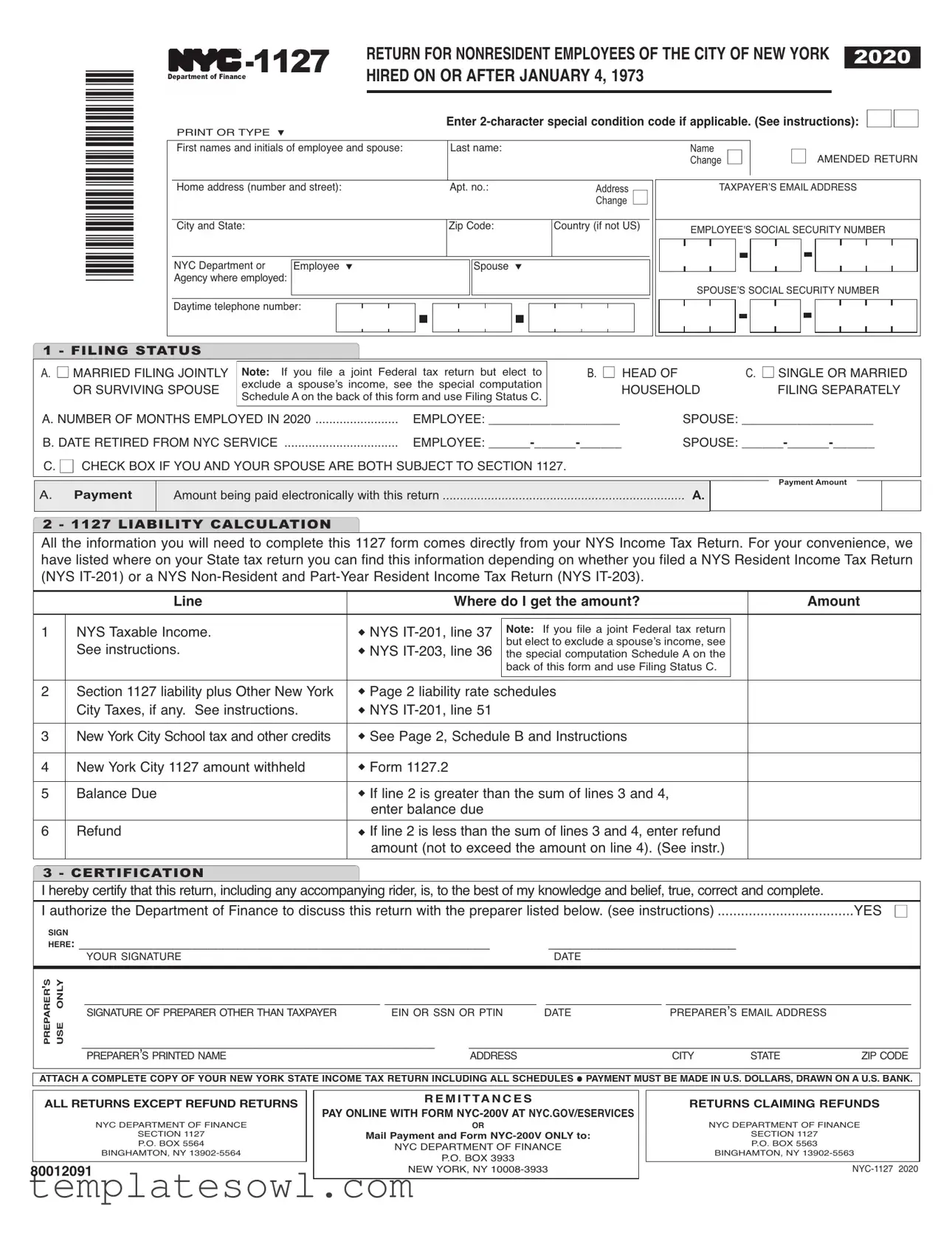

Fill Out Your Nyc 1127 Form

The NYC 1127 form is essential for nonresident employees who began their employment with the City of New York on or after January 4, 1973. This form serves as a crucial tax filing mechanism, allowing these employees to fulfill their tax obligations under Section 1127 of the New York City Charter. One critical aspect of the NYC 1127 form is the requirement to report any payment owed to the city, calculated based on the difference between the city’s personal income tax responsibility for residents and what is reported on the employee's New York State tax return. The form also includes sections for entering personal information, employee and spouse social security numbers, filing status, and applicable credits. Additionally, it provides a calculation of tax liabilities and any potential refunds. Ensuring accurate completion of this form is vital, as errors can lead to penalties or delayed refunds. With deadlines and specific mailing instructions outlined, the NYC 1127 form plays a significant role in maintaining compliance with city tax regulations while addressing the unique situations faced by nonresident employees.

Nyc 1127 Example

RURNRNNRDY |

HCYNYRK |

|

|

2020 |

|

HR NRAANUARY |

|

|

|

|

|

|

|

|

|

|

nn |

PRINT OR TYPE ▼ |

‑chcpecicondioncodeifppicbe( |

|

eincon |

||

|

|

|

|

|

|

*80012091*

First names and initials of employee and spouse: |

Last name: |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

Home address (number and street): |

Apt. no.: |

|

Address |

n |

|

|||

|

|

|

|

|

|

Change |

|

|

|

|

|

|

|

|

|

|

|

City and State: |

|

|

Zip Code: |

|

Country (if not US) |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NYC Department or |

|

Employee ▼ |

|

Spouse |

▼ |

|

|

|

Agency where employed: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Daytime telephone number:

