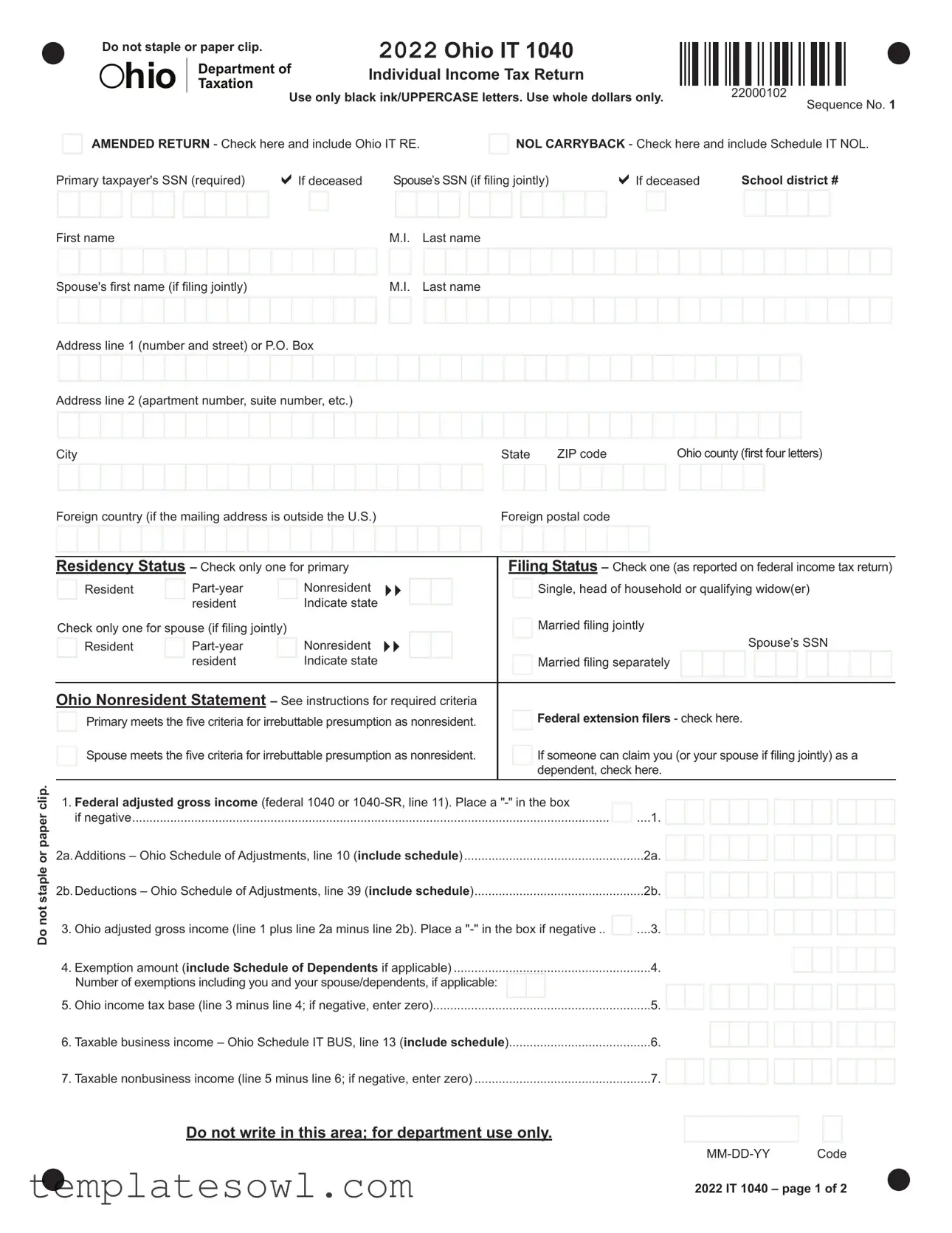

Fill Out Your Ohio It 1040Ez Form

The Ohio IT 1040EZ form is designed for individuals filing their income taxes in Ohio, and it simplifies the process for residents with straightforward tax situations. This form accommodates various filing statuses, such as single, married filing jointly, or head of household. When completing the IT 1040EZ, it's vital to use black ink and uppercase letters and to refrain from stapling or paper clipping the form. The document requires personal details like Social Security numbers, residency status, and income information. Taxpayers need to report their federal adjusted gross income, along with any additions or deductions specific to Ohio tax law. Calculating the Ohio adjusted gross income accurately is crucial, as this number directly impacts your taxable income and potential tax liability. Additionally, sections for nonrefundable credits, withholding, and payments made will ultimately determine if you owe taxes or are eligible for a refund. There’s also a specific focus on how to correctly report business income if applicable. Overall, the Ohio IT 1040EZ is a comprehensive yet straightforward tool tailored for easier tax filing in the Buckeye State.

