Fill Out Your Ok Company Form

The OK Company form is a vital document for anyone looking to establish a Limited Liability Company (LLC) in Oklahoma. This form outlines the operating agreement of the LLC and is essential for defining the company's structure, management, and relationship between the members. Key components of the form include the formation details, specifying the company name, purpose, and principal office location. Additionally, it identifies the initial registered agent and lays out the terms for capital contributions and profit or loss distribution among members. The agreement also addresses the powers and duties of members, management procedures, and expectations around salaries and expenses. More crucially, the OK Company form includes provisions for the admission of new members, transfer of membership interests, and the company’s indemnification policies. Understanding these elements is critical for ensuring compliance with state laws and for fostering a clear and effective operational framework.

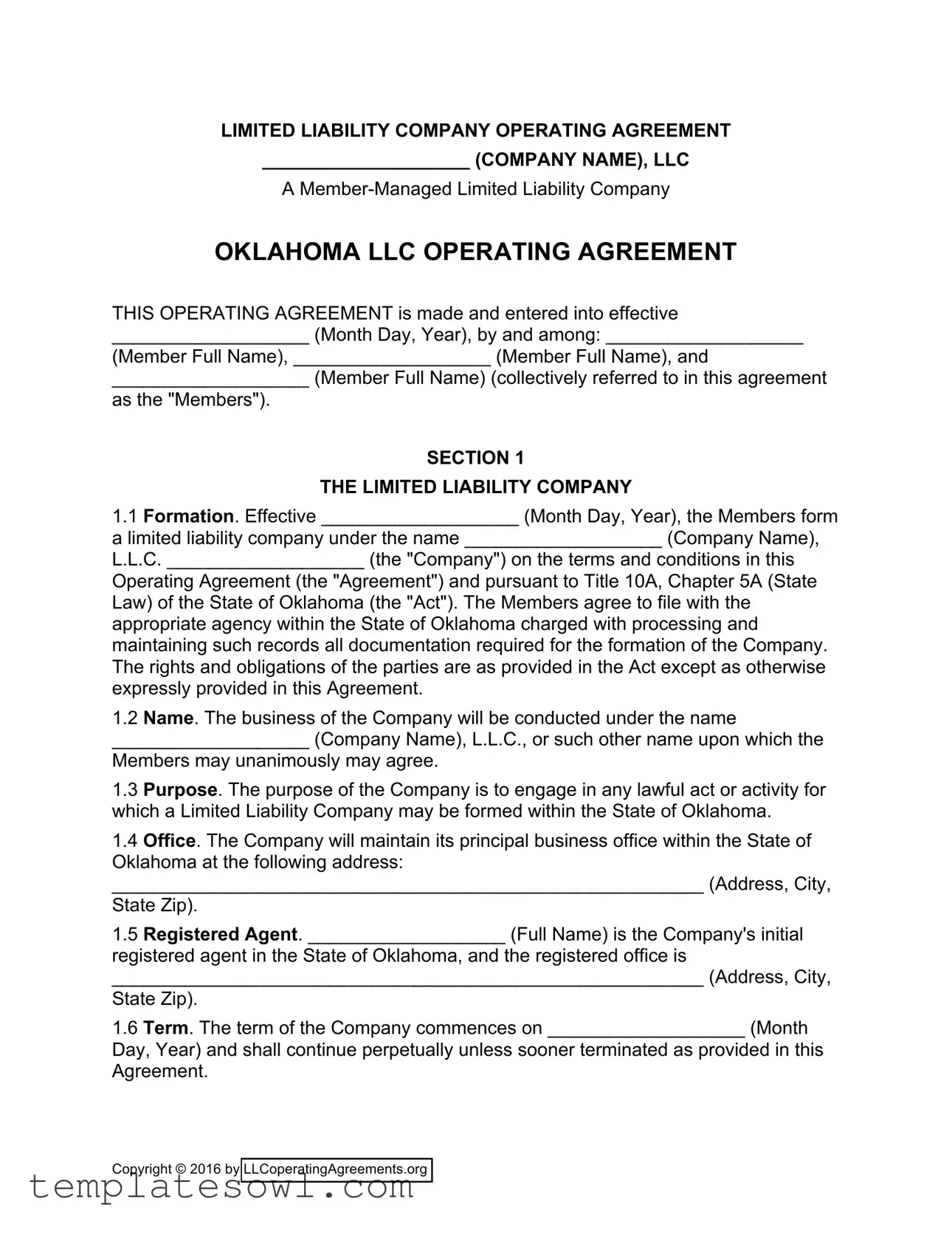

Ok Company Example

LIMITED LIABILITY COMPANY OPERATING AGREEMENT

____________________ (COMPANY NAME), LLC

A

OKLAHOMA LLC OPERATING AGREEMENT

THIS OPERATING AGREEMENT is made and entered into effective

___________________ (Month Day, Year), by and among: ___________________

(Member Full Name), ___________________ (Member Full Name), and

___________________ (Member Full Name) (collectively referred to in this agreement

as the "Members").