Name |

n AMENDED RETURN |

Change n |

TAXPAYER’S EMAILADDRESS

EMPLOYEE'S SOCIAL SECURITY NUMBER

SPOUSE’S SOCIAL SECURITY NUMBER

1 - FILING STATUS

A. n MARRIED FILING JOINTLY |

No If you file a joint Federal tax return but elect to |

B. n HEAD OF |

C. n SINGLE OR MARRIED |

OR SURVIVING SPOUSE |

exclude a spouse’s income, see the special computation |

HOUSEHOLD |

FILING SEPARATELY |

|

Schedule A on the back of this form and use Filing Status C. |

|

|

A. NUMBER OF MONTHS EMPLOYED IN 2020 |

EMPLOYEE: ___________________ |

SPOUSE: ___________________ |

B. DATE RETIRED FROM NYC SERVICE |

EMPLOYEE: ______ ______ ______ |

SPOUSE: ______ ______ ______ |

C. n CHECK BOX IF YOU AND YOUR SPOUSE ARE BOTH SUBJECT TO SECTION 1127. |

|

|

A.yen

......................................................................Amount being paid electronically with this return |

A. |

|

|

Payment Amount

2 - 1127 LIABILITY CALCULATION

All the information you will need to complete this 1127 form comes directly from your NYS Income Tax Return. For your convenience, we have listed where on your State tax return you can find this information depending on whether you filed a NYS Resident Income Tax Return (NYS

|

ine |

Wheedogeeon |

Aon |

||

|

|

|

|

|

|

1 |

NYS Taxable Income. |

◆ NYS |

No If you file a joint Federal tax return |

|

|

|

See instructions. |

◆ NYS |

but elect to exclude a spouse’s income, see |

|

|

|

the special computation Schedule A on the |

|

|

||

|

|

|

back of this form and use Filing Status C. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

Section 1127 liability plus Other New York |

◆ Page 2 liability rate schedules |

|

||

|

City Taxes, if any. See instructions. |

◆ NYS |

|

|

|

|

|

|

|

|

|

3 |

New York City School tax and other credits |

◆ See Page 2, Schedule B and Instructions |

|

||

|

|

|

|

|

|

4 |

New York City 1127 amount withheld |

◆ Form 1127.2 |

|

|

|

|

|

|

|

|

|

5 |

Balance Due |

◆ If line 2 is greater than the sum of lines 3 and 4, |

|

||

|

|

enter balance due |

|

|

|

|

|

|

|

|

|

6 |

Refund |

◆ If line 2 is less than the sum of lines 3 and 4, enter refund |

|

||

|

|

amount (not to exceed the amount on line 4). (See instr.) |

|

||

|

|

|

|

|

|

3 - CERTIFICATION

I hereby certify that this return, including any accompanying rider, is, to the best of my knowledge and belief, true, correct and complete.

I authorize the Department of Finance to discuss this return with the preparer listed below. (see instructions) ...................................YES n

N |

_________________________________________________________ |

__________________________ |

H |

||

|

YOUR SIGNATURE |

DATE |

|

NY |

AR |

U |

_________________________________________ _____________________ |

________________ __________________________________ |

|||||

SIGNATURE OF PREPARER OTHER THAN TAXPAYER |

EIN OR SSN OR PTIN |

DATE |

PREPARER’S EMAIL ADDRESS |

|

||

_________________________________________________ |

_____________________________________________________________ |

|||||

PREPARER’S PRINTED NAME |

|

ADDRESS |

|

CITY |

STATE |

ZIP CODE |

AACHACCYURNYRKANCAXRURN |

NCUDNAHU |

●AYBDNUDARDRAWNNAUBANK |

|

|

|

ARURNRUNDRURN

NYC DEPARTMENT OF FINANCE

SECTION 1127

P.O. BOX 5564

BINGHAMTON, NY

RANC

AYNNWHRNYCVA NYCVVC

R

iyenndoNYCVNY

NYC DEPARTMENT OF FINANCE

P.O. BOX 3933

NEW YORK, NY

RURNCANRUND

NYC DEPARTMENT OF FINANCE

SECTION 1127

P.O. BOX 5563

BINGHAMTON, NY

|

|

|

|

|

|

|

|

Page 2 |

||

SCHEDULE A |

hedefoiediingoinyfopoend |

|

|

pyfopoe(oeinoNYCyog |

|

|

encyep oyee |

|||

|

|

ine |

|

|

|

|

|

|

|

Aon |

|

|

|

|

|

|

|

||||

1 |

NYS Adjusted Gross Income |

◆ NYS |

|

|

|

|||||

|

|

|

|

|

|

|||||

2 |

Non NYC Employee Income |

◆ Enter all income, additions and subtractions attributable to the non NYC employee |

||||||||

|

|

|

|

|

|

|

|

|

||

3 |

Net NYS Gross Income |

◆ Line 1 less Line 2 |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

4 |

Compute limitation percentage |

Line 3: |

$ |

|

|

eepoyeepo |

|

|

|

|

|

|

ndddedconnddependen |

|

|

|

|||||

|

|

|

______ |

|

|

|

|

|

||

|

|

|

Line 1: |

$ |

= _________ % |

exepononbedonn |

|

|

|

|

|

|

|

|

|

beofonepoyedbyNYC |

|

|

|

||

|

|

|

|

|

|

|

||||

5 |

Check only one box: |

n Standard Deduction: $8,000. |

|

|

|

|||||

|

|

|

R |

|

|

|

|

|

|

|

|

|

|

n Itemized deduction: $__________________ X _________ % |

= |

|

|

||||

|

|

|

(See instructions) |

|

amount from IT 201, line 34 % from line 4 |

|

|

|

||

|

|

|

|

|

|

amount from IT 203, line 33 |

|

|

|

|

6New York Dependent Exemption from

NYS return. No exemption is allowed ◆ NYS

filing separately for Section 1127 purposes, apply the limitation percentage from line 4).

