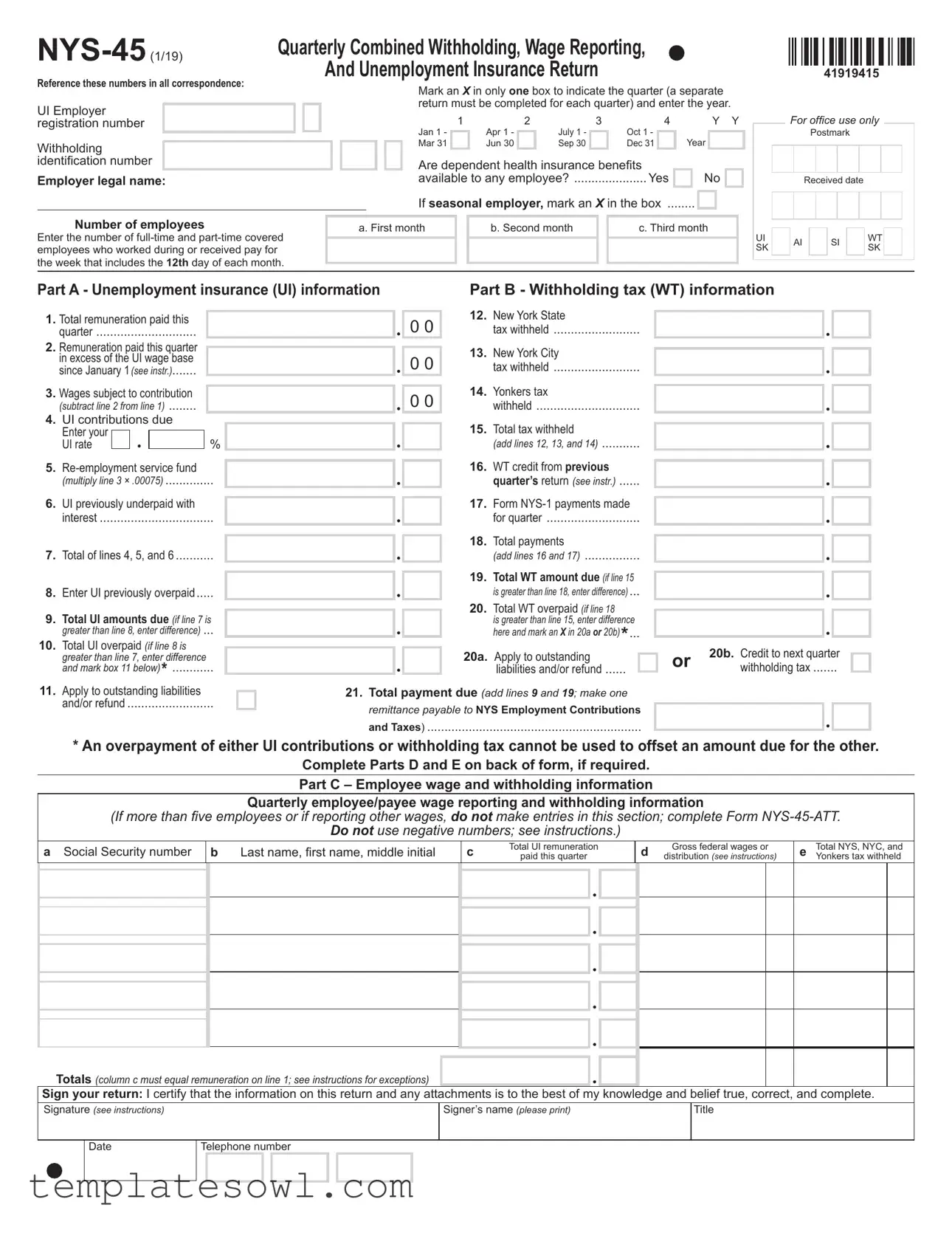

Fill Out Your Nys 45 Form

The NYS-45 form is a crucial document for employers in New York State, serving as the Quarterly Combined Withholding, Wage Reporting, and Unemployment Insurance Return. Each quarter, employers must indicate their reporting period by marking the appropriate box and providing the year. The form not only collects data on wages and taxes withheld but also includes critical information on employee health insurance benefits. Employers will need to disclose the number of employees working during a specific week each month and report on total remuneration and tax withholdings. It also requires the calculation of unemployment insurance contributions and allows for corrections to previously submitted information. Accurate completion of the NYS-45 is essential, as it ensures proper reporting of employee wages and taxes while fulfilling state requirements. Complete instructions are provided to guide employers through this process, making it important for all involved to pay close attention to detail and compliance deadlines.

Nys 45 Example

Quarterly Combined Withholding, Wage Reporting, |

|

|

|

|

|

|

|

|||||||||||||||||||||

Reference these numbers in all correspondence: |

|

|

|

|

And Unemployment Insurance Return |

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

Mark an X in only one box to indicate the quarter (a separate |

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

UI Employer |

|

|

|

|

|

|

|

|

|

|

|

return must be completed for each quarter) and enter the year. |

||||||||||||||||

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

1 |

2 |

3 |

4 |

|

|

|

Y Y |

||||||||||||||||

registration number |

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

Jan 1 - |

|

Apr 1 - |

|

July 1 - |

|

Oct 1 - |

|

Year |

|

|

|

|

||||

Withholding |

|

|

|

|

|

|

|

|

|

|

|

Mar 31 |

|

Jun 30 |

|

Sep 30 |

|

Dec 31 |

|

|

|

|

||||||

identification number |

|

|

|

|

|

|

|

|

|

|

|

Are dependent health insurance benefits |

|

|

|

|

|

|

|

|||||||||

Employer legal name: |

|

|

|

|

|

|

|

|

|

|

available to any employee? ...................... Yes |

|

|

No |

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

If seasonal employer, mark an X in the box |

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

Number of employees |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

a. First month |

|

b. Second month |

|

c. Third month |

