Fill Out Your Oktap Form

The Oklahoma Taxpayer Access Point, commonly known as OkTAP, enhances how taxpayers manage their tax information. With OkTAP, users can register online and have 24/7 access to their tax accounts from anywhere with internet connectivity. The platform currently supports three main tax types: Alcohol, Cigarette, and Tobacco, with plans to introduce additional tax categories in the coming years. Taxpayers can view account balances, file or amend returns, and communicate directly with representatives from the Oklahoma Tax Commission (OTC) through a secure messaging system. Registration for OkTAP requires individuals to create a unique logon ID and password, while existing credentials from other OTC systems will not work. For those needing assistance, a comprehensive FAQ section is conveniently located on every page. The intuitive navigation menu simplifies access to various functions, including account details, requests, notices, and permits, making tax management easier and more efficient. Overall, OkTAP represents a significant move towards digital tax management, providing a streamlined method for taxpayers to engage with their financial obligations.

Oktap Example

OKLAHOMA TAX COMMISSION

ONELINK TAX SYSTEM

TABLE OF CONTENTS |

|

OVERVIEW - OKLAHOMA TAXPAYER ACCESS POINT |

..................................................................3 |

NAVIGATING OKTAP |

4 |

REGISTERING FOR OKTAP |

5 |

THINGS YOU CAN DO WITH OKTAP |

12 |

LETTERS & PERMITS |

17 |

VIEWING AND SENDING NOTICES |

17 |

REQUESTS |

19 |

ACCOUNTS |

20 |

FILING A RETURN |

22 |

ORDERING CIGARETTE STAMPS ON OKTAP |

26 |

ACCESS CHART — TYPES AND LEVELS |

33 |

NAVIGATION MENU DETAILS – ACCOUNT LEVEL |

34 |

WITHHOLDING REGISTRATION APPLICATION |

37 |

To link directly to a topic: hover over the Table of Contents section title, and click.

NOTE:

All account numbers, company names, and graphic examples are fictitious. Any resemblance to an actual company or taxpayer is completely coincidental.

OkTAP Guide |

2 |

|

OVERVIEW - OKLAHOMA TAXPAYER ACCESS POINT

Oklahoma Taxpayer Access Point (OkTAP) is an additional way to access your tax information. Taxpayers who choose to register for OkTAP will have the ability to manage and monitor their tax accounts via the internet anytime, anywhere.

Online messaging is also available and provides a secure connection for the taxpayer and/or their agent to submit a message to an Oklahoma Tax Commission (OTC) representative.

TAX TYPES CURRENTLY SUPPORTED IN OKTAP

Currently, there are three tax types supported in OkTAP: Alcohol, Cigarette, and Tobacco. Over the next few years additional tax types will become available for access through OkTAP.

Tax Type Supported |

Account Balance |

|

View and Print OTC |

File or Amend |

|

|

|

|

and Activity |

|

Correspondence |

Returns |

|

Messaging |

|

Alcohol |

|

|

|

|

|

|

|

Cigarette |

|

|

|

|

|

|

|

Tobacco |

|

|

|

|

|

|

|

FILERS WHO USE THE OTC ONLINE FILING

User IDs and passwords used on QuickTax, the Business Tax Filing System, will not work with OkTAP. The taxpayer must register to use OkTAP.

FREQUENTLY ASKED QUESTIONS

Users who have questions while using OkTAP should navigate to the blue FAQs link located at the left side of every screen.

When users log out of OKTAP they should always close the web browser to ensure that none of their personal data remains in the computer’s cache

memory.

OkTAP Guide |

3 |

|

NAVIGATING OKTAP

OkTAP uses a number of

OkTAP will automatically log off after 15 minutes of inactivity.

Navigation in OkTAP is done by using the

BC

A

D

A.The sidebar on the left of the window contains four key elements:

1.The OkTAP icon will take you to the Oklahoma Tax Commission website.

2.The Menu section contains options for Home, Back, and Log Off. Back will become active once you have moved beyond the Home screen.

