Fill Out Your Offer Report Form

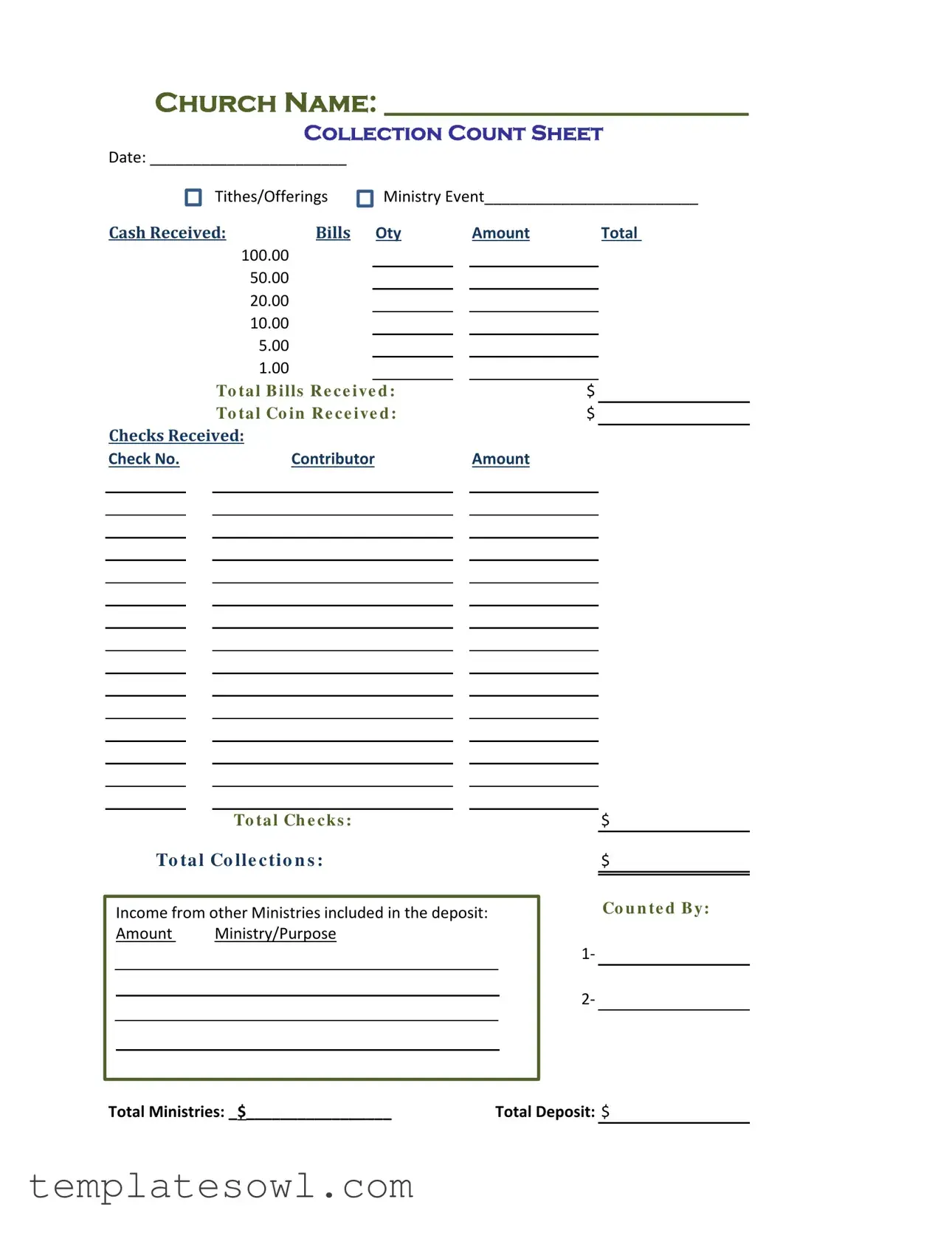

The Offer Report form is an essential tool for churches to track and manage their financial contributions efficiently. This comprehensive document helps in documenting various income sources during ministry events and regular services. Key details such as the church name, date, and specific ministry event are recorded at the top to ensure clarity and organization. The form includes sections for cash receipts, where denominations of bills and coins are detailed, allowing for an accurate count of cash received. Checks received are also documented with space for the check number, contributor's name, and amount to streamline the process of tracking individual donations. Additionally, the form captures income from other ministries, providing a complete picture of all contributions received within the specified period. The counters are clearly indicated, ensuring accountability and accuracy in the financial reporting process. This structured approach makes the Offer Report form invaluable for financial transparency and effective stewardship in a church setting.

