Fill Out Your Nys Dtf 17 Form

The New York State Department of Taxation and Finance's DTF-17 form plays a vital role for entrepreneurs and business owners looking to engage in sales activities within the state. This application allows individuals and companies to register for a Sales Tax Certificate of Authority, which is necessary for collecting sales tax on goods and services. Whether you’re launching a brand-new business, transitioning from a sole proprietorship to a corporation, or simply expanding by adding new locations, filing the DTF-17 is a key step in your journey. Interestingly, you have the option to file this application online, which is not only user-friendly but also minimizes the likelihood of errors and accelerates the approval process. It’s crucial to submit your application at least 20 days before starting your business operations, ensuring compliance with state regulations. The form is structured to gather essential details about your business, including identification, type of entity, and the nature of your sales activities. In addition, it helps establish a clear understanding of your responsibilities as a seller, including guidance on when to consolidate filings or how to manage temporary vendor registrations. Overall, the DTF-17 form is not just a bureaucratic requirement; it is a gateway to legally conducting business while supporting economic growth in New York.

Nys Dtf 17 Example

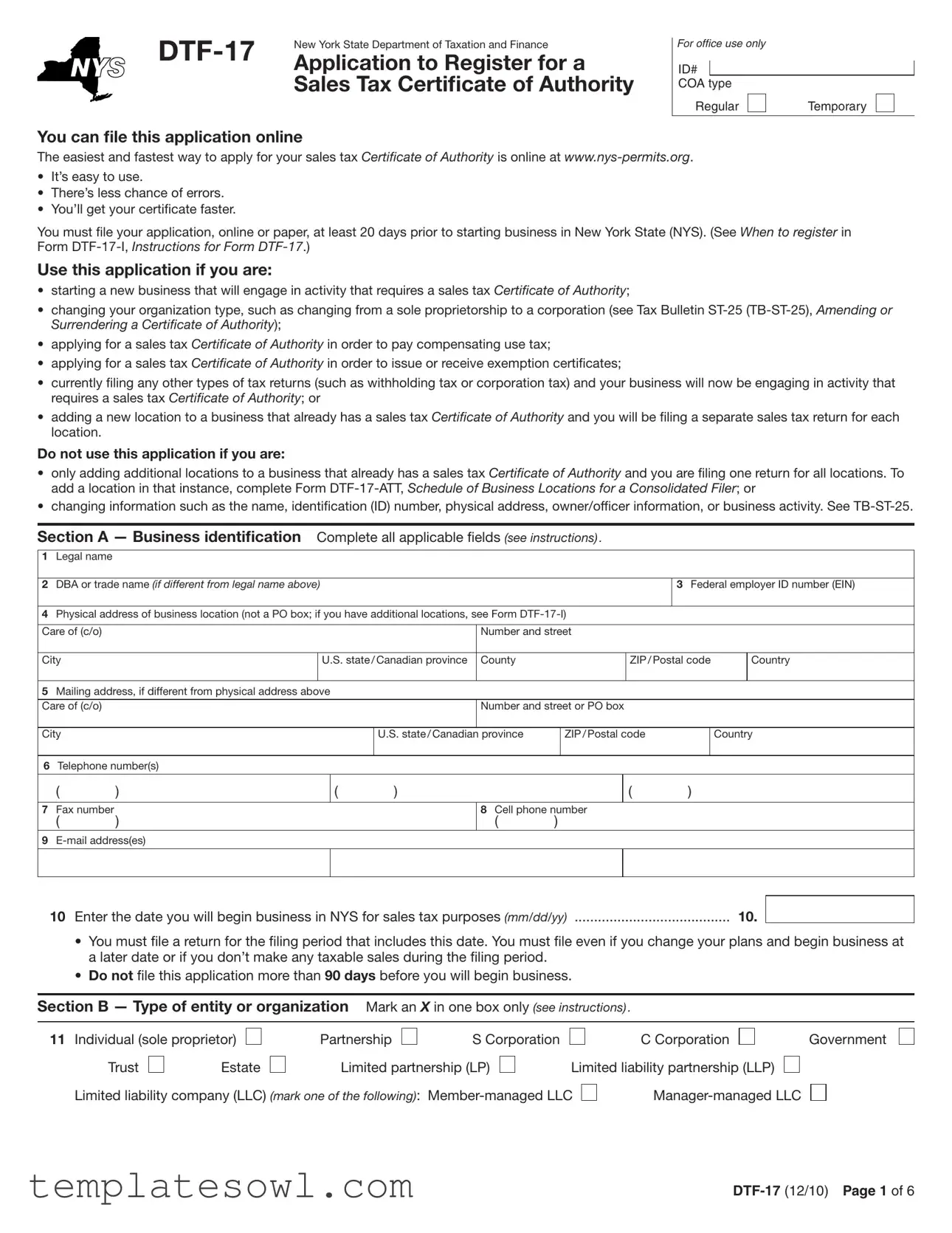

New York State Department of Taxation and Finance |

|

|

|

|

Application to Register for a |

|

Sales Tax Certificate of Authority |

For office use only

ID#

COA type

Regular |

|

Temporary |

You can file this application online

The easiest and fastest way to apply for your sales tax Certificate of Authority is online at

•It’s easy to use.

