Fill Out Your Nys Nf Aob Form

The New York Motor Vehicle No-Fault Insurance Law Assignment of Benefits Form, commonly referred to as the NYS NF AOB form, plays a crucial role in the landscape of healthcare reimbursements following motor vehicle accidents. Designed for accidents occurring on or after March 1, 2002, this form facilitates the assignment of rights to payment for medical services rendered to the injured party. The form lays out a clear agreement between the patient, known as the “Assignor,” and the healthcare provider, referred to as the “Assignee.” By signing this document, the patient authorizes the provider to collect payment directly from the insurance company for services rendered, alleviating the burden of upfront costs associated with medical treatment. Importantly, the Assignee must certify that no prior payment has been received from or on behalf of the Assignor, thus safeguarding both parties. Additionally, the form contains significant legal language regarding fraudulent actions, emphasizing the seriousness of filing false claims. This aspect acts as a deterrent against insurance fraud while also outlining the potential penalties involved. Completing this form accurately ensures a smoother claims process and promotes transparency in financial transactions related to no-fault insurance benefits, ultimately helping patients access the care they need in a timely manner.

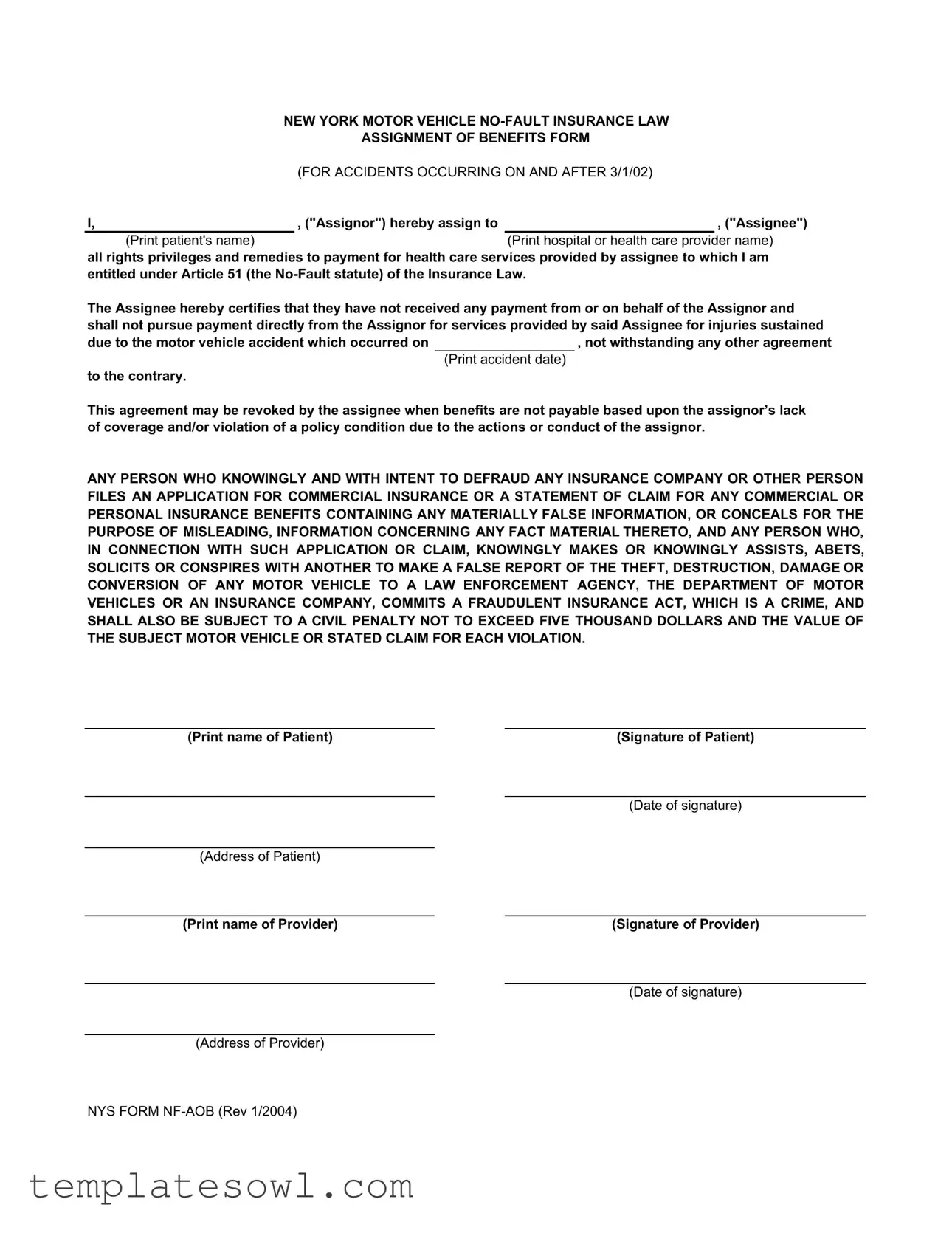

Nys Nf Aob Example

NEW YORK MOTOR VEHICLE

ASSIGNMENT OF BENEFITS FORM

(FOR ACCIDENTS OCCURRING ON AND AFTER 3/1/02)

I, |

|

, ("Assignor") hereby assign to |

|

, ("Assignee") |

|

(Print patient's name) |

|

(Print hospital or health care provider name) |

|

all rights privileges and remedies to payment for health care services provided by assignee to which I am entitled under Article 51 (the

The Assignee hereby certifies that they have not received any payment from or on behalf of the Assignor and shall not pursue payment directly from the Assignor for services provided by said Assignee for injuries sustained

due to the motor vehicle accident which occurred on |

, not withstanding any other agreement |

(Print accident date)

to the contrary.

This agreement may be revoked by the assignee when benefits are not payable based upon the assignor’s lack of coverage and/or violation of a policy condition due to the actions or conduct of the assignor.