3.The Navigation section provides links to:

a.My Accounts – these are the accounts that have been registered for access through your OkTAP login.

**The next group of options will change depending on where you are within your OkTAP account(s).**

4.Help Links section provides links to the Frequently Asked

Questions (FAQ’s) and an electronic copy of this guide.

B.This section displays basic organization information; name, Federal Employer ID or Social Security Number, and overall balance for all accounts that are registered for access through OkTAP.

C.In the top right of the screen is the DBA Name and Mailing Address. This will change to account specific name and mailing address when using the Accounts tab.

D.The main portion of the screen is organized into four tabs:

1.Accounts - contains the list of accounts that have been specified as part of this profile with a small summary.

2.Requests – items that have been submitted, such as, a return or change of address.

3.Notices – messages from the OTC or confirmation that a request has been completed.

4.Letters & Permits – Letters or permits that have been printed and sent.

OkTAP Guide |

4 |

|

OKTAP COLORS

The fields on the forms are

Green: enter information (optional)

Yellow: field is required in order to be submitted

Red: field is in error

White: field is automatically calculated and cannot be modified

Click or hover over the red error field for explanation about the error.

REGISTERING FOR OKTAP

Several tax type accounts are available through OkTAP. (See chart on page 3.) Any taxpayers who have tax accounts available through OkTAP are eligible to register for an OkTAP logon.

The first individual that registers themselves in OkTAP under a company’s FEIN is considered the Master Account Holder. Only the Master Account Holder can manage logons, request to cease an account, and set up Direct Deposit for any tax refunds associated with their account(s). The Master Account Holder will also be alerted by email whenever a subsequent account is accessed under the same FEIN.

It is an easy

1.Register to use OkTAP – provide initial information and an Authorization Code will be emailed to you

2.Initial Logon - Authorization Code required

HOW DOES A TAXPAYER REGISTER ON OKTAP?

You will need the following information

Account Number: 13 digit account number; located on all correspondence received from OTC after October 10, 2011 for all participating tax types.

Federal Employer Identification Number (FEIN) for Business Registration

Social Security Number for individuals, Sole Proprietor

Logon ID: You will create a Logon ID

(up to 30 characters; not case sensitive; spaces are allowed)

Password:

Password must be at least 10 characters long and contain the following:

At least 1

At least 1

At least 1 number

Valid

OkTAP Guide |

5 |

|

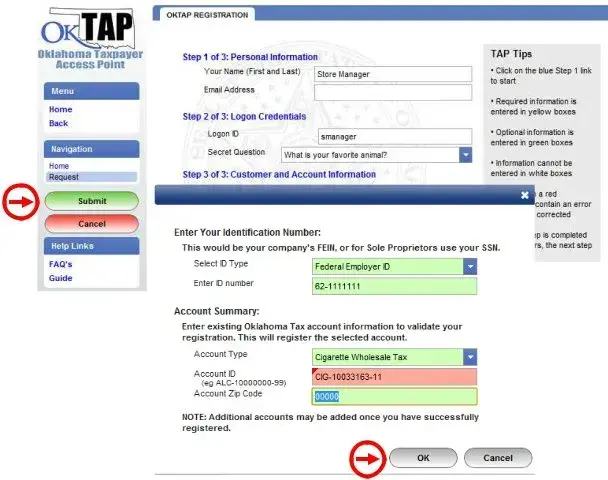

Steps to register for OkTAP:

