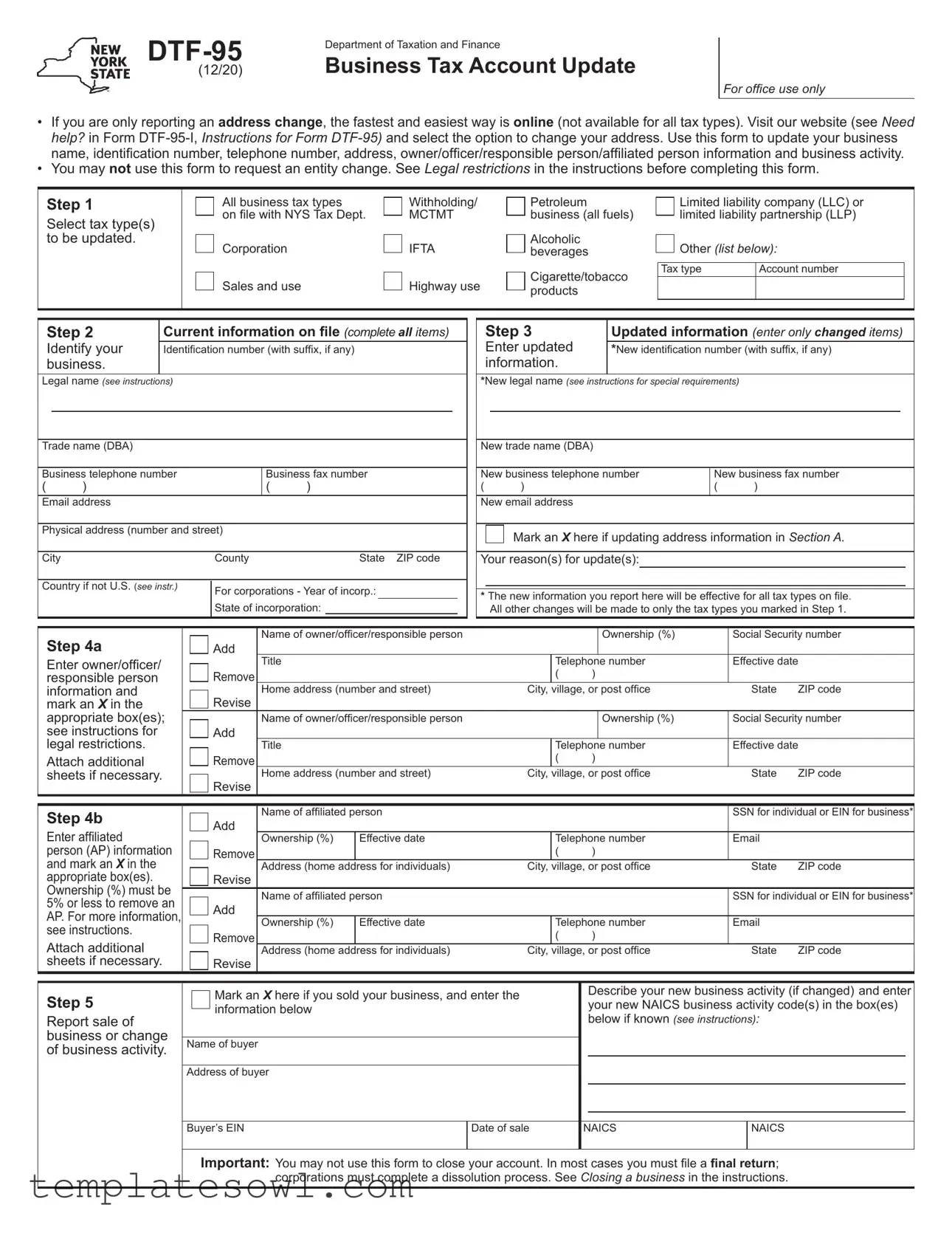

Fill Out Your Nys Dtf 95 Form

The New York State Department of Taxation and Finance (NYS DTF) Form DTF-95 is a crucial tool for businesses seeking to keep their tax information accurate and up to date. It facilitates updating essential business identifiers such as the business name, phone number, address, and details pertaining to business owners or affiliated personnel. When filling out this form, businesses can specifically indicate the tax types they wish to update, ensuring that the changes apply correctly across all relevant accounts. Notably, while the form serves various functions, it cannot be used to request a change in business entity type; those looking to make such a change must refer to the specific guidelines provided in the accompanying instructions. For those looking to report just an address change, convenience is at hand as this can often be accomplished online for certain tax types, although the DTF-95 remains the comprehensive choice for various updates. Completing the DTF-95 involves several organized steps, including providing current and updated contact information, listing any changes in ownership or affiliated persons, and signing off with the assurance of accuracy and completeness. As businesses grow and evolve, ensuring that their tax records reflect their current status is essential for compliance and continued operation.

