Fill Out Your Ny Dissolution Certificate Form

In New York, the process of formally dissolving a corporation involves filing a specific document known as the Certificate of Dissolution. This important form is submitted to the New York State Department of State and is essential for legally ending the existence of a corporation. It requires essential information such as the corporation's name, the filing date of its original certificate of incorporation, and the names and addresses of its officers and directors. Moreover, it includes a declaration confirming that the dissolution was approved through a vote at a shareholders’ meeting, specifying whether it was by a two-thirds majority, a simple majority, or unanimous consent. Additionally, the person filing must sign the document and provide their printed name and title. It’s also crucial to attach consents from the New York State Department of Taxation and Finance and, if applicable, the New York City Department of Finance. Be prepared to pay a $60 filing fee, as this step is necessary to process the dissolution officially. Understanding these components ensures a smooth dissolution process, allowing former corporations to comply with state requirements while focusing on their next steps.

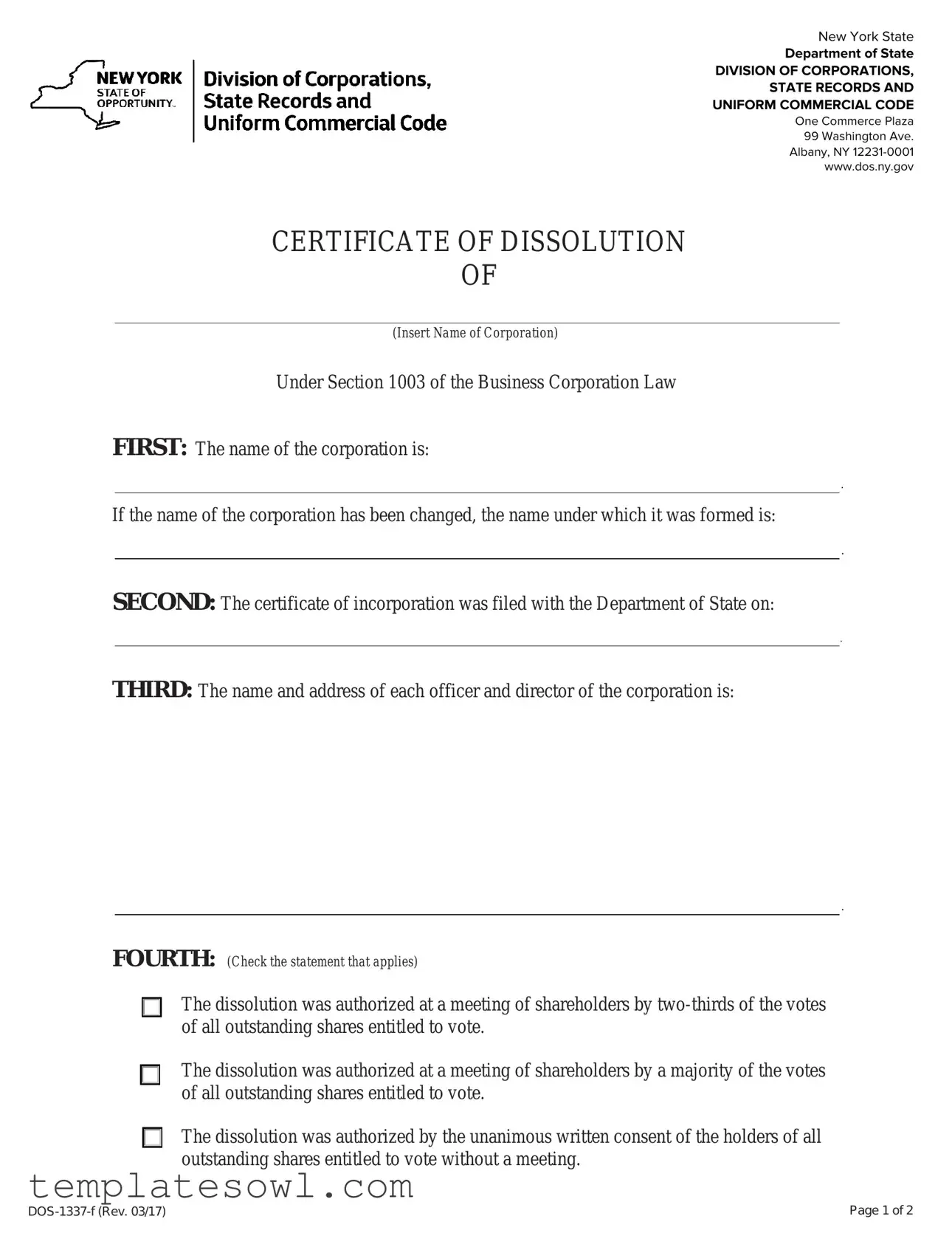

Ny Dissolution Certificate Example

New York State

Department of State

DIVISION OF CORPORATIONS,

STATE RECORDS AND

UNIFORM COMMERCIAL CODE

One Commerce Plaza

99 Washington Ave.

Albany, NY

www.dos.ny.gov

CERTIFICATE OF DISSOLUTION

OF

(Insert Name of Corporation)

Under Section 1003 of the Business Corporation Law

FIRST: The name of the corporation is:

.