SECTION 1

THE LIMITED LIABILITY COMPANY

1.1Formation. Effective ___________________ (Month Day, Year), the Members form a limited liability company under the name ___________________ (Company Name), L.L.C. ___________________ (the "Company") on the terms and conditions in this Operating Agreement (the "Agreement") and pursuant to Title 10A, Chapter 5A (State Law) of the State of Oklahoma (the "Act"). The Members agree to file with the appropriate agency within the State of Oklahoma charged with processing and maintaining such records all documentation required for the formation of the Company. The rights and obligations of the parties are as provided in the Act except as otherwise expressly provided in this Agreement.

1.2Name. The business of the Company will be conducted under the name

___________________ (Company Name), L.L.C., or such other name upon which the Members may unanimously may agree.

1.3Purpose. The purpose of the Company is to engage in any lawful act or activity for which a Limited Liability Company may be formed within the State of Oklahoma.

1.4Office. The Company will maintain its principal business office within the State of Oklahoma at the following address:

_________________________________________________________ (Address, City, State Zip).

1.5Registered Agent. ___________________ (Full Name) is the Company's initial registered agent in the State of Oklahoma, and the registered office is

_________________________________________________________ (Address, City, State Zip).

1.6Term. The term of the Company commences on ___________________ (Month Day, Year) and shall continue perpetually unless sooner terminated as provided in this Agreement.

Copyright © 2016 by LLCoperatingAgreements.org

1.7Names and Addresses of Members. The Members' names and addresses are attached as Schedule 1 to this Agreement.

1.8Admission of Additional Members. Except as otherwise expressly provided in this Agreement, no additional members may be admitted to the Company through issuance by the company of a new interest in the Company without the prior unanimous written consent of the Members.

SECTION 2

CAPITAL CONTRIBUTIONS

2.1Initial Contributions. The Members initially shall contribute to the Company capital as described in Schedule 2 attached to this Agreement.

2.2Additional Contributions. No Member shall be obligated to make any additional contribution to the Company's capital without the prior unanimous written consent of the Members.

2.3No Interest on Capital Contributions. Members are not entitled to interest or other compensation for or on account of their capital contributions to the Company except to the extent, if any, expressly provided in this Agreement.

SECTION 3

ALLOCATION OF PROFITS AND LOSSES; DISTRIBUTIONS

3.1Profits/Losses. For financial accounting and tax purposes, the Company's net profits or net losses shall be determined on an annual basis and shall be allocated to the Members in proportion to each Member's relative capital interest in the Company as set forth in Schedule 2 as amended from time to time in accordance with U.S. Department of the Treasury Regulation

3.2Distributions. The Members shall determine and distribute available funds annually or at more frequent intervals as they see fit. Available funds, as referred to herein, shall mean the net cash of the Company available after appropriate provision for expenses and liabilities, as determined by the Managers. Distributions in liquidation of the Company or in liquidation of a Member's interest shall be made in accordance with the positive capital account balances pursuant to U.S. Department of the Treasury Regulation 1.704.1(b)(2)(ii)(b)(2). To the extent a Member shall have a negative capital account balance, there shall be a qualified income offset, as set forth in U.S. Department of the Treasury Regulation 1.704.1(b)(2)(ii)(d).

3.3No Right to Demand Return of Capital. No Member has any right to any return of capital or other distribution except as expressly provided in this Agreement. No Member has any drawing account in the Company.