Ohio It 1040Ez Example

Do not staple or paper clip. |

|

2022 Ohio IT 1040 |

||

hio |

|

Department of |

Individual Income Tax Return |

|

|

||||

|

Taxation |

Use only black ink/UPPERCASE letters. Use whole dollars only. |

||

|

||||

22000102

Sequence No. 1

AMENDED RETURN - Check here and include Ohio IT RE.

NOL CARRYBACK - Check here and include Schedule IT NOL.

Primary taxpayer's SSN (required) |

|

If deceased |

Spouse’s SSN (if filing jointly) |

|

|

If deceased |

School district # |

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Do not staple or paper clip.

First name |

|

|

|

|

|

|

|

M.I. |

Last name |

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Spouse's first name (if filing jointly) |

|

|

|

|

|

|

|

M.I. |

Last name |

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address line 1 (number and street) or P.O. Box

Address line 2 (apartment number, suite number, etc.)

City |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State |

|

ZIP code |

|

|

|

|

|

Ohio county (first four letters) |

|||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign country (if the mailing address is outside the U.S.) |

|

Foreign postal code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Residency Status – Check only one for primary |

|

|

Filing Status – Check one (as reported on federal income tax return) |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Resident |

|

|

|

Nonresident |

|

|

|

|

|

|

|

|

|

|

|

|

Single, head of household or qualifying widow(er) |

||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

resident |

|

|

Indicate state |

|

|

|

|

|

|

|

|

Married filing jointly |

||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Check only one for spouse (if filing jointly) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Resident |

|

|

|

|

Nonresident |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Spouse’s |

|

SSN |

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

resident |

|

|

|

Indicate state |

|

|

|

|

|

|

|

|

Married filing separately |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ohio Nonresident Statement – See instructions for required criteria |

|

|

|

|

|

Federal extension filers - check here. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Primary meets the five criteria for irrebuttable presumption as nonresident. |

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Spouse meets the five criteria for irrebuttable presumption as nonresident. |

|

|

|

|

|

If someone can claim you (or your spouse if filing jointly) as a |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

dependent, check here. |

||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||

|

1. Federal adjusted gross income (federal 1040 or |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||

|

if negative |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

.....1. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

2a.Additions – Ohio Schedule of Adjustments, line 10 (include schedule) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2a. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

2b.Deductions – Ohio Schedule of Adjustments, line 39 (include schedule) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2b. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

3. Ohio adjusted gross income (line 1 plus line 2a minus line 2b). Place a |

|

|

|

....3. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||

|

..........................................................4. Exemption amount (include Schedule of Dependents if applicable) |

|

|

|

|

|

|

|

|

|

|

|

|

|

4. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||

|

Number of exemptions including you and your spouse/dependents, if applicable: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

5. Ohio income tax base (line 3 minus line 4; if negative, enter zero) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

|

6. Taxable business income – Ohio Schedule IT BUS, line 13 (include schedule) |

|

|

|

|

|

|

|

|

|

6. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

|

7. Taxable nonbusiness income (line 5 minus line 6; if negative, enter zero) |

|

|

|

|

|

|

|

|

|

|

|

|

|

7. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

Do not write in this area; for department use only.

