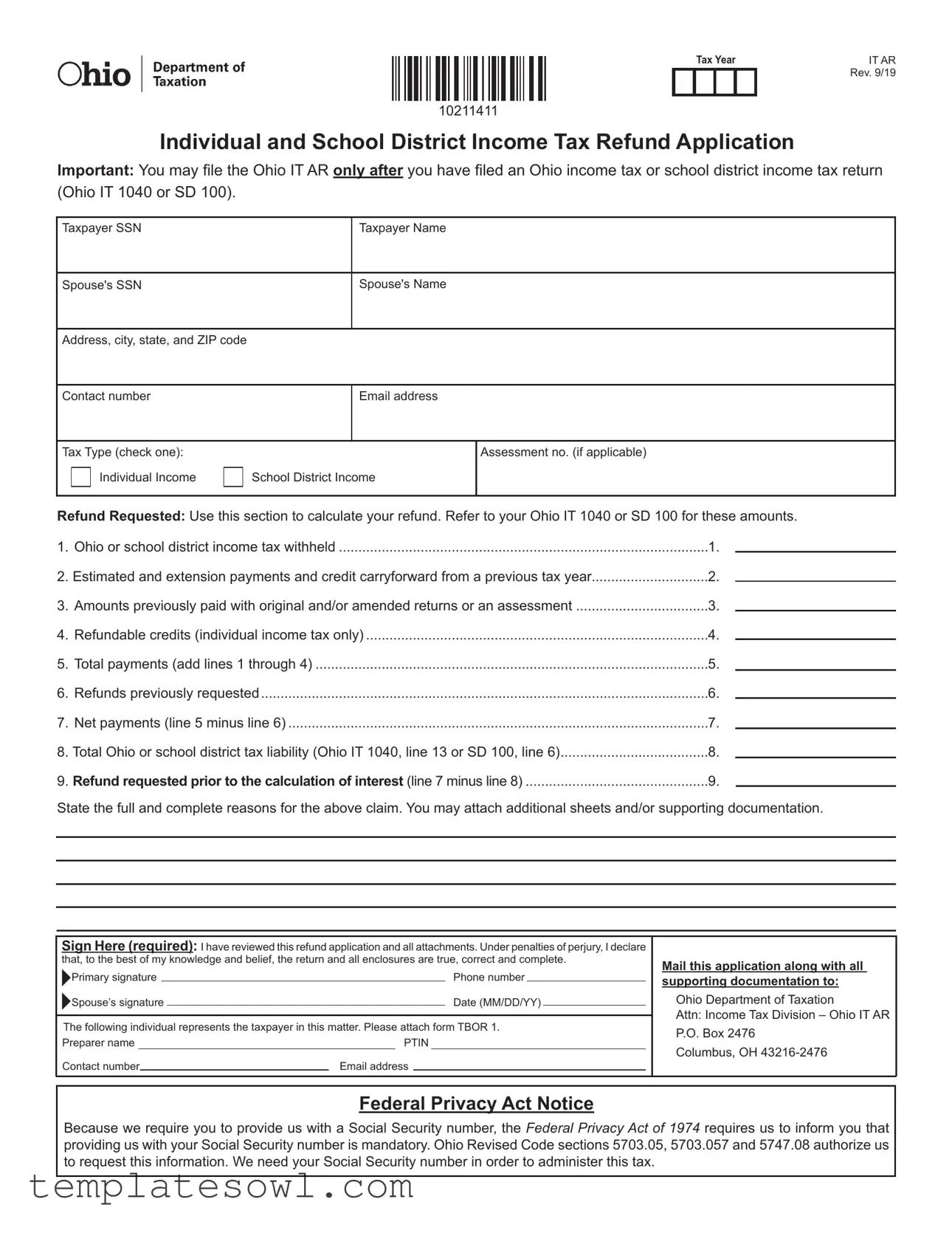

Fill Out Your Ohio It Ar Form

The Ohio IT AR form serves as a crucial tool for residents seeking refunds on their state or school district income taxes after filing the appropriate returns, such as the Ohio IT 1040 or SD 100. Designed specifically for this purpose, the form provides taxpayers with a structured approach to claim any overpayments they may have made. Once completed, individuals detail their personal information, including Social Security numbers and contact details, ensuring the process is both straightforward and secure. The form guides users through a series of calculations to ascertain the refund amount, incorporating various elements such as taxes withheld, estimated payments, and any previous refunds. Additionally, it requires a comprehensive statement of reasons supporting the refund claim, allowing taxpayers to attach further documentation if necessary. Properly signing the application confirms an individual's declaration of truthfulness regarding the information provided. This form is mailed to the Ohio Department of Taxation's Income Tax Division, where it will be reviewed and processed. Taxpayers should remember that their Social Security number is mandatory for this application, adhering to federal privacy regulations while facilitating tax administration as authorized by Ohio law.

Ohio It Ar Example

10211411

|

Tax Year |

|

IT AR |

|

|

|

|

|

Rev. 9/19 |

|

|

|

|

|

Individual and School District Income Tax Refund Application

Important: You may file the Ohio IT AR only after you have filed an Ohio income tax or school district income tax return (Ohio IT 1040 or SD 100).

Taxpayer SSN

Spouse's SSN

Taxpayer Name

Spouse's Name

Address, city, state, and ZIP code

Contact number

Email address

Tax Type (check one): Individual Income

School District Income

Assessment no. (if applicable)

Refund Requested: Use this section to calculate your refund. Refer to your Ohio IT 1040 or SD 100 for these amounts.

1. |

Ohio or school district income tax withheld |

1. |

2. |