SECTION 4

INDEMNIFICATION

The Company shall indemnify any person who was or is a party defendant or is threatened to be made a party defendant, pending or completed action, suit or proceeding, whether civil, criminal, administrative, or investigative (other than an action by or in the right of the Company) by reason of the fact that he is or was a Member of

Copyright © 2016 by LLCoperatingAgreements.org

the Company, Manager, employee or agent of the Company, or is or was serving at the request of the Company, against expenses (including attorney's fees), judgments, fines, and amounts paid in settlement actually and reasonably incurred in connection with such action, suit or proceeding if the Members determine that he acted in good faith and in a manner he reasonably believed to be in or not opposed to the best interest of the Company, and with respect to any criminal action proceeding, has no reasonable cause to believe his/her conduct was unlawful. The termination of any action, suit, or proceeding by judgment, order, settlement, conviction, or upon a plea of "no lo Contendere" or its equivalent, shall not in itself create a presumption that the person did or did not act in good faith and in a manner which he reasonably believed to be in the best interest of the Company, and, with respect to any criminal action or proceeding, had reasonable cause to believe that his/her conduct was lawful

SECTION 5

POWERS AND DUTIES OF MANAGERS

5.1Management of Company.

5.1.1The Members, within the authority granted by the Act and the terms of this Agreement shall have the complete power and authority to manage and operate the Company and make all decisions affecting its business and affairs.

5.1.2Except as otherwise provided in this Agreement, all decisions and documents relating to the management and operation of the Company shall be made and executed by a Majority in Interest of the Members.

5.1.3Third parties dealing with the Company shall be entitled to rely conclusively upon the power and authority of a Majority in Interest of the Members to manage and operate the business and affairs of the Company.

5.2Decisions by Members. Whenever in this Agreement reference is made to the decision, consent, approval, judgment, or action of the Members, unless otherwise expressly provided in this Agreement, such decision, consent, approval, judgment, or action shall mean a Majority of the Members.

5.3Withdrawal by a Member. A Member has no power to withdraw from the Company, except as otherwise provided in Section 8.

SECTION 6

SALARIES, REIMBURSEMENT, AND PAYMENT OF EXPENSES

6.1Organization Expenses. All expenses incurred in connection with organization of the Company will be paid by the Company.

6.2Salary. No salary will be paid to a Member for the performance of his or her duties under this Agreement unless the salary has been approved in writing by a Majority of the Members.

6.3Legal and Accounting Services. The Company may obtain legal and accounting services to the extent reasonably necessary for the conduct of the Company's business.

SECTION 7

BOOKS OF ACCOUNT, ACCOUNTING REPORTS, TAX RETURNS,

Copyright © 2016 by LLCoperatingAgreements.org

FISCAL YEAR, BANKING

7.1 Method of Accounting. The Company will use the method of accounting previously determined by the Members for financial reporting and tax purposes.

7.2Fiscal Year; Taxable Year. The fiscal year and the taxable year of the Company is the calendar year.

7.3Capital Accounts. The Company will maintain a Capital Account for each Member on a cumulative basis in accordance with federal income tax accounting principles.

7.4Banking. All funds of the Company will be deposited in a separate bank account or in an account or accounts of a savings and loan association in the name of the Company as determined by a Majority of the Members. Company funds will be invested or deposited with an institution, the accounts or deposits of which are insured or guaranteed by an agency of the United States government.

SECTION 8

TRANSFER OF MEMBERSHIP INTEREST

8.1Sale or Encumbrance Prohibited. Except as otherwise permitted in this Agreement, no Member may voluntarily or involuntarily transfer, sell, convey, encumber, pledge, assign, or otherwise dispose of (collectively, "Transfer") an interest in the Company without the prior written consent of a majority of the other

8.2Right of First Refusal. Notwithstanding Section 8.1, a Member may transfer all or any part of the Member's interest in the Company (the "Interest") as follows:

8.2.1The Member desiring to transfer his or her Interest first must provide written notice (the "Notice") to the other Members, specifying the price and terms on which the Member is prepared to sell the Interest (the "Offer").

8.2.2For a period of 30 days after receipt of the Notice, the Members may acquire all, but not less than all, of the Interest at the price and under the terms specified in the Offer. If the other Members desiring to acquire the Interest cannot agree among themselves on the allocation of the Interest among them, the allocation will be proportional to the Ownership Interests of those Members desiring to acquire the Interest.

8.2.3Closing of the sale of the Interest will occur as stated in the Offer; provided, however, that the closing will not be less than 45 days after expiration of the 30- day notice period.

8.2.4If the other Members fail or refuse to notify the transferring Member of their desire to acquire all of the Interest proposed to be transferred within the

Copyright © 2016 by LLCoperatingAgreements.org

remaining Members at that other price or other terms; provided, further, that if the sale to a third person is not closed within six months after the expiration of the

8.2.5Notwithstanding the foregoing provisions of Section 8.2, should the sole remaining Member be entitled to and elect to acquire all the Interests of the other Members of the Company in accordance with the provisions of Section 8.2, the acquiring Member may assign the right to acquire the Interests to a spouse, lineal descendent, or an affiliated entity if the assignment is reasonably believed to be necessary to continue the existence of the Company as a limited liability company.

