Fill Out Your Nri Power Of Attorney Format Form

The NRI Power of Attorney Format is a crucial document for Non-Resident Indians looking to manage their financial affairs in India while residing abroad. It empowers a designated individual, referred to as the 'Attorney,' to act on behalf of the account holder in a range of banking and investment activities. This format outlines an array of specific powers that may be granted, including the authority to operate NRE savings accounts or term deposits, conduct transactions including deposits and withdrawals, manage safe deposit lockers, and even handle investment decisions. One of the notable features of this power of attorney is its irrevocability, meaning that the powers conferred to the Attorney remain in effect until expressly revoked by the principal through a written notice. However, it also clearly delineates limitations, ensuring that certain actions, such as opening new accounts or repatriating funds abroad, cannot be taken by the Attorney. The document incorporates provisions for the Attorney to negotiate, collect dividends, and engage in buying and selling securities, making it comprehensive in its scope. Thus, for NRIs, this format serves not only as a legal instrument but also as a bridge to manage and maintain their financial interests seamlessly from a distance.

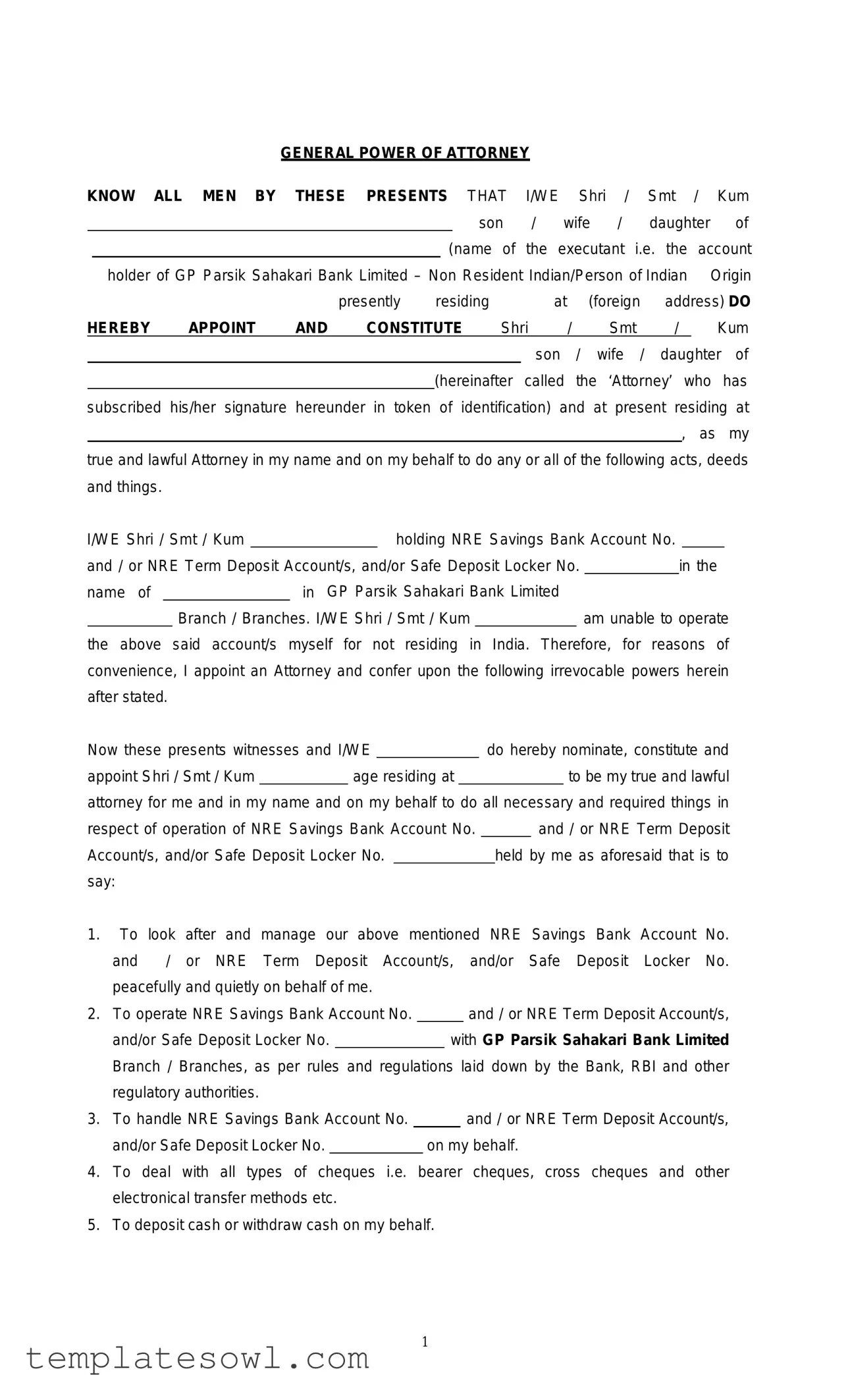

Nri Power Of Attorney Format Example

|

|

GENERAL POWER OF ATTORNEY |

|

|

|

|

|

|

|

|

|||||||

KNOW ALL |

MEN BY |

THESE |

PRESENTS |

THAT |

I/WE |

Shri |

/ |

Smt |

/ |

Kum |

|||||||

|

|

|

|

|

|

|

|

son |

/ |

wife |

/ |

daughter |

|

of |

|||

|

|

|

|

|

|

(name of the executant i.e. the account |

|||||||||||

|

holder of GP Parsik Sahakari Bank Limited – Non Resident Indian/Person of Indian |

|

Origin |

||||||||||||||

|

|

|

presently |

residing |

|

at |

(foreign |

address) DO |

|||||||||

HEREBY |

APPOINT |

AND |

CONSTITUTE |

Shri |

|

/ |

Smt |

/ |

|

|

Kum |

||||||

|

|

|

|

|

|

|

|

|

son / wife / daughter of |

||||||||

|

|

|

|

|

(hereinafter |

called the ‘Attorney’ who has |

|||||||||||

