Fill Out Your Nycers 380 Form

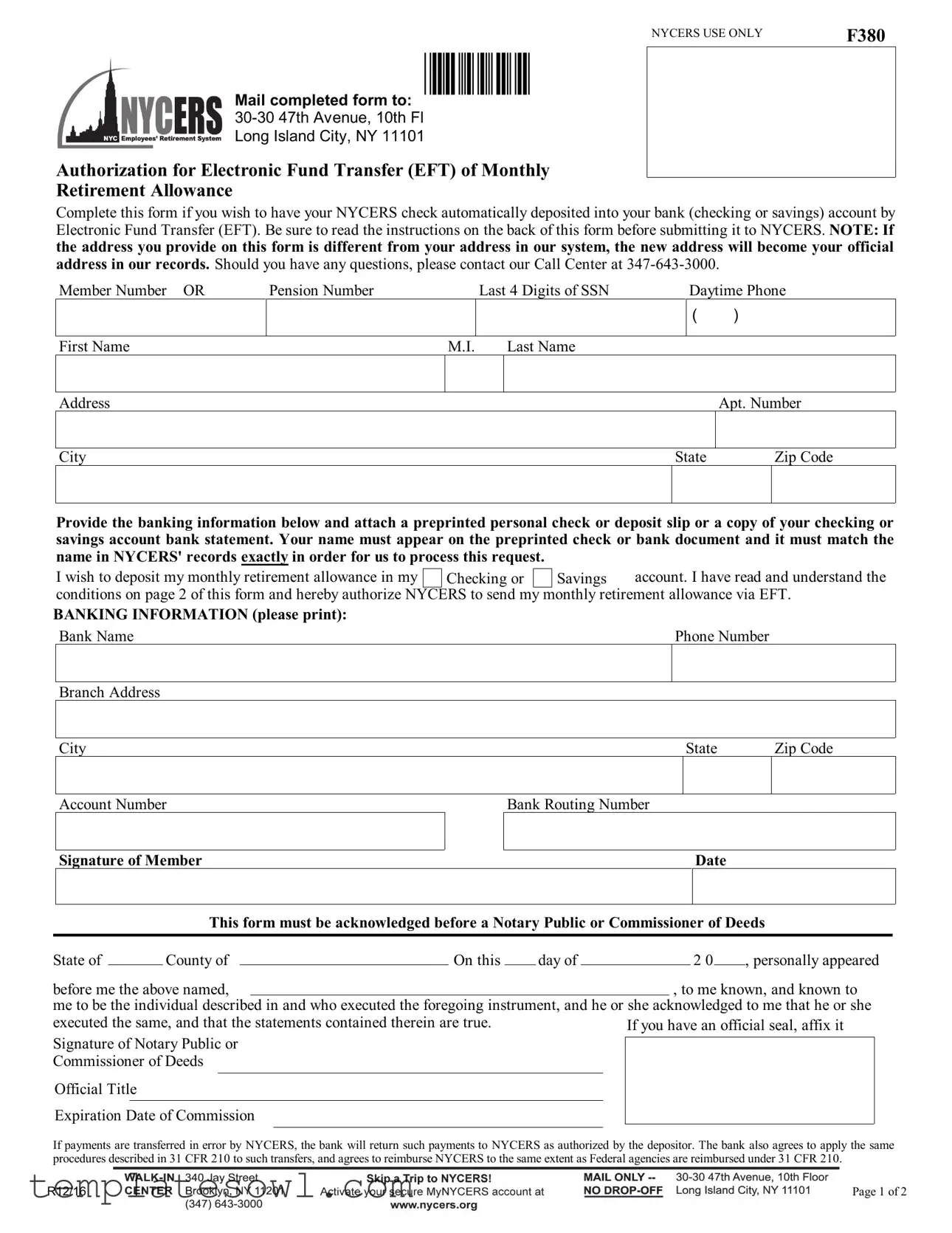

The NYCERS F380 form serves a crucial purpose for members seeking a seamless and convenient way to manage their retirement funds. By completing this form, retirees can authorize the New York City Employees' Retirement System (NYCERS) to electronically deposit their monthly retirement allowance directly into their bank accounts, whether checking or savings. This method, known as Electronic Fund Transfer (EFT), simplifies access to retirement benefits and eliminates the need to wait for physical checks in the mail. Alongside providing personal details such as name and address, members must supply banking information to facilitate the transfers. Additionally, the form requires attaching a preprinted check or bank document that verifies the account details. It is essential to note that the information on the submitted document must match exactly with the details maintained by NYCERS. Members are advised to read the instructions carefully before submission and are provided with the necessary contacts for any inquiries. Acknowledgment by a Notary Public or Commissioner of Deeds is required, ensuring the form's validity. This guide will explore the key components, the step-by-step completion process, and the importance of this form in securing timely retirement payments.

Nycers 380 Example

NYCERS USE ONLY |

F380 |

Mail completed form to: *380*

Long Island City, NY 11101

Authorization for Electronic Fund Transfer (EFT) of Monthly

Retirement Allowance

Complete this form if you wish to have your NYCERS check automatically deposited into your bank (checking or savings) account by Electronic Fund Transfer (EFT). Be sure to read the instructions on the back of this form before submitting it to NYCERS. NOTE: If the address you provide on this form is different from your address in our system, the new address will become your official address in our records. Should you have any questions, please contact our Call Center at

Member Number OR |

Pension Number |

|

Last 4 Digits of SSN |

Daytime Phone |

||

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

First Name |

|

M.I. |

|

Last Name |

|

|

|

|

|

|

|

|

|

Address |

|

|

|

|

|

Apt. Number |

City |

State |

Zip Code

Provide the banking information below and attach a preprinted personal check or deposit slip or a copy of your checking or savings account bank statement. Your name must appear on the preprinted check or bank document and it must match the name in NYCERS' records exactly in order for us to process this request.

