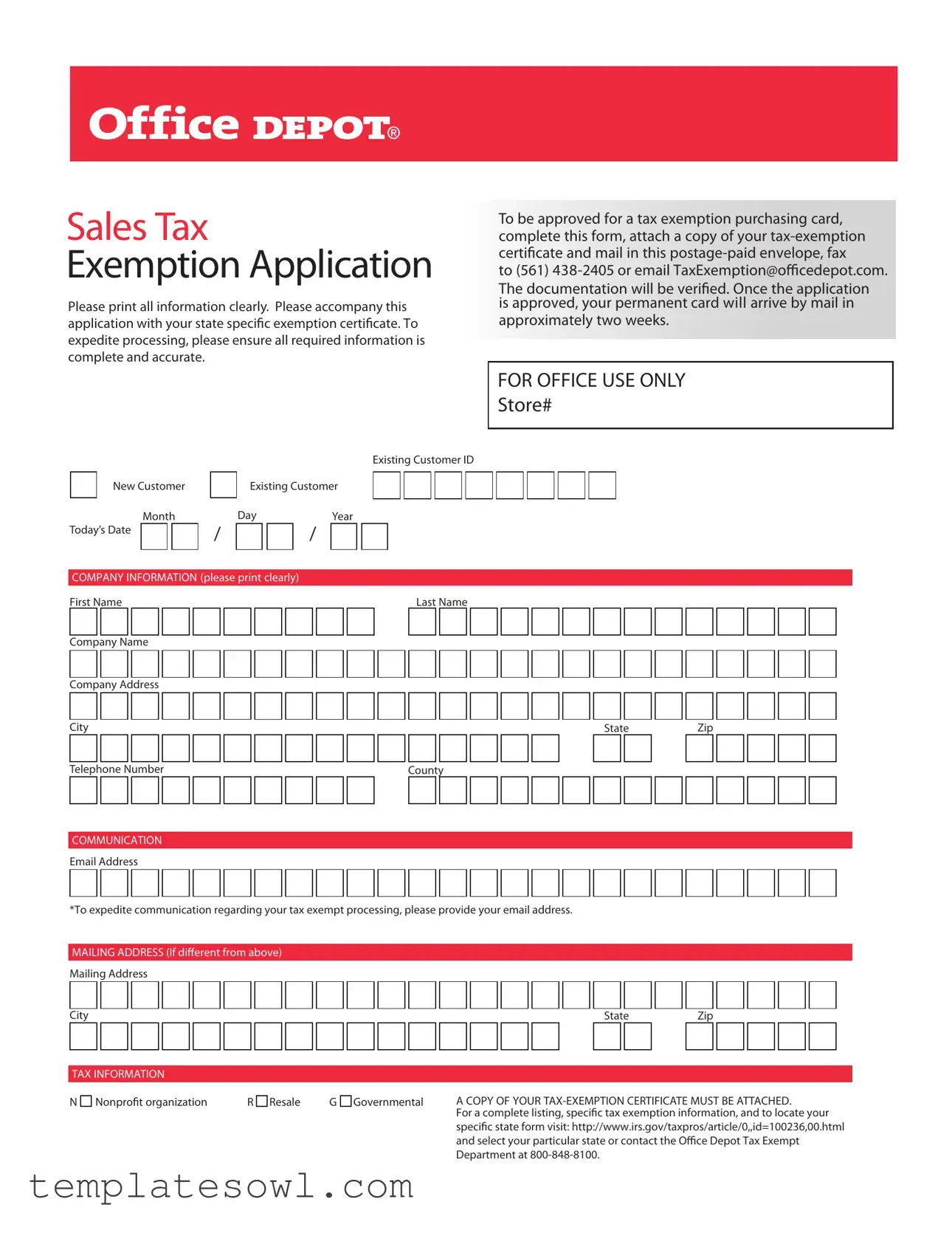

Fill Out Your Office Depot Tax Exempt Form

The Office Depot Tax Exempt form plays a crucial role for organizations, such as non-profit entities, government agencies, and resellers, to responsibly manage their tax obligations while making purchases. This form serves as an application for a tax-exempt purchasing card, enabling eligible applicants to avoid paying sales tax on qualifying items. To begin the process, individuals must provide clear and accurate information, including their existing customer ID if applicable, and the company’s name, address, and contact details. Alongside the form, it is essential to attach a copy of the state-specific tax-exemption certificate, as this documentation is necessary for verification. Submitting the completed form can be done via a prepaid envelope, fax, or email, with a timeframe of approximately two weeks anticipated for receiving the permanent card once the application is approved. Communication and organization are key throughout this process; thus, providing an email address enhances the ability to receive updates regarding application status. Understanding this form is essential for those who seek to navigate the complexities of tax exemptions efficiently.

Office Depot Tax Exempt Example

Sales Tax

Exemption Application

Please print all information clearly. Please accompany this application with your state speci

expedite processing, please ensure all required information is complete and accurate.

Existing Customer ID

|

New Customer |

|

|

Existing Customer |

|||||||

|

|

Month |

|

|

Day |

|

|

Year |

|||

|

|

|

|

|

|

||||||

Today’s Date |

|

|

|

/ |

|

|

|

/ |

|

||

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

To be approved for a tax exemption purchasing card, complete this form, attach a copy of your

to (561)

The documentation will be veri Once the application is approved, your permanent card will arrive by mail in

approximately two weeks.

FOR OFFICE USE ONLY

Store#

COMPANY INFORMATION (please print clearly) First Name

Company Name

Company Address

City

Telephone Number

COMMUNICATION

Email Address

Last Name

StateZip

County

*To expedite communication regarding your tax exempt processing, please provide your email address.

MAILING ADDRESS (If di

Mailing Address

City |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State |

|

Zip |

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

TAX INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

N Nonproorganization |

|

R Resale |

|

G Governmental |

|

A COPY OF YOUR |

|

|

|

||||||||||||||||||||||||||||||||||||

For a complete listing, speci speci

and select your particular state or contact the O Department at

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose of Form | This form is used to apply for a tax exemption purchasing card from Office Depot. |