8.3Substituted Parties. Any transfer in which the Transferee becomes a fully substituted Member is not permitted unless and until:

8.3.1The transferor and assignee execute and deliver to the Company the documents and instruments of conveyance necessary or appropriate in the opinion of counsel to the Company to effect the transfer and to confirm the agreement of the permitted assignee to be bound by the provisions of this Agreement; and

8.3.2The transferor furnishes to the Company an opinion of counsel, satisfactory to the Company, that the transfer will not cause the Company to terminate for federal income tax purposes or that any termination is not adverse to the Company or the other Members.

8.4Death, Incompetency, or Bankruptcy of Member. On the death, adjudicated incompetence, or bankruptcy of a Member, unless the Company exercises its rights under Section 8.5, the successor in interest to the Member (whether an estate, bankruptcy trustee, or otherwise) will receive only the economic right to receive distributions whenever made by the Company and the Member's allocable share of taxable income, gain, loss, deduction, and credit (the "Economic Rights") unless and until a majority of the other Members determined on a per capita basis admit the transferee as a fully substituted Member in accordance with the provisions of Section

8.4.1Any transfer of Economic Rights pursuant to Section 8.4 will not include any right to participate in management of the Company, including any right to vote, consent to, and will not include any right to information on the Company or its operations or financial condition. Following any transfer of only the Economic Rights of a Member's Interest in the Company, the transferring Member's power and right to vote or consent to any matter submitted to the Members will be eliminated, and the Ownership Interests of the remaining Members, for purposes only of such votes, consents, and participation in management, will be proportionately increased until such time, if any, as the transferee of the Economic Rights becomes a fully substituted Member.

8.5Death Buy Out. Notwithstanding the foregoing provision of Section 8, the Members covenant and agree that on the death of any Member, the Company, at its option, by providing written notice to the estate of the deceased Member within 180 days of the

Copyright © 2016 by LLCoperatingAgreements.org

death of the Member, may purchase, acquire, and redeem the Interest of the deceased Member in the Company pursuant to the provision of Section 8.5.

8.5.1The value of each Member's Interest in the Company will be determined on the date this Agreement is signed, and the value will be endorsed on Schedule 3 attached and made a part of this Agreement. The value of each Member's Interest will be redetermined unanimously by the Members annually, unless the Members unanimously decide to redetermine those values more frequently. The Members will use their best efforts to endorse those values on Schedule 3. The purchase price for a decedent Member's interest conclusively is the value last determined before the death of such Member; provided, however, that if the latest valuation is more than two years before the death of the deceased Member, the provisions of Section 8.5.2 will apply in determining the value of the Member's Interest in the Company.

8.5.2If the Members have failed to value the deceased Member's Interest within the prior

8.5.3Closing of the sale of the deceased Member's Interest in the Company will be held at the office of the Company on a date designated by the Company, not be later than 90 days after agreement with the personal representative of the deceased Member's estate on the fair market value of the deceased Member's Interest in the Company; provided, however, that if the purchase price are determined by appraisals as set forth in Section 8.5.2, the closing will be 30 days after the final appraisal and purchase price are determined. If no personal representative has been appointed within 60 days after the deceased Member's

Copyright © 2016 by LLCoperatingAgreements.org

death, the surviving Members have the right to apply for and have a personal representative appointed.

8.5.4At closing, the Company will pay the purchase price for the deceased Member's Interest in the Company. If the purchase price is less than $1,000.00, the purchase price will be paid in cash; if the purchase price is $1,000.00 or more, the purchase price will be paid as follows:

(1)$1,000.00 in cash, bank cashier's check, or certified funds;

(2)The balance of the purchase price by the Company executing and delivering its promissory note for the balance, with interest at the prime interest rate stated by primary banking institution utilized by the Company, its successors and assigns, at the time of the deceased Member's death. Interest will be payable monthly, with the principal sum being due and payable in three equal annual installments. The promissory note will be unsecured and will contain provisions that the principal sum may be paid in whole or in part at any time, without penalty.

8.5.5At the closing, the deceased Member's estate or personal representative must assign to the Company all of the deceased Member's Interest in the Company free and clear of all liens, claims, and encumbrances, and, at the request of the Company, the estate or personal representative must execute all other instruments as may reasonably be necessary to vest in the Company all of the deceased Member's right, title, and interest in the Company and its assets. If either the Company or the deceased Member's estate or personal representative fails or refuses to execute any instrument required by this Agreement, the other party is hereby granted the irrevocable power of attorney which, it is agreed, is coupled with an interest, to execute and deliver on behalf of the failing or refusing party all instruments required to be executed and delivered by the failing or refusing party.

