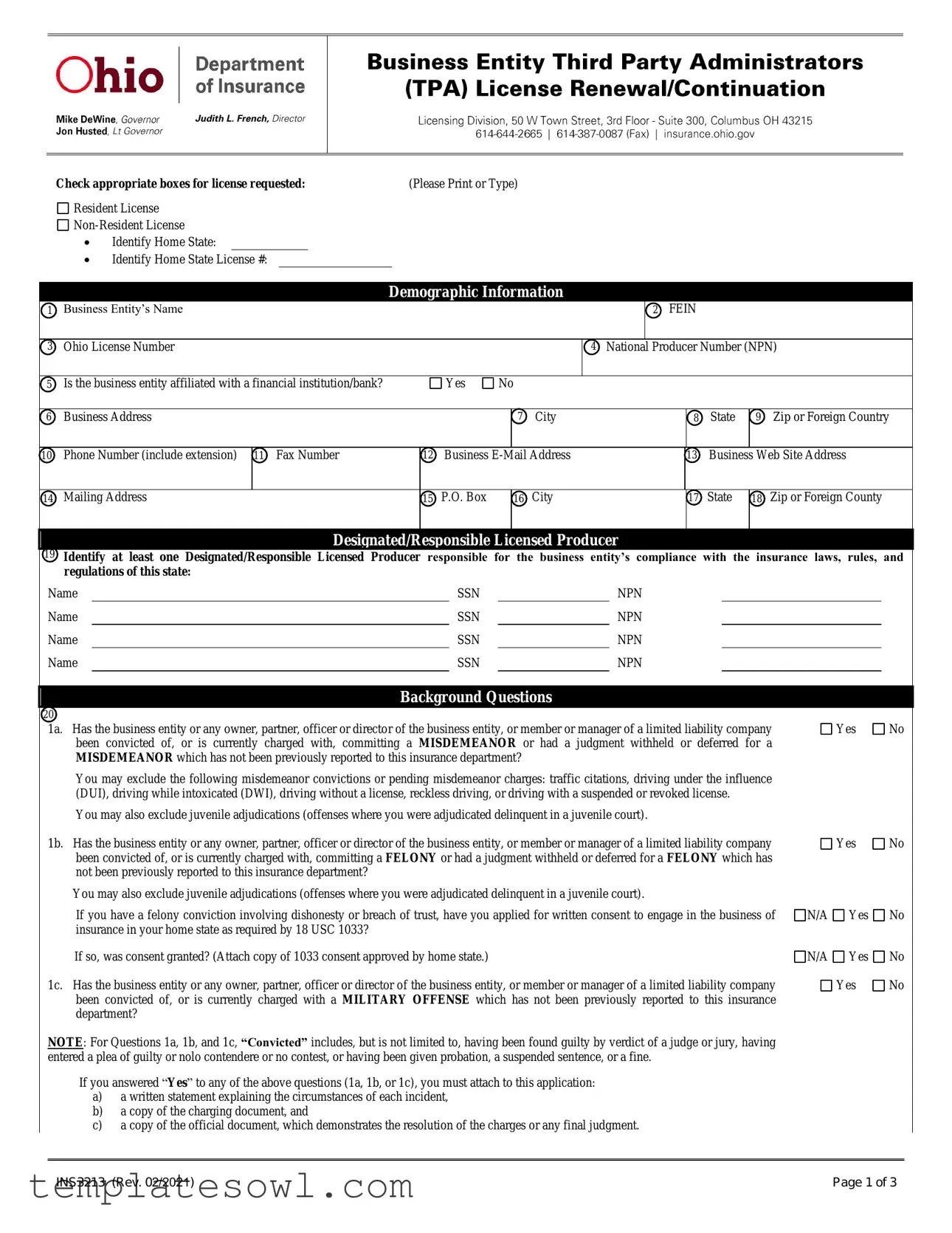

Fill Out Your Ohio Ins3213 Form

The Ohio Ins3213 form is a crucial document for various business entities seeking to engage in insurance-related activities within the state. This form facilitates the application process for licenses, specifically catering to third-party administrators (TPAs) that manage claims and employee benefit plans. Within its structured framework, applicants must provide essential information such as the type of license they are requesting—either resident or non-resident, and details about their business, including name, address, and identification numbers. Additionally, the form requires the disclosure of designated licensed producers who will ensure compliance with Ohio's insurance laws. Background questions delve into the history of the business entity and its key personnel, scrutinizing any past legal issues that might affect their eligibility. Furthermore, applicants must confirm they hold necessary fidelity bonds and professional liability insurance, ensuring they are prepared to handle their responsibilities effectively. This comprehensive approach ensures that the Ohio Department of Insurance can uphold its mandate of protecting consumers while supporting a transparent regulatory framework for insurance practices in the state.

