Fill Out Your Odometer Statement Form

When engaging in a vehicle lease, particularly in the context of transferring ownership, the Odometer Disclosure Statement holds significant importance. This form, mandated by federal laws and sometimes supplemented by state regulations, requires lessees to clearly communicate the vehicle's mileage to the lessor. Its primary aim is to prevent misrepresentation and ensure transparency in the leasing process, safeguarding both parties from potential legal repercussions. If a lessee fails to complete the form accurately or provides false information, they could face hefty fines or even imprisonment. The disclosure process is straightforward: lessees must report the exact odometer reading, select one of the three provided options regarding the accuracy of this reading, and sign the form. The options allow for clarity on whether the mileage reflects the actual distance driven, exceeds the odometer's mechanical limits, or is not reliable. Each vehicle's specifics, including make, model, and identification number, are also detailed, reinforcing the importance of precise communication. Properly compiling and returning this document not only fulfills legal obligations but also fosters trust in the leasing relationship. Understanding the intricacies of this statement can prove invaluable for both lessors and lessees, ensuring a smoother transaction while promoting accountability and transparency.

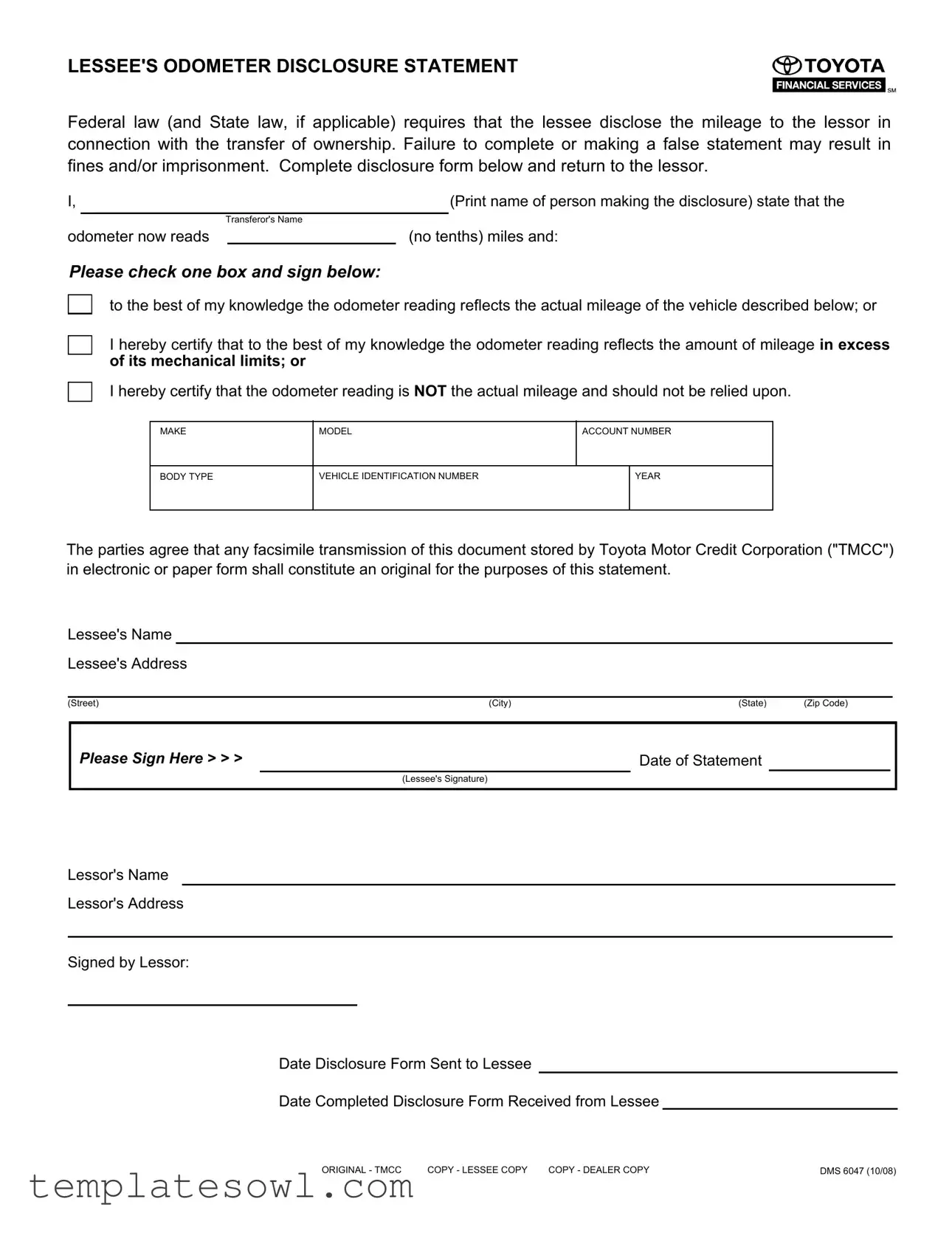

Odometer Statement Example

LESSEE'S ODOMETER DISCLOSURE STATEMENT

Federal law (and State law, if applicable) requires that the lessee disclose the mileage to the lessor in connection with the transfer of ownership. Failure to complete or making a false statement may result in fines and/or imprisonment. Complete disclosure form below and return to the lessor.

