Fill Out Your Nycap Ess Form

The Nycap Employee Self-Service (ESS) form offers a convenient way for employees to manage their HR, payroll, tax, and benefits information all in one place. This online platform provides instant access to essential data, streamlining the management of personal, tax, and payroll details, as well as benefits enrollment. By switching to electronic pay stubs, the system not only cuts down on paper waste but also supports New York City’s “green” initiatives. Employees can perform a variety of tasks through the ESS, including updating personal information, viewing and printing pay stubs, and enrolling in benefits. The portal is easily accessible 24/7 from both City offices and the Internet, ensuring that employees can retrieve their information whenever necessary. Users can log in with unique identification details, making it straightforward to engage with their personal data. Designed with the user in mind, the ESS simplifies annual updates and other important processes, empowering employees to take charge of their employment information efficiently.

Nycap Ess Example

Employee

•Instant access to your HR, payroll, tax, and benefits data.

•Reduced paper waste with electronic pay stubs – in line with PlaNYC “green” initiative.

Frequently Asked Questions |

|

|

Employee |

||

|

||

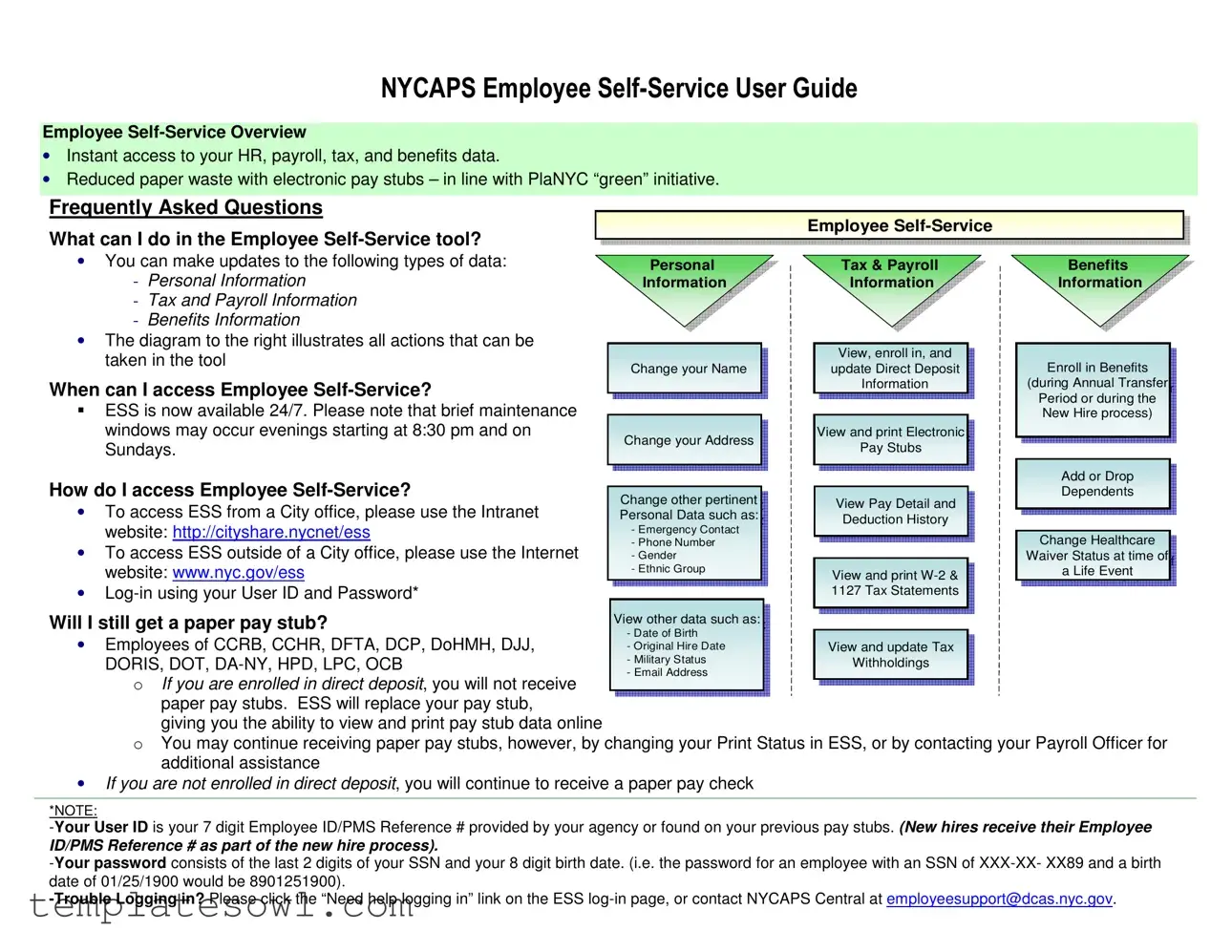

What can I do in the Employee |

Employee |

|

|

• You can make updates to the following types of data: |

Personal |

Tax & Payroll |

Benefits |

- Personal Information |

Personal |

Tax & Payroll |

Benefits |

Information |

Information |

Information |

|

|

Information |

Information |

Information |

-Tax and Payroll Information

-Benefits Information

•The diagram to the right illustrates all actions that can be

taken in the tool |

|

|

|

View, enroll in, and |

|

|

|

Change your Name |

View, enroll in, and |

Enroll in Benefits |

|||||

update Direct Deposit |

|||||||

|

Change your Name |

update Direct Deposit |

Enroll in Benefits |

||||

When can I access Employee |

|

|

|

Information |

(during Annual Transfer |

||

|

|

|

Information |

|

(during Annual Transfer |

||

|

|

|

|

|

Period or during the |

||

ESS is now available 24/7. Please note that brief maintenance |

|

|

|

|

|

Period or during the |

|

|

|

|

|

|

New Hire process) |

||

windows may occur evenings starting at 8:30 pm and on |

