payments are not managed properly. Accurately filled out, the form includes crucial information such as the names and addresses of all parties involved, legal descriptions of the property, and a detailed account of the labor and materials supplied. It further serves as a warning to property owners of Florida’s construction lien laws, which can hold them financially responsible even after they have fully compensated their contractor. Understanding the implications of this form is essential, as it not only protects the rights of those who provide labor and materials but also safeguards property owners from the risk of double payment for services rendered.

Notice Owner Florida Example

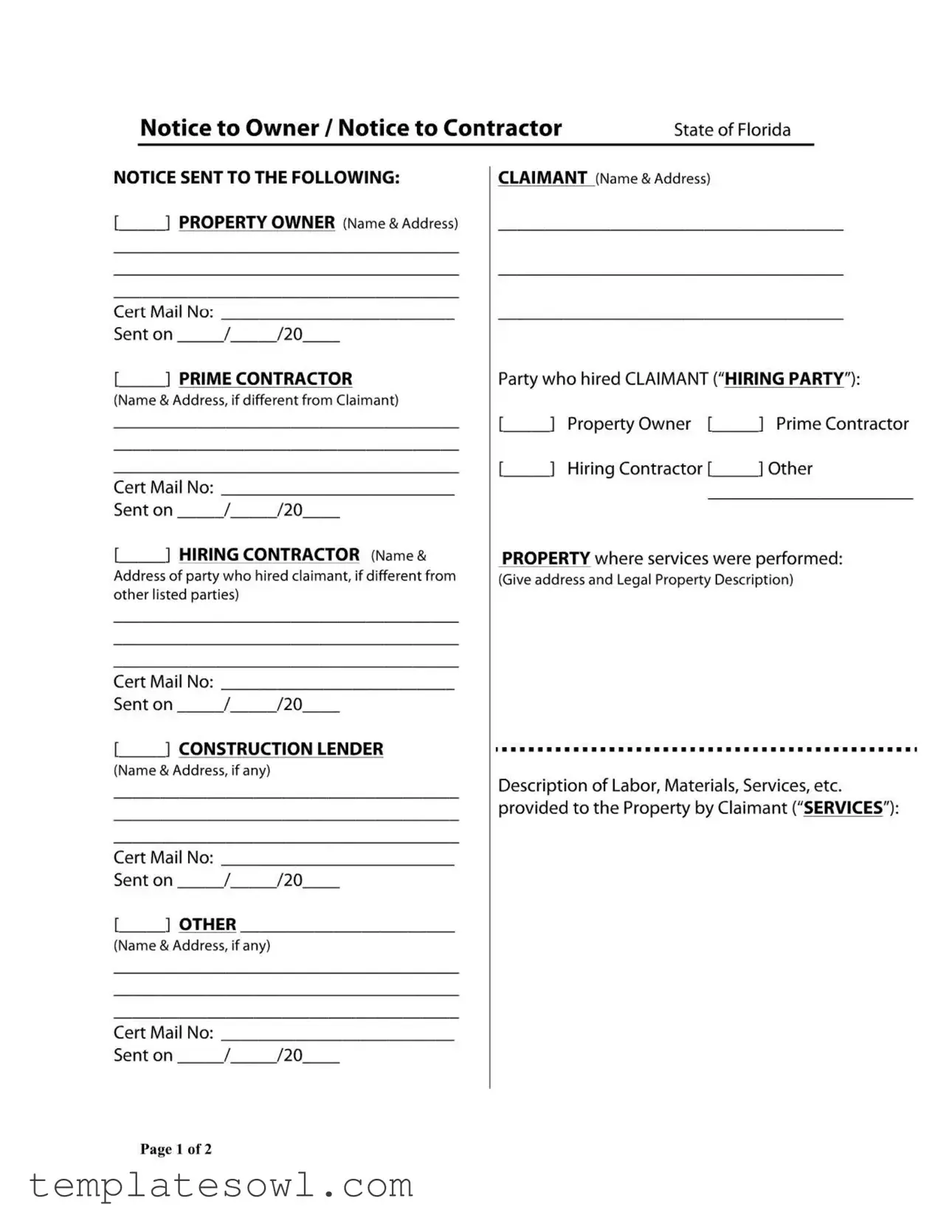

Notice to Owner/ Notice to Contractor |

State of Florida |

NOTICE SENT TO THE FOLLOWING:

~_ _,) PROPERTY OWNER (Name & Address)

Cert Mail No: ___________

Sent on __!__!20

..__..) PRIME CONTRACTOR

(Name & Address, if different from Claimant)

Cert Mail No: ___________

Senton __/__/20__

..__..) HIRING CONTRACTOR (Name &

Address of party who hired claimant, if different from other listed parties)

Cert Mail No:

Senton __/ __/20__

..__..) CONSTRUCTION LENDER

(Name & Address, if any)

Cert Mail No:

Sent on __/__/20__

~_ _,] OTHER __________

(Name & Address, if any)

CLAIMANT (Name & Address)

Party who hired CLAIMANT ("HIRING PARTY"):

Property Owner .__[_ __,) Prime Contractor

Hiring Contractor.__[_ __,) Other

PROPERTY where services were performed:

(Give address and Legal Property Description)

..........•.•.... |

• |

• |

• |

• |

Description of Labor, Materials, Services, et c. provided to t he Property by Claimant ("SERVICES"):

Cert Mail No:

Sent on __/__/20__

Page 1 of2

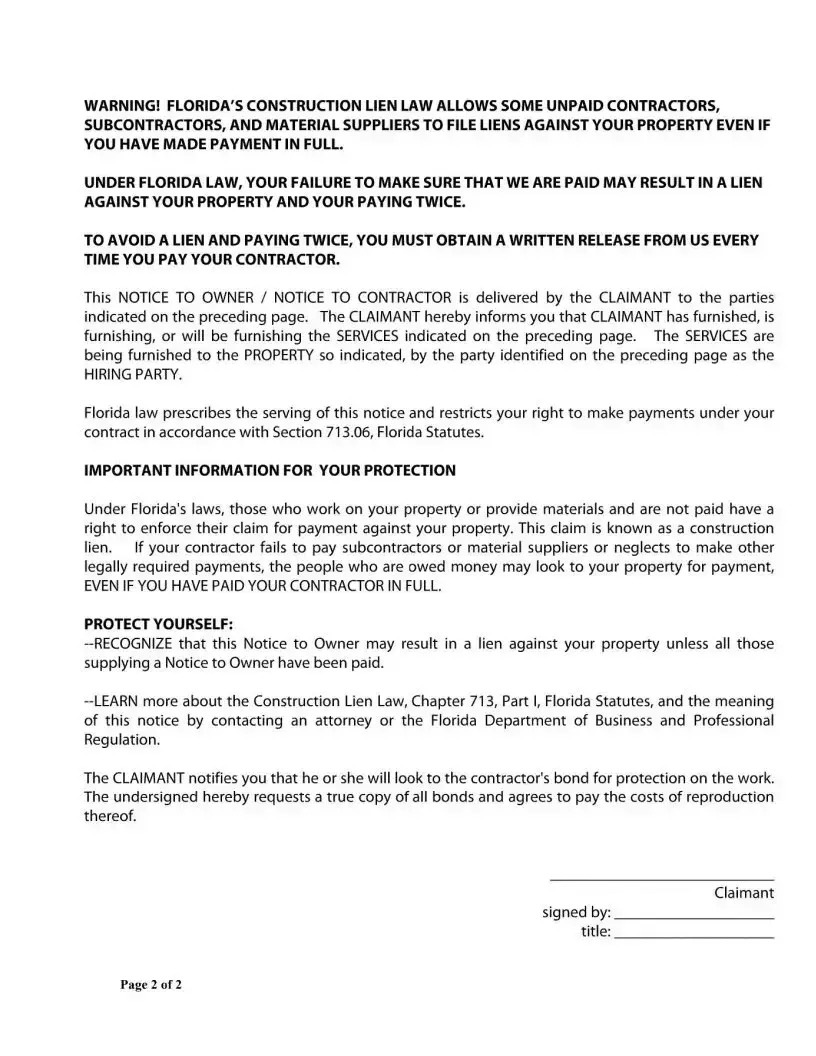

WARNING! FLORIDA'SCONSTRUCTION LIEN LAW ALLOWS SOME UNPAID CONTRACTORS, SUBCONTRACTORS, AND MATERIAL SUPPLIERS TO FILE LIENS AGAINST YOUR PROPERTY EVEN IF YOU HAVE MADE PAYMENT IN FULL.

UNDER FLORIDA LAW, YOUR FAILURE TO MAKE SURE THAT WE ARE PAID MAY RESULT IN A LIEN AGAINST YOUR PROPERTY AND YOUR PAYING TWICE.

TO AVOID A LIEN AND PAYING TWICE, YOU MUST OBTAIN A WRITTEN RELEASE FROM US EVERY TIME YOU PAY YOUR CONTRACTOR.

This NOTICE TO OWNER / NOTICE TO CONTRACTOR is delivered by the CLAIMANT to the parties indicated on the preceding page. The CLAIMANT hereby informs you that CLAIMANT has furnished, is furnishing, or will be furnishing the SERVICES indicated on the preceding page. The SERVICES are being furnished to the PROPERTY so indicated, by the party identified on the preceding page as the

HIRING PARTY.

Florida law prescribes the serving of this notice and restricts your right to make payments under your contract in accordance with Section 713.06, Florida Statutes.

IMPORTANT INFORMATION FOR YOUR PROTECTION

Under Florida'slaws, those who work on your property or provide materials and are not paid have a right to enforce their claim for payment against your property. This claim is known as a construction lien. If your contractor fails to pay subcontractors or material suppliers or neglects to make other legally required payments, the people who are owed money may look to your property for payment,

