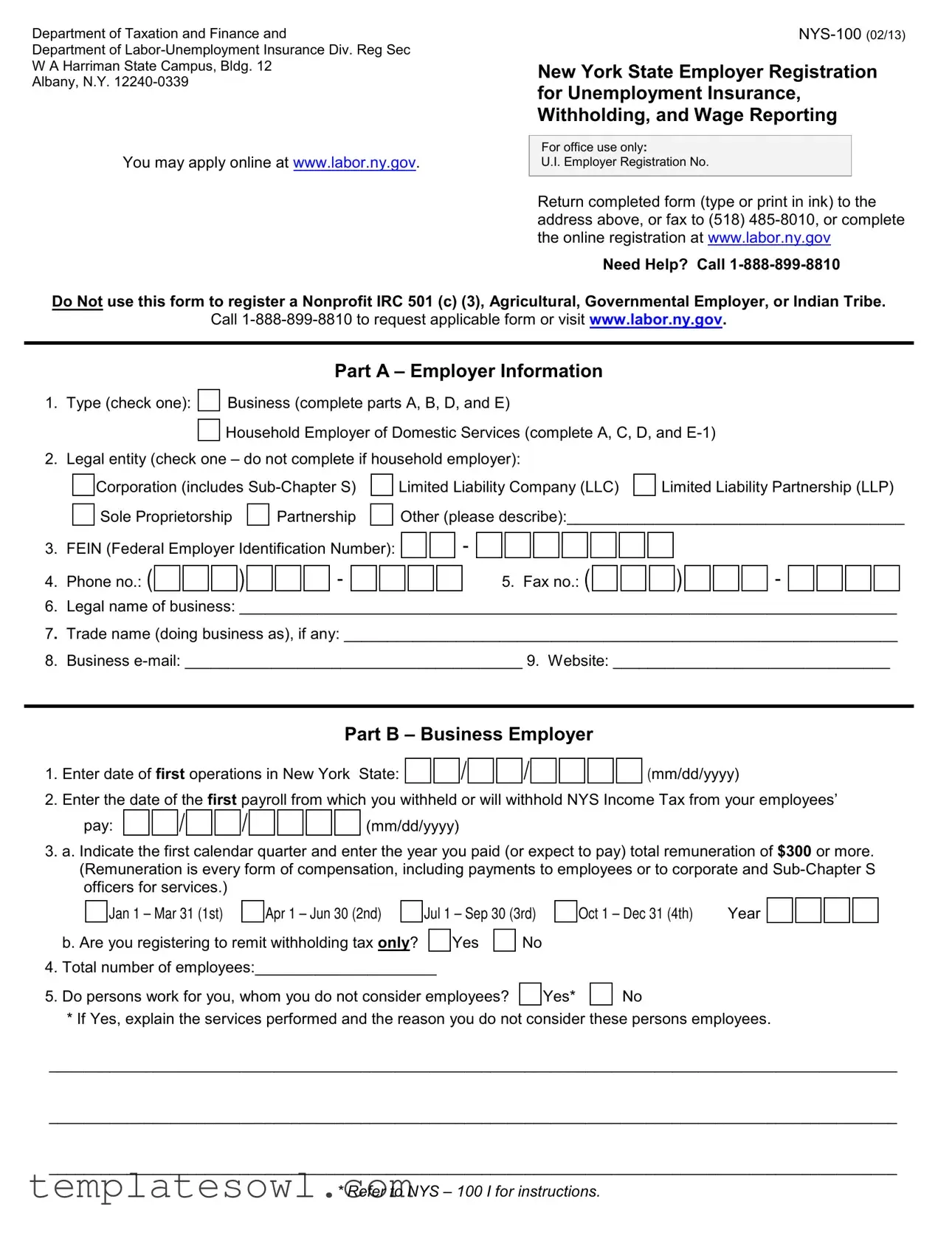

Fill Out Your Nys 100 Form

The NYS-100 form is a crucial tool for employers in New York State, designed to facilitate the registration process for unemployment insurance, wage reporting, and income tax withholding. This comprehensive form, issued by the Department of Taxation and Finance and the Department of Labor, captures essential employer information, such as the type of business entity—whether it be a corporation, limited liability company, or a sole proprietorship—and the corresponding Federal Employer Identification Number (FEIN). Additionally, it requires details about the employer's first operations in New York, payroll history, and the number of employees. Notably, household employers seeking to hire domestic workers must complete a slightly different section tailored for their needs. Employers are also reminded to provide mailing addresses for official correspondence, ensuring they receive important notifications regarding their unemployment insurance responsibilities. While the form may seem daunting at first glance, it streamlines the process of compliance with state regulations, and resources are available for assistance through dedicated hotlines and online platforms. Ultimately, the NYS-100 form plays a significant role in fostering a responsible business environment by ensuring that employers are adequately reporting their employee wages and fulfilling their tax obligations in New York.

Nys 100 Example

Department of Taxation and Finance and

Department of

Albany, N.Y.

New York State Employer Registration for Unemployment Insurance, Withholding, and Wage Reporting

You may apply online at www.labor.ny.gov.

For office use only:

U.I. Employer Registration No.

Return completed form (type or print in ink) to the address above, or fax to (518)

Need Help? Call

Do Not use this form to register a Nonprofit IRC 501 (c) (3), Agricultural, Governmental Employer, or Indian Tribe.

Call

Part A – Employer Information

1. |

Type (check one): |

|

Business (complete parts A, B, D, and E) |

|

|

|||||||

|

|

|

|

|

Household Employer of Domestic Services (complete A, C, D, and |

|||||||

|

|

|

|

|

||||||||

2. |

Legal entity (check one – do not complete if household employer): |

|

|

|||||||||

|

|

|

Corporation (includes |