|

|

|

|

|

New Hire process) |

|

|

|

|

View and print Electronic |

|

|

|

|

|

Change your Address |

|

View and print Electronic |

|

|

|

|

Sundays. |

Change your Address |

|

Pay Stubs |

|

|

|

|

|

|

|

Pay Stubs |

|

|

|

|

|

|

|

|

|

|

Add or Drop |

|

How do I access Employee |

|

|

|

|

|

Add or Drop |

|

Change other pertinent |

|

|

|

|

Dependents |

|

|

|

|

View Pay Detail and |

|

Dependents |

|

||

• To access ESS from a City office, please use the Intranet |

Change other pertinent |

|

|

|

|

||

Personal Data such as: |

|

View Pay Detail and |

|

|

|

||

|

Personal Data such as: |

|

Deduction History |

|

|

|

|

website: http://cityshare.nycnet/ess |

- Emergency Contact |

|

Deduction History |

|

|

|

|

- Emergency Contact |

|

|

|

|

Change Healthcare |

|

|

|

- Phone Number |

|

|

|

|

||

• To access ESS outside of a City office, please use the Internet |

- Phone Number |

|

|

|

Change Healthcare |

|

|

- Gender |

|

|

|

Waiver Status at time of |

|

||

|

- Gender |

|

|

|

Waiver Status at time of |

||

website: www.nyc.gov/ess |

- Ethnic Group |

|

View and print |

|

a Life Event |

||

- Ethnic Group |

|

|

a Life Event |

||||

|

|

|

|

View and print |

|

|

|

• |

|

|

|

1127 Tax Statements |

|

|

|

|

|

|

1127 Tax Statements |

|

|

|

|

|

|

|

|

|

|||

Will I still get a paper pay stub? |

View other data such as: |

|

|

View other data such as: |

|

||

|

- Date of Birth |

|

|

• Employees of CCRB, CCHR, DFTA, DCP, DoHMH, DJJ, |

- Date of Birth |

View and update Tax |

|

- Original Hire Date |

|||

|

- Original Hire Date |

View and update Tax |

|

DORIS, DOT, |

- Military Status |

Withholdings |

|

- Military Status |

|||

- Email Address |

Withholdings |

||

O If you are enrolled in direct deposit, you will not receive |

- Email Address |

|

|

|

|

|

|

paper pay stubs. ESS will replace your pay stub, |

|

|

|

giving you the ability to view and print pay stub data online |

|

|

|

OYou may continue receiving paper pay stubs, however, by changing your Print Status in ESS, or by contacting your Payroll Officer for additional assistance

•If you are not enrolled in direct deposit, you will continue to receive a paper pay check

*NOTE:

ID/PMS Reference # as part of the new hire process).

