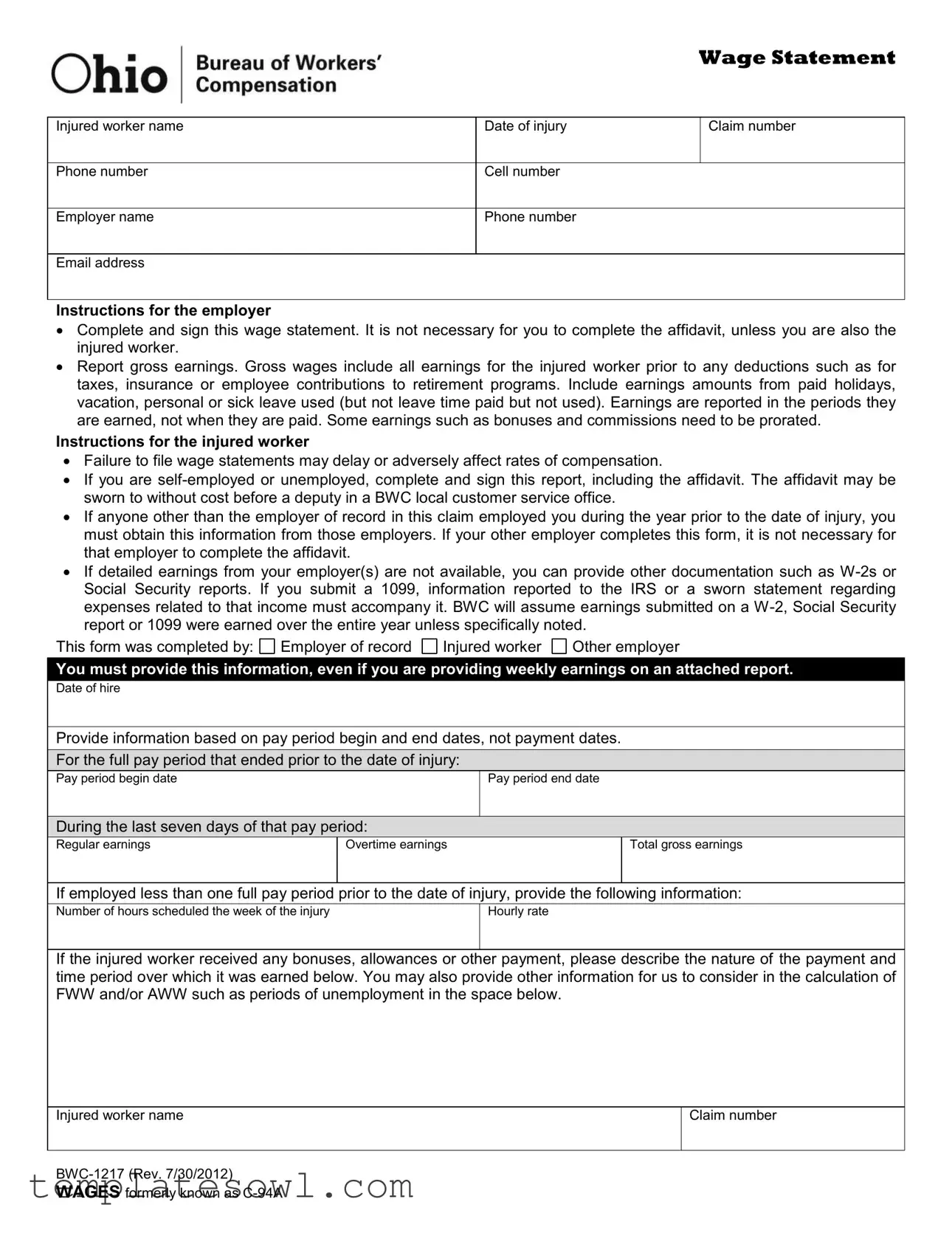

Fill Out Your Ohio Bwc 1217 Form

The Ohio BWC 1217 form, also known as the Wage Statement, plays a crucial role in the workers' compensation process for both injured workers and their employers. Designed to report an injured worker's earnings, it includes essential details such as the worker's name, claim number, and contact information, as well as the employer's name and contact details. The form instructs employers to report gross earnings, which encompass all income before any deductions, including vacation pay and commissions. Clear guidelines are provided for both employers and injured workers to ensure accurate completion. Employers must sign the form and report earnings specific to pay periods, while injured workers are reminded that failing to submit the wage statement can harm their compensation rates. If an injured worker has self-employment or multiple employers, they must account for all sources of income. The integrity of the information is paramount, and incorrect submissions can lead to serious penalties. Understanding the importance of the BWC 1217 form can help ensure that the workers' compensation process proceeds smoothly and fairly for all parties involved.