subscribed his/her signature |

hereunder |

in token |

of identification) |

and at |

present residing |

at |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

, |

as |

my |

|

true and lawful Attorney in my name and on my behalf to do any or all of the following acts, deeds and things.

I/WE Shri / Smt / Kum |

|

|

holding NRE Savings Bank Account No. |

|

|

||||||

and / or NRE Term Deposit Account/s, and/or Safe Deposit Locker No. |

in the |

||||||||||

name of |

|

in GP Parsik Sahakari Bank Limited |

|

|

|

|

|||||

|

|

Branch / Branches. I/WE Shri / Smt / Kum |

|

|

am unable to operate |

||||||

the above said account/s myself for not residing in India. Therefore, for reasons of convenience, I appoint an Attorney and confer upon the following irrevocable powers herein after stated.

Now these presents witnesses and I/WE |

|

|

do hereby nominate, constitute and |

|||

appoint Shri / Smt / Kum |

|

age residing at |

|

|

to be my true and lawful |

|

attorney for me and in my name and on my behalf to do all necessary and required things in

respect of operation of NRE Savings Bank Account No. |

|

|

and / or NRE Term Deposit |

|

Account/s, and/or Safe Deposit Locker No. |

|

held by me as aforesaid that is to |

||

say: |

|

|

||

1.To look after and manage our above mentioned NRE Savings Bank Account No.

|

and |

/ or NRE Term Deposit Account/s, and/or Safe Deposit Locker No. |

||||||||

|

peacefully and quietly on behalf of me. |

|

|

|

|

|||||

2. |

To operate NRE Savings Bank Account No. |

|

|

|

|

and / or NRE Term Deposit Account/s, |

||||

|

and/or Safe Deposit Locker No. |

|

|

with GP Parsik Sahakari Bank Limited |

||||||

|

Branch / Branches, as per rules and regulations laid down by the Bank, RBI and other |

|||||||||

|

regulatory authorities. |

|

|

|

|

|||||

3. |

To handle NRE Savings Bank Account No. |

|

|

|

|

and / or NRE Term Deposit Account/s, |

||||

|

and/or Safe Deposit Locker No. |

|

on my behalf. |

|||||||

4.To deal with all types of cheques i.e. bearer cheques, cross cheques and other electronical transfer methods etc.