I, |

|

|

|

(Print name of person making the disclosure) state that the |

|

|

|

|

|

|

|

|

|

Transferor's Name |

|||

odometer now reads |

|

|

(no tenths) miles and: |

||

Please check one box and sign below:

to the best of my knowledge the odometer reading reflects the actual mileage of the vehicle described below; or

I hereby certify that to the best of my knowledge the odometer reading reflects the amount of mileage IN EXCESS

OF ITS MECHANICAL LIMITS; OR

I hereby certify that the odometer reading is NOT the actual mileage and should not be relied upon.

MAKE

MODEL

ACCOUNT NUMBER

BODY TYPE

VEHICLE IDENTIFICATION NUMBER

YEAR

The parties agree that any facsimile transmission of this document stored by Toyota Motor Credit Corporation ("TMCC") in electronic or paper form shall constitute an original for the purposes of this statement.

Lessee's Name

Lessee's Address

(Street)(City)(State) (Zip Code)

Please Sign Here > > > |

|

Date of Statement |

|

|

|

(Lessee's Signature) |

|||

|

|

|

|

|

Lessor's Name

Lessor's Address

Signed by Lessor:

Date Disclosure Form Sent to Lessee

Date Completed Disclosure Form Received from Lessee

ORIGINAL - TMCC |

COPY - LESSEE COPY |

COPY - DEALER COPY |

DMS 6047 (10/08) |

Form Characteristics

| Fact Name | Details |

|---|---|

| Legal Requirement | The Odometer Statement form is required by both federal law and, in some instances, state law to ensure accurate mileage disclosure during vehicle transfers. |

| Consequences of False Statements | Failure to complete the form accurately or providing false information can lead to legal penalties, including fines or imprisonment. |

| Parties Involved | The form is completed by the lessee, who must disclose the odometer reading to the lessor as part of the vehicle transfer process. |

| Mileage Disclosure Options | The lessee has three options to certify the odometer reading: it reflects actual mileage, exceeds mechanical limits, or is not the actual mileage. |

| Retention of Document | Electronic or paper copies of the completed disclosure document retained by Toyota Motor Credit Corporation serve as original documents. |

| State-Specific Regulations | Depending on the state, additional requirements may apply as outlined in state-specific vehicle transfer laws. |

Guidelines on Utilizing Odometer Statement

When you're ready to fill out the Odometer Statement form, ensure you have all necessary information on hand. This form is essential to provide accurate mileage details during the transfer of vehicle ownership. Completing this document correctly is important to avoid potential legal issues.

- Begin by printing your name in the section labeled "I, (Print name of person making the disclosure)".

- Write the Transferor's Name in the designated area.

- Fill in the current odometer reading. Make sure to record it without any tenths of a mile.

- Check the appropriate box to indicate the status of the odometer reading:

- Correct mileage

- Exceeds mechanical limits

- Not actual mileage

- Complete the vehicle details by providing the following information:

- Make

- Model

- Account Number

- Body Type

- Vehicle Identification Number (VIN)

- Year

- Write your name and address in the "Lessee's Name" and "Lessee's Address" fields.

- Sign and date the form in the "Please Sign Here" section.

- Provide the Lessor's Name and Lessor's Address in the appropriate fields.

- Leave space for the Lessor's signature, date, and disclosure form details to be filled out by the Lessor.

After completing the form, return it to the lessor. Keep a copy for your records. This documentation helps ensure a smooth transfer of vehicle ownership, protecting all parties involved.

What You Should Know About This Form

What is an Odometer Statement form?

The Odometer Statement form is a legal document required by federal and state laws. It is used during the transfer of ownership of a vehicle, primarily leasing situations. The form requires the lessee to disclose the vehicle's mileage to the lessor. By filling out this statement, lessees help ensure transparency and honesty about the vehicle’s condition.

Why is it necessary to provide odometer readings?

Providing accurate odometer readings is crucial to prevent fraud in vehicle transactions. If a lessee does not disclose the correct mileage, they may face legal consequences, including fines or possible imprisonment. The law mandates that the lessee must reveal the current odometer reading and confirm whether it reflects the actual mileage, has exceeded mechanical limits, or is unreliable.

