Fill Out Your Novitas Return Of Monies Form

The Novitas Return of Monies form plays a crucial role for healthcare providers navigating the refund process. This comprehensive form must be accurately completed and submitted alongside any unsolicited or voluntary refund checks to ensure that refunds are recorded and applied correctly. It requires key information such as the provider's name, address, Medicare ID, and details about the claims being refunded. Whether you're refunding one claim or multiple claims, this form helps streamline the process by compiling necessary data, including dates of service and reasons for adjustments. Specific codes are designated for various refund scenarios, simplifying the classification of errors or adjustments. Moreover, it covers essential information related to Medicare Secondary Payments (MSP), requiring documentation from primary insurers if applicable. It's important to note that failure to provide requested details can impact your appeal rights under this protocol. Keeping everything organized and compliant can save time and headaches down the line. A failure to follow the outlined instructions might delay or complicate the refund process significantly. Taking time to familiarize yourself with this form will ensure a smoother experience when addressing refunds and maintaining compliance.

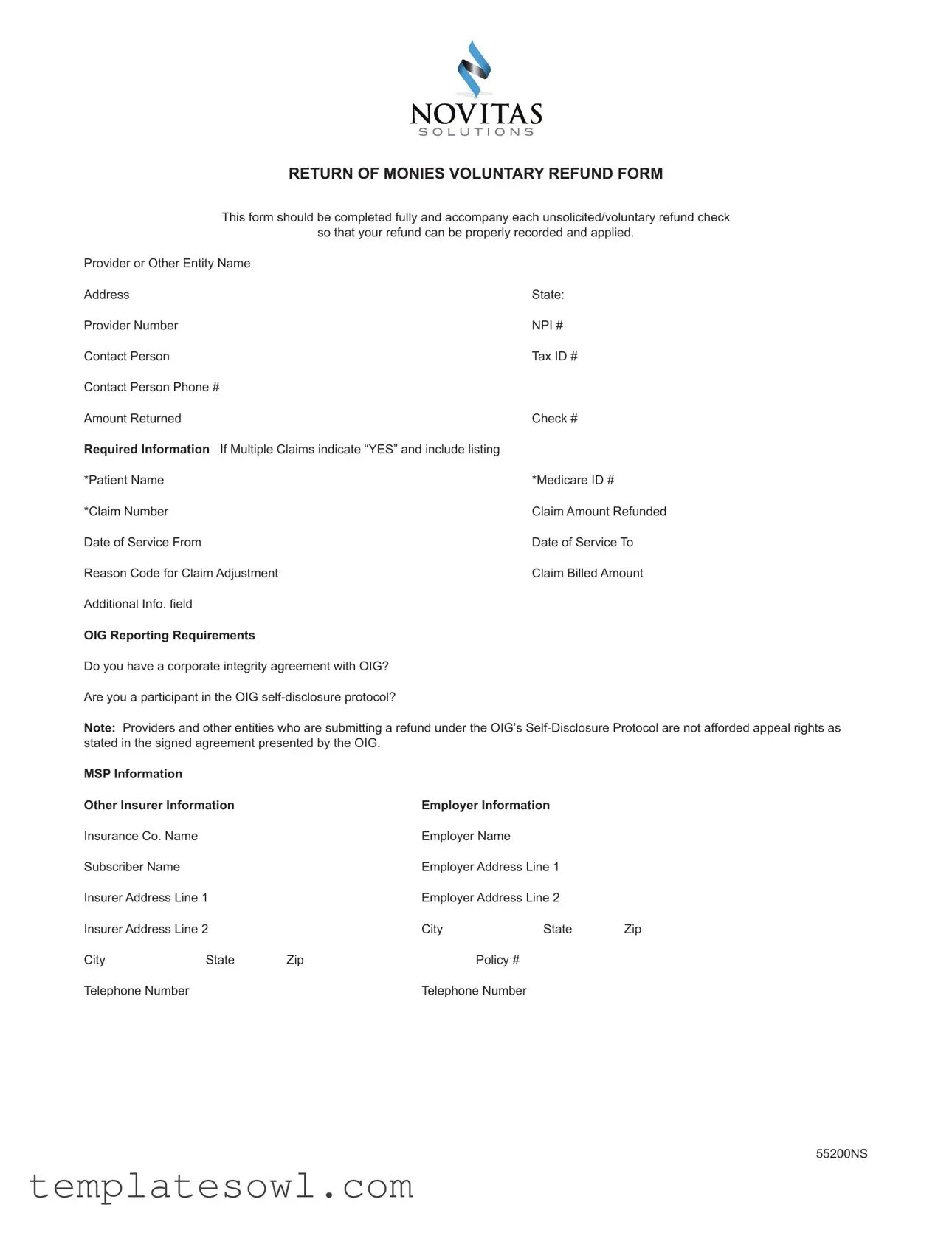

Novitas Return Of Monies Example

RETURN OF MONIES VOLUNTARY REFUND FORM

This form should be completed fully and accompany each unsolicited/voluntary refund check

so that your refund can be properly recorded and applied.

Provider or Other Entity Name |

|

Address |

State: |

Provider Number |

NPI # |

Contact Person |

Tax ID # |

Contact Person Phone # |

|

Amount Returned |

Check # |

Required Information If Multiple Claims indicate “YES” and include listing |

|

*Patient Name |

*Medicare ID # |

*Claim Number |

Claim Amount Refunded |

Date of Service From |

Date of Service To |

Reason Code for Claim Adjustment |

Claim Billed Amount |

Additional Info. field |

|

OIG Reporting Requirements |

|

Do you have a corporate integrity agreement with OIG?

Are you a participant in the OIG

Note: Providers and other entities who are submitting a refund under the OIG’s

MSP Information |