ANY PERSON WHO KNOWINGLY AND WITH INTENT TO DEFRAUD ANY INSURANCE COMPANY OR OTHER PERSON FILES AN APPLICATION FOR COMMERCIAL INSURANCE OR A STATEMENT OF CLAIM FOR ANY COMMERCIAL OR PERSONAL INSURANCE BENEFITS CONTAINING ANY MATERIALLY FALSE INFORMATION, OR CONCEALS FOR THE PURPOSE OF MISLEADING, INFORMATION CONCERNING ANY FACT MATERIAL THERETO, AND ANY PERSON WHO, IN CONNECTION WITH SUCH APPLICATION OR CLAIM, KNOWINGLY MAKES OR KNOWINGLY ASSISTS, ABETS, SOLICITS OR CONSPIRES WITH ANOTHER TO MAKE A FALSE REPORT OF THE THEFT, DESTRUCTION, DAMAGE OR CONVERSION OF ANY MOTOR VEHICLE TO A LAW ENFORCEMENT AGENCY, THE DEPARTMENT OF MOTOR VEHICLES OR AN INSURANCE COMPANY, COMMITS A FRAUDULENT INSURANCE ACT, WHICH IS A CRIME, AND SHALL ALSO BE SUBJECT TO A CIVIL PENALTY NOT TO EXCEED FIVE THOUSAND DOLLARS AND THE VALUE OF THE SUBJECT MOTOR VEHICLE OR STATED CLAIM FOR EACH VIOLATION.

(Print name of Patient) |

|

(Signature of Patient) |

(Date of signature)

(Address of Patient)

(Print name of Provider) |

|

(Signature of Provider) |

(Date of signature)

(Address of Provider)

NYS FORM

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Name | New York Motor Vehicle No-Fault Insurance Law Assignment of Benefits Form |

| Governing Law | Article 51 of the New York Insurance Law |

| Effective Date | This form is applicable for accidents occurring on and after March 1, 2002. |

| Parties Involved | The form involves an Assignor (patient) and an Assignee (health care provider). |

| Certification Requirement | The Assignee must certify that no payment has been received from the Assignor for services provided. |

| Revocation Terms | The Assignee can revoke this assignment if benefits are not payable due to the Assignor's lack of coverage. |

| Fraud Warning | A warning regarding fraudulent claims is included, specifying penalties for false statements. |

| Form Revision | This version of the form was revised in January 2004. |

Guidelines on Utilizing Nys Nf Aob

Completing the New York No-Fault Assignment of Benefits (NF-AOB) form is essential for patients receiving medical care after a motor vehicle accident. This form allows the patient to assign their rights to insurance benefits directly to the healthcare provider. Here are the steps to fill out the form correctly.

