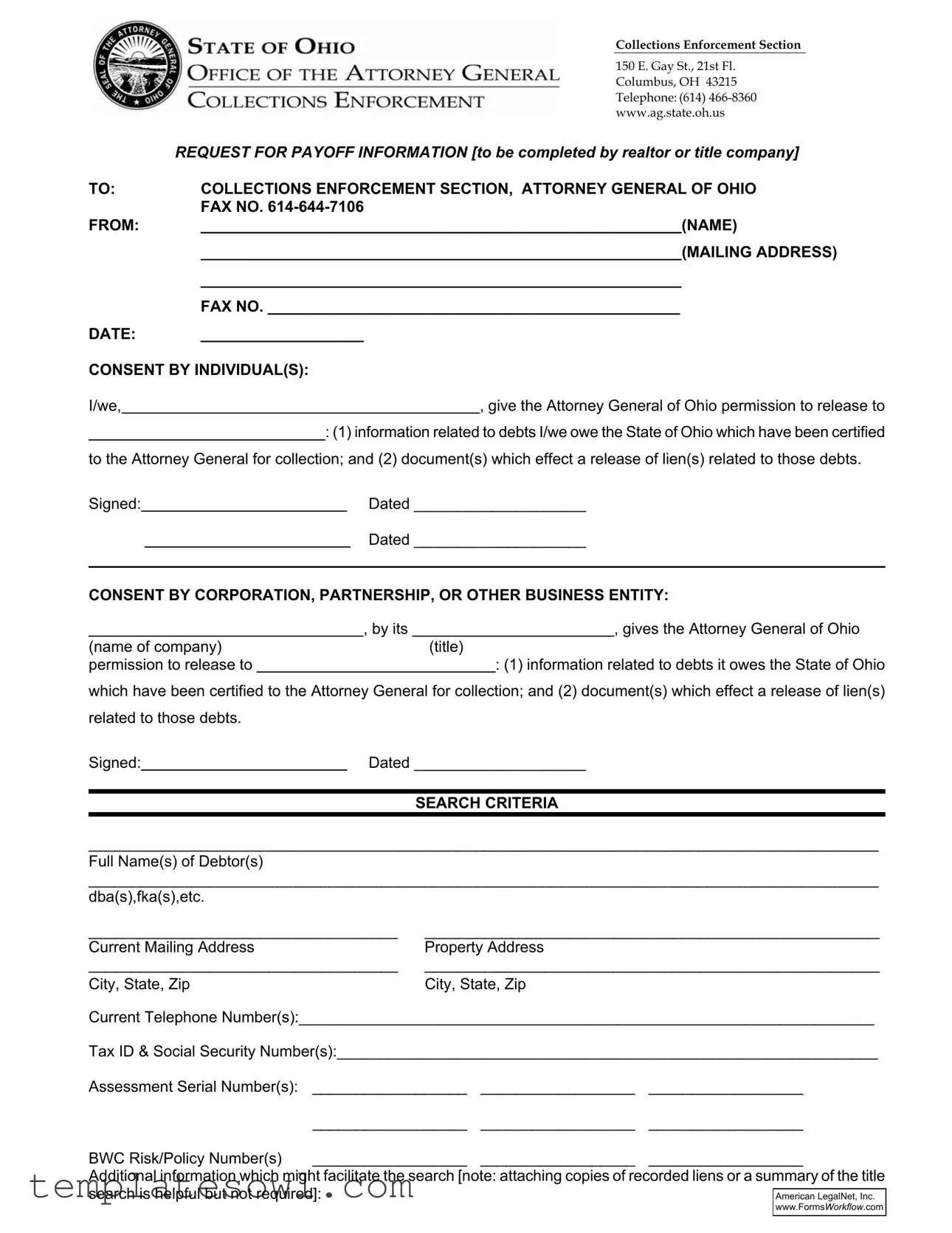

Fill Out Your Ohio Payoff Form

The Ohio Payoff form serves as a vital tool for individuals and businesses looking to obtain important information regarding debts owed to the State of Ohio. This form is primarily used by realtors and title companies as part of the process to request payoff information from the Collections Enforcement Section of the Attorney General's office. It encompasses several key components, beginning with the provision of consent to release information about debts certified for collection. Filers are required to include personal details such as names, addresses, and relevant identification numbers to facilitate the search. Once the request is submitted, it gathers crucial data about liened and unliened debts, including amounts, reference numbers, and vital dates. The form allows individuals to understand their financial obligations clearly. Furthermore, it outlines the process for making payoffs and stipulates that releases will be issued within ten days of payment, ensuring a timely resolution. Consequently, the Ohio Payoff form not only aids in transparency but also plays a significant role in streamlining real estate transactions and debt resolution in Ohio.