EVEN IF YOU HAVE PAID YOUR CONTRACTOR IN FULL.

PROTECT YOURSELF:

The CLAIMANT notifies you that he or she will look to the contractor'sbond for protection on the work. The undersigned hereby requests a true copy of all bonds and agrees to pay the costs of reproduction thereof.

Claimant

signed by: ________

title:

Page 2 of2

Form Characteristics

| Fact Name | Fact Description |

|---|---|

| Purpose | The Notice to Owner (NTO) alerts property owners and contractors of services rendered or materials supplied. |

| Requirement | Florida law requires the NTO to be sent to property owners and contractors to protect lien rights. |

| Governing Law | This form is governed by the Florida Construction Lien Law, specifically Section 713.06, Florida Statutes. |

| Certified Mail | The form must be sent via certified mail to establish proof of delivery to all parties listed. |

| Parties Involved | The NTO includes details of the property owner, prime contractor, hiring contractor, and construction lender. |

| Protection Against Liens | Property owners risk a lien on their property if unpaid contractors or subcontractors have not been compensated. |

| Written Release | To avoid double payment, property owners should obtain a written release from contractors whenever a payment is made. |

| Claim Filing | Subcontractors and suppliers can file a construction lien against the property in case of non-payment. |

| Obtaining Bonds | The claimant may request a true copy of all bonds related to the project for additional protection. |

| Legal Consultation | To understand the implications of this notice, property owners are advised to consult an attorney or the Florida Department of Business and Professional Regulation. |

Guidelines on Utilizing Notice Owner Florida

After completing the Notice to Owner form, it should be sent to all relevant parties to ensure compliance with Florida's construction lien laws. This helps protect against potential liens on your property and ensures all parties involved are informed. Follow these steps to fill out the form correctly.

- Enter the property owner's name and address in the designated space.

- Complete the certified mail number field and the date sent for the property owner.

- If there is a prime contractor (different from the claimant), fill in their name and address.

- Include the certified mail number and the date sent for the prime contractor.