Offer Report Example

CHURCH NAME: __________________________

COLLECTION COUNT SHEET

Date: _______________________ |

|

|

|

|

|

|

||||

|

|

Tithes/Offerings |

Ministry Event_________________________ |

|||||||

CASH RECEIVED: |

BILLS |

Oty |

|

Amount |

|

|

Total |

|||

100.00 |

|

|

|

|

|

|

|

|

||

50.00 |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|||

20.00 |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|||

10.00 |

|

|

|

|

|

|

|

|

||

5.00 |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|||

1.00 |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|||

|

|

To ta l B i lls R e c e i ve d : |

|

|

$ |

|

|

|||

|

|

To ta l Co i n R e c e i ve d : |

|

|

$ |

|

|

|||

CHECKS RECEIVED: |

|

|

|

|

|

|

|

|

||

Check No. |

Contributor |

|

|

Amount |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

To ta l Ch e c k s :

To ta l Co lle c ti o n s :

Income from other Ministries included in the deposit:

Amount Ministry/Purpose

$

$

Co u n te d B y:

1‐

2‐

Total Ministries: _$_________________ |

Total Deposit: $ |

|

|

|

|

Form Characteristics

| Fact Name | Description |

|---|---|

| Church Name | Each Offer Report must include the name of the church collecting the offerings. |

| Collection Date | The date of the collection must be recorded on the report for accurate tracking. |

| Cash Received | The form requires a detailed breakdown of cash received, including denominations. |

| Checks Received | It is necessary to record each check received, along with the contributor's details. |

| Total Collection | The report summarizes the total cash and checks collected on the form. |

| Income from Other Ministries | Income from other ministries included in the deposit must be documented to ensure transparency. |

Guidelines on Utilizing Offer Report

Completing the Offer Report form is a straightforward process that helps track contributions made during a service or special ministry event. Accurate information ensures transparency and assists in financial planning for your organization. Follow these steps to fill out the form properly.

- Start by entering the Church Name at the designated space at the top of the form.

- Write the Date of the collection in the space provided.

- Indicate the Ministry Event for which the report is being completed.

- For the CASH RECEIVED section, list the quantity of each bill type (100s, 50s, 20s, 10s, 5s, and 1s) in the 'Oty' column and the corresponding amount in the 'Amount' column next to it.

- Add the total amount of bills received and write it down in the Total Bills Received section.

- Next, write down the Total Coin Received amount.

- Move to the CHECKS RECEIVED section. List each check's number and the contributor’s name, followed by the amount received for each check.

- Calculate the Total Checks and record that figure.

- To find the Total Collections, combine the amounts from total bills, coins, and checks, then write that total in the appropriate space.

- If there are Income from other Ministries included in your deposit, list those amounts and the corresponding ministries or purposes.

- Write down who Counted By by including the names of the individuals involved in the counting process—be sure to indicate them as 1 and 2 if there are two individuals.

- Finally, calculate and enter the Total Ministries and the Total Deposit in their respective sections at the bottom of the form.

What You Should Know About This Form

What is the purpose of the Offer Report form?

The Offer Report form serves to document and track the financial contributions received by a church during services or events. It ensures transparency and accountability in managing funds, allowing churches to accurately record tithes and offerings for each collection event.

What information is required on the Offer Report form?

Key details include the church name, date of collection, event associated with the collection, and breakdowns of funds received in cash and checks. It also requires identifying the number of bills and checks along with their respective amounts. Other notes on income from additional ministries may also be included.

How should cash contributions be recorded?

For cash contributions, the form provides a section to log the quantity and amounts of each bill. You should total the amount of cash received, including both the total amount of bills and the total coins collected. Be thorough to ensure the final figures are accurate.

How do I record checks received?

Each check should be documented by noting the check number, the contributor’s name, and the amount on the Offer Report form. Summing these amounts will give you the total for checks received. This step is crucial for financial audits later on.

What should be done with income from other ministries?

If your collection includes donations directed toward other ministries, you should note the ministry name or purpose along with the corresponding amount. This way, proper credit is given, and all funds are accounted for in the total collection.

Who is responsible for counting and recording the collections?

Typically, a designated team within the church is responsible for counting collections. The form provides space for recording who counted the cash and checks, ensuring accountability. Often, two individuals should complete this process together to verify accuracy.

What is meant by the ‘Total Deposit’ section?

The ‘Total Deposit’ section summarizes the total amount collected that will be moved to the church’s bank account. It combines cash receipts and checks to present an overall total, offering a clear picture of the day's financial activity.

Can the Offer Report form be modified for specific events?