Ohio Ins3213 Example

Judith L. French, Director

Check appropriate boxes for license requested: |

(Please Print or Type) |

Resident License

Resident License

Identify Home State:

Identify Home State License #:

Demographic Information

1Business Entity’s Name

2FEIN

3Ohio License Number

4National Producer Number (NPN)

5 Is the business entity affiliated with a financial institution/bank? |

Yes |

No |

6Business Address

7City

8State

9Zip or Foreign Country

10Phone Number (include extension)

11Fax Number

12Business

13Business Web Site Address

14Mailing Address

15P.O. Box

16City

17State

18Zip or Foreign County

Designated/Responsible Licensed Producer

19Identify at least one Designated/Responsible Licensed Producer responsible for the business entity’s compliance with the insurance laws, rules, and regulations of this state:

Name |

|

SSN |

|

NPN |

Name |

|

SSN |

|

NPN |

Name |

|

SSN |

|

NPN |

Name |

|

SSN |

|

NPN |

Background Questions

20 |

|

|

|

1a. Has the business entity or any owner, partner, officer or director of the business entity, or member or manager of a limited liability company |

|

Yes |

No |

been convicted of, or is currently charged with, committing a MISDEMEANOR or had a judgment withheld or deferred for a |

|

|

|

MISDEMEANOR which has not been previously reported to this insurance department? |

|

|

|

You may exclude the following misdemeanor convictions or pending misdemeanor charges: traffic citations, driving under the influence |

|

|

|

(DUI), driving while intoxicated (DWI), driving without a license, reckless driving, or driving with a suspended or revoked license. |

|

|

|

You may also exclude juvenile adjudications (offenses where you were adjudicated delinquent in a juvenile court). |

|

|

|

1b. Has the business entity or any owner, partner, officer or director of the business entity, or member or manager of a limited liability company |

|

Yes |

No |

been convicted of, or is currently charged with, committing a FELONY or had a judgment withheld or deferred for a FELONY which has |

|

|

|

not been previously reported to this insurance department? |

|

|

|

You may also exclude juvenile adjudications (offenses where you were adjudicated delinquent in a juvenile court). |

|

|

|

If you have a felony conviction involving dishonesty or breach of trust, have you applied for written consent to engage in the business of |

N/A |

Yes |

No |

insurance in your home state as required by 18 USC 1033? |

|

|

|

If so, was consent granted? (Attach copy of 1033 consent approved by home state.) |

N/A |

Yes |

No |

1c. Has the business entity or any owner, partner, officer or director of the business entity, or member or manager of a limited liability company |

|

Yes |

No |

been convicted of, or is currently charged with a MILITARY OFFENSE which has not been previously reported to this insurance |

|

|

|

department? |

|

|

|

NOTE: For Questions 1a, 1b, and 1c, “Convicted” includes, but is not limited to, having been found guilty by verdict of a judge or jury, having entered a plea of guilty or nolo contendere or no contest, or having been given probation, a suspended sentence, or a fine.

If you answered “Yes” to any of the above questions (1a, 1b, or 1c), you must attach to this application:

a)a written statement explaining the circumstances of each incident,

b)a copy of the charging document, and

c)a copy of the official document, which demonstrates the resolution of the charges or any final judgment.

INS3213 (Rev. 02/2021) |

Page 1 of 3 |

Ohio Department of InsuranceBUSINESS ENTITY TPA LICENSE RENEWAL/CONTINUATION

Background Questions (continued)

2. Has the business entity or any owner, partner, officer or director, or manager or member of a limited liability company, been named or |

Yes |

No |

involved as a party in an administrative proceeding regarding any professional or occupational license or registration, which has not been previously reported to this state?