•There’s less chance of errors.

•You’ll get your certiicate faster.

You must ile your application, online or paper, at least 20 days prior to starting business in New York State (NYS). (See When to register in Form

Use this application if you are:

•starting a new business that will engage in activity that requires a sales tax Certificate of Authority;

•changing your organization type, such as changing from a sole proprietorship to a corporation (see Tax Bulletin

•applying for a sales tax Certificate of Authority in order to pay compensating use tax;

•applying for a sales tax Certificate of Authority in order to issue or receive exemption certiicates;

•currently iling any other types of tax returns (such as withholding tax or corporation tax) and your business will now be engaging in activity that requires a sales tax Certificate of Authority; or

•adding a new location to a business that already has a sales tax Certificate of Authority and you will be iling a separate sales tax return for each location.

Do not use this application if you are:

•only adding additional locations to a business that already has a sales tax Certificate of Authority and you are iling one return for all locations. To add a location in that instance, complete Form

•changing information such as the name, identiication (ID) number, physical address, owner/oficer information, or business activity. See

Section A — Business identification Complete all applicable ields (see instructions) .

1Legal name

2DBA or trade name (if different from legal name above)

3Federal employer ID number (EIN)

4Physical address of business location (not a PO box; if you have additional locations, see Form

Care of (c/o) |

|

Number and street |

|

|

|

|

|

|

|

City |

U.S. state / Canadian province |

County |

ZIP / Postal code |

Country |

|

|

|

|

|

5Mailing address, if different from physical address above

Care of (c/o) |

|

Number and street or PO box |

|

|

|

|

|

|

|

City |

U.S. state / Canadian province |

ZIP / Postal code |

Country |

|

|

|

|

|

|

6Telephone number(s)

( )

( )

( )

7 Fax number

( )

9

8 Cell phone number

( )

10 Enter the date you will begin business in NYS for sales tax purposes (mm/dd/yy) |

10. |

•You must ile a return for the iling period that includes this date. You must ile even if you change your plans and begin business at a later date or if you don’t make any taxable sales during the iling period.

•Do not ile this application more than 90 days before you will begin business.

Section B — Type of entity or organization Mark an X in one box only (see instructions) .

11Individual (sole proprietor)

Trust |

|

Estate |

Partnership |

S Corporation |

Limited partnership (LP)

C Corporation |

Government |

Limited liability partnership (LLP)

Limited liability company (LLC) (mark one of the following):

PAGE 2 of 6

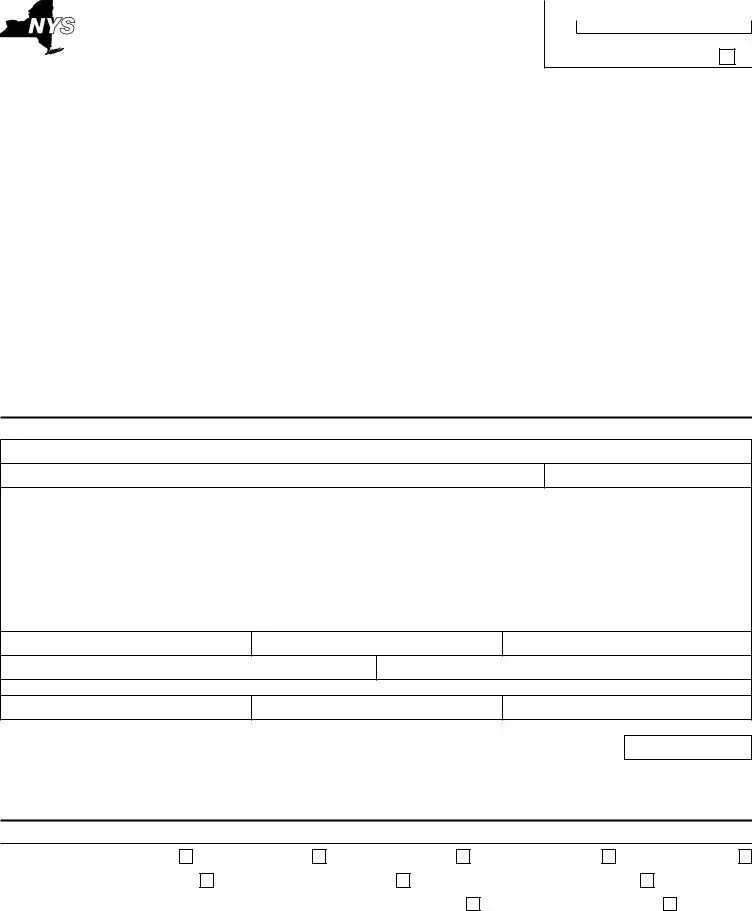

Section B — Type of entity or organization (continued)

12a |

Are you a franchisee? |

12a. Yes |

12b |

If Yes, provide franchisor’s name and address: |

|

No

Franchisor’s name

Franchisor’s address (number and street)

City

U.S. state/Canadian province

ZIP/ Postal code

Country

Section C — Business information (see instructions)

If you have more than one permanent place of business, mark an X in the appropriate box to indicate how you will ile.