Ohio Payoff Example

|

|

|

COLLECTIONS ENFORCEMENT SECTION |

|

|

|

150 E. Gay St., 21st Fl. |

|

|

|

Columbus, OH 43215 |

|

|

|

Telephone: (614) |

|

|

|

www.ag.state.oh.us |

|

|

REQUEST FOR PAYOFF INFORMATION [to be completed by realtor or title company] |

|

TO: |

COLLECTIONS ENFORCEMENT SECTION, ATTORNEY GENERAL OF OHIO |

||

|

|

FAX NO. |

|

FROM: |

________________________________________________________(NAME) |

||

|

|

________________________________________________________(MAILING ADDRESS) |

|

|

|

________________________________________________________ |

|

|

|

FAX NO. ________________________________________________ |

|

DATE: |

___________________ |

|

|

CONSENT BY INDIVIDUAL(S): |

|||

I/we, |

|

|

, give the Attorney General of Ohio permission to release to |

:(1) information related to debts I/we owe the State of Ohio which have been certified to the Attorney General for collection; and (2) document(s) which effect a release of lien(s) related to those debts.

Signed: |

|

|

Dated ____________________ |

|

|||||

|

|

|

|

|

|

Dated ____________________ |

|

||

|

|

|

|

|

|

|

|

|

|

CONSENT BY CORPORATION, PARTNERSHIP, OR OTHER BUSINESS ENTITY: |

|||||||||

|

|

|

|

|

|

, by its |

, gives the Attorney General of Ohio |

||

(name of company) |

|

|

|

(title) |

|

||||

permission to release to |

|

|

|

|

|

: (1) information related to debts it owes the State of Ohio |

|||

which have been certified to the Attorney General for collection; and (2) document(s) which effect a release of lien(s) related to those debts.

Signed:Dated ____________________

SEARCH CRITERIA

____________________________________________________________________________________________

Full Name(s) of Debtor(s)

____________________________________________________________________________________________

dba(s),fka(s),etc.

____________________________________ |

_____________________________________________________ |

Current Mailing Address |

Property Address |

____________________________________ |

_____________________________________________________ |

City, State, Zip |

City, State, Zip |

Current Telephone Number(s):___________________________________________________________________

Tax ID & Social Security Number(s):_______________________________________________________________

Assessment Serial Number(s): |

__________________ |

__________________ |

__________________ |

|

__________________ |

__________________ |

__________________ |

BWC Risk/Policy Number(s) |

__________________ |

__________________ |

__________________ |

Additional information which might facilitate the search [note: attaching copies of recorded liens or a summary of the title search is helpful but not required]:

|

RESPONSE TO REQUEST FOR PAYOFF INFORMATION |

|

[top portion to be completed by realtor or title company] |

TO: |

_____________________________________________________________(NAME) |

|

__________________________________________________(MAILING ADDRESS) |

|

________________________________________________ |

|

FAX NO. ________________________________________ |

FROM: |

COLLECTIONS ENFORCEMENT SECTION, ATTORNEY GENERAL OF OHIO |

RE: |

Name(s) of debtor(s): ________________________________________________ |

|

____________________________________________________________________ |

|

Tax ID & SSN(s): _____________________________________________________ |

|

Risk No(s): _________________________________________________________ |

|

|

|

|

[this portion to be completed by Collections Enforcement Section]

We have conducted a search of our records based on the search criteria provided. As set forth below, we have located liened and unliened debts certified to the Attorney General for collection. Please be advised that : (1) praecipes issued to the clerk on pending liens may be filed by the time of closing; (2) any currently unliened debts may be liened by the time of closing; and

(3) additional certified and uncertified debts may exist which were not located during our search.