8.5.6On completion of the purchase of the deceased Member's Interest in the Company, the Ownership Interests of the remaining Members will increase proportionately to their then existing Ownership Interests.

SECTION 9

DISSOLUTION AND WINDING UP OF THE COMPANY

9.1Dissolution. The Company will be dissolved on the happening of any of the following events:

9.1.1Sale, transfer, or other disposition of all or substantially all of the property of the Company;

9.1.2The agreement of all of the Members;

9.1.3By operation of law; or

9.1.4The death, incompetence, expulsion, or bankruptcy of a Member, or the occurrence of any event that terminates the continued membership of a Member in the Company, unless there are then remaining at least the minimum number of

Copyright © 2016 by LLCoperatingAgreements.org

Members required by law and all of the remaining Members, within 120 days after the date of the event, elect to continue the business of the Company.

9.2Winding Up. On the dissolution of the Company (if the Company is not continued), the Members must take full account of the Company's assets and liabilities, and the assets will be liquidated as promptly as is consistent with obtaining their fair value, and the proceeds, to the extent sufficient to pay the Company's obligations with respect to the liquidation, will be applied and distributed, after any gain or loss realized in connection with the liquidation has been allocated in accordance with Section 3 of this Agreement, and the Members' Capital Accounts have been adjusted to reflect the allocation and all other transactions through the date of the distribution, in the following order:

9.2.1To payment and discharge of the expenses of liquidation and of all the Company's debts and liabilities to persons or organizations other than Members;

9.2.2To the payment and discharge of any Company debts and liabilities owed to Members; and

9.2.3To Members in the amount of their respective adjusted Capital Account balances on the date of distribution; provided, however, that any then outstanding Default Advances (with interest and costs of collection) first must be repaid from distributions otherwise allocable to the Defaulting Member pursuant to Section 9.2.3.

SECTION 10

GENERAL PROVISIONS

10.1Amendments. Amendments to this Agreement may be proposed by any Member. A proposed amendment will be adopted and become effective as an amendment only on the written approval of all of the Members.

10.2Governing Law. This Agreement and the rights and obligations of the parties under it are governed by and interpreted in accordance with the laws of the State of Oklahoma (without regard to principles of conflicts of law).

10.3Entire Agreement; Modification. This Agreement constitutes the entire understanding and agreement between the Members with respect to the subject matter of this Agreement. No agreements, understandings, restrictions, representations, or warranties exist between or among the members other than those in this Agreement or referred to or provided for in this Agreement. No modification or amendment of any provision of this Agreement will be binding on any Member unless in writing and signed by all the Members.

10.4Attorney Fees. In the event of any suit or action to enforce or interpret any provision of this Agreement (or that is based on this Agreement), the prevailing party is entitled to recover, in addition to other costs, reasonable attorney fees in connection with the suit, action, or arbitration, and in any appeals. The determination of who is the prevailing party and the amount of reasonable attorney fees to be paid to the prevailing party will be decided by the court or courts, including any appellate courts, in which the matter is tried, heard, or decided.

Copyright © 2016 by LLCoperatingAgreements.org

10.5Further Effect. The parties agree to execute other documents reasonably

necessary to further effect and evidence the terms of this Agreement, as long as the terms and provisions of the other documents are fully consistent with the terms of this Agreement.

10.6Severability. If any term or provision of this Agreement is held to be void or unenforceable, that term or provision will be severed from this Agreement, the balance of the Agreement will survive, and the balance of this Agreement will be reasonably construed to carry out the intent of the parties as evidenced by the terms of this Agreement.

10.7Captions. The captions used in this Agreement are for the convenience of the parties only and will not be interpreted to enlarge, contract, or alter the terms and provisions of this Agreement.

10.8Notices. All notices required to be given by this Agreement will be in writing and will be effective when actually delivered or, if mailed, when deposited as certified mail, postage prepaid, directed to the addresses first shown above for each Member or to such other address as a Member may specify by notice given in conformance with these provisions to the other Members.

IN WITNESS WHEREOF, the parties to this Agreement execute this Operating Agreement as of the date and year first above written.

