Fill Out Your Oklahoma 20 Form

The Oklahoma 20 form is a vital component in the process of garnishment, a legal means of collecting debts through a court order. This document is designed for use in the District Court of Payne County and serves multiple purposes, primarily dependent on whether it is being utilized for prejudgment or postjudgment garnishment. For those collecting debts before a judgment is finalized, the form allows the creditor to establish that the debtor owes a specific amount. Conversely, in postjudgment situations, it details any outstanding debts, including principal, interest, court costs, and attorney fees, providing a comprehensive view of what is owed. The form also specifies the relationship between the judgment debtor and the garnishee, defining who is responsible for withholding the funds from the debtor’s earnings. Additionally, it outlines the duties of the garnishee, including timelines for responding and distributing withheld amounts. The Oklahoma 20 form thus encapsulates the essential procedural steps involved in garnishing wages and ensures that all parties are informed and able to comply with the legal requirements set forth by the court.

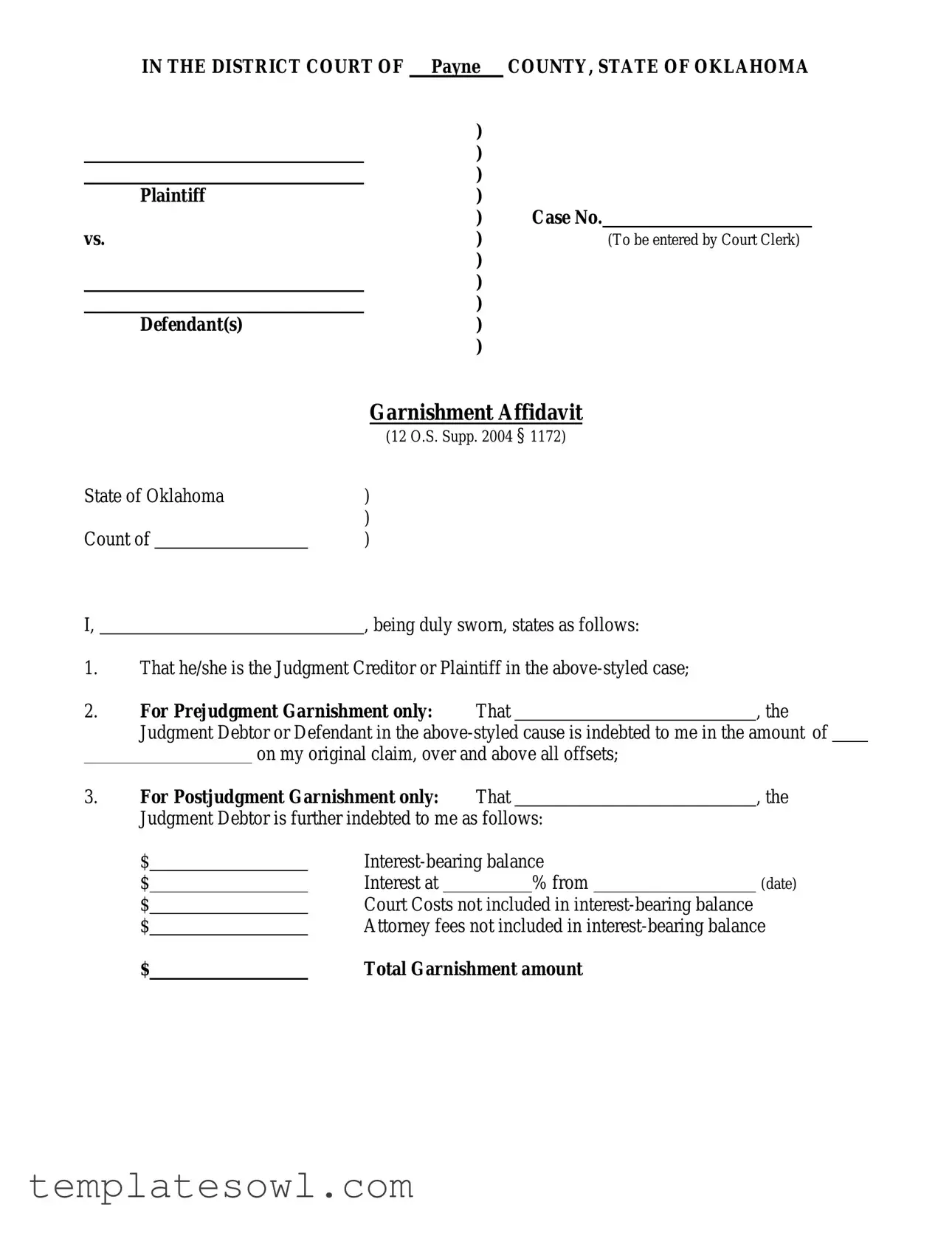

Oklahoma 20 Example

IN THE DISTRICT COURT OF |

Payne |

COUNTY, STATE OF OKLAHOMA |

||

|

|

) |

|

|

|

|

) |

|

|

|

|

) |

|

|

Plaintiff |

) |

|

|

|

|

|

) |

Case No. |

|

vs. |

) |

|

(To be entered by Court Clerk) |

|

|

|

) |

|

|

|

|

) |

|

|

|

|

) |

|

|

Defendant(s) |

) |

|

|

|

|

|

) |

|

|

Garnishment Affidavit

(12 O.S. Supp. 2004 § 1172)

State of Oklahoma |

) |

|

|

|

) |

Count of |

|

) |

I, |

|

, being duly sworn, states as follows: |

1.That he/she is the Judgment Creditor or Plaintiff in the

2. |

For Prejudgment Garnishment only: |

That |

|

, the |

|||||

|

Judgment Debtor or Defendant in the |

||||||||

|

|

|

on my original claim, over and above all offsets; |

|

|||||

3. |

For Postjudgment Garnishment only: |

That |

|

, the |

|||||

|

Judgment Debtor is further indebted to me as follows: |

|

|||||||

|

$ |

|

|

|

|||||

|

$ |

|

|

Interest at |

|

% from |

(date) |

||

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

Court Costs not included in |

|

||||

|

$ |

|

|

Attorney fees not included in |

|||||

|

$ |

|

|

Total Garnishment amount |

|

||||

4. |

That I believe that |

|

|

|

|

is indebted to or has property within his |

|