Nys Dtf 95 Example

Department of Taxation and Finance |

|

|

|

(12/20) |

Business Tax Account Update |

For office use only

•If you are only reporting an address change, the fastest and easiest way is online (not available for all tax types). Visit our website (see Need help? in Form

•You may not use this form to request an entity change. See Legal restrictions in the instructions before completing this form.

Step 1 |

|

|

All business tax types |

|

Withholding/ |

|

Petroleum |

|

|

Limited liability company (LLC) or |

||

|

|

|

|

|

|

|||||||

Select tax type(s) |

|

|

on file with NYS Tax Dept. |

|

MCTMT |

|

business (all fuels) |

|

|

limited liability partnership (LLP) |

||

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

to be updated. |

|

|

Corporation |

|

IFTA |

|

Alcoholic |

|

|

Other (list below): |

||

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

beverages |

|

|

|

|

|

|

|

|

Sales and use |

|

Highway use |

|

Cigarette/tobacco |

Tax type |

Account number |

|

||

|

|

|

|

|

products |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

Step 2 |

Current information on file (complete all items) |

Identify your |

Identification number (with suffix, if any) |

business. |

|

Legal name (see instructions)

Trade name (DBA) |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Business telephone number |

|

Business fax number |

|||||

( |

) |

|

( |

) |

|

|

|

Email address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Physical address (number and street) |

|

|

|

|

|||

|

|

|

|

|

|

|

|

City |

|

County |

|

State ZIP code |

|||

|

|

|

|

|

|

|

|

Country if not U.S. (see instr.) |

For corporations - Year of incorp.: |

|

|

||||

|

|

||||||

|

|

State of incorporation: |

|||||

|

|

|

|

|

|

|

|

Step 3 |

Updated information (enter only changed items) |

Enter updated |

*New identification number (with suffix, if any) |

information. |

|

*New legal name (see instructions for special requirements)

New trade name (DBA)

New business telephone number |

New business fax number |

||

( |

) |

( |

) |

New email address |

|

|

|

Mark an X here if updating address information in Section A. Your reason(s) for update(s):

Mark an X here if updating address information in Section A. Your reason(s) for update(s):

* The new information you report here will be effective for all tax types on file. All other changes will be made to only the tax types you marked in Step 1.

Step 4a |

|

|

Add |

Name of owner/officer/responsible person |

|

|

|

|

|

Ownership (%) |

Social Security number |

||||

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Enter owner/officer/ |

|

|

|

Title |

|

|

Telephone number |

Effective date |

|||||||

responsible person |

|

|

Remove |

|

|

|

( |

) |

|

|

|

|

|||

information and |

|

|

Revise |

Home address (number and street) |

City, village, or post office |

|

State |

ZIP code |

|||||||

mark an X in the |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

appropriate box(es); |

|

|

|

Name of owner/officer/responsible person |

|

|

|

|

|

Ownership (%) |

Social Security number |

||||

see instructions for |

|

|

Add |

|

|

|

|

|

|

|

|

|

|

|

|

legal restrictions. |

|

|

|

Title |

|

|

Telephone number |

Effective date |

|||||||

Attach additional |

|

|

Remove |

|

|

|

( |

) |

|

|

|

|

|||

sheets if necessary. |

|

|

Revise |

Home address (number and street) |

City, village, or post office |

|

State |

ZIP code |

|||||||

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Step 4b |

|

|

Add |

Name of affiliated person |

|

|

|

|

|

|

SSN for individual or EIN for business* |

||||

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Enter affiliated |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ownership (%) |

Effective date |

|

Telephone number |

|

|

|||||||

person (AP) information |

|

|

Remove |

|

|

|

( |

) |

|

|

|

|

|||

and mark an X in the |

|

|

Revise |

Address (home address for individuals) |

City, village, or post office |

|

State |

ZIP code |

|||||||

appropriate box(es). |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ownership (%) must be |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of affiliated person |

|

|

|

|

|

|

SSN for individual or EIN for business* |

|||||

5% or less to remove an |

|

|

Add |

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

AP. For more information, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ownership (%) |