MEMBERS: |

|

|

|

|

|

Printed/Typed Name |

Signature |

|

|

|

|

Printed/Typed Name |

|

Signature |

|

|

|

Printed/Typed Name |

|

Signature |

Copyright © 2016 by LLCoperatingAgreements.org

Listing of Members - Schedule 1

LIMITED LIABILITY COMPANY OPERATING AGREEMENT

FOR _______________________ (COMPANY NAME), L.L.C.

LISTING OF MEMBERS

As of the ____ (Day) day of _______________, 20____ (Month, Year), the following is

a list of Members of the Company:

NAME |

|

ADDRESS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Authorized by Member(s) to provide Member Listing as of this (Day) day of (Month, Year).

Printed/Typed Name |

|

Signature |

|

|

|

Printed/Typed Name |

|

Signature |

|

|

|

Printed/Typed Name |

|

Signature |

Copyright © 2016 by LLCoperatingAgreements.org

Form Characteristics

| Fact Name | Description |

|---|---|

| Governing Law | The OK Company form is governed by Title 10A, Chapter 5A of the Oklahoma Statutes. |

| Company Formation | A limited liability company (LLC) is formed by filing the necessary documentation with the State of Oklahoma. |

| Member Management | The LLC operates on a member-managed basis, allowing members to make decisions collectively. |

| Principal Office | The Company must maintain its principal office in the State of Oklahoma at a specified address. |

| Initial Registered Agent | A registered agent must be designated to receive legal documents for the Company in Oklahoma. |

| Indemnification | The Company provides indemnification for members against expenses incurred in legal actions taken against them. |

| Capital Contributions | Members must outline their initial contributions and any future contributions require unanimous consent. |

| Profit Allocation | Net profits or losses are allocated to members based on their respective capital interests. |

| Transfer of Membership | The transfer of membership interests in the Company requires written consent from a majority of the other members. |

Guidelines on Utilizing Ok Company

Completing the Ok Company form is an essential step for members looking to establish their limited liability company in Oklahoma. Following the steps outlined below will help ensure that all necessary information is accurately provided, allowing for a smoother formation process.

- Begin by entering the Company Name at the top of the form, ensuring that it follows the format of (COMPANY NAME), LLC.

- Fill in the effective date of the Operating Agreement in the designated space. This should be formatted as Month Day, Year.

- List the full names of all Members involved in the company, separating each name with a comma.

- In Section 1.1, enter the effective date of the company formation again, along with the Company Name as it will be registered officially.

- State the principal business office address for the company in Section 1.4.

- Identify the initial registered agent and provide their full name and registered office address in Section 1.5.

- Specify the term of the company in Section 1.6 by entering the commencement date.

- In Schedule 1, attach a list of the Members' names and addresses.

- In Schedule 2, record the initial capital contributions of each Member.

- For profit or loss allocations, follow the instructions under Section 3.1 to determine how profits or losses will be distributed based on each Member’s capital interest.

- In Section 6.2, outline if any salary will be paid to Members, and ensure this is approved by a Majority of Members.

- Review and complete Sections 7 and 8 regarding accounting practices and membership interests to ensure alignment with company policies as described in the form.

- Finally, ensure all signatures are gathered where required before submitting the completed form to the appropriate Oklahoma agency.

What You Should Know About This Form

What is an Oklahoma LLC Operating Agreement?

An Oklahoma LLC Operating Agreement is a legal document that outlines the management structure and operating procedures for a limited liability company (LLC) formed in Oklahoma. This agreement serves as an internal guideline for the members of the LLC, detailing important aspects such as the purpose of the company, capital contributions, profit and loss distribution, and the rights and responsibilities of the members. It's essential for establishing clear expectations and minimizing disputes among members.

Who are the members of the LLC, and how are they defined in the agreement?

The members of the LLC, as defined in the Operating Agreement, are the individuals who have ownership interests in the company. In the document, members are collectively referred to and named specifically at the time of the agreement's creation. Each member's name, along with their addresses, is listed in Schedule 1 to ensure transparency and clear identification. This documentation solidifies each member's role and rights within the company.

How are profits and losses distributed among members?

Profit and loss distribution is determined based on each member's capital interest in the company. Each year, the net profits or losses will be calculated, and distributions are made according to the members' respective capital contributions as outlined in Schedule 2. This method ensures that each member receives their fair share according to their investment in the company, aligning everyone’s interests with the company’s financial results.

Can a member transfer their ownership interest, and if so, how?

