Fill Out Your Obc Mobile Banking Form

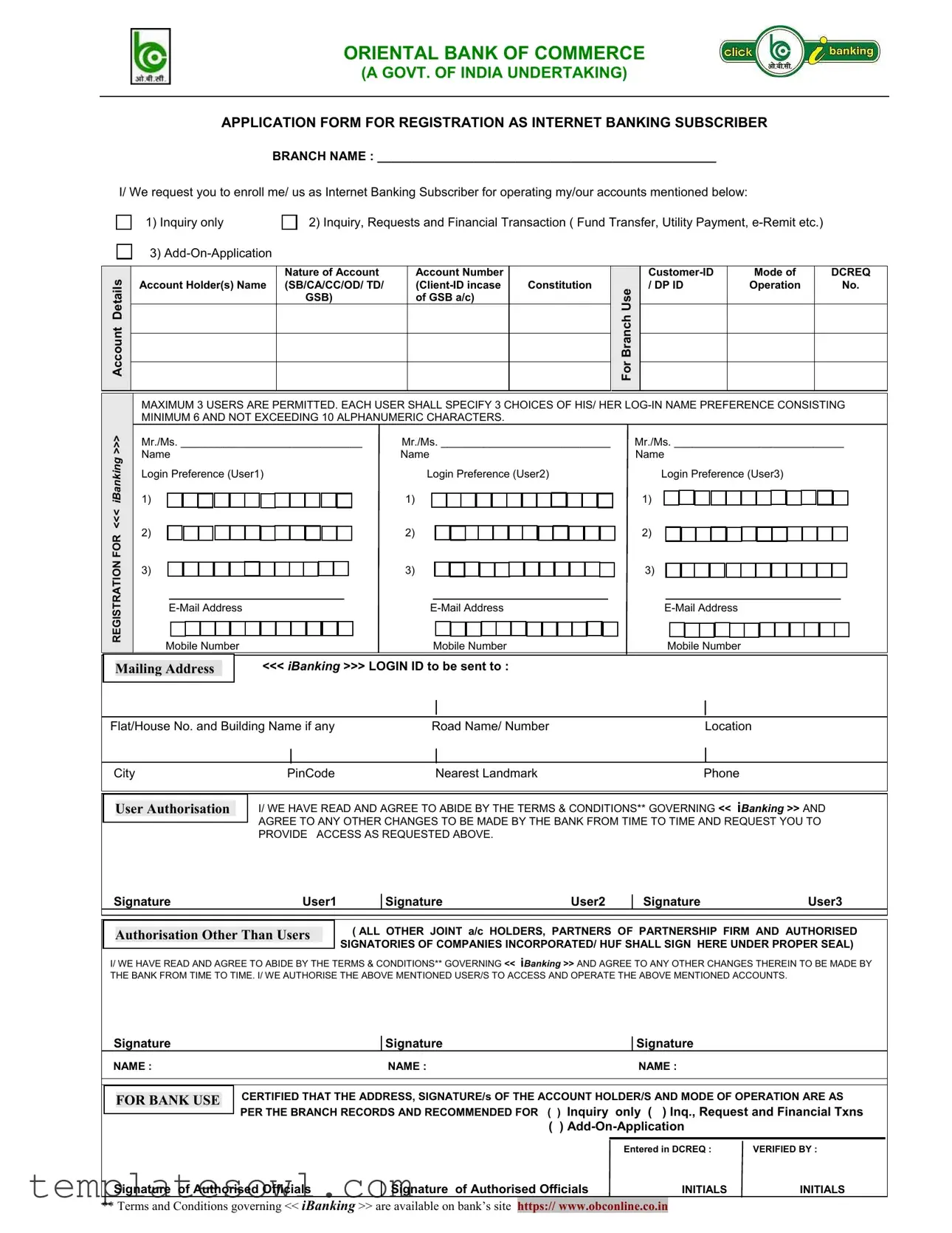

The Oriental Bank of Commerce offers a comprehensive application form for individuals seeking registration as Internet Banking subscribers. This form allows clients to specify their desired level of online access, ranging from inquiry-only capabilities to full transaction features that include fund transfers and utility payments. Users must provide essential account details, including account nature and account holder names, and can register up to three distinct users under their account. Each user needs to select a unique login preference that adheres to specific character requirements. Additionally, individuals must include their email addresses and mobile numbers, ensuring that communication from the bank reaches them effectively. The form also requires signatures from all users and joint account holders, along with an acknowledgment of understanding the terms and conditions governing Internet Banking. Moreover, the bank mandates verification of all provided information before completing the registration process, emphasizing the importance of accurate data collection and user authorization.