| Eligibility Requirement | Applicants must provide a tax-exemption certificate to qualify for the exemption. |

| Submission Method | Complete forms may be mailed, faxed, or emailed to the designated departments for processing. |

| Processing Time | Once approved, the permanent tax exemption card typically arrives by mail within two weeks. |

| State-Specific Forms | Applicants can select and specify their state to ensure compliance with local tax exemption laws. |

| Contact Information | For assistance, applicants can reach out to the Office Depot Tax Exemption Department at 800-848-8100. |

| Important Documentation | A copy of the tax-exemption certificate must be attached to the application to avoid processing delays. |

| Communication Preference | Providing an email address can help expedite communication about tax exemption processing. |

Guidelines on Utilizing Office Depot Tax Exempt

Completing the Office Depot Tax Exempt form is a straightforward process. After filling out this form and attaching the required documentation, the next steps involve submitting it through the appropriate channels. Once Office Depot processes your application, you can expect to receive your permanent tax-exempt purchasing card by mail within two weeks.

- Obtain the Office Depot Tax Exempt form. Ensure you have the latest version.

- Carefully read the instructions included with the form.

- Print all required information clearly in the designated fields. Begin with Today’s Date and specify whether you are a New Customer or an Existing Customer.

- Fill in your Company Information. This includes your First Name, Last Name, Company Name, Company Address, City, State, Zip Code, and Telephone Number.

- Provide a communication Email Address for faster updates on your tax-exempt application.

- If your mailing address differs from your company address, enter your Mailing Address, City, State, and Zip Code.

- Select the appropriate Tax Information category. Options include Nonprofit Organization, Resale, or Governmental, based on your status.

- Attach a copy of your tax-exemption certificate. This document is essential for processing your application.

- Double-check that all required information is complete and accurate to expedite the process.

- Submit the completed form and the attached documentation. You can mail it using the provided postage-paid envelope, fax it to (561) 438-2405, or email it to TaxExemption@OfficeDepot.com.

What You Should Know About This Form

What is the Office Depot Tax Exempt form used for?

The Office Depot Tax Exempt form is used to apply for a tax exemption purchasing card. This card allows eligible entities to make purchases without paying sales tax. Such entities include government agencies, non-profit organizations, and resellers.