2022 IT 1040 – page 1 of 2

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2022 Ohio IT 1040 |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

SSN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Individual Income Tax Return |

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

7a.Amount from line 7 on page 1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7a. |

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

8a.Nonbusiness income tax liability on line 7a (see instructions for tax tables) |

|

|

|

|

|

8a. |

||||||||||||||||||||||||||||||||||

8b.Business income tax liability – Ohio Schedule IT BUS, line 14 (include schedule) |

|

|

|

|

|

8b. |

||||||||||||||||||||||||||||||||||

8c. Income tax liability before credits (line 8a plus line 8b) |

|

|

|

|

|

|

|

|

|

|

|

|

8c. |

|||||||||||||||||||||||||||

9. Ohio nonrefundable credits – Ohio Schedule of Credits, line 35 (include schedule) |

9. |

|||||||||||||||||||||||||||||||||||||||

10.Tax liability after nonrefundable credits (line 8c minus line 9; if negative, enter zero) |

10. |

|||||||||||||||||||||||||||||||||||||||

11. Interest penalty on underpayment of estimated tax (include Ohio IT/SD 2210) |

11. |

|||||||||||||||||||||||||||||||||||||||

12.Unpaid use tax (see instructions) |

............................................................................................................................ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12. |

||||||||||||||||||||||

13.Total Ohio tax liability before withholding or estimated payments (add lines 10, 11 and 12) |

13. |

|||||||||||||||||||||||||||||||||||||||

14.Ohio income tax withheld – Schedule of Ohio Withholding, part A, line 1 (include schedule and |

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||

|

|

income statements) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14. |

|||||||||||||||||||||

15.Estimated and extension payments (from Ohio IT 1040ES and IT 40P), and credit carryforward |

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||

|

|

from last year's return |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15. |

|||||||||||||||||||||

16.Refundable credits – Ohio Schedule of Credits, line 41 (include schedule) |

16. |

|||||||||||||||||||||||||||||||||||||||

17. Amended return only – amount previously paid with original and/or amended return |

17. |

|||||||||||||||||||||||||||||||||||||||

18. Total Ohio tax payments (add lines 14, 15, 16 and 17) |

|

|

|

|

|

|

|

18. |

||||||||||||||||||||||||||||||||

19.Amended return only – overpayment previously requested on original and/or amended return |

19. |

|||||||||||||||||||||||||||||||||||||||

20.Line 18 minus line 19. Place a |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

......20. |

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If line 20 is MORE THAN line 13, skip to line 24. OTHERWISE, continue to line 21. |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

21.Tax due (line 13 minus line 20). If line 20 is negative, ignore the |

21. |

|||||||||||||||||||||||||||||||||||||||

22.Interest due on late payment of tax (see instructions) |

|

|

|

|

|

|

|

22. |

||||||||||||||||||||||||||||||||

23.TOTAL AMOUNT DUE (line 21 plus line 22). Include Ohio IT 40P (if original return) or |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

|

IT 40XP (if amended return) and make check payable to “Ohio Treasurer of State” |

AMOUNT DUE23. |

|||||||||||||||||||||||||||||||||||||

24.Overpayment (line 20 minus line 13) |

|

|

|

|

|

|

|

24. |

||||||||||||||||||||||||||||||||

25. Original return only – portion of line 24 carried forward to next year’s tax liability |

25. |

|||||||||||||||||||||||||||||||||||||||

26. Original return only – portion of line 24 you wish to donate: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

a. Wildlife Species |

|

b. Military Injury Relief |

c. Ohio History Fund |

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total....26g. |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

d. Nature Preserves/Scenic Rivers |

|

e. Breast/Cervical Cancer |

f. Wishes for Sick Children |

|||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||

22000202 Sequence No. 2

27. REFUND (line 24 minus lines 25 and 26g).............................................................................YOUR REFUND27.

|

Sign Here (required): I have read this return. Under penalties of perjury, I declare that, to the best of my knowledge |

If your refund is $1.00 or less, no refund will be issued. |

|||||||||||||||||

|

and belief, the return and all enclosures are true, correct and complete. |

If you owe $1.00 or less, no payment is necessary. |

|||||||||||||||||

Primary signature |

|

|

Phone number |

|

|

NO Payment Included – Mail to: |

|||||||||||||

|

Spouse’s signature |

|

Date |

Ohio Department of Taxation |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

P.O. Box 2679 |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

Check here to authorize your preparer to discuss this return with the Department. |

Columbus, OH |

||||||||||||||||

|

Preparer's printed name |

|

Phone number |

Payment Included – Mail to: |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ohio Department of Taxation |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

P.O. Box 2057 |

|

|

|

|

|

Preparer's TIN (PTIN) |

P |

|

|

|

|

|

|

|

|

|

Columbus, OH |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2022 IT 1040 – page 2 of 2

2022 Ohio Schedule

of Adjustments

Use only black ink. Use whole dollars only.

