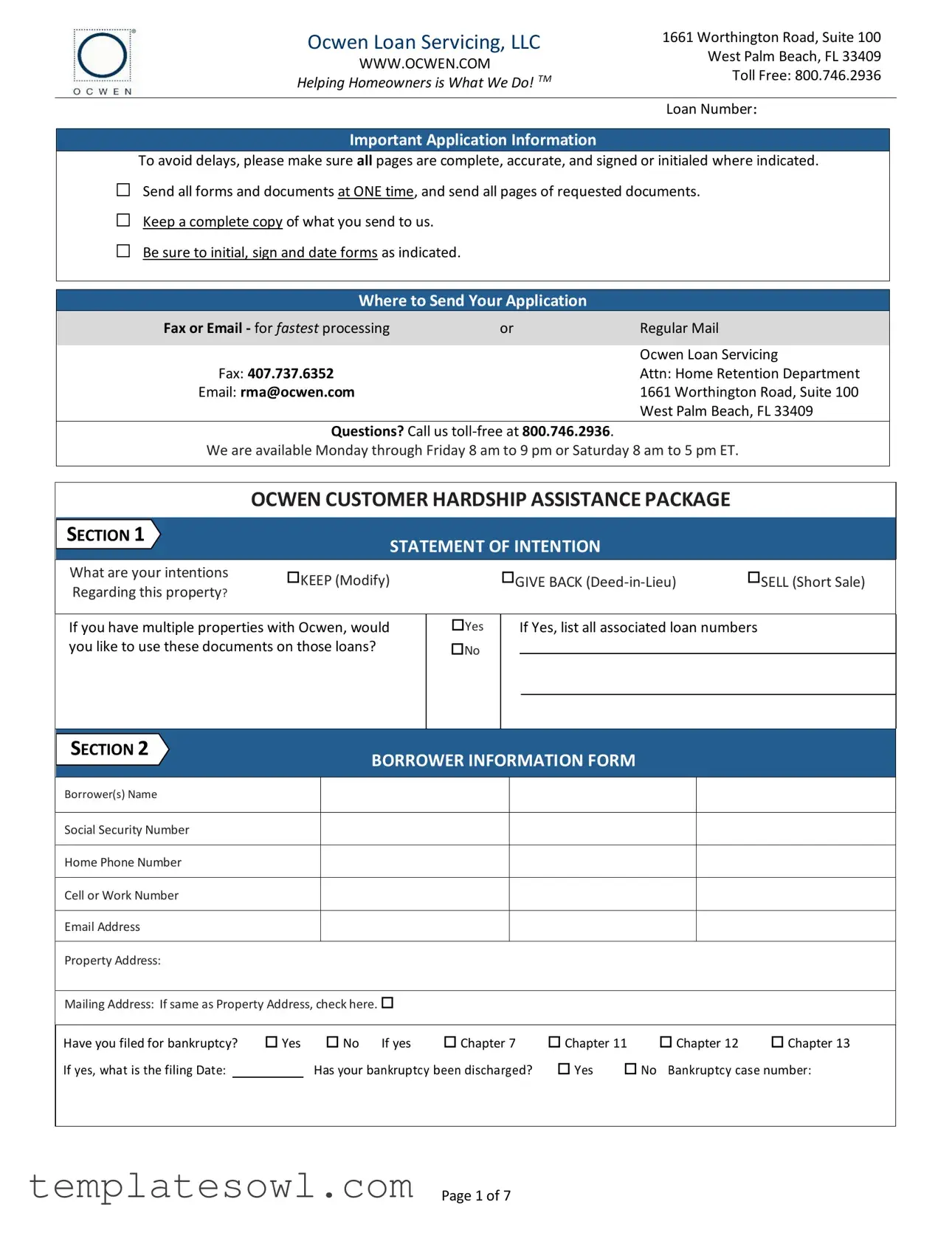

Fill Out Your Ocwen Short Sale Package Form

For homeowners facing financial difficulties, the Ocwen Short Sale Package form plays a crucial role in navigating the complex short sale process. It encompasses essential sections that gather vital information about the homeowner's current situation. Initially, the form asks about the homeowner's intentions regarding their property—whether they plan to keep it, give it back, or sell it through a short sale. After this, it collects important borrower details, including contact information and any bankruptcy history. The package also delves into property occupancy status, household debts, and detailed monthly income and expenses, thus painting a comprehensive picture of the homeowner's financial landscape. As a significant component, the hardship statement section provides insight into the reasons behind the financial strain, ensuring applicants acknowledge and document their circumstances thoroughly. This structured approach not only streamlines the application process but also increases the chances of approval by allowing Ocwen to understand each unique case better. Ensuring accuracy and completeness when filling out this form is vital, as it can significantly impact the outcome of any short sale consideration.

Ocwen Short Sale Package Example

IOI.. |

Ocwen Loan Servicing, LLC |

1661 Worthington Road, Suite 100 |

|

West Palm Beach, FL 33409 |

|||

WWW.OCWEN.COM |

|||

Toll Free: 800.746.2936 |

|||

Helping Homeowners is What We Do! TM |

|||

OCWEN |

|

|

|

|

|

Loan Number: |

Important Application Information

To avoid delays, please make sure all pages are complete, accurate, and signed or initialed where indicated.