13a Separate sales tax returns for each location (you must complete a separate Form |

13a. |

13b One sales tax return for all locations (you must also complete Form |

13b. |

14a If you or your business currently ile, have iled in the past, or were required to ile sales tax returns or returns for other NYS business taxes, such as corporation tax or withholding tax, enter the ID number(s) below.

•

•

•

ID number

ID number

ID number

Tax type

Tax type

Tax type

14b Were you previously registered to collect sales tax, but your Certificate of Authority expired or was |

|

|

|

|

|

surrendered, revoked, or suspended? |

14b. Yes |

No |

|

|

If Yes, provide the ID number from your previous business (if available) |

|

|

|

14c |

14c. |

|

|

|

15You can choose to register as a temporary vendor if your business does not expect to make taxable sales for more than two consecutive sales tax quarters (see instructions). Provide the date that your business

activity will end (mm/dd/yy) |

|

|

|

|

15. |

|

|

|

||

16 If you acquired all or part of the assets of a business that was registered (or required to be registered) for sales tax, |

|

|||||||||

did you ile Form |

... 16. Yes |

No |

||||||||

|

Information about former business owner: |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

|

|

Sales tax ID number |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

Address (number and street) |

|

City |

U.S. state / Canadian province |

ZIP / Postal code |

|

|

Country |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

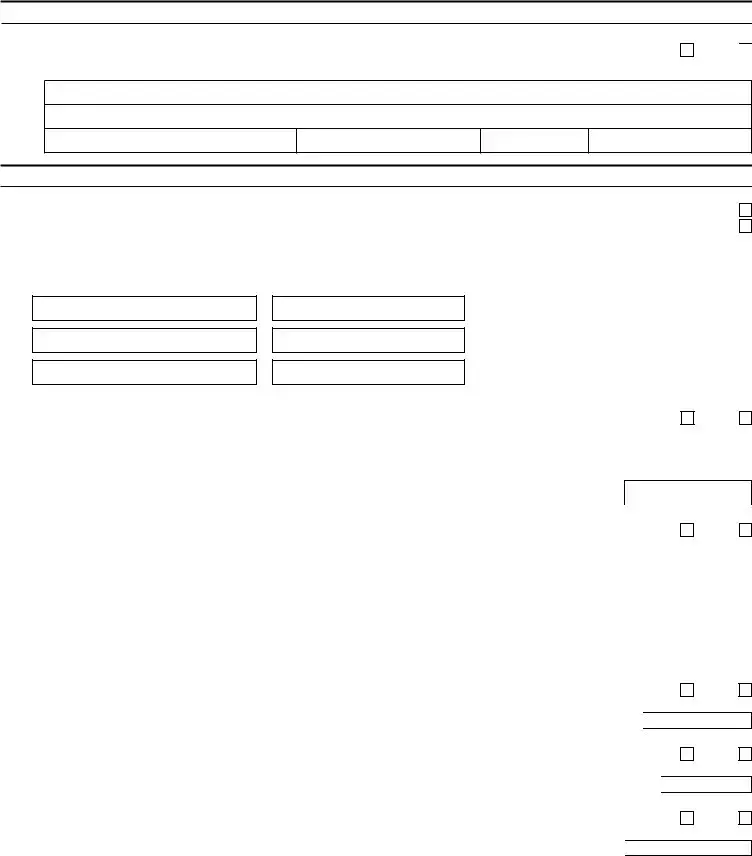

Section D — Business activity |

Mark an X in the applicable box for each item (see instructions). |

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

Licenses

17a Are you or do you intend to be licensed by the NYS Liquor Authority (SLA)? |

17a. |

Yes |

17b If Yes, enter your SLA license number (if available) |

17b. |

|

|

No

18a |

Are you or do you intend to be licensed by the NYS Lottery? |

18a. |

Yes |

|

18b |

If Yes, enter your Lottery retailer number (if available) |

18b. |

|

|

|

|

|||

19a |

.............Do you or will you operate a facility registered with the NYS Department of Motor Vehicles (DMV)? |

19a. |

Yes |

|

19b |

If Yes, enter your DMV facility number (if available) |

19b. |

|

|

|

|

|||

No

No

Section D — Business activity (continued)