Primary taxpayer’s SSN

22000302

Sequence No. 3

|

Additions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Only add the following amounts if they are not included on Ohio IT 1040, line 1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

1. |

|

|

|

|

|

|

|

|

|

|

|

||||

2. |

Ohio |

2. |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

||||||

3. |

Ohio 529 plan funds used for |

3. |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

||||||

4. |

Losses from sale or disposition of Ohio public obligations |

4. |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

||||||

5. |

Nonmedical withdrawals from a medical savings account |

5. |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

||||||

6. |

Reimbursement of expenses previously deducted on an Ohio income tax return |

6. |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

||||||

Federal |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7. |

Internal Revenue Code 168(k) and 179 depreciation expense addback |

7. |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

||||||

8. |

Exempt federal interest and dividends subject to state taxation |

8. |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

||||||

9. |

Federal conformity additions |

9. |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

||||||

10. |

Total additions (add lines 1 through 9 ONLY). Enter here and on Ohio IT 1040, line 2a |

10. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deductions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Only deduct the following amounts if they are included on Ohio IT 1040, line 1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11. |

Business income deduction – Ohio Schedule IT BUS, line 11 |

11. |

|

|

|

|

|

|

|

|

|

|

|

|||

12. |

Employee compensation earned in Ohio by residents of neighboring states |

12. |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

||||||

13. |

Taxable refunds, credits, or offsets of state and local income taxes (federal 1040, Schedule 1, line 1) |

13. |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

||||||

14. |

Taxable Social Security benefits (federal 1040 and |

14. |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

||||||

15. |

Certain railroad benefits |

15. |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

||||||

16. |

Interest income from Ohio public obligations and purchase obligations; gains from the |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

disposition of Ohio public obligations; or income from a transfer agreement |

16. |

|

|

|

|

|

|

|

|

|

|

|

|||

17. |

Amounts contributed to an Ohio county's individual development account program |

17. |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

||||||

18. |

Amounts contributed to a STABLE account: Ohio's ABLE plan |

18. |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

||||||

19. |

Income earned in Ohio by a qualifying |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

work conducted during a disaster response period |

19. |

|

|

|

|

|

|

|

|

|

|

|

|||

Federal |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20. |

Federal interest and dividends exempt from state taxation |

20. |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

||||||

21. |

Deduction of prior year 168(k) and 179 depreciation addbacks |

21. |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

||||||

22. |

Refund or reimbursements from the federal 1040, Schedule 1, line 8z for federal |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

itemized deductions claimed on a prior year return |

22. |

|

|

|

|

|

|

|

|

|

|

|

|||

2022 Schedule of Adjustments – page 1 of 2

2022 Ohio Schedule

of Adjustments

Primary taxpayer’s SSN

23. |

Repayment of income reported in a prior year |

|

|

|

|

|

|

|

|

|

|

|

|

|

23. |

||

|

|

|

|

|

|

|

|

|

|

|

|

||||||

24. |

Wage expense not deducted based on the federal work opportunity tax credit |

24. |

|||||||||||||||

25. |

Federal conformity deductions |

25. |

|||||||||||||||

Uniformed Services |

|

|

|

||||||||||||||

26. |

Military pay received by Ohio residents while stationed outside Ohio |

26. |

|||||||||||||||

27. |

Compensation earned by nonresident military servicemembers and their civilian spouses |

27. |

|||||||||||||||

28. |

Uniformed services retirement income |

28. |

|||||||||||||||

29. |

Military injury relief fund grants and veteran’s disability severance payments |

29. |

|||||||||||||||

30. |

Certain Ohio National Guard reimbursements and benefits |

30. |

|||||||||||||||

Education |

|

|

|

||||||||||||||

31. |

Amounts contributed to Ohio CollegeAdvantage: Ohio’s 529 Plan |

31. |

|||||||||||||||

32. |

Pell/Ohio College Opportunity taxable grant amounts used to pay room and board |

32. |

|||||||||||||||

33. |

Ohio educator expenses in excess of federal deduction |

33. |

|||||||||||||||

Medical |

|

|

|

||||||||||||||

34. |

Disability benefits |

34. |

|||||||||||||||

35. |

Survivor benefits |

35. |

|||||||||||||||

36. |

Unreimbursed medical and health care expenses (see instructions for worksheet; include a copy) |

