Fill Out Your Ohio New Hire Reporting Form

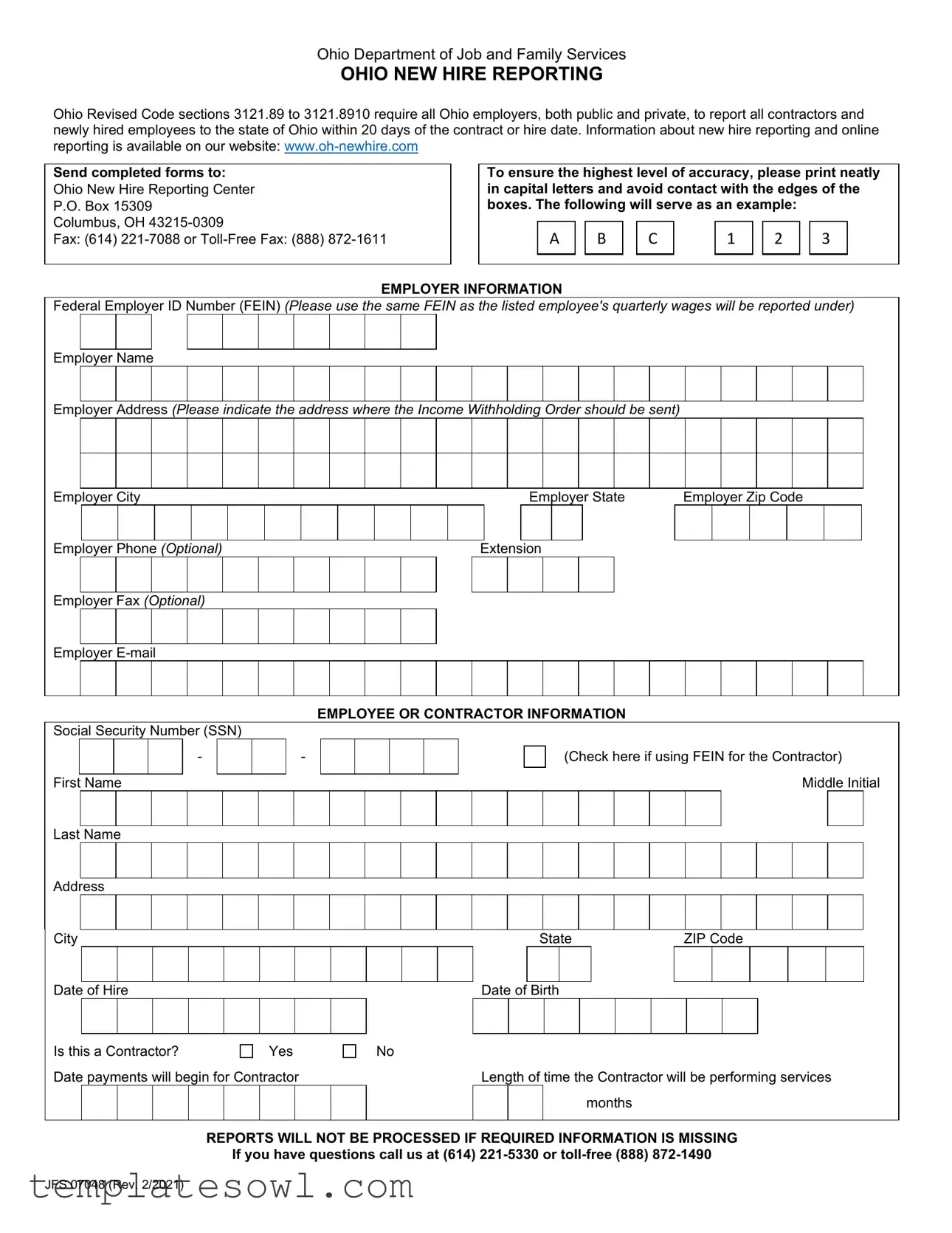

The Ohio New Hire Reporting form is a crucial document that facilitates the state's efforts to track and monitor employment trends, particularly for child support enforcement and unemployment assistance. Under Ohio law, all employers, whether public or private, are mandated to report information about newly hired employees and contractors to the Ohio Department of Job and Family Services within 20 days of their hiring or contract date. This requirement includes specific information such as the Employer’s Federal Employer Identification Number (FEIN), the employer's name and address, and detailed employee or contractor information, including their Social Security Number, hiring date, and whether the individual is a contractor. Accuracy is paramount; thus, employers are urged to complete the form using capital letters and to avoid any extraneous marks that may hinder processing. Failure to provide required information could result in delays, as reports will not be processed if information is missing. For additional support, employers have several options to submit the completed forms, including mailing them directly to the Ohio New Hire Reporting Center or sending them via fax. Utilizing the online portal is also an option, ensuring greater ease of access and submission. Understanding the importance of this form and adhering to the reporting guidelines is essential for compliance and for the benefit of the community at large.