|

|||||||||||||||||

Enter the number of |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

employees who worked during or received pay for |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

the week that includes the 12th day of each month. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

UI SK

41919415

For office use only

Postmark

Received date

AI |

|

SI |

|

WT |

|

|

|

SK |

|

||

|

|

|

|

|

Part A - Unemployment insurance (UI) information |

Part B - Withholding tax (WT) information |

||||||||||||||||||||

1. |

|

|

|

|

|

|

|

|

|

|

|

12. |

New York State |

|

|

|

|

|

|

|

|

Total remuneration paid this |

|

|

|

|

|

0 0 |

|

|

|

|

|

|

|

||||||||

2. |

quarter |

|

|

|

|

..........................tax withheld |

|

|

|

|

|

|

|||||||||

Remuneration paid this quarter |

|

|

|

|

|

|

13. |

New York City |

|

|

|

|

|

|

|

||||||

|

in excess of the UI wage base |

|

|

|

|

|

0 0 |

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

tax withheld |

|

|

|

|

|

|

|

|||||||

|

since January 1 (see instr.) |

|

|

|

|

|

|

|

|

|

|

||||||||||

3. |

|

|

|

|

|

|

|

|

|

|

|

14. |

Yonkers tax |

|

|

|

|

|

|

||

Wages subject to contribution |

|

|

|

|

|

0 0 |

|

|

|

|

|

|

|

||||||||

4. |

(subtract line 2 from line 1) |

|

|

|

|

...............................withheld |

|

|

|

|

|

|

|||||||||

UI contributions due |

|

|

|

|

|

|

15. |

Total tax withheld |

|

|

|

|

|

|

|

||||||

|

Enter your |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

UI rate |

|

|

|

|

% |

|

|

|

|

|

|

(add lines 12, 13, and 14) |

|

|

|

|

|

|

|

|

5. |

|

|

|

|

|

|

16. |

WT credit from previous |

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

(multiply line 3 × .00075) |

|

|

|

|

|

|

.......quarter’s return (see instr.) |

|

|

|

|

|

|

|||||||

6. |

UI previously underpaid with |

|

|

|

|

|

|

17. |

Form |

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

interest |

|

|

|

|

|

|

............................for quarter |

|

|

|

|

|

|

|||||||

7. |

|

|

|

|

|

|

|

|

|

|

|

18. |

Total payments |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Total of lines 4, 5, and 6 |

|

|

|

|

|

|

.................(add lines 16 and 17) |

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

19. |

Total WT amount due (if line 15 |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

