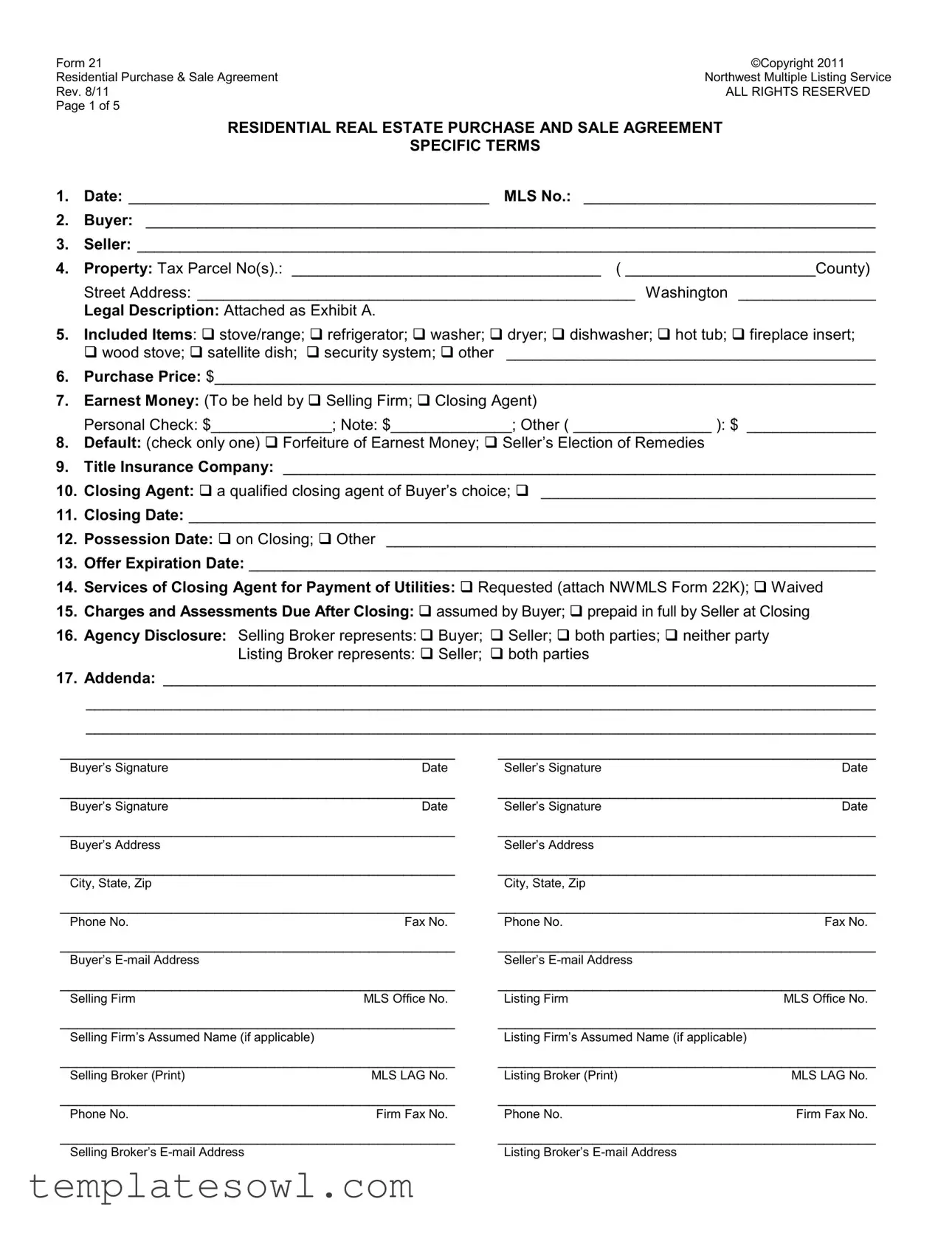

Fill Out Your Nwmls 21 Form

The NWMLS Form 21, also known as the Residential Purchase and Sale Agreement, is a crucial tool for individuals engaging in real estate transactions in Washington State. This comprehensive form includes vital sections detailing key aspects of the sale, such as the identities of the Buyer and Seller, the specific property involved, and the purchase price. Additionally, it outlines essential terms like earnest money requirements, default remedies, title insurance details, and the roles of closing agents. Various included items, which may range from appliances to security systems, are clearly listed to ensure all parties understand what is part of the sale. Important dates, such as the closing date and possession date, are also explicitly stated to manage expectations. Moreover, the form addresses the potential impacts of local assessments and provides guidance regarding professional advice, ensuring that both parties are well-informed throughout the buying and selling process. By outlining these critical components, the NWMLS Form 21 serves as a foundational aspect of facilitating real estate transactions with clarity and mutual understanding.