|

Limited Liability Company (LLC) |

|

Limited Liability Partnership (LLP) |

|||||

|

|

|

|

|

||||||||

|

|

|

Sole Proprietorship |

|

Partnership |

|

|

Other (please describe):_______________________________________ |

||||

|

|

|

|

|

|

|||||||

3. FEIN (Federal Employer Identification Number):

-

4. Phone no.: ( |

|

|

|

|

|

) |

|

|

|

|

|

- |

|

|

|

|

|

|

|

5. Fax no.: ( |

|

|

|

|

|

) |

|

|

|

|

|

- |

6.Legal name of business: ____________________________________________________________________________

7.Trade name (doing business as), if any: ________________________________________________________________

8.Business

Part B – Business Employer

1. |

Enter date of first operations in New York |

State: |

|

|

|

/ |

|

|

|

/ |

|

|

|

|

|

|

|

(mm/dd/yyyy) |

|||||||||||||||

2. |

Enter the date of the first payroll from which you withheld or will withhold NYS Income Tax from your employees’ |

||||||||||||||||||||||||||||||||

|

pay: |

|

|

|

/ |

|

|

|

/ |

|

|

|

|

|

|

|

(mm/dd/yyyy) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

3.a. Indicate the first calendar quarter and enter the year you paid (or expect to pay) total remuneration of $300 or more. (Remuneration is every form of compensation, including payments to employees or to corporate and

|

|

|

Jan 1 – Mar 31 (1st) |

|

Apr 1 – Jun 30 (2nd) |

|

Jul 1 – Sep 30 (3rd) |

|

Oct 1 – Dec 31 (4th) |

Year |

||||||||

|

b. Are you registering to remit withholding tax only? |

|

|

Yes |

|

|

No |

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

||||||||||

4. |

Total number of employees:_____________________ |

|

|

|

|

|

|

|

|

|||||||||

5. |

Do persons work for you, whom you do not consider employees? |

|

|

Yes* |

|

|

No |

|

||||||||||

|

|

|

|

|

||||||||||||||

*If Yes, explain the services performed and the reason you do not consider these persons employees.

__________________________________________________________________________________________________

__________________________________________________________________________________________________

__________________________________________________________________________________________________

* REFER TO NYS – 100 I FOR INSTRUCTIONS.

