Fill Out Your Nys It 201 D Form

The NYS IT-201-D form is an essential document for residents who are filing their state taxes. It helps taxpayers submit their itemized deductions alongside their main tax return, Form IT-201. When completing this form, individuals will input key financial information that impacts their taxable income, including medical and dental expenses, taxes paid, interest paid, and charitable contributions. The form provides a structured way to tally different types of deductions, ensuring that every eligible expense is accounted for. By detailing these items, the IT-201-D allows for adjustments in taxable income, potentially lowering the overall tax liability. Moreover, it guides users through calculating their New York State itemized deductions, which are ultimately reported on Form IT-201. Understanding how to accurately fill out the IT-201-D form is critical for maximizing available deductions and ensuring compliance with state tax requirements.

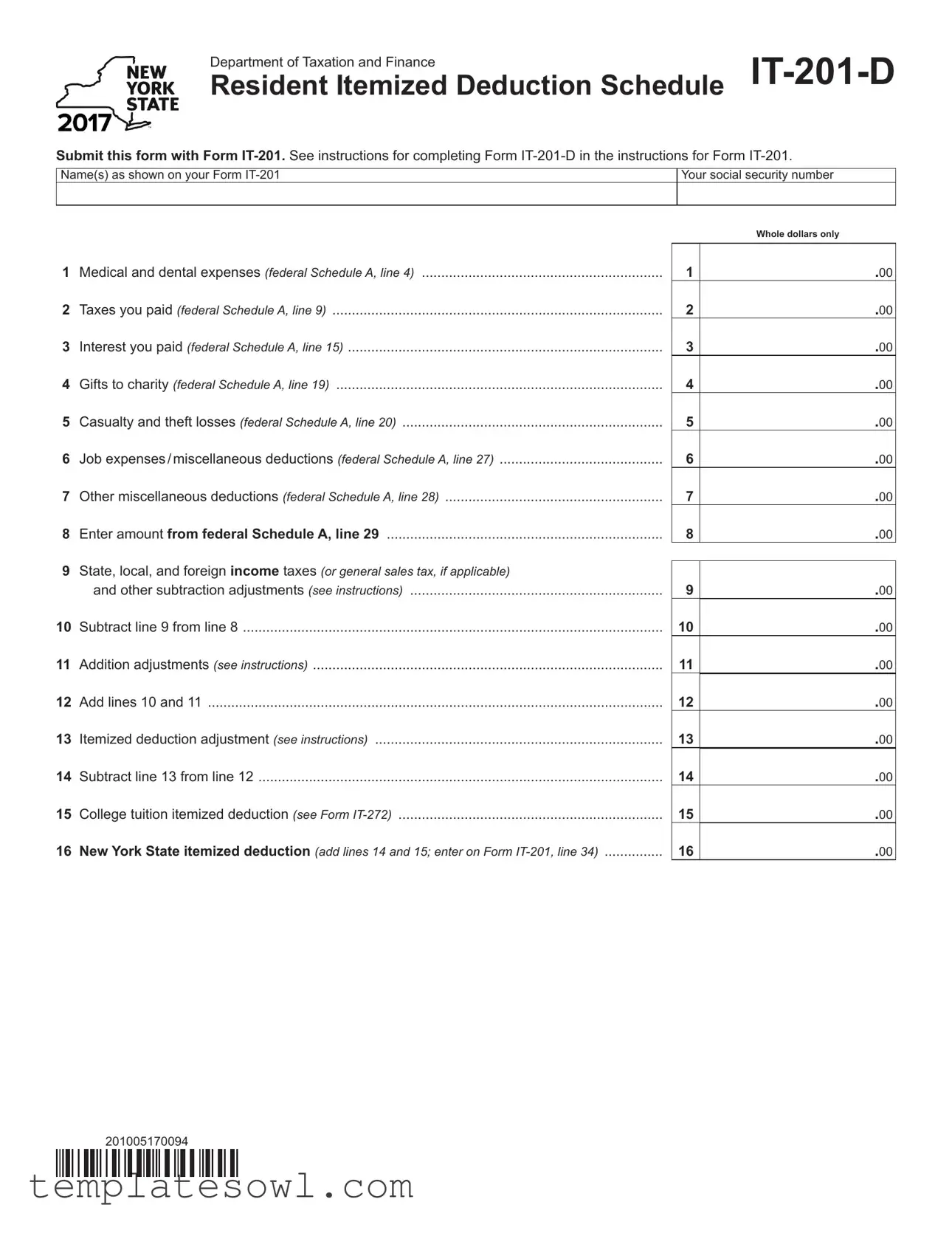

Nys It 201 D Example

Department of Taxation and Finance |

|

Resident Itemized Deduction Schedule |

Submit this form with Form

Name(s) as shown on your Form

Your social security number

|

|

|

Whole dollars only |

|

|

|

|

1 |

Medical and dental expenses (federal Schedule A, line 4) |

1 |

.00 |

2 |

Taxes you paid (federal Schedule A, line 9) |

2 |

.00 |

3 |

Interest you paid (federal Schedule A, line 15) |

3 |

.00 |

4 |

Gifts to charity (federal Schedule A, line 19) |

4 |

.00 |

5 |

Casualty and theft losses (federal Schedule A, line 20) |

5 |

.00 |

6 |

Job expenses/miscellaneous deductions (federal Schedule A, line 27) |

6 |

.00 |

7 |

Other miscellaneous deductions (federal Schedule A, line 28) |

7 |

.00 |

8 |

Enter amount from federal Schedule A, line 29 |

8 |

.00 |

9 |

State, local, and foreign income taxes (or general sales tax, if applicable) |

|

|

|

|

||

|

and other subtraction adjustments (see instructions) |

9 |

.00 |

10 |

Subtract line 9 from line 8 |

10 |

.00 |

11 |

Addition adjustments (see instructions) |

11 |

.00 |

12 |

Add lines 10 and 11 |

12 |

.00 |

13 |

Itemized deduction adjustment (see instructions) |

13 |

.00 |

14 |

Subtract line 13 from line 12 |

14 |

.00 |

15 |

College tuition itemized deduction (see Form |

15 |

.00 |

16 |

New York State itemized deduction (add lines 14 and 15; enter on Form |

16 |

.00 |

201005170094

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The IT-201-D form is used to report itemized deductions for New York State income tax purposes. |

| Filing Requirement | Taxpayers must submit the IT-201-D form along with the IT-201 form. |

| Medical Expenses | Applicants can claim medical and dental expenses according to federal Schedule A, line 4. |

| Taxes Paid | Line 2 allows taxpayers to include various taxes they have paid, as detailed on federal Schedule A, line 9. |

| Interest Deductions | Interest that qualifies can be reported in line 3, based on federal Schedule A, line 15. |

| Charitable Contributions | Donations made to charity can be claimed in line 4, referencing federal Schedule A, line 19. |