|

|

|

|

|

Other Insurer Information |

|

Employer Information |

|

||

Insurance Co. Name |

|

|

Employer Name |

|

|

Subscriber Name |

|

|

Employer Address Line 1 |

|

|

Insurer Address Line 1 |

|

Employer Address Line 2 |

|

||

Insurer Address Line 2 |

|

City |

State |

Zip |

|

City |

State |

Zip |

Policy # |

|

|

Telephone Number |

|

|

Telephone Number |

|

|

55200NS

Instructions

•For each claim the required fields to be completed on the form are noted with *. If the required fields for specific Patient/MBI &

Claim Numbers are not completed, NO appeal rights can be provided for this voluntary refund.

•Multiple Claims being refunded: If refunding multiple claims, list all claim numbers and the required data on separate forms if necessary.

•Medicare Secondary Payment (MSP) Refunds: Include a copy of the primary insurer’s explanation of benefit (EOB) & indicate the MSP reason (see Reason Code List Below)

•Statistical Sampling: If specific Beneficiary/MBI/Claims data is not available, indicate the methodology and formula used to determine the refund amount and explain the reason for the refund

Make check payable to Medicare Part A or Medicare Part B. Mail to Novitas Solutions CASHIER at Address listed below according to state services rendered:

State - LOB |

PO Box |

City |

State |

ZIP |

AR - B |

PO Box 3091 |

Mechanicsburg, |

PA |

|

LA |

PO Box 3090 |

Mechanicsburg, |

PA |

|

NJ - B |

PO Box 3034 |

Mechanicsburg, |

PA |

|

CO/NM/OK - B |

PO Box 3105 |

Mechanicsburg, |

PA |

|

MD - B |

PO Box 3404 |

Mechanicsburg, |

PA |

|

PA - B |

PO Box 3304 |

Mechanicsburg, |

PA |

|

DCMA/DE - B |

PO Box 3405 |

Mechanicsburg, |

PA |

|

MS - B |

PO Box 3128 |

Mechanicsburg, |

PA |

|

TX - B |

PO Box 3106 |

Mechanicsburg, |

PA |

|

AR/LA/MS - A |

PO Box 3103 |

Mechanicsburg, |

PA |

|

PA/NJ/DC/MD - A |

PO Box 3385 |

Mechanicsburg, |

PA |

|

DE - A |

PO Box 3417 |

Mechanicsburg, |

PA |

|

JL - Feb 2011 Transition - A |

PO Box 3122 |

Mechanicsburg, |

PA |

|

CO/NM/TX - A |

PO Box 3113 |

Mechanicsburg, |

PA |

|

OK - A |

PO Box 3114 |

Mechanicsburg, |

PA |

Reason Codes for each Claim Incorrect Payment (Required to Select One Reason code per refunded claim on Form):