8. |

Enter UI previously overpaid |

|

|

|

|

|

20. |

...is greater than line 18, enter difference) |

|

|

|

|

|

|

|||||||

9. |

Total UI amounts due (if line 7 is |

|

|

|

|

|

Total WT overpaid (if line 18 |

|

|

|

|

|

|

|

|||||||

|

|

|

|

is greater than line 15, enter difference |

|

|

|

|

|

|

|

||||||||||

|

greater than line 8, enter difference) |

|

|

|

|

|

|

|

* |

|

|

|

|

|

|

|

|

||||

10. |

|

|

|

|

|

|

here and mark an X in 20a or 20b) ... |

|

|

|

|

|

|

|

|||||||

Total UI overpaid (if line 8 is |

|

|

|

|

|

|

20a. Apply to outstanding |

|

|

|

or |

20b. Credit to next quarter |

|

||||||||

|

greater than line 7, enter difference |

|

|

|

|

|

|

|

|

|

|

||||||||||

11. |

and mark box 11 below) * |

|

|

|

|

|

|

liabilities and/or refund |

|

|

|

|

.......withholding tax |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

Apply to outstanding liabilities |

|

|

|

21. Total payment due (add lines 9 and 19; make one |

|

|

|

|

|

||||||||||||

|

and/or refund |

|

|

remittance payable to NYS Employment Contributions |

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

and Taxes) |

|

|

|

|

|

|

|

|

|

|

||

*An overpayment of either UI contributions or withholding tax cannot be used to offset an amount due for the other.

Complete Parts D and E on back of form, if required.