□Send all forms and documents at ONE time, and send all pages of requested documents.

□Keep a complete copy of what you send to us.

□Be sure to initial, sign and date forms as indicated.

Where to Send Your Application

|

Fax or Email - for fastest processing |

|

or |

|

Regular Mail |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

Ocwen Loan Servicing |

|

|

Fax: 407.737.6352 |

|

|

|

Attn: Home Retention Department |

|

|

Email: rma@ocwen.com |

|

|

|

1661 Worthington Road, Suite 100 |

|

|

|

|

|

|

West Palm Beach, FL 33409 |

|

Questions? Call us

We are available Monday through Friday 8 am to 9 pm or Saturday 8 am to 5 pm ET.

OCWEN CUSTOMER HARDSHIP ASSISTANCE PACKAGE

|

SECTION 1 |

|

STATEMENT OF INTENTION |

|

|

|||

|

|

|

|

|

||||

|

What are your intentions |

KEEP (Modify) |

|

|

GIVE BACK |

SELL (Short Sale) |

|

|

|

Regarding this property? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

If you have multiple properties with Ocwen, would |

|

Yes |

|

If Yes, list all associated loan numbers |

|

||

|

you like to use these documents on those loans? |

|

No |

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SECTION 2

BORROWER INFORMATION FORM

Borrower(s) Name

Social Security Number

Home Phone Number

Cell or Work Number

Email Address

Property Address:

Mailing Address: If same as Property Address, check here. |

|

|

|

|

|

||||

Have you filed for bankruptcy? |

Yes |

No |

If yes |

Chapter 7 |

Chapter 11 |

Chapter 12 |

Chapter 13 |

||

If yes, what is the filing Date: |

|

Has your bankruptcy been discharged? |

Yes |

No |

Bankruptcy case number: |

||||

|

|

|

|

|

|

|

|

|

|

Page 1 of 7

|

IOI.. |

Ocwen Loan Servicing, LLC |

1661 Worthington Road, Suite 100 |

|

|||

|

West Palm Beach, FL 33409 |

|

|||||

|

|

WWW.OCWEN.COM |

|

|

|||

|

|

|

Toll Free: 800.746.2936 |

|

|||

|

Helping Homeowners is What We Do! TM |

|

|||||

|

OCWEN |

|

|

|

|

|

|

|

|

|

|

|

|

Loan Number: |

|

|

|

|

|

|

|

|

|

|

SECTION 3 |

PROPERTY, OCCUPANCY AND RENTAL INFORMATION FORM |

|

||||

|

|

|

|||||

|

Do you occupy this property as a Primary Residence? |

|

Yes |

No |

|

|

|

|

Have you been temporarily displaced and intend to |

|

Yes |

No |

|

|

|

|

occupy this property as a Primary Residence? |

|

|

|

|||

|

|

|

|

|

|

||

Please briefly describe the reason for displacement. Please include whether or not any borrower is an active duty service member or a surviving spouse of a deceased service member who was on active duty at the time of death.

If you do NOT occupy the property, what is the total monthly rent or mortgage payment where you currently live? $ |

.00 |

|||

|

|

|

|

|

Do you have any other debts or obligations secured by this |

Yes |

No |

|

|

property (i.e. second mortgage, home equity loan, judgments |

|

|

||

or liens)? |

|

|

|

|

If Yes, please itemize these debts or obligations below: |

|

|

|

|

Debt Obligations

Amount ($)

Do you own any other property?

Yes

No

How many? |

. If yes, please complete the following items: |

|

|

|

||

|

|

|

|

|

|

|

Other Property Address |

Monthly Mortgage Payment |

Rental Income Received |

Is the Property Currently Vacant? |

|||

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

No |

|

|

|

|

|

Yes |

No |

|

|

|

|

|

Yes |

No |

NOTE – Please attach a separate sheet of paper with details related to any additional properties, additional

SECTION 4 |

HOUSEHOLD ASSETS AND EXPENSES FORM |

|

|

|

|||||

|

|

|

|

||||||

Combined Assets |

|

Monthly Expenses |

|

|

|

||||

Round all figures to the nearest dollar |

|

Round all figures to the nearest dollar |

|

||||||

Total $ in Checking Account(s) |

|

$ |

|

|

Credit Cards/Installment Debt |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

Total $ in Savings Account(s) |

|

$ |

|

|

Child support/ Alimony / Dependent Care |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

Money Market, Stock, Bonds & CD’s |

|

$ |

|

|

Car and |

|

$ |

|

|

Value/Amount |

|

|

|

Auto/Food/Household/Utilities/Water/ |

|

|

|

||

|

|

|

|

|

|

|

|

||

|

|

|

|

|

Sewer/Phone Expenses |

|

|

|

|

Estimated Value of Real Estate Owned |

|

$ |

|

|

Homeowner Association Fees (HOA) |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