“Involved” means having a license censured, suspended, revoked, canceled, terminated; or, being assessed a fine, placed on probation or surrendering a license to resolve an administrative action. “Involved” also means being named as a party to an administrative or arbitration proceeding, which is related to a professional or occupational license. “Involved” also means having a license application denied or the act of withdrawing an application to avoid a denial. You may exclude terminations due solely to noncompliance with continuing education requirements or failure to pay a renewal fee.

If “Yes”, you must attach to this application:

a)a written statement identifying the type of license; identifying all parties involved (including their percentage of ownership, if any) and explaining the circumstances of each incident,

b)a copy of the Notice of Hearing or other document that states the charges and allegations, and

c)a copy of the official document which demonstrates the resolution of the charges or any final judgment.

3. |

Does the TPA hold a fidelity bond or other comparable insurance policy coverage for all employees as required by R.C. 3959.11 and |

Yes |

No |

|

OAC |

|

|

|

If “Yes”, provide a copy of bond or insurance policy coverage. Make sure documentation includes the name of the carrier, policy number |

|

|

|

and effective dates. |

|

|

4. |

Does the TPA carry any type of professional liability and/or E&O insurance for TPA activities as required by ERISA? |

Yes |

No |

|

If “Yes”, provide proof of coverage or bond. Make sure documentation includes the name of the carrier, policy number and effective dates. |

|

|

5. |

Do you understand that any required bond, insurance policy, professional liability and E&O insurance policy must be maintained for |

Yes |

No |

|

the duration of the licensure period? |

|

|

6.Will the TPA’s records continue to be maintained in accordance with the requirements of OAC

|

answer to any of the questions below is “No”, then attach a letter stating how those records are maintained. |

|

|

||

|

a) |

Records reflect all administered transactions? |

|

Yes |

No |

|

b) |

Detailed preparation or journalizing and posting of books and records are maintained? |

Yes |

No |

|

|

c) |

Records are maintained throughout the term of the administration agreement? |

|

Yes |

No |

|

d) |

All disbursement records contain the information required by R.C. 3959.15 |

Yes |

No |

|

|

e) |

Annual reports are required to be filed with insurers and plan sponsors within 90 days of the end of each fiscal year of the plan? |

Yes |

No |

|

|

f) |

Return premiums or contributions are paid to insurer or plan sponsors within 30 days of receipt? |

Yes |

No |

|

7. |

Since the last application or renewal have any Excess Insurers |

Yes |

No |

||

|

administer claims for plans using their |

|

|

|

|

|

If “Yes”, provide the names and contact information for each one on a separate document. |

|

|

|

|

8. |

Since the last application or renewal has the TPA been licensed as a Managing General Agent? |

Yes |

No |

||

|

If “Yes”, provide a name of the States and license status on a separate document. |

|

|

|

|

9. |

What type(s) of claims will the TPA administer or plan to administer within the next year in this state? |

|

|

||

|

(Must check at least one option – Select all appropriate options that apply) |

|

|

|

|

|

|

Traditional |

Government |

|

|

|

|

Preferred Provider Org. (PPO) |

Fully insured employee benefit plans |

|

|

|

|

Prescription drug claims |

Provider billing processing |

|

|

|

|

Life insurance claims |

Medical/Managed care |

|

|

|

|

Disability insurance claims |

Other, attach description on a separate document. |

|

|

|

|

Dental claims |

|

|

|

10. How does the TPA handle plan sponsor and insurer funds? |

|

|

|

||

|

(Must check at least one option – Select all appropriate options that apply) |

|

|

|

|

|

|

Accounts are owned by the insurance company |

|

|

|

|

|

Plan sponsor owns accounts/TPA has check writing ability |

|

|

|

|

|

TPA has a separate fiduciary account(s) for plan sponsor & insurer funds |

|

|

|

|

|

OTHER: Attach a letter of explanation. |

|

|

|

11. Does the applicant understand that the TPA and its officers shall be responsible for the supervision of the actions of any and all personnel |

Yes |

No |

|||

|

and subcontractors who adjust or settle claims on behalf of the applicant according to OAC |

|

|

||

Applicant’s Signature:

Ohio Department of InsuranceBUSINESS ENTITY TPA LICENSE RENEWAL/CONTINUATION

Background Questions (continued)

|

12. |

Does the applicant understand that the TPA may not commingle among its personal assets, or draw against for its own purposes, any |