Ohio Bwc 1217 Example

|

|

Wage Statement |

|

|

|

Injured worker name |

Date of injury |

Claim number |

|

|

|

Phone number |

Cell number |

|

|

|

|

Employer name |

Phone number |

|

|

|

|

Email address |

|

|

|

|

|

Instructions for the employer

Complete and sign this wage statement. It is not necessary for you to complete the affidavit, unless you are also the injured worker.

Report gross earnings. Gross wages include all earnings for the injured worker prior to any deductions such as for taxes, insurance or employee contributions to retirement programs. Include earnings amounts from paid holidays, vacation, personal or sick leave used (but not leave time paid but not used). Earnings are reported in the periods they are earned, not when they are paid. Some earnings such as bonuses and commissions need to be prorated.

Instructions for the injured worker

Failure to file wage statements may delay or adversely affect rates of compensation.

If you are

If anyone other than the employer of record in this claim employed you during the year prior to the date of injury, you must obtain this information from those employers. If your other employer completes this form, it is not necessary for that employer to complete the affidavit.

If detailed earnings from your employer(s) are not available, you can provide other documentation such as

This form was completed by:

Employer of record

Injured worker

Other employer

You must provide this information, even if you are providing weekly earnings on an attached report.

You must provide this information, even if you are providing weekly earnings on an attached report.

Date of hire

Provide information based on pay period begin and end dates, not payment dates.

For the full pay period that ended prior to the date of injury:

For the full pay period that ended prior to the date of injury:

Pay period begin date

Pay period end date

During the last seven days of that pay period:

During the last seven days of that pay period:

Regular earnings

Overtime earnings

Total gross earnings

If employed less than one full pay period prior to the date of injury, provide the following information:

Number of hours scheduled the week of the injury

Hourly rate

If the injured worker received any bonuses, allowances or other payment, please describe the nature of the payment and time period over which it was earned below. You may also provide other information for us to consider in the calculation of FWW and/or AWW such as periods of unemployment in the space below.

Injured worker name

Claim number

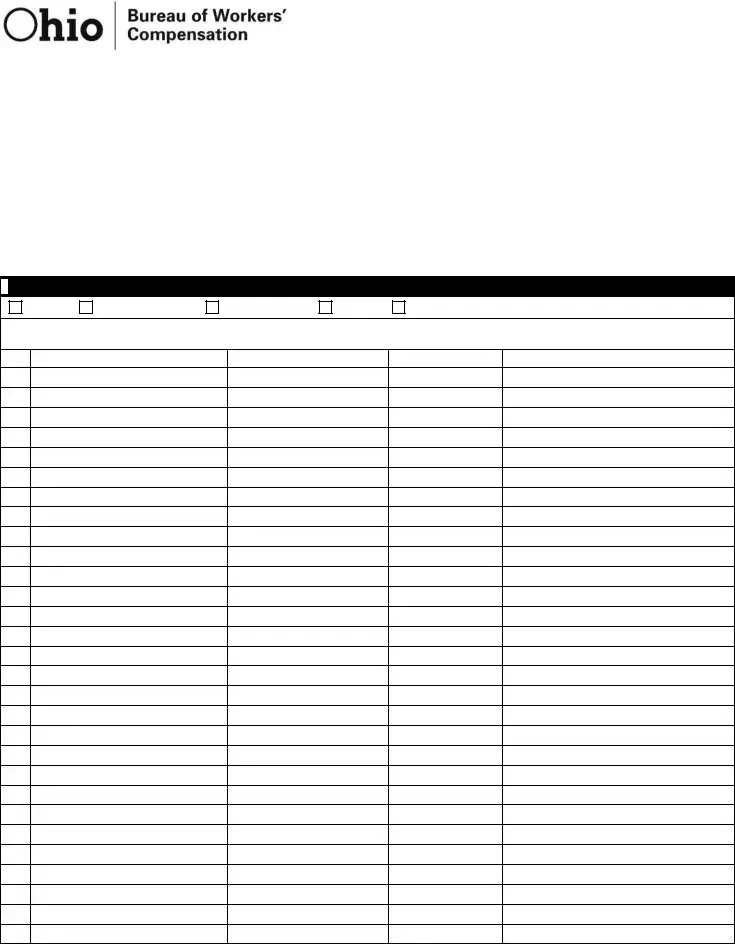

Wage Statement

You may submit earnings by providing a report that includes the required information as described below or by completing this worksheet.