| Casualty Losses | Taxpayers may report losses from theft or casualty incidents on line 5, as indicated by line 20 of federal Schedule A. |

| Miscellaneous Deductions | Job expenses and other miscellaneous deductions are reported in lines 6 and 7, following federal guidelines from Schedule A. |

| State Tax Deductions | Line 9 allows new yorkers to deduct certain state, local, and foreign income taxes. |

| Governing Laws | This form is governed by New York State Tax Law. |

Guidelines on Utilizing Nys It 201 D

After gathering your financial information, it's time to complete the NYS IT-201-D form. This form helps you document your itemized deductions, which you'll need to report when filing your New York State income taxes. Make sure to have your Federal Schedule A on hand for reference as you fill out this form.

- Enter your name(s) as they appear on your Form IT-201 at the top of the form.

- Fill in your social security number in the designated space.

- On line 1, list your total medical and dental expenses from federal Schedule A, line 4.

- On line 2, enter the taxes you paid from federal Schedule A, line 9.

- On line 3, include the interest you paid as shown on federal Schedule A, line 15.

- For line 4, record gifts to charity from federal Schedule A, line 19.

- If applicable, enter any casualty and theft losses on line 5, referring to federal Schedule A, line 20.

- On line 6, include any job expenses or miscellaneous deductions, referencing federal Schedule A, line 27.

- For line 7, note any other miscellaneous deductions as provided on federal Schedule A, line 28.

- Enter the amount from federal Schedule A, line 29 on line 8 of the form.

- On line 9, include your state, local, and foreign income taxes or general sales tax, along with any other subtraction adjustments as per the instructions.

- Subtract line 9 from line 8 and write the result on line 10.

- If you have any addition adjustments, list them on line 11.

- Add the amounts from lines 10 and 11 together and write the total on line 12.

- Calculate the itemized deduction adjustment as directed in the instructions and enter that amount on line 13.

- Subtract line 13 from line 12 and enter the result on line 14.

- If you qualify for a college tuition itemized deduction, report it on line 15. Refer to Form IT-272 for details.

- Finally, add the amounts from lines 14 and 15 together to determine your New York State itemized deduction. Enter this sum on line 16 and ensure it is also reported on Form IT-201, line 34.

What You Should Know About This Form

What is the purpose of the NYS IT-201-D form?

The NYS IT-201-D form, known as the Resident Itemized Deduction Schedule, serves a specific function in the New York tax filing process. It allows residents to itemize deductions they have accrued during the tax year. By submitting this form along with Form IT-201, taxpayers can detail expenses related to medical and dental care, taxes paid, interest, charitable gifts, and other deductions, ultimately aiding in lowering their taxable income. This structured approach helps ensure that all eligible deductions are accounted for, providing potential tax savings.