Obc Mobile Banking Example

ORIENTAL BANK OF COMMERCE

(A GOVT. OF INDIA UNDERTAKING)

APPLICATION FORM FOR REGISTRATION AS INTERNET BANKING SUBSCRIBER

BRANCH NAME : _________________________________________________

I/ We request you to enroll me/ us as Internet Banking Subscriber for operating my/our accounts mentioned below:

1) Inquiry only |

2) Inquiry, Requests and Financial Transaction ( Fund Transfer, Utility Payment, |

3) |

|

Account Details

|

Nature of Account |

Account Number |

|

Account Holder(s) Name |

(SB/CA/CC/OD/ TD/ |

Constitution |

|

|

GSB) |

of GSB a/c) |

|

|

|

|

|

|

|

|

|

|

|

|

|

For Branch Use

Mode of

Operation

DCREQ

No.

REGISTRATION FOR <<< iBanking >>>

MAXIMUM 3 USERS ARE PERMITTED. EACH USER SHALL SPECIFY 3 CHOICES OF HIS/ HER

Mr./Ms. ______________________________ |

Mr./Ms. ____________________________ |

Mr./Ms. ____________________________ |

Name |

Name |

Name |

Login Preference (User1) |

Login Preference (User2) |

Login Preference (User3) |

1) |

1) |

1) |

2) |

2) |

2) |

3) |

3) |

3) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mobile Number |

|

|

|

|

Mobile Number |

|

|

|

|

Mobile Number |

|

|

|

|

|

|

|

|||||||||||||||||||||

Mailing Address

<<< iBanking >>> LOGIN ID to be sent to :

Flat/House No. and Building Name if any |

Road Name/ Number |

Location |

|

|

|

|

|

City |

PinCode |

Nearest Landmark |

Phone |

User Authorisation

I/ WE HAVE READ AND AGREE TO ABIDE BY THE TERMS & CONDITIONS** GOVERNING << iBanking >> AND AGREE TO ANY OTHER CHANGES TO BE MADE BY THE BANK FROM TIME TO TIME AND REQUEST YOU TO PROVIDE ACCESS AS REQUESTED ABOVE.

SignatureUser1

SignatureUser2

SignatureUser3

Authorisation Other Than Users

(ALL OTHER JOINT a/c HOLDERS, PARTNERS OF PARTNERSHIP FIRM AND AUTHORISED SIGNATORIES OF COMPANIES INCORPORATED/ HUF SHALL SIGN HERE UNDER PROPER SEAL)

I/ WE HAVE READ AND AGREE TO ABIDE BY THE TERMS & CONDITIONS** GOVERNING << iBanking >> AND AGREE TO ANY OTHER CHANGES THEREIN TO BE MADE BY THE BANK FROM TIME TO TIME. I/ WE AUTHORISE THE ABOVE MENTIONED USER/S TO ACCESS AND OPERATE THE ABOVE MENTIONED ACCOUNTS.

Signature

NAME :

Signature |

Signature |

NAME :NAME :

FOR BANK USE

CERTIFIED THAT THE ADDRESS, SIGNATURE/s OF THE ACCOUNT HOLDER/S AND MODE OF OPERATION ARE AS PER THE BRANCH RECORDS AND RECOMMENDED FOR ( ) Inquiry only ( ) Inq., Request and Financial Txns

( )

|

|

|

Entered in DCREQ : |

VERIFIED BY : |

Signature of Authorised Officials |

|

Signature of Authorised Officials |

INITIALS |

INITIALS |

|

** Terms and Conditions governing << iBanking >> are available on bank’s site https:// www.obconline.co.in

Form Characteristics

| Fact Name | Description |

|---|---|

| Governing Body | The Oriental Bank of Commerce is a government-owned bank in India. |

| Form Purpose | This form is used for registration as an Internet banking subscriber. |

| Account Types | Users can choose from various account types including Savings, Current, and Others. |

| User Limit | A maximum of three users can be registered for Internet banking access. |

| Login ID Specifications | Each user must provide three choices for a login name, consisting of 6 to 10 alphanumeric characters. |

| Email Requirement | Each user is required to provide a valid email address for communication purposes. |

| Address Verification | The bank certifies that the address and signatures of account holders must match branch records. |

| Terms and Conditions | Users must agree to the bank’s terms and conditions, available on the bank's website. |

Guidelines on Utilizing Obc Mobile Banking

After completing the OBC Mobile Banking form, the next steps involve submitting it to your bank branch for processing. The bank will review the information provided and create your internet banking credentials based on your application. Ensure all details are accurate to avoid delays.

