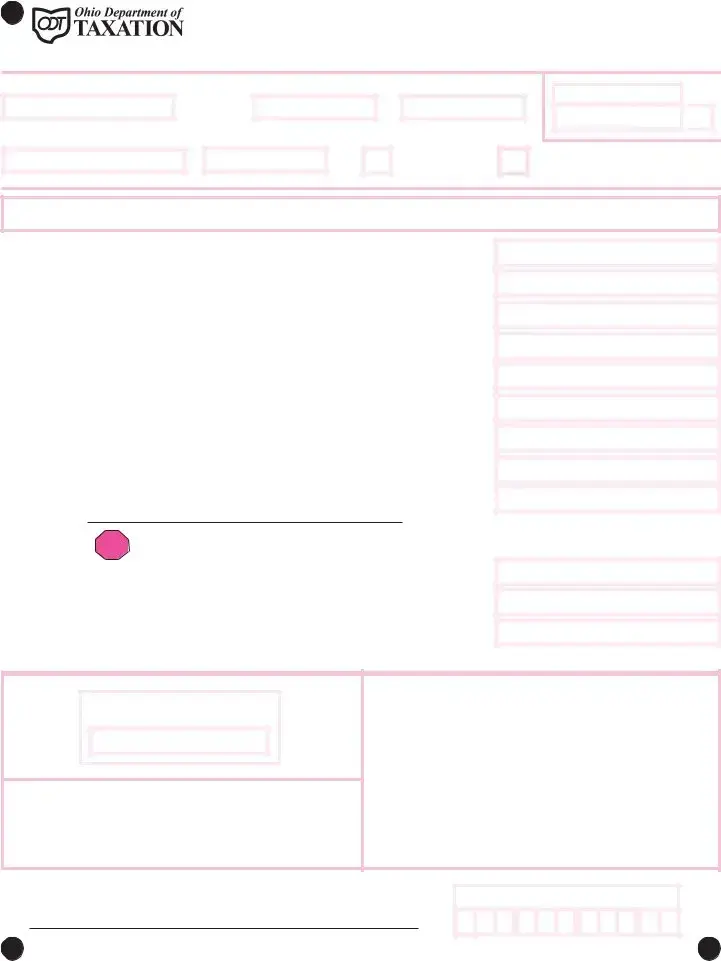

Fill Out Your Ohio Sales Tax Ust 1 Form

The Ohio Sales Tax UST 1 form serves as a crucial tool for businesses operating in Ohio to report their sales and corresponding tax liabilities to the state. This form is designed for businesses that hold a vendor's license and outlines the necessary steps for accurately calculating and remitting sales tax. It encompasses several key sections, including total gross sales, exempt sales, net taxable sales, as well as specific details such as tax liabilities due and applicable discounts. Should businesses need to amend their returns, the form includes a checkbox for such instances. Additionally, the UST 1 form accommodates reports of accelerated sales tax payments and outlines procedures for handling overpayments. It mandates accurate reporting across various counties in Ohio, requiring a supporting schedule to specify taxable sales and tax liabilities on a county-by-county basis. Submission can be made through mail or electronically via the Ohio Business Gateway, providing flexibility in compliance. Properly completing the form is vital for maintaining compliance with Ohio tax regulations, and it carries declarations to verify the accuracy of submitted information.

Ohio Sales Tax Ust 1 Example

|

|

|

|

|

|

|

|

|

Reset Form |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

UST 1 Long Rev. 10/06 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Universal Ohio State, County |

|

07030103 |

|

|

|

|

|

|

||||||||||||||||||||||||||||

Please do not use staples. |

|

|

|

|

|

|

|

|

|

|

|

and Transit Sales Tax Return |

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Vendor’s license number

FEIN or Social Security number

Reporting period (mm dd yy)

to

Must be received by (mm dd yy)

Please mark here if paid through EFT.

For State Use Only

M M

M  D

D  D

D  Y

Y  Y

Y

Please mark here if amended return.

NameAddressCityState ZIP

1. |

Gross sales |

1. |

2. |

Exempt sales (including exempt motor vehicle sales) |

2. |

3. |

Net taxable sales (subtract line 2 from line 1) |

3. |

4. |

Sales upon which tax was paid to clerks of courts (motor vehicles, trailers, etc.) . 4. |

|

5. |

Reportable taxable sales (subtract line 4 from line 3) |

5. |

6. |

Tax liability on sales reported on line 5 |

6. |

7. |

Minus discount (see instructions) |

7. |

8. |

Plus additional charge (see instructions) |

8. |

9. |

Net amount due |

9. |

|

Use the following lines only if you made |

|

|

|

STOP accelerated sales tax payments! |

|

|

10. Accelerated payments and carryover from previous period |

10. |

||

11. Balance due (if line 10 is less than line 9, subtract line 10 from line 9) |

11. |

||

12. Overpayment* (if line 10 is greater than line 9, subtract line 9 from line 10) .... |

12. |

||

*Overpayment will be credited to the next period.