Form Characteristics

| Fact Name | Fact Details |

|---|---|

| Instant Access | ESS provides 24/7 access to HR, payroll, tax, and benefits data. |

| Environmental Initiative | The program reduces paper waste with electronic pay stubs, supporting the PlaNYC "green" initiative. |

| Data Updates | Employees can update personal information, tax and payroll information, and benefits information. |

| Electronic Pay Stubs | Employees enrolled in direct deposit do not receive paper pay stubs; ESS allows viewing and printing of stubs online. |

| Access Methods | Access ESS inside City offices via the intranet or outside via the website www.nyc.gov/ess. |

| Login Information | User ID is a 7-digit Employee ID. The password includes the last two digits of the SSN and the birth date. |

| Maintenance Windows | Brief maintenance may occur evenings starting at 8:30 PM and on Sundays. |

| Employee Eligibility | All employees of CCRB, CCHR, DFTA, DCP, DoHMH, DJJ, DORIS, DOT, DA-NY, HPD, LPC, and OCB can use ESS. |

| Documentation Availability | Employees can view and print W-2 and 1127 Tax Statements from the system. |

Guidelines on Utilizing Nycap Ess

Filling out the NYCap ESS form is a straightforward process that allows employees to access and manage their personal and payroll information efficiently. Following these steps will guide you through filling out the form correctly. Take your time to ensure that each section is completed accurately, as this will help maintain up-to-date records with your HR department.

- Access the appropriate website to log in:

- From a City office, use the Intranet at http://cityshare.nycnet/ess.

- If outside a City office, go to the Internet at www.nyc.gov/ess.

- Enter your User ID, which is your 7-digit Employee ID or PMS Reference number.

- Input your Password:

- The password consists of the last 2 digits of your Social Security Number followed by your 8-digit birth date.

- Click the 'Log In' button to access the Employee Self-Service (ESS) portal.

- Navigate through the various options available, such as updating personal information, tax, payroll, or benefits.

- Make the necessary changes or updates to your information:

- Edit your address or emergency contact information as needed.

- Review and update your direct deposit options or benefits enrollment.

- Review your entries carefully before saving any changes.

- Submit the completed form by clicking 'Save' or 'Submit,' depending on the available options.

After submitting the form, you will receive confirmation of the changes made. It is advisable to keep an eye on your email or check the portal for notifications regarding any updates or important information related to your submission. Keeping your records accurate is essential for seamless HR and payroll processes.

What You Should Know About This Form

What can I do in the Employee Self-Service tool?

The Employee Self-Service (ESS) tool provides a variety of functions that empower you to manage your personal and employment information efficiently. You can view and update personal information like your name, address, and emergency contact. Additionally, you can manage tax and payroll details, including direct deposit options, and enroll in or change your benefits.

When can I access Employee Self-Service?

ESS is available 24/7, allowing you to access your information at any time that is convenient for you. However, keep in mind that brief maintenance windows may occur on Sundays after 8:30 PM, during which you may not be able to log in to the system.

How do I access Employee Self-Service?

You can access ESS from a City office by navigating to the Intranet website: http://cityshare.nycnet/ess. If you are outside of a City office, simply use the Internet site: www.nyc.gov/ess. You will need to log in using your User ID and Password, both of which are detailed in the ESS guide.

Will I still get a paper pay stub?

If you are enrolled in direct deposit, paper pay stubs will no longer be issued. The ESS tool allows you to view and print your pay stub data online. However, if you prefer to receive paper pay stubs, you can change your Print Status in ESS or contact your Payroll Officer for further assistance. If you do not have direct deposit, you will continue to receive a paper paycheck.

How do I log in to Employee Self-Service?