Yes |

No |

|

|

monies or contributions of a plan sponsor or plan participant according to OAC |

|

|

|

13. |

Have there been any changes of officers, directors, partners, members or trustees, or any change of shareholders or other owners or |

Yes |

No |

|

|

members holding 5% or more ownership in the TPA or change of business address that has not been previously reported to the Department |

|

|

|

|

as required by OAC |

|

|

|

|

If “Yes”, include the Department’s document for business entity changes. |

|

|

|

14. |

Is the TPA operating as a Pharmacy Benefit Manager (PBM)? |

Yes |

No |

|

|

|

||

|

|

|

|

|

Applicant’s Certification and Attestation

21

On behalf of the business entity or limited liability company, the undersigned owner, partner, officer or director of the business entity, or member or manager of a limited liability company, hereby certifies, under penalty of perjury, that:

1.All of the information submitted in this application and attachments is true and complete and I am aware that submitting false information or omitting pertinent or material information in connection with this application is grounds for license or registration revocation and may subject me and the business entity or limited liability company to civil or criminal penalties.

2.Unless provided otherwise by law or regulation of the jurisdiction, the business entity or limited liability company hereby designate the Commissioner, Director or Superintendent of Insurance, or other appropriate party in each jurisdiction for which this application is made to be its agent for service of process regarding all insurance matters in the respective jurisdiction and agree that service upon the Commissioner, Director or Superintendent of Insurance, or other appropriate party of that jurisdiction is of the same legal force and validity as personal service upon the business entity.

3.The business entity or limited liability company grants permission to the Commissioner, Director or Superintendent of Insurance, or other appropriate party in each jurisdiction for which this application is made to verify information with any federal, state or local government agency, current or former employer, or insurance company.

4.Every owner, partner, officer or director of the business entity, or member or manager of a limited liability company, either (a) does not have a current

5.I authorize the jurisdictions to give any information concerning me, as permitted by law, to any federal, state or municipal agency, or any other organization and I release the jurisdictions and any person acting on their behalf from any and all liability of whatever nature by reason of furnishing such information.

6.I acknowledge that I understand and will comply with the insurance laws and regulations of the jurisdictions to which I am applying for licensure/registration.

7.For

8.I hereby certify that upon request, I will furnish the jurisdiction(s) to which I am applying, certified copies of any documents attached to this application or requested by the jurisdiction(s).

Must be signed by an officer, director, or partner of the business entity, or member or manager if a limited liability company who has authority to act on behalf of the business entity:

Signature

Type or Print Name

Title

Address

Date

Social Security Number

City |

State |

Zip |

Application Attachments

22The following attachments must accompany the application; otherwise the application may be returned unprocessed or considered deficient.

1.

2.Provide proof of fidelity bond or other comparable insurance policy coverage for all employees as required by R.C. 3959.11 and OAC

3.Provide proof of professional liability insurance coverage and/or E&O insurance as required by ERISA. (Documentation must include the name of the carrier, policy number and effective dates.); and

4.If necessary, any required supporting details or documents.

Requirements for Licensure

23

1.All business entity TPA applicants must be registered with the Ohio Secretary of State.

2.

INS3213 (Rev. 02/2021) |

Page 3 of 3 |

Form Characteristics

| Fact Name | Detail |

|---|---|

| Form Purpose | The Ohio INS3213 form is used for business entity Third Party Administrator (TPA) license renewal or continuation. |

| Governing Laws | This form is governed by R.C. 3959.11 and rules set forth in OAC 3901-8-05. |

| License Types | Applicants can apply for either a Resident License or a Non-Resident License. |

| Required Attachments | A non-refundable fee of $300 along with proof of insurance is required to process the application. |

| Designated Producer | The form requires identification of at least one designated licensed producer for compliance. |

| Background Questions | Applicants must disclose any legal issues involving misdemeanors, felonies, or professional license problems. |

| Insurance Requirements | Provisions for fidelity bond and professional liability insurance coverage are mandatory under ERISA. |

| Compliance Acknowledgment | Signers certify understanding and compliance with Ohio's insurance laws and regulations. |

| Service of Process | Applicants designate the Commissioner as their agent for service of process for all insurance matters. |

Guidelines on Utilizing Ohio Ins3213

Filling out the Ohio Ins3213 form is an essential task for business entities seeking to maintain or renew their license. This process involves providing detailed information about the business, its owners, and its operational practices to ensure compliance with state regulations. Proper completion of the form not only helps in obtaining the necessary licenses but also ensures that all legal requirements are met.