If the name of the corporation has been changed, the name under which it was formed is:

.

SECOND: The certificate of incorporation was filed with the Department of State on:

.

THIRD: The name and address of each officer and director of the corporation is:

.

FOURTH: (Check the statement that applies)

The dissolution was authorized at a meeting of shareholders by

The dissolution was authorized at a meeting of shareholders by a majority of the votes of all outstanding shares entitled to vote.

The dissolution was authorized by the unanimous written consent of the holders of all outstanding shares entitled to vote without a meeting.

Page 1 of 2 |

FIFTH: The corporation elects to dissolve.

X

(Signature) |

|

|

(Print or Type Name of Signer) |

||

|

|

|

|

(Print or Type Title of Signer) |

|

CERTIFICATE OF DISSOLUTION

OF

(Insert Name of Corporation)

Under Section 1003 of the Business Corporation Law

Filer’s Name and Mailing Address:

Name:

Company, if Applicable:

Mailing Address:

City, State and Zip Code:

NOTES:

1.The name of the corporation and its date of incorporation must be exactly as they appear on the records of the Department of State. This information should be verified on the Department of State’s web site at www.dos.ny.gov.

2.This certificate must be signed by an officer, director or duly authorized person.

3.Attach the consent of the NYS Department of Taxation and Finance.

4.Attach the consent of the New York City Department of Finance, if required.

5.The fee for filing this certificate is $60, made payable to the Department of State.

For DOS Use Only

Page 2 of 2 |

Form Characteristics

| Fact Name | Description |

|---|---|

| Governing Law | The NY Dissolution Certificate is governed by Section 1003 of the New York Business Corporation Law. |

| Filing Authority | This form is filed with the New York State Department of State, specifically the Division of Corporations. |

| Submission Address | All submissions should be directed to One Commerce Plaza, 99 Washington Ave., Albany, NY 12231-0001. |

| Required Signatures | The certificate must be signed by an officer, director, or a duly authorized person within the corporation. |

| Dissolution Approval | The dissolution must be authorized by either a two-thirds vote, a majority vote, or unanimous written consent of shareholders. |

| Filing Fee | A fee of $60 is required for filing the certificate, payable to the Department of State. |

| Certificate Contents | The form requires basic information such as the corporation's name, incorporation date, and addresses of officers. |

| Verification Requirement | It is necessary to verify the corporation's name and incorporation date on the Department of State's website prior to submission. |

| Consent Attachments | Attachments include the consent from the NYS Department of Taxation and Finance and, if required, the NYC Department of Finance. |

| Form Revocation | This version of the form is marked as DOS-1337-f and is dated Rev. 03/17. |

Guidelines on Utilizing Ny Dissolution Certificate

Completing the New York Dissolution Certificate form requires careful attention to specific details regarding your corporation. After filling out the necessary information and ensuring accuracy, submit the form alongside any required attachments and the filing fee.

- Begin by writing the name of the corporation in the first blank. If the corporation has changed its name, fill in the former name in the second blank.

- In the next section, record the date when the certificate of incorporation was filed with the Department of State.

- List the names and addresses of each officer and director of the corporation in the designated area.

- Choose the appropriate statement regarding how the dissolution was authorized. Options include:

- The dissolution was authorized at a meeting of shareholders by two-thirds of the votes of all outstanding shares entitled to vote.

- The dissolution was authorized at a meeting of shareholders by a majority of the votes of all outstanding shares entitled to vote.

- The dissolution was authorized by the unanimous written consent of the holders of all outstanding shares entitled to vote without a meeting.

- Sign the certificate in the designated area. Below the signature, print or type the name of the signer and the title of the signer.

- Complete the filer’s information by adding the name, company name (if applicable), and mailing address, including city, state, and zip code.

- Verify that the name of the corporation and its date of incorporation exactly match the records on the Department of State’s website.

- Ensure that the certificate is signed by an officer, director, or a duly authorized person.

- Attach the consent from the NYS Department of Taxation and Finance, as well as the consent from the New York City Department of Finance if required.

- Prepare the filing fee of $60, made payable to the Department of State, and include it with your submission.

What You Should Know About This Form

What is the New York Dissolution Certificate form?

The New York Dissolution Certificate form is a document that officially dissolves a corporation in New York State. This form, filed with the Department of State, provides necessary information about the corporation, including its name, date of incorporation, and the process by which the dissolution was authorized.