Effective date |

|

Telephone number |

|

|

|||||||

see instructions. |

|

|

|

|

|

|

|||||||||

|

|

Remove |

|

|

|

( |

) |

|

|

|

|

||||

Attach additional |

|

|

|

|

|

|

|

|

|

||||||

|

|

|

Address (home address for individuals) |

City, village, or post office |

|

State |

ZIP code |

||||||||

sheets if necessary. |

|

|

Revise |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Step 5 |

|

|

Mark an X here if you sold your business, and enter the |

|

|

Describe your new business activity (if changed) and enter |

|||||||||

|

|

information below |

|

|

|

|

|

your new NAICS business activity code(s) in the box(es) |

|||||||

|

|

|

|

|

|

||||||||||

Report sale of |

|

|

|

|

|

|

|

|

|

below if known (see instructions): |

|

|

|||

business or change |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of buyer |

|

|

|

|

|

|

|

|

|

|

|

||||

of business activity. |

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Address of buyer |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

||||||

|

Buyer’s EIN |

|

Date of sale |

|

NAICS |

|

NAICS |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

||||||

|

|

Important: You may not use this form to close your account. In most cases you must file a final return; |

|

|

|||||||||||

|

|

|

|

corporations must complete a dissolution process. See Closing a business in the instructions. |

|

|

|||||||||

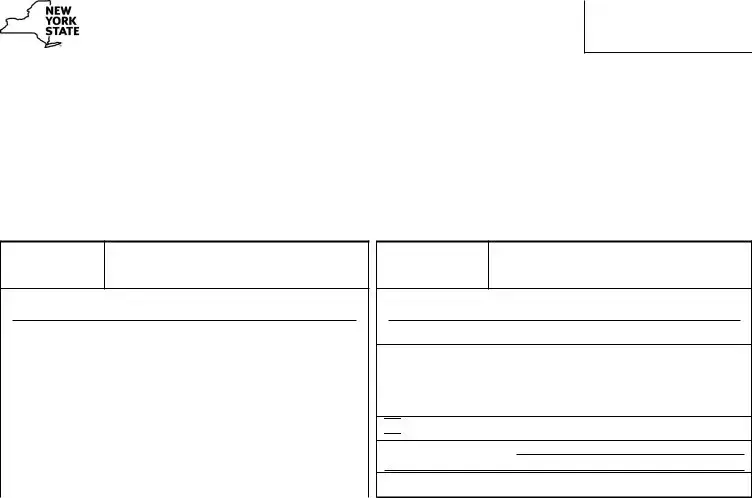

Page 2 of 2

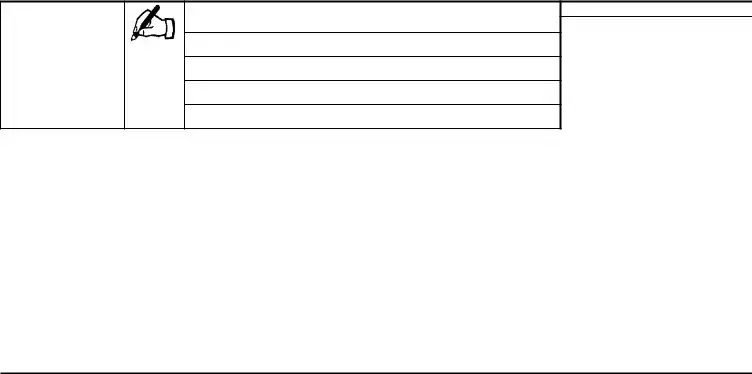

Step 6

Sign and mail your update. For where to file see instructions.

Sign here

I certify to the best of my knowledge and belief that this report is true, correct, and complete, and that I am authorized to report account updates.

Signature

Title |

|

Date |

Print contact name |

|

|

Contact’s daytime telephone number |

||

|

( ) |

|

Email address of contact person |

|

|

For office use only

Previous doc loc number

Address changes for business tax accounts

If not doing so online, you may report an address change for businesses on Form

Note: If you wish to change the address for more than one tax type, and the address is different for each tax type, you must either attach another Form

Important: Complete steps 1, 2, and 6 before continuing below. Mail the completed form to the address listed in Step 6 of the instructions.