Estimated and extension payments and credit carryforward from a previous tax year |

2. |

3. |

Amounts previously paid with original and/or amended returns or an assessment |

3. |

4. |

Refundable credits (individual income tax only) |

4. |

5. |

Total payments (add lines 1 through 4) |

5. |

6. |

Refunds previously requested |

6. |

7. |

Net payments (line 5 minus line 6) |

7. |

8. Total Ohio or school district tax liability (Ohio IT 1040, line 13 or SD 100, line 6) |

8. |

|

9. |

Refund requested prior to the calculation of interest (line 7 minus line 8) |

9. |

State the full and complete reasons for the above claim. You may attach additional sheets and/or supporting documentation.

|

Sign Here (required): I have reviewed this refund application and all attachments. Under penalties of perjury, I declare |

|

||||||||||||||

|

that, to the best of my knowledge and belief, the return and all enclosures are true, correct and complete. |

Mail this application along with all |

||||||||||||||

|

Primary signature |

|

|

|

|

|

|

|

Phone number |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

supporting documentation to: |

||||

|

|

|

|

|

|

|

|

|

||||||||

|

Spouse’s signature |

|

|

|

|

|

|

Date (MM/DD/YY) |

|

|

Ohio Department of Taxation |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Attn: Income Tax Division – Ohio IT AR |

|

The following individual represents the taxpayer in this matter. Please attach form TBOR 1. |

|||||||||||||||

|

P.O. Box 2476 |

|||||||||||||||

|

Preparer name |

|

|

|

PTIN |

|

|

|||||||||

|

|

|

Columbus, OH |

|||||||||||||

|

Contact number |

|

|

|

Email address |

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Federal Privacy Act Notice

Because we require you to provide us with a Social Security number, the Federal Privacy Act of 1974 requires us to inform you that providing us with your Social Security number is mandatory. Ohio Revised Code sections 5703.05, 5703.057 and 5747.08 authorize us to request this information. We need your Social Security number in order to administer this tax.