Report the pay period dates, not the date payment was made.

Report any periods the injured worker did not work. If payment was made during those periods, report the amount and description of payment the injured worker received.

If the employee received an allowance for meals, lodging, tips, etc in addition to wages, report as other earnings with a description of the earnings. It is not necessary to report reimbursements made to the injured for travel, uniforms, etc. BWC does not consider reimbursements earnings for calculations of wages.

If the injured worker received a bonus during the reporting period, report as other earnings with a description of the earnings which includes the period of time over which it was earned.

Report earnings beginning with the full pay period that ended prior to the date of injury. When setting the

periods to report, you may adjust the reporting periods backward to line up the reporting time frames with the employer’s pay cycle. Do not report wages earned on or after the date of injury.

Payment is made (check one)

Payment is made (check one)

Weekly |

Every two weeks |

Twice a month |

Monthly |

Other |

Use the worksheet below, or attach other documentation to provide earnings information for the 52 weeks prior to the date of injury, beginning with the full pay period prior to the date of injury.

Pay period end date |

Gross amount earned |

Other earnings |

Description of exceptions |

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

WAGES formerly known as

Wage Statement

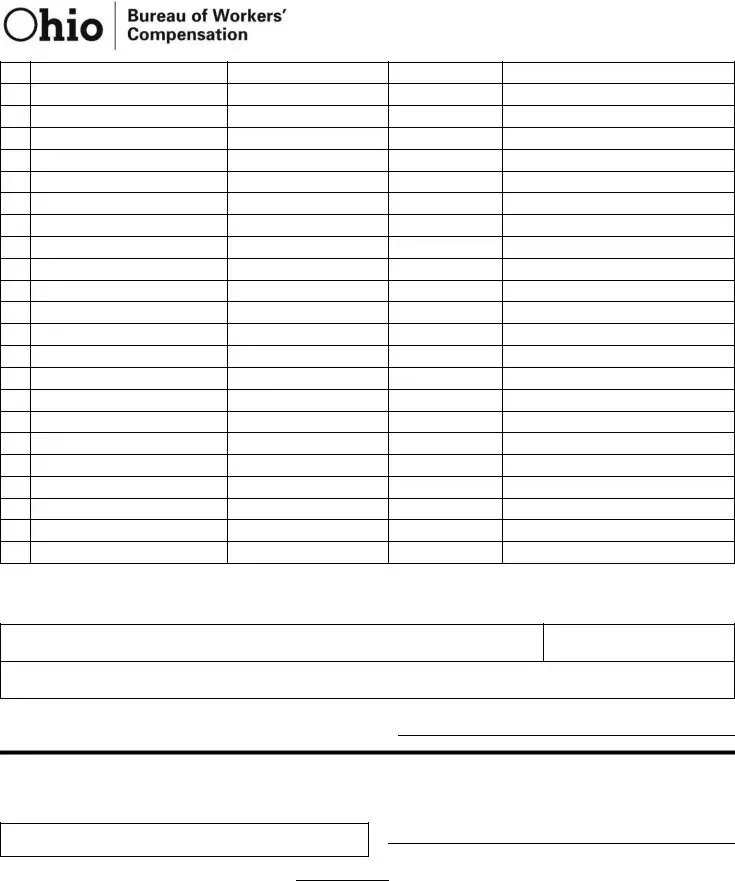

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

I certify the information provided is correct to the best of my knowledge. I am aware that any person who knowingly makes a false statement, misrepresentation, concealment of fact, or any other act of fraud to obtain payment as provided by the BWC or who knowingly accepts payment to which that person is not entitled, is subject to felony criminal prosecution and may, under appropriate criminal provisions, be punished by a fine, imprisonment or both.

Signature

Date

Employer name and title

X

Employer signature and title

Affidavit

State of Ohio, County of __________________________________ Social Security number: __________________________________

being first duly sworn, says that the entire earnings from ___________________ to ___________________ ; as listed above is correct.

If unable to write, mark must be witnessed by two persons.