NYS 100 page 2 |

|

|

|

|

|

Legal Name: __________________________________ER Number: _________________________ |

|||||||||||||||||||||||||||||||||||||||||||||||

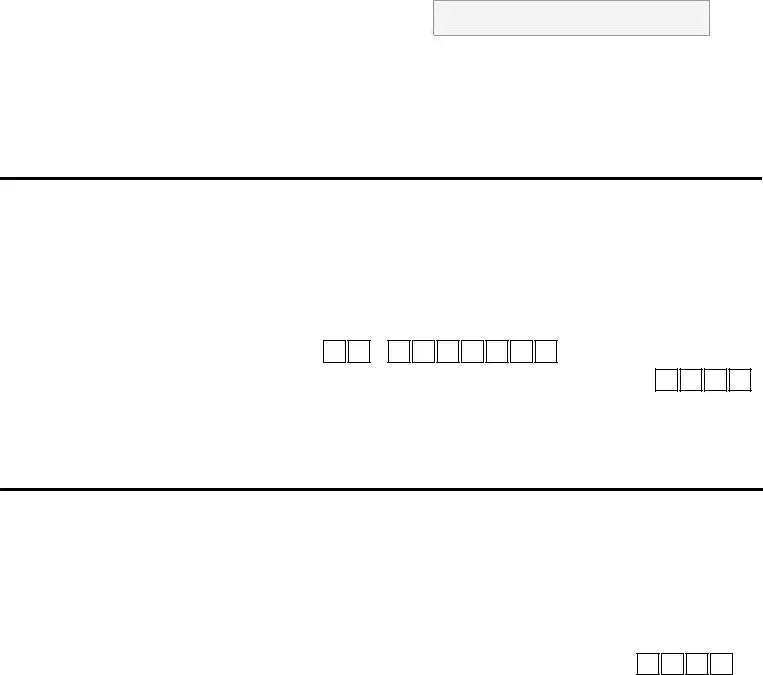

6. |

Have you acquired the business of another employer liable for NYS Unemployment Insurance? |

|

|

|

|

|

Yes* |

|

No |

||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||

|

* If Yes, did you acquire |

|

All or |

|

|

Part? |

Date of acquisition: |

|

|

|

|

|

/ |

|

|

|

/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(mm/dd/yyyy) |

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

Prior Owner’s: Registration number: |

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

FEIN: |

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

Legal name of business: ______________________________________________________________ |

||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Address:___________________________________________________________________________ |

||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

7. |

Have you changed legal entity? |

|

|

Yes* |

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

* If Yes, date of legal entity change:

Previous employer’s: Registration number:

Previous employer’s: Registration number:

/

/

-

(mm/dd/yyyy)

FEIN:

-

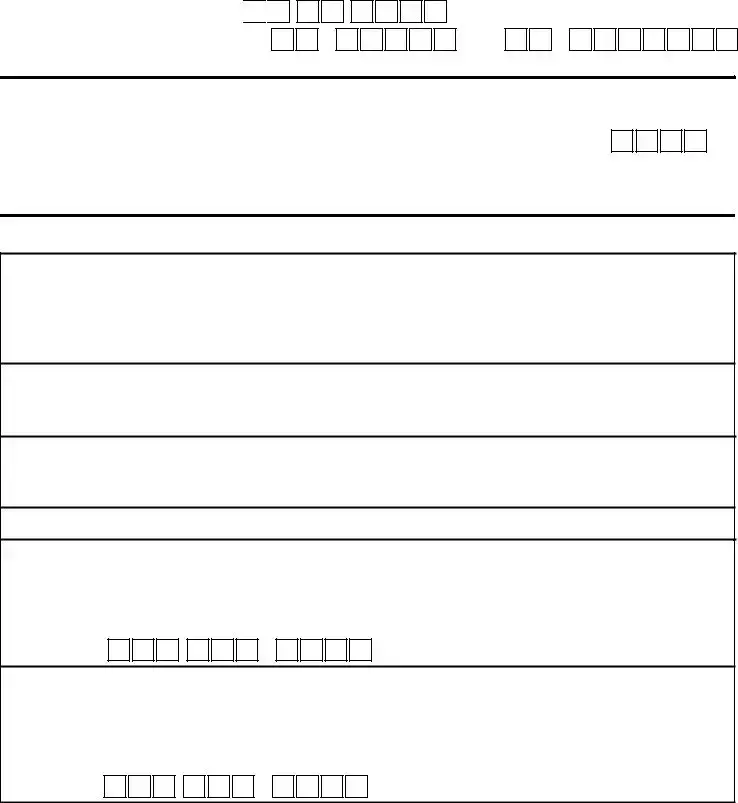

Part C – Household Employer of Domestic Services

1. Indicate the first calendar quarter and enter the year you paid (or expect to pay) total cash wages of $500 or more:

|

|

|

Jan 1 – Mar 31 (1st) |

|

Apr 1 – Jun 30 (2nd) |

|

Jul 1 – Sep 30 (3rd) |

|

|

Oct 1 – Dec 31 (4th) |

Year |

|||

2. |

Enter the total number of persons employed in your home: ________________________ |

|

||||||||||||

|

|

|

|

|

|

|

|

|||||||

3. |

Will you withhold New York State income tax from these employees? |

|

|

Yes |

|

No |

|

|||||||

Part D – Required Addresses

1.Mailing Address: This is your business mailing address where your Withholding Tax (WT) and Unemployment Insurance (UI) mail will be delivered. However, if you elect to have your UI mail directed to an address other than your place of business, complete number 4 below.

Street or PO Box: _______________________________________________________________________________

City:_______________________________________________________ State: _________ZIP Code:____________

2.Physical Address: This is the physical location of your business, if different from the Mailing Address in number 1.

Street: ________________________________________________________________________________________

City:_______________________________________________________ State: _________ZIP Code:____________

3.Location of Books/Records: This is the physical location where your Books and Records are maintained.

Street: ________________________________________________________________________________________

City:_______________________________________________________ State: _________ZIP Code:____________

Optional Addresses

4.Agent Address (C/O): Complete this if your UI mail should be sent to an address other than your business address.

C/O: __________________________________________________________________________________________

Street or PO Box: _______________________________________________________________________________

City:_______________________________________________________ State: _________ZIP Code:____________

Telephone: (

)

-

ext:________________

5.LO 400 Form - Notice of Entitlement and Potential Charges Address: If completed, this is where the LO 400 will be directed. (It is mailed each time a former employee files a claim for Unemployment Insurance benefits.)

C/O: __________________________________________________________________________________________

Street or PO Box: _______________________________________________________________________________

City:_______________________________________________________ State: _________ZIP Code:____________

Telephone: (

)

-

ext:________________

* REFER TO NYS – 100 I FOR INSTRUCTIONS.

NYS 100 page 3 |

Legal Name: __________________________________ER Number: _________________________ |