- Begin by identifying the Assignor, which is the patient. Print the patient's name in the designated space.

- Next, identify the Assignee, which is the healthcare provider. Print the name of the hospital or health care provider in the specified field.

- Clearly write the date of the accident in the appropriate area. This should be the date the motor vehicle accident occurred.

- In the space provided, include a statement that certifies the Assignee has not received any payment from or on behalf of the Assignor.

- Ensure to note that the Assignee will not pursue payment from the Assignor for services related to the accident.

- Confirm that the Assignee understands the agreement can be revoked if payment benefits are not available due to the Assignor's lack of coverage or policy violations.

- Fill out the name of the patient again, as well as their signature and the date they are signing the form.

- Provide the address of the patient in the relevant field.

- Print the name of the provider in the designated spot.

- Have the provider sign the form and include the date of their signature.

- Finally, fill out the address of the provider in the final section of the form.

What You Should Know About This Form

What is the NYS NF AOB form?

The NYS NF AOB form, or New York State No-Fault Assignment of Benefits form, is a document that allows a patient (the Assignor) to assign their rights to receive insurance benefits for medical services to a healthcare provider (the Assignee). This form is primarily used in the context of accidents involving motor vehicles that occur in New York State. By filling out this form, the patient ensures that the healthcare provider can directly receive payment from the patient's insurance for services rendered as a result of the accident.

Who should use the NYS NF AOB form?

This form is designed for individuals who have been involved in a motor vehicle accident and need medical treatment. If a patient wishes for their healthcare provider to bill their no-fault insurance directly rather than billing the patient initially, then filling out this form is necessary. It simplifies the payment process, ensuring that medical services can be covered efficiently under the no-fault insurance system.

What information is required to complete the form?

To properly fill out the NYS NF AOB form, several key details are needed. The patient's name, the name of the healthcare provider, the date of the accident, and signatures from both the patient and the provider are essential components. Additionally, the form requires an acknowledgment that the provider has not yet received any payment for their services and agrees not to pursue the patient for payment directly.

Can the assignment of benefits be revoked?

Yes, the assignment of benefits can be revoked. If the provider finds that benefits are not payable due to a lack of coverage or a violation of the insurance policy's conditions by the patient, they have the authority to revoke the assignment. It's essential for patients to understand that this aspect of the form protects both the provider and the patient from potential payment disputes.

What are the consequences of providing false information on the form?

Entering false information on the NYS NF AOB form can lead to severe consequences. Any individual who knowingly misrepresents facts or conceals information in an attempt to defraud an insurance company may commit a fraudulent insurance act. This can result in criminal charges, civil penalties, or fines up to $5,000, in addition to any potential recovery of the stated claim or vehicle's value for each violation. Therefore, it’s vital to provide accurate and complete information.

How does this form protect healthcare providers?

The NYS NF AOB form offers protection to healthcare providers by ensuring they can receive payment directly from insurance companies for the services rendered following an accident. By having the patient assign their benefits, the provider secures a claim to payment and mitigates the risk of not being compensated. This arrangement allows providers to focus on delivering care rather than worrying about payment chasing.

Is there a specific date when this form must be used?

This particular form applies to accidents that occur on or after March 1, 2002. If an accident took place before this date, a different version of the form or procedure may apply. To avoid discrepancies, it is crucial to ensure that the form aligns with the accident date and meets current regulations. Always double-check that you're using the right form for your specific situation.

Common mistakes

Filling out the NYS NF AOB form correctly is important to ensure timely processing of benefits. One common mistake is leaving the Assignor's name field blank. This section is crucial as it identifies the patient assigning their rights to the provider. Omitting this information can lead to delays in processing claims.

Another frequent error involves the Assignee details. Failing to provide the name of the hospital or health care provider can create confusion. The Assignee must be clearly identified, as this is the entity that will receive payment for services rendered.

A third mistake is not accurately filling in the accident date. This date is vital for determining coverage and eligibility under the no-fault insurance statute. If this information is incorrect or omitted, it can complicate the claims process and delay payments.