Other Cash on Hand |

|

$ |

|

|

Other Loans (excluding Mortgage) |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

Other |

|

$ |

|

|

Other |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

Assets TOTAL |

|

$ |

|

.00 |

Expenses TOTAL |

|

$ |

|

.00 |

|

|

|

|

|

|

|

|

|

|

Page 2 of 7

IOI.. |

Ocwen Loan Servicing, LLC |

|

|

|

1661 Worthington Road, Suite 100 |

|

||||||||||||||||||||||||||||

|

|

|

|

|

West Palm Beach, FL 33409 |

|

||||||||||||||||||||||||||||

|

|

|

WWW.OCWEN.COM |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Toll Free: 800.746.2936 |

|

|||||||||||||||||||

Helping Homeowners is What We Do! TM |

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

OCWEN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loan Number: |

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SECTION 5 |

|

|

|

MONTHLY INCOME FORM |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

ALL figures should represent the total amount received per month for that income category |

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

Primary Borrower Name |

|

|

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employer Name* |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Base Pay/Salary |

|

$ |

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

||||

(Monthly gross amount before deductions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Hire Date |

|

|

|

| |

|

|

|

| |

|

|

|

|

|

| |

|

|

|

| |

|

|

|

|

|

| |

|

|

| |

|

|

|

|

|||

|

|

|

|

MM |

DD |

|

|

YY |

|

|

MM |

DD |

|

|

YY |

|

|

|

MM |

|

DD |

|

|

YY |

|

|||||||||

|

|

Weekly |

|

|

Monthly |

Weekly |

|

Monthly |

|

Weekly |

|

Monthly |

|

|||||||||||||||||||||

How often are you paid? |

|

Every 2 |

|

|

Twice a |

Every 2 |

Twice a |

|

Every 2 |

|

Twice a |

|

||||||||||||||||||||||

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

|

|

|

weeks |

|

|

|

|

month |

|

|

weeks |

|

|

|

month |

|

|

|

weeks |

|

|

|

month |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

$ |

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Unemployment Benefits |

|

$ |

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Public Assistance/Food Stamps |

|

$ |

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Social Security Benefits |

|

$ |

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Disability Benefits: (check one) |

|

$ |

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

||||

Less than 1 Year 1 Year or Greater |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Supplemental Security Income (SSI) |

|

$ |

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Pensions, Annuities, or Retirement Plans |

$ |

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Alimony |

|

$ |

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Child Support |

|

$ |

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Monthly Gross Rental Income from all |

|

$ |

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

||||

Properties |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other Income – Examples: |

|

$ |

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

||||

Investment, Interest, Dividends, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total (Gross Income) |

$ |

|

|

|

|

|

.00 |

|

$ |

|

|

|

.00 |

|

$ |

|

|

|

|

.00 |

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

*If there are more than one employer, please provide additional information on a separate sheet. |

|

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Page 3 of 7

IOI.. |

Ocwen Loan Servicing, LLC |

1661 Worthington Road, Suite 100 |

|

West Palm Beach, FL 33409 |

|||

WWW.OCWEN.COM |

|||

Toll Free: 800.746.2936 |

|||

Helping Homeowners is What We Do! TM |

|||

OCWEN |

|

|

Loan Number:

SECTION 6 |

HARDSHIP STATEMENT |

|

Date hardship began (MM|YY): ________|________ |

The hardship is/was:

Reason for Hardship |

Documentation Needed |

Check ALL that apply below and add description if needed |

Documents to include with your application |

Household income has declined

Reduction in hours with current employer

Current year |

Prior Year |

Expenses have increased

Cash reserves, including all liquid assets, are insufficient to maintain the current mortgage payment and cover basic living expenses at the same time.

Monthly debt payments are excessive and I am overextended with my creditors. Debt includes credit cards, home equity or other debt.

Death of primary or secondary wage earner

Divorce/separation

Disability or serious injury of a borrower or family member

*No documentation needed shall require providing detailed medical information.

Disaster (natural or

Distant Employment Transfer/Relocation

Business failure

No hardship documentation required

No hardship documentation required

No hardship documentation required

No hardship documentation required

No hardship documentation required

Death Certificate OR

Obituary or newspaper article reporting the death

Divorce Decree copy signed by the court; OR

Separation Agreement copy signed by the court; OR

Current credit report copy evidencing divorce, separation, or non- occupying borrower has a different address

Proof of monthly insurance benefits or government assistance (if applicable); OR

Written statement or other documentation verifying Disability; OR

Doctor’s certificate of injury or Disability OR

Copies of Medical Bills

Insurance claim; OR

Federal Emergency Management Agency grant or Small Business loan;

OR

Borrower or employee property located in a Federally Declared Disaster Area

For

For employment transfer/new employment:

Signed offer letter copy or notice from employer showing transfer to a new employment location: OR

Paystub from new employer; OR

If none above apply, provide written explanation

In addition to the above, documentation showing the amount of any relocation assistance provided, if applicable (not required for those with PCS orders).