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Purpose | The Ohio IT AR form is used to apply for a refund of individual and school district income taxes. |

| Eligibility | Taxpayers may file the IT AR form only after submitting an Ohio income tax return or school district income tax return. |

| Required Information | Completing the form requires taxpayers to provide personal information such as Social Security Numbers, names, and contact details. |

| Refund Calculation | The form includes sections for calculating the refund based on various payment amounts and tax liabilities. |

| Supporting Documentation | Taxpayers must attach supporting documents and may include additional sheets to explain their claim thoroughly. |

| Signatures Required | The form requires signatures from both the taxpayer and spouse, along with a declaration statement. |

| Mailing Address | Completed forms must be mailed to the Ohio Department of Taxation at P.O. Box 2476, Columbus, OH 43216-2476. |

| Governing Laws | The submission and processing of the IT AR form are governed by Ohio Revised Code sections 5703.05, 5703.057, and 5747.08. |

Guidelines on Utilizing Ohio It Ar

After filing an Ohio income tax return, you may be eligible to apply for a refund. The Ohio IT AR form allows you to claim any refunds due based on your tax filings. Ensure you have all required information ready before starting the application process.

- Gather Your Documents: Collect your Ohio IT 1040 or SD 100, as well as any supporting documents that detail your tax payments and credits.

- Provide Your Information: Fill in your Social Security number and your spouse's Social Security number, if applicable. Then, enter your full name and address, including city, state, and ZIP code.

- Add Contact Information: Include your contact number and email address for potential follow-up communications.

- Select Tax Type: Check the appropriate box for either Individual Income or School District Income.

- Complete Refund Calculation: Accurately fill in the refund requested section by adding details about taxes withheld, payments made, and any credits. Use the provided lines to calculate your total payments, net payments, and tax liability.

- Write Reasons for Claim: Clearly state the reasons for your refund claim. You may attach additional sheets or documentation if necessary.

- Sign Your Application: Sign and date the form, ensuring that both you and your spouse sign if applicable. This confirms that all information provided is true and complete.

- Mail Your Application: Send the completed form along with all supporting documents to the Ohio Department of Taxation at the provided address.

What You Should Know About This Form

What is the Ohio IT AR form?

The Ohio IT AR form, or Individual and School District Income Tax Refund Application, allows taxpayers to request a refund for overpaid state or school district income taxes. This form is specifically designed for individuals who have already filed their income tax return and believe they qualify for a refund based on their filings.

Who is eligible to file the Ohio IT AR form?

Any taxpayer who has filed an Ohio income tax return (Ohio IT 1040) or a school district income tax return (SD 100) can file the Ohio IT AR form. It is essential that the initial tax return has been submitted before requesting a refund. This avoids confusion and ensures that all calculations are based on recorded income.

What information do I need to complete the Ohio IT AR form?

To fill out the Ohio IT AR form, you will need your Social Security Number and your spouse's SSN (if applicable). You will also require details such as your name, address, and contact information. Additionally, you will need figures related to your income tax withheld, estimated payments, previous refunds, and any refundable credits you may have received in the past. This information can typically be gathered from your previously filed IT 1040 or SD 100 forms.

How is the refund amount calculated?

The refund is calculated by adding together the total payments—this includes tax withheld, estimated payments, payments made with previous returns, and any refundable credits. From this total, you subtract any refunds previously requested. Next, you will compare the calculated net payments with your total tax liability to determine the refund amount.

What should I include with my Ohio IT AR form when I submit it?

When submitting the Ohio IT AR form, it's important to attach any necessary supporting documentation that validates your claim for a refund. This may include copies of your tax returns, W-2 forms, or other relevant financial documents. Ensure that all these materials clearly demonstrate the reason for your refund request, as this will help expedite the review process.

How do I submit the Ohio IT AR form?

Your completed Ohio IT AR form, along with all supporting documentation, should be mailed to the Ohio Department of Taxation’s Income Tax Division at the address specified on the form. Make sure you keep a copy of everything you send for your records. Using certified mail or a similar trackable service is also advisable to ensure your application arrives safely and on time.

What happens after I submit my refund request?

After you submit your Ohio IT AR form, the Ohio Department of Taxation will review your application and supporting documents. Processing times may vary, so it’s wise to allow a few weeks before following up. If additional information is required or if clarifications are necessary, they will contact you; otherwise, you will receive a notification regarding the status of your refund.

Is my Social Security number required on the Ohio IT AR form?