Additionally, many people forget to include their signature. Without the necessary signatures from both the patient and the provider, the form lacks authenticity. This oversight can result in the rejection of the submitted claim.

Another mistake arises from misunderstanding the revocation clause within the form. Some individuals do not clarify that the agreement can be revoked due to lack of coverage or policy violations. Failing to acknowledge this can lead to confusion later on regarding the terms of the assignment.

People often neglect to provide complete contact information, which includes addresses for both the patient and the provider. Without accurate addresses, communication regarding the claim may falter, leading to additional complications in the processing of benefits.

Lastly, one of the most critical errors is the inclusion of false information. Misrepresenting facts is a serious issue and can lead to severe legal repercussions. Always ensure that all information provided is honest and accurate to avoid any allegations of fraud.

Documents used along the form

When filing a New York No-Fault Insurance Assignment of Benefits (NYS NF AOB) form, there are several other documents that can be crucial in supporting your claim. Each of these documents serves a specific purpose and can help streamline the process of obtaining necessary benefits. Below is a list of commonly used forms and documents that accompany the NYS NF AOB form.

- No-Fault Insurance Application: This form is completed by the insured individual to apply for no-fault benefits after an accident. It collects basic information about the accident and medical treatment received.

- Police Accident Report: Often generated at the scene of an accident, this report documents details such as the parties involved, injuries, and any observed traffic violations. It strengthens your claim by providing an official account of the incident.

- Health Insurance Claim Form: Used to submit claims for medical services to health insurance providers, this form may be necessary if no-fault benefits don’t cover all expenses.

- Medical Records Release Form: This document allows healthcare providers to share your medical records with your insurer and any involved parties. It ensures that all pertinent medical information is accessible for your claim.

- Verification of Coverage Form: This is often used to confirm that the insured party has maintained a no-fault insurance policy. It provides proof of coverage status at the time of the accident.

- Liability Waiver: If applicable, this form releases certain parties from liability, often used in cases involving shared blame for an accident. It can clarify responsibility between involved parties.

- Letter of Medical Necessity: This document outlines the specific medical treatments that are deemed necessary for recovery following an accident. It can be critical for justifying claims for specific services.

- Settlement Agreement: In situations where a claim is settled, this form outlines the terms and conditions agreed upon by all parties. It can help in documenting the resolution of the claim.

Collecting these documents can significantly aid in the processing of your no-fault insurance claim. Having the right paperwork in order ensures a smoother experience with insurance providers and potentially a quicker resolution to your situation.

Similar forms

The New York Motor Vehicle No-Fault Insurance Law Assignment of Benefits (NYS NF AOB) form plays a critical role in the process surrounding health care claims stemming from motor vehicle accidents. Several documents share similar purposes or functions:

- Health Care Provider Assignment Form: This form allows a patient to assign their insurance benefits directly to a healthcare provider. Like the NF AOB form, it enables the provider to receive payment more efficiently without involving the patient in subsequent claims processes.

- Personal Injury Protection (PIP) Claim Form: This document is utilized to claim benefits under a no-fault insurance policy for medical expenses and lost wages. It parallels the NF AOB form by providing a structured way to report claims related to injuries from vehicular accidents.

- Release of Information Form: This document authorizes healthcare providers to share patient information with the insurance company. Similar to the NF AOB form, it ensures that necessary medical records are available to process claims effectively.

- Proof of Claim Form: Used when filing claims with an insurance company, this form requires detailed information regarding the accident and the incurred expenses. Its function is akin to the NF AOB in that it aims to establish the claims process for benefits.

- Subrogation Agreement: This document allows an insurer to recover costs from a third party responsible for an accident. It relates to the NF AOB by engaging the same insurance principles and rights regarding recovery of benefits post-accident.

Dos and Don'ts

When filling out the NYS NF AOB form, it is important to follow specific guidelines to ensure accuracy and compliance.

- Do print clearly and legibly to avoid misunderstandings.

- Do double-check that all required fields are completed before submitting the form.

- Do ensure that the signatures of both the Assignor and Assignee are included.

- Do keep a copy of the completed form for your records.