|

I wish to deposit my monthly retirement allowance in my |

Checking or |

Savings |

account. I have read and understand the |

|||||||||||||

|

conditions on page 2 of this form and hereby authorize NYCERS to send my monthly retirement allowance via EFT. |

||||||||||||||||

BANKING INFORMATION (please print): |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Bank Name |

|

|

|

|

|

|

|

|

Phone Number |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Branch Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

|

|

|

|

|

State |

|

Zip Code |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Account Number |

|

|

Bank Routing Number |

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature of Member |

|

|

|

|

|

|

|

|

Date |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

This form must be acknowledged before a Notary Public or Commissioner of Deeds |

|

|||||||||||||

State of |

|

County of |

|

|

On this |

day of |

|

|

|

|

2 0 |

|

, personally appeared |

||||

|

|

|

|

|

|

||||||||||||

before me the above named, |

|

|

|

|

|

|

, to me known, and known to |

||||||||||

me to be the individual described in and who executed the foregoing instrument, and he or she acknowledged to me that he or she

executed the same, and that the statements contained therein are true. |

If you have an official seal, affix it |

||||

Signature of Notary Public or |

|

||||

|

|||||

Commissioner of Deeds |

|

||||

|

|

|

|

|

|

Official Title |

|

||||

|

|

|

|

|

|

Expiration Date of Commission |

|

||||

|

|

|

|

|

|

If payments are transferred in error by NYCERS, the bank will return such payments to NYCERS as authorized by the depositor. The bank also agrees to apply the same procedures described in 31 CFR 210 to such transfers, and agrees to reimburse NYCERS to the same extent as Federal agencies are reimbursed under 31 CFR 210.

R12/16 |

Page 1 of 2 |

NYCERS USE ONLY |

F380 |

Mail completed form to:

Long Island City, NY 11101

Filling out this form and submitting it to NYCERS authorizes:

1.The Office of the Comptroller of the City of New York, on behalf of the New York City Employees' Retirement

System (NYCERS) to send my monthly retirement allowance via Electronic Fund Transfer (EFT) to the bank* designated on this form for deposit in my account.