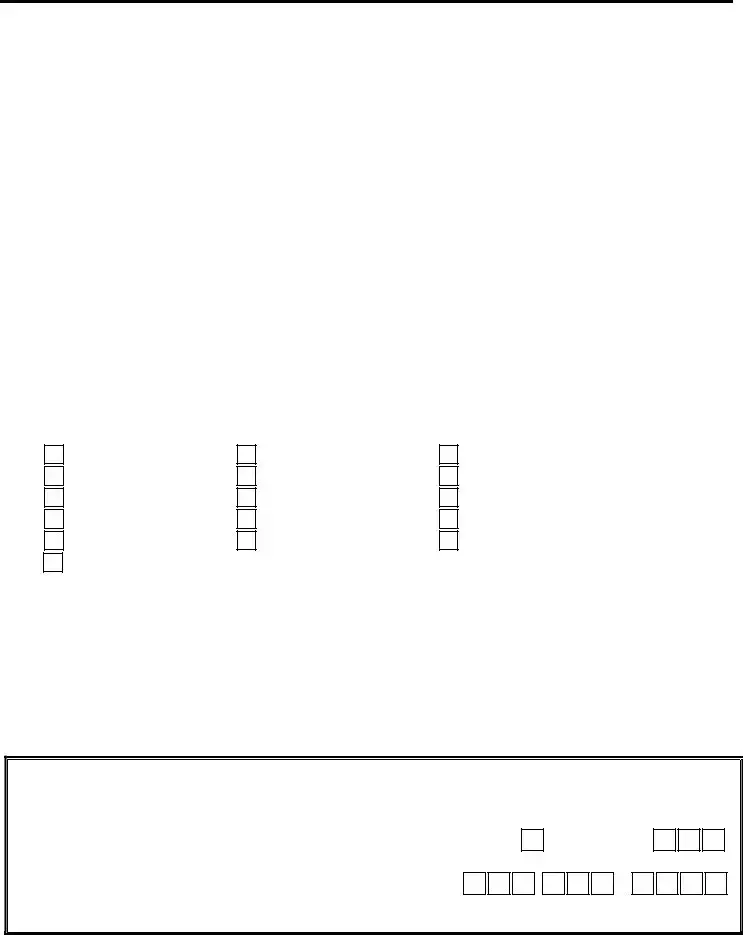

Part E – Business Information

1.Complete the following for sole proprietor (owner), household employer of domestic services, all partners, including partners of LP, LLP or RLLP, all members of LLC or PLLC, and corporate officers (President, Vice President, etc.), whether or not remuneration is received or services are performed in New York State.

Name |

|

Social Security |

|

Title |

|

Residence Address |

|

|

Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2.Please enter the number of physical locations at which your company operates: _____. You MUST list the physical address and answer questions A through E below, for each location. Use a separate sheet of paper for each.

a. Location: _______________________ |

____________________ |

_____________________ |

___________ |

Number and Street |

City or Town |

County |

Zip Code |

b. Approximately how many persons do you employ there? _______________

c. Check the principal activity at the above location:

Manufacturing

Wholesale trade

Retail trade

Construction

Warehousing

Transportation

Computer services

Educational services

Health & social assistance

Real estate

Scientific/professional & technical services

Finance & insurance

Arts, entertainment & recreation

Food service, drinking & accommodations

Corporate, subsidiary managing office

Other (Please specify):_____________________________________________________________________

d. If you are primarily engaged in manufacturing, complete the following:

Principal Products Produced |

Percent of Total Sales Value |

Principal Raw Materials Used |

____________________________ |

__________________________ |

_________________________ |

e. If your principal activity is not manufacturing, indicate products sold or services rendered:

Type of Establishment |

Principal Product Sold or |

Percent of Total Revenue |

|

Service Rendered |

|

_____________________________ |

__________________________ |

________________________ |

I affirm that I have read the above questions and that the answers provided are true to the best of

my knowledge and belief.

X________________________________________________________________

Signature of Officer, Partner, Proprietor, Member or Individual

_______________________________________________ Phone no.: (

Official Position

)

|

/ |

|

|

|

/ |

|

(mm/dd/yyyy)

-

* REFER TO NYS – 100 I FOR INSTRUCTIONS.

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The NYS-100 form is used for registering employers for Unemployment Insurance, tax withholding, and wage reporting in New York State. |

| Governing Law | This form is governed by the New York State Labor Law and Department of Taxation and Finance regulations. |

| Eligibility Restrictions | This form cannot be used by nonprofit organizations, agricultural businesses, government entities, or Indian tribes. |

| Online Application | Employers may apply electronically via the New York State Department of Labor website at www.labor.ny.gov. |

| Submission Options | The completed form can be returned by mail, fax, or submitted online. For faxing, use the number (518) 485-8010. |

| First Payroll Reporting | Employers must indicate the date of the first payroll that included New York State income tax withholdings. |

| Required Information | Information such as the employer's legal name, FEIN, and business location addresses are required to complete the form. |

Guidelines on Utilizing Nys 100

Completing the NYS-100 form is an important step for employers registering for Unemployment Insurance, Withholding, and Wage Reporting in New York. Once filled out, the form needs to be returned to the designated office or submitted online. Following the steps below will ensure accurate and timely submission.