|

possession or under his control, which is not by law exempt from seizure or sale upon |

||||||

|

execution, belonging to the Judgment Debtor or Defendant. |

||||||

5. |

That I (check one) |

|

|

am, or, |

|

am not seeking a continuing garnishment. |

|

Judgment Creditor or Plaintiff, or

Attorney for Judgment Creditor or Plaintiff

Oklahoma Bar Association No.

Subscribed and sworn to this |

|

day of |

|

, |

|

. |

Court Clerk or Notary Public

Deputy

(Seal)

My Commission Expires:

IN THE DISTRICT COURT OF |

Payne |

COUNTY, STATE OF OKLAHOMA |

||

|

|

) |

|

|

Plaintiff |

) |

|

|

|

|

|

) |

|

|

vs |

) |

|

|

|

|

|

) |

Case No. |

|

|

|

) |

|

|

Defendant |

) |

|

|

|

|

|

) |

|

|

and |

) |

|

|

|

|

|

) |

|

|

|

|

) |

|

|

Garnishee |

) |

|

|

|

Continuing Postjudgment Earnings Garnishment Summons

The State of Oklahoma, to said Garnishee:

You are hereby summoned pursuant to the attached affidavit as garnishee of the judgment debtor,

,and required, within seven (7) days after the end of judgment debtor’s present pay period or thirty (30) days from the date of service of this summons upon you, whichever is earlier, to answer according to law whether you are the employer of, or indebted to, or under any liability to, the judgment debtor and to withhold the required amount from the judgment debtor’s earnings for the earnings pay periods for which this summons is effective, and pay the required amount to the attorney for the judgment creditor, or the judgment creditor if not represented by an attorney, unless otherwise ordered by the court. At the time that you file your answer with the clerk of this court, you must deliver or mail a copy of your answer to the judgment creditor’s attorney, or judgment creditor if not represented by an attorney, and to the judgment debtor unless the judgment debtor is otherwise given actual written notice, which may consist of a notation on judgment debtor’s statement of earnings. You are directed to withhold the amount calculated on the answer form or the present judgment balance, whichever is less, and to pay the same to the judgment creditor’s attorney, or the judgment creditor if not represented by an attorney, at the time you file your answer. For garnishment purposes, “earnings” means any form of payment to an individual including, but not limited to salary, commission, or other compensation, but does not include reimbursements for travel for state employees.