2.My bank: (a) to receive my monthly retirement allowance via EFT for deposit in my account AND

(b)to deduct from my designated account or deposits in my name at this bank all amounts transferred in error by NYCERS or any amounts sent after my death and to reimburse NYCERS to the extent of such deductions, applying the same procedures described in 31 CFR 210 to such transfers in error and reimbursing NYCERS to the same extent as Federal agencies are reimbursed under 31 CFR 210.

3.My heirs, my estate and designated beneficiaries of my monthly retirement allowance, respectively, to reimburse NYCERS for any amount deposited in error after my death, in event that my account is closed or contains an insufficient balance to reimburse

NYCERS.

This EFT authorization will remain in effect until I have given written notice to NYCERS canceling the EFT.

* The bank you name must be a member of the Automated Clearing House in order for your funds to be deposited electronically.

HOW EFT WORKS:

1.Your net retirement allowance is automatically credited to your bank account on the last day of each month providing it's a business day; if the last day is a weekend or holiday, the funds are deposited on the next business day.

2.Your monthly net retirement allowance will appear on your bank statement.

3.A quarterly statement, issued by the Office of the Comptroller, will be mailed to your home address. It will reflect details of your monthly retirement allowance, including deductions for union dues, health insurance and federal income tax withheld during the

Your monthly retirement allowance can be deposited in either your checking or savings account - NOT split between both.

TO AUTHORIZE EFT:

•Provide your personal and banking information on page 1.

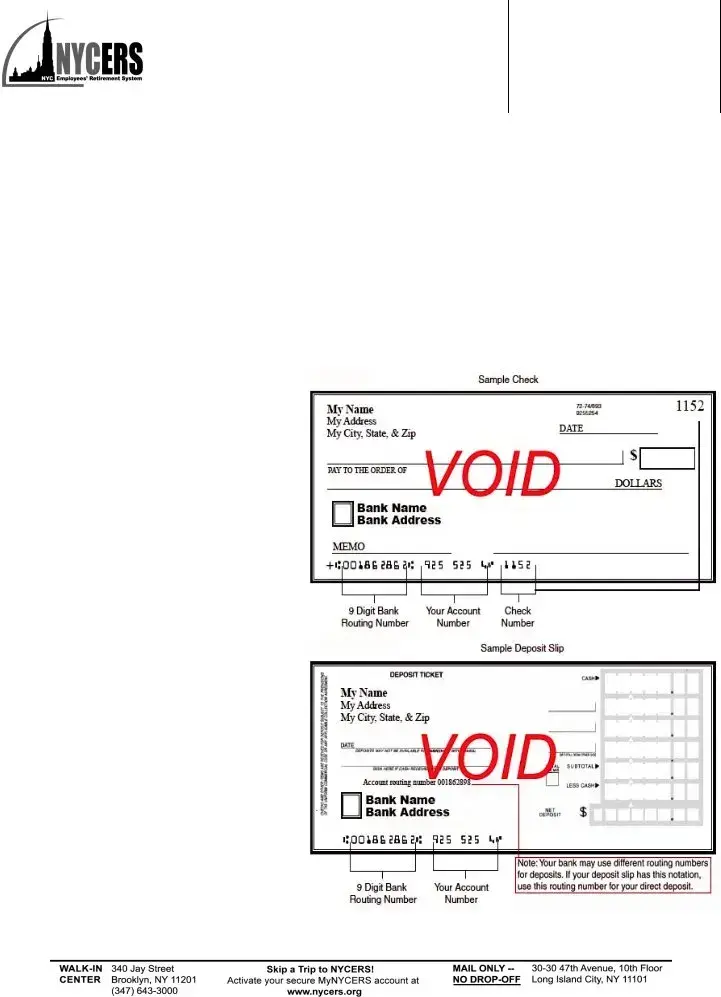

•Attach a preprinted personal check

(name must appear on check) or preprinted savings deposit slip to this page. If your bank no longer provides personal checks or preprinted savings deposit slips, attach a copy of the top portion of your Checking or Savings Account Bank Statement.

•If submitting a preprinted check or deposit slip write VOID (in large letters) across the face, as indicated in the sample.

•Do NOT sign the check that you are attaching to this page.

•The name on your bank account must match exactly your name in NYCERS' records.