7. Total Deductions and Exemptions |

◆ Line 5 + line 6 |

8.Allocated New York State

|

Taxable Income |

|

◆ Line 3 less line 7. |

Enter on Page 1, line 1. |

|

|

|

|

|

|

|

SCHEDULE B |

Nonefndbecedi |

|

|

|

|

|

|

|

|

|

|

|

ine |

|

|

Wheedogeeon |

Aon |

|

|

|

|

|

|

A1. |

NYC School Tax Credit (fixed amount) |

◆ See Instructions. |

*See below. |

|

|

|

|

|

|

|

|

A2. |

NYC School Tax Credit (rate reduction amount) |

◆ See Instructions |

|

|

|

|

|

|

|

|

|

B. |

UBT Paid Credit |

|

◆ See Instructions |

|

|

|

|

|

|

||

C. |

NYC household credit |

◆ from |

|

||

|

|

|

|

||

D. |

NYC Claim of Right Credit |

◆ from Form |

|

||

|

|

|

|

|

|

E. |

NYC Earned Income Credit |

◆ (attach |

|

|

|

|

|

|

|

|

|

F. |

Other NYC taxes |

|

◆ See Instructions |

|

|

|

|

|

|

||

G. |

NYC Child and Dependent Care Credit |

◆ See Instructions (attach |

|

||

|

|

|

|

||

H. |

Total of lines A1 - G |

◆ enter on page 1, line 3 |

|

||

|

|

|

|

|

|

*Enter income used to calculate eligibility for credit on Line A1: ____________________________

*80022091*

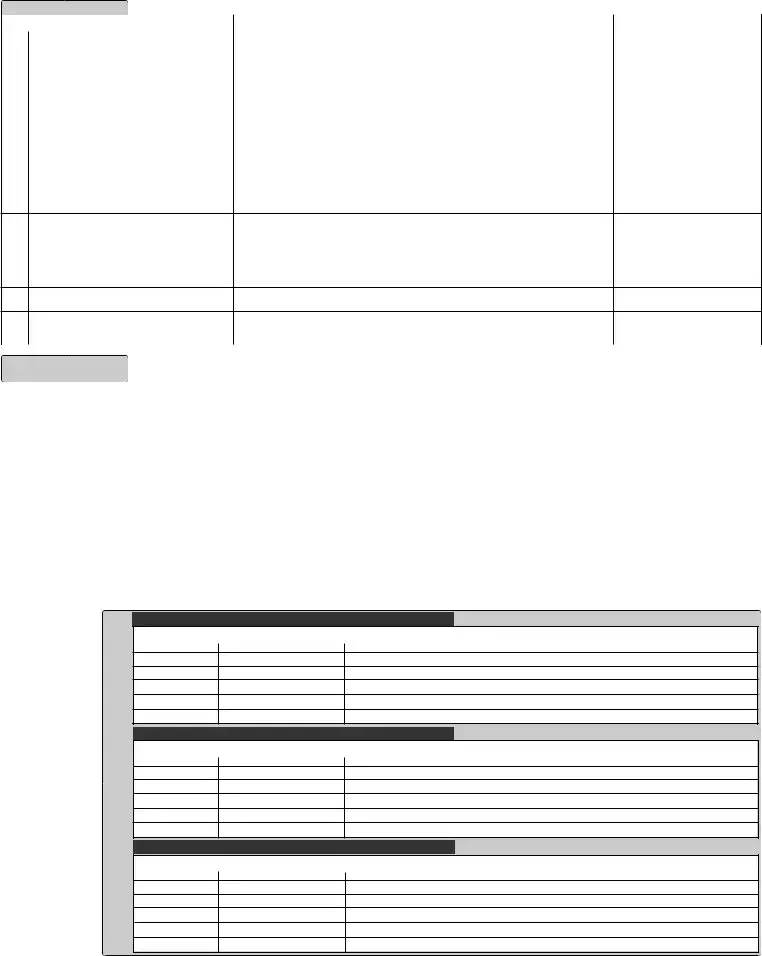

NEW YORK CITY 1127 LIABILITY RATES

beAiedfiingjoinyovivingpoe

If Form

VBUNV

$ |

0 |

$ |

21,600 |

$ |

21,600 |

$ |

45,000 |

$ |

45,000 |

$ |

90,000 |

$90,000

beBHedofhoehod

If Form

VBUNV

$ |

0 |

$ |

14,400 |

$ |

14,400 |

$ |

30,000 |

$ |

30,000 |

$ |

60,000 |

$60,000

beCngeoiedfiingepy

If Form

VBUNV

$ |

0 |

$ |

12,000 |

$ |

12,000 |

$ |

25,000 |

$ |

25,000 |

$ |

50,000 |

$50,000

HABY

|

|

|

3.078% |

of Form 1127, line 1 |

|

|

$ |

665 |

plus |

3.762% |

of the excess over |

$ |

21,600 |

$ |

1,545 |

plus |

3.819% |

of the excess over |

$ |

45,000 |

$ |

3,264 |

plus |

3.876% |

of the excess over |

$ |

90,000 |

|

|

|

HABY |

|

|

|

|

|

|

3.078% |

of Form 1127, line 1 |

|

|

$ |

443 |

plus |

3.762% |

of the excess over |

$ |

14,400 |

$ |

1,030 |

plus |

3.819% |

of the excess over |

$ |

30,000 |

$ |

2,176 |

plus |

3.876% |

of the excess over |

$ |

60,000 |

|

|

|

HABY |

|

|

|

|

|

|

3.078% |

of Form 1127, line 1 |

|

|

$ |

369 |

plus |

3.762% |

of the excess over |

$ |

12,000 |

$ |

858 |

plus |

3.819% |

of the excess over |

$ |

25,000 |

$ |

1,813 |

plus |

3.876% |

of the excess over |

$ |

50,000 |

NYRKCYDARNANC |

|

Instructions for Form |

|

ReturnforNonresidentEmployeesof theCityof NewYorkhiredonorafterJanuary 4,1973 |

2020 |

IMPORTANT INFORMATION CONCERNING FORM

Payments may be made on the NYC Department of Finance website at nycgoveevice , or via check or money order. If paying with check or money order, do not include these payments with your NewYork City return. Checks and money orders must be accompanied by payment voucher form