If garnishee is indebted to or holds earnings belonging to judgment debtor, the garnishee immediately shall mail by

You are hereby directed to pay with your answer the amounts required by law and in case of your failure to do so, you will be liable to further proceedings according to law, and judgment shall be rendered against you in the amount of the judgment rendered against the principal judgment debtor which has a present balance of $

together with costs in the principal action and costs of the garnishment proceedings.

Because this is a continuing garnishment, garnishee will withhold and continue to withhold and pay to the judgment creditor’s attorney, or the judgment creditor if not represented by an attorney, the amounts calculated on the answer form from judgment debtor’s earnings as they accrue until one of the following first occurs: (1) the total earnings withheld equals the total balance due on the judgment, (2) the employment relationship is terminated, (3) the judgment is vacated, modified or satisfied in full, (4) the garnishment

summons is dismissed, or (5) 180 days have elapsed from the date of service of the garnishment summons. The garnishment summons shall continue in effect and shall apply to a pay period beginning before the end of the 180- day period even if the conclusion of the pay period extends beyond the

Issued this |

|

day of |

|

, |

|

, and shall be returned with proof of service within ten |

(10) days of this date. |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Court Clerk |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By: Deputy |

|

|

|

|

|

|

|||

Judgment Creditor |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Attorney |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

OBA # |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Phone |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

Officer’s Return |

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Received this writ on the |

|

day of |

|

, |

|

|

|

, at |

|

o’clock |

|

m and |

||||||||||||||||

Executed the same in |

|

|

|

County on the |

|

|

|

day of |

|

|

, |

|

|

, at |

||||||||||||||

|

o’clock |

|

|

|

m by |

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Dated this |

|

day of |

|

|

|

, |

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sheriff

Deputy

AOC Form 52b

Revised 8/05

|

IN THE DISTRICT COURT OF |

Payne COUNTY, STATE OF OKLAHOMA |

||||||

|

|

|

|

) |

|

|

|

|

Plaintiff |

) |

|

|

|

|

|||

|

|

|

) |

|

|

|

|

|

|

vs |

) |

Case No. |

|||||

|

|

|

) |

|

|

|

|

|

|

|

|

|

) |

|

|

|

|

Defendant |

) |

|

|

|

|

|||

|

|

|

) |

|

|

|

|

|

|

and |

) |

|

|

|

|

||

|

|

|

) |

|

|

|

|

|

|

|

|

|

) |

|

|

|

|

Garnishee |

) |

|

|

|

|

|||

|

|

|

Continuing and Garnishee’s Answer/Affidavit |

|||||

State of Oklahoma |

) |

|

|

|

|

|||

County of |

|

|

) |

SS |

||||

I, |

|

|

, being duly sworn deposes and says: |

|||||

If Garnishee is an Individual:

That he is the garnishee herein. That he does business in the name of

.

If Garnishee is a Partnership:

That he is a member of |

|

, a partnership composed |

||

of garnishee and |

|

|

. |

|

If Garnishee is a Corporation:

That he is the |

|

|

|

(official title) of |

|

, |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

(garnishee) organization, organized under the laws of the state of |

|

|

. |

|||||||||

Garnishee, or |

|

|

on behalf of garnishee, having been served with a |

|||||||||

garnishment summons on the |

|

day of |

|

, |

|

|

, and having knowledge of |

|||||

the facts and being sworn, states: |

|

|

|

|

|

|

|

|

|

|||

1.At the time of the service of the garnishment summons, or upon the date it became

effective, the garnishee was not indebted to the judgment debtor for any amount of money nor did the garnishee have possession or control of any property, money, goods, chattels, credits, negotiable instruments or effects belonging to the judgment debtor or in which the judgment

debtor had an interest because the employee/individual/judgment debtor was:

appropriate response)

Not employed

Employed but not amounts due; specify reason:

Other; specify:

2.At the time of service of the garnishment summons or upon the date it became effective, the garnishee was indebted to the judgment debtor or had possession or control of the following property, money, goods, chattels, credits, negotiable instruments or effects belonging to the

judgment debtor as follows: (Please check appropriate response)

Earnings as shown on the attached Calculation for Garnishment of Earnings form which is incorporated by reference into this answer;

Other, specify:

3.Nothing has been withheld due, to a prior garnishment or continuing garnishment which will

|

expire on |

|

|

|

|

and is in Case Number |

|

in the District |

|||

|

Court of |

|

|

|

County, Oklahoma. |

|

|

||||

4. |

On |

|

|

, |

|

|

|

, the garnishee mailed a copy of the Notice of |

|||

Garnishment & Exemptions and Application for Hearing by

Address

City

StateZip

Date Mailed

Or, hand delivered the same to judgment debtor at:

Judgment Debtor

Place

Note: This must be done during each pay period in which the garnishment is in effect.

