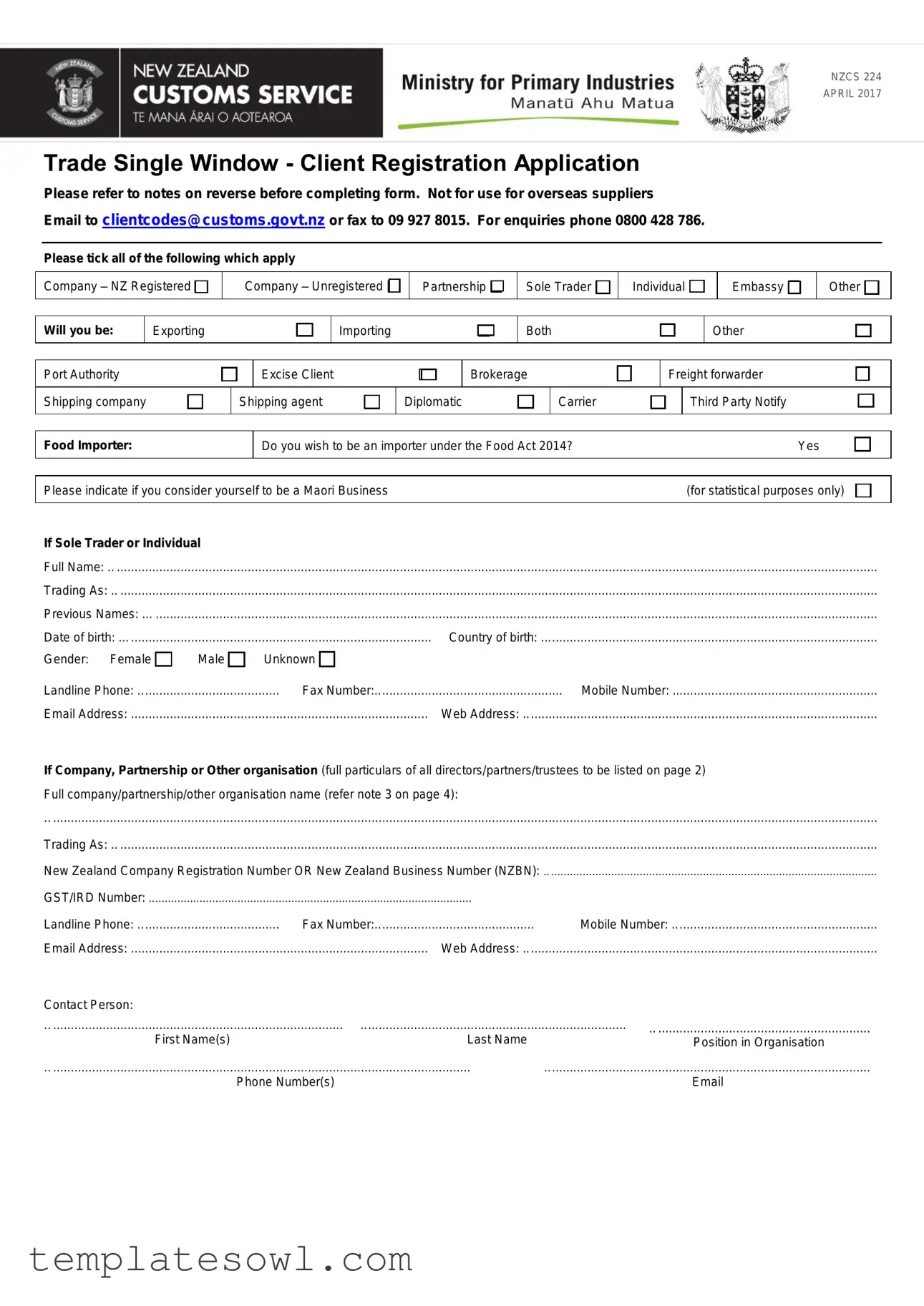

Fill Out Your Nzcs 224 Form

The NZCS 224 form, known as the Trade Single Window Client Registration Application, serves as a crucial tool for individuals and organizations engaged in importing or exporting within New Zealand. This form is not just a bureaucratic hurdle; it streamlines the process of registering with customs authorities, facilitating smoother trade operations. Applicants must provide comprehensive details about their business structure, whether it be a registered company, partnership, sole trader, or even an embassy. The information collected is extensive, including essential identifiers like business names, registration numbers, and contact details such as phone numbers and email addresses. For entities like companies and partnerships, a list of all directors and pertinent personal information is required to ensure accountability and compliance. Specific questions prompt individuals to indicate their involvement in areas like food importation under the Food Act 2014 and whether they identify as a Māori business, highlighting New Zealand's commitment to inclusivity. Furthermore, the form also addresses preferences for communication regarding lodgment notifications and optional access for customs brokers, reflecting the varied nature of trade operations. Thorough completion is essential; incomplete applications will be returned for correction. Thus, navigating the NZCS 224 form with diligence ensures that businesses remain compliant while fostering international trade relationships effectively.