Who needs to complete the IT-201-D form?

Individuals who are filing their tax returns as residents of New York State need to complete the IT-201-D form if they choose to itemize their deductions rather than taking the standard deduction. It is crucial for those whose itemized deductions exceed the standard deduction amount. By thoroughly documenting their expenses through this form, taxpayers can present a comprehensive view of their finances, which may lead to significant tax benefits.

What information is required on the IT-201-D form?

When completing the IT-201-D form, taxpayers must provide their names as shown on Form IT-201, as well as their social security numbers. The form requires the reporting of various expense categories including medical and dental expenses, taxes paid, gifts to charity, and miscellaneous deductions. Each line item must reflect whole dollars only, simplifying the reporting process. Additionally, taxpayers will need to compute certain adjustments, which may include additions or subtractions, to derive their New York State itemized deductions accurately.

How can I file the NYS IT-201-D form?

The IT-201-D form must be submitted as part of your overall tax return, specifically accompanying Form IT-201. Taxpayers have the option to file their forms electronically or by mail. For electronic filing, many tax preparation software programs include the IT-201-D form as part of their service. If choosing to file by mail, ensure that the completed IT-201-D form is attached securely to the IT-201 form before submission to the Department of Taxation and Finance. It is important to adhere to submission deadlines to avoid any penalties or interest charges.

Common mistakes

When filling out the NYS IT-201-D form, many people make mistakes that can affect their tax filings. One common error is forgetting to correctly enter whole dollar amounts. The form requires that only whole dollars be reported, meaning no cents should be included. Even a stray decimal can lead to complications, resulting in delays or miscalculations.

Another frequent mistake is neglecting to double-check personal information. It's important to ensure that names and Social Security numbers match what is provided on Form IT-201. A simple typo can create confusion and may lead to the processing of the tax return being held up.

Many people also overlook the instructions related to adjustments. Various lines on the form require specific inputs or deductions that need proper documentation. Missing out on these adjustments can lead to an inaccurate total deduction amount, which could mean paying more in taxes than necessary.

Some filers forget to carry over amounts from Schedule A accurately. It is crucial for individuals to pay careful attention to lines when transcribing amounts from that schedule. Misplacing a number can change the calculations significantly and affect future tax obligations.

Lastly, people often fail to submit the form alongside the correct documents. The NYS IT-201-D form must be submitted with Form IT-201 for it to be processed effectively. Not including this form or sending it separately can lead to the tax return being considered incomplete and possibly facing further delays.

Documents used along the form

The NYS IT-201-D form is used for detailing itemized deductions by residents when filing their personal income tax returns in New York State. This form is submitted along with the IT-201 form, which is for the state's income tax return. Various supporting documents are often required or recommended to accompany the NYS IT-201-D to ensure accurate reporting and compliance with tax regulations.

- Form IT-201: This is the primary form for filing an individual income tax return in New York State. It summarizes income, deductions, and tax liability.

- Federal Schedule A: This federal form is used to report itemized deductions, which are also referenced in the IT-201-D. It details expenses for various categories, including medical expenses and charitable donations.

- Form IT-272: This form allows taxpayers to claim deductions for qualified college tuition expenses. The amount calculated is included in the NYS IT-201-D.

- Federal Form 1040: This is the standard individual income tax form in the U.S. Reference is often made to this form when calculating allowable deductions for state taxes.

- Schedule C: Used to report income or loss from a business operated as a sole proprietorship. It helps determine business-related deductions that may also apply to the itemized deductions.

- Form NYS-45: This is the quarterly combined withholding, wage reporting, and exemption certificate form. It provides information relevant to state tax withholdings that may affect overall tax liability.

- Form IT-215: This form is for the New York State credit for household credit and can be filed alongside the IT-201 and IT-201-D for additional tax credits related to household expenses.

- Form IT-198: This form is used to claim a New York State deduction for qualified medical expenses that were not reported as itemized deductions on the federal return.

Having these documents organized and available can facilitate a smoother tax filing process. Ensure that all necessary information is accurately reflected in the relevant forms to comply with New York State tax regulations.

Similar forms

The NYS IT-201 D form is a vital document for residents who want to itemize their deductions when filing their state income taxes. Several other forms serve a similar purpose in helping taxpayers navigate deductions, credits, and tax liabilities. Here’s a look at five such documents:

- Federal Schedule A: This form allows taxpayers to report itemized deductions on their federal tax returns. Like the IT-201 D, it includes categories such as medical expenses, taxes paid, and charitable contributions, allowing taxpayers to optimize their deductions at the federal level.