5.The garnishee makes the following claim of exemption on the part of the judgment debtor, or has the following objections, defenses, or setoffs to judgment creditor’s right to apply garnishee’s indebtedness to judgment debtor upon judgment creditor’s claim:

|

|

Check here ( ) if additional pages are necessary. |

|

|

|

|

||||||

By: |

|

|

|

|

Date: |

|

|

|

|

|

||

Title: |

|

|

|

|

|

|

|

|

||||

Subscribed and sworn to before me on this |

|

|

day of |

|

, |

|

. |

|||||

Notary Public

My Commission expires:

A continuing garnishment remains in effect until one of the following occurs: (1) the judgment is paid in full; (2) the employment relationship is terminated; (3) the judgment is vacated, modified or paid in full;

(4)garnishment action is dismissed; (5) the expiration of 180 days from the date of service of the summons. (If a pay period begins within 180 days but ends after the expiration, the pay period is subject to the garnishment).

AOC Form 54; Revised 8/05

|

Calculation for Continuing Garnishment of Earnings |

|

|

|

|

|

|||

For the pay period in effect at the time of said service: |

|

|

|

|

|

||||

1. |

(a) Enter the pay period of judgment debtor |

1(a) |

|||||||

|

(weekly, biweekly, semimonthly, monthly or other) |

|

|

|

|

|

|||

|

If other, please describe: |

|

|

|

|

|

|

|

|

|

(b) Enter the date the judgment debtor’s present pay period |

1 |

(b) |

||||||

|

began (present pay period means the pay period for which the |

|

|

|

|

|

|||

|

calculation is made): |

|

|

|

|

|

|||

|

(c) Enter the date the judgment debtor’s present pay period ends: |

1 |

(c) |

|

|||||

2. |

(a) Enter the gross earnings for entire pay period: |

2 |

(a) |

|

|||||

|

(b) Calculate deductions from said amount as required by law: |

2 |

(b) |

||||||

|

(2(b) is the total of i, ii, and iii) |

|

|

|

|

|

|||

|

i. Federal income tax withholding |

|

|

|

|

|

|

|

|

|

ii. FICA income tax withholding |

|

|

|

|

|

|

|

|

|

iii. State income tax withholding |

|

|

|

|

|

|

|

|

|

(c) Net earnings: 2(a) less 2(b): |

2 |

(c) |

|

|||||

3. |

(a) If judgment debtor is subject to withholding for child support |

3 |

(a) |

||||||

|

garnishment or income assignment, enter maximum allowable |

|

|

|

|

|

|||

|

percentage (50%, 55%, 60%, 65%) |

|

|

|

|

|

|||

|

(b) Enter actual percentage withheld: |

3 |

(b) |

|

|||||

|

(c) Subtract 3(b) from 3(a) and enter percentage: |

3 |

(c) |

|

|||||

|

(d) Enter the lesser of 25% or line 3(c) here (if no child support or |

3 |

(d) |

||||||

|

Income assignment, enter 25%): |

|

|

|

|

|

|||

4. |

Multiply the percentage in 3(d) times the net earnings in 2(c) and enter: |

4. |

|

|

|

|

|||

5. |

(a) Multiply and enter the present federal minimum wage as follows: |

5 |

(a) |

||||||

|

Weekly or more often by 30; |

|

|

|

|

|

|||

|

Biweekly by 60; |

|

|

|

|

|

|||

|

Semimonthly by 65; |

|

|

|

|

|

|||

|

Monthly by 130. |

|

|

|

|

|

|||

|

For any other pay period, increase the multiple for a weekly pay |

|

|

|

|

|

|||

|

period using the assumption that a month contains |

|

|

|

|

|

|||

|

(b) Subtract the amount on line 5(a) from the amount on line 2(c): |

5 |

(b) |

|

|||||

6. |

Enter the smaller of the amounts entered on line 4 or 5(b). Pay this |

6. |

|

amount to the attorney for judgment creditor, or judgment creditor |

|

|

if not represented by an attorney. |

|

When completed, mail original answer to: |

|

, District Court |

||||

Clerk, |

|

County Court House in |

|

|

County, |

|

Oklahoma. |

|

|

|

|

|

|

You must send your check for the amount garnished with a copy of your answer to the attorney for judgment creditor, or the judgment creditor if there is no attorney. (Check the appropriate response and show address used in the mailing):