Ohio New Hire Reporting Example

Ohio Department of Job and Family Services

OHIO NEW HIRE REPORTING

Ohio Revised Code sections 3121.89 to 3121.8910 require all Ohio employers, both public and private, to report all contractors and newly hired employees to the state of Ohio within 20 days of the contract or hire date. Information about new hire reporting and online reporting is available on our website:

Send completed forms to: Ohio New Hire Reporting Center P.O. Box 15309

Columbus, OH

Fax: (614)

To ensure the highest level of accuracy, please print neatly in capital letters and avoid contact with the edges of the boxes. The following will serve as an example:

|

A |

|

B |

|

C |

|

1 |

|

2 |

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EMPLOYER INFORMATION

Federal Employer ID Number (FEIN) (Please use the same FEIN as the listed employee's quarterly wages will be reported under)

Employer Name

Employer Address (Please indicate the address where the Income Withholding Order should be sent)

Employer City |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employer State |

Employer Zip Code |

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employer Phone (Optional) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Extension |

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employer Fax (Optional) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EMPLOYEE OR CONTRACTOR INFORMATION |

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

Social Security Number (SSN) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

- |

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Check here if using FEIN for the Contractor) |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Middle Initial |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Last Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

City |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State |

ZIP Code |

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date of Hire |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date of Birth |

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

Is this a Contractor? |

Yes |

|

|

|

|

|

|

No |

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||

Date payments will begin for Contractor |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Length of time the Contractor will be performing services |

|||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

months |

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REPORTS WILL NOT BE PROCESSED IF REQUIRED INFORMATION IS MISSING

If you have questions call us at (614)

JFS 07048 (Rev. 2/2021)

Form Characteristics

| Fact Name | Description |

|---|---|

| Legal Requirement | Ohio Revised Code sections 3121.89 to 3121.8910 mandate all employers in Ohio to report newly hired employees and contractors. |

| Reporting Deadline | The new hire report must be submitted within 20 days of the hire or contract date, ensuring timely compliance. |

| Submission Methods | Employers can send completed forms by mail, fax, or utilize online reporting options available on the Ohio New Hire website. |

| Importance of Accuracy | To avoid processing delays, it is crucial to provide accurate information and complete all required fields on the form. |

Guidelines on Utilizing Ohio New Hire Reporting

After completing the Ohio New Hire Reporting form, submit it to the Ohio New Hire Reporting Center to ensure that the state has the necessary information about your new hires or contractors. This helps maintain compliance with Ohio law, allowing for the proper tracking of employment activities.

- Obtain the Ohio New Hire Reporting form. This can be downloaded from the Ohio Department of Job and Family Services website or requested by phone.

- Begin by entering the Employer Information. Fill out the Federal Employer ID Number (FEIN), the employer's name, address, city, state, and zip code. Optionally provide the employer's phone, fax, and email.

- Next, provide Employee or Contractor Information. Enter the social security number (SSN) of the new hire or contractor. If reporting a contractor, check the box indicating you are using the FEIN for the contractor.

- Complete the personal details for the employee or contractor. This includes their first name, middle initial, last name, address, city, state, ZIP code, date of hire, and date of birth.

- Indicate if the individual is a contractor by selecting "Yes" or "No." If they are a contractor, fill out the date payments will begin and the length of time they will be performing services.

- Double-check that all required information is completed. Reports cannot be processed if information is missing.

- Print the form neatly in capital letters. Ensure that you do not touch the edges of the boxes while filling it out.

- Submit the completed form. Send it to the Ohio New Hire Reporting Center at P.O. Box 15309, Columbus, OH 43215-0309 or fax it to (614) 221-7088 or toll-free to (888) 872-1611.

What You Should Know About This Form

What is the Ohio New Hire Reporting form and why is it necessary?

The Ohio New Hire Reporting form is a requirement for all employers in Ohio, including both public and private sectors. According to specific laws, this form must be completed and submitted whenever a new employee is hired or when a contractor is engaged. Reporting must occur within 20 days of the hire or contract date. This process helps ensure that proper records are maintained for tax purposes and supports various state programs, such as child support enforcement.

How do I submit the Ohio New Hire Reporting form?