Yes, a member can transfer their ownership interest, but there are specific rules they must follow. The member desiring to transfer their interest must provide written notice to the other members, detailing the price and terms of the proposed sale. The remaining members then have a 30-day period to decide if they wish to buy the interest at the specified terms. If they do not respond in that period, the transferring member may sell to an outside party, but they have to notify the existing members if a better offer comes in after that sale. This process helps protect the interests of all members while allowing for flexibility in ownership transitions.

What happens to a member's interest in the event of their death or incapacity?

Upon a member's death or incapacitation, their ownership interest generally passes to their estate or designated successor, but they will initially only hold economic rights without any management rights. This means they are entitled to share in distributions and receive information but cannot participate in company decisions. For the new holder to gain full membership rights, a majority of the other members must agree to admit them as a fully substituted member. This procedure ensures that the remaining members retain control over who becomes involved in the management of the LLC.

Common mistakes

Filling out the Ok Company form correctly is essential for establishing a limited liability company (LLC) in Oklahoma. Many individuals, however, make common mistakes that can lead to complications down the line. Recognizing these pitfalls can help ensure a smoother process.

One frequent mistake involves leaving sections incomplete. Each blank in the form serves a specific purpose, and omitting information can render the agreement invalid. It is vital to fill out every required section, including the names of all members and the company name without leaving any gaps.

Another issue arises when individuals fail to provide accurate dates. The effective date is crucial, and an incorrect date can affect the LLC's formation timeline. Make sure to double-check the month, day, and year entered to avoid confusion.

Misunderstanding the purpose of the LLC can lead to another common mistake. It's important to specifically define the business purpose. Those who write vague descriptions may face challenges in future operations. Clarity here can prevent issues with compliance and operations later on.

People also sometimes neglect the registered agent section. This person is a vital point of contact for legal documents and important communications. Without a designated registered agent, your LLC can miss crucial documents, potentially leading to legal complications.

Additionally, some individuals do not pay enough attention to the capital contributions outlined in the document. It’s essential to specify what each member is contributing at the start. Skipping this detail can result in misunderstandings regarding ownership percentages and profit-sharing, leading to disputes later.

There can also be confusion surrounding the rules for admitting new members. Many people fail to realize that unanimous written consent is typically required. Overlooking this can cause disputes and might even invalidate agreements made for new members.

Another common mistake includes not providing updated schedules attached to the agreement. Schedule 1 and Schedule 2 are attached lists that detail the names, addresses, and capital contributions of members. Failing to attach these schedules can lead to misunderstandings about each member's role and responsibilities.

Finally, many people overlook the importance of reviewing the entire agreement before signing. This step is crucial, as one may overlook significant clauses that impact their rights and obligations within the LLC. Taking the time to read the document carefully can prevent future regrets.

By avoiding these frequent pitfalls, individuals can ensure a successful filing of the Ok Company form, setting a strong foundation for their limited liability company.

Documents used along the form

The Ok Company form is a crucial document for any limited liability company (LLC) operating in Oklahoma. Alongside it, several other forms and documents complement the operating agreement, establishing a well-rounded framework for governance and management of the LLC. Understanding these documents helps ensure smooth operations and clear communication among members.

- Articles of Organization: This document formally establishes the LLC with the state. It includes vital information such as the company name, address, and registered agent, and must be filed with the appropriate state authority.

- Bylaws: While not legally required for an LLC, bylaws outline the internal structure and governance rules of the company. They can specify how decisions are made, member responsibilities, and how to handle disputes.

- Membership Certificates: These documents serve as proof of a member's ownership interest in the LLC. They can help clarify ownership stakes and rights, providing members with tangible recognition of their investment.

- Initial Capital Contributions Agreement: This document details the initial contributions made by each member when the LLC is formed. It can clarify financial responsibilities and set expectations for future investments.

- Operating Capital Agreement: This outlines how funds will be managed and distributed among members. It may govern distributions from profits, covering when and how members receive payments based on their ownership percentages.

- Transfer of Membership Interest Agreement: This agreement establishes the conditions under which a member can sell or transfer their ownership interest in the LLC. It ensures that other members have a say in potential new ownership changes.

- Member Resignation or Withdrawal Agreement: This document governs the process if a member chooses to leave the LLC. It defines the steps for resignation and how the member’s interests will be handled following their departure.

Each of these documents plays a specific role in framing the operational and financial dynamics of the LLC. Collectively, they aid members in navigating their rights and responsibilities while promoting transparency and cooperation among the organization’s members.

Similar forms

- Articles of Organization: Similar to the Ok Company form, the Articles of Organization outlines the initial setup of a limited liability company (LLC). This document includes essential information such as the company's name, purpose, and registered agent, establishing the legal existence of the LLC.