GENERALINFORMATION

LEGISLATIVE HIGHLIGHT

For tax years beginning before January 1, 2022, the

WHO MUST FILE

If you became an employee of the City of NewYork on or after January 4, 1973, and if, while so employed, you were a nonresident of the City during any part of 2020, you are subject to Section 1127 of the New York City Charter and must file Form

If you are subject to that law, you are required to pay to the City an amount by which a City personal income tax on resi- dents, computed and determined as if you were a resident of the City, exceeds the amount of any City tax liability computed andreportedbyyouontheCityportionof your 2020 NewYork State tax return.

NOTE:The payment required by Section 1127 of the NewYork City Charter is not a payment of any City tax, but is a pay- ment made to the City as a condition of employment. If you are subject to the fil- ing requirements of the City Resident Income Tax during any part of 2020, you must file tax returns with the New York

StateDepartmentofTaxationandFinance in the manner and at the time provided in the instructions for the State tax forms, regardless of any obligation you may have under Section 1127 of the Charter.

WHENAND WHERE TO FILE

Completed Forms

NYC Department of Finance

Section 1127

P.O. Box 5564

Binghamton, NY

Remittances - Pay online with Form

NYC Department of Finance

P.O. Box 3933

New York, NY

Forms claiming refunds:

NYC Department of Finance

Section 1127

P.O. Box 5563

Binghamton, NY

If you have been granted an extension of time to file either your federal income tax return or your New York State tax return, Form

If you file a State tax return or amended

return and the information reported on your original Form

CHANGE OFRESIDENCE

If you were a resident of the City of New York during part of 2020 and a nonresi- dent subject to the provisions of Section 1127 of the New York City Charter dur- ing all or part of the remainder of 2020, you must file a Form

If you were a New York City employee for only part of 2020, you must report that portion of your federal items of income and deduction which is attributa- ble to your period of employment by the City of New York.

MARRIED EMPLOYEES

Amarried employee whose spouse is not a New York City resident or an employ-

eeof the City should refer to instructions on page 1 of the return.

If you and your spouse are both employ- ees of the City of New York subject to Section 1127 of the New York City Charter

●and you and your spouse file sepa- rate New York State returns, you and your spouse must file separate Forms