Payoff Balance of Filed Lien(s) |

$ |

|

(see attached detail) |

|

Payoff Balance of Lien(s) Issued (but not yet filed per our records) |

$ |

|

(see attached detail) |

|

Payoff Balance of Unliened Debts |

$ |

(see attached detail) |

||

|

|

Total |

$ |

|

Payoff Good Thru ___/___/___ |

|

|

|

|

Date of Search ___/____/___ |

|

|

|

|

Search conducted by: ___________________________ |

|

|

|

|

Make check payable to Attorney General of Ohio and send to Collections Enforcement Section, Attn. Payoff Staff, 150 East Gay St., 21st Floor, Columbus, Ohio 43215. All tax identification numbers and risk numbers noted on the attached detail must accompany the payment to ensure that the correct accounts are credited.

The current balance due is available for viewing at http://www.ag.state.oh.us/ Account and CRN numbers from the Attorney General letter are needed to access the information. If an account is assigned to special counsel attorneys, additional fees may apply.

American LegalNet, Inc.

www.FormsWORKFLOW.com

Name(s) of Debtor(s): ______________________________________________ |

|

||

DETAIL: PAYOFF BALANCE OF FILED LIEN(S) |

|

|

|

Reference Number |

_____________________________ |

Amount _________________ |

|

Reference Number |

_____________________________ |

Amount _________________ |

|

Reference Number |

_____________________________ |

Amount _________________ |

|

Reference Number |

_____________________________ |

Amount _________________ |

|

Reference Number |

_____________________________ |

Amount _________________ |

|

Reference Number |

_____________________________ |

Amount _________________ |

|

Reference Number |

_____________________________ |

Amount _________________ |

|

Reference Number |

_____________________________ |

Amount _________________ |

|

Reference Number |

_____________________________ |

Amount _________________ |

|

Reference Number |

_____________________________ |

Amount _________________ |

|

Reference Number |

_____________________________ |

Amount _________________ |

|

Reference Number |

_____________________________ |

Amount _________________ |

|

Reference Number |

_____________________________ |

Amount _________________ |

|

Reference Number |

_____________________________ |

Amount _________________ |

|

Reference Number |

_____________________________ |

Amount _________________ |

|

|

|

SUBTOTAL |

$ |

DETAIL: PAYOFF BALANCE OF LIEN(S) ISSUED (BUT NOT YET FILED PER OUR RECORDS) |

|||

Reference Number |

_____________________________ |

Amount _________________ |

|

Reference Number |

_____________________________ |

Amount _________________ |

|

Reference Number |

_____________________________ |

Amount _________________ |

|

Reference Number |

_____________________________ |

Amount _________________ |

|

Reference Number |

_____________________________ |

Amount _________________ |

|

Reference Number |

_____________________________ |

Amount _________________ |

|

|

|

SUBTOTAL |

$ |

Note: Release(s) will be issued within 10 days after we receive payment in full for the lien(s) and we receive from the Clerk/Recorders Office the recording references needed to prepare the release(s).

DETAIL OF PAYOFF BALANCE OF UNLIENED DEBTS

Reference Number |

_____________________________ |

Reference Number |

_____________________________ |

Reference Number |

_____________________________ |

Reference Number |

_____________________________ |

Make check payable to “Attorney General of Ohio” and send to Collections Enforcement Section, Attn. Payoff Staff, 150 East Gay St., Columbus, Ohio 43215.

The current balance due is available for viewing at http://www.ag.state.oh.us. Account and CRN numbers from the Attorney General letter are needed to access the information. If an account is assigned to special counsel attorneys, additional fees may apply.

Indicate which debts on this sheet are being paid and attach a copy of this sheet to the payment to ensure that the correct accounts are credited.