Your User ID is your 7-digit Employee ID or PMS Reference number, which is provided by your agency or found on previous pay stubs. For new hires, you receive this information during the onboarding process. Your password consists of the last two digits of your Social Security Number combined with your 8-digit birth date in the format MM/DD/YYYY. If you encounter issues logging in, look for the “Need help logging in” link on the ESS login page or reach out to NYCAPS Central at employeesupport@dcas.nyc.gov.

What information can I view and update in ESS?

You have the ability to view and update a range of information through the ESS tool. This includes personal identifiers like your name and address, tax withholdings, emergency contact, email address, military status, and gender waiver status. Furthermore, you can enroll in and manage your benefits during designated periods.

How do I view my pay statements?

Your pay statements can be viewed and printed directly from the ESS tool. If you have opted for direct deposit, you will be able to see and manage your pay stub information electronically, minimizing the need for paper documents.

Can I change my benefit enrollment through ESS?

Yes, you can enroll in or make changes to your benefits through the Excel tool. Depending on the time of year, you can enroll during the Annual Transfer Period or during a new hire process. Make sure to familiarize yourself with any applicable deadlines.

What should I do if I cannot remember my password?

If you cannot remember your password, visit the ESS login page and click on the “Need help logging in” link. That will guide you through the steps to reset your password. If you continue to experience difficulties, don't hesitate to contact NYCAPS Central at the email provided earlier for additional assistance.

Common mistakes

When completing the NYCAP Employee Self-Service (ESS) form, individuals often make critical mistakes that can lead to complications in their HR, payroll, and benefits processing. Understanding these common errors can help ensure that information is submitted accurately, thus facilitating a smoother experience for all employees.

One prevalent error occurs when users fail to enter their User ID correctly. This identifier is crucial for accessing the system, as it consists of a 7-digit Employee ID or PMS Reference number provided by the agency. Without this accurate entry, users may experience difficulties logging in or encounter delays in accessing their personal data.

Another frequent mistake involves incorrect password entry. The required password incorporates the last two digits of the Social Security Number coupled with the individual’s 8-digit birth date. Miscalculations or typos in this data can prevent access to the ESS platform. It is essential for users to check their inputs carefully before attempting to log in.

An insufficient review of personal information before submission can also lead to errors. Many users neglect to confirm that their details, such as address, emergency contacts, and tax information, are current. This oversight can create problems for HR and payroll, possibly resulting in missed communications or incorrect tax filings.

Individuals often overlook the importance of enrolling in direct deposit or updating their bank details. Failure to maintain this information can lead to delays in receiving payments. Moreover, without direct deposit, employees may continue to receive paper checks, which many aim to avoid by utilizing the ESS system.

Lastly, employees sometimes neglect to review the available functionalities of the ESS tool. Understanding what actions can be taken—like enrolling in benefits or changing personal information—can significantly impact one’s experience. Failing to leverage these features may lead to missed opportunities for improving one’s employment benefits.

Documents used along the form

The Nycap Ess form is an essential tool for employees to manage their HR, payroll, tax, and benefits information electronically. It streamlines various processes, allowing easy access to important data. Alongside this form, several other documents are commonly used to ensure that employee information is complete and up-to-date.

- W-2 Form: This document summarizes an employee's annual income and taxes withheld. It is essential for filing personal income tax returns. Employees can view and print their W-2 forms through the Employee Self-Service tool.

- Direct Deposit Authorization Form: Employees use this form to authorize their employer to deposit wages directly into their bank accounts. This simplifies payroll and ensures timely access to funds.

- Change of Address Form: When employees move, they need to update their address with HR. This form facilitates the update of personal records to ensure that all communications and tax documents are sent to the correct address.

- Benefits Enrollment Form: This form allows employees to enroll in or change their benefit selections during open enrollment periods or after qualifying life events. It's crucial for ensuring that employees receive the benefits they need.

- Emergency Contact Information Form: Employees provide this document to specify who should be contacted in case of an emergency. Keeping this information current is vital for employee safety and well-being.

These documents enhance the functionality of the Nycap Ess form and help create a comprehensive and organized system for managing employee data. Maintaining accurate records across these forms is crucial for both employees and employers alike.

Similar forms

The Nycap ESS form shares similarities with several other documents. Here are seven documents that serve similar purposes, along with explanations of their analogous features:

- W-2 Form: Like the Nycap ESS form, the W-2 provides important tax information for employees. It helps individuals understand their wages and taxes withheld for the year, which ties directly to the financial data accessible through Employee Self-Service.