Sworn to before me, and subscribed in my presence

Signature of applicant

day of |

. |

|

|

|

|

|

|

|

Official title

WAGES formerly known as

Form Characteristics

| Fact Name | Fact Detail |

|---|---|

| Purpose | The BWC-1217 form, also known as the Wage Statement, is used to report the earnings of an injured worker for compensation calculations. |

| Requirement | The form must be completed and signed by the employer. The injured worker may need to provide additional information if self-employed or unemployed. |

| Governing Law | The form adheres to the Ohio Revised Code, particularly Chapter 4123. This chapter covers workers' compensation regulations. |

| Gross Earnings | When filling out the form, report all gross earnings prior to deductions, including bonuses and vacation pay if applicable. |

| Filing Consequences | Failure to file the wage statement may lead to delays or issues in compensation rates for the injured worker. |

| Documentation | In the absence of detailed earnings, W-2s or other financial documents can be used to support reported earnings. |

| Affidavit Requirement | An affidavit must be completed if the employer is also the injured worker. This can be sworn in a BWC local office at no cost. |

| Reporting Period | Employers should report based on the pay period's start and end dates, not on the date payment was issued. |

| Criminal Penalties | Submitting false information can result in felony charges, including fines and imprisonment, as per Ohio law. |

Guidelines on Utilizing Ohio Bwc 1217

Completing the Ohio BWC 1217 form is essential for accurately reporting wage information. When filling out the form, ensure all necessary details are provided to prevent delays in the processing of compensation claims. Follow the steps outlined below to complete the process efficiently.

- Begin by entering the injured worker's name at the top of the form.

- Next, provide the date of injury and the claim number.

- Input the injured worker's phone number and cell number below their name.

- Fill out the employer's name and their contact information, including phone number and email address.

- Check the instructions section for employers. If you are the employer, complete and sign the wage statement. Do not complete the affidavit unless you are also the injured worker.

- Report the gross earnings. Make sure to include all earnings, including amounts from paid holidays and sick leave used. Note that earnings are reported based on when they were earned rather than paid.

- If the injured worker works less than a full pay period prior to the injury, provide the number of hours scheduled that week and the hourly rate.

- Detail any bonuses, allowances, or other payments received, providing a clear description and time period they were earned.

- Indicate the pay period dates and specify how often payments are made (e.g., weekly, bi-weekly, etc.).

- Fill in the earnings report for the previous 52 weeks. Start with the full pay period before the date of injury, reporting gross earnings and any exceptions.

- At the bottom, include a certification statement confirming the accuracy of the information provided. Sign and date the form.

- If an affidavit is needed, complete it and have it sworn to before an official.

After completing the Ohio BWC 1217 form, ensure all information is accurate and submitted promptly. This step is critical in facilitating the claims process and ensuring timely compensation for the injured worker.

What You Should Know About This Form

What is the Ohio BWC 1217 form?

The Ohio BWC 1217 form, also known as the Wage Statement, is used by employers to report the gross earnings of an injured worker. This information is essential for determining the rate of compensation the worker may receive after an injury. Accurate and timely completion of this form can impact the injured worker's compensation benefits.

Who is responsible for completing the BWC 1217 form?

The primary responsibility for completing the form lies with the employer of record for the injured worker. However, if the injured individual is self-employed or unemployed, they must complete and sign the form, including the affidavit. If other employers were involved, they may also need to provide information, though they do not need to complete the affidavit if they are solely providing wage details.

What information must be provided on the form?

The form requires several pieces of information, including the injured worker's name, date of injury, claim number, and details about the employer. Employers must report gross earnings, which include all wages before any deductions. This encompasses vacation pay, sick leave, and other forms of compensation received during the specified pay periods. Details about any bonuses or commissions earned must also be included.

What should an injured worker do if they do not have detailed earnings available?

If detailed earnings from the employer are not accessible, an injured worker can provide alternative documentation such as W-2 forms or Social Security reports. For 1099s, the worker must include additional information reported to the IRS or a sworn statement that details related expenses. It is important to indicate the timeframe during which the reported earnings were earned.

How does the form affect the compensation process?

Filing the BWC 1217 form is crucial for the timely processing of compensation claims. If wage statements are not filed, it may lead to delays or negative impacts on compensation rates. Injured workers are encouraged to ensure that their forms are submitted correctly and promptly to avoid any issues with benefit payments.

When should the earnings be reported?

Earnings reported on the BWC 1217 form should correspond to the periods they were earned, not the dates they were paid. Employers are required to report full pay periods that ended prior to the injury date. Any bonuses or allowances should be described along with their respective earning periods for accuracy in wage calculations.