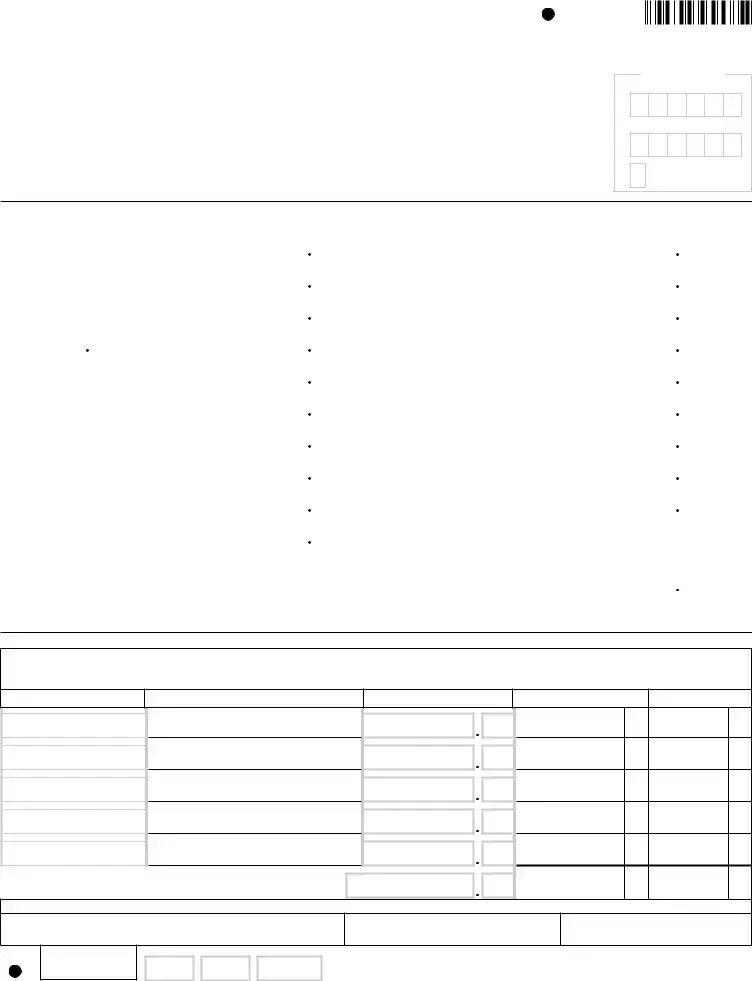

Part C – Employee wage and withholding information

Quarterly employee/payee wage reporting and withholding information

(If more than five employees or if reporting other wages, do not make entries in this section; complete Form

Do not use negative numbers; see instructions.)

aSocial Security number

bLast name, first name, middle initial

c

Total UI remuneration

paid this quarter

d Gross federal wages or distribution (see instructions)

e Total NYS, NYC, and Yonkers tax withheld

Totals (column c must equal remuneration on line 1; see instructions for exceptions)

Sign your return: I certify that the information on this return and any attachments is to the best of my knowledge and belief true, correct, and complete.

Signature (see instructions)

Signer’s name (please print)

Title

Date

Telephone number

Withholding identification number

41919422

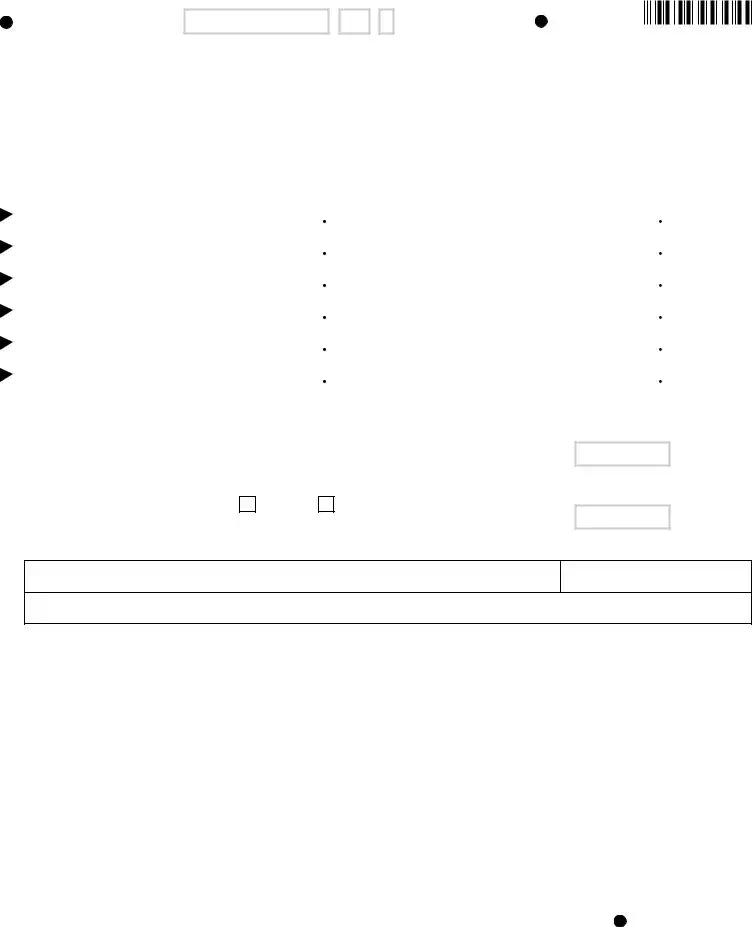

Part D - Form

Use Part D only for corrections/additions for the quarter being reported in Part B of this return. To correct original withholding information reported on Form(s)

|

a |

|

b |

|

|

c |

|

d |

|

|

|

||||

|

Original |

|

Original |

|

|

Correct |

|

Correct |

|

|

|

||||

last payroll date reported |

|

total withheld |

|

last payroll date |

|

total withheld |

|

|

|

||||||

on Form |

|

reported on Form |

|

|

(mmdd) |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part E - Change of business information

22. This line is not in use for this quarter.

23. If you permanently ceased paying wages, enter the date (mmddyy) of the final payroll (see Note below).........

24. If you sold or transferred all or part of your business:

• Mark an X to indicate whether in whole or in part

• Enter the date of transfer (mmddyy).................................................................................................................