|

|

01 - Corrected Date of Service |

Date Required |

02 - Duplicate |

|

03 - Corrected CPT Code Correct CPT Code Required |

|

04 - Not Our Patient |

|

05- Mod. Add/Remove |

|

06- Billed in Error |

|

MSP/Other Payer Involvement |

|

07- MSP Group Health Plan Insurance |

|

08- MSP No Fault Insurance |

Date of Incident Required |

09- MSP Liability Insurance |

Date of Incident Required |

10- MSP, Workers Comp (including Black Lung) Date of Incident Required |

|

Miscellaneous |

|

11- Veterans Administration |

|

12- Insufficient Data |

|

13- Patient Enroll HMO |

|

14- Svcs Not Rendered |

|

15- Medical Necessity |

|

16- Hospice |

|

Description Required |

|

55200NS

Provider or Other Entity Name – Provider/Physician/Supplier/Entity Name

Address - Provider/Physician/Supplier/Entity Address State – State services rendered in

Provider Number – Provider Transaction Access Number

NPI # - National Provider Identifier Number (10 digits)

Tax ID # - Provider Tax Identification Number

Contact Person – Name of person to contact if additional information is required Contact’s Phone # - Phone number of contact person if additional information is required Amount Returned – Total amount of voluntary refund check

Check # - Check number of voluntary refund check

Required Information – If returning Multiple Claims, indicate “YES” in box provided. Include listing of claims with Required Information with check.

Patient Name – Name of patient on claim for which money is being voluntarily returned (Required for Appeal rights)

Medicare ID # - Medicare Beneficiary Identification # on claim for which money is being voluntarily returned (Required for Appeal rights). Claim Number – Claim Number for which money is being voluntarily returned (Required for Appeal rights)

Claim Amount Refunded – Amount voluntarily returned for specific claim listed Date of Service From – Date services started for specific claim listed

Date of Service To – Date services ended for specific claim listed

Reason Code for Claim Adjustment – Select appropriate reason code listed under “Reason Codes for each Claim Incorrect Payment” Claim Billed Amount – Original Billed amount for specific claim listed

Additional Info. Field – To be populated when Reason Codes 01, 03, 08, 09, 10 or 17 are selected. OIG Reporting Requirements – Select Yes or No to each question.

MSP Information Other Insurer Information (Required if Reason Codes 08, 09 or 10 selected)

Insurance Co. Name – Name of Insurance Company that should have paid as primary.

Subscriber Name – Name of Subscriber to insurance that should have paid as primary.

Insurer Address – Address of Insurance Company that should have paid as primary

City/State/ZIP – City/State/ZIP of Insurance Company that should have paid as primary

Telephone Number – Telephone Number of Insurance Company that should have paid as primary

Employer Information (If Primary Insurance is Provided by Employer)

Employer Name - Name of employer that provided Primary Insurance

Employer Address - Address of employer that provided Primary Insurance

City/State/ZIP – City/State/ZIP of employer that provided Primary Insurance

Policy # - Policy # of Primary Insurance

Telephone Number - Telephone of employer that provided Primary Insurance

55200NS

Form Characteristics

| Fact Name | Fact Details |

|---|---|

| Purpose of the Form | This form is used to request the return of excess payments to Medicare. It helps ensure that refunds are properly recorded and applied. |

| Completion Requirement | All required fields must be filled out to ensure the refund is processed correctly. Missing information can lead to a lack of appeal rights for the refund. |

| Multiple Claims | If multiple claims are being refunded, you should indicate this on the form. Each claim's details will need to be provided, potentially requiring multiple forms. |

| OIG Reporting | If you have a corporate integrity agreement with the Office of Inspector General, you must disclose this on the form. Failure to do so may affect your refund process. |

| Mailing Instructions | The completed form and check must be mailed to the appropriate Novitas Solutions address based on the state where services were rendered. |

| Reason Codes | Each claim refund must include a reason code. These codes help categorize the nature of the refund and are essential for proper processing. |

Guidelines on Utilizing Novitas Return Of Monies

Completing the Novitas Return Of Monies form requires careful attention to detail. Ensuring that all necessary fields are filled out accurately will help facilitate the processing of your voluntary refund. Follow these steps to properly complete the form.

- Begin by entering the Provider or Other Entity Name at the top of the form.

- Fill in the Address, State, Provider Number, and NPI #.