Sales of goods and services

Do you intend to sell or provide any of the following goods and services? |

|

|

|

20a Cigarettes or other tobacco products sold at retail |

20a. |

Yes |

|

|

If Yes, complete and attach Form |

|

|

|

and Vending Machines for Sales of Cigarettes and Tobacco Products. |

|

|

20b |

New tires (automotive, motorcycle, trailer, etc.) |

20b. |

Yes |

20c |

Passenger car rentals |

20c. |

Yes |

20d |

Motor fuel sold at a illing station |

20d. |

Yes |

20e |

Diesel motor fuel sold at a illing station |

20e. |

Yes |

20f |

Heating fuels, including diesel, irewood, pellets, or coal |

20f. |

Yes |

20g |

Electricity or gas (including propane in containers of 100 pounds or more), steam, or refrigeration |

20g. |

Yes |

20h |

Mobile telecommunications service |

20h. |

Yes |

20i |

Other telecommunications service, including telephone answering service |

20i. |

Yes |

20j |

Clothing or footwear |

20j. |

Yes |

20k |

Hotel, motel, or other accommodations located in Nassau County or Niagara County |

20k. |

Yes |

20l |

Restaurant or tavern food or drink, or other food service (including catering, |

|

|

|

located in Nassau County or Niagara County |

20l. |

Yes |

20m |

Admissions to places of amusement, club dues, and/or cabaret charges located in Niagara County |

20m. |

Yes |

No

No

No

No

No

No

No

No

No

No

No

No

No

New York City only:

20n |

Parking or garaging services |

20n. |

Yes |

20o |

Interior decorating or design services |

20o. |

Yes |

20p |

Beauty, barbering, or miscellaneous personal services |

20p. |

Yes |

20q |

Interior cleaning or maintenance services |

20q. |

Yes |

20r |

Protective or detective services |

20r. |

Yes |

20s |

Credit rating or reporting services |

20s. |

Yes |

20t |

Hotel, motel, or other accommodations |

20t. |

Yes |

|

Other: |

|

|

20u |

Are you a manufacturer or a wholesaler that does not make retail sales? |

20u. |

Yes |

20v |

Will you participate solely in lea markets, antique shows, or other shows? |

20v. |

Yes |

20w |

Will you conduct business solely as a sidewalk vendor? |

20w. |

Yes |

No

No

No

No

No

No

No

No

No

No

Section E — Account and reporting information

21Enter the information for the bank account where sales tax money will be deposited. You must provide this information even if the account you list will not be used exclusively for sales tax purposes.

Manufacturers and wholesalers: enter the primary bank account information for your business.

Bank name

Routing number

Account number

22 Do you intend to accept credit cards? |

22. Yes |

No

23If this is not the entity that will be reporting the income from the operations of this business on an income tax return or corporation tax return, enter the name and EIN of the legal entity or social security number (SSN) for the individual that will be reporting the income from the operations of the business iling sales and use tax returns.

Name of legal entity or individual

EIN or SSN

PAGE 4 of 6

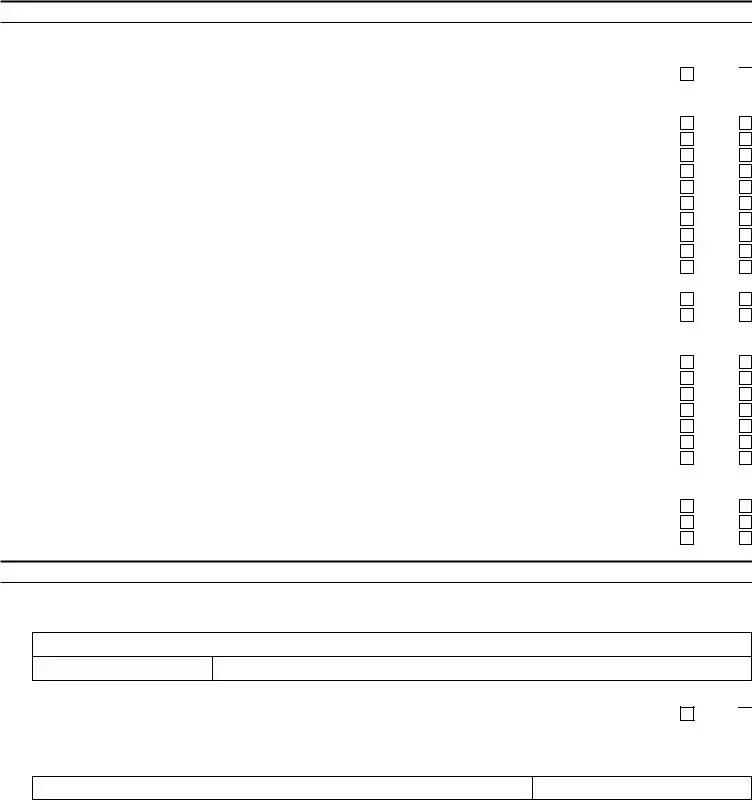

Section F — Business description (see instructions)

24a In the space below, briely describe your business activities. Describe the products or services that you will sell in NYS from the business location(s) that you are registering. Please be speciic. See the instructions for examples.