Amount _________________

Amount _________________

Amount _________________

Amount _________________

SUBTOTAL $

TOTAL $

Good Thru ____/____/____

Date of Search____/____/____

Search conducted by:

_____________________________

American LegalNet, Inc. www.FormsWORKFLOW.com

Form Characteristics

| Fact Name | Fact Details |

|---|---|

| Purpose | The Ohio Payoff form is used to request information about debts owed to the State of Ohio, specifically those certified for collection by the Attorney General. |

| Who Completes It | This form should be completed by a realtor or title company on behalf of an individual or a business entity seeking payoff information. |

| Governing Law | The process related to this form is governed by Ohio Revised Code Section 131.02, which pertains to debt collection and lien management. |

| Response Time | Upon receipt of this form and the payment, the Attorney General's office will issue release documents within 10 days, providing it has the necessary recording references. |

| Payment Instructions | Payments must be made out to the Attorney General of Ohio and sent to the Collections Enforcement Section in Columbus to ensure accurate accounting. |

Guidelines on Utilizing Ohio Payoff

Filling out the Ohio Payoff form involves a detailed process where accuracy is essential. Below are the clearly outlined steps to guide you through completing the form. This process will help ensure that your request for payoff information is submitted correctly, allowing for an efficient resolution.

- Start with the "To" section: On the top of the form, write "Collections Enforcement Section, Attorney General of Ohio."

- Fill in your details: In the "From" section, provide your full name, mailing address, and fax number.

- Add the date: Write the date you are completing the form.

- Consent section: If this request is made on behalf of individuals, list their names, and make sure they sign and date the permission section. For businesses, fill in the company name and title of the person providing consent.

- Input the search criteria: Clearly provide the full names of the debtors and any previous names (dba, fka, etc.). Include their current mailing and property addresses along with telephone numbers.

- Tax and identification details: Fill in the Tax ID and Social Security numbers as well as any assessment serial numbers that may apply.

- Provide additional information: If you have any details that could help with the search, you can add those in the designated area. For instance, attaching copies of recorded liens is recommended but not required.

- Response section: After submitting, you’ll wait for the response. Note that this section will be filled out by the Collections Enforcement Section.

- Payment instructions: Make note of where to send the payment, ensuring it is made out to "Attorney General of Ohio." Include all necessary identification numbers related to the account.

Once you have completed the form, double-check all the information before submitting it to prevent delays. After submission, you’ll receive information pertaining to the debts and any necessary actions you might need to take based on what is discovered during the search process.

What You Should Know About This Form

What is the Ohio Payoff form?

The Ohio Payoff form is a document used to request payoff information related to debts owed to the State of Ohio. It is typically completed by realtors or title companies during a property transaction. This form enables the Attorney General's office to provide details about any certified debts and their associated liens against a property.

Who can complete the Ohio Payoff form?

The form can be completed by realtors or title companies. The person filling it out must provide their name, mailing address, and fax number. They should also obtain consent from the individuals or entities owing the debt, allowing the Attorney General's office to release relevant information.

What information do I need to provide on the form?

You will need to provide several details on the form, including the full names of the debtors, any business names, current mailing addresses, property addresses, contact numbers, and Social Security or Tax Identification Numbers. Additional information that could assist the search, such as recorded liens, is helpful but not mandatory.

How does the Attorney General confirm the debts?

Once the Attorney General receives the completed form, they conduct a search of their records based on the provided information. They verify any debts that have been certified for collection and check for existing liens against the individual or property specified in the request.

What happens after submitting the Ohio Payoff form?

After submission, the Attorney General's office will respond to your request with the details of any debts that have been found. This response will include the payoff balances for both filed and unpaid debts, and a good-through date for the balances provided.

How do I make a payment for the payoff?

Payments should be made via check, payable to the "Attorney General of Ohio." Send the check to the Collections Enforcement Section at their Columbus address, including the necessary details such as account numbers to ensure proper crediting of your payments.

What if I have multiple debts?

If you have multiple debts, ensure to indicate which specific debts you are paying on the payoff detail sheet. Attach this sheet to your payment so that the Attorney General's office can correctly apply your payment to the respective debts.

How long does it take to receive a release of lien?

After full payment is made for the liens, a release will be issued within 10 days. However, the issuance is contingent upon receiving the recording references needed for preparation from the Clerk/Recorder's Office.

Can additional debts accrue after my request?

Yes, additional debts may arise. The Attorney General's response will warn that any new liens on currently unliened debts may be processed by the time of closing. Therefore, staying updated on your account status is crucial.

How can I check my current balance due?

You can check your current balance by visiting the Ohio Attorney General's website. You'll need the account and CRN numbers provided in the Attorney General's letter to access your information.

Common mistakes

When completing the Ohio Payoff form, individuals often make several common mistakes that can lead to confusion or delays in processing. Understanding these pitfalls can help ensure a smoother experience.