- Include the Tax ID # and the name of the Contact Person.

- Provide the Contact Person Phone #.

- Enter the Amount Returned and the Check #.

- For required information about the claims, indicate if multiple claims are being refunded by checking “YES” and including separate documentation if necessary.

- Complete the details for each claim including Patient Name, Medicare ID #, Claim Number, Claim Amount Refunded, Date of Service From, and Date of Service To.

- Select a Reason Code for Claim Adjustment from the provided list.

- Fill in the Claim Billed Amount, and if applicable, provide Additional Info. based on the selected reason code.

- Answer the OIG Reporting Requirements questions by selecting "Yes" or "No."

- If relevant, provide details under the MSP Information section, including Other Insurer Information such as Insurance Co. Name, Subscriber Name, and Insurer Address.

- For Employer Information, fill in the Employer Name, Employer Address, City/State/ZIP, Policy #, and Telephone Number if the primary insurance is provided by an employer.

- Make the check payable to Medicare Part A or Medicare Part B.

- Mail the completed form and check to the appropriate address based on the state where services were rendered.

After filling out the form, review all entries for accuracy. This verification step is crucial for a smooth submission process. Once confirmed, send the form along with your refund check to the specified Novitas Solutions address to ensure your refund is properly recorded and processed.

What You Should Know About This Form

What is the Novitas Return Of Monies form used for?

The Novitas Return Of Monies form is designed for providers or entities to voluntarily return funds to Medicare. This includes instances where overpayments were made or when services billed are no longer applicable. Properly completing this form ensures that the refund is recorded accurately and that any necessary adjustments to claims can be made.

Who should complete the form?

The form should be filled out by the provider or other entity who received the payment. This can include physicians, suppliers, or healthcare businesses responsible for the billing. It is essential that the individual completing the form has a thorough understanding of the claims being refunded.

What information is required on the form?

Key details needed on the form include the provider or entity's name, address, tax ID number, contact person, and the amount being returned. Additionally, specific patient details such as the Medicare ID number, claim number, and reason for adjustment must also be provided. Required fields are marked with an asterisk (*) and must be filled out to maintain appeal rights.

How do I know if I need to return multiple claims?

If you are refunding amounts from more than one claim, you should indicate “YES” on the form and provide a list of all the claims being refunded. If space is tight, feel free to use separate forms for each claim to ensure all required information is captured properly.

What should I include if I’m filing for a Medicare Secondary Payment (MSP) refund?

When submitting an MSP refund, you must include a copy of the primary insurer’s explanation of benefits (EOB). Additionally, it’s necessary to note the specific MSP reason code applicable to the claim. This helps to clarify the basis for the refund and is crucial for proper processing.

What happens if I don't fill in required fields on the form?

If required fields such as patient name or Medicare ID number are left blank, you will not be granted any appeal rights for the voluntary refund. It is essential to complete these fields accurately; otherwise, the refund process may be delayed or rejected.

What is the purpose of the OIG reporting requirements section?

This section asks whether the provider has a corporate integrity agreement with the Office of Inspector General (OIG) or is participating in the OIG's self-disclosure protocol. Answering these questions is necessary for compliance with these regulations. It’s important to note that entities disclosing under this protocol relinquish their right to appeal.

How do I determine the appropriate reason code for my claim adjustment?

You can find a list of reason codes in the form's instructions. Each code correspondingly reflects specific scenarios like billing errors or situations involving other payers. Selecting the correct reason code is crucial for identifying why funds are being returned, which helps expedite processing.

How should I submit the completed form and refund check?

Once the form is fully completed, you will mail it along with the refund check to the appropriate Novitas Solutions address. There are different P.O. boxes based on the state where services were rendered, so ensure that you send it to the correct location as specified in the instructions.

Can I amend the information on the form once it has been submitted?

Once the form is submitted, the information cannot be amended. If changes are required after submission, it may necessitate the submission of a new form with accurate information. Therefore, double-checking all entries before sending is recommended to avoid complications.

Common mistakes

When completing the Novitas Return of Monies form, individuals should be cautious to avoid common mistakes that can complicate the refund process. Understanding these pitfalls can help providers ensure that their forms are submitted correctly and efficiently.

One prevalent error occurs when the required fields marked with an asterisk are not filled out completely. Omitting details such as the *Patient Name or *Claim Number results in the forfeiture of appeal rights. Providers ought to double-check their entries to make certain that all mandatory information is included before submission.