Instructions for Form |

Page 2 |

● and you and your spouse file a joint |

there are no applicable special condition |

the year, enter on line 1 the amount from |

||

New York State return and were |

codes for tax year 2020. |

Check the |

line 47 of Form |

|

both subject to Section 1127 for the |

Finance website for updated special con- |

the period of employment is the period |

||

same period of time, you and your |

dition codes. If applicable, enter the two |

of NYC residence. |

||

spouse must file a joint Form NYC- |

charactercodeintheboxprovidedonthe |

|

||

1127. |

form. |

|

LINE 2 - LIABILITYAMOUNT |

|

|

|

|

Employees who are married and include |

|

PreparerAuthorization: Ifyouwantto |

In order to complete lines 1 through 6 of |

spouse’s income in Form |

||

allow the Department of Finance to dis- |

Form |

use Liability Table A on page 2 to com- |

||

cuss your return with the paid preparer |

you to refer to the instructions for filing |

pute the liability amount. |

||

who signed it, you must check the "yes" |

Form |

|

||

box in the signature area of the return. |

Form - State of New York) or Form IT- |

Married employees who choose not to |

||

This authorization applies only to the |

203 (Nonresident and |

include their spouse’s income on Form |

||

individual whose signature appears in |

Resident Income Tax Form - State of |

|||

the "Preparer's Use Only" section of |

NewYork). Booklets |

compute the liability amount. |

||

yourreturn. Itdoesnotapplytothefirm, |

I, issued by the New York State |

|

||

if any, shown in that section. By check- |

Department of Taxation and Finance, |

LIABILITYFOR OTHER NEW |

||

ing the "Yes" box, you are authorizing |

can be obtained from any District Tax |

YORK CITY TAXES |

||

the Department of Finance to call the |

Office of the New York State Income |

Include on line 2 the sum of your 1127 |

||

preparer to answer any questions that |

Tax Bureau. |

|

liability and the total of your liability for |

|

may arise during the processing of your |

|

|

other New York City taxes from New |

|

return. Also,youareauthorizingthepre- |

LINE 1 - NEWYORK STATE |

York State Form |

||

parer to: |

TAXABLE INCOME |

|

|

|

|

If you file NYS Form |

LINE 3 - NEWYORK CITY |

||

● Give the Department any informa- |

amount on line 37. If you |

file NYS |

SCHOOLTAX CREDITS |

|

tion missing from your return, |

Form |

Add lines a1 through g on page 2, |

||

|

36. If the amount withheld pursuant to |

Schedule B, to report credits and pay- |

||

● Call the Department for information |

Section 1127 was included in itemized |

ments that would have reduced your |

||

about the processing of your return |

deductions when calculating your New |

New York City resident income tax lia- |

||

or the status of your refund or pay- |

York State Personal IncomeTax liability, |

bility had you been a City resident. No |

||

ment(s), and |

you must add back that amount to the |

amount reported on line 3 is refundable. |

||

|

amount from line 37 of NYS |

Refunds of overpayments of tax and |

||

● Respond to certain notices that you |

line 36 of NYS |

refundable credits available to NewYork |

||

have shared with the preparer |

this line. |

|

State residents and |

|

aboutmatherrors,offsets,andreturn |

|

|

City residents must be claimed by filing |

|

preparation. The notices will not be |

NOTE: If you file a joint Federal tax |

forms |

||

sent to the preparer. |

return but elect to exclude a spouse’s |

|

||

|

income, see the special computation |

LINE 4 - PAYMENTS |

||

You are not authorizing the preparer to |

Schedule A on the back of this form and |

Enter on line 4 the amount withheld by |

||

receive any refund check, bind you to |

use Filing Status C. |

|

theCityfromyourwagesduring2020for |

|

anything(includinganyadditionalliabil- |

|

|

the amount due under Charter Section |

|

ity), or otherwise represent you before |

If you contributed to a New York State |

1127 as shown on your City Wage and |

||

the Department. The authorization can- |

Charitable Gifts Trust Fund, claim a |

Withholding Tax Statements for 2020. |

||

not be revoked, however, the authoriza- |

New York State itemized deduction for |

(Attach a copy of Form |

||

tion will automatically expire no later |

that contribution, and the period of your |

|

||

than the due date (without regard to any |

NYC employment encompassed the full |

LINE 5 - BALANCE DUE |

||

extensions) for filing next year's return. |

year, enter on line 1 the amount that you |

After completing this return, enter the |

||

Failure to check the box will be |

would have entered on line 47 of Form |

amount of your remittance on line A, |

||

deemed a denial of authority. |

page 1. Remittances must be made |

|||

|

payable to the order of: NYC DEPART- |

|||

SPECIFIC INSTRUCTIONS |

you contributed to a New York State |

MENTOFFINANCE |

||

|

Charitable Gifts Trust Fund, claim a |

|

||

Special Condition Codes |

New York State itemized deduction for |

LINE 6 - OVERPAYMENT |

||

that contribution and the period of your |

Ifline2islessthanthesumoflines3and |

|||

At the time this form is being published, |

||||

NYC employment encompassed part of |

4 you may be entitled to a refund. Note: |

|||

|

|

|

|

|

Instructions for Form |

Page 3 |

the refund may not exceed the amount |

|

A1 - NEWYORK CITYSCHOOL |

|

|||||

on line 4. To determine your refund |

|

TAX CREDIT (fixed amount) |

|

|||||

amount, compute the difference between |

|

ASchoolTaxCreditisallowedfor2020asfollows: |

|

|||||

the sum of lines 3 and 4, and line 2 (sub- |

|

|

|

|

|

|

|

|

|

iing |

fyoincoei |

|

|

|

Yocedii |

|

|

tractline2fromthesumoflines3and4). |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