What happens if the Odometer Statement form is not completed correctly?

Failure to correctly complete the Odometer Statement form can lead to significant repercussions. If the lessee provides false information or fails to fill out the form, they may incur legal penalties. Both federal and state laws take these inaccuracies seriously, and violators may confront fines or other criminal charges.

Who should sign the Odometer Statement form?

The Odometer Statement form must be signed by the lessee, the individual making the mileage disclosure. The lessor, or the organization receiving the form, also signs it to acknowledge receipt. Both parties involved in the transaction need to ensure all information is complete and accurate before signing.

What should I include when filling out the Odometer Statement form?

When filling out the Odometer Statement form, the lessee must provide their name and address, the vehicle's make and model, the vehicle identification number (VIN), and the current odometer reading without tenths. Additionally, they must confirm the accuracy of this mileage by checking one of the provided boxes and signing the document. All details are essential for ensuring the paper trail reflects the true state of the vehicle’s mileage.

Common mistakes

Filling out the Odometer Statement form can seem straightforward, yet many individuals make errors that can lead to significant complications. One common mistake involves failing to fill in the odometer reading accurately. When reporting the mileage, it is essential to provide the exact number, without tenths. An omission or incorrect figure can lead to misunderstandings and potential legal issues.

Another frequent error occurs when individuals neglect to check the correct box regarding the odometer reading. The form offers three specific options, and it is crucial to choose the one that accurately reflects the vehicle's mileage status. Miscommunication on this point could cause problems later, especially if the lessor relies on the information provided for their records.

It's also important to pay attention to the signing process. Many individuals either forget to sign or place their signature in the incorrect area. The signature is not merely a formality; it serves as a binding agreement of the statements made in the disclosure. The absence of a signature renders the document invalid, leading to potential disputes between the lessee and lessor.

In some instances, people may fill in the form but forget to include their complete name and address. Such omissions can create confusion and make it challenging for the lessor to establish contact. Ensuring that all personal details are accurately provided offers clarity and can expedite any future communications.

Moreover, the date of the statement is often overlooked. Failing to include the date can complicate matters, especially if there are disputes regarding the timeline of the transaction. Providing the date reinforces the validity of the document and showcases the intent behind the disclosure.

Lastly, individuals might be unaware of the requirement for additional copies of the form. Proper distribution includes keeping copies for both the lessee and lessor, along with a version for the dealer, if applicable. Neglecting to make necessary copies could lead to a lack of documentation, which may affect future transactions involving the vehicle.

Documents used along the form

When dealing with vehicle transactions, especially when transferring ownership, there are several important documents to consider alongside the Odometer Statement form. These forms help ensure transparency and protect both parties involved by clearly outlining obligations and conditions. Below is a list of commonly used forms that should accompany the Odometer Statement.

- Bill of Sale: This document serves as proof of the sale and outlines the transaction details, such as the sale price, vehicle description, and the names of both the buyer and seller. It's essential for confirming the transfer of ownership.

- Title Certificate: A title is essential in proving ownership of the vehicle. It provides vital information about the vehicle, including the Vehicle Identification Number (VIN) and any liens that may exist on the vehicle.

- Application for Title: This form is usually filed with the state’s Department of Motor Vehicles (DMV) to register the vehicle in the new owner's name. It's important for legally establishing ownership after the sale.

- Vehicle Registration: Once ownership is established, registering the vehicle with the DMV is necessary for legal operation on the roads. Registration documents will provide the new owner with license plates and registration certificates.

- Release of Liability: This form protects the seller after the vehicle is sold. It notifies the DMV that the seller is no longer responsible for the vehicle, which can prevent future liability issues.

- Emissions and Safety Inspection Certificates: Many states require a vehicle to pass certain inspections before it can be sold. These certificates confirm that the vehicle complies with safety and environmental standards.

- As-Is Agreement: This document outlines that the vehicle is being sold without any warranties. Buyers acknowledge that they accept the vehicle in its current condition, providing protection to the seller from future claims.

Using these documents in conjunction with the Odometer Statement form helps create a smooth and legally sound transfer of ownership. Always ensure that everything is filled out carefully and retained for future reference. Being thorough now can save you from potential headaches down the line.

Similar forms

- Title Transfer Form: Similar to the Odometer Statement, the Title Transfer Form requires the seller to disclose specific information about the vehicle's mileage during ownership transfer. Both documents aim to protect buyers from inaccurate mileage reporting.

- Vehicle Bill of Sale: This document is essential for documenting the sale of a vehicle. Like the Odometer Statement, it includes critical information regarding the condition and mileage of the vehicle, ensuring transparency in the transaction.