• Complete the information below about the acquiring entity

Legal name

EIN

Address

Note: For questions about other changes to your withholding tax account, call the Tax Department at

Paid |

Preparer’s signature |

|

Date |

Preparer’s NYTPRIN |

|

|

Preparer’s SSN or PTIN |

|

NYTPRIN |

||||

|

|

|

|

|

|

|

|

|

excl. code |

||||

preparer’s |

|

|

|

|

|

|

|

|

|

|

|

|

|

use |

|

|

|

|

|

|

|

|

|

|

|

|

|

Preparer’s firm name (or yours, if |

Address |

|

Firm’s EIN |

Telephone number |

|||||||||

|

|

|

|

|

|

|

|

|

( ) |

||||

Payroll service’s name |

|

|

|

|

Payroll |

|

|

|

|

|

|

||

|

|

|

|

|

|

service’s |

|

|

|

|

|

|

|

|

|

|

|

|

|

EIN |

|

|

|

|

|

|

|

Checklist for mailing: |

|

|

Mail to: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

•File original return and keep a copy for your records.

•Complete lines 9 and 19 to ensure proper credit of payment.

•Enter your withholding ID number on your remittance.

•Make remittance payable to NYS Employment Contributions and Taxes.

•Enter your telephone number in boxes below your signature.

•See Need help? on Form

NYS EMPLOYMENT CONTRIBUTIONS AND TAXES PO BOX 4119 BINGHAMTON NY

Form Characteristics

| Fact Name | Detail |

|---|---|

| Purpose | The NYS-45 form is used for reporting quarterly combined withholding, wage reporting, and unemployment insurance contributions. |

| Filing Frequency | This form must be filed quarterly, marking the appropriate box for each quarter: January to March, April to June, July to September, or October to December. |

| Governing Laws | It is governed under the New York State Tax Law and Employment Security Law. |

| Employee Reporting | The form requires listing the total number of full-time and part-time employees who worked during the week including the 12th day of each month. |

| Tax Calculation | It includes calculations for total remuneration, tax withheld, and any UI contributions due for the quarter. |

| Overpayment Procedures | Should there be an overpayment, the form allows for differences to be marked and applied to outstanding liabilities or next quarter's credit. |

| Corrections | If changes to reporting are necessary, Part D of the form accommodates corrections or additions for the quarter. |

| Submission Instructions | To submit, file the original return to NYS Employment Contributions and Taxes, and keep a copy for your records. |

Guidelines on Utilizing Nys 45

Once you have gathered all the required information, you can begin filling out the NYS-45 form. This process involves several steps, ensuring that all necessary details are accurately provided to meet reporting requirements. Follow the steps below carefully to complete the form correctly.

- Obtain the NYS-45 form from the New York State Department of Taxation and Finance website or your payroll service.

- Mark an "X" in the box corresponding to the quarter for which you are reporting and enter the year.

- Fill in your registration number and withholding identification number.

- Complete the employer's legal name section and indicate if dependent health insurance benefits are available to any employee.

- If you are a seasonal employer, mark the box indicated.

- Enter the total number of employees for the first, second, and third months.

- In Part A, provide the total remuneration paid during the quarter and the total tax withheld.

- Complete lines for New York City and Yonkers taxes withheld as applicable.

- Provide your unemployment insurance (UI) rate and any UI contributions due.

- Calculate any overpaid or underpaid amounts for UI contributions.

- Complete Part C with employee wage and withholding information, filling in the required details for each employee.

- If necessary, use Part D for corrections to previous withholding reported on Form NYS-1.

- Fill out Part E if your business has undergone any significant changes.

- Sign the return, print your name, and enter your title, date, and telephone number in the appropriate sections.

- Ensure that you have filled out any additional information for a paid preparer if applicable.