Note: It may take up to 45 days from receipt of this form for the account to be processed for EFT.

R12/16 |

Page 2 of 2 |

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | This form allows NYCERS members to authorize the direct deposit of their monthly retirement allowance into their bank accounts through Electronic Fund Transfer (EFT). |

| Submission Address | Completed forms must be mailed to NYCERS, located at 30-30 47th Avenue, 10th Floor, Long Island City, NY 11101. |

| Bank Requirements | The designated bank must be a member of the Automated Clearing House (ACH) system to permit electronic deposits of funds. |

| Matching Names | The name on the bank document must match the member's name in NYCERS records exactly to process the EFT request. |

| Notarization Requirement | This form requires acknowledgment by a Notary Public or Commissioner of Deeds for legal validity, ensuring the identity of the signatory is confirmed. |

Guidelines on Utilizing Nycers 380

Completing the NYCERS 380 form is essential for setting up the automatic deposit of your monthly retirement allowance into your bank account. After filling out the form, submit it to NYCERS for processing. It’s important to ensure that all details are accurate to avoid any delays in receiving your funds.

- Start by filling out your Member Number or Pension Number, followed by the last four digits of your Social Security Number.

- Enter your Daytime Phone number.

- Provide your First Name, Middle Initial, and Last Name.

- Fill in your Address, including the Apt. Number, City, State, and Zip Code.

- Specify your banking information by entering the Bank Name, Phone Number, and the Branch Address, along with the City, State, and Zip Code.

- Provide your Account Number and Bank Routing Number.

- Sign the form where indicated and include the Date.

- Visit a Notary Public or Commissioner of Deeds to have your signature acknowledged.

- Attach a preprinted check or bank document showing your name—this must match the name in NYCERS' records. Write “VOID” in large letters across the face of the check or deposit slip if you are including it.

- Mail the completed form and attachments to NYCERS at: 30-30 47th Avenue, 10th Fl, Long Island City, NY 11101.

Remember, the bank you choose must participate in the Automated Clearing House for successful processing of your funds. It may take up to 45 days for the initiation of your Electronic Fund Transfer.

What You Should Know About This Form

What is the NYCERS F380 form?

The NYCERS F380 form is an authorization document that allows members of the New York City Employees' Retirement System to set up direct deposit for their monthly retirement allowance. By completing this form, members can ensure that their pension payments are automatically deposited into their designated bank accounts via Electronic Fund Transfer (EFT).

Who should complete the F380 form?

The form should be completed by NYCERS members who wish to receive their retirement payments through direct deposit. This is especially beneficial for those who prefer the convenience of having their funds deposited automatically into their checking or savings account instead of receiving paper checks.

What information do I need to provide on the F380 form?

When filling out the F380 form, members must provide personal information including their name, member or pension number, and contact phone number. Additionally, banking information is required, such as the bank name, account number, and routing number. A preprinted check or deposit slip must also be attached to ensure accuracy.

What happens if my address changes?

If the address you provide on the F380 form differs from what NYCERS currently has on file, the new address will replace the old one in their records. It is crucial to ensure that your address is accurate to prevent delays in receiving important communications or your retirement allowance.

How does the Electronic Fund Transfer (EFT) work?

With EFT, members will receive their retirement allowance deposited directly into their bank accounts on the last business day of each month. If that day falls on a weekend or holiday, the funds will be deposited on the next business day. Members will see a record of their net retirement allowance on their bank statements and will receive quarterly statements detailing deductions and payments.

What if I want to cancel my EFT authorization?

The authorization for EFT remains in effect until you provide written notice to NYCERS to cancel it. Members should ensure that their cancellation request is submitted in a timely manner to avoid any disruption in receiving their retirement payments.

Is there anything specific I need to do when submitting my check?

Yes. When attaching a preprinted check or deposit slip, write "VOID" in large letters across the face. Do not sign the check, and ensure that your name on the check matches exactly with the name on file at NYCERS.

How long does it take for the EFT to be processed?