Federal Tax Return from the previous year (including all schedules) AND

Proof of business failure supported by one of the following:

Bankruptcy filing for the business; OR

Two months recent Bank Statement for the business account evidencing cessation of business activity; OR

Most recent signed and dated quarterly or

Page 4 of 7

|

IOI.. |

Ocwen Loan Servicing, LLC |

1661 Worthington Road, Suite 100 |

|

|

|

West Palm Beach, FL 33409 |

|

|||

|

WWW.OCWEN.COM |

|

|||

|

Toll Free: 800.746.2936 |

|

|||

|

Helping Homeowners is What We Do! TM |

|

|||

|

OCWEN |

|

|

|

|

|

|

|

|

Loan Number: |

|

|

|

|

|

|

|

|

SECTION 6 |

|

HARDSHIP STATEMENT |

|

|

|

|

|

|

|

|

|

I am unemployed and receiving benefits |

|

|

|

|

|

I am/was receiving unemployment benefits from |

No hardship documentation required |

|

||

|

______|______|________ to ______|______|________ |

|

|||

|

|

|

|

||

|

Start Date ( MM|DD|YY ) |

End Date ( MM|DD|YY ) |

|

|

|

|

I am unemployed and NOT receiving benefits |

No hardship documentation required |

|

||

|

Other Hardship(s) – describe below: |

Written explanation describing the details of the hardship and relevant |

|

||

|

documentation. Space provided below. |

|

|||

|

|

|

|

||

Hardship Explanation (continue on a separate sheet of paper if necessary)

SECTION 7

INCOME DOCUMENTATION REQUIRED

ANY and ALL borrowers or Contributors must report and provide evidence of ALL income sources

IMPORTANT – Avoid processing delays by providing COMPLETE documentation as described below.

Include ALL pages of any statements.

Income Record Type - Check all that apply |

|

|

Documentation Required - Please provide for each borrower |

|

|

|

|

|

|

|

|

1. |

Complete, signed individual federal income tax return and, as applicable, |

|

|

|

|||

PROFIT AND LOSS STATEMENT |

|

|

the business tax return, AND |

|

|

2. |

Either the last three monthly Profit and Loss Statements OR one for the most |

|

|

{If |

|

|

recent quarter, OR copies of bank statements for the business account for the |

|

|

|

|

last two months evidencing continuation of business activity. |

|

|

|

3. |

Include only business related gross/net income and itemized expenses. |

|

|

|

|

BASE PAY – SALARY/HOURLY WAGE INCOMEPaystubs dated within 90 days which shows at least 30 days of

UNEMPLOYMENT BENEFITS |

|

Award letter showing the amount, frequency, and duration of benefits that have begun |

|||

|

or will begin in 60 days |

||||

|

|

|

|||

|

|

|

|

|

|

|

PUBLIC ASSISTANCE & FOOD STAMPS; SOCIAL |

|

|

|

|

|

SECURITY RETIREMENT, SURVIVORS, OR DISABILITY |

|

Examples include exhibits, disability policy or benefits statement(s) from provider AND |

|

|

|

|

|

|||

|

BENEFITS; SUPPLEMENTAL SECURITY INCOME; |

|

|

||

|

|

proof of receipt of payment (such as two most recent bank statements or deposit |

|

||

|

WORKERS’ COMPENSATION; PENSIONS, ANNUITIES, |

|

|

||

|

|

advice dated within 90 days) |

|

||

|

OR RETIREMENT PLANS; AND/OR ADOPTION |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

ASSISTANCE |

|

|

|

|

|

|

1. |

Copy of divorce decree, separation agreement, or other written legal agreement |

||

|

|

|

|

filed with the court documents must show the amount of payments AND the |

|

ALIMONY, CHILD SUPPORT, OR MAINTENANCE |

|

|

period of time that you are entitled to payment(s) AND |

||

2. |

Copies of two most recent bank statements, deposit advices showing receipt of |

||||

|

PAYMENTS |

|

|

payment, cancelled checks, or third party documentation dated within 90 days. |

|

|

|

|

NOTE – Alimony, child support or separate maintenance income need not be disclosed if |

||

|

|

|

it is not to be considered for repaying the mortgage debt. |

||

|

|

|

1. |

Copy of the most recent filed federal tax return with all schedules, |

|

MONTHLY GROSS INCOME FROM RENTAL PROPERTIES |

|

|

including Schedule E - Supplemental Income and Loss OR |

|

|

|

|

||||

|

2. |

If rental income is not reported on Schedule E - Supplemental Income and Loss, |

|

||

|

|

|

|

provide a copy of the current Lease Agreement (All pages) AND one bank |

|

|

|

|

|

statement showing deposit of rent checks OR rent receipts. |

|

Other Income - Investment, Interest Dividends, |

|

Proof of payment receipt (such as a two most recent investment or bank statements or |

|||

|

deposit advice, dated within the last 90 days). Must include source, amount, and |

||||

|

Royalty, overtime, Bonuses, Commissions, Etc. |

|

|||

|

|

frequency. |

|||

|

|

|

|||

Page 5 of 7

IOI.. |

Ocwen Loan Servicing, LLC |

1661 Worthington Road, Suite 100 |

|

West Palm Beach, FL 33409 |

|||

WWW.OCWEN.COM |

|||

Toll Free: 800.746.2936 |

|||

Helping Homeowners is What We Do! TM |

OCWEN

Loan Number:

SECTION 8 |

||

Complete if including income from a |

||

|

||

|

|

IMPORTANT - Ocwen cannot consider

A

not be on the original security instrument), but whose income is used to support the mortgage payment or monthly expenses.