- Begin by writing your branch name in the designated space.

- Indicate the type of services you wish to enroll for: choose between "Inquiry only," "Inquiry, Requests and Financial Transactions," or "Add-On-Application".

- Fill in your account details. For each account, include the nature of the account, account number, and account holder(s) name.

- In the user section, write the names of up to three users who will have access. Each user must propose three options for a login name, ensuring each option has between six and ten alphanumeric characters.

- Provide email addresses and mobile numbers for each user. Ensure this information is accurate for communication purposes.

- Complete the mailing address section. Include details like flat/house number, road name, location, city, pincode, and a nearest landmark.

- Each user should sign the authorization section, agreeing to the terms and conditions.

- If necessary, joint account holders, partners, or authorized signatories should sign under the authorisation section.

- In the 'For Bank Use' section, appropriate officials will review and indicate recommendations before processing.

What You Should Know About This Form

What is the OBC Mobile Banking form used for?

The OBC Mobile Banking form is used to register as an Internet Banking subscriber for accessing and managing accounts online. It allows you to request various services, such as making inquiries about your account or completing financial transactions like fund transfers and utility bill payments. Filling out this form is the first step towards enjoying the convenience of online banking through Oriental Bank of Commerce.

Who can apply for Internet Banking through this form?

Any account holder of Oriental Bank of Commerce can apply using this form. This includes individual account holders, joint account holders, and authorized signatories for companies or partnerships. Each user must be specified clearly within the form to ensure proper access rights are granted based on account ownership.

How many users can be registered on a single account with this form?

You can register a maximum of three users on a single account using the OBC Mobile Banking form. Each user must create their own login name preference, consisting of 6 to 10 alphanumeric characters. This allows for secure and individualized access for everyone involved.

What information is required to complete the form?

To complete the OBC Mobile Banking form, you will need to provide crucial details such as your branch name, account type, account number, and the names of the users. Additionally, you must specify login name preferences, email addresses, mobile numbers, and your mailing address. It's important to fill in all the required fields accurately to ensure a smooth registration process.

What should I do if I encounter issues during the application process?

If you run into any problems while filling out the OBC Mobile Banking form, don’t hesitate to reach out to the customer service team at your local OBC branch. They can assist you with any questions or concerns you may have regarding the form or the registration process. You can also refer to the bank’s website for more information on terms and conditions related to Internet Banking.

Common mistakes

Filling out the OBC Mobile Banking form can seem straightforward, but there are several common mistakes people often make. First, skipping the section to specify the branch name is a frequent oversight. This detail is vital, as it links your application to the correct branch of the bank.

Another mistake is not clearly identifying the nature of the account. Whether you have a savings, current, or any other type of account, this information is crucial. Failure to provide this detail can delay processing and may even lead to rejection of the application.

Many applicants also struggle with the login preference section. Each user can choose three login names, but they must follow the guidelines of being between 6 to 10 characters. Unintentionally using symbols or spaces is a common error that can hinder the setup process.

People sometimes forget to include their email addresses or mobile numbers. These details are not just for communication; they're also used for security verification. Omitting them can lead to a frustrating experience later when trying to access banking services.

Signature errors tend to create significant issues as well. It's essential that each user signs where indicated. Often, individuals either forget to sign or make a mistake in indicating who they are, causing confusion during the verification process.

Another common mistake involves the section for authorization by joint account holders or partners. All required signatures must be present. Failing to secure the necessary approvals could lead the bank to refuse the request for mobile banking access.

Finally, neglecting to read and agree to the terms and conditions might seem trivial, but it’s critical. This agreement is part of the application process, and without it, the form is incomplete. Make sure to read through it and check the box stating your agreement.

Documents used along the form

The OBC Mobile Banking form is a key document for accessing internet banking services. However, several other forms and documents are often needed to complete the banking registration process. Below is a list of these documents along with brief descriptions.

- Account Opening Form: This form is necessary for opening a new bank account. It captures essential details about the account holder, such as personal information, communication details, and initial deposit information.

- KYC Documents: Know Your Customer (KYC) documents are required to verify the identity and address of the account holder. This typically includes a government-issued ID and proof of residence, such as a utility bill.

- Joint Account Holder Declaration: If the account has multiple holders, this document outlines the rights and responsibilities of each account holder. It is crucial for resolving disputes and clarifying access rights.

- Mobile Verification Form: This form verifies the mobile number linked to the banking account. It ensures that all communication and transaction confirmations are sent to the correct number.

- Terms and Conditions Acknowledgment: This document confirms that users have read and agreed to the bank's terms and conditions associated with mobile banking and internet banking usage.