One frequent error is providing incomplete or incorrect contact information. This includes both the mailing address and fax number. Without accurate data, it becomes challenging for the Ohio Attorney General’s office to reach out for any necessary follow-ups. Double-checking these details before submitting the form can prevent unnecessary delays.

Another mistake is neglecting to include all required signatures. If the form is signed by individuals, it must include all necessary parties. For corporate or partnership submissions, authorized representatives must sign as well. Failing to secure all required signatures can result in the form being rejected.

Many users overlook the section for search criteria. Providing detailed information about the debtor, including full names, current addresses, and any relevant identification numbers is vital. Omitting this data can lead to an inability to locate the correct accounts in the system.

Additionally, errors often occur in the Tax ID and Social Security number sections. Providing incorrect numbers can result in legal complications or delays in processing. Individuals should ensure that these identifiers are accurate and complete, as they are critical for proper identification.

Some people forget to attach any additional documentation that could assist with the search. While attaching copies of recorded liens is not mandatory, doing so can expedite the process. Providing this additional information can be helpful.

Another common mistake involves failing to calculate the totals accurately. Ensuring all amounts are correctly summed is essential, as any discrepancies can cause further complications. Users should verify all calculations before submission to avoid issues.

Submitting the form without reviewing the instructions is another frequent oversight. Each section of the Ohio Payoff form has specific requirements and guidelines. By thoroughly reading the instructions, individuals can mitigate errors and ensure compliance with all necessary criteria.

Lastly, some users do not confirm that they have chosen the correct debts to be paid. Indicating which debts on the sheet are being addressed is critical for the processing of the payment. Leaving this unclear can lead to miscommunication and potential misdirection of funds.

Documents used along the form

The Ohio Payoff form is an important document used during the closing process, particularly when debts owed to the State of Ohio need to be settled. Along with this form, several other documents may be required to ensure compliance and smooth processing. Below is a list of commonly used forms that complement the Ohio Payoff form, along with brief descriptions of each.

- Authorization to Release Information: This form grants permission for the Ohio Attorney General's office to disclose information concerning debts owed by an individual or entity. It protects the privacy of the debtor while facilitating necessary communication.

- Debt Certification Letter: This document certifies the amount of any debts owed and is usually issued by the Ohio Attorney General's office. It outlines what is owed, helping to clarify the payoff obligations for real estate transactions.

- Settlement Agreement: When debts are negotiated or settled, this agreement lays out the terms of repayment or reduction. This ensures that all parties understand their responsibilities and helps prevent future disputes.

- Release of Lien Form: Once debts are paid, this form is essential for formally releasing any liens associated with those debts. It acts as proof that the obligations have been satisfied and the property is clear of claims from the State.

- Title Search Report: A title search report provides a comprehensive look at the legal ownership of a property and any associated liens or encumbrances. This report is invaluable for identifying outstanding debts that may need to be resolved.

- Payment Remittance Form: This form accompanies payments made to the Attorney General's office. It details the amounts being paid and ensures that funds are properly allocated to the right accounts.

- Personal Identification Documents: Such documents (like a driver’s license or passport) are often required to verify the identity of the debtor, ensuring that the request for payoff information is legitimate.

- Corporate Resolution: If the debtor is a business entity, this document shows that the person signing the Ohio Payoff form is authorized to do so on behalf of the corporation or partnership.

- Tax Clearance Certificate: This certificate verifies that all state taxes are up to date. It can be critical for ensuring that no further claims are attached to a property due to unpaid taxes.

- Affidavit of Payment: This document serves as a sworn statement confirming that all payments have been made regarding the debts in question. It may be necessary during closing to confirm compliance with debt obligations.

These documents work together with the Ohio Payoff form to ensure that all debt obligations are clear and appropriately addressed. Having these forms ready can streamline the closing process and facilitate proper communication among all parties involved.

Similar forms

- Release of Lien Form: Like the Ohio Payoff Form, a release of lien form is used to formally remove a lien once a debt has been satisfied. It includes details about the debt and to whom it pertains, ensuring clarity in lien removal.

- Notice of Default: Similar to the Ohio Payoff Form, a notice of default informs parties of impending foreclosure or collection actions due to unpaid debts. It outlines the debt amount and provides a timeline for resolution.