Who can apply for a tax exemption?

Eligible applicants include governmental agencies, non-profit organizations, and businesses involved in resale. Each applicant must provide a valid tax-exemption certificate to verify their status.

How do I complete the tax exemption application?

You should fill out the application by printing all information clearly. This includes your name, company name, address, and relevant tax information. Be sure to attach a copy of your tax-exemption certificate for processing.

Where do I send my completed application?

You can send your completed application by mailing it in the postage-paid envelope provided, faxing it to (561) 438-2405, or emailing it to TaxExemption@officedepot.com.

How long does it take to get my tax exemption card?

After your application has been approved, you can expect to receive your permanent tax exemption card by mail in approximately two weeks.

What if I am already an Office Depot customer?

If you are an existing customer, indicate this on the application and provide your existing customer ID. This helps streamline the approval process for your tax exemption.

What happens if my application is missing information?

If your application is incomplete, it may delay the processing of your tax exemption. It’s crucial to double-check all fields and ensure you have included your tax-exemption certificate.

Can I find my state's tax-exemption requirements through Office Depot?

Yes, for a complete listing of requirements specific to your state, visit the Office Depot website or contact their customer support at 800-848-8100 for assistance.

Why should I provide my email address on the application?

Providing your email address helps Office Depot communicate quickly and efficiently regarding your application status and any additional requirements. It’s a great way to expedite the process.

Common mistakes

Filling out the Office Depot Tax Exempt form might seem straightforward, but many individuals make common errors that can delay processing. One of the most frequent mistakes is failing to fill out all required fields. Each section of the form must be completed clearly; otherwise, your application may be rejected or delayed. Always double-check your information before submission to ensure completeness.

Another common error is neglecting to attach a copy of your tax-exemption certificate. This document is essential for validation. Remember, any application submitted without this important attachment will not move forward in the approval process. It’s best to gather all necessary documents beforehand to avoid this pitfall.

People often overlook the importance of using clear, legible handwriting. If the reviewers cannot decipher your information, they may need to contact you for clarifications, which can prolong the process. It's advisable to print the information neatly or, if possible, fill the form out digitally to guarantee clarity.

Additionally, many applicants forget to provide accurate contact information. Including your email address is critical for expediting communication regarding your application. If the Office Depot team cannot reach you, the approval process may take longer than necessary.

Choosing the wrong type of tax exemption category is yet another mistake. On the form, there are various classification options to select from, such as nonprofit organization, resale, or governmental. Ensure you select the category that accurately reflects your status; incorrect choices could lead to disqualification.

Some individuals fail to sign and date the form before sending it. A missing signature can be a dealbreaker for the processing team. Your signature confirms that all provided information is true and accurate, so never skip this step.

Missing mailing details can also lead to complications. Make certain that your mailing address is complete, including city, state, and ZIP code. An incomplete address may prevent your approval card from reaching you in a timely manner.

Another mistake is not keeping copies of the submitted documents. It’s a good practice to retain copies for your records. If any issues arise, having a thorough record can help resolve matters more quickly.

Finally, many people underestimate the importance of following up after sending in their applications. A quick phone call or email to the designated contacts can provide reassurance and possibly expedite the approval process. Taking these extra steps can save time and prevent further frustration.

Documents used along the form

When applying for tax exemption at Office Depot, you may need to submit several forms and documents alongside the Tax Exempt form. Each document serves a specific purpose in verifying eligibility for tax-exempt purchases. Below is a list of key documents that are often required.

- Tax Exemption Certificate: This is an official document issued by your state that proves your organization is exempt from paying sales tax. It typically includes your organization’s name, address, and tax ID number.

- Proof of Non-Profit Status: Non-profit entities must often provide documentation that establishes their non-profit status. This can include IRS Form 501(c)(3) or other relevant paperwork that confirms your organization’s tax-exempt status.

- Government Purchase Orders: For government entities, including municipalities and agencies, providing a purchase order can help validate tax-exempt transactions. This document outlines the specifics of the purchase, including item details and pricing.

