Fill Out Your Ohp 515 Form

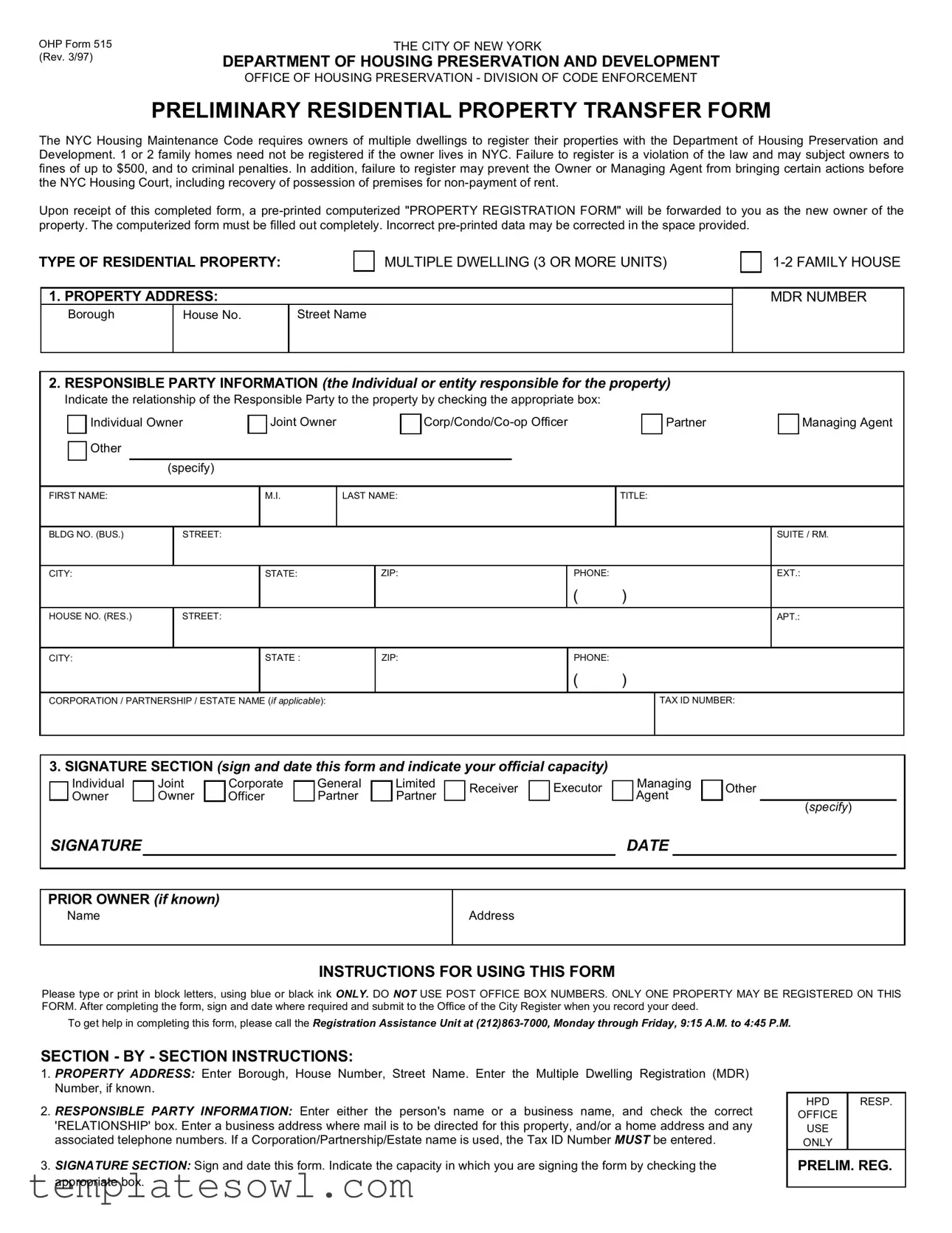

The OHP 515 form, officially known as the Preliminary Residential Property Transfer Form, plays a crucial role in the regulatory framework for property ownership in New York City. This form is designed primarily for owners of multiple dwellings, ensuring that they meet the requirements set forth by the NYC Housing Maintenance Code by registering their properties with the Department of Housing Preservation and Development. While owners of one- or two-family homes may not need to register if they reside in the city, this exemption does not apply to those owning multiple units. Failing to register can lead to significant repercussions, including fines up to $500 and potential criminal penalties. Moreover, unregistered owners may find themselves unable to pursue certain legal actions, such as eviction for non-payment of rent. Upon submission, the completed form prompts the issuance of a computerized Property Registration Form, which must be filled out accurately. The OHP 515 form asks for critical information like the property address, details about the responsible party, and a signature section to validate the submission. Providing accurate information is essential to avoid complications down the line, so understanding how to correctly fill out each section is vital for property owners engaging with the NYC housing system.