Nwmls 21 Example

Form 21 |

©Copyright 2011 |

Residential Purchase & Sale Agreement |

Northwest Multiple Listing Service |

Rev. 8/11 |

ALL RIGHTS RESERVED |

Page 1 of 5 |

|

RESIDENTIAL REAL ESTATE PURCHASE AND SALE AGREEMENT |

|

SPECIFIC TERMS |

|

1. Date: __________________________________________ MLS No.: |

__________________________________ |

2.Buyer: _____________________________________________________________________________________

3.Seller: ______________________________________________________________________________________

4. Property: Tax Parcel No(s).: ____________________________________ ( ______________________County)

Street Address: ___________________________________________________ Washington ________________

Legal Description: Attached as Exhibit A.

5.Included Items: stove/range; refrigerator; washer; dryer; dishwasher; hot tub; fireplace insert;

wood stove; satellite dish; security system; other ___________________________________________

6.Purchase Price: $_____________________________________________________________________________

7.Earnest Money: (To be held by Selling Firm; Closing Agent)

Personal Check: $______________; Note: $______________; Other ( ________________ ): $ _______________

8.Default: (check only one) Forfeiture of Earnest Money; Seller’s Election of Remedies

9.Title Insurance Company: _____________________________________________________________________

10.Closing Agent: a qualified closing agent of Buyer’s choice; _______________________________________

11.Closing Date: ________________________________________________________________________________

12.Possession Date: on Closing; Other _________________________________________________________

13.Offer Expiration Date: _________________________________________________________________________

14.Services of Closing Agent for Payment of Utilities: Requested (attach NWMLS Form 22K); Waived

15.Charges and Assessments Due After Closing: assumed by Buyer; prepaid in full by Seller at Closing

16.Agency Disclosure: Selling Broker represents: Buyer; Seller; both parties; neither party

Listing Broker represents: Seller; both parties

17.Addenda: ___________________________________________________________________________________

____________________________________________________________________________________________

____________________________________________________________________________________________

______________________________________________ |

____________________________________________ |

||

Buyer’s Signature |

Date |

Seller’s Signature |

Date |

______________________________________________ |

____________________________________________ |

||

Buyer’s Signature |

Date |

Seller’s Signature |

Date |

______________________________________________ |

____________________________________________ |

||

Buyer’s Address |

|

Seller’s Address |

|

______________________________________________ |

____________________________________________ |

||

City, State, Zip |

|

City, State, Zip |

|

______________________________________________ |

____________________________________________ |

||

Phone No. |

Fax No. |

Phone No. |

Fax No. |

______________________________________________ |

____________________________________________ |

||

Buyer’s |

|

Seller’s |

|

______________________________________________ |

____________________________________________ |

||

Selling Firm |

MLS Office No. |

Listing Firm |

MLS Office No. |

______________________________________________ |

____________________________________________ |

||

Selling Firm’s Assumed Name (if applicable) |

|

Listing Firm’s Assumed Name (if applicable) |

|

______________________________________________ |

____________________________________________ |

||

Selling Broker (Print) |

MLS LAG No. |

Listing Broker (Print) |

MLS LAG No. |

______________________________________________ |

____________________________________________ |

||

Phone No. |

Firm Fax No. |

Phone No. |

Firm Fax No. |

______________________________________________ |

____________________________________________ |

||

Selling Broker’s |

|

Listing Broker’s |

|

Form 21 |

|

|

©Copyright 2011 |

|

Residential Purchase & Sale Agreement |

Northwest Multiple Listing Service |

|||

Rev. 8/11 |

RESIDENTIAL REAL ESTATE PURCHASE AND SALE AGREEMENT |

ALL RIGHTS RESERVED |

|

|

Page 2 of 5 |

|

|

||

|

|

GENERAL TERMS |

|

|

|

|

Continued |

|

|

a. Purchase Price. Buyer shall pay to Seller the Purchase Price, including the Earnest Money, in cash at Closing, unless |

1 |

|||

otherwise specified in this Agreement. Buyer represents that Buyer has sufficient funds to close this sale in accordance |

2 |

|||

with this Agreement and is not relying on any contingent source of funds, including funds from loans, the sale of other |

3 |

|||

property, gifts, retirement, or future earnings, except to the extent otherwise specified in this Agreement. |

4 |

|||

b. Earnest Money. Buyer shall deliver the Earnest Money within 2 days after mutual acceptance of this Agreement to |

5 |

|||

Selling Broker who will deposit any check to be held by Selling Firm, or deliver any Earnest Money to be held by Closing |

6 |

|||

Agent, within 3 days of receipt or mutual acceptance, whichever occurs later. If the Earnest Money is held by Selling |

7 |

|||

Firm and is over $10,000.00 it shall be deposited into an interest bearing trust account in Selling Firm’s name provided |

8 |

|||

that Buyer completes an IRS Form

Buyer shall reimburse Selling Firm for bank charges and fees in excess of the interest earned, if any. If the Earnest |

10 |

Money held by Selling Firm is over $10,000.00 Buyer has the option to require Selling Firm to deposit the Earnest |

11 |

Money into the Housing Trust Fund Account, with the interest paid to the State Treasurer, if both Seller and Buyer so |

12 |

agree in writing. If the Buyer does not complete an IRS Form |

13 |

or the Earnest Money is $10,000.00 or less, the Earnest Money shall be deposited into the Housing Trust Fund 14