You have several options for submitting the Ohio New Hire Reporting form. Completed forms can be mailed to the Ohio New Hire Reporting Center at P.O. Box 15309, Columbus, OH 43215-0309. If you prefer, you may also send the form via fax at (614) 221-7088 or use the toll-free fax number (888) 872-1611. Regardless of the method, it's essential to ensure that all required information is filled in accurately.

What information is required on the form?

Your submission must include both employer and employee (or contractor) information. For employers, this includes the Federal Employer ID Number (FEIN), name, address, phone number, and optional fax and email. For employees or contractors, you'll need to provide their Social Security Number (SSN) or indicate if the FEIN is being used. You'll also have to fill in the employee’s name, address, date of hire, date of birth, and specify if they are a contractor. Failing to provide any required information may lead to processing delays.

What happens if I don’t report a new hire?

Not reporting a new hire or contractor can result in penalties for non-compliance, including fines. The law mandates that all employers fulfill this reporting obligation. To avoid any issues, it’s best to ensure that forms are submitted accurately and promptly. If you have concerns or questions, reaching out for clarification is advisable.

Who should I contact if I have questions about the form?

If you're unsure about any part of the Ohio New Hire Reporting process or have specific questions regarding the form, you can contact the Ohio Department of Job and Family Services. Their office is available at (614) 221-5330 or toll-free at (888) 872-1490. They are there to help you understand your obligations and ensure that you comply with the reporting requirements.

Common mistakes

Filling out the Ohio New Hire Reporting form accurately is vital for compliance with state laws. However, many individuals make common mistakes that can result in delays and complications. Understanding these pitfalls can save time and ensure that the reporting process goes smoothly.

One frequent mistake is failing to provide the correct Federal Employer ID Number (FEIN). It is crucial to use the same FEIN under which the employee's quarterly wages will be reported. If an incorrect number is listed, it can lead to confusion and potential fines. Always double-check the provided FEIN against official documents.

Another error involves incomplete addresses. Many people neglect to fully detail the employer's address, particularly omitting vital components like the city, state, or zip code. Incomplete addresses make it difficult for the state to process the information and to send necessary communications. Make sure to fill in every part of the address block to avoid processing delays.

Important information is sometimes overlooked as well. The section asking for the Social Security Number (SSN) must be filled out in its entirety. Leaving this blank or providing an incorrect number can result in reports being rejected or delayed. When entering information, ensure it’s accurate and legible.

Improper formatting of the employee's name is another common issue. Names should be clearly printed in capital letters. Errors often occur when forms are filled out hastily, which may lead to misinterpretations. Take your time and ensure that names are written as they appear on official documents.

A common oversight is neglecting to indicate whether the individual is a contractor. This is a crucial piece of information that affects how reports are processed. Be diligent in checking the appropriate box and providing any required contractor-specific details.

Finally, many individuals fail to verify that all required fields are filled out before submitting the form. Reports will not be processed if any essential information is missing. Conduct a thorough review of the form to ensure all sections are completed to avoid unnecessary delays in processing.

By taking these precautions and minimizing common mistakes, compliance with New Hire Reporting laws in Ohio can be achieved efficiently. Accurate submissions help maintain good standing with state regulations.

Documents used along the form

When hiring new employees or contractors in Ohio, it's important to complete the Ohio New Hire Reporting form. However, several other documents may accompany it, each serving a specific purpose for both compliance and record-keeping. Below are key forms to consider.

- W-4 Form: Employees must complete this form to indicate their marital status and the number of allowances they wish to claim for tax withholding purposes.

- I-9 Form: This document verifies the identity and employment authorization of individuals hired for employment in the United States.

- Ohio Employee Withholding Exemption Certificate (IT-4): This form allows employees to claim exemptions from state income tax withholding if they meet specific criteria.

- Direct Deposit Authorization Form: Employees can use this form to provide their bank information for direct deposit of their paychecks.

- Employment Agreement: A written agreement that outlines the terms and conditions of employment, including compensation, responsibilities, and other pertinent information.

- Job Description Document: This document outlines the responsibilities and expectations of the position, helping to set clear guidelines for performance.

- Non-Disclosure Agreement (NDA): If applicable, this agreement protects sensitive company information by outlining confidentiality expectations for employees and contractors.

- Benefits Enrollment Form: New hires can use this form to enroll in company-sponsored benefits such as health insurance, retirement plans, and other employee benefits.

Completing each of these documents ensures compliance with federal and state regulations as well as smooth onboarding for new employees. Taking these steps will help you build a solid foundation for your workforce.

Similar forms

The Ohio New Hire Reporting form shares similarities with several other employment-related documents. Here’s a list of those documents, illustrating how they are alike:

- W-4 Form: Both the Ohio New Hire Reporting form and the W-4 form require employer and employee information. Each form is crucial for tax purposes, ensuring accurate withholding of federal income tax for newly hired employees.