What are the potential consequences of providing false information on the form?

Anyone who knowingly provides false information or misrepresents facts on the BWC 1217 form may face serious legal consequences. This includes potential felony criminal prosecution and penalties could include fines or imprisonment. Therefore, it is essential for both employers and injured workers to provide truthful and accurate information when completing the form.

Common mistakes

The process of filling out the Ohio BWC 1217 form can often be daunting, leading to common mistakes that could impede an injured worker’s compensation claims. Understanding these pitfalls is vital for both employers and injured workers. One major error occurs when individuals fail to accurately report gross earnings. Gross wages should encompass all earnings prior to any deductions. Many mistakenly report net income instead, which can lead to confusion and potential delays in processing claims. It is essential to remember that all income sources, including bonuses and commissions, need to be included and prorated as necessary.

Another frequent mistake is neglecting to provide detailed information about pay periods. The form requires reporting based on the pay period begin and end dates rather than the actual payment dates. This oversight can result in incorrect wage calculations. Furthermore, some individuals forget to include information about periods of unemployment or any hours worked during such times. It is crucial to provide a full picture of earnings, even if there were gaps in employment, to ensure accurate compensation rates.

Injured workers also commonly overlook the importance of submitting supporting documentation. If detailed earnings from employers are unavailable, alternative records such as W-2s or Social Security reports should be provided. Those who submit a 1099 form must accompany it with additional information to clarify income sources. Failing to include these documents might result in BWC assuming earnings over an entire year, which is not always accurate.

Employers sometimes misunderstand the requirement to include earnings descriptions. It's not enough to report the gross pay; additional context about any allowances, bonuses, or other earnings is necessary. If any earnings arose from non-standard arrangements, such as tips or commissions, they must be itemized correctly. Misreporting in this area can lead to significant issues in calculating the Average Weekly Wage (AWW) or the Fractional Weekly Wage (FWW).

Finally, a critical error is the omission of signatures and dates. Whether it is the employer or the injured worker completing the form, missing this essential step can result in the form being deemed invalid. A signature signifies that the information provided is accurate, and it should always be included with the date of completion. Double-checking for completeness before submission is vital in addressing these common oversights effectively.

Documents used along the form

The Ohio BWC 1217 Wage Statement form serves a crucial role in reporting the earnings of an injured worker. To ensure a seamless process in the compensation claims, several related forms and documents are often utilized alongside the BWC 1217. Each serves a specific purpose and aids in collecting the necessary information for accurate wage reporting and compensation determination.

- BWC Application for Benefits (BWC Form A): This form initiates the process for an injured worker to request compensation and outlines the details of the injury, including the type and severity. It must be completed and submitted promptly to establish a claim.

- Incident Report: This document details the circumstances surrounding the injury, including where, when, and how it occurred. It is typically completed by the employer and is vital for establishing the context of the claim.

- Medical Authorization Form: By completing this form, the injured worker gives permission for the release of medical records related to the injury. This information is necessary for the BWC to evaluate the claim and decide on the appropriate benefits.

- BWC Wage Verification (BWC Form C-24): Used to confirm the accuracy of wage information provided by the employer, this form seeks additional details about the worker's earnings and job duties, ensuring a thorough assessment of compensation.

- Self-Employment Disclosure Form: For those who are self-employed, this document captures details about business income and expenses related to the claim. It provides insight into earnings and potential compensation amounts for self-employed individuals.

- Affidavit of Earnings: In some cases, this sworn statement verifies the injured worker’s reported earnings, particularly if formal documentation like W-2s is not available. It emphasizes the need for accurate and truthful reporting of income.

Each of these forms and documents contributes to a comprehensive understanding of the injured worker’s situation, ensuring that the compensation process is both fair and efficient. Properly completing and submitting these documents can significantly impact the outcome of a claim.

Similar forms

- Ohio BWC Form C-94: Similar to the BWC 1217, this form also outlines the wage details of injured workers for claims. Both documents are used to report gross earnings and ensure accurate compensation calculations.

- Workers' Compensation Wage Verification Form: This document serves a similar purpose by verifying the earnings of injured employees. It collects information necessary for determining wage loss benefits similar to the BWC 1217.

- Wage Affidavit: Like the BWC 1217, this affidavit attests to the accuracy of wage information. It is a sworn statement that emphasizes the importance of honesty in reporting earnings.