Ohp 515 Example

OHP Form 515 |

THE CITY OF NEW YORK |

(Rev. 3/97) |

DEPARTMENT OF HOUSING PRESERVATION AND DEVELOPMENT |

|

|

|

OFFICE OF HOUSING PRESERVATION - DIVISION OF CODE ENFORCEMENT |

|

PRELIMINARY RESIDENTIAL PROPERTY TRANSFER FORM |

The NYC Housing Maintenance Code requires owners of multiple dwellings to register their properties with the Department of Housing Preservation and Development. 1 or 2 family homes need not be registered if the owner lives in NYC. Failure to register is a violation of the law and may subject owners to fines of up to $500, and to criminal penalties. In addition, failure to register may prevent the Owner or Managing Agent from bringing certain actions before the NYC Housing Court, including recovery of possession of premises for

Upon receipt of this completed form, a

TYPE OF RESIDENTIAL PROPERTY:

MULTIPLE DWELLING (3 OR MORE UNITS)

1. PROPERTY ADDRESS:

Borough |

House No. |

Street Name |

|

|

|

MDR NUMBER

2.RESPONSIBLE PARTY INFORMATION (the Individual or entity responsible for the property)

Indicate the relationship of the Responsible Party to the property by checking the appropriate box:

Individual Owner |

|

|

Joint Owner |

|

|

|

|

|

|

|

|

Other

Other

(specify)

Partner

Partner

Managing Agent

Managing Agent

FIRST NAME:

M.I.

LAST NAME:

TITLE:

BLDG NO. (BUS.) |

STREET: |

|

|

|

SUITE / RM. |

|

|

|

|

|

|

|

|

CITY: |

|

STATE: |

ZIP: |

PHONE: |

|

EXT.: |

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

HOUSE NO. (RES.) |

STREET: |

|

|

|

APT.: |

|

|

|

|

|

|

|

|

CITY:

STATE :

ZIP:

PHONE:

()

CORPORATION / PARTNERSHIP / ESTATE NAME (if applicable):

TAX ID NUMBER:

3.SIGNATURE SECTION (sign and date this form and indicate your official capacity)

Individual |

|

|

Joint |

|

|

Corporate |

|

|

General |

|

|

Limited |

|

|

|

|

|

Executor |

Owner |

|

Owner |

|

Officer |

|

Partner |

|

Partner |

|

Receiver |

|

|||||||

|

|

|

|

|

|

|

|

|

||||||||||

Managing Agent

Other

Other

(specify)

SIGNATURE |

|

DATE |

PRIOR OWNER (if known)

Name

Address

INSTRUCTIONS FOR USING THIS FORM

Please type or print in block letters, using blue or black ink ONLY. DO NOT USE POST OFFICE BOX NUMBERS. ONLY ONE PROPERTY MAY BE REGISTERED ON THlS FORM. After completing the form, sign and date where required and submit to the Office of the City Register when you record your deed.

To get help in completing this form, please call the Registration Assistance Unit at

SECTION - BY - SECTION INSTRUCTIONS:

1.PROPERTY ADDRESS: Enter Borough, House Number, Street Name. Enter the Multiple Dwelling Registration (MDR) Number, if known.

2.RESPONSIBLE PARTY INFORMATION: Enter either the person's name or a business name, and check the correct 'RELATIONSHIP' box. Enter a business address where mail is to be directed for this property, and/or a home address and any associated telephone numbers. If a Corporation/Partnership/Estate name is used, the Tax ID Number MUST be entered.

3.SIGNATURE SECTION: Sign and date this form. Indicate the capacity in which you are signing the form by checking the appropriate box.

HPD |

RESP. |

OFFICE |

|

USE |

|

ONLY |

|

PRELIM. REG.