- For the hiring contractor, provide their name and address, if applicable.

- Fill in the certified mail number and date sent for the hiring contractor.

- If there's a construction lender, add their name and address in the respective section.

- Complete the certified mail number and date sent for the construction lender.

- Specify any other parties involved, including their name and address.

- Enter the claimant's name and address in the appropriate area.

- Identify the hiring party related to the claimant. This could be the property owner, prime contractor, hiring contractor, or others as applicable.

- In the designated area, provide the property address and the legal property description for where services were performed.

- Describe the labor, materials, and services provided to the property.

- Fill in the certified mail number and the date sent concerning the services provided.

- In the last section, ensure the claimant signs and indicates their title.

What You Should Know About This Form

What is the purpose of the Notice to Owner form in Florida?

The Notice to Owner form serves a crucial function in Florida's construction industry. It officially informs property owners, contractors, and other interested parties that work or materials have been provided for a specific property. This notice is important because it helps protect contractors, subcontractors, and suppliers from non-payment. It also alerts property owners of their responsibilities under Florida law, particularly regarding potential liens on their property for unpaid work. By providing this notice, the contractor aims to ensure that all parties are aware of who is involved in the construction project and establishes a formal line of communication regarding financial responsibilities.

Who needs to receive the Notice to Owner?

The Notice to Owner must be sent to several key parties involved in the construction process. This includes the property owner, the prime contractor (if there is one), the hiring contractor, and sometimes the construction lender. Each of these individuals or entities plays an important role in the construction project, and keeping them informed through this notice is vital. Additionally, any other parties that may be relevant to the construction work or financing of the property should also receive the notice to ensure comprehensive coverage of all interested parties.

What are the consequences of not sending a Notice to Owner?

If a contractor or subcontractor fails to send the Notice to Owner, they may lose significant legal rights and protections. Specifically, they might forfeit their ability to file a construction lien against the property for unpaid services or materials. This means that if a contractor has not been paid for their work, and they did not issue the notice, they may be unable to seek recovery directly from the property owner. It is crucial for anyone involved in construction work to send this notice promptly to ensure their ability to claim payment rights later on.

How can property owners protect themselves against potential liens?

Property owners can take a few steps to shield themselves from possible construction liens. First, they should always request and acquire a written release from contractors after payments are made. This release serves as proof that the contractor has compensated any subcontractors or suppliers associated with the project. Additionally, owners should consider verifying whether the contractors have the necessary licenses and bonds in place. Educating themselves about the Construction Lien Law and consulting with an attorney can also help property owners navigate these complexities and understand their rights and obligations better.

What should a contractor do after sending the Notice to Owner?

After sending the Notice to Owner, a contractor should keep track of all payments made and request receipts or releases from the property owner. It is also advisable to maintain open communication with all parties involved throughout the duration of the project. If payments become delayed, the contractor may want to follow up to remind the property owner of their obligations. Additionally, if payment issues arise, keeping accurate records of communications and agreements is beneficial should any formal dispute resolution be necessary in the future. Lastly, staying informed about relevant laws and any changes to the Construction Lien Law is critical for effective navigation of the construction landscape in Florida.

Common mistakes

Filling out the Notice Owner Florida form is a critical step in ensuring that everyone involved in a construction project is protected from potential payment issues. However, several mistakes often occur during this process. Identifying and avoiding these pitfalls can save you time, money, and stress. Here are six common mistakes people make when completing this important document.

One significant mistake is failing to include accurate names and addresses. The form requires precise information about all parties involved. Missing or incorrect details can cause delays or invalidate the notice altogether. Always double-check the spelling of names and verify the addresses for all parties: the owner, contractors, and suppliers.

Another frequent error is neglecting to provide a legal property description. Merely writing an address is insufficient. The form should include a detailed description of the property where the services were performed. This description helps to clearly identify the property in question and prevents confusion later.