● Single |

|

|

$250,000 or less |

$63 |

|

||

Your refund amount is the lesser of this |

|

|

|

|

||||

|

|

|

|

|

||||

|

● Married filing |

|

|

|

|

|

||

difference and the amount on line 4. |

|

separate return |

|

Over $250,000 |

$0 |

|

||

|

|

|

|

|

|

|

||

|

|

● Head of household |

|

|

|

|

|

|

If the amount on line 2 is equal to the |

|

● Married filing |

|

$250,000 or less |

$125 |

|

||

|

joint return |

|

|

|||||

sum of lines 3 and 4, enter 0 on line 6. |

|

● Qualifying widow(er) |

|

Over $250,000 |

$0 |

|

||

|

|

with dependent child |

|

|

||||

Refunds cannot be processed unless a |

|

*Income, for purposes of determining your school |

|

|||||

|

tax credit means your federal adjusted gross |

|

||||||

complete copy of yourNewYork State |

|

income (FAGI) from Form |

|

|||||

return, including all schedules, and |

|

distributions from an individual retirement |

|

|||||

|

account and an individual retirement annuity from |

|

||||||

wageandtaxstatement (Form1127.2) |

|

|

||||||

are attached to your form. |

|

**The statutory credit amounts have been rounded. |

|

|||||

|

|

|

|

|

|

|

|

|

|

See also the instructions to Line 69 of New |

|

||||||

SPECIALINSTRUCTIONS FOR |

|

|

||||||

|

York State Form |

|

||||||

2020 FOR SCHEDULEA, PAGE 2. |

|

|

||||||

|

were employed by the City for only part of |

|

||||||

If you contributed to a New York State |

|

theyearshoulduseTable2inthoseinstruc- |

|

|||||

Charitable Gifts Trust Fund, filed a New |

|

tionstodeterminetheallowablecredit. See |

|

|||||

York State return claiming married filing |

|

also instructions to the other lines of New |

|

|||||

jointly status and claiming an itemized |

|

York State Form |

|

|||||

deduction for that contribution, you must |

|

|

|

|

|

|

|

|

recalculate NYS AGI by adding back the |

|

A2 - NEWYORK CITYSCHOOL |

|

|||||

amount of the contribution to the |

|

TAX CREDIT (rate reduction |

|

|||||

Charitable Gifts Trust Fund. Enter the |

|

amount) |

|

|

|

|

||

recalculated NYS AGI on line 1. Attach a |

|

The New York City tax credit rate reduc- |

|

|||||

worksheetshowingthecalculations.Ifyou |

|

tion amount is calculated as follows: |

|

|||||

contributedtoaNewYorkStateCharitable |

|

|

|

|

|

|

|

|

|

|

CconofNYCchooxcedi |

|

|

||||

Gifts Trust Fund, claim a New York State |

|

|

|

|

||||

|

(edcononfoiedfiingjoiny |

|

|

|||||

|

|

|

|

|||||

itemized deduction for that contribution |

|

|

ndqifyingido(e |

|

|

|||

|

|

|

|

|

|

|

|

|

and the period of your NYC employment |

|

fcixbeincoei |

|

hecedii |

|

|

||

encompassed part of the year, the amount |

|

ove |

bnoove |

|

|

|

|

|

online1ofScheduleAshouldbecalculat- |

|

$0 |

$21,600 |

|

|

.171% of taxable income* |

|

|

ed as if the period of employment is the |

|

$21,600 |

$500,000 |

|

|

$37 plus .228% of the |

|

|

period of NYC residence. |

|

|

|

|

|

excess over $21,600 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CconofNYCchooxcedi |

|

|

|||

SCHEDULEA, PAGE 2 - LINE 5 |

|

(edcononfoingendied |

|

|

||||

|

|

fiingepy |

|

|

||||

If the amount withheld pursuant to |

|

|

|

|

|

|

|

|

|

fcixbeincoei |

|

hecedii |

|

|

|||

Section 1127 was included in the item- |

|

ove |

bnoove |

|

|

|

|

|

ized deductions when calculating your |

|

$0 |

$12,000 |

|

|

.171% of taxable income* |

|

|

New York State Personal Income Tax |

|

|

|

|

|

|

|

|

|

$12,000 |

$500,000 |

|

|

$21 plus .228% of |

|

||

liability, you must reduce the amount of |

|

|

|

|

|

the excess over $12,000 |

|

|

your itemized deductions for purposes of |

|

|

|

|

|

|

|

|

|

|

CconofNYCchooxcedi |

|

|

||||

this line by that amount. |

|

|

(edconon |

|

|

|||

|

|

fohedofhoehod |

|

|

||||

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

SCHEDULE B, PAGE 2 |

|

fcixbeincoei |

|

hecedii |

|

|

||

|

ove |

bnoove |

|

|

|

|

||

|

|

|

|

|

|

|||

On Schedule B, report items for employ- |

|

|

|

|

|

|

|

|

|

$0 |

$14,400 |

|

|

.171% of taxable income* |

|

||

ee and spouse if filing a joint Form |

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

$14,400 |

$500,000 |

|

$25 plus .228% of |

|

|||

|

|

|

||||||

choose not to include their spouse’s |

|

|

|

|

|

the excess over $14,400 |

|

|

|

|

|

|

|

|

|

|

|

income in Form |

|

*If the period of your NYC employment encompassed the |

|

|||||

for employee only. |

|

full year, use the amount entered on page 1, line 1. If it |

|

|||||

|

encompassed part of the year, use the amount from line |

|

||||||

|

|

47 of Form |

|

|||||

|

|

ment is the period of NYC residence. |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

B - UBT PAID CREDIT

If you were a partner in a partnership doing business in the City, you may be entitled to a credit for a portion of the City Unincorporated Business Tax paid by that partnership. See Form

F- OTHER CITYTAXES

203)if any, as City tax (Form

G - NYC CHILDAND DEPENDENT CARE CREDIT

Refer to New York State Form

MAILING INSTRUCTIONS

In order for your form to be processed, you must attach the following to Form

◆Complete copy of New York State Income Tax Return, including all schedules

◆Wage and withholding statement (Form 1127.2)

◆Agency verification, if claiming line of duty injury deduction

SIGNATURE

You must sign and date your return at the bottom of page 1. If you file jointly on Form

and/orrefundcannotbeprocessedifit is not signed.

Instructions for Form |

Page 4 |

If you have a

ACCESSING NYC TAX FORMS

By Computer - Download forms from the Finance website at nyc.gov/finance

PRIVACYACT NOTIFICATION

The Federal Privacy Act of 1974, as amended, requires agencies requesting Social Security Numbers to inform individuals from whom they seek this information as to whether com- pliance with the request is voluntary or manda- tory,whytherequestisbeingmadeandhowthe information will be used. The disclosure of Social Security Numbers for taxpayers is mandatory and is required by section

Form Characteristics

| Fact Name | Detail |

|---|---|

| Governing Law | The NYC 1127 form is governed by Section 1127 of the New York City Charter, which applies to nonresident employees hired on or after January 4, 1973. |

| Filing Requirement | If you were a nonresident employee of New York City during any part of 2020, you must file this form if eligible under Section 1127. |

| Filing Deadline | Forms must be filed by May 15, 2021, excluding forms claiming a refund, which have different submission guidelines. |

| Payment Information | Payments can be made electronically on the NYC Department of Finance website or via a check/money order along with Form NYC-200V. |

| Information Source | All required information to complete the NYC 1127 comes directly from your NYS Income Tax Return, specifically the NYS IT-201 or IT-203 forms. |

| Filing Status Options | The form accommodates various filing statuses, including Married Filing Jointly, Married Filing Separately, Single, or Head of Household. |

| Certification Requirement | Taxpayers must certify that the information on the form is true and complete, with both spouses required to sign if filing jointly. |

| Refund Eligibility | If your calculated liability is less than total credits and payments, you may be entitled to a refund, which cannot exceed the amount withheld. |

| Additional Submissions | To process your return, you must attach a complete copy of your New York State Income Tax Return and any relevant schedules or forms. |

Guidelines on Utilizing Nyc 1127

After gathering the necessary information from your New York State tax returns and relevant documents, you're ready to fill out Form NYC-1127. Following these clear steps will help ensure that the form is completed accurately.