Account. Selling Firm may transfer the Earnest Money to Closing Agent at Closing. If all or part of the Earnest Money is |

15 |

to be refunded to Buyer and any such costs remain unpaid, the Selling Firm or Closing Agent may deduct and pay them |

16 |

therefrom. The parties instruct Closing Agent to provide written verification of receipt of the Earnest Money and notice of |

17 |

dishonor of any check to the parties and Brokers at the addresses and/or fax numbers provided herein. |

18 |

Upon termination of this Agreement, a party or the Closing Agent may deliver a form authorizing the release of Earnest |

19 |

Money to the other party or the parties. The party(s) shall execute such form and deliver the same to the Closing Agent. 20

If either party fails to execute the release form, the other party may make a written demand to the Closing Agent for the |

21 |

Earnest Money. If only one party makes such a demand, Closing Agent shall promptly deliver notice of the demand to |

22 |

the other party. If the other party does not object to the demand within 10 days of Closing Agent’s notice, Closing Agent |

23 |

shall disburse the Earnest Money to the party making the demand. If Closing Agent complies with the preceding 24

process, each party shall be deemed to have released Closing Agent from any and all claims or liability related to the |

25 |

disbursal of the Earnest Money. The parties are advised that, notwithstanding the foregoing, Closing Agent may require |

26 |

the parties to execute a separate agreement before disbursing the Earnest Money. If either party fails to authorize the |

27 |

release of the Earnest Money to the other party when required to do so under this Agreement, that party shall be in |

28 |

breach of this Agreement. Upon either party’s request, the party holding the Earnest Money shall commence an 29

interpleader action in the county in which the Property is located. For the purposes of this paragraph, the term Closing |

30 |

Agent includes a Selling Firm holding the Earnest Money. The parties authorize the party commencing an interpleader |

31 |

action to deduct up to $500.00 for the costs thereof. |

32 |

c.Included Items. Any of the following items, including items identified in Specific Term No. 5 if the corresponding box is 33 checked, located in or on the Property are included in the sale:

lighting fixtures; shrubs, plants and trees planted in the ground; all bathroom and other fixtures; and all associated |

38 |

operating equipment. If any of the above Included Items are leased or encumbered, Seller shall acquire and clear title at |

39 |

or before Closing. |

40 |

d.Condition of Title. Unless otherwise specified in this Agreement, title to the Property shall be marketable at Closing. 41 The following shall not cause the title to be unmarketable: rights, reservations, covenants, conditions and restrictions, 42 presently of record and general to the area; easements and encroachments, not materially affecting the value of or 43 unduly interfering with Buyer’s reasonable use of the Property; and reserved oil and/or mining rights. Monetary 44 encumbrances or liens not assumed by Buyer, shall be paid or discharged by Seller on or before Closing. Title shall be 45

conveyed by a Statutory Warranty Deed. If this Agreement is for conveyance of a buyer’s interest in a Real Estate |

46 |

Contract, the Statutory Warranty Deed shall include a buyer’s assignment of the contract sufficient to convey after |

47 |

acquired title. |

48 |

e.Title Insurance. Seller authorizes Buyer’s lender or Closing Agent, at Seller’s expense, to apply for the

Initials: BUYER: _________________ |

Date: _____________ |

SELLER: ________________ |

Date: ___________ |

BUYER: _________________ |

Date: _____________ |

SELLER: ________________ |

Date: ___________ |

Form 21 |

|

|

©Copyright 2011 |

|

Residential Purchase & Sale Agreement |

Northwest Multiple Listing Service |

|||

Rev. 8/11 |

RESIDENTIAL REAL ESTATE PURCHASE AND SALE AGREEMENT |

ALL RIGHTS RESERVED |

|

|

Page 3 of 5 |

|

|

||

|

GENERAL TERMS |

|

|

|

|

Continued |

|

|

|

made so insurable prior to the Closing Date, then as Buyer’s sole and exclusive remedy, the Earnest Money shall, |

60 |

|||

unless Buyer elects to waive such defects or encumbrances, be refunded to the Buyer, less any unpaid costs described |

61 |

|||

in this Agreement, and this Agreement shall thereupon be terminated. Buyer shall have no right to specific performance |

62 |

|||

or damages as a consequence of Seller’s inability to provide insurable title. |

|

|

63 |

|

f.Closing and Possession. This sale shall be closed by the Closing Agent on the Closing Date. If the Closing Date falls 64 on a Saturday, Sunday, legal holiday as defined in RCW 1.16.050, or day when the county recording office is closed, 65 the Closing Agent shall close the transaction on the next day that is not a Saturday, Sunday, legal holiday, or day when 66 the county recording office is closed. “Closing” means the date on which all documents are recorded and the sale 67 proceeds are available to Seller. Seller shall deliver keys and garage door remotes to Buyer on the Closing Date or on 68 the Possession Date, whichever occurs first. Buyer shall be entitled to possession at 9:00 p.m. on the Possession Date. 69 Seller shall maintain the Property in its present condition, normal wear and tear excepted, until the Buyer is entitled to 70 possession. If possession transfers at a time other than Closing, the parties agree to execute NWMLS Form 65A 71