- Don't leave any blank spaces in the form that may lead to confusion.

- Don't submit the form without verifying that the information provided is correct.

- Don't rush through the process; take time to review the details.

- Don't disregard the importance of the accident date; it must be filled in accurately.

Misconceptions

Misconceptions about the New York State No-Fault Assignment of Benefits (NYS NF AOB) form can lead to confusion and potentially hinder the claims process. Below is a list of 10 common misconceptions along with clarifications to enhance understanding.

-

It is only for major accidents.

The NYS NF AOB form can apply to any motor vehicle accident, regardless of its severity. It facilitates the assignment of benefits for medical treatment following various types of accidents.

-

Patients must pay upfront for medical services.

One of the primary purposes of this form is to allow healthcare providers to receive payment directly from insurance companies, reducing the need for patients to make upfront payments for treatment related to their accident injuries.

-

All healthcare providers can receive payment using this form.

Not every provider is eligible. Only those who are certified and recognized by the No-Fault insurance system can utilize the NYS NF AOB form for assignments of benefits.

-

Filling out the form is optional for providers.

While participation in the No-Fault system can be voluntary for some providers, those who wish to bill through insurance must fill out the form. It is critical for ensuring compliance with regulations and securing payment.

-

Submitting the form guarantees payment.

While the form is necessary for the assignment of benefits, its submission does not guarantee payment. Insurance companies may still deny claims based on various factors, such as coverage limits or policy violations.

-

The form can be used for personal injury claims.

The NYS NF AOB form specifically pertains to No-Fault insurance benefits and should not be confused with bodily injury or liability claims, which are separate processes entirely.

-

Patients cannot revoke the assignment of benefits.

Patients retain the right to revoke the assignment if necessary. However, doing so may complicate the process of obtaining reimbursement for medical expenses incurred due to accident-related injuries.

-

All types of medical providers can use this form.

Not all medical providers are recognized under the No-Fault regulations. Only authorized healthcare providers, such as hospitals and specific clinics, are permitted to utilize the NYS NF AOB form for assignments of benefits.

-

Insurance companies are not required to notify patients.

Insurance companies are obligated to keep patients informed regarding the status of their claims. Patients should receive updates about the payment process and any issues that may arise.

-

The form is only necessary at the time of the accident.

The NYS NF AOB form should be submitted when the patient begins treatment for accident-related injuries, not just at the time of the accident. This ensures that the insurance claim process proceeds smoothly from the outset.

Understanding these misconceptions can empower individuals in navigating their No-Fault insurance claims more effectively. It is essential for all parties involved to be well-informed about their rights and the procedures surrounding the NYS NF AOB form.

Key takeaways

When filling out and utilizing the New York State No-Fault Assignment of Benefits (NYS NF AOB) form, it is crucial to keep the following key points in mind:

- The form must be completed following an accident that occurs on or after March 1, 2002.

- It requires the patient’s name (Assignor) and the hospital or health care provider’s name (Assignee) for proper identification.

- Make sure to clearly indicate the date of the accident. This helps in processing your claim accurately.

- The Assignor is assigning their rights to receive benefits for healthcare services to the Assignee.

- Assignees must certify that they have not received any payment from the Assignor prior to filing the claim.

- Be aware that the Assignee may revoke this agreement if there is a lack of coverage or violation of a policy condition by the Assignor.

- The form not only serves as a document for benefits assignment but also contains important legal disclaimers regarding the consequences of fraudulent claims.

- Signatures from both the Assignor and Assignee are mandatory; without them, the form may be considered invalid.

- Keeping a copy of the filled-out form is a good practice, as it serves as a reference in future communications regarding the claim.

- Filling out the form accurately is essential to avoid delays in processing your benefits. Always double-check for errors before submission.

By recognizing these points, you can confidently navigate the process of filling out and using the NYS NF AOB form, ensuring that you understand your rights and responsibilities under New York's No-Fault Insurance Law.

Browse Other Templates

Michigan Subpoena Rules - The MC 11 Subpoena facilitates the collection of crucial evidence in legal matters.

Dea Application - It serves as a legal document to facilitate the process of scheduling controlled substances.

How to Appeal Unemployment - Seek assistance or legal guidance if necessary when filling out the form.