A third mistake is not sending the notice via certified mail. Certified mail serves as proof that the notice was sent and received. It’s essential to keep records of the mailing process, including tracking numbers and receipts. Many overlook this step, which can lead to disputes over whether the notice was properly delivered.

Some individuals also mistakenly assume that the notice can be sent at any time. Florida law has specific timelines for sending the Notice to Owner, typically required within 45 days of the first work performed or materials supplied. Missing this deadline can impact your legal rights, so be conscious of the timing.

The fifth mistake often made is underestimating the importance of obtaining a written release after payment. Many people think that paying their contractor is enough. However, to fully protect yourself, ensure you receive a written release from the contractor after each payment. Without this release, you may be at risk of paying twice.

Lastly, failing to keep copies of all documents related to the notice can create significant problems down the line. Organizing and retaining copies of the Notice to Owner, certified mail receipts, and any correspondence with contractors is crucial. This documentation serves as valuable evidence should any disputes arise in the future.

By being mindful of these common mistakes and taking the necessary precautions, you can successfully navigate the completion of the Notice Owner Florida form. Being diligent in this process will ultimately safeguard your property and financial interests.

Documents used along the form

The Notice to Owner form serves as an important document in Florida's construction lien process, ensuring that property owners are informed about unpaid claims against their property. However, several additional documents complement this form, helping all parties navigate the complexities of construction-related payments and obligations.

- Claim of Lien: This document is filed by contractors, subcontractors, or suppliers when they are not paid for their services or materials provided. It formally asserts a right to payment and places a lien against the property, which can complicate future transactions or sales of the property.

- Release of Lien: This document is produced when a claimant receives payment for services rendered. It serves as a confirmation that the claimant waives their right to enforce the lien against the property, thereby providing security for the property owner that no further claims will arise from the paid debt.

- Construction Contract: This is the foundational agreement between the property owner and the contractor. It outlines the scope of work, payment terms, and responsibilities of each party. A well-drafted contract is essential for minimizing disputes and ensuring compliance with the law.

- Subcontractor Agreement: This document is used when a contractor hires subcontractors to perform part of the construction work. It defines the roles, responsibilities, and payment terms for the subcontractors, ensuring clarity and legal protection for the primary contractor.

Understanding these documents is crucial for protecting the rights of all parties involved in a construction project. Proper management and timely execution of these forms can prevent disputes and ensure compliance with Florida's construction lien laws.

Similar forms

The Notice to Owner Florida form bears similarities to several other documents related to construction and payment processes. Each of these documents serves a specific purpose in protecting the rights of those involved in construction projects, particularly contractors and property owners. Below is a list of nine documents that are related to the Notice Owner Florida form, along with explanations of how they are similar:

- Notice of Intent to Lien: This document is sent by contractors or suppliers before filing a lien. Like the Notice to Owner, it aims to inform the property owner of potential claims against their property due to unpaid services.

- Claim of Lien: This document is filed after a contractor or supplier has not received payment. It formally places a lien on the property, similar to how the Notice to Owner alerts the property owner of potential claims.

- Release of Lien: This document is issued when a contractor is paid, clearing any claims against the property. It serves a purpose similar to the Notice to Owner by indicating that financial obligations have been satisfied, thus protecting property owners.

- Construction Contract: This agreement outlines the terms between the property owner and the contractor. Like the Notice to Owner, it establishes the expectations and responsibilities associated with payment and services rendered.

- Notice of Non-Payment: This document is used to inform property owners of non-payment issues. It shares the same purpose as the Notice to Owner by alerting property owners about potential liens due to unpaid contractors.

- Subcontractor's Lien Waiver: This is a document that subcontractors provide to waive their right to file a lien after payment. It complements the Notice to Owner by ensuring that property owners are aware of their payment obligations to avoid future claims.

- Supplier's Notice of Non-Payment: This document serves to notify property owners when suppliers are not paid by the contractor. Similar to the Notice to Owner, it emphasizes the importance of ensuring that all parties in the chain of payments are compensated.