- Business License: A business license may be necessary for certain organizations or by specific state requirements. This document proves that your entity is authorized to conduct business in your region.

Gathering these documents can streamline the tax exemption application process. Ensure all information is accurate to avoid delays. Following submission, there may be a waiting period for verification, so it’s best to prepare everything in advance.

Similar forms

IRS Form 5500 - This form is used by employee benefit plans to report information about their financial condition and operations. Similar to the Office Depot Tax Exempt form, it requires detailed information and documentation to be submitted for approval.

State Sales Tax Exemption Certificates - These certificates allow organizations to make tax-exempt purchases in their respective states. Like the Office Depot form, they require the entity's tax-exempt status and often require submission of a tax identification number.

Nonprofit Organization Application - Nonprofits often must submit a specific form to claim their tax-exempt status. Both this form and the Office Depot form ask for clear company information and supporting documents for verification.

Resale Certificate - A resale certificate is used by businesses to purchase goods tax-free which they will resell. This is akin to the Office Depot Tax Exempt form as both facilitate tax-free transactions under specific conditions.

Government Purchase Order - Similar to the Office Depot Tax Exempt form, a government purchase order allows government entities to acquire products or services without incurring sales tax, provided they present valid documentation.

Education Institution Tax Exemption Form - Schools and educational institutions can use this form to make tax-free purchases. It mirrors the Office Depot form in its requirements for documentation and entity verification.

501(c)(3) Application for Tax-Exempt Status - This application is submitted to the IRS for non-profit organizations seeking tax-exempt status. Similarly, both forms require extensive information about the organization and its intended use of funds.

Vendor Tax Exemption Forms - Vendors often provide their own forms for tax-exempt sales, needing specific purchaser information. Like the Office Depot form, these require documentation for the exemption to be valid.

Hospital Tax Exemption Application - Hospitals typically must fill out a specific form to gain tax-exempt status for certain expenses. This is similar in process and requirement to the Office Depot Tax Exempt form.

Dos and Don'ts

When filling out the Office Depot Tax Exempt form, it is important to adhere to certain guidelines. The following list provides helpful dos and don'ts to ensure successful completion and processing of your application.

- Do print all information clearly to avoid any misinterpretation.

- Do provide a valid copy of your tax-exemption certificate along with the application.

- Do ensure that all required information is complete and accurate before submission.

- Do include your email address to expedite communication regarding your application status.

- Don't leave any sections of the form blank; all fields must be filled out.

- Don't forget to double-check that the mailing address is correct if it differs from the company address.

- Don't send your application without confirming that you have attached the necessary documentation.

- Don't assume your application is complete without a final review.

Misconceptions

- Tax Exempt Means Free from All Taxes - Many believe that a tax-exempt status eliminates all taxes. In fact, tax-exempt status only applies to sales tax, not other types of taxes.

- All Customers Qualify for Tax Exemption - Not all customers qualify. Only specific organizations such as nonprofits, governmental entities, or resellers can apply for tax-exempt purchasing.

- One Application Covers All Purchases - An individual tax-exempt form must be submitted for each company location. Each physical location may require its own application.

- Emailing the Form is Sufficient - Some believe that simply emailing the form will suffice. However, a hard copy along with the tax-exemption certificate must be submitted for processing.

- Temporary Tax Exemption is Common - Once approved, tax-exempt status is not temporary. It remains effective as long as the organization's credentials do not change.

- Application Processing is Instant - Expect a waiting period after submission. It can take approximately two weeks to receive your permanent tax-exempt purchasing card.

- You Don't Need to Follow Up - Regular follow-ups may be necessary. If you haven’t received your card after two weeks, it’s wise to contact customer service for updates.

Key takeaways

The form requires clear printing of all information to ensure accuracy during processing.

It is essential to attach a copy of the relevant tax-exemption certificate when submitting the application.

Providing an email address can facilitate communication regarding the status of the tax-exempt processing.

Applicants can submit the form by mail, fax, or email to expedite processing.

After approval, the permanent tax-exempt card will be mailed within approximately two weeks.

Browse Other Templates

Heroin - Indicate your current age on the form.

Title Change - The form emphasizes the owner's responsibility to provide truthful information.