- Start by entering your first names and initials along with your last name.

- Fill in the home address, including the number and street, apartment number, city, state, and zip code.

- Provide your daytime telephone number and your email address.

- Input your Employee's Social Security Number and the Spouse’s Social Security Number.

- Choose your filing status by checking either A, B, or C.

- For section 1127 liability calculation, refer to your NYS Income Tax Return and fill in line items as needed, pulling the relevant numbers from your tax return.

- Complete the certification section by signing and dating the form at the designated area.

- If a preparer assisted you, have them provide their information and signature at the bottom of the form.

- Before mailing, ensure you attach your complete New York State Income Tax Return, along with the Wage and Withholding Statement (Form 1127.2).

- Send the completed form to the NYC Department of Finance at the appropriate address based on your situation.

What You Should Know About This Form

What is the NYC 1127 form?

The NYC 1127 form is a tax return specifically for nonresident employees of New York City who were hired on or after January 4, 1973. If you were a nonresident and employed by the City during any part of the year, this form is required to calculate your New York City personal income tax liability. It helps determine the difference between what you owe as a nonresident and what you would owe as a resident.

Who needs to file the NYC 1127 form?

If you became an employee of New York City on or after January 4, 1973, and were a nonresident of the City during part of 2020, you must file the NYC 1127. This form ensures you meet your tax obligations based on your employment with the City, even if you do not reside there.

When is the NYC 1127 form due?

The completed NYC 1127 form must be filed by May 15, 2021. If you were granted an extension for your federal or New York State tax returns, your NYC 1127 must be submitted within 15 days following the extended due date. Make sure it is postmarked by the due date to avoid any penalties.

How can I file the NYC 1127 form?

You can file the NYC 1127 form by mailing it to the NYC Department of Finance or by filing online. Many prefer the online method for speed and convenience. If mailing, make sure to send it to the appropriate address provided in the form instructions. Attach all required documents for processing, including your New York State tax returns.

What do I include with the NYC 1127 form?

To complete the form correctly, you must include a complete copy of your New York State Income Tax Return, including all schedules. Additionally, provide your wage and withholding statement (Form 1127.2) and any necessary agency verification if you plan to claim a line-of-duty injury deduction.

Can I receive a refund with the NYC 1127 form?

Yes, if your tax liability calculated on the NYC 1127 form is less than the total amount of New York City taxes withheld from your earnings, you may be entitled to a refund. To receive your refund, ensure that you fill out the refund section correctly and attach all required documents.

What is the liability calculation for the NYC 1127 form?

The liability calculation on the NYC 1127 form is based on your New York State taxable income, which you can find on your NYS tax return. The form includes detailed instructions on how to compute your tax liability and any applicable credits. Carefully follow each step to ensure accurate reporting.

What happens if my information changes after filing?

If you file an amended New York State tax return after submitting your NYC 1127 form, you must file an amended NYC 1127 form as well. This ensures that all your information is accurate and reflects any changes made to your state returns. Filing an amendment within the required timeframes helps avoid confusion and potential penalties.

Where do I mail the NYC 1127 form?

Depending on the nature of your filing, you must mail your NYC 1127 form to specific addresses. For general submissions, send it to the NYC Department of Finance, Section 1127, P.O. Box 5564, Binghamton, NY 13902-5564. If claiming a refund, you would mail it to a different address outlined in the instructions. Always check that you’re using the right address for your specific situation.

Common mistakes

Completing the NYC 1127 form can be a complex process, and many individuals make mistakes that could delay their tax returns or create unnecessary issues. One common mistake involves not entering correct personal information. For example, failing to accurately fill in the first names, initials, or last name can create complications. Additionally, errors in the home address may result in the form being sent to the wrong location, potentially causing missed communications.

Another mistake to avoid is not referencing the correct lines from the New York State tax return. Section 1127 requires information that must match the data on your NYS Income Tax Return. People often overlook the importance of double-checking figures to ensure consistency, particularly when filling out lines related to NYS Taxable Income or credits. Inaccurate figures will lead to complications during processing.

Many filers neglect to sign and date the return. The NYC Department of Finance cannot process a return if it is not signed, whether it’s being filed jointly or separately. Failure to sign the form often leads to delays or even rejections. Both spouses must sign when filing jointly, which is a detail that shouldn’t be overlooked.

Lastly, a frequent error relates to the attachment of necessary documents. Filers sometimes forget to include a complete copy of their New York State tax return or the wage and withholding statement (Form 1127.2). The absence of required documents can lead to a significant delay in the processing of the tax return. Ensuring all required paperwork is attached helps to avoid unnecessary back-and-forth communications with the tax department.

Documents used along the form

The NYC 1127 form is a specific tax document that nonresident employees of the City of New York must complete under certain circumstances. It is often used in conjunction with several other forms and documents to ensure that individuals adhere to the city’s taxation requirements effectively. Below is a list of related forms and documents that may accompany the NYC 1127 form.

- New York State Income Tax Return (NYS IT-201 or IT-203): This is the central tax form for reporting income and calculating tax liability for residents (IT-201) and non-residents or part-year residents (IT-203) of New York State. Information from this return is essential for completing the NYC 1127 form.

- NYC Wage and Withholding Statement (Form 1127.2): This form provides a detailed record of wages earned and taxes withheld for the year. It is crucial for accurately reporting the amounts associated with the section 1127 liability.

- New York State Charitable Gifts Trust Fund Deduction Worksheet: If a taxpayer has contributed to this fund, they must calculate the implications on their New York State adjusted gross income. This worksheet helps ensure proper reporting of deductions.