(Rental Agreement/Occupancy Prior to Closing) or NWMLS Form 65B (Rental Agreement/Seller Occupancy After |

72 |

Closing) (or alternative rental agreements) and are advised of the need to contact their respective insurance companies |

73 |

to assure appropriate hazard and liability insurance policies are in place, as applicable. |

74 |

g.Section 1031

party at or prior to Closing. Notwithstanding the Assignment paragraph of this Agreement, any party completing a |

79 |

Section 1031 |

80 |

purposes of completing a reverse exchange. |

81 |

h.Closing Costs and Prorations and Charges and Assessments. Seller and Buyer shall each pay

services of Closing Agent in disbursing funds necessary to satisfy unpaid utility charges in accordance with RCW 60.80 |

90 |

and Seller shall provide the names and addresses of all utilities providing service to the Property and having lien rights |

91 |

(attach NWMLS Form 22K Identification of Utilities or equivalent). |

92 |

Buyer is advised to verify the existence and amount of any local improvement district, capacity or impact charges or |

93 |

other assessments that may be charged against the Property before or after Closing. Seller will pay such charges that |

94 |

are encumbrances at the time of Closing, or that are or become due on or before Closing. Charges levied before |

95 |

Closing, but becoming due after Closing shall be paid as agreed in Specific Term No. 15. |

96 |

i.Sale Information. Listing Broker and Selling Broker are authorized to report this Agreement (including price and all 97

terms) to the Multiple Listing Service that published it and to its members, financing institutions, appraisers, and anyone |

98 |

else related to this sale. Buyer and Seller expressly authorize all Closing Agents, appraisers, title insurance companies, |

99 |

and others related to this Sale, to furnish the Listing Broker and/or Selling Broker, on request, any and all information 100

and copies of documents concerning this sale. |

101 |

j.FIRPTA - Tax Withholding at Closing. The Closing Agent is instructed to prepare a certification (NWMLS Form 22E or 102

equivalent) that Seller is not a “foreign person” within the meaning of the Foreign Investment In Real Property Tax Act. 103 Seller shall sign this certification. If Seller is a foreign person, and this transaction is not otherwise exempt from FIRPTA, 104

Closing Agent is instructed to withhold and pay the required amount to the Internal Revenue Service. |

105 |

k.Notices. In consideration of the license to use this and NWMLS's companion forms and for the benefit of the Listing 106 Broker and the Selling Broker as well as the orderly administration of the offer, counteroffer or this Agreement, the 107 parties irrevocably agree that unless otherwise specified in this Agreement, any notice required or permitted in, or 108 related to, this Agreement (including revocations of offers or counteroffers) must be in writing. Notices to Seller must be 109 signed by at least one Buyer and shall be deemed given only when the notice is received by Seller, by Listing Broker or 110 at the licensed office of Listing Broker. Notices to Buyer must be signed by at least one Seller and shall be deemed 111 given only when the notice is received by Buyer, by Selling Broker or at the licensed office of Selling Broker. Receipt by 112 Selling Broker of a Form 17, Disclosure of Information on

Initials: BUYER: _________________ |

Date: _____________ |

SELLER: ________________ |

Date: ___________ |

BUYER: _________________ |

Date: _____________ |

SELLER: ________________ |

Date: ___________ |

Form 21 |

|

|

©Copyright 2011 |

Residential Purchase & Sale Agreement |

Northwest Multiple Listing Service |

||

Rev. 8/11 |

RESIDENTIAL REAL ESTATE PURCHASE AND SALE AGREEMENT |

ALL RIGHTS RESERVED |

|

Page 4 of 5 |

|

||

|

|

GENERAL TERMS |

|

Continued

Seller must keep Selling Broker and Listing Broker advised of their whereabouts in order to receive prompt notification 118

of receipt of a notice. |

119 |

l.Computation of Time. Unless otherwise specified in this Agreement, any period of time measured in days and stated 120 in this Agreement shall start on the day following the event commencing the period and shall expire at 9:00 p.m. of the 121 last calendar day of the specified period of time. Except for the Possession Date, if the last day is a Saturday, Sunday 122 or legal holiday as defined in RCW 1.16.050, the specified period of time shall expire on the next day that is not a 123 Saturday, Sunday or legal holiday. Any specified period of 5 days or less shall not include Saturdays, Sundays or legal 124 holidays. If the parties agree that an event will occur on a specific calendar date, the event shall occur on that date, 125 except for the Closing Date, which, if it falls on a Saturday, Sunday, legal holiday as defined in RCW 1.16.050, or day 126 when the county recording office is closed, shall occur on the next day that is not a Saturday, Sunday, legal holiday, or 127 day when the county recording office is closed. If the parties agree upon and attach a legal description after this 128 Agreement is signed by the offeree and delivered to the offeror, then for the purposes of computing time, mutual 129

acceptance shall be deemed to be on the date of delivery of an accepted offer or counteroffer to the offeror, rather than 130

on the date the legal description is attached. Time is of the essence of this Agreement. |