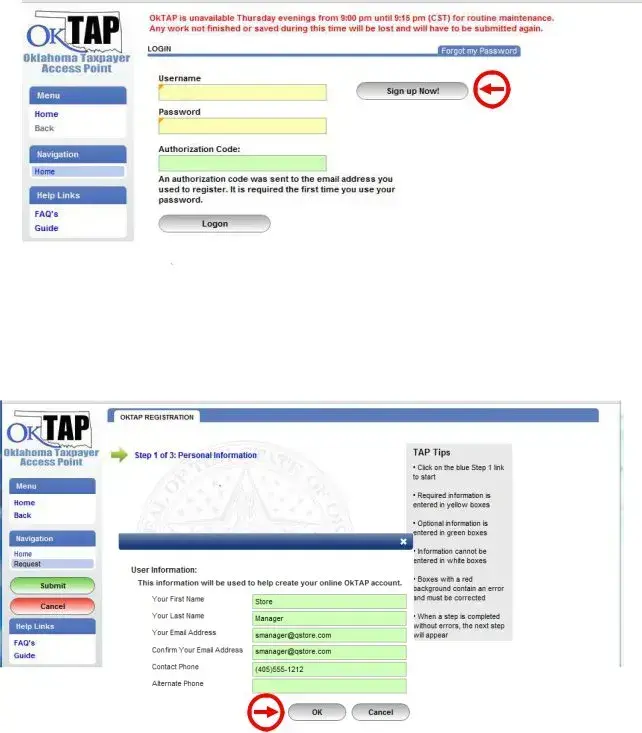

1. Click the button: Sign Up Now!

2.To begin the registration process click the link, Step 1 of 3: Personal Information a. Complete the required information and click OK:

i.

ii.

iii.

iv.

OkTAP Guide |

6 |

|

Once the first window is completed the information entered will appear on the registration page and the next link will become available.

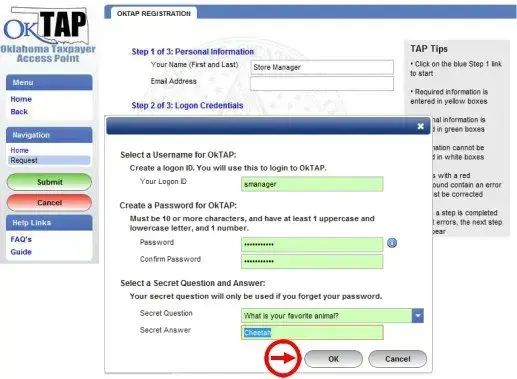

3.Click Step 2 of 3: Create Logon Credentials

Complete the required information and click OK:

-Logon ID: (30 character maximum)

-Password: Passwords must contain 10 or more characters and include:

At least 1

At least 1

At least 1 number

-Secret Question and Answer

OkTAP Guide |

7 |

|

4.Click Step 3 of 3: Customer and Account Information

Complete the required information and click OK:

5. Click the Submit button to complete the registration.

OkTAP Guide |

8 |

|

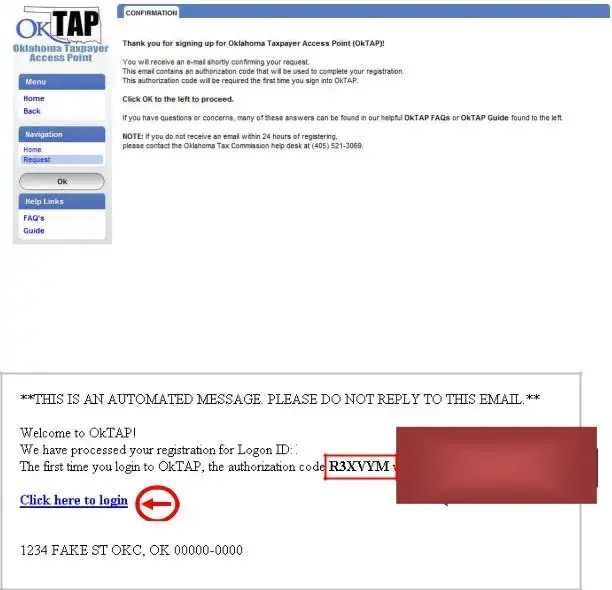

Next, you will receive an OkTAP confirmation screen. The confirmation screen will provide the New Registration request confirmation number.