To Cancel Vendor’s License Enter

Last Day of Business (mm dd yy)

Do not staple check to form or attach check stub. Do not send cash. Make remittance payable to the

Ohio Treasurer of State and mail all four pages of this form to:

Ohio Department of Taxation

P.O. Box 16560

Columbus, OH

Go paperless!

File your return through Ohio Business Gateway.

www.obg.ohio.gov

I declare under penalties of perjury that this return, including any accompanying schedules and statements, has been examined by me and, to the best of my knowledge and belief, is a true, correct and complete return and report.

Signature |

Title |

Date |

For State Use Only

, ,

UST 1 – pg. 1 of 4

Please do not use staples. Vendor’s license number

UST 1 Long Rev. 10/06

Universal Ohio State, County and Transit Sales Tax Return

Supporting schedule must be completed showing taxable sales and the combined state, county and transit authority taxes on a

County Name |

County Number |

|

|

Taxable Sales* |

|

|

Tax Liability* |

|||

*If this amount is a negative, please mark an “X” in the box provided. |

||||||||||

|

|

|||||||||

Adams |

01 |

|

|

|

|

|

|

|

|

|

Allen |

02 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Ashland |

03 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Ashtabula |

04 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Athens |

05 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Auglaize |

06 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Belmont |

07 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Brown |

08 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Butler |

09 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Carroll |

10 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Champaign |

11 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Clark |

12 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Clermont |

13 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Clinton |

14 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Columbiana |

15 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Coshocton |

16 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Crawford |

17 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Cuyahoga |

18 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Darke |

19 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Defiance |

20 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Delaware |

21 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Delaware (COTA) |

96 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Erie |

22 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Fairfield |

23 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Fairfield (COTA) |

93 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Fayette |

24 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Franklin |

25 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Fulton |

26 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Gallia |

27 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Geauga |

28 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Greene |

29 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Guernsey |

30 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Hamilton |

31 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Page 2 subtotal

UST 1 – pg. 2 of 4

Please do not use staples. Vendor’s license number

UST 1 Long Rev. 10/06

Universal Ohio State, County and Transit Sales Tax Return

Supporting schedule must be completed showing taxable sales and the combined state, county and transit authority taxes on a

County Name |

County Number |

|

|

Taxable Sales* |

|

|

Tax Liability* |

|||

*If this amount is a negative, please mark an “X” in the box provided. |

||||||||||

|

|

|||||||||

Hancock |

32 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Hardin |

33 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Harrison |

34 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Henry |

35 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Highland |

36 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Hocking |

37 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Holmes |

38 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Huron |

39 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Jackson |

40 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Jefferson |

41 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Knox |

42 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Lake |

43 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Lawrence |

44 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Licking |

45 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Licking (COTA) |

94 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Logan |

46 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Lorain |

47 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Lucas |

48 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Madison |

49 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Mahoning |

50 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Marion |

51 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Medina |

52 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Meigs |

53 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Mercer |

54 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Miami |

55 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Monroe |

56 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Montgomery |

57 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Morgan |

58 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Morrow |

59 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Muskingum |

60 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Noble |

61 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Ottawa |

62 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Paulding |

63 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Page 3 subtotal

UST 1 – pg. 3 of 4

|

|

|

|

|

|

|

|

|

|

|

Reset Form |

||||||||||||||

Please do not use staples. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

07030403 |

|

||||||||||||||||||||||||

Vendor’s license number |

Reporting period (mm dd yy) |

||||||||||||||||||||||||

to

UST 1 Long Rev. 10/06

Universal Ohio State, County and Transit Sales Tax Return

Supporting schedule must be completed showing taxable sales and the combined state, county and transit authority taxes on a

County Name |

County Number |

|

|

Taxable Sales* |

|

|

Tax Liability* |

|||

*If this amount is a negative, please mark an “X” in the box provided. |

||||||||||

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

Perry |

64 |

|

|

|

|

|

|

|

|

|

Pickaway |

65 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Pike |

66 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Portage |

67 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Preble |

68 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Putnam |

69 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Richland |

70 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Ross |

71 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Sandusky |

72 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Scioto |

73 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Seneca |

74 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Shelby |

75 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Stark |

76 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Summit |

77 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Trumbull |

78 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Tuscarawas |

79 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Union |

80 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Van Wert |

81 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Vinton |

82 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Warren |

83 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Washington |

84 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Wayne |

85 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Williams |

86 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Wood |

87 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Wyandot |

88 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Subtotal this page

Page 2 subtotal

Page 3 subtotal

Grand total*

*Enter totals on lines 5 and 6 on the front page of this return.