Additionally, another mistake involves failing to indicate “YES” when returning multiple claims. If refunds cover various claims, it is essential to specify this clearly and provide a thorough listing. A lack of clarity here can lead to delays in processing the refund.

Many providers also overlook the importance of attaching relevant documentation. For Medicare Secondary Payment (MSP) refunds, it is vital to include a copy of the primary insurer's Explanation of Benefits (EOB). Some individuals mistakenly assume that this step is unnecessary, but omitting it can result in complications with the refund request.

The selection of the appropriate Reason Code for each claim is another critical factor. Choosing an incorrect code may cause confusion and hinder the processing of the refund. A detailed understanding of the reason codes and their definitions is necessary to make the right choice.

Moreover, inaccuracies can arise from not providing the necessary OIG Reporting Requirements information. Providers must correctly answer whether they have a corporate integrity agreement or are participating in the OIG self-disclosure protocol. Failing to do so could lead to further complications.

It is also important to pay close attention to the mailing address. Sending the check to the incorrect address based on the state services rendered can delay the resolution. Each state has specified mailing addresses, and providers should ensure they refer to the correct one according to the details provided on the form.

Lastly, when submitting reality-based figures, providers should be cautious about presenting accurate amounts. This includes the *Claim Amount Refunded and the original Claim Billed Amount. A discrepancy between these figures can lead to inquiries and delays in processing the refund.

By being mindful of these common mistakes, providers can navigate the process of completing the Novitas Return of Monies form more effectively. Efforts to submit accurate and thorough applications ultimately facilitate the refund process and promote timely resolutions.

Documents used along the form

The Novitas Return of Monies form is crucial for ensuring that voluntary refund checks are accurately processed. Several other documents may be used alongside this form to facilitate the refund procedure. Below is a brief description of these forms and documents.

- Medicare Secondary Payer (MSP) Request Form: This form is used to report any instances where Medicare is not the primary payer for a patient's medical billing. It helps establish the proper sequence of payments.

- Explanation of Benefits (EOB): The EOB is a document provided by the primary insurance company, detailing what medical services were covered and what portion of the costs remains the responsibility of the patient. A copy of the EOB should be included with the refund request, especially for MSP claims.

- OIG Self-Disclosure Protocol Form: This form is used by healthcare providers to disclose potential violations of the law to the Office of Inspector General (OIG). It is important for providers participating in this protocol as they forfeit certain appeal rights.

- Claim Adjustment Request Form: This document is submitted when there is a need to revise or correct a claim that was previously billed. It requests changes to billing codes or patient information based on new information.

- Corporate Integrity Agreement (CIA): This formal agreement between a healthcare provider and the OIG outlines the compliance obligations related to laws and regulations. It is often requested when a provider is under scrutiny.

- Provider Certification Form: This form verifies the identity and credentials of the healthcare provider requesting the refund. It may be required to ensure the provider's qualifications and legitimacy are confirmed.

Having the necessary documents readily available aids in creating a smoother refund process. Ensuring that all forms are filled out accurately minimizes delays and complications, allowing for efficient handling of voluntary refund requests.

Similar forms

- Medicare Secondary Payer (MSP) Form: Similar to the Novitas Return Of Monies form, the MSP form requires detailed information about claims and additional payers involved. Both documents demand accuracy in reporting patient details, claim numbers, and the reasons for adjustments or refunds to ensure compliance with Medicare regulations.

- Claim Adjustment Request Form: This form allows providers to appeal or adjust previously submitted claims. Like the Return Of Monies form, it necessitates specific identifiers, such as patient names and claim numbers, along with clear reasons for requesting adjustments. Both forms emphasize the importance of completed information to uphold the rights of the provider.

- Voluntary Disclosure Protocol Form: This document is for providers seeking to self-disclose overpayments to Medicare. Mirroring the Return Of Monies form, it includes questions regarding corporate integrity agreements and requires a comprehensive outline of claims and refund amounts. Both forms aim to document compliance with OIG guidelines.

- Refund Request Form for Professional Services: Just as the Novitas Return Of Monies form records unsolicited refunds, this form captures requests for returning funds for professional services. It requires detailed claim information and the rationale for the refund, reinforcing the need for thorough documentation in similar contexts.