Who needs to file a Dissolution Certificate?

Any corporation registered in New York that decides to terminate its existence must file a Dissolution Certificate. This applies to corporations that have completed their business objectives or no longer wish to operate. It is essential to follow this process to ensure that the corporation is legally dissolved and not subject to ongoing corporate obligations.

What information is required to complete the form?

To successfully complete the form, you need the corporation's name and any previous names it may have had, the date the certificate of incorporation was filed, the names and addresses of all officers and directors, and a statement confirming how the dissolution was authorized. There are options to indicate whether a two-thirds majority or a simple majority was required for the decision or if it was based on unanimous written consent.

What are the filing requirements for the Dissolution Certificate?

Along with the completed form, you must include the consent from the New York State Department of Taxation and Finance. If your corporation is located in New York City, you may also need to attach consent from the New York City Department of Finance. Additionally, the form must be signed by an officer or director of the corporation, and the filing fee is $60, payable to the Department of State.

How can I verify the corporation's name and incorporation date?

You can verify the corporation's name and incorporation date by visiting the New York State Department of State's website at www.dos.ny.gov. It’s crucial to ensure that all details match exactly with what is on file to avoid any delays or complications with your dissolution application.

What happens after I file the Dissolution Certificate?

Once you file the Dissolution Certificate and it is accepted, the corporation will officially cease to exist. However, you should keep a record of the dissolution for your files. It's wise to notify other stakeholders, such as banks, vendors, and tax authorities, that your corporation has been dissolved. This helps prevent any potential issues down the line regarding liabilities or obligations.

Common mistakes

Filing a Certificate of Dissolution in New York can be straightforward, but many people make common mistakes that can lead to delays or denials. Understanding these pitfalls can help streamline the process and ensure that your dissolution is approved without unnecessary hassle.

One of the most significant errors occurs with the corporation's name and date of incorporation. It's essential to fill out this information exactly as it appears in the records of the Department of State. If a name change has taken place, it needs to be clearly expressed. Omitting or altering this information can result in outright rejection of the application. Always double-check the details by visiting the Department of State's website.

Another mistake often seen is the failure to gather and provide the consent from the New York State Department of Taxation and Finance. This requirement is non-negotiable, and omitting it can halt the process. Additionally, for those corporations operating within New York City, a similar consent from the New York City Department of Finance may also be necessary. Missing these documents is a frequent oversight.

People also frequently misunderstand the voting requirements section. It is crucial to check the correct box that corresponds to how the dissolution was authorized. The choices range from a two-thirds majority of outstanding shares to unanimous written consent. If the wrong option is selected, it may imply improper authorization, which can lead to complications in the dissolution process.

Moreover, signatures are another common stumbling block. The form must be signed by an officer, director, or another duly authorized person. An unauthorized person’s signature will not be accepted, potentially causing delays. Not only does the form require a signature, but it also demands that the signer's name and title are printed or typed clearly. Neglecting this step can create confusion about who is submitting the dissolution.

Lastly, individuals often forget to include the filing fee. The required payment of $60 is made payable to the Department of State and must accompany the form. Omitting the fee can lead to processing delays or, worse, rejection of the application. By ensuring that all components are carefully reviewed and included, you can help avoid these common missteps when filing a Certificate of Dissolution in New York.

Documents used along the form

The process of dissolving a corporation in New York involves several important forms and documents, each serving a specific purpose in formalizing the dissolution. Understanding these documents is crucial for a smooth procedure and compliance with state regulations.

- Certificate of Authority: This document allows a business entity formed in another state to operate in New York. If a corporation was doing business in New York prior to dissolution, the Certificate of Authority must be surrendered to show that the corporation is no longer authorized to operate in the state.

- Final Tax Returns: Businesses must file final state and federal tax returns to report any earnings and pay outstanding taxes. These returns are often required before a corporation can fully conclude its business affairs and legally dissolve.

- Consent Forms from Tax Authorities: Prior to dissolution, corporations might need to obtain consents from tax authorities, including the New York State Department of Taxation and Finance and possibly the New York City Department of Finance. These forms confirm that all tax obligations have been settled.

- Notice of Dissolution: Although not always required, a notice may be published in a local newspaper to inform the public of the corporation's dissolution. This demonstrates transparency and allows creditors or other interested parties to address any outstanding issues.

- Letter of Confirmation from the New York Department of State: After filing the Certificate of Dissolution, a corporation may receive a confirmation letter from the Department of State. This letter acts as official documentation that the dissolution process has been completed.

Each of these documents plays a vital role in ensuring that a corporation dissolves correctly, avoiding potential legal complications down the line. Being prepared and understanding these necessary forms can significantly ease the dissolution process.