...................36. |

|||||||||||||||

37. |

Medical savings account contributions/earnings (see instructions for worksheet; include a copy) |

37. |

|||||||||||||||

38. |

Qualified organ donor expenses |

38. |

|||||||||||||||

39. |

Total deductions (add lines 11 through 38 ONLY). Enter here and on Ohio IT 1040, line 2b |

39. |

|

|

|||||||||||||

|

|

||||||||||||||||

22000402

Sequence No. 4

2022 Schedule of Adjustments – page 2 of 2

2022 Ohio Schedule IT BUS |

|

|

Business Income |

|

|

Use only black ink/UPPERCASE letters. |

22260102 |

|

Primary taxpayer’s SSN |

||

|

Sequence No. 5

Enter all business income that you (and your spouse, if filing jointly) received during the tax year on this schedule. Enter only those amounts that are included in your federal adjusted gross income. Only one IT BUS should be used for each return filed. See R.C. 5747.01(B). Use whole dollars only.

Part 1 – Business Income From IRS Schedules

Note: Do not include amounts listed on the IRS schedules below that are nonbusiness income.

See R.C. 5747.01(C). If the amount on a line is negative, place a

1. |

Schedule B – Interest and Ordinary Dividends |

1. |

||

2. |

Schedule C – Net Profit or Loss From Business (Sole Proprietorship) |

|

|

|

|

....2. |

|||

|

||||

3. |

Schedule D – Capital Gains and Losses |

|

|

|

|

....3. |

|||

4. |

Schedule E – Supplemental Income and Loss |

|

|

....4. |

|

|

|||

5. |

Guaranteed payments or compensation from a |

|

|

|

|

or indirect owner |

5. |

||

6. |

Schedule F – Net Profit or Loss From Farming |

|

|

|

|

.... 6. |

|||

|

||||

7. |

Other business income or loss not reported above (e.g. form 4797 amounts) |

|

....7. |

|

|

||||

8. |

Total business income (add lines 1 through 7) |

|

....8. |

|

|

||||

Part 2 – Business Income Deduction |

|

|

||

9. |

Enter the lesser of line 8 above or Ohio IT 1040, line 1. If negative, enter zero; |

|

|

|

|

stop here and do not complete Part 3 |

9. |

||

10. |

Enter $250,000 if filing status is single or married filing jointly; OR |

|

|

|

|

Enter $125,000 if filing status is married filing separately |

10. |

||

11. |

Enter the lesser of line 9 or line 10. Enter here and on Ohio Schedule of Adjustments, line 11 |

11. |

||

Part 3 – Taxable Business Income

Note: If Ohio IT 1040, line 5 is zero, do not complete Part 3.

12. |

Line 9 minus line 11 |

12. |

|

|

|

|

|

|

|

|

|

|

|

|

13. |

Taxable business income (enter the lesser of line 12 above or Ohio IT 1040, line 5). Enter. |

here and |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

on Ohio IT 1040, line 6 |

13. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14. |

Business income tax liability – multiply line 13 by 3% (.03). Enter here and on Ohio IT 1040, line 8b |

14. |

|

|

|

|

|

|

|

|

. |

|

|

|

Do not write in this area; for department use only.

2022 Schedule IT BUS – page 1 of 2

2022 Ohio Schedule IT BUS

Business Income

Primary taxpayer’s SSN

Part 4 – Business Sources

22260202

Sequence No. 6

List all sources of business income, with Ohio sources listed first. Also separately list your ownership percentage and/or your spouse’s ownership percent- age (if filing jointly). If necessary, complete additional copies of this page and include with your return.

1. FEIN / SSNPrimary ownership

.

Business name

%

Spouse’s ownership

|

|

|

. |

|

|

% |

|

|

|

|

|

|

2. FEIN / SSN |

Primary ownership |

Spouse’s ownership |

.