Yes, while the standard form serves its purpose well, churches may modify it to better fit their unique needs. This could include adding sections for special contributions or unique fundraising events, provided the essential information is still captured.

How often should the Offer Report be completed?

The Offer Report should be completed for every collection event, whether it occurs weekly, monthly, or during special occasions. Regular documentation helps maintain accurate financial records and ensures that accountability is kept consistently.

What should be done with the completed Offer Report?

After filling out the Offer Report form, it is recommended to store it securely, whether in physical form or digitally. This report not only facilitates financial oversight for church leadership but may also be necessary for tax purposes and external audits.

Common mistakes

Filling out an Offer Report form may seem straightforward, but many people make common mistakes that can lead to inaccuracies. One frequent error is leaving the church name section blank. It may appear insignificant, but accurately identifying the church is crucial for maintaining proper records. Omitting this information can lead to confusion and misattribution in financial reporting.

Another mistake often observed is neglecting to enter the date appropriately. Without a correct date, it becomes challenging to track the timing of collections, which is essential for both accountability and financial analysis. Misdating the report can also lead to discrepancies when reconciling bank statements later.

When listing cash received, people sometimes fail to fill in the amounts for various denominations. For example, if someone receives $100 in one-dollar bills but only notes the total cash without specifying how many of each type of bill were counted, it creates gaps in the record. It’s important to provide detailed information for transparency and accuracy.

Additionally, checks can be an area of confusion. People often forget to include the check numbers or contributor names, which can complicate tracking donations. Having detailed records helps in understanding who contributed, as well as in acknowledging their generosity in a timely manner.

Many also overlook the section regarding income from other ministries. When individuals do not report amounts from these contributions, it can distort the overall financial picture of the church's finances. Accurate reporting ensures that all sources of income are accounted for, which helps in budgeting and planning for future ministry activities.

In some cases, people may incorrectly total the various amounts listed on the form. Failing to double-check calculations can lead to significant errors in financial reporting. It is essential to verify that the totals match the sums of their respective categories, as this reflects the church’s financial health.

Lastly, not having a designated person sign off on the form can be problematic. The section for who counted the collection serves as a verification method, providing accountability. When this signature is absent, it introduces uncertainty and can lead to questions about the legitimacy of the reported figures. Every safeguard matters in financial documentation.

Documents used along the form

The Offer Report form is essential for documenting the collection of tithes and offerings within a church. This form provides transparency and helps in maintaining accurate financial records. Alongside the Offer Report form, several other documents are commonly utilized to ensure that all financial transactions are properly recorded and accounted for. Below is a brief overview of these documents.

- Donation Receipt: This document serves as a formal acknowledgment of a contribution made by a donor. It typically includes the donor’s name, the amount donated, and the date of the contribution, providing essential proof for tax purposes.

- Bank Deposit Slip: A bank deposit slip is used to document the deposits made into the church's bank account. It details the total amount being deposited and includes information about the sources of that income, such as cash and checks.

- Cash Receipt: Issued when cash is received, this receipt confirms the transaction. It often includes the date, the amount, and the purpose of the payment, serving as a record for both the church and the donor.

- Financial Report: This report provides an overview of the church's financial status over a specific period. It typically includes income, expenses, and balance information, helping stakeholders understand overall financial health.

- Contribution Statements: These statements summarize an individual's total contributions over the year. They are often sent to donors for tax reporting and are important both for the church’s record-keeping and for the donors' financial planning.

- Budget Report: A budget report outlines projected income and expenses for the congregation. This document guides financial decision-making and helps in planning for future ministry needs.

- Transaction Log: This log maintains a chronological record of all financial transactions. It facilitates tracking of donations and expenditures and ensures compliance with church financial policies.

- Volunteer Time Sheet: While not directly related to monetary transactions, this document records the hours contributed by volunteers. It plays a role in understanding the total contribution of time and effort to the church’s mission.

- Event Financial Summary: After hosting a ministry event, this summary assesses the financial outcome, per event basis. It details income generated versus expenses incurred, thus providing a clear picture of event profitability.

Incorporating these documents alongside the Offer Report form enhances financial oversight and ensures rigorous and transparent accounting practices within the church. Each of these documents plays a critical role in managing the financial resources of the congregation effectively.

Similar forms

Collection Report: This document tracks the total collections from a specific event or time period. Like the Offer Report, it lists cash and check amounts received, but it may include categories such as donations and special gifts.

Donation Receipt: This document provides proof of a donation made to a church. It typically includes the contributor’s name, date of donation, and amount, similar to the Offer Report’s details on contributions.

Financial Statement: A broader overview of the church's finances. This document summarizes all income and expenses, including collections listed in the Offer Report.