5.To deposit cash or withdraw cash on my behalf.

1

6.To make all local payments in Rupees including payments for eligible investments subject to compliance with relevant regulations made by the Reserve Bank of India.

7.If any problem arises at that time to approach to the Bank’s Branch/Branches and solve the problems.

8.My attorney is also permitted to sign, draw, accept Cheques and other Negotiable Instruments.

9.To sign all the documents, correspondence to be made with the Bank authorities and other required authorities on behalf of me for making operations, complaints, requests, representations and also to make any claim, pay penalties, damages, charges etc. on my behalf.

10.And I hereby for myself, my heirs, executors and administrators ratify and confirm and agree to ratify and confirm whatsoever my said attorney acting under here shall so or purport to do by virtue of these presents.

11.To liaise with above bank for the purchase, sale/transfer of shares/securities/debentures/units/etc. and to represent me in all the dealings to the said bank and to give instructions to the said bank for payment for shares/securities/debentures/units etc. and to take on credit receipts in shares/securities/debentures/units/etc.

12.To purchase or acquire securities of any State Government in India or Union Government and Debentures and Shares(Equity and/ or preference) in any limited company and units of Units Trust of India/Mutual Funds/Financial Institutions/deposits/Investments of whatsoever nature in Banks/Company and to sell any such shares/securities/ debentures and /or units/investments etc. now standing in my name and such shares/securities/debenture units/etc hereafter to be purchased and to sign all transfer deeds whether as Transferor or Transferee and other applications and necessary papers for the purpose of purchasing or selling the same.

13.To operate Safe Custody Locker Account or to keep / take out in/from safe custody shares/ securities/ debentures and/or units/etc. purchased pursuant to the above authority.

14.To make applications for shares/debentures and additional shares of any company / banks and receive and hold bonus shares.

15.To collect, receive and give good and effectual receipt (s) sum (s) and discharge (s) for all and any dividends, bonuses or any other sum (s) and/or Income arising from share/securities/debentures etc., subject to rules and regulations made under FEMA,1999 and other applicable rules and regulations from time to time.

16.To negotiate with any person whether body corporate or otherwise and effect the sale of shares/ securities/ debentures etc. on such terms and at such price as the Attorney considers best price under the circumstances and to execute any agreements, etc. for effecting the sale of said shares/ securities/debentures/units etc.

17.To execute all deeds of transfer and other instruments necessary or proper for transferring the said shares and all other securities to the purchaser or purchasers thereof.

18.To deposit the monies realised from sale of the aforesaid shares/ securities/ debentures/units, etc with the above said bank and keep them invested/deposited until repatriation of the same.

19.To operate all or any of my bank account/s and to draw cheques on the said account and to give instruction in writing involving debits to the said account transfers thereon etc, for

2

local payments only. To make withdrawals for investments in India where either I hold general or specific permission from RBI.

20.To deposit and/or discount cheques and other instruments in the said account and for this purpose to endorse on my behalf cheques, drafts, pay orders and other instruments payable to me and also to execute necessary documents in this regard. To make deposit from balances available in the account in my name and renew such deposit etc. for such periods as may be given in writing.