- Debt Validation Letter: A debt validation letter, akin to the payoff form, requests proof of a debt from a creditor. It serves to confirm the legitimacy of the claim and can include details on the debt and payer information.

- Loan Payoff Statement: A loan payoff statement provides the total amount due for a loan, similar to the payoff information in the Ohio Payoff Form. It clarifies remaining balances, including any accrued interest or fees.

- Judgment Collection Request: This document requests the collection of a judgment against a debtor. It is similar in purpose to the Ohio Payoff Form, as both facilitate the process of satisfying and documenting debts owed.

- Bankruptcy Claim Form: A bankruptcy claim form is similar to the Ohio Payoff Form in that it is used to establish a debtor's obligations during bankruptcy proceedings. It lists the debts and verifies amounts due for distribution among creditors.

Dos and Don'ts

When filling out the Ohio Payoff form, certain best practices should guide you. Here are some key dos and don’ts to consider.

- Do provide accurate and complete information regarding the debtor(s).

- Do include all necessary identification numbers, such as Tax ID and Social Security numbers.

- Do double-check that the mailing address you provide is up to date.

- Do attach any relevant documents or summaries that might assist in the search.

- Don’t leave any sections blank unless they are not applicable.

- Don’t forget to sign and date the consent section for individual or corporate submissions.

- Don’t ignore the need for accurate lien details on the submission.

- Don’t underestimate the importance of clearly indicating the debts being paid.

Misconceptions

The Ohio Payoff form is a crucial document for handling debt situations involving the State of Ohio. However, several misconceptions exist regarding its use and requirements. Here are six common misunderstandings, along with clarifications.

- The form can only be submitted by attorneys. Many believe that only licensed attorneys can complete and submit the Ohio Payoff form. In reality, it can also be completed by realtors and title companies, as noted in the form instructions.

- All debts will be immediately cleared upon submission. Some individuals think that once they submit the form, all debts will be paid off without delay. However, a release of lien will typically occur only after payment is received in full, along with the required documentation.

- The form is only for individuals. Many assume that this payoff process is limited to individuals only. In truth, corporations, partnerships, and other business entities can also use this form to manage their debts with the State.

- The form guarantees accurate debt amounts. A common belief is that the amounts listed in the form represent the final or accurate balances due. However, the state warns that additional debts may exist which were not identified during the search.

- Submitting the form is enough to resolve debts. Some may think that simply submitting the payoff form will resolve their debts. It is important to remember that full payment must accompany the submission for the process to proceed.

- Payment can be made through any method. There is a misconception that payments can be sent through various channels. The instructions specify that payments must be made via check, directed specifically to the Attorney General of Ohio.

Understanding these misconceptions can lead to more effective planning and ensure compliance with the requirements outlined in the Ohio Payoff form.

Key takeaways

Filling out and using the Ohio Payoff form is a straightforward process, but understanding its details is crucial. Here are key takeaways to keep in mind:

- Who Can Request: Only realtors or title companies are allowed to complete the form, so make sure you're eligible before proceeding.

- Information Required: Essential details such as the full name of the debtor, mailing address, and tax identification numbers need to be provided accurately. Inaccurate data can lead to complications.

- Consent Matters: The form includes sections for consent from both individuals and businesses. Ensure that signatures are obtained from all necessary parties to avoid delays.

- Search Criteria: Be thorough when filling out the search criteria. If available, attach copies of recorded liens to assist in the search process.

- Response Time: Expect some time to pass between submission and response. The office may take up to 10 days to issue releases after payment is made.

- Payment Instructions: All payments must be made via check, payable to the "Attorney General of Ohio," and sent to the specified address. This ensures your payment is properly credited.

- Monitor for Changes: Be aware that debt statuses can change. Liened debts not recorded yet, and newly certified debts could impact your payoff before closing.

- Accessing Account Information: Use the account and CRN numbers provided by the Attorney General in their communication to view the current balance online.

Browse Other Templates

Registered Retail Merchant Certificate - Different tax types can be selected when registering a business or location with the BT-1 form.

Green Card Affidavit of Support - It provides a contract that binds the household member to support obligations.

What Is a Certificate of Compliance Maryland - The Workers' Compensation Commission manages the processing of these exclusion requests.