- Form 1099: Although primarily used for reporting independent contractor earnings, this IRS form parallels the BWC 1217 in that it requires accurate income reporting, which may also affect workers' compensation calculations.

- W-2 Form: This tax document provides a summary of an employee's annual wages and taxes withheld. It works similarly to the BWC 1217 by giving a clear snapshot of earnings for the previous year of employment.

- Incident Report: While focused on the details of workplace injuries, it relates to the BWC 1217 by establishing a connection between the reported incidents and the compensation process, including wage information.

- Employer's Report of Injury: This document is used to report an employee's injury. It shares common goals with the BWC 1217 in documenting all necessary details affecting the worker's claims and compensations.

Dos and Don'ts

When filling out the Ohio BWC 1217 form, it's essential to follow guidelines to avoid mistakes. Here’s a list of things you should and shouldn’t do:

- Do: Provide complete and accurate information for the injured worker, including name, date of injury, and claim number.

- Do: Report gross earnings without deductions for taxes, insurance, or retirement contributions.

- Do: Include earnings from holidays, vacation, sick leave, and any additional payments like bonuses.

- Do: Use the correct pay period dates instead of payment dates.

- Do: Sign the form to verify the information is true to the best of your knowledge.

- Don't: Delay filing the wage statement, as this may affect compensation rates.

- Don't: Submit a form without necessary evidence if you’re self-employed or unemployed.

- Don't: Report wages earned after the date of injury.

- Don't: Include reimbursements for travel or uniforms as part of earnings.

- Don't: Forget to report periods when the injured worker did not work, along with any payments received during that time.

By following these guidelines, you can ensure a smoother process when completing the BWC 1217 form.

Misconceptions

The Ohio Bureau of Workers' Compensation (BWC) 1217 form, also known as the Wage Statement, is essential for injured workers seeking compensation. However, several misconceptions about this form can lead to confusion. Below are common misconceptions explained clearly.

- The form is only for employers. Many believe that only employers need to worry about this form. In reality, injured workers must also complete and sign the form, especially if they are self-employed or unemployed.

- Gross earnings refer to net pay. Some assume that gross earnings denote net pay after deductions. In fact, gross earnings must include all earnings before any deductions like taxes or retirement contributions.

- Submitting the form is optional. A misconception persists that filling out the wage statement is optional. Failure to file this wage statement can delay compensation rates for injured workers.

- Bonuses do not need to be reported. Many workers think bonuses and commissions are not necessary to report. However, these earnings should be included and may need to be prorated based on the reporting period.

- The form only covers one pay period. Some mistakenly believe the form is only relevant for the pay period immediately prior to injury. Instead, it requires a comprehensive report for the 52 weeks leading up to the injury.

- All employers need to fill out the affidavit. There's a belief that anyone completing the form must also complete an affidavit. This is not true; only certain employers need to complete the affidavit, particularly if they are also the employee's employer of record.

- Reimbursements count as earnings. Some individuals think that all payments, including reimbursements for travel or uniforms, should be reported as earnings. The BWC does not consider these items as earnings for compensation calculations.

- The submission of documentation is not needed. There is a belief that filling out the form alone is sufficient. However, when detailed earnings are unavailable, additional documentation like W-2s or Social Security reports should accompany the form to validate earnings.

Understanding these misconceptions can help injured workers and employers navigate the BWC 1217 form more effectively, ensuring compliance and timely compensation.

Key takeaways

- Completion is Required: Both employers and injured workers must complete the Ohio BWC 1217 form accurately to ensure timely processing of wage statements.

- Detail Gross Earnings: Report gross wages, which include all earnings before any deductions, such as taxes or insurance contributions.

- Timely Submission Matters: Delaying the submission of wage statements can adversely affect the compensation rates for the injured worker.

- Affidavit Requirements: If you are self-employed or unemployed, you must also complete the affidavit section of the form.

- Use Accurate Time Frames: Provide information based on the pay period start and end dates, rather than the dates when payments were made.

- Include Other Documentation: If detailed earnings are not available, you can submit alternative documents, such as W-2s or 1099s, to support your wage statement.

- Review for Accuracy: Before signing, ensure all provided information is accurate to avoid potential legal consequences for fraud or misrepresentation.

Browse Other Templates

Form 779 Oklahoma - It requests information about the service member, including name, rank, and military unit.

Un Geoscheme - Reporting requirements for corrective actions may be triggered by incidents involving USTs.

How to Be a Notary in Mississippi - The business telephone number must be included if you wish it to be published online.