- Mail the completed form to the address specified on the checklist, keeping a copy for your records.

By following these steps, you will effectively complete the NYS-45 form and ensure compliance with New York State’s labor and tax requirements.

What You Should Know About This Form

What is the NYS-45 form used for?

The NYS-45 form is specifically designed for employers in New York State to report crucial details related to quarterly withholding, wage reporting, and unemployment insurance. This form helps in tracking employee wages, tax withholdings, and unemployment insurance contributions, ensuring compliance with state regulations. By filing this form, employers provide necessary information that aids in the accurate calculation of taxes and ensures that employees receive their rightful benefits.

Who needs to file the NYS-45 form?

Any employer in New York State who has employees and is subject to withholding tax and unemployment insurance must fill out the NYS-45 form. This includes both full-time and part-time workers. If you pay wages or provide health insurance benefits to employees, completing this form is essential for staying compliant with state laws.

What information do I need to provide on the NYS-45 form?

On the NYS-45 form, you'll need to input various pieces of information. This includes your employer identification number, labor statistics such as the number of employees, the total remuneration paid during the quarter, tax withheld, and wage reporting for your employees. Additionally, you must indicate if dependent health insurance benefits are available to any employees and declare if you’re a seasonal employer.

What are the key parts of the NYS-45 form?

The NYS-45 consists of several parts. Part A covers unemployment insurance information, while Part B focuses on withholding tax details. Part C allows for detailed employee wage reporting. If any corrections or additions are necessary from a previously filed NYS-1 form, Part D is designated for that purpose. Lastly, Part E is intended for notifying any changes in business information, such as ceasing operations or transferring ownership. Each section plays a crucial role in gathering comprehensive and accurate information.

How often do I need to file the NYS-45 form?

The NYS-45 form must be filed quarterly. Specifically, it is due after the end of each calendar quarter, which means submissions are required for the quarters ending on March 31, June 30, September 30, and December 31. Failing to file on time can result in penalties or interest charges, so keeping an eye on the deadlines is vital for any responsible employer.

Are there penalties for failing to file the NYS-45?

Yes, there are penalties for not filing the NYS-45 form within the specified time frame. Employers who fail to submit their reports as required may incur fines, late fees, or interest on unpaid contributions and taxes. It is important to file accurately and on time to avoid these unwanted financial consequences, fostering a healthy relationship with state tax authorities.

How do I submit the NYS-45 form?

You can submit the NYS-45 form by mailing it to the appropriate address, which is the NYS Employment Contributions and Taxes, PO Box 4119, Binghamton NY 13902-4119. Make sure to keep a copy for your own records. If you're using a paid preparer or payroll service, they can assist with the filing process and ensure that everything is accurate and timely.

What should I do if I make a mistake on the NYS-45 form?

If you discover an error after submitting the NYS-45 form, it’s crucial to act quickly. Use Part D of the NYS-45 to report necessary corrections for the reported quarter. Make sure to follow the instructions for completing this section accurately to rectify any misunderstandings from the original filing. Correct and timely reporting can help avoid penalties and maintain compliance.

Common mistakes

Completing the NYS-45 form accurately is crucial for employers in New York. However, many make common mistakes that can lead to delays or penalties. Understanding these issues can help ensure compliance and accuracy.

First, failing to select the correct quarter can cause significant problems. The form requires an “X” in only one box to indicate which quarter is being reported. Forgetting this step or marking more than one box will likely result in a rejected form. This oversight can affect an employer's timeline in reporting and paying taxes.

Secondly, many people miscalculate the remuneration paid during the reporting period. The total compensation must reflect the correct information as listed on the form. Errors in this calculation can lead to incorrect tax withholding figures, which may in turn create complications with state tax authorities.

Another frequent pitfall involves the reporting of employee wages and withholdings. The form specifies that if more than five employees are included, one should not make entries in that section. Instead, a separate Form NYS-45-ATT is necessary. Ignoring this requirement can render the form invalid.