131 |

m.Facsimile and

Closing Agent, the parties will confirm facsimile transmitted signatures by signing an original document.

writing. |

136 |

n.Integration and Electronic Signatures. This Agreement constitutes the entire understanding between the parties and 137 supersedes all prior or contemporaneous understandings and representations. No modification of this Agreement shall 138

be effective unless agreed in writing and signed by Buyer and Seller. The parties acknowledge that a signature in 139

electronic form has the same legal effect and validity as a handwritten signature. |

140 |

o.Assignment. Buyer may not assign this Agreement, or Buyer’s rights hereunder, without Seller’s prior written consent, 141 unless the parties indicate that assignment is permitted by the addition of “and/or assigns” on the line identifying the 142

Buyer on the first page of this Agreement. |

143 |

p.Default. In the event Buyer fails, without legal excuse, to complete the purchase of the Property, then the following 144

provision, as identified in Specific Term No. 8, shall apply: |

145 |

i.Forfeiture of Earnest Money. That portion of the Earnest Money that does not exceed five percent (5%) of the 146 Purchase Price shall be forfeited to the Seller as the sole and exclusive remedy available to Seller for such failure. 147

ii.Seller’s Election of Remedies. Seller may, at Seller’s option, (a) keep the Earnest Money as liquidated damages 148 as the sole and exclusive remedy available to Seller for such failure, (b) bring suit against Buyer for Seller’s actual 149

damages, (c) bring suit to specifically enforce this Agreement and recover any incidental damages, or (d) pursue 150

any other rights or remedies available at law or equity. |

151 |

q.Professional Advice and Attorneys’ Fees. Buyer and Seller are advised to seek the counsel of an attorney and a 152 certified public accountant to review the terms of this Agreement. Buyer and Seller agree to pay their own fees incurred 153

for such review. However, if Buyer or Seller institutes suit against the other concerning this Agreement the prevailing 154

party is entitled to reasonable attorneys’ fees and expenses. |

155 |

r.Offer. Buyer shall purchase the Property under the terms and conditions of this Agreement. Seller shall have until 9:00 156 p.m. on the Offer Expiration Date to accept this offer, unless sooner withdrawn. Acceptance shall not be effective until a 157

signed copy is received by Buyer, by Selling Broker or at the licensed office of Selling Broker. If this offer is not so 158

accepted, it shall lapse and any Earnest Money shall be refunded to Buyer. |

159 |

s.Counteroffer. Any change in the terms presented in an offer or counteroffer, other than the insertion of the Seller’s 160 name, shall be considered a counteroffer. If a party makes a counteroffer, then the other party shall have until 9:00 p.m. 161 on the counteroffer expiration date to accept that counteroffer, unless sooner withdrawn. Acceptance shall not be 162

effective until a signed copy is received by Seller, by Listing Broker or at the licensed office of Listing Broker. If the 163

counteroffer is not so accepted, it shall lapse and any Earnest Money shall be refunded to Buyer. |

164 |

t.Offer and Counteroffer Expiration Date. If no expiration date is specified for an offer/counteroffer, the 165

offer/counteroffer shall expire 2 days after the offer/counteroffer is delivered by the party making the offer/counteroffer, 166

unless sooner withdrawn. |

167 |

u.Agency Disclosure. Selling Firm, Selling Firm’s Designated Broker, Selling Broker’s Branch Manager (if any) and 168 Selling Broker’s Managing Broker (if any) represent the same party that Selling Broker represents. Listing Firm, Listing 169 Firm’s Designated Broker, Listing Broker’s Branch Manager (if any), and Listing Broker’s Managing Broker (if any) 170 represent the same party that the Listing Broker represents. If Selling Broker and Listing Broker are different persons 171 affiliated with the same Firm, then both Buyer and Seller confirm their consent to Designated Broker, Branch Manager 172

Initials: BUYER: _________________ |

Date: _____________ |

SELLER: ________________ |

Date: ___________ |

BUYER: _________________ |

Date: _____________ |

SELLER: ________________ |

Date: ___________ |

Form 21 |

|

|

©Copyright 2011 |

Residential Purchase & Sale Agreement |

Northwest Multiple Listing Service |

||

Rev. 8/11 |

RESIDENTIAL REAL ESTATE PURCHASE AND SALE AGREEMENT |

ALL RIGHTS RESERVED |

|

Page 5 of 5 |

|

||

|

|

GENERAL TERMS |

|

Continued

(if any), and Managing Broker (if any) representing both parties as dual agents. If Selling Broker and Listing Broker are 173 the same person representing both parties then both Buyer and Seller confirm their consent to that person and his/her 174 Designated Broker, Branch Manager (if any), and Managing Broker (if any) representing both parties as dual agents. All 175

parties acknowledge receipt of the pamphlet entitled “The Law of Real Estate Agency.” |