- Begin by printing or typing the business entity's name in the designated space at the top of the form.

- Check the appropriate box to indicate whether you are applying for a Resident License or a Non-Resident License.

- Identify your home state and enter the home state license number, if applicable.

- Provide demographic information for the business entity:

- FEIN (Federal Employer Identification Number)

- Ohio license number

- National Producer Number (NPN)

- Business address, city, state, zip or foreign country, and phone number

- Fax number

- Business email address

- Business website address

- Mailing address and P.O. Box (if applicable), including city, state, and zip or foreign country

- Designate at least one licensed producer responsible for compliance:

- Enter the name, Social Security Number (SSN), and NPN for each designated producer.

- Answer the background questions thoroughly, indicating "Yes" or "No" as applicable, and provide any required attachments for "Yes" answers.

- If the business has a fidelity bond or comparable insurance policy, confirm its existence and attach proof if answering "Yes" to the question regarding fidelity bonds.

- Indicate the types of claims the TPA will administer in the next year by checking the relevant boxes.

- Confirm understanding of responsibilities regarding fund management and supervision of personnel involved in claims processes.

- Have the appropriate representative sign the application, ensuring that all provided information is true and complete, acknowledging the statements listed in the Applicant’s Certification and Attestation section.

- Prepare to submit required attachments, including a non-refundable fee of $300.00 made payable to the “State of Ohio Treasurer” and proof of insurance coverage.

What You Should Know About This Form

What is the Ohio Ins3213 form used for?

The Ohio Ins3213 form is primarily utilized for the application or renewal of a Third Party Administrator (TPA) business entity license in the state of Ohio. By completing this form, businesses can demonstrate their compliance with the state's insurance regulations and requirements. This form gathers necessary information about the business entity, including ownership, financial affiliations, and requisite insurance coverage.

Who needs to fill out the Ohio Ins3213 form?

Businesses operating as Third Party Administrators in Ohio are required to complete the Ohio Ins3213 form. This includes both resident and non-resident entities seeking to obtain or renew their license. It is essential for those responsible for managing or overseeing insurance claims or benefits on behalf of others to submit this form, ensuring they meet state laws.

What information do I need to provide on the form?

The Ohio Ins3213 form requires a range of information. Applicants must provide their business entity’s name, federal employer identification number (FEIN), Ohio license number, and national producer number (NPN), along with contact information. Additionally, details related to designated responsible licensed producers, such as their names and identification numbers, must be included. The form also asks about any legal background, such as previous convictions or administrative actions related to the business or its members.

Are there any fees associated with submitting the Ohio Ins3213 form?

Yes, there is a non-refundable application fee of $300. This payment must be made via check or money order, made payable to the “State of Ohio Treasurer.” This fee is important to note as failure to include it could result in the application being returned or deemed deficient.

What happens if I answer “Yes” to the background questions on the form?

If you answer “Yes” to any of the background questions regarding convictions, administrative proceedings, or similar circumstances, you must provide additional documentation. This includes a written explanation of the incidents, copies of relevant legal documents, and information demonstrating the resolutions of any associated charges. Providing complete and accurate information is crucial to avoid potential complications in the licensing process.

What documents must I attach to my application?

Along with the Ohio Ins3213 form, several important documents must accompany your application. These include proof of fidelity bond or insurance coverage for employees, proof of professional liability insurance or errors and omissions (E&O) insurance, and any necessary supporting documents that provide additional details about your business operations. Omitting these documents could delay or obstruct the processing of the application.

How long does the licensing process take after submitting the form?

The duration of the licensing process can vary. Generally, once the Ohio Ins3213 form and all required documents are submitted, the processing may take several weeks. Factors that can influence the timeline include the completeness of the application, the need for additional information, and the current volume of applications being processed by the Ohio Department of Insurance. It is advisable to plan ahead and submit the application well before licensing deadlines.

Common mistakes

Filling out the Ohio INS3213 form requires attention to detail. One common mistake people make is overlooking the home state identification. This part is crucial for both resident and non-resident license applications. Failing to clearly indicate the home state and its corresponding license number can delay the process or lead to outright rejection.