Form Characteristics

| Fact Name | Description |

|---|---|

| Governing Body | The OHP 515 form is overseen by the Department of Housing Preservation and Development (HPD) of New York City. |

| Form Purpose | This form is used to register residential properties, specifically focusing on multiple dwellings and 1-2 family homes within NYC. |

| Registration Requirement | Owners of multiple dwellings must register their properties with the HPD. However, those owning 1-2 family homes are exempt only if they reside in NYC. |

| Penalties for Non-compliance | Failure to register can result in fines of up to $500 and potential criminal penalties. |

| Impact on Legal Actions | Non-registered owners may be barred from filing certain actions in NYC Housing Court, including evictions for non-payment of rent. |

| Submission Process | After completing the form, sign, date, and submit it to the Office of the City Register upon recording the deed. |

| Assistance Availability | For help with the form, owners can contact the Registration Assistance Unit at (212) 863-7000 during business hours. |

| Form Specifics | Only one property may be registered per form, and all information should be typed or printed in blue or black ink. |

Guidelines on Utilizing Ohp 515

Filling out the OHP 515 form is an important step for new property owners in New York City. Completing this form accurately ensures compliance with local housing regulations. Once submitted, the form triggers the issuance of a property registration form, which is needed for future legal processes related to the property.

- Property Address: In the first section, enter the borough, house number, and street name. If you know the Multiple Dwelling Registration (MDR) number, include it as well.

- Responsible Party Information: Provide the full name of the responsible party. You can enter either an individual’s name or a business name. Check the box that indicates your relationship to the property, such as “Individual Owner,” “Corp/Condo/Co-op Officer,” or any other applicable option. Fill in the mailing address and contact details, including phone numbers. If applicable, enter the corporation, partnership, or estate name and the Tax ID number.

- Signature Section: Sign and date the form. Indicate your official capacity by checking the appropriate box that describes your role, such as “Owner,” “Managing Agent,” or “Other.”

Once you have completed the form, make sure to double-check all entries for accuracy. Submitting the form to the Office of the City Register is your next step, along with any associated documents needed for property deed recording.

What You Should Know About This Form

What is the OHP 515 form used for?

The OHP 515 form serves as a Preliminary Residential Property Transfer Form in New York City. It is necessary for owners of multiple dwellings to register their properties with the Department of Housing Preservation and Development (HPD). The form ensures compliance with the NYC Housing Maintenance Code, which mandates property registration to avoid legal penalties and fines.

Who is required to file the OHP 515 form?

Owners of multiple dwellings, specifically those containing three or more residential units, are required to file this form. For one or two-family homes, registration is not necessary if the owner resides in New York City. Failing to register can lead to fines of up to $500 and hinder the owner's ability to initiate certain legal actions in Housing Court.

What happens after submitting the OHP 515 form?

Upon submission of the completed OHP 515 form, a pre-printed computerized Property Registration Form will be sent to the new property owner. This form must be filled out completely and returned, ensuring all information is accurate. Any incorrect pre-printed data can be adjusted in the designated spaces.

Can I register multiple properties using the OHP 515 form?

No, this form is intended for the registration of only one property at a time. If you have multiple properties to register, you will need to fill out a separate OHP 515 form for each property to ensure compliance with the registration requirements.

What information do I need to provide on the OHP 515 form?

The form requires specific details, including the property address, the responsible party's information (individual or entity responsible for the property, along with contact details), and the signature section where you must sign and date the form. Also, if you are using a corporation or partnership name, the Tax ID Number is necessary.

How can I get assistance with completing the OHP 515 form?

You can contact the Registration Assistance Unit at (212) 863-7000, where trained staff can help you with questions or difficulties related to completing the form. They are available Monday through Friday from 9:15 A.M. to 4:45 P.M. for your convenience.

Common mistakes

Filling out the OHP 515 form can be a straightforward task, yet many people inadvertently make mistakes that can lead to delays or potential penalties. One common error occurs during the entry of the property address. It is essential to accurately provide the borough, house number, and street name. Failing to include the complete address or leaving out key details may lead to miscommunication with the Department of Housing Preservation and Development.

Another frequent mistake involves the registration of multiple properties on a single form. Each OHP 515 form is meant for the registration of only one property. Submitting multiple properties together can nullify the registration and cause headaches for the owner. It’s essential to complete a separate form for each property to ensure accurate processing.