176 |

v.Commission. Seller and Buyer agree to pay a commission in accordance with any listing or commission agreement to 177 which they are a party. The Listing Firm’s commission shall be apportioned between Listing Firm and Selling Firm as 178 specified in the listing. Seller and Buyer hereby consent to Listing Firm or Selling Firm receiving compensation from 179 more than one party. Seller and Buyer hereby assign to Listing Firm and Selling Firm, as applicable, a portion of their 180 funds in escrow equal to such commission(s) and irrevocably instruct the Closing Agent to disburse the commission(s) 181 directly to the Firm(s). In any action by Listing or Selling Firm to enforce this paragraph, the prevailing party is entitled to 182

court costs and reasonable attorneys’ fees. Seller and Buyer agree that the Firms are intended third party beneficiaries 183

under this Agreement. |

184 |

w.Cancellation

receives a Disclosure of Information on

mutual acceptance, Buyer may rescind this Agreement at any time up to 3 days thereafter. |

187 |

x.Information Verification Period and Property Condition Disclaimer. Buyer shall have 10 days after mutual 188 acceptance to verify all information provided from Seller or Listing Firm related to the Property. This contingency shall 189 be deemed satisfied unless Buyer gives notice identifying the materially inaccurate information within 10 days of mutual 190 acceptance. If Buyer gives timely notice under this section, then this Agreement shall terminate and the Earnest Money 191 shall be refunded to Buyer. Buyer and Seller agree, that except as provided in this Agreement, all representations and 192 information regarding the Property and the transaction are solely from the Seller or Buyer, and not from any Broker. The 193 parties acknowledge that the Brokers are not responsible for assuring that the parties perform their obligations under 194 this Agreement and that none of the Brokers has agreed to independently investigate or confirm any matter related to 195 this transaction except as stated in this Agreement, or in a separate writing signed by such Broker. In addition, Brokers 196 do not guarantee the value, quality or condition of the Property and some properties may contain building materials, 197 including siding, roofing, ceiling, insulation, electrical, and plumbing, that have been the subject of lawsuits and/or 198 governmental inquiry because of possible defects or health hazards. Some properties may have other defects arising 199 after construction, such as drainage, leakage, pest, rot and mold problems. Brokers do not have the expertise to identify 200 or assess defective products, materials, or conditions. Buyer is urged to use due diligence to inspect the Property to 201 Buyer’s satisfaction and to retain inspectors qualified to identify the presence of defective materials and evaluate the 202 condition of the Property as there may be defects that may only be revealed by careful inspection. Buyer and Seller 203 acknowledge that home protection plans may be available which may provide additional protection and benefit to Buyer 204 and Seller. Brokers may assist the parties with locating and selecting third party service providers, such as inspectors or 205

contractors, but Brokers cannot guarantee or be responsible for the services provided by those third parties. The parties 206

agree to exercise their own judgment and due diligence regarding |

207 |

Initials: BUYER: _________________ |

Date: _____________ |

SELLER: ________________ |

Date: ___________ |

BUYER: _________________ |

Date: _____________ |

SELLER: ________________ |

Date: ___________ |

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The Nwmls 21 form is designed for residential real estate transactions, serving as the primary purchase and sale agreement between buyers and sellers. |

| Governing Law | This form is governed by the laws of Washington State, particularly the Revised Code of Washington (RCW). |

| Earnest Money | Earnest money must be delivered within two days of mutual acceptance and serves as a deposit demonstrating the buyer's serious intent. |

| Included Items | The contract specifies which items are included in the sale, such as appliances and fixtures, and requires buyer confirmation of those items. |

| Closing Procedure | The closing must occur on the specified Closing Date and ensures that all required documents are recorded and proceeds are disbursed. |

| Title Insurance | The seller must allow the buyer’s lender or closing agent to apply for title insurance at the seller’s expense to protect against title defects. |

| Possession Date | The agreement allows for the buyer to take possession on the Closing Date or as otherwise arranged, with specific rights outlined. |

| Counteroffer Conditions | Any changes to the terms must be treated as a counteroffer, which the other party must sign to accept within a specified timeframe. |

| Lead-Based Paint Disclosure | If the property was built before 1978, the buyer must receive the lead-based paint disclosure and has three days to rescind the agreement. |

| Agreements on Utilities | The buyer and seller must disclose and agree to payment of any outstanding utility charges, with specific provisions outlined in the terms. |

Guidelines on Utilizing Nwmls 21

To fill out the NWMLS Form 21, follow these steps carefully to ensure that all necessary information is provided correctly. This form is essential for initiating the process of a residential real estate purchase and sale agreement.

- In section 1, enter the date and the MLS number.

- In section 2, write the full name of the buyer.

- In section 3, write the full name of the seller.

- In section 4, provide the tax parcel numbers, county name, street address, and state for the property.

- Attach the legal description of the property as Exhibit A in section 4.

- In section 5, check the boxes for any included items with the property, specifying additional items if necessary.

- Enter the purchase price in section 6.

- In section 7, detail the earnest money amount and indicate who will hold it (either Selling Firm or Closing Agent).

- In section 8, check the appropriate box regarding default consequences.

- Provide the title insurance company name in section 9.