Attorney for Judgment Creditor:

Judgment Creditor:

Revised 8/05

IN THE DISTRICT COURT OF |

Payne COUNTY, STATE OF OKLAHOMA |

||||

|

) |

|

|

|

|

Plaintiff |

) |

|

|

|

|

|

) |

|

|

|

|

vs |

) |

Case No. |

|||

|

) |

|

|

|

|

|

) |

|

|

|

|

Defendant |

) |

|

|

|

|

|

) |

|

|

|

|

and |

) |

|

|

|

|

|

) |

|

|

|

|

|

) |

|

|

|

|

Garnishee |

) |

|

|

|

|

Claim for Exemption and Request for Hearing

1. Funds sought in garnishment are exempt from execution because they are (check applicable box):

A. Social Security benefits – 42 U.S.C. §407.

B. Supplemental security income – 42 U.S.C. §1383(d).

C. Unemployment benefits – 40 O.S.

D. Workmen’s Compensation benefits – 85 O.S. §48.

E. Welfare benefits – 56 O.S. §173.

F. Veteran’s benefits – 38 U.S.C. §3101, 31 O.S. §7.

G. Monies in Possession of Police Pensions – 11 O.S.

H. Monies in Possession of Fireman’s Relief & Pension Fund – 11 O.S.

I. Monies in Possession of County Employees Retirement System – 19 O.S. §959.

J. Monies in Possession of Public Employees Retirement Fund – 74 O.S. §923.

K. Teacher’s Annuities or Retirement Allowance – 70 O.S.

L. Annuities and pension payments under Railroad Retirement Act – 45 U.S.C. §231(m).

M. United States Civil Service Retirement and Disability Pension Fund Payments – 5 U.S.C. §8346.

N. United States Civil Service Survivor Annuities – 5 U.S.C. §8346.

O. Interest in Retirement, Pension, and Profit Sharing Plans – 60 O.S. §327, 60 O.S. §328.

P. The Wages of Seamen – 46 U.S.C. §601.

Q. Funds vested in the Alien Property Custodian – 50 U.S.C. Appx. §9(f).

R. Prepaid Burial Benefits – 36 O.S. §6125.

S. Proceeds of

T. Alimony, support, separate maintenance, or child support necessary for support of judgment debtor or dependent – 31 O.S. §1.1.

U. Personal wage exemption because of undue hardship – 31 O.S. §1.1.

V. Other (please state):

2. |

Check one box: |

|

|

||||

|

|

|

All funds are exempt, or, |

|

|

||

|

|

|

|

|

|||

|

|

|

I believe the following amount of money is exempt: $ |

||||

|

|

|

|||||

|

|

|

|||||

|

|

|

(Fill in the amount of funds to be exempt). |

|

|

||

3. |

Check if applicable: |

|

|

||||

|

|

|

I have attached copies of the documents that show that my money is exempt. |

||||

|

|

|

|||||

|

|

|

|||||

4. |

If garnishment is for wages, this claim and request is filed for the pay period |

||||||

|

|

|

|

through |

|

, inclusive. |

|

5. |

I request that this matter be set for hearing. |

|

|

||||

Signature

Address for mailing of Court Hearing Notice

|

|

Address for mailing a copy of Claim to Judgment |

||

|

|

|

|

|

|

|

|

|

|

You must mail the original to the Court Clerk of |

Payne County at the following address: |

|||

606 South Husband, Room 206 |

|

|

|

|

Stillwater, Oklahoma 74074 |

|

|

|

|

AOC Form 22 Revised 8/05

Form Characteristics

| Fact Name | Details |

|---|---|

| Governing Law | The Oklahoma 20 form is governed by 12 O.S. Supp. 2004 § 1172. |

| Purpose | This form is used to initiate garnishment proceedings against a judgment debtor to collect owed amounts. |

| Required Information | The form requires details about the judgment creditor, judgment debtor, amounts owed, and property in possession. |

| Filing Requirements | The affidavit must be sworn and filed with the district court, alongside the garnishment summons. |

| Response Time | The garnishee must respond within seven days after the judgment debtor’s pay period ends or within thirty days of being served. |

Guidelines on Utilizing Oklahoma 20

Filling out the Oklahoma 20 form requires careful attention to detail in order to ensure proper submission to the court. Following the steps outlined below will assist in completing the form accurately.