Section A

List your new |

|

|

|

|

||||||

New |

Note: To change the physical address for petroleum business, alcoholic beverages, and cigarette |

|

Effective date of this address change |

|||||||

address(es); |

tax types, see Legal restrictions in the instructions. |

|

|

|

|

|

|

|

||

physical |

|

|

|

|

|

|

|

|||

enter only |

|

|

|

|

|

|

||||

Physical location of business (number and street) - Do not enter a PO box here. |

|

|

New telephone number |

|||||||

if different |

address |

|

|

|

|

|

( |

) |

||

from current |

|

|

|

|

|

|

|

|

|

|

|

City |

County |

State |

ZIP code |

|

|

|

|

Country if not U.S. (see instr.) |

|

information. |

|

|

|

|

|

|

|

|

|

|

Note: The |

|

|

|

|

|

|

||||

New |

Business or firm name to which NYS Tax Department mailings are to be sent |

|

|

Effective date of this address change |

||||||

address(es) |

|

|

|

|

|

|

|

|

|

|

mailing |

|

|

|

|

|

|

|

|

|

|

you list in |

|

|

|

|

|

|

|

|

|

|

Name of person to whom NYS Tax Department mailings are to be sent (optional) |

|

|

|

|

|

|

||||

Section A will |

address |

|

|

|

|

|

|

|

|

|

be used for |

|

New number and street or PO box |

|

|

|

New contact telephone number |

||||

the tax types |

|

|

|

|

|

( |

|

) |

|

|

you marked in |

|

City |

County |

State |

ZIP code |

|

|

|

|

Country if not U.S. (see instr.) |

Step 1. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The DTF-95 form is used to update business information with the New York State Department of Taxation and Finance. |

| Content Scope | This form allows businesses to change their name, address, phone number, and ownership information, among other details. |

| Legal Restrictions | You cannot use this form to request an entity change, as stated in the form's instructions. |

| Filing Requirement | The completed DTF-95 must be mailed to the address provided in the instructions. Be sure to sign and date the form. |

| Applicable Law | The use of this form is governed by New York State Tax Law and regulations pertaining to business tax reporting. |

Guidelines on Utilizing Nys Dtf 95

To update your business information with the New York State Department of Taxation and Finance, complete the DTF-95 form. This process ensures the state has your current details, including business name, contact information, and ownership data. Follow the steps outlined below to accurately fill out the form.

- In Step 1, select the tax type(s) that apply to your business from the options provided. These may include withholding, corporation, sales and use, or other listed tax types.

- Step 2 requires you to provide your current information. Fill in the items requested, including your legal name, trade name, business contact information, and physical address. Include the identification number, and for corporations, the year and state of incorporation.

- In Step 3, enter any updated information only for the items that have changed. For instance, if your business name has changed, provide the new legal name and mark the appropriate box indicating address changes if necessary.

- Step 4a is for adding, removing, or revising information about owners, officers, or responsible persons. Specify details such as ownership percentage, title, and contact information. If necessary, attach additional sheets for more entries.

- Step 4b addresses affiliated persons. Provide the name, contact information, and ownership percentage for individuals or businesses affiliated with your company. Similar to Step 4a, you can add or revise details as needed.

- Mark Step 5 to report a sale of your business or a change in business activity. Fill in the buyer's details and the new NAICS code, if available.

- Finally, in Step 6, sign the form. Confirm that all the information is accurate to the best of your knowledge. Include your title, date, and your contact information before mailing the updated form to the specified address.

What You Should Know About This Form

What is the purpose of the NYS DTF-95 form?

The NYS DTF-95 form is used to update various aspects of a business's tax account with the New York State Department of Taxation and Finance. This includes changes to the business name, identification number, contact information, ownership details, and business activities. It streamlines the process for businesses to keep their tax information current and accurate.

Who should use the DTF-95 form?

Any business entity registered with New York State that needs to update its tax account information should use the DTF-95 form. This includes corporations, limited liability companies (LLCs), limited liability partnerships (LLPs), and other business entities. However, note that this form cannot be used to request an entity change.

How can I change my business address?

If the only change is your business address, the fastest way is to use the online service available on their website. If you need to report additional changes, you should complete the DTF-95 form. For businesses with different addresses under multiple tax types, you must either complete separate forms or attach a detailed listing that includes all necessary address information.

What if I need to report a change in business ownership?

You can report changes in ownership using the DTF-95 form. You will need to provide details about the new owner or officer, including their percentage of ownership and contact information. If you are removing an owner or officer from the records, mark the appropriate box on the form. Ensure to follow any instructions regarding legal restrictions on ownership changes.