- Obtain the form: Download the NYS-100 form from the New York Department of Labor's website or collect a paper copy from a local office.

- Indicate employer type: In Part A, check the box for your type of employer: Business or Household Employer of Domestic Services.

- Complete legal entity information: If a business, select the applicable legal entity type, such as Corporation or Sole Proprietorship, and provide any required details.

- Enter your FEIN: If you have a Federal Employer Identification Number, fill it out in the specified space.

- Provide contact information: Fill in your phone and fax numbers, legal name, trade name (if any), email, and website.

- Specify operational dates: In Part B, enter the date of first operations in New York State and the date of your first payroll from which you withheld NYS Income Tax.

- Fill in remuneration details: Indicate the first calendar quarter and year when you paid total remuneration of $300 or more to employees.

- Total employee count: Enter the total number of employees in your organization.

- Service explanation: If there are individuals working for you who you do not classify as employees, explain their services and reason accordingly.

- Address requirements: In Part D, detail your mailing address, physical address, and the location where your books/records are maintained.

- Agent and notice addresses: If applicable, provide addresses for an agent or for LO 400 Form delivery; include telephone numbers as needed.

- Complete Part E: List business information about ownership, including name, social security number, and address for all relevant persons involved.

- Fill additional business locations: If you operate in multiple locations, specify the details for each, along with the number of employees and principal activities.

- Sign and date: An authorized individual must sign the form, indicating the accuracy of the submitted information. Provide their contact number and official title.

Once the form is completed, submit it via mail, fax, or online as directed on the form. Keep a copy for your records, as confirmation may be required later. If you have questions or need assistance, contacting the provided help number is recommended.

What You Should Know About This Form

What is the NYS 100 form?

The NYS 100 form is the New York State Employer Registration for Unemployment Insurance, Withholding, and Wage Reporting. This form is essential for new employers in New York to register for unemployment insurance, employee withholding, and wage reporting. Proper completion is required to comply with state regulations if you plan to hire employees and pay them wages subject to New York State laws.

Who needs to fill out the NYS 100 form?

Any individual or business hiring employees in New York State must complete the NYS 100 form. This includes households employing domestic services, corporate entities, partnerships, and sole proprietorships. However, nonprofits, agricultural entities, governmental employers, and Indian tribes should not use this form. They need to obtain specific forms tailored to their circumstances by calling the Department of Labor.

How can I submit the NYS 100 form?

You can submit the NYS 100 form in several ways. The completed form may be mailed or faxed to the Department of Taxation and Finance at the address provided on the form, or you can complete the registration online at the New York State Department of Labor's website at www.labor.ny.gov. This flexibility allows employers to choose their preferred method of submission.

What information do I need to provide while filling out the form?

When completing the NYS 100 form, you will need to provide various details, including your legal business name, trade name, contact information, type of entity, and Federal Employer Identification Number (FEIN). Additionally, you need to answer specific questions regarding employee numbers, payroll details, and the business's start date in New York.

What are the deadlines for submitting the NYS 100 form?

While there isn't a strict deadline, you should complete and submit the NYS 100 form before you begin hiring employees or paying wages in New York. It's best to register as soon as you know your business will employ individuals to ensure compliance and avoid potential penalties associated with late registration.

What if my business changes ownership or structure?

If your business undergoes a change in ownership or structure, such as becoming a corporation or changing partners, you must update your registration with the NYS 100 form. Be sure to indicate any changes in the legal entity section of the form, including details about the previous owner's registration number and FEIN if applicable.

Can I fill out the NYS 100 form if I am an employee?

As an employee, you will not fill out the NYS 100 form. This form is solely for employers looking to register their business for unemployment insurance and tax purposes. If you are an employee, focus on ensuring that your employer registers correctly to secure your rights to unemployment benefits and proper withholding of state taxes.