Nzcs 224 Example

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NZCS 224 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

APRIL 2017 |

|

|

Trade Single Window - Client Registration Application |

|

|

|

|

|

||||||||||||||

|

Please refer to notes on reverse before completing form. Not for use for overseas suppliers |

|

|

|

|

|

||||||||||||||

|

Email to clientcodes@customs.govt.nz or fax to 09 927 8015. For enquiries phone 0800 428 786. |

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Please tick all of the following which apply |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Company – NZ Registered |

|

Company – Unregistered |

|

Partnership |

Sole Trader |

Individual |

|

|

Embassy |

Other |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Will you be: |

|

Exporting |

|

|

|

Importing |

|

|

|

Both |

|

|

|

|

Other |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

Port Authority |

|

|

|

Excise Client |

|

|

Brokerage |

|

Freight forwarder |

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Shipping company |

|

|

Shipping agent |

Diplomatic |

|

Carrier |

|

|

|

Third Party Notify |

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Food Importer:

Do you wish to be an importer under the Food Act 2014? |

Yes |

Please indicate if you consider yourself to be a Maori Business |

(for statistical purposes only) |

|||

|

|

|

||

If Sole Trader or Individual |

|

|

||

Full Name: |

|

|

||

Trading As: |

.. ...................................................................................................................................................................................................................... |

|

|

|

Previous Names: |

|

|

||

Date of birth: |

Country of birth: |

|||

Gender: |

Female |

Male |

Unknown |

|

Landline Phone: |

Fax Number: |

Mobile Number: |

||

Email Address: |

Web Address: |

|||

If Company, Partnership or Other organisation (full particulars of all directors/partners/trustees to be listed on page 2) Full company/partnership/other organisation name (refer note 3 on page 4):

.. .........................................................................................................................................................................................................................................

Trading As: |

|

|

|

New Zealand Company Registration Number OR New Zealand Business Number (NZBN): |

.. ....................................................................................................... |

||

GST/IRD Number: |

|

|

|

Landline Phone: |

Fax Number: |

Mobile Number: |

|

Email Address: |

Web Address: |

|

|

Contact Person: |

|

|

|

.. .................................................................................. |

........................................................................... |

.. ............................................................ |

|

First Name(s) |

Last Name |

|

Position in Organisation |

.. ...................................................................................................................... |

............................................................................................ |

||

|

Phone Number(s) |

|

|

NZCS 224 | APRIL 2017

Physical Address: |

|

Street Number: |

|

Unit Number: |

Floor Level: |

Property Name: |

Property Type: |

Street Name: |

Street Type: |

Suburb : |

Town/City: |

State: |

Country: |

Postcode: |

|

Postal Address (if not same as above): |

|

Street Number: |

|

Unit Number: |

Floor Level: |

Property Name: |

Property Type: |

PO Box: |

Private Bag: |

Street Name: |

Street Type: |

Suburb : |

Town/City: |

State: |

Country: |

Postcode: |

|

|

|

|

Full particulars of all directors/partners/trustees (refer note 3 on page 4) |

|

|

||

1 |

.. ...................................................... |

.. ............................ |

.............................................. .. .............................. |

|

First Name(s) |

Last Name |

Date of Birth |

Identification Type |

Number |

2 |

.. ...................................................... |

.. ............................ |

.............................................. .. .............................. |

|

First Name(s) |

Last Name |

Date of Birth |

Identification Type |

Number |

3 |

.. ...................................................... |

.. ............................ |

.............................................. .. .............................. |

|

First Name(s) |

Last Name |

Date of Birth |

Identification Type |

Number |

4 |

.. ...................................................... |

.. ............................ |

.............................................. .. .............................. |

|

First Name(s) |

Last Name |

Date of Birth |

Identification Type |

Number |

Billing Address (if not same as above): |

|

|

|

|

Street Number: |

|

|

|

|

Unit Number: |

Floor Level: |

|

||

Property Name: |

Property Type: |

|

||

PO Box: |

Private Bag: |

|

||

Street Name: |

Street Type: |

|

||

Suburb : |

Town/City: |

|

||

State: |

Country: |

|

||

Postcode: |

|

|

|

|

Payment Account Details (if applicable) |

|

|

|

|

Ministry for Primary Industries account number: ...……………………………………………

P2 of 4

NZCS 224 | APRIL 2017

Lodgement Notifications

To receive TSW notifications for lodgements - select ONE of the following notification methods:

Do not notify

B2B Messaging

Add name(s) to be notified: ...……………………………………………

Email: ...……………………………………………………………………..