- Chain of Custody Form: Although typically used in legal scenarios to track evidence, this form shares a foundational purpose with the Return Of Monies form: accountability. Both forms require meticulous record-keeping and detail, ensuring transparency and proper handling of funds or claims, reinforcing principles of integrity in financial processes.

Dos and Don'ts

When filling out the Novitas Return Of Monies form, follow these guidelines to ensure accuracy and compliance:

- Complete all required fields marked with an asterisk (*).

- Ensure the Patient Name and Medicare ID # are accurately filled out.

- Double-check the Claim Number and Claim Amount Refunded for accuracy.

- Use separate forms for each claim if refunding multiple claims.

- Attach the primary insurer's explanation of benefit (EOB) for MSP refunds.

There are also some important things to avoid:

- Do not leave any required fields blank, as this will prevent appeal rights.

- Avoid submitting inaccurate information related to the claims.

- Do not mix up the mailing addresses for different states.

- Refrain from providing incomplete information regarding OIG Reporting Requirements.

- Do not disregard the necessary documentation for statistical sampling. This could lead to processing delays.

Act promptly to complete and submit the form. Timely and accurate submissions ensure that refunds are processed efficiently.

Misconceptions

Here are ten common misconceptions about the Novitas Return Of Monies form, along with clarifications.

-

Misconception 1: This form is only for large healthcare providers.

This form can be used by any provider or entity seeking to return funds. It is not exclusive to larger organizations.

-

Misconception 2: You can submit the form without the required patient details.

All required fields, including patient name and Medicare ID, must be completed. Without these, the refund may not be processed.

-

Misconception 3: There are no consequences for errors on the form.

Errors can lead to the rejection of the refund. It’s essential to complete the form accurately.

-

Misconception 4: Only one claim can be refunded at a time.

You can refund multiple claims, but must provide the necessary information for each. Separate forms may be required.

-

Misconception 5: The submission of this form guarantees a refund.

A refund is not guaranteed. It depends on the review process and adherence to guidelines.

-

Misconception 6: All claims submitted will be automatically accepted.

Claims will be reviewed, and not all are accepted. Proper documentation is crucial.

-

Misconception 7: You do not need to provide a reason for the refund.

A reason code must be selected for each claim. This is a required step in the process.

-

Misconception 8: Completing the form is optional if money is being returned.

Using this form is mandatory for returning payment. It ensures that the transaction is recorded properly.

-

Misconception 9: Submitting a refund means you lose your right to appeal.

Only specific circumstances with the OIG’s Self-Disclosure Protocol lead to loss of appeal rights. Always check the context first.

-

Misconception 10: There is no specific format for submitting claims information.

The form outlines mandatory fields. Each must be provided in the specified format or the submission may be rejected.

Key takeaways

When filling out the Novitas Return Of Monies form, it is essential to ensure that all required fields are completed fully. Any missing information might delay your refund or jeopardize your right to appeal.

Each refund check must be accompanied by a filled-out form. This step allows Novitas to accurately record and apply the refund. Ensure that the check is made payable to either Medicare Part A or Part B, depending on the services rendered.

If you are refunding multiple claims, check the box indicating “YES,” and list all claim numbers on separate forms if necessary. Properly doing this prevents confusion and helps streamline the process.

Be mindful of the OIG reporting requirements. If you have a corporate integrity agreement with the OIG, you must indicate this on the form. Participants in the OIG self-disclosure protocol must be aware that appeal rights are not guaranteed.

In cases of Medicare Secondary Payment (MSP) refunds, it is mandatory to include a copy of the primary insurer’s explanation of benefits (EOB) and to specify the MSP reason. Missing this information can result in processing delays.

Finally, take care when selecting the reason code for each claim adjustment. Selecting the correct reason code is vital, as it provides clarity about the nature of the refund and helps avoid future billing errors.

Browse Other Templates

Military Buy Back Calculator - Keep in mind the purpose of this form when gathering your records.

Job Activity Safety Assessment,Workplace Risk Evaluation,Safety Task Analysis,Job Risk Assessment Form,Hazard Identification and Evaluation,Safety Measures Documentation,Worksite Safety Review,Activity Hazard Assessment,Risk Management Evaluation,Saf - The form aids in compliance with occupational health and safety regulations as outlined by law.