- In section 10, indicate the choice of closing agent.

- Specify the closing date in section 11.

- For possession date, select whether the buyer will take possession on closing or another date in section 12.

- Fill in the offer expiration date in section 13.

- In section 14, indicate whether you want the closing agent to handle payment of utilities.

- In section 15, specify which party will cover any charges and assessments due after closing.

- In section 16, check the appropriate agency representation options for the selling and listing brokers.

- Complete any additional notes or details in the addenda section 17.

- Ensure both buyer and seller sign and date the form at indicated places.

- Provide addresses, phone numbers, and email addresses for both parties in the respective sections.

- Fill out the details for the selling and listing firms in their respective sections.

- Finally, include the printed names and contact information for both the selling and listing brokers.

What You Should Know About This Form

What is the NWMLS Form 21?

The NWMLS Form 21 is a Residential Purchase and Sale Agreement used for real estate transactions in Washington State. This form outlines the specific terms and conditions agreed upon by the Buyer and Seller, including property details, purchase price, and important dates such as the closing date and possession date.

What key information is required in the form?

Key information includes the date of the agreement, MLS number, names of the Buyer and Seller, property details (including tax parcel number and street address), and the purchase price. Additionally, the form requires details about included items in the sale, earnest money deposit, title insurance company, and closing agent. This information ensures both parties have a clear understanding of the transaction.

What is earnest money, and how is it handled?

Earnest money is a deposit made by the Buyer to demonstrate their good faith in purchasing the property. The form specifies how and where the earnest money will be held, typically by the Selling Firm or Closing Agent. If the agreement is terminated, the earnest money can be returned to the Buyer, or it may be forfeited to the Seller depending on the circumstances outlined in the agreement.

What are the implications of default on the agreement?

If a Buyer defaults on the agreement without legal justification, the Seller may choose how to proceed. They can either keep the earnest money as liquidated damages or pursue additional remedies, such as suing for actual damages or seeking specific performance to enforce the agreement. The Buyer should be aware that failure to comply could lead to financial loss.

What does the form say about closing and possession?

The form outlines that the transaction will close on a specified closing date. If this date falls on a weekend or holiday, the closing will occur the next business day. The Buyer is entitled to possession of the property at 9:00 p.m. on the specified possession date, either on the closing date or another agreed-upon date. This timing is crucial for the smooth transition of property ownership.

Can a party assign their rights in the agreement to someone else?

No party may assign their rights under the NWMLS Form 21 without prior written consent from the other party unless the agreement specifically allows for assignment. This provision protects the interests of both the Buyer and Seller by ensuring that neither party can transfer their obligations or rights without agreement.

What should Buyers and Sellers consider regarding legal advice?

Both Buyers and Sellers are advised to seek legal counsel and possibly an accountant before entering into the agreement. Consulting professionals can help ensure that all terms are understood and appropriate for the individual's circumstances. If a legal dispute arises later, the prevailing party may recover reasonable attorney’s fees and expenses from the other party.

What disclosure requirements exist for properties built before 1978?

If the property was built prior to 1978, the Buyer must receive a disclosure regarding lead-based paint and hazards. The Buyer has a right to rescind the agreement within three days if they receive this information after the agreement is accepted. This protection is in place to ensure that Buyers are aware of potential health risks associated with lead-based paint exposure.

Common mistakes

When filling out the NWMLS Form 21, many people overlook important details, which can lead to complications later. One common mistake is failing to provide complete and accurate property information. Buyers and sellers should ensure that the legal description and street address of the property are correct. Incomplete or incorrect details can cause issues during the closing process or lead to disputes about which property is being sold.

Another frequent error occurs in the section concerning the purchase price and earnest money. Some individuals mistakenly leave these areas blank or enter vague figures. It’s crucial to specify the total purchase price as well as the earnest money amount. Missing or unclear information could delay the transaction or lead to misunderstandings between the parties involved.

Accurate completion of the included items section is vital. Buyers often forget to check all items that should transfer with the sale. This might include appliances or fixtures that the seller intends to leave behind. Leaving any boxes unchecked without clarification can create confusion and potential conflict over what is included in the sale.

Another area where errors are common is in the signature and date section at the end of the form. Sometimes, buyers or sellers may forget to sign or provide the date. This oversight can render the agreement invalid. It’s essential to ensure that all required parties sign and date the document to confirm their acceptance of the terms.

Finally, failing to check the agency disclosure can cause problems. Many people either overlook this section or misunderstand its implications. Understanding who is representing whom in the transaction is essential, as it impacts the obligations and responsibilities of each party. An incomplete or incorrect agency disclosure can lead to unexpected surprises down the line.

Documents used along the form

The Nwmls 21 form, known as the Residential Purchase and Sale Agreement, is a foundational document in real estate transactions. Accompanying this form are several other important documents that help clarify the terms of the sale and protect the interests of all parties involved. Below is a brief overview of four commonly used forms related to the Nwmls 21 form.

- Nwmls Form 22K: Identification of Utilities - This form provides a detailed list of utilities servicing the property, ensuring that both the buyer and seller know who to contact for services and payments. This document is crucial for managing utility accounts at the time of closing.