- Pay Stub: Both the pay stub and Nycap ESS form allow employees to view their earnings. The Nycap ESS form digitizes the pay stub experience, providing instant online access while reducing paper waste.

- Direct Deposit Authorization Form: This document is similar as it allows employees to manage how they receive their pay. Just like ESS, it offers a platform to update their banking information conveniently.

- Employee Tax Withholding Allowance Certificate (W-4): The W-4 form outlines an employee's tax withholding preferences. The Nycap ESS form allows employees to view and update their tax information, making it an essential tool for tax management.

- Benefits Enrollment Form: The benefits enrollment form works similarly by allowing employees to choose their benefits. Nycap ESS includes the ability to enroll in or modify benefits through the online platform, making management easier.

- Emergency Contact Information Form: This form collects important personal data regarding emergency contacts. Nycap ESS enables employees to view and update their emergency contact details immediately, enhancing safety and communication.

- Employment Data Change Form: Like the Nycap ESS form, this document is used to update personal information regarding employment status. Both platforms serve to maintain accuracy in crucial employment details.

Dos and Don'ts

Do's when filling out the NYCap ESS form:

- Access the Employee Self-Service tool using the correct website for your location.

- Make sure your User ID is accurate; it should be your 7-digit Employee ID/PMS Reference #.

- Use the correct format for your password, which includes the last 2 digits of your SSN followed by your 8-digit birth date.

- View and update your personal information regularly to keep your records current.

Don'ts when filling out the NYCap ESS form:

- Do not share your login credentials with anyone.

- Do not forget to check for any brief maintenance windows, especially during evenings and Sundays.

- Do not skip reviewing your Direct Deposit information to ensure accuracy.

- Do not ignore the “Need help logging in” option if you have trouble accessing your account.

Misconceptions

Here are eight common misconceptions about the Nycap Ess form, explained simply and clearly.

- You can only access ESS during business hours. Many believe that access is limited to work hours, but the ESS is available 24/7, allowing you to manage your information whenever it suits you.

- You must be in a City office to use ESS. While you can access ESS from a City office, you can also log in from any location using the internet.

- The ESS only allows updates to payroll information. This isn't true. You can update various personal data, including tax withholdings and benefits information.

- Using ESS means you won’t receive pay stubs. If you are enrolled in direct deposit, you won't receive a physical pay stub. However, you can view and print pay stub data online.

- New hires can't access ESS until they're fully onboard. New hires can access ESS right away, using the login information provided during the hiring process.

- I need to contact HR for every update. Many people think this, but you can make many updates yourself through the ESS tool.

- You can't change your personal information. You can change significant personal details, like your address and emergency contact information, through the ESS.

- Logging in to ESS is complicated. It actually has a straightforward login process using your Employee ID and a password based on your SSN and birth date.

Understanding these points can help you use the Nycap Ess form more effectively and make the most of the services provided.

Key takeaways

- Access: The Nycap ESS form allows employees to access HR, payroll, tax, and benefits data 24/7, except for brief maintenance periods typically scheduled on Sunday evenings.

- Data Updates: Employees can utilize the form to update personal information, tax and payroll details, and benefits information efficiently.

- Electronic Pay Stubs: By enrolling in direct deposit, employees eliminate the need for paper pay stubs and can view and print their pay stub data online.

- User Log-In: Accessing the system requires a User ID, which is the employee's 7-digit Employee ID/PMS Reference #, along with a password based on the last two digits of their SSN and their birth date.

- Form Access Locations: Employees can access the Employee Self-Service (ESS) tool both from City offices via the Intranet and remotely through the Internet.

- Support: If issues arise during the log-in process, employees can seek assistance by clicking the “Need help logging in” link or contacting NYCAPS Central via email.

Browse Other Templates

New Car Registration Nevada - Individuals completing the form should be aware of any attached penalties if misrepresented.

Hamilton Book - The order form allows for easy tracking of your requested titles.

Child Support Paperwork - Ensure to redact sensitive social security numbers on filed documents.