It may take up to 45 days from the receipt of the F380 form for the Electronic Fund Transfer setup to be processed. It’s advisable to plan accordingly and keep an eye on your bank statements for the first deposit after submitting the form.

Common mistakes

Completing the NYCERS 380 form accurately is crucial for a smooth transition to Electronic Fund Transfer (EFT) for retirement allowances. However, many individuals make common mistakes that can delay processing or result in rejected applications. Understanding these errors can help ensure a seamless experience.

One frequent mistake is providing inaccurate personal information. It is essential that the name, member number, and contact details match exactly with what is in NYCERS' records. Even minor discrepancies can lead to significant delays. Double-checking for typos or misspellings can prevent issues.

An additional error involves the banking details. Some applicants do not ensure that the bank name and account information are correct. If the account number or routing number is wrong, the funds will not be deposited as intended. It's advisable to confirm these numbers with the bank before submission.

Many people overlook the requirement to attach a preprinted personal check or bank statement. Simply filling out the form without this documentation will result in an incomplete application. The check or statement must clearly display the applicant's name and match the information in NYCERS' records.

Inadequate attention to the notary section is another misstep. The form must be signed and acknowledged before a Notary Public or Commissioner of Deeds. Failure to do this can invalidate the entire form, requiring the applicant to start the process over.

Some applicants mistakenly think they can split their retirement deposits between multiple accounts. The NYCERS 380 form allows for deposits into one account only, either checking or savings. Selecting both will cause issues with processing the EFT.

It's also important to remember the signature. Signing the check intended for attachment is not permitted. Applicants should write 'VOID' across the face of the check instead. This oversight can confuse the processing department and lead to delays.

Lastly, many individuals do not account for the processing time after submission. It can take up to 45 days for the account to be set up for EFT. Having realistic expectations about the timeline will help avoid unnecessary frustration and follow-up inquiries.

Documents used along the form

The NYCERS 380 form is an important document for those wishing to enroll in the Electronic Fund Transfer (EFT) program for their retirement allowances. Alongside this form, there are several additional documents that may be required for a complete application or to ensure smooth processing of your retirement funds. Here are a few commonly used forms.

- NYCERS Authorization for Direct Deposit: This form allows retirees to authorize the direct deposit of their monthly retirement checks into their bank accounts. It ensures that funds are deposited automatically on a designated day each month, providing peace of mind and convenience.

- Tax Withholding Form (W-4P): This document is necessary for retirees who wish to specify how much federal tax should be withheld from their retirement benefits. It's important to submit this form to ensure that tax withholdings align with personal financial situations.

- Beneficiary Designation Form: This form is used to identify individuals who will receive benefits in the event of the retiree's passing. It is crucial to keep this designation updated, as it determines the distribution of retirement benefits.

- Change of Address Form: If a retiree moves, this form must be completed to update the address on file with NYCERS. Keeping address information current ensures that all communications and financial documents reach the retiree without delay.

It is essential to have all relevant forms completed accurately to facilitate the smooth processing of your retirement benefits. Each document plays a significant role in your financial security and timely access to your funds. Should you have any questions or require assistance, do not hesitate to reach out for help.

Similar forms

The NYCERS 380 form is primarily an authorization document for setting up Electronic Fund Transfers (EFT) for monthly retirement allowances. Several other documents serve similar purposes within the realm of financial authorization and banking. Here’s a list of documents that closely align with the NYCERS 380 form:

- Direct Deposit Authorization Form: Like the NYCERS 380, this form allows individuals to have their salary or other payments directly deposited into their bank accounts, ensuring timely access to funds.

- Electronic Payments Authorization Form: This document grants permission for recurring electronic payments, whether for bills or other financial commitments, analogous to how the NYCERS form facilitates monthly allowance transfers.

- Bank Credit Application: While primarily used for credit, it requires detailed banking information, much like the NYCERS 380 form, ensuring correct routing of electronic transactions.

- Automatic Bill Payment Enrollment Form: This form allows individuals to set up automatic debits for bill payments, mirroring the same principle of seamless transaction processing found in the NYCERS 380.