Note: Without these authorizations,

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Print Name |

|

|

|

|

|

|

|

|

|

|

Print Name |

|

|

|

|

|

|

|

|

|

|

Amount contributing towards the mortgage payment |

|

|

|

Amount contributing towards the mortgage payment |

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

I confirm that I contribute towards the mortgage payments and consent to the use of my contribution for the calculation of monthly income. I will also provide |

|

||||||||||||||||||||

any supporting documentation showing my monthly income as referenced in Section 7. I authorize and give permission to the Servicer and their respective |

|

||||||||||||||||||||

agents, to assemble and use a current consumer report if necessary as part of this assistance review. I understand that you may collect and record personal |

|

||||||||||||||||||||

information that I submit, including but not limited to my name, address, and income information. I understand and consent to the disclosure of my personal |

|

||||||||||||||||||||

informationSIGN |

to third parties, including but not limited to, the Servicer and their respectiveSIGN agents, successors, and assigns, any investor, insurer, guarantor, |

|

|||||||||||||||||||

stateHEREHFA or any |

|

|

HERE |

|

|

|

|

|

|

|

|

||||||||||

,. |

|

|

|

|

|

|

|

,. |

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|_ |_ |

|

|

|

|

|

|

|

|

|_ | |

|

|

|

|

||

|

|

|

|

|

Date(MM|DD|YY) |

|

|

|

|

|

|

Date(MM|DD|YY) |

|

||||||||

|

|

Signature |

|

|

|

|

|

|

|

|

Signature |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|||||||||||||||||

SECTION 9 |

|

|

BORROWER /CO- BORROWER ACKNOWLEDGEMENT AND AGREEMENT |

|

|||||||||||||||||

|

|

|

|||||||||||||||||||

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I certify, acknowledge, and agree to the following:

1.All of the information in this Request for Mortgage Assistance is truthful and the hardship that I have identified contributed to my need for mortgage relief.

2.The accuracy of my statements may be reviewed by the servicer, owner or guarantor of my mortgage, their agent(s), or an authorized third party, and I may be required to provide additional supporting documentation. I will provide all requested documents and will respond timely to all servicer or authorized third party communications. An authorized third party may include, but is not limited to, those outlined in the Authorization to Release Information, a counseling agency, Housing Finance Agency (HFA) or other similar entity that is assisting in obtaining mortgage assistance.

3.Knowingly submitting false information may violate Federal and other applicable law.

4.If I have intentionally defaulted on my existing mortgage, engaged in fraud or misrepresented any fact(s) in connection with this request for mortgage assistance or if I do not provide all required documentation, the servicer may cancel any mortgage assistance offer granted and may pursue foreclosure on my property and/or pursue any available legal remedies allowable under federal and state law.

5.The servicer is not obligated to offer me assistance based solely on the representations in this document or other documentation submitted in connection with my request.

6.I may be eligible for a trial period plan, repayment plan, or forbearance plan. If I am eligible for one of these plans, I agree that:

a . A l l the terms of this Acknowledgement and Agreement are incorporated into such plan by reference as if set forth in such plan in full.

b.My first timely payment under the plan will serve as acceptance of the terms set forth in the notice of the plan sent by the servicer.

c.The servicer's acceptance of any payments under the plan will not be a waiver of any acceleration of my loan or foreclosure action that has occurred and will not cure my default unless such payments are sufficient to completely cure my entire default under my loan.

7.Payments due under a trial period plan for a modification will contain escrow amounts. If I was not previously required to pay escrow amounts, and my trial period plan contains escrow amounts, I agree to the establishment of an escrow account and agree that any prior waiver is revoked. Payments due under a repayment plan or forbearance plan may or may not contain escrow amounts. If I was not previously required to pay escrow amounts and my repayment plan or forbearance plan contains escrow amounts, I agree to the establishment of an escrow account and agree that any prior escrow waiver is revoked.

8.A condemnation notice has not been issued for the property.

9.The servicer or authorized third party may obtain a current credit report on all borrowers obligated on the Note.

Page 6 of 7

IOI.. |

Ocwen Loan Servicing, LLC |

1661 Worthington Road, Suite 100 |

|

West Palm Beach, FL 33409 |

|||

WWW.OCWEN.COM |

|||

Toll Free: 800.746.2936 |

|||

Helping Homeowners is What We Do! TM |

|||

OCWEN |

|

|

Loan Number:

SECTION 9 |

BORROWER /CO- BORROWER ACKNOWLEDGEMENT AND AGREEMENT |

10.The servicer and its respective agents, successors, and assigns or authorized third party will collect and record personal information that I submit in this Request for Information and during the evaluation process, I am authorizing these respective parties to obtain, share, release, discuss, and otherwise provide to and with each other public and

(d)my income, and (e) my payment history and information about my account balances and activity. I understand and consent to the servicer or authorized third party, as well as any investor or guarantor (such as Fannie Mae or Freddie Mac), disclosing my personal information and the terms of any relief or mortgage assistance that I receive to the following:

a.Any investor, insurer, guarantor, or servicer that owns, insures, guarantees, or services my first lien or subordinate lien ( if applicable) mortgage loan(s) or any companies that perform support services for them,

b.State HFA or any

c.The authorization includes but is not limited to any parties listed below.