- Form IT-272: This document specifically addresses the college tuition itemized deduction within New York State. It allows taxpayers to deduct qualified tuition expenses for eligible students, similar to how the IT-201 D incorporates college tuition deductions into the overall itemized deductions structure.

- Form IT-2104: This form is used for state withholding allowances for employees. While its primary focus is on the number of allowances claimed, it ultimately influences the amount of state income tax withheld from paychecks, indirectly affecting itemized deductions when filing the IT-201 D.

- Federal Form 4868: This is the application for automatic extension of time to file a U.S. individual income tax return. It is not a deduction form itself, but helps ensure that taxpayers have sufficient time to gather documentation for items they might include on the IT-201 D.

- New York State Form IT-225: This form is used for claiming the New York State itemized deduction for certain business or farming losses. Its purpose mirrors that of the IT-201 D in that it focuses on capturing and calculating deductions specific to New York State, allowing residents to ensure they take full advantage of available deductions.

Understanding these forms can help taxpayers navigate their deductions more effectively, ensuring they maximize their potential savings.

Dos and Don'ts

When completing the NYS IT-201-D form, being careful and thorough can make a significant difference in your experience. Below is a list of recommendations that outline what to do and what to avoid.

- Do: Ensure that your name matches exactly as it appears on your Form IT-201.

- Do: Use whole dollars only when entering amounts for each line item.

- Do: Double-check all calculations before submitting the form.

- Do: Provide your social security number accurately to avoid processing delays.

- Do: Follow the instructions from Form IT-201 closely to avoid mistakes.

- Don't: Leave any required fields blank; all relevant sections must be completed.

- Don't: Use decimals or cents in the amounts listed; only whole dollar amounts are allowed.

- Don't: Forget to sign and date the form; failure to do so could result in it being considered incomplete.

- Don't: Submit the form without ensuring it is attached to Form IT-201, as it is required.

Misconceptions

- Misconception 1: The IT-201-D form is only for high-income earners.

- Misconception 2: You don’t need to submit the IT-201-D if you are using tax software.

- Misconception 3: Medical and dental expenses don’t count as deductions.

- Misconception 4: Only certain types of charitable contributions can be deducted.

- Misconception 5: You can only itemize deductions if you have large expenses.

- Misconception 6: You cannot claim miscellaneous deductions.

- Misconception 7: Filing the IT-201-D will slow down the processing of your tax return.

- Misconception 8: The deductions on the IT-201-D are only for federal taxes.

This form can be used by any resident taxpayer looking to itemize deductions, regardless of income level. Many people can benefit from detailing their expenses.

Even if you are using tax software, it is important to ensure the IT-201-D form is completed and submitted with your tax return if you are itemizing. The software should guide you through this process.

In fact, medical and dental expenses can be significant deductions. They are included on the IT-201-D form and can help reduce taxable income when itemized.

While not all contributions qualify, many types of gifts to charitable organizations are deductible. The key is to ensure you’re following the federal guidelines.

Many taxpayers fail to realize that even smaller expenses can add up. Every little bit counts when it comes to itemizing, so it’s worth reviewing all possible deductions.

Miscellaneous deductions are indeed claimable. This category can include unreimbursed job expenses, so it’s worth considering what qualifies when filling out the form.

Submitting all necessary forms, including the IT-201-D, properly completed, usually does not delay processing. Incomplete submissions tend to be the real cause of delays.

The IT-201-D specifically serves as a schedule for New York State taxes. It assists state residents in itemizing their state tax deductions and in properly preparing their state tax return.

Key takeaways

Using the NYS IT-201 D form can be straightforward when you keep these important takeaways in mind:

- Submission Requirement: Always submit Form IT-201 D alongside Form IT-201 to ensure your itemized deductions are processed correctly.

- Accurate Personal Information: Make sure the name(s) and social security number entered on Form IT-201 D match those on Form IT-201 to avoid processing issues.

- Whole Dollars Only: When filling out the form, remember to enter amounts in whole dollars. This helps prevent rounding errors that could complicate your deductions.

- Refer to Federal Schedule A: Many of the items on this form directly correlate with lines from Federal Schedule A, so verify your entries against that schedule for accuracy.

- Adjustment Lines: Pay special attention to the lines that involve subtraction and addition adjustments; errors here can affect your final deductions.

- College Tuition Deduction: If applicable, include the college tuition itemized deduction from Form IT-272 to maximize your potential deductions.

By keeping these key points in mind, you will navigate the process with greater ease and confidence.

Browse Other Templates

Kansas Child Support Calculator - Understanding each section of the guidelines is critical for compliance and effective utilization.

Texas Health and Human Services Forms - This document serves as a benchmark for assessing quality in early childhood programs.