Enter the NAICS code that best describes the principal (and secondary, if appropriate) activity of the business location(s) that you are registering. You can ind a list of NAICS codes in Publication 910, Principal Business Activity for New York State Purposes, or by using the online NAICS Code Lookup on our Web site (see Need help? in Form

24b Principal NAICS code (required)

24c Secondary NAICS code

Section G — Responsible person(s) (see instructions)

Enter the applicable information for all responsible persons (see instructions). This includes, but is not limited to, owners, partners, members, oficers, and any other person responsible for the business’s

25 |

Name (first, middle initial, last, suffix) |

|

|

|

|

Business title |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Home address (number and street; not a PO Box) |

|

City |

|

|

U.S. state /Canadian province |

ZIP/ Postal code |

Country |

||

|

|

|

|

|

|

|

|

|

|

|

|

SSN |

Home phone number |

|

Effective date of assuming responsibility |

|

|||||

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Primary duties |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

All responsible persons must complete the following — except those in |

Ownership |

Proit distribution percentage, if different than |

|||||||

|

C corporations, government entities, trusts, and estates |

percentage if over 5%: |

ownership percentage and if over 5%: |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

Name (first, middle initial, last, suffix) |

|

|

|

|

Business title |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Home address (number and street; not a PO Box) |

|

City |

|

|

U.S. state /Canadian province |

ZIP/ Postal code |

Country |

||

|

|

|

|

|

|

|

|

|

|

|

|

SSN |

Home phone number |

|

Effective date of assuming responsibility |

|

|||||

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Primary duties |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

All responsible persons must complete the following — except those in |

Ownership |

Proit distribution percentage, if different than |

|||||||

|

C corporations, government entities, trusts, and estates |

percentage if over 5%: |

ownership percentage and if over 5%: |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

Name (first, middle initial, last, suffix) |

|

|

|

|

Business title |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Home address (number and street; not a PO Box) |

|

City |

|

|

U.S. state /Canadian province |

ZIP/ Postal code |

Country |

||

|

|

|

|

|

|

|

|

|

|

|

|

SSN |

Home phone number |

|

Effective date of assuming responsibility |

|

|||||

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Primary duties |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

All responsible persons must complete the following — except those in |

Ownership |

Proit distribution percentage, if different than |

|||||||

|

C corporations, government entities, trusts, and estates |

percentage if over 5%: |

ownership percentage and if over 5%: |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

Name (first, middle initial, last, suffix) |

|

|

|

|

Business title |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Home address (number and street; not a PO Box) |

|

City |

|

|

U.S. state /Canadian province |

ZIP/ Postal code |

Country |

||

|

|

|

|

|

|

|

|

|

|

|

|

SSN |

Home phone number |

|

Effective date of assuming responsibility |

|

|||||

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Primary duties |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

All responsible persons must complete the following — except those in |

Ownership |

Proit distribution percentage, if different than |

|||||||

|

C corporations, government entities, trusts, and estates |

percentage if over 5%: |

ownership percentage and if over 5%: |

|||||||

|

|

|

|

|

|

|

|

|

|

|

Section G — Responsible person(s) (continued)

|

Name (first, middle initial, last, suffix) |

|

|

|

|

Business title |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Home address (number and street; not a PO Box) |

|

City |

|

|

U.S. state /Canadian province |

ZIP/ Postal code |

Country |

||

|

|

|

|

|

|

|

|

|

|

|

|

SSN |

Home phone number |

|

Effective date of assuming responsibility |

|

|||||

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Primary duties |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

All responsible persons must complete the following — except those in |

Ownership |

Proit distribution percentage, if different than |

|||||||

|

C corporations, government entities, trusts, and estates |

percentage if over 5%: |

ownership percentage and if over 5%: |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

Name (first, middle initial, last, suffix) |

|

|

|

|

Business title |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Home address (number and street; not a PO Box) |

|

City |

|

|

U.S. state /Canadian province |

ZIP/ Postal code |

Country |

||

|

|

|

|

|

|

|

|

|

|

|

|

SSN |

Home phone number |

|

Effective date of assuming responsibility |

|

|||||

|

|

( |

) |

|

|

|

|

|

|

|

|

Primary duties |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

All responsible persons must complete the following — except those in |

Ownership |

Proit distribution percentage, if different than |

|||||||

|

C corporations, government entities, trusts, and estates |

percentage if over 5%: |

ownership percentage and if over 5%: |

|||||||

|

|

|

|

|

|

|

|

|

|

|

Section H — Tax preparer information

Tax preparer’s or irm’s name |

|

|

Preparer’s or irm’s EIN (if known) |

Preparer’s NYTPRIN (if known) |

|||||

|

|

|

|

|

|

|

|

|

|

Preparer’s or irm’s address (number and street) |

City |

U.S. state/Canadian province |

ZIP/Postal code |

|

|

Country |

|||

|

|

|

|

|

|

|

|

|

|

Preparer’s |

|

|

|

Preparer’s telephone number |

|

Preparer’s PTIN (if known) |

|||

|

|

|

|

( |

) |

|

|

|

|

If you want sales tax information mailed to this preparer, mark an X in the box .............................................................................................