Counseling Agency |

|

Other Third Party viz. Authorized Agent/ Realtor/ Broker |

|

|

|

Agency/ Third Party Contact Name & Phone Number |

|

Agency/ Third Party Email Address |

In addition to this financial statement and its attachments, there may be times when additional information is needed to review the situation thoroughly and my information may be provided to complete the review, such as (a) Ordering credit reports, (b) verifying bank accounts in this disclosure, and (c) obtaining any other information necessary to properly analyze this request.

BY SIGNING BELOW I UNDERSTAND AND AGREE WITH THE TERMS OF THIS AUTHORIZATION TO RELEASE INFORMATION

11.I consent to be contacted concerning this request for mortgage assistance or any other loan related matter at any telephone number,

including mobile telephone number, or email address I have provided to the lender/servicer/or authorized third party* by checking this box, I also consent to being contacted by □ text messaging.

SIGN |

_____________________________ |

_____|_____|_____ |

SIGN |

_____________________________ |

_____|_____|_____ |

|

HERE |

HERE |

|||||

|

|

|

|

|||

|

|

Date (MM|DD|YY) |

|

|

Date (MM|DD|YY) |

|

|

Signature |

|

|

|

||

|

|

|

Signature |

|

SIGN

HERE _____________________________ _____|_____|_____

Date (MM|DD|YY)

Signature

*An authorized third party may include, but is not limited to, a counseling agency, Housing Finance Agency (HFA) or other similar entity that is assisting me in obtaining a foreclosure prevention alternative.

Page 7 of 7

Form Characteristics

| Fact Name | Fact Description |

|---|---|

| Submit Application in One Package | Applicants must submit all forms and documents at once to avoid delays. Keeping a copy of the complete application is strongly advised. |

| Hardship Statement Requirement | A detailed hardship statement is essential for processing the short sale. The reason for the hardship should be specified, along with relevant dates and documentation. |

| Contact Information | Ocwen Loan Servicing can be contacted via fax at 407.737.6352 or email at rma@ocwen.com. Their main office is located at 1661 Worthington Road, Suite 100, West Palm Beach, FL 33409. |

| Bankruptcy Disclosure | Borrowers must disclose if they have filed for bankruptcy, indicating the chapter and filing date. This information is crucial for determining eligibility for the short sale process. |

| Assistance Availability | Ocwen provides customer support Monday to Friday from 8 am to 9 pm and Saturday from 8 am to 5 pm ET, offering assistance for any questions regarding the short sale package. |

Guidelines on Utilizing Ocwen Short Sale Package

Filling out the Ocwen Short Sale Package is an essential step in initiating a short sale for your property. It is important to ensure that all sections of the form are completed accurately to avoid processing delays. Once you have filled in the required information, be prepared to gather and submit any necessary supporting documents along with your application.

- Obtain the Form: Download or print the Ocwen Short Sale Package form from the official Ocwen website.

- Fill Out Statement of Intention: Indicate your intentions for the property—whether to keep, give back, or sell, and note if there are multiple loans.

- Complete Borrower Information: Provide all requested details, including names, social security numbers, phone numbers, and email addresses for all borrowers. Mention the property address and if it matches the mailing address.

- Provide Bankruptcy Details: If you have filed for bankruptcy, select the appropriate chapter and include the filing date and case number as needed.

- Complete Property, Occupancy, and Rental Information: Answer questions about your occupancy status and any debts tied to the property. Include rental income details if you own additional properties.

- List Household Assets and Expenses: Document all assets and expenses, rounding off numbers to the nearest dollar. Ensure all values are accurate and up-to-date.

- Detail Monthly Income: Enter income information for all borrowers. Include details about employment, other income sources, and indicate how often payments are received.

- State Hardship Details: Describe the hardship that led to your need for a short sale. Specify the start date and duration of the hardship, and select the appropriate reasons that apply.

- Gather Income Documentation: Compile necessary documentation for all sources of income listed on the form. This could include tax returns, pay stubs, or proof of other income.

- Review and Sign: Go through the completed form for any inaccuracies. Ensure all signatures and initials are correctly placed where indicated.

- Submit the Application: Compile the completed form and all supporting documents. Send everything via fax or email for faster processing, or opt for regular mail to the address provided.

- Keep a Copy: Maintain a complete copy of all submitted documents for your records.

What You Should Know About This Form

What is the Ocwen Short Sale Package form?