Another frequent error is neglecting the demographic information section. Many applicants rush through this, but critical information such as the business entity’s name, FEIN, and Ohio license number must be filled out accurately. Missing even one digit in these numbers can cause significant issues down the line.

Applicants often forget to provide accurate contact details—such as a valid phone and fax number. This information is essential as it allows the Department of Insurance to reach the business entity with any questions or required clarifications. Not listing a reliable email can also lead to missed communications, adding unnecessary hiccups to the application process.

Coupled with this, individuals sometimes fail to attach required documentation. Questions regarding misdemeanor and felony convictions require attachments like written explanations and copies of court documents. Missing these can render the application incomplete. Therefore, it’s vital to review every question and ensure that all necessary paperwork is attached before submitting.

The background questions section tends to be a minefield for errors. Some applicants mistakenly think they can skip answering questions simply because they’re not relevant. However, each question needs to be answered fully. Omitting a response can raise red flags and possibly suggest dishonesty, leading to denials or further inquiries.

Moreover, people often confuse the insurance requirements needed for the application. It's not enough to simply state that a business has insurance; applicants must provide credible proof, including names of insurance carriers, policy numbers, and effective dates. Without this proof, the application cannot move forward.

Finally, many applicants neglect the signature page or erroneously think someone else within the company can sign. This must be completed by an authorized individual, such as an owner or partner of the business entity. Not following this guideline can lead to the application being returned and may prolong the licensing process.

Documents used along the form

The Ohio Ins3213 form is utilized by business entities seeking to apply for or renew a Third Party Administrator (TPA) license. Various other documents and forms may be required alongside it to ensure compliance with state regulations. Each document serves a distinct purpose in the licensing process.

- Non-refundable Fee Payment: A check or money order made payable to the "State of Ohio Treasurer" for the application fee, typically amounting to $300. This payment is mandatory for processing the application.

- Proof of Fidelity Bond: Documentation that verifies the TPA has a fidelity bond or comparable insurance policy for employees, as required by R.C. 3959.11. The documentation must detail the insurance carrier, policy number, and effective dates.

- Proof of Professional Liability Insurance: Evidence showing that the TPA holds professional liability coverage or Errors and Omissions (E&O) insurance as mandated by ERISA. The relevant documenting details must include the carrier's name, policy number, and effective dates.

- Written Explanation of Background Issues: If there are any felony, misdemeanor, or military offense convictions against the entity or its governing members, a statement explaining the circumstances is required, along with supporting legal documents.

- Administrative Proceedings Documentation: Should the entity or its leaders have been involved in administrative actions regarding any professional or occupational licenses, additional documentation is necessary. This includes a statement identifying the nature of the proceedings and related paperwork.

- Detailed Records Maintenance Letter: A letter must be submitted if the organization cannot confirm that it maintains detailed records of all administered transactions, along with adherence to required record-keeping protocols.

- Change of Entity Information: If there have been any changes in ownership, officers, or business address that have not previously been reported to the department, supporting documentation must be provided.

- Annual Reports Confirmation: Documentation ensuring compliance with filing annual reports to insurers and plan sponsors as required by law, highlighting the timeliness of these submissions.

- Third-Party Contracts: If applicable, copies of any agreements with third parties that relate to the claims management responsibilities must be included to demonstrate compliance with regulatory standards.

It is essential for applicants to carefully prepare and submit these documents to avoid delays in the licensing process. Failure to provide the necessary information can result in the application being returned unprocessed or considered deficient.

Similar forms

Ohio Ins 3214 Form: This application is for individual producers seeking licensure. Like the Ins 3213 form, it requires personal and professional information, including background questions related to criminal history and professional conduct.

Ohio Ins 3215 Form: This document focuses on service entity licensing. Similar to Ins 3213, it emphasizes compliance with state insurance laws and requires details about affiliated producers and business practices.

Ohio Ins 3216 Form: This form pertains to agency licenses. Just as Ins 3213 asks for demographic information and compliance details, the Ins 3216 mandates similar disclosures related to agency operations and affiliations.

Ohio Ins 3217 Form: This application is for surplus lines brokers. Like the Ins 3213, it includes sections for background checks and legal compliance to ensure the broker meets state regulatory standards.