Bank Deposit Slip: Used when making bank deposits, it specifies the amounts of cash and checks deposited. This document can reflect totals derived from the Offer Report.

Cash Flow Statement: This outlines the inflows and outflows of cash. It may summarize data from the Offer Report to reflect cash received over a period.

Account Ledger: A running record of all transactions. The amounts listed in the Offer Report can be entered into the ledger to track financial health.

Budget Report: This document forecasts expected income and expenses. Insights from the Offer Report may influence future budgets.

Year-End Financial Report: Offers a comprehensive view of finances over the year. It includes data that the Offer Report may contribute to, especially regarding tithes and offerings.

Event Financial Summary: After a church event, this summarizes income and expenses. It may detail the collection totals summarized in the Offer Report.

Membership Contribution History: Tracks an individual’s contributions over time. Similar to the Offer Report, it breaks down contributions by date and amount.

Dos and Don'ts

When filling out the Offer Report form, there are several important considerations to keep in mind. Here is a list of things you should do and things you should avoid:

- Do ensure all sections are filled out completely. Accuracy is key to providing a clear financial picture.

- Do double-check the amounts recorded. Mistakes in the financial figures can lead to confusion and misreporting.

- Do use clear handwriting. Clear communication is essential, especially when others will review the form.

- Do specify the ministry or purpose for any other income included. This helps to maintain a transparent record of finances.

- Don’t forget to sign and date the form. Proper completion requires confirmation from the person who filled it out.

- Don’t leave any sections blank if they apply. Leaving sections incomplete might create gaps in the report.

By following these guidelines, the process of filling out the Offer Report form can be both efficient and accurate, facilitating better record-keeping for the church.

Misconceptions

Misconceptions can often cloud our understanding of important documents like the Offer Report form. Below are some common myths and clarifications regarding this form.

- Misconception 1: The Offer Report form is only for reporting monetary contributions.

- Misconception 2: Only the church administrator can fill out the Offer Report form.

- Misconception 3: The form must be completed in one sitting.

- Misconception 4: The totals need to balance perfectly on the first attempt.

- Misconception 5: The form is not necessary if contributions are made electronically.

- Misconception 6: The Offer Report form is irrelevant after the deposit is made.

While it primarily focuses on tithes and offerings, it also allows for the inclusion of income from other ministries. Thus, it provides a more comprehensive view of total contributions.

In fact, anyone designated by the church, whether it's a volunteer or a staff member, can complete this form. It's important that the person filling it out is detail-oriented and understands how to accurately record contributions.

It's perfectly acceptable to fill out the Offer Report form in stages. Contributions may come in throughout an event, and it's important to record them as they are counted to ensure accurate reporting.

Sometimes, counting errors occur. Don’t be discouraged if the initial totals don’t match up. It is essential to review the counts and resolve discrepancies before finalizing the report.

Even if donations are processed online, keeping an Offer Report form is crucial for accurate record-keeping. This helps to track and reconcile all contributions, ensuring transparency and accountability.

On the contrary, the Offer Report serves as an essential historical record. It should be retained for future reference, providing insight into giving patterns and assisting in budget planning.

Key takeaways

Filling out and using the Offer Report form is crucial for accurately tracking donations. Follow these key takeaways to ensure you complete it efficiently.

- Identify the Church Name at the top of the form. This helps designate where the funds are coming from.

- Always input the date for accurate record-keeping. The date should reflect when the donations were collected.

- Specify the ministry event associated with the donations. This helps in understanding the purpose of the collection.

- Enter the cash received in both bills and coins. This includes quantities and their corresponding values.

- Total the cash amounts thoroughly to ensure all funds are accounted for. Double-check your addition.

- Record the checks received by including the check numbers, contributors, and amounts. This is vital for tracking who donated.

- Calculate the total collections by adding cash and check amounts together.

- List any income from other ministries included in the deposit, along with their purposes. This provides clarity on the funds' origins.

- Make sure to sign off on the form with the names of those who counted the funds. This adds an extra layer of accountability.

By keeping these takeaways in mind, the Offer Report form can effectively serve its purpose, ensuring accountability and transparency for all contributions received.

Browse Other Templates

What Is a Hisa Grant - Detailed remarks about the application process can be added in the designated section.

Due Diligence Money - Documentation must be provided by the seller upon completion of the agreed adjustments for the buyer's verification.

Incident Report Form,Eyewitness Account Sheet,Testimony Registration Form,Incident Witness Declaration,Statement of Observations,Witness Account Document,Eyewitness Statement Form,Incident Observation Report,Witness Testimony Record,Formal Witness De - Facilitates easier recall of facts surrounding the event.