21.To certify balance confirmation statement and statement of accounts issued by the Bank in respect of the said account/s. To receive and acknowledge on my behalf any notices letters, communication etc. from the above bank and which shall be deemed to have been received/acknowledged by me. To make, draw, endorse, accept or otherwise sign, deposit any cheques, bills of exchange, promissory notes or other negotiable instruments and to discount the same with your bank

22.To invest any amount from the said deposit in shares, debentures, fixed deposits, bonds and units, etc.

23.To issue written instructions with regard to the said account/s for local disbursements only.

24.To enter into, make, sign, execute, deliver, acknowledge and perform any agreement, deed, writing or thing that may in the opinion of the ‘Attorney’ be necessary, proper and expedient for the aforesaid purposes. The acts, deeds and things lawfully done or got done by my Attorney by virtue of these presents for the purpose shall be construed as acts, deeds and things done by me.

25.This Power of Attorney shall continue to be in force until I/we expressly revoke it by a notice in writing delivered to the bank.

26.This POA issued is not for any monetary consideration and is only with intention to enable the said attorney to do all acts specified in these presents solely on my behalf as my lawful attorney. I do hereby confirm and declare that no consideration has been flown to the said attorney for acting as my lawful attorney as stated herein.

27.However, my aforesaid attorney is specifically excluded from powers i) to open any bank Accounts on my behalf, ii) to repatriate funds abroad, iii)to make application for obtaining any financial assistance or loan facility from GP Parsik Sahakari Bank Limited , iv) to close my account, v) to make payment by way of gift to any resident Indian on my behalf and vi) to transfer funds from my account to any other NRE Account.

28.Bank shall be indemnified and held harmless by me for any and all actions taken by my POA holder regarding my accounts at Bank, regardless of whether within the intended scope of this Power of Attorney or not; therefore, Bank shall have no liability for the actions of my POA Holder or for following the directions of my POA Holder in connection with my bank accounts at Bank.

29.The signature of the attorney so appointed by me is attested below. Ratify and confirm all and whatsoever the said Attorney should do or purport to do or cause to be done by virtue of these presents.

IN WITNESS WHEREOF, I/WE the Executant have put my hands on these presents in the presence of the following witnesses and seal on this day and year herein below mentioned.

I hereby undertake to ratify and confirm all and any acts that the ‘Attorney’ does or causes to do on the basis of this Power of Attorney.

3

In Witness Whereof, I/WE |

|

|

|

|

have hereunto set |

|

and subscribed my hands at |

|

on |

|

. |

||

Passport number of Executant: -

Driving License / PAN / Voter ID Card / NREGA Card / Aadhaar Government ID Card / Defence ID Card of ‘Attorney’ (Please enclose of corresponding document of Attorney):-

Card / Passport No /

(Specimen signature of ‘Attorney’)

Please paste passport size photograph of ‘Attorney’, which has to be attested by the Executant

Signed and delivered by

(Signature of Donor / Executant)

in the presence of

Please paste passport size

photograph of Donor / Executant

Witness :`

1.

2.

4

Form Characteristics

| Fact Name | Detail |

|---|---|

| Document Title | General Power of Attorney |

| Parties Involved | The executor (donor) and appointed attorney. |

| Purpose | To authorize an attorney to manage NRE accounts and investments on behalf of the donor. |

| Scope of Powers | Includes managing accounts, handling transactions, and making investments. |

| Governing Law | Regulated by the Foreign Exchange Management Act (FEMA) 1999 in India. |

| Limitations | Attorney cannot open new accounts, repatriate funds, or make loans on behalf of the donor. |

| Duration | This Power of Attorney remains effective until revoked in writing. |

| Indemnification Clause | The bank is indemnified from actions taken by the attorney, ensuring no liability. |

| Signature Requirements | Signatures of the donor and attorney, along with passport-sized photographs, are required. |

Guidelines on Utilizing Nri Power Of Attorney Format

Completing the NRI Power of Attorney (POA) Format form requires careful attention to detail to ensure that all necessary information is accurately provided. This document appoints an attorney to act on behalf of the individual (the executant) in dealing with bank accounts and related transactions in India. Following these steps will help streamline the process of filling out the form.