If TSW notification preferences requested - select any/all of the following WCO lodgement types:

Import

Export

OCR

CRE

ICR

ANA

Excise

AND

For the lodgement type requested - select any/all of the following lodgement status:

Cancelled

Cleared

Directions given

Error

Declaration Required

Written Off

OPTIONAL: Set TSW Brokerage Access |

|

|

|

Please indicate if you wish to restrict the use of your code to nominated Brokers only? |

Yes |

No |

|

If yes: |

|

|

|

Brokerage Code (if known): |

Brokerage Name: .. |

............................................................................. |

|

Brokerage Code (if known): |

Brokerage Name: .. |

............................................................................. |

|

Brokerage Code (if known): |

Brokerage Name: .. |

............................................................................. |

|

(attach a supplementary list if more than three brokers) |

|

|

Optional: Please advise Customs Broker |

..................................................... |

of the code at email: |

|

|

|

DECLARATION (refer Note 4 below) |

|

|

I |

(position) |

of |

declare that the information provided is true and correct. |

|

|

Signature: |

Date: |

|

Date: .....................................

Processing Officer: ... ..................................................

Client Code: ... .......................................................

P3 of 4

NZCS 224 | APRIL 2017

IMPORTANT INFORMATION

NOTES:

1.You must tick ALL boxes that apply.

2.Private individuals must supply clearly legible photo ID – preferably a copy of your passport or drivers licence.

3(a). For registered companies: A copy of your company’s Certificate of Incorporation must be attached. Provide your trading name - if different from registered company name. All directors must be listed – add a supplementary page if required. Clearly legible photo ID is required for each name listed – a copy of the passport biography details page or drivers licence is preferred.

3(b) For Partnerships and sole traders: A trading name must be specified, along with full names of all sole traders/partners. Photo ID (as described above) is required for all sole traders/partners.

3(c). For other organisations (such as schools, sports clubs, registered trusts, charities or similar): All trustees, the principal, or other relevant person(s) of responsibility must be listed. Photo ID (as described above) is required for all listed persons. For New Zealand registered trusts, societies and charities, a copy of your certificate must be supplied. For schools, sports clubs and similar, a letterhead of the organisation must be supplied.

4.The application must be completed and signed by an authorised person of the entity concerned (for example an officer of the organisation or a Customs broker) or the importer/exporter of the goods.

5.Incomplete applications will be rejected and returned for completion.

6.Please note you are required to keep business records in New Zealand pursuant to section 95 of the Customs and Excise Act 1996.

7Applications can be lodged electronically to email clientcodes@customs.govt.nz or, if you do not have access to email, faxed to 09 927 8015.

Note that fax copies of ID’s are often illegible and therefore may be rejected, so email is the recommended method of submission.

8.For enquiries phone 0800 428 786.

The information on the client registration application form (and any subsequent customs entries) may be supplied to Statistics New Zealand for use in official statistics.

The personal information on this form will be used as part of the assessment of the client registration application in accordance with the Customs and Excise Act 1996 and for

The New Zealand Customs Service and the Ministry for Primary Industries may collect and use information for border management and

For Food Importers

This information is being collected for the purpose of listing importers of food for sale and for

All information provided to the Ministry for Primary Industries for the purposes of listing importers of food for sale is official information and subject to the Official Information Act 1982. If a request is made under that Act for information you have provided in this application, the Ministry for Primary Industries will consider any such request taking into account its obligation under the Official Information Act 1982 and any other applicable legislation.

Set TSW broker access –

This is an optional field that allows you to nominate a specific brokerage or group of brokers who can use your client registration code to make lodgements through TSW. If no selection is made, then any brokerage will be able to make lodgements on your behalf.

P4 of 4

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Title | NZCS 224 - Trade Single Window - Client Registration Application |

| Governing Law | Customs and Excise Act 1996, Food Act 2014 |

| Submission Methods | Forms can be submitted via email or fax. Email: clientcodes@customs.govt.nz; Fax: 09 927 8015 |

| Contact for Enquiries | For questions, call 0800 428 786. |

| Personal Information Use | The information collected may be used for border-related risk management and official statistics. |

| Eligibility Criteria | Individuals and businesses must provide personal identification and specific details as required by the form. |

| Record Keeping Requirement | Businesses are required to keep records in New Zealand per section 95 of the Customs and Excise Act 1996. |

Guidelines on Utilizing Nzcs 224

Filling out the NZCS 224 form requires specific information about the entity registering. After completing the form, it must be submitted via email or fax. If submitting through email, send it to clientcodes@customs.govt.nz. For those lacking email access, fax it to 09 927 8015. Keep in mind that incomplete applications could be rejected and returned for correction.