Business name

%

.

%

3. FEIN / SSN |

Primary ownership |

Spouse’s ownership |

.

Business name

%

.

%

4. FEIN / SSN |

Primary ownership |

Spouse’s ownership |

.

Business name

%

.

%

5. FEIN / SSN |

Primary ownership |

Spouse’s ownership |

.

Business name

%

.

%

6. FEIN / SSN |

Primary ownership |

Spouse’s ownership |

.

Business name

%

.

%

7. FEIN / SSN |

Primary ownership |

Spouse’s ownership |

.

Business name

%

.

%

8. FEIN / SSN |

Primary ownership |

Spouse’s ownership |

.

Business name

%

.

%

2022 Schedule IT BUS – page 2 of 2

hio

hio

Department of |

2022 Ohio Schedule of Credits |

||||||||||||

Taxation |

Use only black ink. Use whole dollars only. |

||||||||||||

|

|

|

Primary taxpayer’s SSN |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

22280102 Sequence No. 7

Many of these credits must be calculated using a worksheet and/or be supported by additional required documentation. See the instructions for worksheets and information on supporting documentation.

Nonrefundable Credits

1. |

Tax liability before credits (from Ohio IT 1040, line 8c) |

1. |

|||

2. |

Retirement income credit (include |

2. |

|||

3. |

Lump sum retirement credit (include a copy of the worksheet and |

3. |

|||

4. |

Senior citizen credit (must be 65 or older to claim this credit) |

4. |

|||

5. |

Lump sum distribution credit (include a copy of the worksheet and |

5. |

|||

6. |

Child care & dependent care credit (include a copy of the worksheet) |

6. |

|||

7. |

Displaced worker training credit (include a copy of the worksheet and all required documentation) |

7. |

|||

8. |

Campaign contribution credit for Ohio statewide office or General Assembly |

8. |

|||

9. |

|

|

|

9. |

|

10. |

Total (add lines 2 through 9) |

|

|

|

10. |

11. |

Tax less credits (line 1 minus line 10; if negative, enter zero) |

11. |

|||

12. |

Joint filing credit (see instructions for table). |

|

|

% times line 11, up to $650 |

12. |

|

|

||||

13. |

Earned income credit |

|

|

|

13. |

|

|

|

|||

14. |

Home school expenses credit (include copies of all required documentation) |

14. |

|||

15. |

Scholarship donation credit (include copies of all required documentation) |

15. |

|||

16. |

Nonchartered, nonpublic school tuition credit (include copies of all required documentation) |

16. |

|||

17. |

Vocational job credit (include a copy of the credit certificate) |

17. |

|||

18. |

Ohio adoption credit |

|

|

|

18. |

19. |

Nonrefundable job retention credit (include a copy of the credit certificate) |

19. |

|||

20. |

Credit for eligible new employees in an enterprise zone (include a copy of the credit certificate) |

20. |

|||

21. Grape production credit |

|

|

|

21. |

|

22. |

InvestOhio credit (include a copy of the credit certificate) |

22. |

|||

23. |

Lead abatement credit (include a copy of the credit certificate) |

23. |

|||

24. |

Opportunity zone investment credit (include a copy of the credit certificate) |

24. |

|||

Do not write in this area; for department use only.

2022 Schedule of Credits – page 1 of 2

|

2022 Ohio Schedule of Credits |

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|||||||||||||

|

|

|

Primary taxpayer’s SSN |

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

25. |

Technology investment credit carryforward (include a copy of the credit certificate) |

25. |

|||||||||||||||||

26. |

Enterprise zone day care & training credits (include a copy of the credit certificate) |

26. |

|||||||||||||||||

27. |

Research & development credit (include a copy of the credit certificate) |

27. |

|||||||||||||||||

28. |

Nonrefundable Ohio historic preservation credit (include a copy of the credit certificate) |

28. |

|||||||||||||||||

29. |

Total (add lines 12 through 28) |

29. |

|||||||||||||||||

30. |

Tax less additional credits (line 11 minus line 29; if negative, enter zero) |

30. |

|||||||||||||||||

22280202

Sequence No. 8

Nonresident Credit

Dates of Ohio residency

to

Other state of residency

31. |

Nonresident Portion of Ohio adjusted gross income - |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Ohio IT NRC Section I, line 18 (include a copy) |

31. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

32. |

Ohio adjusted gross income (Ohio IT 1040, line 3) |

32. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

33a. |

Divide line 31 by line 32 (four decimals; do not round; |

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

if greater than 1, enter 1.0000) |

|

|

|

|

|

33a. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

33. |

Nonresident credit (line 30 times line 33a) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

33. |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Resident Credit |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

34. |

Resident credit – Ohio IT RC, line 7 (include a copy) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

34. |

|

|

|

|

|

|

|

|

|

|

|

||

35. |

Total nonrefundable credits (add lines 10, 29, 33 and 34; enter here and on Ohio IT 1040, line 9) |

35. |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Refundable Credits |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

36. |

Refundable Ohio historic preservation credit (include a copy of the credit certificate) |

36. |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

37. |

Refundable job creation credit & job retention credit (include a copy of the credit certificate) |

37. |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

38. |

|

|

|

|

|

|

|

38. |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

39. |

Motion picture & Broadway theatrical production credit (include a copy of the credit certificate) |

39. |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

40. |

Venture capital credit (include a copy of the credit certificate) |

|

|

|

|

|

|

|

40. |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

41. |

Total refundable credits (add lines 36 through 40; enter here and on Ohio IT 1040, line 16) |

41. |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

2022 Schedule of Credits – page 2 of 2

2022 Ohio Schedule

of Dependents

Use only black ink/UPPERCASE letters.

Primary taxpayer's SSN

22230102

Sequence No. 9

Do not list the primary filer and/or spouse (if filing jointly) as dependents on this schedule. Use this schedule to claim dependents. If you have more than 15 dependents, complete additional copies of this schedule and include them with your income tax return. Abbreviate the “Dependent’s relationship to

you” if necessary. |

|

|

1. Dependent’s SSN |

Dependent's date of birth |

Dependent’s relationship to you |

-

-

Dependent’s first name |

|

|

|

|

|

|

|

|

|

M.I. Dependent's last name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. Dependent’s SSN |

|

|

|

|

Dependent's date of birth |

|

|

|

Dependent’s relationship to you |

|||||||||||||||||||||||||||||

-

-

|

Dependent’s first name |

|

|

|

|

|

|

|

|

|

|

|

|

M.I. |

Dependent's last name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

3. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dependent’s SSN |

|

|

|

|

Dependent's date of birth |

|

|

|

Dependent’s relationship to you |

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Dependent’s first name |

|

|

|

|

|

|

|

|

|

|

|

|

M.I. |

Dependent's last name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. |

Dependent’s SSN |

|

|

|

|

Dependent's date of birth |

|

|

|

Dependent’s relationship to you |

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||

-

-

|

Dependent’s first name |

|

|

|

|

|

|

|

|

|

|

|

|

M.I. |

Dependent's last name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

5. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dependent’s SSN |

|

|

|

|

Dependent's date of birth |

|

|

|

Dependent’s relationship to you |

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Dependent’s first name |

|

|

|

|

|

|

|

|

|

|

|

|

M.I. |

Dependent's last name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6. |

Dependent’s SSN |

|

|

|

|

Dependent's date of birth |

|

|

|

|

Dependent’s relationship to you |

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||

-

-

Dependent’s first name |

|

|

|

|

|

|

|

|

|

M.I. Dependent's last name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7. Dependent’s SSN |

|

|

|

|

Dependent's date of birth |

|

|

|

Dependent’s relationship to you |

|||||||||||||||||||||||||||||

-

Dependent’s first name

-

M.I. Dependent's last name

Do not write in this area; for department use only.

2022 Schedule of Dependents – page 1 of 2

2022 Ohio Schedule

of Dependents

22230202

Primary taxpayer's SSN

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sequence No. 10 |

||||

8. Dependent’s SSN |

|

|

|

|

|

|

Dependent's date of birth |

|

|

|

|

|

|

Dependent’s relationship to you |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

Dependent’s first name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

M.I. |

|

Dependent's last name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9. Dependent’s SSN |

|

|

|

|

|

Dependent's date of birth |

|

|

|

|

|

Dependent’s relationship to you |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|