Yes, entering your Social Security number on the Ohio IT AR form is mandatory. It is required to process your tax refund request. The Ohio Department of Taxation operates under specific legal frameworks that mandate the collection of this information to effectively administer and validate tax-related matters.

Common mistakes

Completing the Ohio IT AR form can present challenges that may lead to errors. One common mistake is failing to submit the form after filing an Ohio income tax return. The Ohio IT AR can only be filed once the Ohio IT 1040 or SD 100 has been submitted. Therefore, it is essential to check that the income tax return was filed before proceeding with the refund application.

Another frequent error involves entering incorrect Social Security Numbers (SSNs). Both the taxpayer's and spouse's SSNs are necessary for proper processing. A simple mistype can cause a significant delay in refund processing, or worse, it may lead to the application being rejected altogether.

Omitting essential personal information is also a common oversight. The form requires the full names, addresses, contact numbers, and email addresses of the taxpayer and spouse. Failure to provide complete information can complicate communications and may also result in processing delays.

When calculating the refund, individuals often make mathematical errors. It is important to ensure that amounts for withheld taxes, estimated payments, and credits have been accurately calculated. Errors in these calculations can lead to refund requests being too high or too low, potentially causing further complications with the tax authorities.

Many applicants neglect to explain their refund request thoroughly. In the designated area, a detailed explanation of the reasons for the claim is required. Failing to provide this information or attaching insufficient supporting documentation can lead to additional inquiries from the Ohio Department of Taxation, resulting in longer processing times.

Finally, forgetting to sign the application is a critical mistake. The application must include the taxpayer's and spouse’s signatures along with the date. Without these signatures, the form is incomplete and cannot be processed. Reviewing the requirement for signatures can prevent this common issue and help ensure timely processing.

Documents used along the form

The Ohio IT AR form is used to apply for a refund of either individual or school district income tax. When filing this form, several other documents may be necessary to support your claims and ensure accurate processing. Below is a list of commonly used forms along with brief descriptions to help you understand their purpose.

- Ohio IT 1040: This is the standard income tax return form for individuals filing in Ohio. It provides a comprehensive overview of your income, deductions, and credits for the tax year.

- SD 100: The School District Income Tax return form is used for residents of Ohio school districts that impose an income tax. It details the income earned and the tax amount owed to the specific school district.

- Form TBOR 1: This form is necessary when designating a representative to act on behalf of the taxpayer. It authorizes the designated individual to discuss and navigate tax matters with the state.

- W-2 Forms: These forms report annual wages and the taxes withheld from those wages. They are crucial for accurately completing your income tax return.

- 1099 Forms: If you are a freelancer or independent contractor, 1099 forms report income received other than wages. They help in itemizing additional income on your tax return.

- Any Supporting Documentation: This can include bank statements, previous year's tax returns, or receipts for deductible expenses. Such documents provide evidence for claims made in the refund application.

When preparing your refund application, ensure that you gather all necessary forms and supporting documentation. This not only facilitates the process but also helps prevent delays in receiving your refund. Being organized can significantly reduce stress during tax season.

Similar forms

- IRS Form 1040X: This is a U.S. federal tax form used for amending a tax return. Similar to the Ohio IT AR form, it allows individuals to request refunds based on previously reported tax information. The form serves to correct income or deductions after the original filing.

- Ohio IT 1040: This is the primary income tax return form for residents of Ohio. The IT AR form is filed after the IT 1040 to request a refund based on the calculations reported in the initial return.

- IRS Form 8379: This form is for injured spouse relief. It allows a spouse to claim their portion of a joint tax refund that may be withheld due to the other spouse’s tax liabilities. Like the IT AR, it seeks to rectify the allocation of a refund.

- Ohio SD 100: This is the form used for school district income tax returns in Ohio. The IT AR specifically addresses refunds related to amounts reported on the SD 100, similar in purpose to its correlation with the IT 1040.