- Indicate the type of entity by ticking the appropriate box. Options include: Company, Partnership, Sole Trader, Individual, Embassy, and others.

- Select the activities pertaining to your registration: Exporting, Importing, Both, or Other.

- If applicable, indicate if you are a Maori Business for statistical purposes.

- For Sole Traders or Individuals, provide the following personal information:

- Full Name

- Trading As (if different)

- Previous Names (if any)

- Date of Birth

- Country of Birth

- Gender

- Contact information: Landline Phone, Fax Number, Mobile Number, Email Address, and Web Address

- For Companies, Partnerships, or Other Organizations, provide:

- Full name of the organization

- Trading As (if different)

- New Zealand Company Registration Number or New Zealand Business Number (NZBN)

- GST/IRD Number

- Contact information: Landline Phone, Fax Number, Mobile Number, Email Address, and Web Address

- Name and position of a Contact Person

- Complete the Physical Address section with accurate details.

- Fill out the Postal Address section, using it if different from the Physical Address.

- List the full particulars of all directors, partners, or trustees, ensuring to include:

- First Name(s), Last Name, Date of Birth, Identification Type, and Number

- Provide Billing Address details if different from Physical Address.

- Include Payment Account Details if applicable, like the Ministry for Primary Industries account number.

- Select your preferred notifications for lodgement notifications and add any names or email addresses to be notified if desired.

- If applicable, indicate if you wish to restrict the code use to nominated Brokers and provide their details if necessary.

- Complete the Declaration section with your position, signature, and date.

What You Should Know About This Form

What is the purpose of the NZCS 224 form?

The NZCS 224 form serves as a registration application for clients who wish to conduct importing and exporting activities with New Zealand Customs. It gathers essential information about individuals and organizations, allowing Customs to process requests for client codes efficiently.

Who needs to complete the NZCS 224 form?

Any business or individual planning to import or export goods in New Zealand must complete the NZCS 224 form. This includes registered companies, unregistered businesses, partnerships, sole traders, individuals, and embassies. The form is necessary to obtain a client registration code, which is required for all Customs transactions.

How should the completed NZCS 224 form be submitted?

The completed NZCS 224 form can be submitted electronically via email to clientcodes@customs.govt.nz. Alternatively, if email is not accessible, the form can be faxed to 09 927 8015. Email is preferred to ensure the legibility of photo identification included with the application.

What happens if the NZCS 224 form is incomplete?

Incomplete submissions of the NZCS 224 form will be rejected and returned for completion. It is crucial to ensure all required information and documentation are provided to avoid delays in processing your application.

Common mistakes

Filling out the NZCS 224 form can be daunting, and many individuals make crucial mistakes that can delay the registration process. One common error is failing to tick all relevant boxes during the registration section. Applicants must thoroughly review the available options, such as their business type or the nature of their activities, and ensure that they check every box that applies. Incomplete selections could result in the rejection of the application.

Another frequent mistake involves providing unclear or incomplete details for personal identification. The form requires photo ID, particularly a passport or driver’s license, for private individuals. However, applicants often neglect to provide clear copies of these documents. Illegible submissions can hinder processing; thus, providing a well-scanned, clear ID is critical. Failing to do so may cause unnecessary delays.

Additionally, many applicants overlook the requirement to list all relevant parties in organizations, such as directors or partners. For companies or partnerships, full particulars of all individuals involved must be included. Some individuals incorrectly assume that listing just a few names suffices. This oversight can lead to complications, as the form mandates complete transparency for effective processing of client codes.

Lastly, applicants often forget the importance of signing the declaration at the end of the form. This signature confirms that the information provided is accurate and true. Without it, the application is incomplete and will be returned for rectification. By ensuring all sections are filled out completely and accurately, and by carefully reviewing the requirements, applicants can avoid these missteps and streamline their registration process.

Documents used along the form

The NZCS 224 form is a key document for registering clients in the Trade Single Window. Along with this form, several other documents and forms are often required to ensure compliance and streamline the registration process. Here's a list of commonly associated forms and documents:

- Certificate of Incorporation: This document is necessary for registered companies. It serves as proof that the company is legally incorporated and active in New Zealand.