UST 1 – pg. 4 of 4

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The UST 1 form is used to report state, county, and transit sales tax in Ohio. |

| Filing Deadline | This form must be received by the Ohio Department of Taxation by the specified due date for the reporting period. |

| Vendor Requirements | Businesses must include their vendor's license number and either their FEIN or Social Security number on the form. |

| Supporting Schedule | A supporting schedule detailing taxable sales and tax liabilities must be attached, broken down by county. |

| Governing Law | The Ohio Revised Code, Section 5743, governs the collection and reporting of sales tax in the state. |

Guidelines on Utilizing Ohio Sales Tax Ust 1

Completing the Ohio Sales Tax UST 1 form requires careful attention to detail. It is essential to ensure that all information is accurate to avoid delays in processing. The following steps outline how to fill out the form correctly.

- Obtain the UST 1 form: First, download the Ohio Sales Tax UST 1 form from the Ohio Department of Taxation website or obtain a physical copy.

- Fill out your vendor information: Enter your vendor’s license number, FEIN or Social Security number, and your name, address, city, state, and ZIP code on the first page of the form.

- Indicate the reporting period: Specify the beginning and ending dates of the reporting period in the format mm dd yy.

- Provide sales data:

- Report your gross sales on line 1.

- Report any exempt sales, including exempt motor vehicle sales, on line 2.

- Calculate your net taxable sales by subtracting line 2 from line 1 and enter the result on line 3.

- Report sales on which tax was paid to clerks of courts (e.g., motor vehicles, trailers) on line 4.

- Calculate reportable taxable sales by subtracting line 4 from line 3 and enter this on line 5.

- Calculate tax liability on sales reported on line 5 and enter it on line 6.

- If applicable, indicate any discount on line 7 and add any additional charge on line 8. Combine these figures to show the net amount due on line 9.

- Complete additional sections: If you made accelerated sales tax payments, fill in lines 10, 11, and 12 as necessary.

- If canceling a vendor’s license: Write the last day of business in the designated area.

- Review your form: Ensure that all information is accurate and that no staples are used.

- File your return: Sign and date the form. Make your remittance payable to the Ohio Treasurer of State and mail all pages to the Ohio Department of Taxation or file online through the Ohio Business Gateway.

After submission, keep a copy of the signed form and any payment confirmation for your records. It is important to submit the form on time to avoid any penalties. Ensure you follow up to confirm the receipt and processing of your return.

What You Should Know About This Form

What is the Ohio Sales Tax UST 1 form used for?

The Ohio Sales Tax UST 1 form is designed for vendors in Ohio to report their sales tax collections and calculations. This form allows businesses to declare their gross sales, exempt sales, and net taxable sales. By completing this form, vendors ensure they comply with state tax regulations and remit the correct amount of sales tax to the Ohio Department of Taxation.

What information do I need to fill out on the UST 1 form?

When completing the UST 1 form, you will need to provide several key pieces of information. This includes your vendor's license number, federal Employer Identification Number (FEIN) or Social Security number, and the reporting period for which you are submitting the form. You'll also need to detail your gross sales, any exempt sales, and your calculations of taxable sales. Accurate financial records will help you fill in these details correctly.

How do I submit the UST 1 form?

The UST 1 form should be completed and submitted without staples, either via mail or electronically through the Ohio Business Gateway. If you opt for the mail method, send the form along with payment (if due) to the Ohio Department of Taxation at the given address. It’s crucial to ensure that your submission is sent before the due date to avoid penalties.

What if I made an error on my UST 1 form?

If you discover an error after submitting your UST 1 form, you should mark the form as an "amended return" for the reporting period in question. This indicates to the Ohio Department of Taxation that you are correcting or updating previously reported information. Be sure to clearly outline the changes to ensure your records are accurate and in compliance with state regulations.

What happens if I overpay or underpay my sales tax?

In the event of an overpayment on your UST 1 form, the Ohio Department of Taxation will apply this overpayment as a credit towards your next sales tax period. If you underpay, however, you may be responsible for paying the remaining balance along with any potential penalties or interest. Staying diligent with your calculations will help prevent these issues.