Ohio Ins 3218 Form: The business entity license application for product-specific agents shares many attributes with Ins 3213. Both forms inquire about affiliations, business addresses, and compliance with state regulations.

Ohio Ins 3219 Form: This applies to adjusters. Mirroring the Ins 3213, it includes sections for criminal history and professional conduct related to prior licensing, ensuring a thorough review for integrity.

Ohio Ins 3220 Form: This document targets license renewals for established entities, much like the Ins 3213. It requires confirmation of ongoing compliance with state laws and renewal fees.

Ohio Ins 3221 Form: Used for claims administrators, it echoes the Ins 3213 by collecting essential information regarding the administrator's operational details and adherence to regulations.

Ohio Ins 3222 Form: This is for third-party administrators in health insurance. Similar to the Ins 3213, it requires evidence of fidelity bonds and professional liability insurance to operate legally.

Ohio Ins 3223 Form: This application deals with managing general agents. Like the Ins 3213, it ensures agents demonstrate compliance through detailed personal and professional disclosures, reinforcing accountability in the industry.

Dos and Don'ts

When completing the Ohio Ins3213 form, there are several critical actions to take and avoid to ensure a smooth submission process. Below are guidelines focused on both practices to embrace and pitfalls to circumvent.

- Do use clear and legible handwriting if you are filling out the form by hand.

- Don’t leave any required fields blank; provide all necessary information to avoid delays.

- Do double-check all numbers, such as the Ohio License Number and National Producer Number (NPN), for accuracy.

- Don’t submit the application without enclosing the required non-refundable fee of $300.00.

- Do attach all necessary supporting documents, such as proof of fidelity bond or professional liability insurance.

- Don’t forget to include any explanation letters if answers to background questions require it.

- Do sign the application and include your title, ensuring that it’s signed by an authorized individual.

- Don’t provide false information or omit important details, as this can lead to legal repercussions.

Misconceptions

-

Misconception 1: The Ohio Ins3213 form is only for resident businesses.

In reality, both resident and non-resident businesses must complete this form. This ensures that all entities, regardless of their primary state of operation, are held to the same regulatory standards in Ohio.

-

Misconception 2: Completion of the form guarantees instant approval for a license.

Filling out the form accurately does not automatically lead to license approval. The Ohio Department of Insurance reviews all applications independently, and any discrepancies can delay or prevent issuance.

-

Misconception 3: There are no background checks related to the Ins3213 form.

This assumption is incorrect. The form includes sections that require disclosure of any criminal convictions or involvement in administrative proceedings, which are thoroughly evaluated as part of the licensing process.

-

Misconception 4: Only corporate entities apply using the Ins3213 form.

Another misconception is that only corporations use this form. In fact, partnerships, limited liability companies, and other business structures may also apply, reflecting the diverse business landscapes in Ohio.

-

Misconception 5: All required documents can be submitted after the form.

This misunderstanding can lead to complications. All necessary attachments, including proof of insurance, must be submitted along with the application; failure to do so may result in the application being deemed incomplete.

Key takeaways

Understanding the Ohio Ins3213 form is crucial for completing the application accurately. Here are key takeaways for filling out and using the form:

- Identify License Type: Indicate clearly if applying for a resident or non-resident license.

- Demographic Information: Provide all required demographic details, such as the business entity’s name, contact information, and relevant identification numbers.

- Designated Licensed Producer: Name at least one responsible licensed producer who will oversee compliance with state insurance laws.

- Background Questions: Answer all background questions honestly. Attach necessary documents if any "Yes" responses are provided.

- Fidelity Bond Requirement: Ensure that proof of a fidelity bond or comparable coverage is included, as required by Ohio law.

- Liability Insurance: Provide proof of professional liability and E&O insurance along with relevant policy details.

- Record Maintenance: Confirm understanding of ongoing record-keeping requirements in accordance with Ohio regulations.

- Application Fees: Include a non-refundable fee of $300 payable to the "State of Ohio Treasurer" with your application.

Review the entire form for completeness before submission to avoid delays. Properly managing these steps can facilitate a smoother application process.

Browse Other Templates

Ohio Drivers License - The affidavit reflects the commitment to safe driving education.

Proclamation Template Honoring Someone - It emphasizes the need for comprehensive mental health services in the community.