- Company Trading Name Registration: A registration detailing the trading name if it differs from the official company name, ensuring accurate representation in business dealings.

- Identification Documents: Clear copies of photo ID, such as a driver’s license or passport, are needed for all individuals listed on the NZCS 224, including directors and partners.

- Trust Documentation: For organizations like trusts or charities, providing a copy of the trust deed or similar documentation is often required to verify the legal structure.

- GST Registration Confirmation: A document confirming the registration for GST purposes is crucial. It ensures that the business is compliant with tax laws in New Zealand.

- Payment Account Details: Information about the account used for transactions can be critical for processing payments and maintaining financial records.

- Brokerage Agreement: If you choose to restrict access to nominated brokers, a brokerage agreement outlines the terms of the relationship with those brokers.

- Food Importer Registration (if applicable): For businesses planning to import food, this additional registration under the Food Act 2014 is essential for compliance.

- Customs Broker Access Agreement (optional): This document specifies a customs broker authorized to act on behalf of the client, which simplifies the import and export processes.

Collecting and submitting these documents alongside the NZCS 224 ensures a smooth registration process and compliance with New Zealand regulations. Proper preparation can help avoid delays and complications during the registration period.

Similar forms

- Application for Employer Identification Number (EIN): This form is used by businesses to obtain a unique identifier from the IRS. Similar to the NZCS 224 form, both require detailed information about the business structure, contacts, and purposes for registration.

- Business License Application: Just like the NZCS 224 form, a business license application gathers information about the business and its operators. Both documents must be filled out accurately to comply with legal requirements before a business can operate.

- Importer Security Filing (ISF): The ISF form is crucial for importers to pre-report shipments entering the U.S. Similar to the NZCS 224 form, the ISF also collects data about the business and its transactions with customs, ensuring compliance with trade regulations.

- Customs Registration Application: This document registers entities with customs authorities. Like the NZCS 224 form, it necessitates personal identification, business details, and the reason for registration to process the application for trade purposes.

Dos and Don'ts

When filling out the NZCS 224 form, consider the following suggestions to ensure completeness and accuracy:

- Do: Tick all boxes that apply to your situation.

- Do: Ensure all personal and company information is clear and complete.

- Do: Provide a valid and legible photo identification.

- Do: Sign the declaration section to confirm the information is correct.

- Don't: Leave any required fields blank.

- Don't: Use outdated contact information or submit illegible documents.

Following these guidelines can help reduce delays in processing and improve your application experience.

Misconceptions

The NZCS 224 form is essential for client registration within the Trade Single Window. Despite its importance, several misconceptions exist regarding this form. The following list outlines these misconceptions with clarifying information.

- Misconception 1: The NZCS 224 form is only for exporters.

- Misconception 2: Only companies need to provide photo identification.

- Misconception 3: Submitting the form electronically means no documents need to be attached.

- Misconception 4: The form can be completed by anyone in the organization.

- Misconception 5: There is no need to keep records once the application is submitted.

- Misconception 6: Faxing the application is just as effective as emailing it.

This form is actually intended for both exporters and importers. Individuals or businesses involved in either activity can complete this application.

All private individuals must submit clearly legible photo identification, regardless of whether they are part of a company, a sole trader, or an unregistered entity.

The application must be completed and signed by an authorized person. This typically includes an officer of the organization or the importer/exporter directly involved with the goods.

Applicants are required to maintain business records in New Zealand, as outlined in the Customs and Excise Act 1996. This is vital for compliance and audits.

Fax copies of identification often turn out to be illegible, increasing the chance of application rejection. Email submissions are generally recommended to ensure clarity and proper processing.

Key takeaways

Here are key takeaways regarding the NZCS 224 form, which is the Trade Single Window - Client Registration Application.

- All applicants must tick all relevant boxes that apply to their business type when filling out the form.

- If you are a private individual, submit a clearly legible photo ID, like a passport or driver's license.

- For registered companies, attach a copy of your Certificate of Incorporation and list all directors.

- Partnerships and sole traders must specify a trading name and provide ID for all individuals listed.

- Ensure that the application is signed by an authorized representative of the entity to avoid rejection.

- Provide accurate contact details, including phone numbers and email addresses, to facilitate communication.

- Be aware that incomplete applications may be returned, so double-check everything before submitting.

- Applications can be submitted electronically via email or fax—emailing is preferred to ensure clarity of information.

Browse Other Templates

Oklahoma New Hire Reporting Form - Be sure to inform OESC of any changes to your banking information.

Ched-unifast Online Scholarship Application Portal - Accessibility of the form is meant to simplify the financial aid request process.

Repossessing - It is important to attach any necessary supporting documents when submitting the form.