How do I know if my NYS 100 form has been processed?

Where can I find more help or instructions regarding the NYS 100 form?

For additional information or guidance on filling out the NYS 100 form, refer to the instructions that accompany the form. You can also visit the New York State Department of Labor’s website at www.labor.ny.gov, where comprehensive resources and contact information for assistance are available. If you have specific questions, calling the provided help number is an excellent way to get targeted answers.

Common mistakes

When completing the NYS-100 form, many individuals make common mistakes that can lead to delays or issues with their registrations. One frequent error occurs when people fail to check the correct type of employer. It’s essential to select whether you are a business or a household employer of domestic services. Not choosing the right category means the rest of the form may not be processed correctly.

Another mistake is neglecting to enter a Federal Employer Identification Number (FEIN). This number is crucial for processing as it identifies your business at the federal level. Some individuals either leave this blank or assume they can submit the form without it, which can lead to rejection.

Inaccurate contact information is also a common pitfall. Many people miswrite their phone numbers or emails, making it difficult for tax authorities to reach them if necessary. Ensure that all contact information is correct and up to date to avoid any communication issues.

Moreover, individuals often miscalculate their employment status. They may overlook counting certain workers or misclassify independent contractors as employees. It's vital to accurately report the total number of employees you have to avoid penalties.

Completing the form without thorough checks is another frequent error. Some might fill out the form in haste and forget to review for missing information or typographical errors. Taking a moment to double-check can prevent unnecessary complications.

Another confusion arises in the ‘Required Addresses’ section. Some fail to provide both a mailing address and a physical address when they differ. This omission can lead to misplaced correspondence and missed deadlines.

Additionally, a significant number of applicants misinterpret questions about past businesses or legal entity changes. They might not provide complete information on a previous business registration or fail to indicate if there was a change in the ownership structure. Detailed answers are necessary to maintain transparency.

Finally, individuals may neglect to sign the form. Not providing a signature may delay processing, as the form is considered incomplete without it. Always remember to sign and date your application before submission to avoid this hassle.

Documents used along the form

The NYS-100 form is a crucial document for employers in New York State, helping to register for unemployment insurance, withholding, and wage reporting. Alongside this form, there are several other documents that are commonly required or helpful during the registration process. Below is a list of those documents, along with a brief description of each.

- NYS-100.1: This is the supplementary form required for corporations and partnerships to provide additional information regarding their business structure and registered employees.

- NYS-4: This is the Employee's Withholding Allowance Certificate, which employees complete to determine the amount of state income tax withholding from their paychecks.

- Certificate of Incorporation: For businesses registering as corporations, this document confirms the legal establishment of the business entity in New York State.

- Application for Federal Employer Identification Number (EIN): This form is required to obtain an EIN from the IRS, essential for tax purposes and hiring employees.

- NYS-45: This quarterly report outlines unemployment insurance contributions and withheld income tax for state employees.

- LO-400 Form: This form serves as a notice of entitlement and potential charges, crucial for tracking unemployment claims by former employees.

- Business Tax Registration Form: A necessary document for registering various tax types with the New York State Department of Taxation and Finance.

- Occupational Safety and Health Administration (OSHA) Forms: These forms ensure employers meet workplace safety regulations and requirements.

- Wage Theft Prevention Act Notice: This document informs employees about their rights concerning wages and wage deductions under New York law.

Incorporating these additional forms and documents with the NYS-100 will facilitate a smoother registration process. Understanding each piece's purpose is essential for compliance and ensuring the business operates efficiently.

Similar forms

IRS Form SS-4: This form is used to apply for an Employer Identification Number (EIN). It serves a similar purpose to the NYS-100 in that both are essential for employers to operate officially and handle their tax responsibilities.

IRS Form W-2: The W-2 form reports wages paid to employees and the taxes withheld. Like the NYS-100, it involves employer registration details and is crucial for tax compliance.

IRS Form 940: This form is for reporting annual Federal Unemployment Tax Act (FUTA) tax. It's similar in focus on unemployment taxes, just at the federal level rather than state.