- Operating Agreement: The Operating Agreement is akin to the Ok Company form, detailing the ownership structure, management responsibilities, and policies for profit distribution among members. It serves as the internal rulebook for the LLC, much like the agreement discussed in the Ok Company form.

- Bylaws: Bylaws serve a similar function as the Ok Company form by laying out the company’s structure and operational procedures. This document governs meetings, voting rights, and roles of members or managers, ensuring orderly management and governance.

- Shareholder Agreement: A Shareholder Agreement, often used in corporations, is comparable to the Ok Company form. This document governs the relationship among shareholders and outlines rights, obligations, and procedures for selling shares, analogous to transfer provisions in the operating agreement.

- Partnership Agreement: Like the Ok Company form, a Partnership Agreement defines the roles, responsibilities, and financial arrangements among partners. It establishes the terms under which partners agree to operate a business together, similar to member agreements in the LLC context.

- Joint Venture Agreement: This document shares similarities with the Ok Company form by detailing the terms of collaboration between two or more parties for a specific business venture. It outlines contributions, profit-sharing, and the duration of the partnership, akin to how members operate within the LLC framework.

- Business Plan: While less formal, a Business Plan shares common ground with the Ok Company form by providing a strategic overview of the business. It includes the mission, market analysis, and operational structure, guiding overall direction and decision-making.

Dos and Don'ts

- Do fill in all required fields accurately to avoid any delays.

- Do double-check the company name for spelling errors.

- Do use the correct format for dates, especially for the effective date.

- Do ensure the addresses provided are complete and correctly formatted.

- Do obtain unanimous consent from all members before adding new members.

- Don't leave any sections blank; incomplete forms may be rejected.

- Don't forget to attach any required schedules mentioned in the agreement.

- Don't use abbreviations or informal language in your responses.

- Don't forget to include your initials and signatures in the required areas.

- Don't ignore state-specific requirements; make sure to comply with Oklahoma law.

Misconceptions

- Misconception 1: The OK Company form is only suitable for large businesses.

- Misconception 2: An operating agreement isn't necessary if the members get along.

- Misconception 3: All members must contribute equally to the company.

- Misconception 4: The operating agreement cannot be changed once it is signed.

- Misconception 5: The OK Company form guarantees personal asset protection.

This is not true. The OK Company form works for businesses of all sizes, including small and startup companies. It offers flexibility and protects members' personal assets, making it an ideal choice.

While friendly relationships among members are beneficial, having an operating agreement is crucial. It outlines roles, responsibilities, and procedures, reducing the chances of misunderstandings in the future.

This is a common misunderstanding. Members can contribute different amounts, and these can affect ownership percentages, profit sharing, and voting power. It's important to document these contributions in the operating agreement.

This is incorrect. The operating agreement can be amended at any time if all members agree. Allowing for flexibility can help the company adapt as it grows or changes.

While the structure provides a level of protection, it does not automatically shield personal assets. Proper compliance with state laws and maintaining a separation between personal and business finances is essential for this protection to hold.

Key takeaways

Filling out and utilizing the Ok Company form requires careful attention to detail and a solid understanding of the structure it provides. Here are ten key takeaways to arm you with the essential knowledge about this process:

- The form facilitates the creation of a Limited Liability Company (LLC) in Oklahoma, which offers liability protection and flexibility in management.

- Accurate formation requires the collection of specific details, including the name of the LLC, member names, and addresses.

- Members must agree on the purpose and operational details of the LLC, which allows for a wide range of business activities within legal boundaries.

- Clearly define the term of the LLC, which can continue indefinitely unless a member requests termination.

- Members are required to formally record initial and subsequent capital contributions to maintain transparency and equity.

- Profit and loss allocations should reflect each member's contribution, ensuring fair distribution based on relative ownership interests.

- Indemnification clauses protect members from liabilities incurred during their member activities, provided they acted in good faith.

- Proper management protocols are vital. Members must outline how decisions are made and ensure compliance with majority interests for significant actions.

- Clear rules on transferring membership interests help maintain ownership stability, allowing existing members the first opportunity to purchase shares.

- In the event of a member's death, careful steps must be taken to manage the transition of interests according to agreed-upon terms.

Browse Other Templates

What Is a Ddq - This form is used to declare efforts made to serve legal process.

Aircraft Weighing - Gross weight must be recorded in the appropriate section.

Fbi Background Check for Visa - Ensure that you sign and date the request at the bottom of the form.