- Form NYC-200V (Payment Voucher): This document is used to accompany electronic or mailed payments made to the NYC Department of Finance. It ensures that payments are processed correctly and on time, avoiding penalties.

- Form IT-215 (Earned Income Credit): This form helps determine eligibility for earned income credits, supporting tax relief for qualifying individuals. It may be necessary for claimants of earned income credits related to their NYC tax obligations.

- Agency Verification Documentation: Individuals claiming a line-of-duty injury deduction must provide proof from their agency. This documentation supports the legitimacy of the requested deduction on their tax return.

- New York City School Tax Credit Application: For those who qualify, this form allows applicants to apply for credits that may reduce their overall city tax liability. It is sometimes filed alongside the NYC 1127 when applicable credits are sought.

In conclusion, the NYC 1127 form interacts with a variety of other forms and documentation. Each of these documents plays a role in ensuring that tax obligations are accurately reported and fulfilled, reflecting an individual’s compliance with New York City's tax laws. Properly completing all associated forms is essential for avoiding potential issues and penalties with the Department of Finance.

Similar forms

- IRS Form 1040: Both forms require personal information and details regarding filing status. The 1040 is the standard federal income tax return used by U.S. taxpayers, similar to how NYC-1127 is utilized by non-resident employees for NYC tax calculations.

- New York State IT-201: This form is for New York State residents filing their income tax returns. NYC-1127 draws information from the IT-201, specifically for liability calculations, making them interconnected.

- New York State IT-203: This form is for non-residents and part-year residents of New York. It similarly outlines income and tax obligations, directing how information is applied in the NYC-1127 for those non-resident employees.

- Form NYC-200V: This payment voucher is used to submit payments for tax obligations. It's essential for remittance with NYC-1127 to ensure compliance and payment of balances due.

- NYS IT-215: This form claims the Earned Income Credit, relevant for many taxpayers. It parallels NYC-1127 where credits and deductions can significantly affect the final tax amounts.

- Form IT-216: This form is used to claim the Child and Dependent Care Credit at the state level. Similar to NYC-1127, it deals with credits that could potentially offset tax liabilities, reflecting specific deductions applicable for non-residents as well.

Dos and Don'ts

- Do ensure all sections are completed accurately, including your and your spouse’s names, addresses, and Social Security numbers.

- Do double-check any relevant lines with your New York State Income Tax Return. This helps confirm accuracy.

- Do file your NYC-1127 form by the deadline to avoid any late fees or penalties.

- Do sign your return to validate its authenticity. Unsigned forms will not be processed.

- Don't leave any mandatory fields blank. Incomplete forms can lead to processing delays.

- Don't combine your NYC-1127 payment with your regular New York City tax return. They must be submitted separately.

- Don't ignore instructions on supporting documents. Ensure you include all required attachments, such as Form IT-201 or IT-203.

- Don't assume your tax situation is the same as last year. Review your situation carefully, as it may differ.

Misconceptions

- Misconception 1: The NYC 1127 form is only for full-time residents of New York City.

- Misconception 2: Filing the NYC 1127 form is optional if you have already filed your state taxes.

- Misconception 3: All non-resident city employees owe the same tax amount.

- Misconception 4: Only married couples can use the NYC 1127 for filing jointly.

- Misconception 5: Submitting the form electronically eliminates the need for a physical signature.

This form is actually designed for non-resident employees of New York City who were employed by the city during part of the tax year. If you worked for the City of New York but lived elsewhere, this form may apply to you, requiring you to calculate tax liabilities based on being treated as a city resident for tax purposes.

It is essential to file the NYC 1127 if you meet the requirements set by the New York City Charter. Failure to file can result in penalties, as this form is specifically meant to calculate the additional amount due based on your employment with the city. It is a necessary step to ensure compliance with city tax laws.

Tax liability can vary significantly based on your income level, the specific deductions you qualify for, and your filing status. The form utilizes a tiered tax rate system, meaning that the amount owed changes as your income changes. Understanding your unique situation is key to accurately calculating your tax responsibility.

While married employees can file jointly, single individuals also have the right to file using the NYC 1127 form. The form accommodates various filing statuses, including single or head of household, ensuring that different taxpayers can accurately report their situation and liabilities.

Regardless of whether you file electronically or by mail, it is still crucial to provide a signature. The NYC 1127 form requires the taxpayer's signature to validate the submission. Omitting this step can delay processing and potentially lead to issues with your tax return.

Key takeaways

Here are some essential points to know about filling out and using the NYC 1127 form:

- The NYC 1127 form is required for nonresident employees of New York City hired on or after January 4, 1973.

- This form is used to calculate the additional city taxes owed based on how your income would have been taxed if you were a city resident.

- Make sure to provide accurate information including your and your spouse's names, social security numbers, and employment details.

- Refer to your New York State tax return to find relevant figures needed for the NYC 1127 calculations.

- Be aware of the filing deadline; typically, the completed form must be submitted by May 15 of the following year.

- If you are married, you may have to file jointly or separately depending on your circumstances; check the space provided for indication.

- Attachments are essential while submitting your form; include a complete copy of your New York State tax return and wage statements.

- Ensure you sign and date your form. Without your signature, processing your return or refund will be delayed.

Understanding these takeaways will help you navigate the filing process more smoothly.

Browse Other Templates

What Is an Itil Certification - User feedback is crucial in assessing project outcomes.

Fl 421 - A clear and accurate record of payments avoids confusion and disputes in family law matters.

New Colorado License - Photocopies of proof of ownership and insurance are necessary attachments.