- Affidavit of Payment: This document is often used to confirm that all subcontractors and suppliers have been paid for their work on a project. Like the Notice to Owner, it is a protective measure for property owners against potential liens.

- Change Order: This document records any changes to the original construction agreement and may affect compensation. Similar to the Notice to Owner, it highlights the complexity of construction services and the importance of clear communication regarding payments and responsibilities.

Understanding these documents can help property owners protect themselves from financial risks associated with construction projects. It is essential to acknowledge the interconnected nature of these forms to ensure that all parties are aware of their rights and obligations.

Dos and Don'ts

When completing the Notice to Owner form in Florida, it is essential to follow specific guidelines to ensure accuracy and compliance. Below is a list of actions to consider.

- DO use clear and legible handwriting or opt for typed entries to avoid confusion.

- DO ensure that all required names and addresses are filled out completely and accurately.

- DO confirm that you use the correct construction lender and claimant information, if applicable.

- DO double-check the dates on the form to ensure they are current and appropriately filled in.

- DO keep a copy of the completed form for your records.

- DON'T leave any required sections blank; incomplete forms may cause delays or issues.

- DON'T rush through the form; mistakes can lead to financial repercussions.

- DON'T forget to note all services provided and their corresponding dates.

- DON'T ignore the necessity of sending the notice within the timeline prescribed by law.

- DON'T underestimate the importance of understanding the implications of construction lien laws.

Misconceptions

There are several misconceptions surrounding the Notice to Owner form in Florida. Understanding these misconceptions can help property owners navigate the construction lien process more effectively.

- Misconception 1: The Notice to Owner is optional.

- Misconception 2: Sending a Notice to Owner guarantees payment.

- Misconception 3: Only the property owner can receive a Notice to Owner.

- Misconception 4: Paying the general contractor means all parties are paid.

- Misconception 5: The Notice to Owner form is the same for every construction project.

- Misconception 6: A construction lien can be filed at any time without notice.

In reality, this notice is a legal requirement in Florida for contractors and subcontractors who want to preserve their right to file a lien against a property. Failing to send this notice may jeopardize their ability to collect payment.

While the notice informs property owners of potential claims, it does not ensure that the contractor or subcontractor will be paid. Payment must still be arranged separately between the parties involved.

This notice can also be sent to other parties involved in the construction process, such as contractors, subcontractors, and lenders, making it a broader communication tool.

Property owners can still be liable for unpaid subcontractors or suppliers, even after fully paying the general contractor. It is advisable to ensure all parties have been compensated to avoid potential liens.

There are specific requirements for the Notice to Owner form based on the type of project and the parties involved. Each case may require careful attention to detail to ensure compliance with Florida law.

Florida law requires that a Notice to Owner be sent within a certain time frame after services or materials are provided. Failure to comply with these timelines can result in losing the right to file a lien.

Key takeaways

Understanding the Notice to Owner form is crucial for property owners in Florida to protect themselves from potential liens.

This form is sent to various parties involved in a construction project, including the property owner, prime contractor, hiring contractor, construction lender, and others as necessary.

Sending the notice via certified mail is essential. Each party should receive their copy, which establishes a formal record of communication.

Property owners must provide complete addresses and legal descriptions for the property listed in the form.

The Description of Labor, Materials, Services section requires clear and detailed information to avoid misunderstandings and confirm supplied services.

Florida law states that unpaid contractors and suppliers can file liens against property, even if the property owner has fully paid their contractor.

The notice serves as a warning: failure to ensure all parties are paid can lead to costly consequences, including the risk of paying twice.

To avoid liens, it’s critical to obtain a written release after making payments to contractors or suppliers.

Property owners are encouraged to learn more about Florida's Construction Lien Law, specifically Chapter 713, Part I, to fully understand their rights and obligations.

Consulting an attorney or the Florida Department of Business and Professional Regulation may provide valuable insights regarding these notices and construction liens.

Browse Other Templates

Mgccc - Make sure your email is valid for timely updates.

Crime Scene Reports - 3. Facilitates updates to the case as new information arises.