Common mistakes

Completing the Ohio Sales Tax UST 1 form can be straightforward, but several common mistakes can lead to issues. One frequent error is not providing the correct vendor's license number. This number is essential for identifying your business, and missing or incorrect information can delay processing and lead to penalties.

Another common mistake involves miscalculating gross and exempt sales. Accurate figures are crucial for determining your net taxable sales. Failure to subtract the exempt sales from gross sales correctly will result in either overpayment or underpayment of taxes, complicating future filings.

Many people also overlook the requirement to complete the supporting schedules accurately. Lines for taxable sales and tax liabilities must reflect the correct county details. Not marking a negative amount with an "X" can lead to confusion or inaccurate processing, which may cause delays or additional fees.

Not using the right reporting period is another aspect where errors frequently occur. Inaccuracies can occur when businesses do not ensure their reporting period aligns with their financial records. This oversight can result in incorrect tax calculations and complications with the state. Remember, accuracy in dates helps avoid future discrepancies.

Sometimes, taxpayers forget to declare any overpayment. If a taxpayer fails to indicate an overpayment from a prior period, it can lead to excessive payments in the current reporting period. This mistake not only affects cash flow but also requires additional steps to correct the situation with the state.

Lastly, many people neglect to fully sign and date the form. Without an original signature, the form might not be considered valid. Completing this final step is crucial for ensuring that the return is accepted. Incomplete submissions can cause processing delays and could lead to further complications down the line.

Documents used along the form

Filing the Ohio Sales Tax UST 1 form requires keeping track of several additional documents. These documents accompany the form to ensure accurate reporting, compliance, and proper record-keeping. Below is a list of important forms and documents commonly used alongside the UST 1 form.

- Vendor’s License: This document confirms that a business has the right to sell goods and services in Ohio. It is necessary for collecting sales tax from customers.

- Tax Exemption Certificate: Issued to vendors or purchasers, this certificate verifies that the buyer is exempt from paying sales tax on specific purchases, such as for resale or certain qualifying exemptions.

- Federal Employer Identification Number (FEIN) Certificate: This number is required for businesses that have employees or operate as corporations. It acts as a unique identifier for federal tax purposes.

- Sales Tax Recordkeeping Form: This internal document helps businesses track sales tax collected and owed over time, aiding in the completion of the UST 1 form.

- Schedule of Qualifying Exempt Sales: This schedule lists all sales eligible for exemption from sales tax. Keeping this up to date is necessary for accurate reporting.

- County Tax Allocation Detail: Required for businesses selling in multiple counties, this detail breaks down sales and corresponding tax liabilities by county.

- Sourcing Documents: These documents support the allocation of sales to specific jurisdictions and may include invoices, receipts, or contracts.

- Amendment Request Form: If an error is identified after filing, this form is used to formally amend the UST 1 submission.

- Accounting Records: Comprehensive accounting records including books, ledgers, and receipts are essential for validating reported sales figures and tax calculations.

- Payment Confirmation: A receipt or confirmation of sales tax payment. Retaining this as proof can protect businesses during audits or inquiries.

Using these forms not only ensures compliance with Ohio's tax regulations but also assists businesses in accurately reporting their sales tax liabilities. This diligence pays off in protecting a business's financial health and standing with tax authorities.

Similar forms

The Ohio Sales Tax UST 1 form serves a crucial role in the reporting and payment of sales tax in the state. Several other documents are similar in purpose and structure, allowing businesses to comply with tax regulations. Below are ten documents that share similarities with the UST 1 form:

- Federal Income Tax Form 1040 - Just as the UST 1 is used for sales tax reporting, the Federal Form 1040 is for individuals to report their annual income tax. Both require the disclosure of relevant financial activities and result in a liability or refund of taxes owed.

- Ohio Corporate Franchise Tax Return (FT 1120) - Much like the UST 1, this form is utilized by businesses to report their income and determine tax obligations, making it necessary for compliance with state tax laws.

- Sales Tax Exemption Certificate (ST 2) - This document, similar to the UST 1, is used to claim exemption from sales tax. Both documents focus on the sales transaction details and help ensure appropriate tax application.

- Monthly Sales and Use Tax Return (California Form BOE 401-A) - Like the UST 1, this form is designed for reporting sales and use tax on a regular basis, necessitating the reporting of gross and exempt sales.

- Annual Business Personal Property Tax Return - Similar in nature, this document reports the value of personal property owned by businesses, enabling the calculation of tax owed, akin to how the UST 1 determines sales tax.