NYS Form IT-2104: This form helps determine the amount of New York State income tax withheld from employee wages. It is related, as it deals with employee tax obligations similar to what the NYS-100 addresses.

NYS Form NYS-1: This form is the New York State Withholding Tax Return. It is completed regularly by employers to report and pay taxes withheld from employees, reinforcing the purpose of collecting and reporting employee tax information.

Dos and Don'ts

When filling out the NYS-100 form, there are essential do's and don'ts that can help ensure your application is complete and accurate.

- Do apply online if possible. This can save you time and help avoid mistakes.

- Do provide correct and complete information about your business structure. This includes the legal name and FEIN.

- Do verify dates carefully, particularly your start date and payroll dates, to ensure compliance with tax withholding regulations.

- Do double-check the physical and mailing addresses to ensure you receive important documents promptly.

- Don’t use the form for nonprofit organizations, agricultural employers, or government entities. Call for the appropriate form if needed.

- Don’t provide inaccurate information or omit required fields. Missing details can delay processing.

- Don’t forget to include your contact information, especially a phone number and email, for follow-up inquiries.

- Don’t assume prior registrations are still valid. Always check for updates or changes in your business entity status.

Misconceptions

Misconceptions about the NYS 100 form can lead to confusion for employers and may affect compliance with state regulations. Here are nine common misunderstandings:

- The NYS 100 form is only for large businesses. Many believe the form is exclusive to large employers. In fact, the form is required for any employer in New York State who has employees, regardless of size.

- You can use this form to register a nonprofit organization. Some mistakenly think the NYS 100 is appropriate for registering nonprofits. However, this form is not intended for organizations classified under IRC 501(c)(3).

- The NYS 100 only needs to be filled out once. There is a belief that the registration is one-time. In reality, if there are changes in business ownership, structure, or location, a new form must be submitted.

- All workers are considered employees for the purpose of this form. Some employers do not distinguish between employees and independent contractors. The NYS 100 requires clarification on the status of all workers.

- You don't need an FEIN if you are a sole proprietor. It's a common assumption that sole proprietors can skip the Federal Employer Identification Number (FEIN). However, even sole proprietors generally must provide an FEIN on this application.

- The NYS 100 is only for reporting wages. Many think this form is solely for wage reporting. It also serves to register for unemployment insurance and withholding taxes.

- The information on the form is confidential. While personal information is collected, it's important to understand that certain data may be subject to public disclosure in compliance with state laws.

- Filing online eliminates the need for any paper forms. Some employers assume that completing the NYS 100 online means they have no further obligations. However, they must ensure that all necessary information is accurately submitted regardless of the method.

- You can ignore the deadlines for filing the NYS 100. Lastly, some believe that deadlines are flexible. In contrast, timely filing of the NYS 100 is critical to avoid penalties and ensure compliance with state regulations.

Key takeaways

- Before starting, visit www.labor.ny.gov to review the form and ensure you have all necessary information ready.

- Filling out the NYS-100 form is essential for registering for unemployment insurance and to comply with state tax requirements.

- Complete all relevant sections fully and accurately; errors can delay processing or result in compliance issues.

- If you are a household employer, be sure to follow the instructions specific to that option in the form.

- Include your Federal Employer Identification Number (FEIN) and contact information; this helps avoid miscommunication.

- Make sure to indicate whether you are submitting the form for a new business or a change of ownership or legal entity.

- Submit the completed form via mail, fax, or online, and keep a copy for your records.

Browse Other Templates

Illinois Address Update Request,Real Estate Licensee Address Modification Form,IL Address Change Submission,Department of Financial Regulation Address Amendment,Professional Regulation Address Change Application,License Holder Address Update Form,Ill - This form is unique to Illinois and is specifically tailored for real estate professionals licensed in the state.

Lic 279 Spanish - Understanding child abuse reporting requirements is crucial when applying.

Background Check in Nj - Applicants are required to enter a cost code associated with the service.