The Ocwen Short Sale Package form is a collection of documents and information that homeowners must complete to formally request a short sale on their property. This process allows homeowners to sell their home for less than the amount owed on the mortgage, under specific financial hardship circumstances. Completing the form correctly is essential for processing the request effectively.

What should I include when submitting my Short Sale Package?

When submitting your Short Sale Package, ensure that all forms are complete, accurate, and signed or initialed where necessary. Attach all requested supporting documents, including financial statements and hardship explanations. It is important to send everything at once to avoid processing delays. Be sure to keep a copy of everything you submit for your own records.

How can I submit my application for the Ocwen Short Sale Package?

You have multiple options to submit your application. For the quickest processing, you can fax it to Ocwen at 407.737.6352 or email it to rma@ocwen.com. Alternatively, you can send it via regular mail to Ocwen Loan Servicing, 1661 Worthington Road, Suite 100, West Palm Beach, FL 33409. Choose the method that works best for your situation.

What information do I need to provide about my financial situation?

You will need to provide detailed information regarding your income, assets, and expenses. This includes your monthly earnings, savings accounts, debts, and any monthly expenses you have. This information helps Ocwen understand your financial situation better and evaluate your request for a short sale.

What if I have filed for bankruptcy?

If you have filed for bankruptcy, you must indicate that in the application. Your bankruptcy status will affect the short sale process. If it has been discharged or is still ongoing, provide the respective details such as the bankruptcy case number and pertinent dates. This information is crucial in assessing your eligibility for the short sale.

What types of hardships qualify for a short sale?

Common hardships include unemployment, reduction in income, medical emergencies, divorce, or any disaster impacting your ability to pay your mortgage. It is important to describe your hardship clearly in your application and provide any needed documentation, such as proof of income loss or medical expenses.

How long can the short sale process take?

The time frame for a short sale can vary. Typically, it can take several weeks to a few months, depending on the specifics of your case and how quickly you provide the necessary information and documents. Ocwen will keep you updated throughout the process, so it is important to remain in contact.

What can I do if my short sale request is denied?

If your short sale request is denied, you should receive a reason from Ocwen. You may want to review your application to identify any possible errors or missing documents. In some cases, you can appeal the decision or consider other options like loan modification or a deed-in-lieu of foreclosure. Consult with a housing advisor for guidance on your next steps.

How do I reach Ocwen if I have questions about my application?

If you have questions, you can call Ocwen's customer service at 800.746.2936. They are available Monday to Friday from 8 AM to 9 PM and Saturday from 8 AM to 5 PM ET. It's important to seek clarification on any concerns you have during this process.

Common mistakes

Filling out the Ocwen Short Sale Package form requires careful attention to detail. One common mistake is the **incomplete submission of required documents**. Applicants often fail to send all pages of the necessary documents. Sending partial information can lead to processing delays, as Ocwen requires a complete package to evaluate the application properly.

Another frequent error involves **incorrectly marking the intentions regarding the property**. Many individuals overlook the section where they must indicate whether they intend to keep, give back, or sell the property. Misinterpretation of this simple choice might result in confusion and unnecessary follow-up questions.

Providing **inaccurate borrower information** is also a common pitfall. Some applicants may mistakenly enter the wrong Social Security number or fail to include their alternative contact information. This may hinder communication between Ocwen and the borrower and can further complicate the review process.

Additionally, many applicants neglect to keep **a complete copy of what they send**. Failing to retain this record can pose problems if a follow-up is necessary. It is crucial for applicants to have easy access to their original submission for clarification or confirmation purposes.

People often make mistakes in the **monthly income reporting section**. For instance, they may either overestimate or underestimate their income figures. Accurate reporting is vital as any discrepancies can be viewed as inconsistent or misleading, which could affect eligibility for assistance.

In section six, applicants sometimes forget to address the **hardship statement adequately**. It is essential to describe any hardships fully. Incomplete or vague explanations may lead to difficulties in understanding the situation and can result in delayed assessments.

Missing or outdated **documentation of income** constitutes another significant error. Applicants should provide current paystubs and any required proof of income sources. Failing to do so can raise questions about the authenticity of the reported income.

Another factor to review is **the failure to check off all relevant hardship reasons**. Inadequate selection can overlook critical factors that may have contributed to the applicant's financial distress. This can lead to an inappropriate evaluation of their request for assistance.

Applicants sometimes misallocate **assets and expense figures** when filling out the assets and expenses section. Round figures can be tricky if not accurately calculated, and inconsistencies between reported assets and expenses can distort the overall financial picture.

Lastly, many inadvertently overlook **the need for signatures and dates** on specific forms. Each section that requires acknowledgment must be signed and dated appropriately. Missing signatures could render the application incomplete and result in unnecessary delays for processing.

Documents used along the form

When considering a short sale, submitting the Ocwen Short Sale Package form is just one step in the process. To ensure a thorough application, there are several additional documents and forms that are often required. These documents provide critical information about your financial situation, and they help the lender assess your eligibility for a short sale. Below are commonly used forms that accompany the Ocwen Short Sale Package.

- Customer Hardship Assistance Package: This document outlines your financial challenges or hardships that have led you to consider a short sale. It’s essential for explaining your current predicament to the lender.