- I-9 Form: The Ohio New Hire Reporting form and the I-9 form are used to verify employment eligibility. Employers must complete the I-9 form for new hires within a specified timeframe, similar to the 20 days required for the New Hire Reporting form.

- State Tax Registration Form: Like the New Hire Reporting form, state tax registration forms collect essential information about new employees. They are required to ensure compliance with state taxation laws, particularly for income withholding.

- Employee Information Form: Both documents gather employee details, such as name, address, and Social Security number. This information is vital for payroll processing and reporting to state agencies.

- Unemployment Insurance (UI) Registration Form: Similar to the New Hire Reporting form, this document is required for tracking employment for unemployment benefits. Employers report new hires to ensure accurate UI records.

- Workers’ Compensation Enrollment Form: Both forms require employer and employee details. Reporting a new hire helps establish coverage for workers' compensation, protecting both parties in case of job-related injuries.

- Contractor Agreement: The New Hire Reporting form and contractor agreements often share common information about the contracting party. Both documents ensure that the employer maintains accurate records for the various types of workers engaged.

Dos and Don'ts

When filling out the Ohio New Hire Reporting form, clarity and accuracy are paramount. Below are important guidelines to follow to ensure a smooth reporting process.

- Use Capital Letters: Print neatly in capital letters to enhance readability.

- Complete All Required Fields: Ensure every mandatory section is filled out. Reports will not be processed if information is missing.

- Use the Correct Federal Employer ID Number: The Federal Employer ID Number (FEIN) should match the one under which the employee's quarterly wages will be reported.

- Check for Accuracy: Double-check all information, especially Social Security Numbers and dates, to avoid errors.

Conversely, it is equally important to avoid certain pitfalls when completing the form:

- Don't Rush: Take your time to fill out the form accurately, as mistakes can delay processing.

- Avoid Contact with Box Edges: Ensuring responses are clear and within the lines will help prevent confusion.

- Don't Skip Optional Information: While optional fields like employer phone or fax numbers may not be mandatory, including them can facilitate communication.

- Avoid Leaving Blank Spaces: Even if you have no information for a certain section, write "N/A" instead of leaving it blank.

By adhering to these do's and don'ts, you can help streamline the reporting process and contribute to efficient employee documentation in Ohio.

Misconceptions

Misconceptions about the Ohio New Hire Reporting form can create confusion among employers. Below are five common misunderstandings.

- Only new employees need to be reported. Many employers believe that the form is only for new hires. However, it is also essential to report all contractors engaged by the business. This ensures compliance with state regulations.

- The reporting deadline is flexible. There is a misconception that the 20-day reporting period is negotiable. In reality, all employers must report new hires and contractors within this strict timeframe to avoid penalties.

- The information can be sent via email. Some may think that submitting the New Hire Reporting form through email is acceptable. In fact, the form must be mailed or faxed to the appropriate office for processing.

- Only private employers must comply. It is a common belief that only private employers are required to report. However, both public and private employers in Ohio are mandated to submit the necessary information.

- Inaccurate or incomplete forms can be corrected later. Employers may think they can submit a completed form and later rectify any mistakes. Reports will not be processed if required information is missing, emphasizing the need for accuracy upon submission.

Key takeaways

Filling out and using the Ohio New Hire Reporting form is crucial for Ohio employers. Here are some key takeaways to keep in mind:

- Timeliness is essential: Employers must report new hires and contractors to the state within 20 days of the hire or contract date.

- Applicable to all employers: Both public and private employers in Ohio are required to complete this reporting.

- Include all necessary information: Missing information will result in reports not being processed. Ensure all required details are provided.

- Use clear writing: Write neatly in capital letters to avoid misinterpretations. Keep text away from the edges of the boxes.

- Submit by various methods: Completed forms can be sent via mail, fax, or toll-free fax, giving flexibility to employers.

- Identify contractors accurately: Clearly indicate if the individual is a contractor and provide the start date for payments.

- Employer information is crucial: Use the correct Federal Employer ID Number (FEIN) as it links to the reported wages.

- Stay informed: Additional information about new hire reporting and online options is available at www.oh-newhire.com.

- Reach out for assistance: If questions arise, employers can call the provided support numbers for clarification.

By adhering to these guidelines, employers can ensure they meet their obligations efficiently and effectively.

Browse Other Templates

Atm Card Activation - Enter your email address for updates regarding your application.

Easement Agreement Template - Structuring the framework for servicing sewage systems reflects a commitment to public health.