Individuals often neglect to check off the correct box that indicates their relationship to the property in the responsible party information section. This step is not merely a formality; it helps identify the specific role an owner or managing agent plays in relation to the property. Omitting or incorrectly selecting this option can create confusion and potential issues down the line.

Many also forget to include the tax identification number when registering as a corporation or partnership. This information is mandatory and aids the city in tracking ownership structures. Without it, the form may be deemed incomplete and could delay registration.

Using incorrect or illegible writing is another pitfall that individuals face. The instructions specifically recommend using blue or black ink and printing in block letters. If the handwriting is unclear or the colors deviate from the guidelines, processing may be hindered, affecting the reliability of the property record.

Additionally, providing a post office box number can lead to complications. The form explicitly states that post office box numbers should not be used for the property address. Instead, a physical, identifiable address is necessary to ensure accurate correspondence and processing.

Many people also overlook the signature section. It is critical to not only sign and date the form but also to specify the capacity in which one is signing. Failing to fulfill any of these requirements can render the form invalid, prompting a need to re-submit the documents.

Another frequent oversight is neglecting to fill in the phone numbers. This part of the form is vital for communication regarding any issues or questions that could arise after submission. Without contact information, the department may struggle to reach out to the responsible party if necessary.

Finally, it’s important to be mindful of providing information regarding the prior owner. While not always mandatory, mentioning the previous owner, if known, can facilitate smoother processing. Leaving this section blank could potentially raise questions during the registration process.

Documents used along the form

When dealing with property transactions in New York City, several forms and documents often accompany the OHP Form 515. Understanding these documents can help ensure that you comply with housing regulations and maintain the integrity of your ownership responsibilities. Below is a list of ten forms, each serving a specific purpose in the property registration and management process.

- Property Registration Form: This is a follow-up document that is sent after the OHP Form 515 is submitted. It consolidates information about the property and must be completed accurately to ensure proper registration with the Department of Housing Preservation and Development.

- Deed: The deed is a critical document that evidences ownership of the property. It must be recorded with the city and serves as official proof of property transfer from the seller to the buyer.

- NYC Housing Maintenance Code Documentation: This outlines the legal responsibilities that landlords have regarding maintenance and repair obligations within their rental properties. Compliance is crucial to avoid potential violations.

- Lease Agreements: These are contracts between landlords and tenants that outline the terms of tenancy, including rent amounts, property rules, and responsibilities of both parties, ensuring a clear understanding of obligations.

- Tenant Registration Forms: Landlords must often maintain records of tenants living in their buildings. These forms help monitor occupancy and ensure that all tenants are accounted for in accordance with housing laws.

- Property Management Agreement: This document outlines the responsibilities of a property management company, if applicable. It details the services provided and the fees involved, clarifying the relationship between the owner and manager.

- Inspection Reports: These are documents generated during routine inspections of the property to ensure it meets local housing codes. They can help identify issues before they lead to penalties or legal disputes.

- Financial Statements: These documents reflect the financial health of the property, detailing income, expenses, and any debt obligations. They are particularly useful for owners overseeing investment properties.

- Eviction Notices: In cases where tenants fail to comply with lease terms, eviction notices are necessary legal documents that initiate the process of tenant removal, outlining the reasons for eviction.

- Insurance Policies: Landlords need comprehensive insurance coverage to protect their property and liabilities. Insurance policies outline coverage limits, terms, and conditions of the protection offered.

By familiarizing yourself with these accompanying documents, you can manage your property more effectively and comply with New York City's legal requirements. Each form plays a vital role in ensuring a smooth transition of ownership and a clear understanding of responsibilities throughout the property management process.

Similar forms

The OHP Form 515 can be compared to several other important documents related to property registration and maintenance. Each document serves a similar purpose in ensuring compliance with housing regulations, yet they may differ in specific requirements or the types of properties they pertain to. Below are seven documents that share similarities with the OHP 515 form:

- Property Registration Form: This document is essential for all landlords and property owners to officially register their rental properties with local housing authorities. Like the OHP 515, it requires detailed information about the property and its responsible party.

- New York State Sales Tax Certificate: This form is used when purchasing or selling real property in New York. Both forms require accurate property details and provide a framework for compliance with state regulations, ensuring that taxes are collected appropriately.