- Nwmls Form 22E: Certification of Non-Foreign Status - This form certifies whether the seller is a foreign person under the Foreign Investment in Real Property Tax Act (FIRPTA). The certification is necessary to determine if tax withholding is required at closing.

- Nwmls Form 65A and 65B: Rental Agreements - These forms are used when the sellers remain in the property after the sale closes, or buyers occupy before the closing. They outline the terms of the rental arrangement to protect both parties during this transitional period.

- Nwmls Form 22J: Disclosure of Lead-Based Paint - Required for homes built before 1978, this form informs buyers of the potential risks associated with lead-based paint. This disclosure is pivotal for ensuring that buyers are aware of and can address any associated hazards.

Understanding these accompanying forms is essential for navigating real estate transactions smoothly. Each document plays a role in promoting transparency and ensuring that the rights and responsibilities of buyers and sellers are clearly defined.

Similar forms

Residential Lease Agreement: Similar to the NWMLS 21 form, the Residential Lease Agreement outlines terms for the use and occupancy of a property. Both documents clearly describe parties involved, property details, and specific terms such as payment schedules and conditions for possession. One key difference is that the lease typically covers a specified time period, whereas the purchase agreement focuses on transferring ownership.

Purchase and Sale Agreement: The NWMLS 21 form is essentially a type of Purchase and Sale Agreement, detailing the essential elements of buying a residential property. Like many other purchase agreements, it includes information about the buyer, seller, and property, along with terms related to earnest money and contingencies. The differences may lie in the format and any region-specific stipulations set forth by local real estate boards.

Offer to Purchase: This document is often the initial step in a real estate transaction, similar to the NWMLS 21 form. Both documents outline the buyer’s intention to purchase the property and may include purchase price and contingencies. However, while the NWMLS 21 acts as a formal agreement once accepted, an Offer to Purchase serves as a proposal that can be accepted, countered, or rejected.

Real Estate Purchase Agreement: This document, like the NWMLS 21, serves as a formal contract between the buyer and seller. It contains similar components, including earnest money details, closing dates, and provisions for title insurance. However, the Real Estate Purchase Agreement may differ in terms and conditions depending on the specific laws and regulations governing sales in various states.

Dos and Don'ts

- Do double-check all personal information for accuracy, including names, contact details, and addresses.

- Don't leave any sections blank; ensure every relevant field is completed to avoid delays.

- Do clearly indicate the included items in the sale using the checkboxes provided.

- Don't forget to specify the earnest money amount correctly and who will hold it.

- Do review the closing and possession dates carefully for alignment with everyone's availability.

- Don't rush through the agreement; take time to understand each clause and its implications.

Misconceptions

Misconception 1: The NWMLS Form 21 is only for buyers.

Many people believe that this form is solely for the benefit of buyers. In fact, the form is designed to protect the interests of both buyers and sellers during a real estate transaction. It outlines the terms and conditions that both parties must agree upon.

Misconception 2: Signing the form means the sale is final.

This is a common error. Signing the NWMLS Form 21 indicates that both parties agree to the terms, but it doesn't finalize the sale. The sale is only completed when all conditions are met, and the closing occurs.

Misconception 3: Earnest money is non-refundable.

Some people think that earnest money is automatically lost if the buyer backs out. However, the form provides specific conditions under which earnest money can be refunded, particularly if the buyer withdraws within specified time frames or due to certain issues with the property.

Misconception 4: The property is sold as-is, with no recourse for defects.

While the form does state that buyers should conduct their own inspections, it does not eliminate the seller's responsibilities for disclosing known defects. Buyers have the right to verify information and can seek recourse if significant issues arise.

Misconception 5: Fees and closing costs are always split evenly between buyer and seller.

This is not always the case. While the form suggests that closing costs are generally shared, the actual division of these fees varies based on the agreement made by the buyer and seller. Specific terms can be negotiated and documented in the agreement.

Key takeaways

Understanding the NWMLS Form 21 is vital for both buyers and sellers in real estate transactions. Here are four key takeaways regarding how to fill out and effectively use this form:

- Complete Information Thoroughly: Make sure to fill in all relevant details, including the date, buyers, sellers, and property specifics. Incomplete information may lead to misunderstandings or disputes later on.

- Carefully Outline Included Items: Specify what items are included in the sale by checking the appropriate boxes. This clarity prevents confusion about whether fixtures like appliances or outdoor equipment are part of the deal.

- Be Mindful of Earnest Money: Ensure that the earnest money is documented clearly. Decide who will hold it and how it will be managed. This deposit shows the buyer’s serious intent and can affect negotiations if not handled correctly.

- Understand Default Remedies: Familiarize yourself with the options for default, including the potential forfeiture of earnest money or the seller’s right to pursue other remedies. Knowing these provisions helps in strategizing your approach to the agreement.

Browse Other Templates

Guyana Visa - In such cases, you must apply for a new passport.

Oklahoma New Hire Reporting Form - Ensure your name is pre-printed on the voided check.