Moreover, the section regarding the employer's legal name often contains errors. A mismatch between the name on the NYS-45 form and the employer’s registration information can result in processing delays. Maintaining consistency with the official name is essential to avoid complications.

It's also common for individuals to skip the certification section. All forms must be signed, with the date and printed name of the signer included. Without this certification, the submission may be considered incomplete, prompting unnecessary follow-up actions.

Individuals sometimes neglect to report total UI contributions accurately. Misreporting these figures or omitting applicable amounts can lead to audits or assessments. Employers should carefully review previous reports to ensure accuracy.

Another misstep occurs when calculating the UI rate and total payments. The form requires specific multiplication and addition procedures to arrive at the correct figures. Mistakes in this area can not only cause an overstatement of liabilities but also might attract penalties for underpayment.

Additionally, some fail to include supporting documentation when making corrections or alterations on the form. Omitting necessary details can create confusion for tax authorities, leading to further inquiries or assessments against the business.

Lastly, improper mailing can also create issues. The completed form must be sent to the specified address, and a copy should be kept for the employer’s records. Not following these instructions can lead to lost submissions and, consequently, unresolved tax obligations.

A comprehensive understanding of these common pitfalls can help employers navigate the complexities of the NYS-45 form. Careful attention to detail is essential for timely compliance and avoiding potential penalties.

Documents used along the form

The NYS-45 form is essential for employers in New York State, serving as a Quarterly Combined Withholding, Wage Reporting, and Unemployment Insurance Return. Alongside this form, several other documents are commonly used to ensure compliance with state regulations and accurate reporting of employee wages and taxes. Below is a list of related forms and documents that are often accompanied by the NYS-45.

- NYS-1: This form is used for reporting and paying New York State's withholding tax. Employers submit it periodically (monthly or quarterly) to detail the amounts withheld from employee wages.

- NYS-45-ATT: Employers complete this attachment to report wages for more than five employees or to provide additional wage information required by the NYS-45 form.

- Form IT-2104: This form is an Employee's Withholding Allowance Certificate. Employees fill it out to inform their employer of the number of withholding allowances to claim, directly affecting the amount of tax withheld from their paycheck.

- Form IT-2104-E: The Certificate of Exemption from Withholding, used by employees who believe they are exempt from New York State withholding tax and wish to inform their employer accordingly.

- Form NYS-45.1: An extension of the NYS-45 form, this can be utilized by employers who make changes or corrections after filing the original return. It ensures that any discrepancies are formally recorded.

- Form NYS-500: This is the New York State Annual Withholding Tax Reconciliation. It summarizes the withholding tax collections for the entire year and is due by January 31st of the following year.

- Quarterly Reports of Unemployment Insurance (UI): Separate documents used to report unemployment insurance contributions paid for the employees each quarter, ensuring proper funding for the state’s unemployment system.

Each of these documents plays a significant role in maintaining compliance with state tax and unemployment regulations. Understanding their purpose ensures that employers can effectively manage their payroll and tax obligations, thereby supporting their workforce and adhering to legal requirements.

Similar forms

The NYS-45 form, known as the Quarterly Combined Withholding, Wage Reporting, and Unemployment Insurance Return, serves several critical functions for employers in New York. It is similar to a variety of other documentation that businesses must complete for regulatory compliance. Below is a list of six documents that share similarities with the NYS-45 form, along with explanations of those similarities:

- Form NYS-1: This form is used to report and remit New York State withholding taxes. Similar to the NYS-45, it provides a breakdown of tax withheld from employee wages, making it essential for compliance with state regulations.

- Form 941: Employers use this IRS form to report quarterly federal income tax withheld, Social Security, and Medicare taxes. Like the NYS-45, Form 941 requires detailed information about employee wages and tax withholdings during the reporting period.

- Form W-2: This document provides a summary of an employee’s annual wages and tax withholding. While Form W-2 is submitted at year-end, it serves a similar purpose in reporting wage information as the NYS-45 does on a quarterly basis.