- Payroll Deduction Authorization Form: Workers utilize this form to authorize specific deductions from their paychecks for various purposes, akin to how the NYCERS 380 form permits direct retirement fund transfers.

- Retirement Fund Distribution Form: Similar to the NYCERS 380, this document specifies how a retiree wants their funds dispersed and may include options for EFT, ensuring the efficient handling of retirement benefits.

- Check Authorization Form: This form is used to authorize the issuance of checks directly to vendors or for specific payments, reflecting a parallel in confirming where funds should be sent.

- Financial Account Change Form: This document allows individuals to update or change their banking details with a financial institution, much like the way updates are facilitated through the NYCERS 380 form.

Each of these documents centers around the essential theme of authorizing the transfer or management of funds, making them similar in function and purpose to the NYCERS 380 form.

Dos and Don'ts

When filling out the NYCERS F380 form, it is important to follow specific guidelines to ensure the process runs smoothly. Below are five recommendations on what to do and what to avoid:

- Do provide accurate and complete personal and banking information on the form.

- Do attach a preprinted personal check or deposit slip that includes your name.

- Do ensure that the name on your bank account matches exactly with the name in NYCERS' records.

- Do read and understand all conditions mentioned in the instructions before submitting.

- Do acknowledge your signature before a Notary Public or Commissioner of Deeds.

- Don't submit the form if any of your information is incorrect or incomplete.

- Don't attach a check that is signed; simply write "VOID" across the face.

- Don't use a bank account that is not a member of the Automated Clearing House.

- Don't expect the EFT to process immediately; it may take up to 45 days post-submission.

- Don't assume that prior forms or information are still valid; verify that everything is current.

Misconceptions

Misconception 1: The NYCERS 380 form is optional for receiving retirement payments.

This form is necessary if you want to set up automatic deposits of your retirement allowance into your bank account.

Misconception 2: I can split my monthly payments between different accounts.

You cannot divide your retirement allowance between checking and savings accounts. It must go into one account only.

Misconception 3: Any bank can be used for electronic fund transfers.

The bank must be a member of the Automated Clearing House to accept electronic deposits.

Misconception 4: I don’t need to provide a check or deposit slip with the form.

You'll need to attach a preprinted personal check or a deposit slip, ensuring that your name matches the name in NYCERS records.

Misconception 5: LEDger details of my payments won't be available.

A quarterly statement will be mailed to you detailing your payments and any deductions made.

Misconception 6: I can update my address anytime without any effect on my records.

If you provide a new address on this form, it will become your official address in NYCERS records.

Misconception 7: My retirement payments start immediately once I submit the form.

It may take up to 45 days from when NYCERS receives your form for your account to be set up.

Misconception 8: I need to sign the check I provide with the form.

You should not sign the attached check or deposit slip.

Misconception 9: There are no penalties if I inaccurately fill out the form.

Incorrect information can delay your payments or result in your application being rejected.

Misconception 10: I can cancel the EFT at any time without notice.

To cancel the EFT, you must give written notice to NYCERS.

Key takeaways

Understanding how to fill out and use the NYCERS 380 form can help streamline your monthly retirement allowance payments. Here are key takeaways to keep in mind:

- Fill in Personal and Banking Information: Make sure to complete all required fields, including your member number, Social Security number, and banking details.

- Use Correct Documentation: Attach a preprinted personal check, deposit slip, or a copy of your bank statement that clearly shows your name.

- Signature Requirement: Your application must be signed and notarized to authenticate your request.

- Official Address Change: If you provide a new address, it will update your official address on file with NYCERS.

- Single Account Limitation: You can only designate one account for the electronic transfer (either checking or savings, but not both).

- Processing Time: After you submit the form, allow up to 45 days for processing before EFT begins.

- Quarterly Statements: You will receive quarterly statements detailing your retirement allowance, showing any deductions made.

By keeping these points in mind, you can ensure that your direct deposit setup for your retirement benefit goes smoothly and without unnecessary delays.

Browse Other Templates

Types of Health Savings Accounts - To expedite your claim, ensure all receipts are dated and include necessary details.

Dental Class - Completion of the DD 2813 is voluntary but important for assessing dental needs.