- Begin by clearly stating the name of the executant (the individual granting the power) and their relationship (son, wife, daughter, etc.) in the designated space.

- Include the foreign address where the executant currently resides.

- Appoint the attorney by entering their name and specifying their relationship to the executant.

- Provide the attorney's current address for communication purposes.

- Fill in the NRE Savings Bank Account Number(s) and/or NRE Term Deposit Account Number(s) along with any Safe Deposit Locker Numbers if applicable.

- Indicate that the executant is unable to operate the accounts personally, mentioning the reasons related to being a Non-Resident Indian.

- Clearly state the powers conferred to the attorney, including management, operation, and access to the specified bank accounts and assets.

- Include any restrictions, such as excluding the ability to open additional accounts or repatriate funds.

- Provide the signatures of both the executant and the attorney to validate the document. Ensure that the attorney's signature is attested.

- Attach a recent passport-sized photograph of both the attorney and the executant, ensuring the photographs are attested where required.

- Sign and date the form in the presence of a witness, ensuring that the witness also signs the document.

- Retain a copy of the completed form for personal records and provide copies to the bank and the appointed attorney.

What You Should Know About This Form

What is an NRI Power of Attorney Format?

The NRI Power of Attorney Format is a legal document that allows a non-resident Indian (NRI) to authorize another individual, known as the Attorney, to manage their financial and legal affairs in India. This document is crucial for NRIs who are unable to manage their bank accounts, investments, or other property due to their absence from the country.

What powers does the Attorney receive under this document?

The document provides the Attorney with comprehensive powers including managing bank accounts, handling investments, conducting transactions, and communicating with banks and financial institutions. Specific powers can include operating NRE savings accounts, making local payments, signing documents, and overseeing investments in shares and securities, among others.

Is it necessary for the Attorney to be a resident of India?

Though it is common for the Attorney to be a resident of India, it is not strictly necessary. The important factor is that the Attorney has the legal capacity to act on behalf of the NRI and is trusted to carry out financial and legal matters responsibly. The relationship should be based on trust and understanding of the powers being conferred.

Can the NRI revoke the Power of Attorney at any time?

Yes. The NRI can revoke the Power of Attorney by providing a written notice of revocation to the bank and the Attorney. It is crucial that the revocation is communicated clearly to ensure that the Attorney ceases to act on behalf of the NRI promptly and legally.

Are there any limitations imposed on the Attorney?

The document specifies several limitations on the powers of the Attorney. For instance, the Attorney cannot open new bank accounts, repatriate funds abroad, apply for loans, or make gifts on behalf of the NRI. These limitations help safeguard the NRI’s interests and maintain control over key financial decisions.

What should be included in the NRI Power of Attorney Format?

The format should include the full names and addresses of the NRI and the Attorney, a clear list of powers granted to the Attorney, and any limitations. Additionally, it should have provisions for the NRI's confirmation of the Attorney's actions and a designated space for signatures. Witnesses may need to be present during the signing process to add authenticity to the document.

Common mistakes

Filling out the NRI Power of Attorney format form can be a straightforward task, but errors often occur. Understanding these common mistakes can lead to a smoother process. One prevalent mistake is neglecting to provide thorough personal information. This includes missing the complete name and citizenship status of the executant, which are crucial for identification. Without this information, the authority granted could become ambiguous.

Another frequent error is omitting the full details of the appointed attorney. Individuals sometimes forget to include the attorney's complete name and address. This lack of clarity can lead to misunderstandings about who has been designated to act on behalf of the account holder. It's essential to ensure that the attorney is clearly identified to avoid any confusion in future transactions.

Many people also mistakenly overlook the signatures required on the form. All necessary parties—including the executant and witnesses—must sign the document for it to be valid. Failing to secure these signatures can render the Power of Attorney ineffective, and thus, the intended authority would not be properly granted.