- Building Registration Form: Landlords must often complete this document to register multiple dwelling buildings. Similar to the OHP 515, it mandates the submission of the owner’s information and property address, reinforcing the need for complete and accurate data.

- CAMA Report (Computer Assisted Mass Appraisal Report): This report includes property assessments used for tax purposes. Like the OHP 515, it relies on up-to-date property information and owner's data which can significantly impact future financial obligations.

- Certificate of Occupancy: Essential for ensuring that a property is fit for habitation, this certificate is similar in that it focuses on the applicable regulations governing residential properties. Both documents exhibit the importance of compliance in housing safety and standards.

- Lease Agreement: This legally binding document between landlords and tenants provides detailed information on rental terms. Its relevance to the OHP 515 lies in the regulations both documents uphold regarding housing conditions and owner responsibilities.

- Annual Rent Registration: Required for all rental properties, this document ensures compliance with rent control laws. Similar to the OHP 515, it requires property details and owner information to maintain up-to-date records and compliance.

It is vital for property owners and responsible parties to be familiar with these forms. Completing and filing these documents correctly can help avoid legal complications, and ensure that properties are managed in accordance with local regulations.

Dos and Don'ts

When completing the OHP 515 form, adherence to guidelines ensures a smooth registration process. Below are important points to consider:

- Do use blue or black ink. The form should be filled out in a clear, legible manner.

- Do provide a complete property address. Include the borough, house number, and street name.

- Do indicate the relationship of the responsible party accurately. Check the appropriate box to clarify ownership status.

- Do sign and date the form. Ensure your signature corresponds with the capacity in which you are signing.

- Don’t use post office box numbers. A physical address is required for the property.

- Don’t attempt to register more than one property on this form. Each property needs its own submission.

- Don’t leave any sections blank. Complete all required fields to avoid processing delays.

- Don’t forget to include the Tax ID number if applicable. This is necessary when a corporation or partnership is involved.

Following these guidelines will greatly enhance the likelihood of successful registration without issues. If assistance is needed, prompt help is available through the Registration Assistance Unit.

Misconceptions

There are many misconceptions surrounding the OHP 515 form. Understanding the facts can help property owners avoid unnecessary complications. Here are eight common misunderstandings:

- Only big property owners need to register. Many believe that only owners of large apartment buildings must file this form. However, any multiple dwelling with three or more units requires registration, regardless of size.

- 1-2 family homes are always exempt. It's a common myth that all one- or two-family homes don’t need to register. They only avoid registration if the owner resides in New York City.

- Fines are not a real concern for non-registration. Some think that penalties for failing to register are minimal. In reality, the law allows fines of up to $500, along with potential criminal penalties.

- Submitting this form is optional. A notable misconception is that filing this form is merely a good practice. Instead, registration is a legal requirement for the specified properties, making it mandatory.

- Any individual can submit the form. Many believe that anyone can file this form without being tied to the property. Instead, the responsible party must be the owner or managing agent associated with the property.

- The OHP 515 form only needs to be filled out once. This misunderstanding leads to trouble, as the form must be updated any time there’s a change in ownership or management of the property.

- The information can be vague. Some assume they can provide their details without much specificity. In truth, all sections must be completed accurately to avoid future problems.

- The form is only a paperwork hassle. Others view the registration as a mere inconvenience. In reality, failure to complete it can restrict actions in housing court, particularly regarding non-payment issues.

Addressing these misconceptions helps property owners navigate their responsibilities more effectively and ensures compliance with local laws.

Key takeaways

Here are some important points to keep in mind when filling out and using the OHP 515 form:

- Registration Requirement: Owners of multiple dwellings must register their properties. One or two family homes are exempt if the owner resides in NYC.

- Consequences of Non-Registration: Failing to register can result in fines up to $500 and potential criminal penalties. More importantly, it may restrict your ability to take legal action in housing court.

- Completing the Form: Use blue or black ink only when filling out the form. Carefully enter all information, including the property address and responsible party details.

- Submission Guidelines: After completing and signing the form, submit it to the Office of the City Register when you record your deed.

If you need assistance, don’t hesitate to contact the Registration Assistance Unit. They're there to help!

Browse Other Templates

What Is a Permissible Withdrawal From 401k - Be sure to provide accurate personal information, as this will help streamline your request processing.

State Farm Life Insurance Cash Surrender Form - The form protects all parties involved by documenting the agreement for service payments.