- At the top of the form, fill in the name of the court as "IN THE DISTRICT COURT OF Payne COUNTY, STATE OF OKLAHOMA."

- Identify the plaintiff by entering their name next to "Plaintiff."

- Leave the case number blank for the court clerk to fill in.

- Enter the name of the defendant in the "vs." section.

- For the garnishment affidavit, begin by stating your name where indicated in the text: "I, [Your Name], being duly sworn, states as follows."

- Check the appropriate box to indicate if this is a prejudgment or postjudgment garnishment.

- If applicable, fill in the details regarding the Judgment Debtor, including the amount owed on your original claim.

- For postjudgment garnishment, specify the amounts for interest and court costs.

- State your belief about the garnishee’s indebtedness to the judgment debtor in the provided section.

- Check one of the options regarding whether you are seeking a continuing garnishment.

- Sign the affidavit section, and include the date of signature.

- Have a court clerk or notary public sign and stamp the document to validate it.

- Ensure all sections are completed and double-check for accuracy before submission.

What You Should Know About This Form

What is the Oklahoma 20 form?

The Oklahoma 20 form is a legal document used in the garnishment process in the state of Oklahoma. It includes the details of a plaintiff, the judgment debtor, and the garnishee, or the entity from which the debtor's funds are being sought. This form is essential for initiating garnishment proceedings in both prejudgment and postjudgment situations, ensuring the creditor can collect the amounts owed.

Who fills out the Oklahoma 20 form?

The form is filled out by the judgment creditor or their attorney. They must provide information about the amounts owed by the judgment debtor and indicate the garnishee’s name. If the judgment is postjudgment, additional information, such as interest and court costs, must be included as well.

What information is required in the Oklahoma 20 form?

Key information includes the names and addresses of the plaintiff, judgment debtor, and garnishee. The creditor must also specify the amount owed on the original claim and any additional debts of the judgment debtor. This can include interest, attorney fees, and total garnishment amounts. The form requires the creditor to affirm that the garnishee holds property or funds belonging to the debtor that are not legally exempt from garnishment.

What is the process for garnishee once they receive the Oklahoma 20 form?

Upon receipt, the garnishee must respond within a specified timeframe, typically seven days after the end of the judgment debtor’s pay period, or within thirty days of the summons being served. They must disclose if they have any obligation to the debtor and withhold the appropriate amount from the debtor’s earnings, directing those funds to the judgment creditor or their attorney.

How long does a garnishment order remain in effect?

The garnishment order remains effective until one of several conditions occurs: the total amount owed is paid, the debtor's employment is terminated, the judgment is modified or satisfied, the garnishment order is dismissed, or 180 days pass from service of the garnishment summons. This timeline ensures that creditors can recover payments while providing safeguards for those affected by the garnishment.

What are the rights of the judgment debtor in this process?

Judgment debtors have the right to receive a copy of the garnishment notice and to be informed of any exemptions. They can contest the garnishment by applying for a hearing if they believe the garnishment is improper or if they dispute the amount owed. It is critical for debtors to be aware of their rights in order to navigate the garnishment process effectively.

What happens if a garnishee does not comply with the Oklahoma 20 form?

If a garnishee fails to respond appropriately, they risk further legal action, including being held liable for the total amount owed to the creditor. The court may render a judgment against the garnishee equal to the original judgment amount, along with additional costs incurred during the garnishment proceedings. Compliance is essential to avoid such penalties.

Can the Oklahoma 20 form be modified or suspended?

Yes, the garnishment order can be modified or suspended by mutual agreement between the creditor and the garnishee. This agreement must be documented in writing and filed with the court. Such flexibility allows parties to adjust their obligations in response to changes in circumstances.