Can I use the DTF-95 form to close my business account?

No, you cannot use the DTF-95 form to close your business account. To properly end your tax obligations, you must file a final tax return. Corporations, in particular, are required to complete a formal dissolution process.

What happens if I only want to report an address change?

If you are solely reporting an address change, you can do so quickly online, provided your tax type is eligible. Alternatively, if you need to make additional updates, including address changes, the DTF-95 form is the correct choice to consolidate all changes in a single submission.

What must I do after completing the form?

After filling out the DTF-95 form, it is crucial to sign and date it. You must then mail the completed form to the address indicated in the instructions. Be sure to check that you have completed all required sections, particularly Steps 1, 2, and 6, before mailing your submission.

What information do I need to provide about affiliated persons?

For any affiliated persons you wish to add or update, you will need to provide their full name, Social Security number (SSN) or employer identification number (EIN), percentage of ownership, contact information, and the effective date of the change. Keep in mind that ownership percentage must be 5% or less for the purpose of removal.

Common mistakes

Filling out the NYS DTF-95 form can feel overwhelming, and mistakes can happen easily. One common error is failing to complete all required sections. It is essential to fill out each item in the form, especially in Step 2, where current information must be provided. Missing or incomplete information can delay processing. Review every section carefully before submitting.

Another mistake is misunderstanding what changes the form can address. People often believe they can use the DTF-95 for any type of business update, including entity changes. However, this form is specifically limited to updates like name changes or address corrections. Familiarize yourself with the legal restrictions outlined in the instructions to avoid unnecessary complications.

Incorrectly marking selected tax types can lead to further issues. In Step 1, you need to select the tax types that are going to be updated. Failing to indicate the appropriate types or marking the wrong ones can result in incorrect information being recorded. Make sure to double-check your selections to ensure accuracy.

Finally, neglecting to sign and date the form is a simple yet significant mistake. The certification section at the end of the form requires a signature, confirming the accuracy of the provided information. Without this, your form may be deemed incomplete. Always sign and date your form before mailing it to avoid delays in processing.

Documents used along the form

The New York State DTF-95 form is essential for updating your business tax information. It can be used to change your business name, address, and other key details. When filing this form, you may also need to consider several other related documents to ensure all your records are accurate and up to date. Here are five important documents often used alongside the DTF-95:

- DTF-96: This form is specifically for reporting address changes for business tax accounts. If you only need to update your address, this is the quickest way to do so. It allows you to report changes efficiently without needing to fill out multiple forms.

- Form ST-100: Also known as the New York State Sales and Use Tax Return, this form must be filed by businesses that collect sales tax. If you've updated your business entity, you may need to update this return to reflect accurate business information.

- Form DTF-620: This form is used to establish a new business account for various taxes. If your updates on the DTF-95 include significant changes that affect your tax identification, this form will be necessary to create or update your account.

- Form CT-6: This is the New York State Election by a Federal S Corporation to be Treated as a New York S Corporation. If your business structure is changing, you may have to file this form to ensure compliance with state tax regulations.

- Annual Report Forms: Depending on your business structure (LLC, corporation, etc.), you may need to file annual reports with New York Secretary of State. Keeping these reports updated alongside your DTF-95 ensures consistency across all documents and legal requirements.

When dealing with updates to any business information, accuracy is key. These forms play a vital role in keeping your records compliant and current, so take the time to fill them out carefully. Always refer to the official instructions for each form to ensure you’re following the correct procedures.

Similar forms

The DTF-95 form, used for updating business tax information in New York State, shares similarities with several other business-related documents. Here are nine documents that serve comparable functions or have overlapping purposes:

- DTF-96 - Report of Address Change for Business Tax Accounts: This form is specifically designed for submitting address changes for businesses. Unlike DTF-95, DTF-96 focuses solely on address updates.

- Form SS-4 - Application for Employer Identification Number: Businesses use this IRS form to apply for a new Employer Identification Number (EIN). While DTF-95 updates existing information, Form SS-4 establishes a new identity for a business.

- Form CT-6 - Election for Subchapter S Status: This form is used by corporations to elect S corporation status. While DTF-95 updates affiliations and ownership, CT-6 defines the tax structure of a corporation.

- Form TP-584 - Combined Real Estate Transfer Tax Return: This document is filed when transferring ownership of real estate. It is similar to DTF-95 in that it involves the reporting of business ownership changes but is specific to property transactions.