- Borrower Information Form: This form collects basic personal information, including names, contact details, and Social Security numbers of all borrowers. It's vital for establishing your identity within the loan records.

- Property, Occupancy, and Rental Information Form: This document outlines details about the property in question, including occupancy status and any rental income. It assists the lender in understanding how the property is managed and occupied.

- Monthly Income Form: This form captures all sources of income for the borrowers, detailing gross monthly income. This is necessary for assessing your ability to meet ongoing financial obligations.

- Hardship Statement: Here, you'll describe the specific circumstances that created your financial issues. This narrative is important, as it gives context to the numerical data you've provided and helps the lender understand your situation.

Collecting and submitting these forms alongside the Ocwen Short Sale Package can significantly streamline the review process. Having all necessary documentation ready demonstrates your commitment to resolving your financial challenges and increases the likelihood of a favorable outcome in your short sale request.

Similar forms

The Ocwen Short Sale Package form shares similarities with several other types of documents that facilitate mortgage modifications and financial assessments. Each document serves a unique purpose, yet they all contribute to the evaluation of a borrower’s situation. Below is a list highlighting these comparable documents:

- Loan Modification Application: Like the Short Sale Package, this document requires borrowers to provide detailed personal and financial information. It aims to assess the borrower's eligibility for a change in loan terms to avoid foreclosure, focusing on financial hardship and repayment capabilities.

- Deed in Lieu of Foreclosure Application: This application is similar in that it also requests a comprehensive financial disclosure. It allows homeowners who cannot maintain their mortgage payments to voluntarily transfer property ownership to the lender, often leading to a more streamlined process than foreclosure.

- Hardship Letter: This document is essential for both the Ocwen Short Sale Package and other mortgage assistance requests. Borrowers must describe their financial difficulties to justify the need for relief measures. The thoroughness of the details provided can significantly impact processing speed and outcomes.

- Request for Mortgage Assistance (RMA): This request is also akin to the Ocwen Short Sale Package. It serves the purpose of evaluating various options for mortgage relief, including short sales, loan modifications, and other alternatives. Borrowers are required to present both personal and financial disclosures to establish their current situation.

Dos and Don'ts

- Do: Ensure that all pages are complete, accurate, and signed or initialed where indicated.

- Do: Send all forms and documents at one time, including all pages of requested documents.

- Do: Keep a complete copy of what you send to Ocwen for your records.

- Do: Double-check to ensure that you have initialed, signed, and dated forms where necessary.

- Don't: Submit incomplete forms, as this can cause delays in processing your application.

- Don't: Use different methods to send parts of your application; it should be sent as a whole.

- Don't: Forget to keep copies of any documents sent, as they may be needed later.

- Don't: Ignore the instructions regarding initialing, signing, and dating; this is crucial for processing.

Misconceptions

The Ocwen Short Sale Package form comes with several misconceptions that could hinder the process for homeowners. Understanding these misbeliefs is crucial. Here is a list of seven common misconceptions:

- All documents can be sent at different times. This is incorrect. To avoid delays, it is essential to send all forms and documents at once.

- Only the borrower needs to sign the application. This is not true. Every borrower listed on the mortgage needs to initial, sign, and date all forms as required.

- Sending partial documents is sufficient. Some might think this is acceptable, but it is not. Complete documentation is essential for efficient processing.

- There are no deadlines for submission. In fact, there could be specific time frames for submitting the application, particularly if a buyer is interested in the property.

- The form is only necessary for primary residences. This is a misconception. The form should be submitted for any property associated with the Ocwen loan, even if it is not a primary residence.

- Meeting with a representative guarantees acceptance. While discussions with a representative may ease the process, approvals are based on the submission’s completeness and accuracy.

- Documentation needed for hardship is optional. This is misleading; adequate supporting documentation for the claimed hardship is mandatory to move forward with the process.

Clarifying these misconceptions can help streamline the short sale process with Ocwen, making it easier for homeowners to navigate their options.

Key takeaways

Filling out the Ocwen Short Sale Package form can feel overwhelming, but understanding key points can simplify the process. Here are five important takeaways:

- Complete Your Form Thoroughly: Make sure all sections of the form are filled out, accurate, and signed. Incomplete forms can lead to processing delays.

- Submit Everything at Once: It’s crucial to send all forms and supporting documents at the same time. This ensures that your application is reviewed as quickly as possible.

- Keep Copies: Always keep a complete copy of what you submit. This serves as a reference if any issues arise during the processing of your application.

- Use Multiple Submission Options: You can fax, email, or mail your application. For quicker processing, consider using fax or email.

- Be Prepared with Documentation: Provide all required documentation with your application. Missing documents can lead to additional delays or even denial of your request.

By following these guidelines, you can navigate the Ocwen Short Sale Package form with greater confidence and efficiency.

Browse Other Templates

Rifts Rpg Character Sheet - Save vs. Coma: +20%, tough in critical scenarios.

How Can I Enroll My Child in a Different School District - Any student under suspension or expulsion needs special consideration in the transfer application.