Common mistakes

Filling out the Oklahoma 20 form can be straightforward, but many make common mistakes that can lead to complications down the line. One major error is leaving blank fields. Whether it's the name of the judgment debtor or the amount owed, missing information can cause delays in the legal process. Always ensure that every relevant section is completed.

Another frequent mistake is failing to sign the affidavit. It is crucial that the judgment creditor or their attorney properly sign the form. Without a signature, the court will not accept the document, and this could lead to further issues. Taking a moment to double-check that a signature is included can save time and frustration.

A third common pitfall involves the failure to provide accurate amounts. This includes not only the total judgment amount but also any interest, attorney fees, and court costs. Miscalculating these figures can result in problems, as the garnishee may not withhold the correct amount. Be thorough when calculating and recheck the numbers to avoid errors.

Poor documentation of the garnishee is another mistake that can complicate matters. It's essential to ensure that the information about the garnishee, including their name and address, is accurate. If this information is incorrect, it could hinder the garnishment process. Verify the garnishee's details to facilitate a smoother legal procedure.

Lastly, some individuals overlook the requirement to provide notice to the judgment debtor. Even though it’s often the garnishee's responsibility to notify the debtor, the judgment creditor's attorney must also ensure proper notification is fulfilled. Failure to do this could lead to claims of improper service, which can seriously disrupt the garnishment process. Keeping communication clear and documenting all necessary notifications can mitigate this risk.

Documents used along the form

In addition to the Oklahoma 20 form, several other forms and documents are commonly used in the garnishment process in Oklahoma. These documents help facilitate communication between the parties involved and ensure compliance with legal requirements. Below is a list of key forms that may be necessary alongside the Oklahoma 20 form.

- Garnishment Summons: This document notifies the garnishee (the party holding the debtor’s property) of the garnishment action. It requires them to withhold funds from the judgment debtor’s earnings and respond within a specified timeframe.

- Garnishee's Answer/Affidavit: This form is completed by the garnishee. It confirms whether they owe money to the judgment debtor and details any property or funds they may control or possess.

- Notice of Garnishment: This notice informs the judgment debtor about the garnishment action. It provides them with information regarding their rights and the process they can follow to contest the garnishment.

- Application for Hearing: A judgment debtor can file this form if they wish to contest the garnishment. It requests a hearing to challenge either the validity of the garnishment or the amounts being withheld.

- Order for Continuing Garnishment: This court order specifies that the garnishment should continue over multiple pay periods until a certain condition is met, such as the satisfaction of the judgment.

- Motion to Vacate Garnishment: If a judgment debtor believes the garnishment is improper or unjust, they can file this motion to ask the court to vacate or cancel the garnishment order.

- Motion for Release of Funds: This document is used to request the release of funds that have been garnished, typically when the judgment has been satisfied or if the funds are exempt from garnishment.

- Affidavit of Indigency: A judgment debtor may submit this affidavit to prove they cannot afford to pay the debts owed. It can be crucial in requesting exemptions from garnishment.

- Judgment Creditor’s Notice of Change of Address: This form updates the court and other parties regarding a change in address for the judgment creditor, ensuring they receive all necessary communications.

Understanding these documents can significantly ease the process of dealing with garnishments. Using the appropriate forms ensures that all parties fulfill their legal obligations and protects the rights of both creditors and debtors.

Similar forms

Garnishment Affidavit: Similar to the Oklahoma 20 form, this document serves as a declaration by the judgment creditor, outlining the debt owed by the judgment debtor. It includes details about amounts due, interest, and related fees.

Summons for Garnishment: Like the Oklahoma 20 form, this document informs the garnishee about their obligation to withhold a portion of the judgment debtor's earnings. It provides specific instructions on how to respond and the timeline for compliance.

Answer of Garnishee: This document allows the garnishee to respond to the summons, detailing whether they owe money to the judgment debtor or possess any property of theirs. It establishes a formal record of the garnishee's position.

Writ of Garnishment: Comparable to the Oklahoma 20 form, this legal order directs the garnishee to withhold funds from the judgment debtor's earnings. It emphasizes the garnishee’s responsibilities and outlines consequences for non-compliance.

Notice of Garnishment: This document informs the judgment debtor of the garnishment proceedings, similar to the notification indicated in the Oklahoma 20 form. It explains their rights and any exemptions available to them.