- Form NYS-1 - Quarterly Combined Withholding, Wage Reporting, and Unemployment Insurance Return: This form is utilized for reporting employee wages and taxes. Like DTF-95, it is essential for maintaining correct business information in state records.

- Form ST-120 - Exempt Use Certificate: This certificate is utilized by businesses to claim tax exemptions. While it serves a distinct purpose, it similarly requires the reporting of business identity and tax liabilities.

- Form DTF-95-I - Instructions for Form DTF-95: While essentially instructional, it supports the functions of DTF-95 by clarifying how to complete this form accurately. Understanding the instructions is crucial for proper business reporting.

- Form DTF-77 - Application for a Refund/Adjustment of Sales Tax: This form allows businesses to request refunds. It parallels DTF-95 in that both require accurate businesses identification and tax type details.

- Form CT-3 - General Business Corporation Franchise Tax Return: This form is filed by corporations to report tax obligations. Similar to DTF-95, it requires comprehensive business information but focuses on tax reporting rather than updates.

Dos and Don'ts

When filling out the NYS DTF-95 form, it is crucial to approach it with care to ensure accuracy and compliance. Here are some essential guidelines to follow:

- Do ensure that all required sections are completed accurately, especially your business identification number and legal name.

- Don't leave any sections blank unless instructed, as this could delay the processing of your updates.

- Do use clear and legible handwriting if filling out the form by hand, to avoid misinterpretation of your information.

- Don't forget to sign and date the form before submitting it, as an unsigned form may be considered incomplete.

- Do refer to the instructions provided for specific requirements regarding changes to ownership or other updates.

- Don't submit the form if you are only changing your address; instead, consider using the online option if available.

By adhering to these guidelines, you will help ensure your updates are processed smoothly and efficiently.

Misconceptions

Understanding the DTF-95 form is crucial for anyone involved in business in New York State. Unfortunately, several misconceptions can lead to confusion. Here are ten common misunderstandings, cleared up for better clarity:

- This form is only for address changes. Many believe that the DTF-95 form is only applicable for changing an address. In reality, it can be used to update a variety of business details, including the business name, identification number, and owner information.

- You can use the DTF-95 for entity changes. This is false. The DTF-95 cannot be used to request an entity change. Specific forms and processes are required for that purpose.

- All tax types can be updated with one submission. Not true! While the DTF-95 allows updates, some changes apply only to the tax types you select in Step 1.

- You need to submit a form for each type of update. Individuals might think they must fill out separate forms for each change. The DTF-95 is designed so that you can list multiple changes in one submission.

- Email and fax number changes aren’t important. On the contrary, keeping your email and fax up to date is essential for timely communication from the tax department.

- The DTF-95 should be submitted online. Although online submissions are available for some updates, many might prefer the traditional mail option. Ensure you know your preferred method of submission.

- You should use a PO Box for the physical address. This is incorrect. The DTF-95 specifically requires a physical address. A PO Box will not be accepted.

- Signature on the form is optional. Many assume that signing the form is not essential. However, it is a requirement to certify that the information submitted is accurate and complete.

- The DTF-95 can close your business account. This is misleading. The form cannot be used to officially close your business. You must file a final return or complete other specified processes to do so.

- You can change your business activity at any time. While you can update your business activity, there are certain legal restrictions and requirements related to the nature of your business that you need to consider.

Each of these misconceptions can lead to mistakes or delays in processing. When in doubt, always refer to the instructions provided with the DTF-95 or consult a professional for guidance.

Key takeaways

Here are some key takeaways about filling out and using the NYS DTF-95 form:

- Use for Updates: This form is primarily for updating your business information such as name, address, and contact details. If you only need to change your address, consider using online options for faster processing.

- No Entity Changes: You cannot use the DTF-95 to request changes to your business entity type. Make sure to read the instructions carefully for any legal restrictions.

- Multiple Tax Types: When updating information, each change will apply to all tax types on your account unless specified otherwise in Step 1.

- Final Returns: If you sold your business or changed its activity, be aware that you cannot use this form to close your account. Ensure to file the necessary final returns or complete the dissolution process for corporations.

Make sure to fill out the required steps and mail the completed form to the specified address for processing.

Browse Other Templates

Where Can I Get Hazmat Certified - It serves as a layer of protection for employers against liability claims.

Winn Residential Affordable Housing Application - Include the full name and date of birth for each occupant.