- IRS Form 941 - This form is used for reporting payroll taxes. While it pertains to employee taxation, both the UST 1 and Form 941 require regular submission based on specific reporting periods.

- Ohio Employer Withholding Tax Return (IT 501) - This document, like the UST 1, is a reporting tool for tax collection. It summarizes the state income tax withheld from employees and needs to be filed regularly.

- IRS Form 1065 - The partnership tax return collects information on the income and deductions of partnerships, drawing parallels in reporting financial performance, similar to the sales reporting on the UST 1.

- Ohio Lodging Tax Return - Much like the UST 1, this form is specific to a type of revenue generating activity (lodging) and outlines income received, tax liability, and payment specifics.

- Excise Tax Return (e.g., Form 720) - This form is used for various excise taxes and mirrors the UST 1 in that it reports specific revenues and associated tax liabilities from particular sales activities.

Understanding these similarities can greatly assist individuals and businesses in navigating their tax obligations. Each form serves to ensure compliance with the respective tax authority, reflecting the importance of accurate reporting in maintaining good standing with regulatory requirements.

Dos and Don'ts

When filling out the Ohio Sales Tax UST 1 form, it’s crucial to follow certain best practices to ensure accuracy and compliance. Here are seven important dos and don'ts:

- Do use printed or typed information to complete the form for clarity.

- Don't staple any documents together as this may cause processing issues.

- Do double-check the reporting period and ensure that all dates are correct before submission.

- Don't send cash with your form; this creates a risk of being lost or stolen.

- Do include your vendor’s license number and FEIN or Social Security number as required.

- Don't forget to sign and date the form. An unsigned form can delay processing.

- Do keep a copy of the completed form and any correspondence for your records.

Following these guidelines can help make the process smoother and prevent unnecessary complications with your tax return.

Misconceptions

When it comes to the Ohio Sales Tax UST 1 form, there are several misconceptions that often lead to confusion. Here are four common misunderstandings clarified:

- Myth 1: The UST 1 form only applies to retail sales.

- Myth 2: Filing the UST 1 form is optional for businesses.

- Myth 3: I can submit the UST 1 form late without any consequences.

- Myth 4: I only need to report sales tax once annually.

This is not correct. While the UST 1 form is primarily used for retail transactions, it also covers any taxable sales made by various types of businesses. This includes services and certain exempt sales like motor vehicles.

Filing the UST 1 form is a requirement for businesses that have a vendor's license and make taxable sales in Ohio. Not filing can lead to penalties and interest on unpaid sales tax. It's essential to understand your obligations as a business owner.

This is a misconception. The UST 1 form has a specific due date. Late submissions may incur penalties, and businesses may also be charged interest on any tax owed. Filing on time is crucial to avoid these charges.

This is not accurate for many businesses. Depending on your sales volume, you may be required to file the UST 1 form quarterly or even monthly. Understanding your reporting obligations can help ensure compliance.

Key takeaways

When filling out and using the Ohio Sales Tax UST 1 form, several key points should guide you to ensure accuracy and compliance. Here are some takeaways:

- Understand the Basics: The UST 1 form is used to report sales tax for a designated reporting period. It is essential to enter both your vendor's license number and your FEIN (Federal Employer Identification Number) or Social Security number at the beginning of the form.

- Accurate Reporting Period: Make sure to clearly indicate the beginning and ending dates of the reporting period. This information is crucial as it dictates the period under review and the associated sales.

- Exempt Sales: Line 2 requires you to report any exempt sales, including exempt motor vehicle sales. These should be accurately calculated, as they directly affect your net taxable sales.

- Calculate Net Taxable Sales Correctly: Line 3 is critical as it subtracts exempt sales (reported on Line 2) from gross sales (reported on Line 1). Ensure that these calculations are accurate to avoid discrepancies.

- Review Additional Charges and Discounts: Be mindful when adding any additional charges or applying discounts. Lines 7 and 8 allow for adjustments that can change your total tax liability significantly.

- Keep Records of Payments: If accelerated sales tax payments were made in the previous period, ensure you complete Lines 10 to 12 accurately. These lines help calculate whether you owe additional tax or if there’s an overpayment that can be credited to the next period.

By paying close attention to these elements, you can ensure a smoother filing process and maintain compliance with Ohio's sales tax regulations.

Browse Other Templates

Tax Collector's Office - If current year figures are unavailable, the Tax Commission may accept prior year documentation with appropriate explanations.

Preliminary Notice Form - It requires specific project details, including the job site address.

What Qualifies for Handicap Parking - Information submitted is protected but may be shared with authorized parties.