Section I — Signature of responsible person – Complete all ields (see instructions)

I certify that the above statements are true, complete, and correct, and that no material information has been omitted. I make these statements with the knowledge that willfully providing false or fraudulent information with this document may constitute a felony or other crime under New York State Law, punishable by a substantial ine and possible jail sentence. I also understand that the Tax Department is authorized to investigate the validity of any information entered on this document.

Name

Signature

|

SSN |

|

|

Date |

|

|

|

|

|

Title |

Daytime telephone number |

|||

|

|

( |

) |

|

If your application is missing information or is not signed, we will return it to you.

Mail your application to: NYS TAX DEPARTMENT

SALES TAX REGISTRATION UNIT

W A HARRIMAN CAMPUS

ALBANY NY 12227

PAGE 6 of 6

This page was intentionally left blank.

Form Characteristics

| Fact Name | Detail |

|---|---|

| Form Title | DTF-17, Application to Register for a Sales Tax Certificate of Authority. |

| Governing Law | Related to New York State tax laws, specifically sections of the Tax Law pertaining to sales tax registration. |

| Filing Options | Applications can be submitted online or on paper. Online filing is recommended for efficiency. |

| Application Deadline | Submit your application at least 20 days before starting business operations in New York State. |

| Usage Criteria | This form is for new businesses, entity changes, and situations that require a new sales tax certificate. |

| Exclusions | Do not use Form DTF-17 for adding locations that file under one return or updating existing information. |

| Temporary Vendor Option | Businesses not expecting taxable sales for more than two consecutive quarters may register as temporary vendors. |

| Responsible Persons | All responsible individuals must be accounted for in the application, including owners and partners. |

| Data Requirements | Detailing business activities and providing identifiers like EIN and NAICS codes is mandatory. |

| Signature Certification | The applicant must certify the truthfulness of the information provided, understanding the implications of false statements. |

Guidelines on Utilizing Nys Dtf 17

After completing the NYS DTF-17 form, you'll be ready to submit your application for a Sales Tax Certificate of Authority. Ensure that all fields are filled out accurately to avoid any delays in processing. It's crucial to send in your application at least 20 days before commencing business in New York State.

- Section A - Business Identification: Fill in all applicable fields, including:

- Legal name

- DBA or trade name (if different)

- Federal employer ID number (EIN)

- Physical address of business location (not a PO box)

- Mailing address (if different)

- Telephone number(s)

- Fax number

- Email address(es)

- Cell phone number

- Date you will begin business in NYS for sales tax purposes (mm/dd/yy)

- Section B - Type of Entity or Organization: Mark an X in one box only to indicate the type of entity, such as individual, corporation, or LLC. If a franchisee, answer accordingly.

- Section C - Business Information: Indicate how you will file sales tax returns. Enter any previous sales tax ID numbers if applicable.

- Section D - Business Activity: Mark an X next to the applicable goods and services. Provide details about licenses if necessary.

- Section E - Account and Reporting Information: Enter the bank account information where sales tax deposits will be made. Indicate if you will accept credit cards.

- Section F - Business Description: Describe your business activities and include the principal and secondary NAICS codes.

- Section G - Responsible Person(s): Include the details of all responsible persons in the business, such as owners or partners. Provide required information for each individual.

- Section H - Tax Preparer Information: If applicable, provide your tax preparer’s information. If you have no preparer, you can leave this section blank.

- Section I - Signature of Responsible Person: Sign and date the form. Ensure that all fields are completed to avoid return of your application.

After completing these steps, save a copy for your records. Then mail the application to the address provided in the form. Be sure to send it in well before your starting date to avoid any complications.

What You Should Know About This Form

What is the NYS DTF-17 form?

The NYS DTF-17 form is an application to register for a Sales Tax Certificate of Authority in New York State. It is necessary for businesses engaging in activities that require the collection of sales tax. This form can be filed online or via paper, but filing online is recommended for efficiency and to minimize errors.

Who needs to fill out the DTF-17 form?

You should fill out the DTF-17 form if you are starting a new business that requires a sales tax Certificate of Authority, changing your business structure (for instance, from a sole proprietorship to a corporation), applying to pay compensating use tax, or issuing/exempting certificates. Additionally, if you need to file separate sales tax returns for multiple business locations, this form is also required.

When should I file the DTF-17 form?

It is important to file your DTF-17 form at least 20 days before you intend to begin business operations that involve sales tax in New York State. However, do not submit the application more than 90 days in advance of your intended start date. This timeline ensures that your Certificate of Authority is processed in time for compliance.

Can I apply online for the DTF-17?

Yes, applying online for the DTF-17 is the easiest and fastest option. You can complete your application through the website www.nys-permits.org. This method reduces the chance of errors and ensures a quicker receipt of your sales tax Certificate of Authority.

What information do I need to provide in the form?

The form requires various details, including your business legal name, DBA (if applicable), physical and mailing addresses, contact information, and business type. You also need to specify the date you plan to commence business in New York State and describe your business activities. Additional sections concern responsible persons in the business and the bank account details for tax deposits.