The OkTAP Registration request will be processed and you will receive your Authorization Code within a few minutes. The Authorization Code is required for your initial login and will be sent to the

Below is an example of the Authorization Code

SMANAGER

Authorization Code

STORE MANAGER

OkTAP Guide |

9 |

|

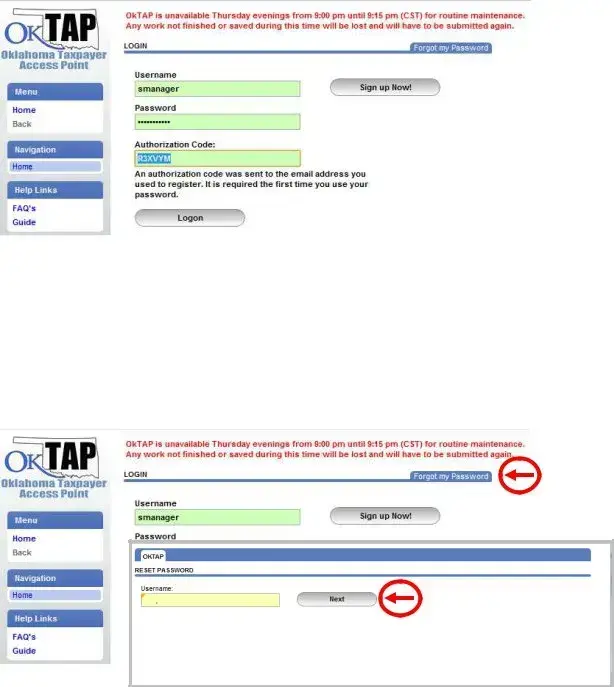

LOGGING ON FOR THE FIRST TIME

Once registration is complete, your Authorization Code will be sent to the specified e- mail address. The Authorization Code must be used to logon for the first time.

WHAT IF I FORGET MY PASSWORD?

If you forget your OkTAP password, you can reset your password yourself.

Click the tab: Forgot my Password on the main Logon screen.

Initially, only the first two items will be displayed in the window. Enter in your Logon ID, and then click the Next button.

OkTAP Guide |

10 |

|

Form Characteristics

| Fact Name | Details |

|---|---|

| System Overview | OkTAP stands for Oklahoma Taxpayer Access Point, allowing taxpayers to manage tax accounts online. |

| Supported Tax Types | Currently, OkTAP supports Alcohol, Cigarette, and Tobacco tax types. |

| Registration Requirement | Users must register for OkTAP; existing QuickTax credentials won’t work. |

| Navigation | OkTAP features an on-screen navigation menu for easy access to different sections. |

| Master Account Holder | The first registered user under a company’s FEIN becomes the Master Account Holder, who can manage logons. |

| Error Indicators | Color-coded fields indicate actions: green for optional, yellow for required, and red for errors. |

| Automatic Logout | For security, OkTAP will automatically log off after 15 minutes of inactivity. |

| Access to Notices | Users can view and manage notices and letters from the Oklahoma Tax Commission via OkTAP. |

| Email Alerts | The Master Account Holder receives an email alert whenever a related account is accessed. |

| Security Measures | Online messaging provides a secure connection between taxpayers and the Oklahoma Tax Commission. |

Guidelines on Utilizing Oktap

Once you are ready to fill out the OkTAP form, follow the steps carefully to ensure accurate registration. This process involves providing necessary information to create your account and gain access to your tax information.

- Gather essential information, including:

- Your 13-digit account number from any correspondence received from the Oklahoma Tax Commission (OTC) after October 10, 2011.

- Federal Employer Identification Number (FEIN) if you are a business.

- Your Social Security Number (SSN) if you are an individual or Sole Proprietor.

- A Logon ID of up to 30 characters, which can include spaces and is not case sensitive.

- A password that is at least 10 characters long, containing at least one upper-case letter, one lower-case letter, and one number.

- A valid email address for confirmation and receiving the Authorization Code.

- Access the OkTAP registration page on the Oklahoma Tax Commission website.

- Fill in your account number, FEIN, or SSN as prompted on the form.

- Create your chosen Logon ID and password according to the specified guidelines.