- Lease Agreement: A Lease Agreement outlines the terms of leasing a vehicle, including provisions related to mileage and condition. Both the Lease Agreement and Odometer Statement help clarify the lessee's responsibilities regarding the vehicle's use and mileage reporting.

- Vehicle Inspection Report: A Vehicle Inspection Report details the condition of the vehicle at the time of inspection, similar to the Odometer Statement which provides mileage details. Both documents serve as records of the vehicle's status and can impact future transactions.

- Mileage Validation Form: This document specifically confirms the odometer reading during a transaction. Much like the Odometer Statement, it aims to safeguard against fraud by ensuring accurate mileage reporting.

- Insurance Application: When applying for vehicle insurance, applicants are often required to disclose mileage and vehicle condition. This is similar to the Odometer Statement in its purpose of providing crucial vehicle information to protect all parties involved.

- State Emission or Safety Compliance Certificate: These certificates often require a disclosure of the vehicle's mileage as part of the inspection process. Both this document and the Odometer Statement focus on ensuring compliance with regulations and accurate record-keeping.

Dos and Don'ts

When filling out the Odometer Statement form, it is important to keep the following guidelines in mind:

- Do: Print your name clearly in the designated area.

- Do: Report the odometer reading accurately, without including tenths of a mile.

- Do: Select the appropriate box that reflects your knowledge of the odometer reading.

- Do: Sign the form to verify that the information provided is accurate to the best of your knowledge.

- Don't: Provide false information; this can lead to legal consequences.

- Don't: Forget to include your complete address when filling out the form.

- Don't: Leave any sections of the form blank if they require information.

- Don't: Disregard the submission timeline—ensure the completed form is sent back promptly.

Misconceptions

Misconceptions can lead to confusion when it comes to the Odometer Statement form. Here are ten common misconceptions and their clarifications:

- The Odometer Statement is optional. Many people believe the Odometer Statement is not necessary; however, federal and state laws require its completion during the transfer of vehicle ownership.

- Only the lessee needs to sign the form. Some think only the lessee's signature is required. The form must also include the lessor's information and signature for it to be valid.

- Filling out the form incorrectly has no consequences. This is not true. Falsifying or failing to complete the form can lead to fines and potential imprisonment.

- The mileage reported on the form is always accurate. It's a misconception that all reported mileage is truthful. The form includes disclaimers for situations where mileage may not be reliable.

- The Odometer Statement can be submitted after the vehicle transfer. The form must be completed and submitted at the time of transfer. Delaying it can have legal ramifications.

- Handwritten forms are unacceptable. There is no requirement that the form must be typed. Handwritten forms are valid as long as they are legible and complete.

- All states follow the same requirements for the Odometer Statement. Not all states have identical laws regarding odometer disclosures. It's important to be familiar with your specific state laws.

- Only cars are subject to these requirements. This is incorrect. The odometer statement applies to all motor vehicles, not just passenger cars.

- Once submitted, the form cannot be modified. While changes make it necessary to resubmit the form, adjustments can be made if the disclosure indicates incorrect information.

- Electronic submissions are never accepted. In many cases, facsimile transmissions and electronic copies can be considered original documents, per the wording in the form.

Key takeaways

1. Purpose of the Odometer Statement: This form is required by federal and, in some cases, state law to disclose the mileage of a vehicle during ownership transfer.

2. Importance of Accuracy: It is crucial to provide accurate information. Providing false information can lead to significant penalties, including fines or imprisonment.

3. Disclosure Requirements: The lessee must disclose the current odometer reading and certify its accuracy by checking the appropriate box on the form.

4. Odometer Reading Entries: Enter the odometer reading in whole miles only. Tenths should not be included.

5. Signature Requirement: The lessee must sign and date the form to validate the disclosure. Ensure the signature is clear and legible.

6. Lessor Information: Include the names and addresses of both the lessee and the lessor. This information is essential for proper documentation.

7. Storage of Documents: Any facsimile transmission of this form, whether electronically or on paper, is considered an original for record-keeping purposes.

8. Multiple Copies: Keep copies of the completed form, as designated for the lessee, dealer, and original will be submitted to Toyota Motor Credit Corporation (TMCC).

9. Timing of Document Submission: Note the dates when the disclosure form is sent to the lessee and when it is received back. These dates are important for the transaction's timeline.

Browse Other Templates

What Is a 1004d Appraisal - Clarifies the roles of operators, heirs, and assigns in the agreement.

Security Deposit Demand Letter - This document serves as a formal notification for the return of a security deposit.

Da 2823 - Completing this form is essential for official Army investigations.