Continuing Garnishment Order: Like the Oklahoma 20 form, this order allows for ongoing deductions from the judgment debtor’s earnings until the debt is satisfied, providing clear guidelines on the duration and conditions of the garnishment.

Exemption Claim Form: This document permits the judgment debtor to claim any exemptions from garnishment. It parallels aspects of the Oklahoma 20 form by protecting certain assets from being seized.

Judgment Creditor’s Statement: This statement is similar as it outlines the total amount owed, including interest and fees. It reinforces the claims made in the Oklahoma 20 form and is used during garnishment proceedings.

Dos and Don'ts

When filling out the Oklahoma 20 form, it is essential to carefully follow instructions to ensure accuracy and avoid delays. The following list highlights important actions to take and avoid:

- Do read the entire form thoroughly before starting.

- Do provide accurate and complete information.

- Do double-check all numbers and calculations related to amounts owed.

- Do sign and date the form where indicated.

- Do make sure to include all required documents with your submission.

- Don't rush through the form. Take your time to ensure all details are correct.

- Don't leave any blanks where information is needed.

- Don't ignore the instructions regarding the delivery of your answer to the judgment creditor and debtor.

- Don't forget to retain a copy of the completed form for your records.

- Don't assume that oral communication with the court is sufficient; always provide written documentation.

Misconceptions

Misconception 1: The Oklahoma 20 form is only for postjudgment garnishments.

In fact, the form can be used for both prejudgment and postjudgment garnishments. Users can select the appropriate section based on the timing of the judgment.

Misconception 2: Completing the form guarantees payment from the debtor.

While submitting the Oklahoma 20 form initiates the garnishment process, it does not guarantee that the debtor has sufficient funds or assets to satisfy the claim.

Misconception 3: Only the judgment creditor can fill out and file the Oklahoma 20 form.

In many cases, an attorney representing the judgment creditor can also complete and file the form on their behalf. Both parties can play a role in this process.

Misconception 4: All forms of earnings are exempt from garnishment.

This is not accurate. The term "earnings" includes various forms of compensation, like salary or commissions, but excludes certain reimbursements, such as travel expenses for state employees.

Misconception 5: The garnishee does not need to notify the judgment debtor about the garnishment.

It is required for the garnishee to notify the judgment debtor by mail or hand-delivery after receiving the garnishment summons. This ensures transparency in the process.

Misconception 6: Garnishment stops immediately when the judgment debtor pays off a portion of the debt.

Garnishment continues until specific conditions are met, such as the judgment being satisfied in full, employment being terminated, or a new garnishment taking effect.

Misconception 7: The Oklahoma 20 form is the same for all counties and situations.

While there are standard components, specific requirements can vary by county and case type. It is essential for users to review local rules and procedures prior to submission.

Key takeaways

Utilizing the Oklahoma 20 form effectively requires attention to several important points. Here are key takeaways to consider:

- Understand the Purpose: This form is designed for garnishment proceedings, allowing a judgment creditor to collect on a debt from the judgment debtor's earnings or property.

- Sworn Affidavit: The judgment creditor or their attorney must complete the form under oath, verifying the debt and the debtor's obligations.

- Detail the Amounts: Precise figures regarding the original claim, interest, court costs, and attorney fees must be included for clarity.

- Identify the Garnishee: Clearly state the name of the entity or individual being garnished, as they are responsible for withholding the owed amounts.

- Continuing Garnishment: Indicate whether you are seeking a one-time garnishment or a continuing garnishment that withholds amounts over multiple pay periods.

- Timely Responses: The garnishee must respond within seven days of the pay period ending or within thirty days of receiving the summons, whichever comes first.

- Notify the Judgment Debtor: The garnishee is responsible for informing the judgment debtor of the garnishment and providing them with the necessary notices.

- Adherence to Limitations: The garnishment continues until the debt is satisfied, employment is terminated, or 180 days have passed from the service date, unless otherwise modified.

- Submission Deadlines: Ensure that all responses and documents are filed timely to avoid penalties or further legal action.

Browse Other Templates

Stanley-brown Safety Plan - Understanding the resources available fosters proactive engagement with mental health care.

Texas Workman's Comp - Make use of the clear checkboxes to simplify the selection of request types on the form.

Insurance Business Plans - Utilizing data about existing businesses helps refine target markets for services.