- Form 1099-MISC: This form is used for reporting miscellaneous income and payments made to independent contractors. Like the NYS-45, it enables the collection and reporting of tax information relevant to employment, albeit in a different context.

- New York City (NYC) Unincorporated Business Tax Return (Form NYC-202): This form is used by unincorporated businesses to report income and pay taxes. The need for accurate reporting of business activity creates a parallel with the NYS-45, which tracks wages and tax obligations.

- Form NYS-45-ATT: This attachment is completed when more than five employees are reported on the NYS-45. It captures additional wage and withholding data, reflecting a similar purpose of ensuring comprehensive wage reporting.

Each of these documents plays a vital role in maintaining accurate record-keeping for payroll and tax obligations. Employers should ensure they are familiar with these forms to remain compliant with federal and state regulations.

Dos and Don'ts

When filling out the NYS-45 form, careful attention is required. Follow these guidelines to ensure accuracy. Here’s what you should and shouldn’t do:

- Do mark an X in only one box for the correct quarter.

- Do enter your registration number accurately.

- Do calculate the total remuneration and withholdings precisely.

- Do report employee information without making negative entries.

- Do sign and date the return, certifying the accuracy of the information.

- Don't submit the form without a copy for your records.

- Don't leave required fields blank; provide all necessary information.

- Don't mix payments; an overpayment of UI contributions cannot offset withholding tax dues.

- Don't forget to enter your telephone number below your signature for contact purposes.

By following these guidelines, you can ensure that your NYS-45 form is filled out correctly and efficiently. If you encounter difficulties, seek assistance before submitting the form.

Misconceptions

- Misconception: The NYS 45 form is only for large employers. In reality, this form is required for all employers, regardless of size. If you have employees in New York, you must complete it.

- Misconception: The NYS 45 form is optional. Many people believe that filing this form is just a suggestion. However, it is mandatory for reporting wages and taxes.

- Misconception: You can mark more than one box for the reporting quarter. The instructions clarify that you should only mark an X in one box to indicate the specific quarter for which you are reporting. This simplifies the process.

- Misconception: There are no consequences for missing the filing deadline. Some individuals think missing deadlines for the NYS 45 form is inconsequential. However, late filing can result in penalties and interest charges, which can add up quickly.

- Misconception: Only taxes withheld during the last month need to be reported. The NYS 45 requires a summary of all taxes withheld during the quarter, not just the last month. Accurate reporting is essential for compliance.

- Misconception: Overpayments can be used to offset future amounts due. It's a common misunderstanding that an overpayment in one area (like unemployment insurance) can clear a debt in another area (like withholding tax). Each category is treated separately.

- Misconception: The information on the NYS 45 form doesn’t need to be verified. Some people assume that once the form is submitted, that’s the end of it. However, the employer must certify that the information provided is true and complete, raising the stakes for accurate reporting.

Key takeaways

Here are some key points to consider when filling out the NYS-45 form:

- Mark an X in only one box to indicate the quarter for which you are reporting.

- Make sure to enter the correct year along with your registration number.

- If you are a seasonal employer, remember to check the appropriate box.

- Count all full-time and part-time employees who worked during the relevant week.

- Accurately calculate total remuneration paid for the quarter; it must match your employee totals.

- Note that UI contributions and withholding taxes can be different; keep them separate.

- Be consistent; totals from the employee section must equate with your calculation in Part B.

- If corrections are needed, use Part D to update information about withholding taxes.

- Complete Part E if any significant changes occurred in your business, such as closing or transferring ownership.

- Mail the form to the specified address, ensuring you keep a copy for your records.

Double-check all entries to avoid errors, as inaccuracies could lead to fines or processing delays. The importance of keeping a copy for your records cannot be underestimated, as you may need it for future inquiries. If assistance is required, contact the Tax Department or use the resources listed on the form.

Browse Other Templates

Metro Pcs Rebate - MetroPCS Prepaid Cards can be used anywhere MasterCard is accepted.

Do You Need a Permit to Buy a Pistol in North Carolina - Approval of the application does not equate to an unrestricted license to carry a weapon.