- Power of Attorney (PoA): In cases where someone else manages the account, a PoA document allows that person to act on behalf of the account holder. It must be signed and notarized for validity.

Each of these documents plays a vital role in ensuring a seamless banking experience. Having them ready will help facilitate the account setup process and compliance with banking regulations.

Similar forms

Account Opening Form: Like the Obc Mobile Banking form, the Account Opening Form gathers essential personal information of the account holder, such as name, address, and contact details. Both aim to register individuals for a banking service, establishing the necessary identification before account access is granted.

Online Banking Registration Form: This document is similar as it also serves as a means to enroll customers for digital banking services. Both forms require the inclusion of account details and user preferences for login credentials, emphasizing secure access to accounts.

Loan Application Form: Both forms collect comprehensive information from the applicant. The Loan Application Form similarly necessitates personal identification, account details, and consent for processing, enabling the bank to evaluate eligibility for services.

Change of Address Form: Like the Obc Mobile Banking form, this document requests updates on the customer’s personal details. Both forms require the signature of the individual to authorize any changes to ensure the bank has accurate records.

ATM Card Request Form: This form parallels the Obc Mobile Banking form in functionality, as both are used to request access to banking services. They require personal identification and account information, ensuring the proper issuance of banking tools.

Electronic Fund Transfer (EFT) Form: Both forms allow customers to perform transactions electronically. The EFT form, similar to the Obc Mobile Banking form, requires details of the accounts involved and user authorization for processing transactions securely.

Signature Verification Form: This document serves to confirm the identity of the individual exercising banking privileges. Like the Obc Mobile Banking form, it requires personal details and signatures to validate the authority over the account’s operations.

Dos and Don'ts

When completing the OBC Mobile Banking form, it is important to follow certain guidelines to ensure your application is processed smoothly. Below are eight recommendations, divided between what you should and shouldn’t do.

- Do ensure all fields are filled out accurately. Double-check your information before submission.

- Do read the terms and conditions. Understand the rules governing your internet banking access.

- Do provide a valid email address. This will be used for important communication from the bank.

- Do select login names that meet the character requirement. Each name must have between 6 and 10 alphanumeric characters.

- Don’t leave any required fields blank. Incomplete forms may delay processing.

- Don’t use special characters in your login name. Stick to alphanumeric characters only.

- Don’t ignore the mobile number field. This information is crucial for account verification.

- Don’t forget to sign the form. Signatures are necessary for authorization.

Misconceptions

以下是关于

OBC移动银行表格的七个常见误解的澄清。

-

误解1: 移动银行注册要求亲自到银行。

实际上,您可以通过填写OBC移动银行表格在线申请注册,而无需亲自到访银行。

-

误解2: 所有账户类型均可注册。

并非所有账户都能注册移动银行服务。通常,特定类型的账户(如储蓄账户或当前账户)可以注册。

-

误解3: 登录名的选择没有限制。

每个用户在选择登录名时必须遵循指导方针,选择的登录名长度必须在6到10个字符之间。

-

误解4: 提交表格后,注册是自动的。

注册并非自动,银行会在审核后确认并激活移动银行服务。

-

误解5: 每个账户可以有无限数量的用户。

每个OBC移动银行账户最多允许三位不同的用户访问。

-

误解6: 无需任何责任协议。

在申请表上,所有用户必须同意条款和条件,这表示他们理解使用移动银行的责任。

-

误解7: 账户信息会自动共享。

用户的信息和账户操作是保密的,银行遵循隐私政策以保护客户数据。

Key takeaways

When filling out the OBC Mobile Banking form, consider the following key points:

- Make sure to complete all required sections accurately to avoid delays.

- Clearly indicate the branch name where you hold your account.

- Select the appropriate enrollment type based on your needs: inquiry only or full access for transactions.

- Only a maximum of 3 users are allowed for each account. Choose wisely.

- Each user must create a unique login name, ensuring it is between 6 and 10 characters long.

- Provide accurate email addresses and mobile numbers for all users to receive important information.

- Check the mailing address carefully. The login ID will be sent there.

- Read the terms and conditions carefully, as they will govern your use of Internet Banking.

- Ensure all signatures are properly executed, including those of all joint account holders if applicable.

Browse Other Templates

Snow Plowing Contracts - Ensuring safety during snow removal operations is a core component of the contract.

Flashcard Maker Free - Flashcards created from this form support active recall strategy, crucial for learning retention.

Disability Determination Office - Individuals may indicate if they have not worked in their lifetime, providing dates for any health-related work stoppages.