- IRS Form 8862: This form, used to claim the Earned Income Tax Credit after it has been denied, also serves to amend claims and secure refunds. It shows a similar intent as the IT AR in correcting previous filings for tax benefits.

- IRS Form 4442: This form is a request for the release of tax information to a third party. It often accompanies situations where a refund is being pursued, paralleling how the IT AR documents claim information regarding a refund.

- State Tax Refund Request Form: Each state typically has its own form for requesting state tax refunds. These forms are similar to the Ohio IT AR in that they provide a structured way for taxpayers to submit claims for overpayments and refunds.

Dos and Don'ts

When filling out the Ohio IT AR form, there are some important dos and don'ts to keep in mind. Following these guidelines can help ensure a smoother application process and potentially expedite your refund.

- Do double-check that you have filed your Ohio income tax return (form IT 1040) or your school district income tax return (form SD 100) before submitting the IT AR form.

- Do make sure all names and Social Security numbers are entered accurately. Any errors can delay processing.

- Do gather all necessary documentation that supports your refund claim. Attach copies of any relevant documents to strengthen your application.

- Do thoroughly complete the refund calculation section. Be certain you’ve included all payments to avoid discrepancies.

- Don't leave any required fields blank. Incomplete applications may be returned or rejected.

- Don't submit the form without signing it first. An unsigned application can’t be processed.

- Don't forget to mail the form and documentation to the correct address. Ensure it’s sent to the Ohio Department of Taxation’s Income Tax Division.

Misconceptions

Understanding the Ohio IT AR form can be complicated, and there are several misconceptions that can cause confusion. Here are six common myths debunked:

- Filing the IT AR is optional. Many taxpayers believe they can choose whether or not to file the IT AR form, but it's mandatory for those seeking a refund after submitting their Ohio income tax or school district income tax returns.

- You can file the IT AR form anytime. Some people think they can submit the IT AR at their convenience. However, this form must be filed after your return is submitted and within a specific timeframe, so timely processing is crucial.

- The IT AR form can be used for any type of refund. Not all refunds are applicable through the IT AR form. This form is specifically for individual and school district income tax refunds, making it important to verify eligibility before use.

- Previous year’s taxes don’t matter. There is a misconception that the current tax year's information is all that is needed. It's essential to factor in estimated payments and credits from the previous year when calculating your refund.

- All attachments are unnecessary. Some may think submitting only the IT AR form is enough, but providing supporting documentation is important for a comprehensive review of your application. Missing this step can lead to delays.

- Your Social Security number is optional on the form. This is not true. The Ohio IT AR form requires your Social Security number for processing. Neglecting to include it can result in rejection of your application.

Awareness of these misconceptions can help ensure a smoother refund application process. It’s always a good idea to read through the instructions carefully and consult a tax professional if questions arise.

Key takeaways

Here are key takeaways regarding the Ohio IT AR form, which is used for requesting a refund of individual or school district income taxes:

- Eligibility Requirement: The Ohio IT AR form can only be submitted after filing the appropriate Ohio income tax return, such as the Ohio IT 1040 or SD 100.

- Detailed Information Required: Taxpayers need to provide their Social Security number, contact information, and specific details about their income tax situation, including the type of tax and amounts withheld.

- Refund Calculation: There are multiple steps involved in calculating the refund, requiring taxpayers to add various sources of tax payments and credits before determining the refund amount.

- Documentation Submission: Supporting documentation may be attached to substantiate the refund claim. Complete and accurate information is crucial.

- Signature and Declaration: The form mandates a signature from the taxpayer and their spouse, if applicable, alongside a declaration stating that all provided information is true and correct.

Browse Other Templates

SNHU Educational Record Release Form,Authorization for Privacy Waiver,Student Information Disclosure Authorization,SNHU FERPA Rights Waiver,Confidential Information Consent Form,Academic Records Release Agreement,Information Release Authorization For - The form must remain unaltered from its original format.

Supplemental Secure and Verifiable Identification Colorado - Witness verification is also necessary on the DR 2842 form for validation.

Form N-2 Instructions - The N 2 form supports multiple projects and welding types.