Properly specifying the powers granted to the attorney is critical. Some individuals write vague descriptions of what the attorney can do rather than listing specific powers clearly. When powers are not well-defined, it can create complications when the attorney attempts to execute their duties. Clear and specific instructions help prevent potential disputes down the line.

In addition to the above, neglecting to keep a copy of the signed document can lead to complications. Without a personal copy, the account holder may struggle to prove what powers were conferred and to whom, should questions arise later. It is wise to retain records for future reference.

Filling out the NRI Power of Attorney format can also lead to mistakes in the section related to limitations on the attorney’s powers. Sometimes, important exclusions are omitted, which could inadvertently grant the attorney more authority than intended. It is essential to be explicit about what actions the attorney is not permitted to carry out.

Many executants forget to update the document if there are changes in personal circumstances, such as a change of address or marital status. Keeping the information current is vital for ensuring that the Power of Attorney remains effective and corresponds accurately with the account holder's current situation.

Failing to comply with local regulations is another common pitfall. Different jurisdictions may have specific requirements regarding Powers of Attorney, and not adhering to these can invalidate the document. It is imperative to be aware of the legal standards that apply and ensure compliance to safeguard against unintended consequences.

Finally, some individuals do not consult with a legal expert before signing the document. While obtaining a Power of Attorney is a significant responsibility, it's essential to understand its implications fully. Without appropriate guidance, executants may inadvertently authorize actions they did not intend to allow.

Documents used along the form

The NRI Power of Attorney Format is a vital legal document, allowing a non-resident Indian to authorize someone to manage their financial affairs in India. To effectively use this document, several other forms and documents often accompany it. Here’s a list of commonly used forms along with a brief description of each.

- Attested Identity Proof: This document verifies the identity of both the executor and the appointed attorney. Common proofs include a passport, voter ID, or national ID card. Attestation confirms that the document is genuine.

- Bank Account Application Form: Required to operate NRI accounts, this form details the account holder's information. It helps the attorney operate the bank accounts specified in the Power of Attorney.

- Nomination Form: This form allows individuals to name beneficiaries for their accounts or investments. It specifies who will receive the assets or funds if something happens to the account holder.

- Tax Residency Self-Certification: To comply with tax regulations, this document establishes where the individual is considered a tax resident. It’s essential for managing tax obligations for the accounts.

- Investment Authorization Letter: This is essential for allowing the attorney to manage investment accounts. It gives the attorney the authority to make decisions regarding stocks, bonds, and other financial instruments.

- Transfer Instructions: This document provides direction on transferring funds or assets, specifying the amounts and recipients. It ensures that the attorney knows how to act on the account holder's behalf.

- Revocation of Power of Attorney Form: If an individual decides to cancel or change the Power of Attorney, this document is necessary. It formally ends the previous authority granted to the attorney.

These documents are crucial for ensuring that the NRI Power of Attorney operates smoothly and complies with legal requirements. Together, they empower the attorney to manage the account holder's financial affairs efficiently and securely.

Similar forms

- General Power of Attorney (GPA): Similar to the NRI Power of Attorney format, a General Power of Attorney grants broad authority to an appointed agent to act on behalf of the principal in legal and financial matters, often allowing for the management of various accounts and transactions.

- Special Power of Attorney (SPA): This document varies from a GPA by limiting the agent's authority to specific tasks, such as handling particular financial matters, while still allowing the principal to designate someone to act on their behalf.

- Durable Power of Attorney: Unlike a typical power of attorney, this document remains effective even if the principal becomes incapacitated. It ensures that the designated agent can continue managing affairs without interruption.

- Medical Power of Attorney: This form is used to appoint an agent to make healthcare decisions for the principal, differing significantly from financial powers typically granted in the NRI Power of Attorney.

- Financial Power of Attorney: Similar in scope to the NRI Power of Attorney, this document specifically focuses on financial matters, allowing the designated agent to manage bank accounts, investments, and other financial affairs.