Similar forms

- Certificate of Incorporation: This document is essential for establishing a corporation. Similar to the Ny Dissolution Certificate, it requires specific information about the corporation, such as its name and registered address. Both forms serve as formal filings with the state, showcasing a corporation's status.

- Certificate of Good Standing: Issued by the state, this certificate confirms that a corporation is compliant with state regulations. Like the dissolution certificate, it validates key information and is often necessary when conducting business activities, such as mergers or raising funds.

- Articles of Organization: Used for forming a limited liability company (LLC), this document shares similarities with the dissolution certificate, including basic identifying information and filings with the state. Both serve to inform the state about the entity's existence and operations.

- Certificate of Amendment: Corporations may need to change their name or other important details. This certificate follows the same protocol as the dissolution certificate by detailing the specific changes and requiring state approval.

- Certificate of Merger: When two or more corporations merge, this document certifies the merger. It contains similar essential elements, like the names of the involved entities and the approval by shareholders, just like in the dissolution process.

- Certificate of Revival: If a corporation becomes inactive, it can file this certificate to regain its good standing. Both the revival and dissolution certificates involve the formal recognition of the status of the corporation and necessitate state involvement.

- Bylaws: While bylaws provide internal governance rules for a corporation, they must be consistent with state laws and regulations. They, too, highlight the organizational structure, much like how the dissolution certificate outlines the decision-making process behind the corporation's closure.

- Application for Certificate of Authority: Out-of-state corporations must file this application to conduct business in New York. While this processes the entry into a state, it functions similarly to the dissolution certificate by requiring specific corporate information and state approval.

Dos and Don'ts

Filling out the NY Dissolution Certificate form correctly is important to ensure a smooth process. Here are some dos and don'ts to consider:

- Do ensure the corporate name matches exactly with the records held by the Department of State.

- Do verify the date of incorporation before completing the form.

- Do include the names and addresses of all officers and directors accurately.

- Do choose the appropriate statement regarding authorization for dissolution carefully.

- Do sign the certificate with the correct title and printed name of the signer.

- Don't forget to attach the necessary consents from the NYS Department of Taxation and Finance.

- Don't skip attaching the NYC Department of Finance consent if it's required for your corporation.

- Don't omit the filing fee of $60 made out to the Department of State.

- Don't submit the form without double-checking for any potential errors or omissions.

Misconceptions

- Misconception 1: The NY Dissolution Certificate is the same as a business closure form.

- Misconception 2: Only businesses that are financially failing need to file for dissolution.

- Misconception 3: You don’t need consent from the Department of Taxation and Finance.

- Misconception 4: Filing the Dissolution Certificate is a quick and easy process.

- Misconception 5: All corporations can dissolve immediately without any waiting period.

- Misconception 6: You can file the Dissolution Certificate online.

- Misconception 7: The filing fee for the Dissolution Certificate is negotiable.

- Misconception 8: The dissolution process is the same for all types of businesses.

This is not accurate. The Dissolution Certificate specifically formalizes the end of a corporation’s legal existence, while a business closure form may not fulfill all legal requirements.

This is a common misunderstanding. Companies might choose to dissolve for various reasons, including strategic shifts or mergers, not just financial issues.

This is incorrect. It is mandatory to attach this consent when filing for dissolution. Without it, the dissolution may not be processed.

The process can be time-sensitive and requires careful documentation. Ensuring all required signatures and consents are in place can take time.

This is misleading. Depending on the corporate structure and any outstanding obligations, there may be necessary waiting periods or additional requirements before dissolution can be completed.

Currently, the filing must be done by mail or in person. Therefore, it is important to plan accordingly and allow sufficient time for processing.

This is not true. The fee is set at $60 and is mandatory. Failing to include this amount will result in the rejection of the application.

This is a misconception, as the requirements may vary based on the type of business entity. Different rules apply to corporations, LLCs, and partnerships.

Key takeaways

When filling out and using the New York Dissolution Certificate form, keep these key takeaways in mind:

- Accurate Information is Crucial: Ensure the name of the corporation and the date of incorporation exactly match the records maintained by the Department of State. Verify this information on their official website, www.dos.ny.gov.

- Authorized Signature Required: The certificate must be signed by an officer, a director, or another duly authorized individual. An incorrect signature can lead to delays or rejection.

- Attachments are Necessary: Remember to include the consent forms from both the New York State Department of Taxation and Finance as well as the New York City Department of Finance, if applicable.

- Filing Fee: There is a filing fee of $60 that must be paid. This fee should be made payable to the Department of State upon submission of the certificate.

Browse Other Templates

What Do You Need to Renew Your License in Nc - This document is a simple way to confirm auto liability coverage.

Nasd Rules - This is a document used to notify a brokerage firm of a potential conflict of interest due to employee affiliation.