What if I need to change my business information after I've registered?

If you need to change your business information, such as the business name or address, you will not use the DTF-17 form for this purpose. Instead, you should refer to Tax Bulletin ST-25 for instructions on amending or surrendering your Certificate of Authority as needed.

Common mistakes

Filling out the DTF-17 form is a crucial step for anyone looking to register for a Sales Tax Certificate of Authority in New York State. However, many individuals make common mistakes that can lead to delays or complications in their application. Understanding these mistakes can help ensure a smoother process.

One frequent error occurs in Section A, where applicants fail to provide the complete legal name of their business. This may seem minor, but inaccuracies or omissions can result in serious issues with your registration. Always double-check the name to ensure it matches your official business documents.

Another mistake happens with the physical address. Many people mistakenly use a P.O. box instead of a physical address, which is required. The form specifically asks for the actual business location, and using a P.O. box can lead to an immediate rejection of your application.

In Section B, applicants often misunderstand their entity type. Selecting the wrong box can cause confusion and misclassification. Applicants should carefully review the definitions for each entity type to ensure they are accurately categorized.

Completing Section C can also pose challenges. Some individuals fail to mark how they intend to file sales tax returns, which is essential for determining filing requirements. It’s important to clarify this aspect accurately to avoid complications later on.

Another common oversight occurs with the date of business commencement listed in Section A. Many applicants either label a date that is too far in the future or forget to file altogether if they change their start date. The form specifies that the application cannot be submitted more than 90 days in advance, so attention to timing is critical.

A growing number of applicants neglect to include their Federal Employer Identification Number (EIN), which is vital for tax purposes. Omitting this information will likely delay processing, requiring individuals to refile the application.

Section E pertains to banking information, and errors here can be significant. Providing the wrong account number or routing number could lead to issues with tax deposits. Therefore, verify all banking details carefully before submitting the form.

Finally, in Section I, the signature area is often overlooked. Some applicants forget to sign or date their application, which can result in it being returned. Ensuring all fields are complete is essential for a successful submission.

In summary, while applying for the DTF-17 form can seem straightforward, attention to detail is paramount. By avoiding these common mistakes, applicants can facilitate a smoother and more efficient registration process.

Documents used along the form

The New York State DTF-17 form is integral for businesses seeking a Sales Tax Certificate of Authority. However, a number of other supporting documents may also be necessary to ensure compliance with tax regulations. Below is a list of forms commonly utilized in conjunction with the DTF-17, along with brief descriptions.

- Form DTF-17-ATT: This form serves as the Schedule of Business Locations for businesses filing a consolidated return. It's important for businesses that plan to operate multiple sites under one sales tax registration to document their locations.

- Form AU-196.10: Known as the Notification of Sale, Transfer, or Assignment in Bulk, this form is required when a business acquires the assets of another registered entity. It ensures that all relevant tax obligations transfer accordingly.

- Form DTF-716: This form is used to register as a retail dealer and vending machine operator for the sales of cigarettes and tobacco products. It is essential for businesses in this niche to comply with specific legal requirements.

- Tax Bulletin ST-25: This bulletin outlines the rules for amending or surrendering a Certificate of Authority. It is a key reference for those looking to change their business structure or cease operations.

- Form NYS-100: This is the New York State Employer Registration for Unemployment Insurance and Withholding Tax. It's necessary for businesses that will hire employees, ensuring they comply with employment tax obligations.

- Form IT-2104: This form allows new employees to claim withholding allowances for state income tax. It helps ensure that withholding amounts are accurate from the start of employment.

- Form NYS-45: This is the quarterly combined withholding, wage reporting, and unemployment insurance return. It's important for reporting employee wages and ensuring the proper payment of withholding taxes.

- Form CT-6: Filing for an exemption from sales tax requirements, Form CT-6 is for certain organizations that are exempt from sales and use tax under New York State law.

- Form DTF-500: The sales tax return form, DTF-500, is necessary for all registered sellers to report taxable sales and remit sales tax collected to the tax department.

- Form DTF-507: This is utilized for the annual reconciliation of sales tax collections and payments. It ensures accuracy in taxed amounts and protects against discrepancies.

Understanding the forms often needed alongside the DTF-17 can streamline the registration process for new businesses. Proper documentation supports compliance with New York tax laws and can ultimately save time and reduce potential penalties.

Similar forms

Form DTF-17-ATT: This document is used to report additional business locations for entities already filing a sales tax return. Unlike DTF-17, it consolidates information for businesses that file one return for multiple locations.

Form AU-196.10: This is the Notification of Sale, Transfer, or Assignment in Bulk. It is required when a business acquires assets from another registered entity. DTF-17, on the other hand, is used to apply for a new sales tax certificate.

Form ST-120: This is the Exempt Use Certificate for purchases made without sales tax. While DTF-17 registers businesses for sales tax collection, ST-120 allows buyers to claim exemptions after registration.