- Limited Power of Attorney: This type grants the agent authority for a specific period or for a particular purpose, contrasting with the broader powers often conferred in the NRI Power of Attorney.

- Letter of Authorization: While not legally the same as a power of attorney, this document can authorize someone to act on behalf of another in specific situations, such as dealing with administrative tasks.

- Trustee Authorization: In estate planning, a trustee authorization allows an appointed individual to manage trust assets, sharing similarities with the powers granted in an NRI Power of Attorney regarding management but focused on a trust context.

- Withdrawal Authorization Form: Used to permit someone to withdraw funds from an account, this form is more limited than a power of attorney but serves a similar purpose in enabling another individual to act on behalf of the account holder.

Dos and Don'ts

Things You Should Do:

- Ensure that all personal information, including your name and account details, is correctly filled in the form.

- Double-check that the attorney's information matches their identification documents.

- Sign the form in the presence of witnesses to validate the document legally.

- Include any required supporting documents, such as identification and photographs.

- Clearly outline the specific powers you are granting to the attorney to avoid any ambiguity.

- Keep a copy of the completed form for your own records.

Things You Shouldn't Do:

- Avoid leaving any sections of the form blank; this can lead to complications.

- Do not provide false information about yourself or the attorney.

- Refrain from granting more powers than necessary, which can lead to misuse.

- Do not sign the form without confirming it has been filled out entirely and correctly.

- Avoid using illegible handwriting or unclear language in any part of the form.

- Do not forget to specify any exclusions of power to prevent misunderstandings.

Misconceptions

1. The NRI Power of Attorney can be used for any purpose. This is not accurate. The power of attorney specifically allows the appointed attorney to manage NRE accounts, but there are limitations. For example, the attorney cannot open new accounts, repatriate funds abroad, or apply for loans on behalf of the NRI.

2. Once signed, the NRI Power of Attorney cannot be revoked. This misconception is false. The document remains valid until the NRI decides to revoke it. The revocation must be communicated in writing to the bank to be effective.

3. The Power of Attorney allows the attorney to act without oversight. This is misleading. While the attorney has a range of powers, they are acting on behalf of the NRI, who ultimately holds the responsibility. The bank is also indemnified against actions taken by the attorney, ensuring a level of oversight is maintained.

4. All actions taken using the Power of Attorney are automatically valid. This is incorrect. The actions must still comply with the rules and regulations set by the bank and the Reserve Bank of India. Any transactions outside these guidelines could be flagged or denied.

Key takeaways

Here are key takeaways regarding the NRI Power of Attorney format form:

- The form is intended for Non-Resident Indians (NRIs) who wish to appoint an attorney to manage their financial affairs in India.

- It requires detailed personal information about both the principal (the NRI) and the attorney being appointed.

- NRIs hold accounts with GP Parsik Sahakari Bank Limited, which this document specifically pertains to.

- The attorney can manage various types of accounts, including NRE Savings Bank Accounts, Term Deposits, and Safe Deposit Lockers.

- Activities permitted under this power include handling cheques, making deposits, and withdrawing funds.

- The attorney has the authority to manage local payments and investments, while adhering to related regulations.

- Any issues encountered with the bank can be addressed by the attorney, who has the authority to interact with bank officials.

- It is important that the form is signed in front of authorized witnesses to ensure its validity.

- This Power of Attorney remains effective unless it is formally revoked by the principal.

- The attorney is prohibited from opening new accounts, repatriating funds abroad, or transferring funds to other NRE accounts.

Browse Other Templates

What Is a Bonded Title Arkansas - This form serves to protect both applicants and authorities from fraudulent claims.

Dot Physical Form - Vision and hearing standards are critical to qualify for bus driving duties.

Dmv Release of Liability Printable Form - The web address of the Illinois Secretary of State is printed for easy access to information.