Form ST-121: This form is the Resale Certificate allowing businesses to purchase items for resale without paying sales tax. DTF-17 registers the business entity before it can utilize ST-121.

Form ST-810: This is the New York State Sales Tax Exempt Use Certificate. It applies to items used in production. Again, DTF-17 is about registering for sales tax authority.

Form ST-121-A: This form is for manufacturers to certify tax-exempt purchases. Similar to DTF-17, it is necessary for business operations that qualify for tax exemptions.

Form ST-30: This is the Direct Pay Permit Application. It allows businesses to pay use tax on purchases instead of sales tax. DTF-17 serves a different purpose of registering for sales tax collection.

Tax Bulletin ST-25: This bulletin provides guidance for amending or surrendering a Certificate of Authority. It is relevant for businesses already registered, while DTF-17 is for initial applications.

Form CT-3: This is the New York Corporation Franchise Tax Return. Businesses may need both this and DTF-17 for full tax compliance, as DTF-17 is focused on sales tax registration.

Form IT-203: This is the New York Nonresident and Part-Year Resident Income Tax Return. Similar to DTF-17, it is part of the tax registration process, albeit for income taxes instead of sales tax.

Dos and Don'ts

When filling out the NYS DTF-17 form, there are several best practices to follow and common mistakes to avoid. Adhering to these guidelines will help ensure a smooth application process for your Sales Tax Certificate of Authority.

- Do complete all applicable fields. This is essential for processing your application without delays.

- Do file your application on time. Submit your application at least 20 days before you begin business to avoid complications.

- Do use the correct form. Ensure that you are using DTF-17 for the right purposes, like registering a new business.

- Do check for accuracy. Double-check all entries for mistakes, as errors can lead to denials or delays.

- Do keep a copy of your application. This will serve as a reference and help track your application status.

- Don't submit the form too early. Filing more than 90 days before your business starts is not allowed.

- Don't forget to sign your application. An unsigned form will be returned, delaying your registration.

- Don't use this form for existing businesses. If you are merely adding locations without filings, use Form DTF-17-ATT instead.

- Don't provide incomplete information. Missing data can result in rejections or delays in processing.

- Don't mix up the mailing addresses. Ensure the mailing address is distinct from the physical address, if applicable.

Misconceptions

- Filing Only Paper Applications Is Required: Many people believe that the only way to file the DTF-17 form is by paper. In reality, you can easily submit your application online, which is often faster and less prone to errors.

- You Can File the Application Anytime: Some assume there's no deadline for filing. However, it’s crucial to submit your application at least 20 days before starting your business to ensure you meet all requirements.

- Only New Businesses Need This Form: While this form is primarily for new businesses, existing businesses undergoing changes — like changing their entity type — also need to file it.

- A Sales Tax Certificate Is Not Necessary for Small Businesses: Many small business owners think they don’t need a sales tax certificate. However, if you sell taxable goods or services in New York, obtaining this certificate is essential, no matter the size of your business.

- All Businesses Need a Permanent Certificate: It's a common misconception that every business must apply for a permanent sales tax certificate. If you expect to make taxable sales for only a short time, you may qualify for a temporary vendor registration.

- Changes to Business Information Are Automatically Updated: Some assume that simply continuing to operate means their business information is current. Changes to names, addresses, or ownership require a separate submission to update information with the state.

- One Return Covers All Locations: Businesses with multiple locations often think they can file one sales tax return for everything. If you file separate returns for each location, you’ll need to complete a separate DTF-17 for each site.

- Filing the DTF-17 Is Optional: Finally, many businesses mistakenly believe that filing this form is discretionary. In reality, obtaining a Sales Tax Certificate of Authority is a legal requirement for any business selling taxable items in New York.

Understanding these misconceptions can help streamline your business registration process. It’s always best to clarify your obligations and ensure compliance with state regulations to avoid complications down the road.

Key takeaways

When filling out the New York State DTF-17 form, it is essential to pay attention to specific details to ensure a smooth application process. Here are five key takeaways to keep in mind:

- Online Filing is Recommended: Submitting your application online is the quickest and easiest method. Completing it online can help reduce errors and expedite the receipt of your Certificate of Authority.

- Timely Application Submission: It is crucial to file your application at least 20 days before commencing business activities that require a sales tax Certificate of Authority.

- Eligibility Criteria: Use this form if you are starting a new business, changing your organization type, or adding a new location, among other specific situations outlined in the instructions.

- Do Not File for Certain Changes: If your business already possesses a sales tax Certificate of Authority and you only want to add locations while filing one return, a different form (DTF-17-ATT) should be used.

- Accurate Information is Key: Ensure all fields are filled accurately, such as your legal name, the business address, and responsible individual details, as incomplete or incorrect submissions can lead to delays.

Browse Other Templates

What Is a Da Form 1059 Used for - The accuracy of the information on the form is crucial for future opportunities.

Bmo Harris Payment - Your Social Security Number will help verify your identity.

Crew Time Card - Indicate any overtime hours worked to receive appropriate compensation.