- Provide your valid email address in the designated field.

- Submit your registration form.

- Check your email for the Authorization Code from OkTAP.

- Use the Authorization Code to complete your initial logon to OkTAP.

What You Should Know About This Form

What is OkTAP and how can it benefit me as a taxpayer?

OkTAP, or the Oklahoma Taxpayer Access Point, is an online platform that allows you to manage your tax information from anywhere at any time. By registering for OkTAP, you gain access to view and print your tax returns, manage account balances, and even send secure messages to representatives from the Oklahoma Tax Commission. This online system supports several types of taxes, including alcohol, cigarette, and tobacco taxes, making it easier for you to keep track of your obligations and communicate directly with the tax authorities.

How do I register for an OkTAP account?

Registering for OkTAP is straightforward. First, you'll need to provide some personal information, including your 13-digit account number, Federal Employer Identification Number (FEIN), or Social Security Number if you're a sole proprietor. You'll also create a unique Logon ID and a secure password that meets specific criteria. Once you submit this information, you'll receive an Authorization Code via email. Use this code to log in for the first time, and you're all set!

What if I forget my Logon ID or password?

If you forget your Logon ID or password, don't worry! There are options available to recover your access. You can use the "Forgot Logon ID" or "Forgot Password" links on the login screen. Just follow the prompts to verify your identity, and you will be able to reset your information. It’s always a good idea to have your email and other verifying details handy for this process.

What can I do after I register and log in to OkTAP?

Once you’ve registered and logged into OkTAP, a variety of options will be at your fingertips. You'll be able to view and print your returns, manage account balances, and submit requests or change your address. Additionally, you will receive electronic notices and letters from the Oklahoma Tax Commission directly through the platform. With everything organized in one place, handling your tax information becomes much simpler.

Common mistakes

Filling out the Oktap form can be a straightforward process, but there are common mistakes that can lead to delays or complications. Awareness of these potential pitfalls can save time and frustration.

One frequent mistake is not using the correct account number. Taxpayers must ensure they are entering a 13-digit account number, which is found in any correspondence received from the Oklahoma Tax Commission (OTC) after October 10, 2011. Double-checking this number is essential, as errors can prevent access to important tax information.

Another mistake occurs when individuals neglect to confirm their Federal Employer Identification Number (FEIN). This number is crucial for business registrations. Without it, the system may not recognize the business account, leading to a cycle of frustration. Always ensure the FEIN is accurate to avoid unnecessary hurdles.

Password creation often trips people up. The Oktap system requires a password to be at least 10 characters long and to include a combination of upper-case letters, lower-case letters, and numbers. Failing to meet these criteria may result in the system rejecting the password and causing delays in registration.

A valid email address is another critical requirement. Some taxpayers mistakenly think they can use a general email account that is not regularly checked. It's vital that the email provided is one that the user can access easily, as the Authorization Code and confirmation messages will be sent there.

Additionally, many users overlook the importance of disabling pop-up blockers when working within the Oktap interface. The online system utilizes pop-ups to offer important options and notifications. If these are blocked, critical functionality may be lost, hindering the user experience.

Perhaps one of the most frustrating mistakes is leaving fields that are required blank. The form color codes are there for a reason. Yellow fields indicate required information. Ensure that all yellow fields are filled out completely and accurately to proceed without issue.

Lastly, failing to log out and properly close the web browser can have significant security implications. The system will automatically log off after 15 minutes of inactivity. However, not closing the browser can leave personal data cached in the computer's memory, putting sensitive information at risk.

By avoiding these common mistakes, taxpayers can streamline their experience with the Oktap system and ensure that their tax matters are handled efficiently. Attention to detail is key, and taking the time to double-check information will pay off in the long run.

Documents used along the form

Along with the Oktap form, several other important documents and forms often come into play for managing your tax accounts. Understanding these documents can streamline your tax filing process and ensure compliance with state regulations.

- Withholding Registration Application: This form registers employers for withholding tax purposes. It helps employers establish accounts for withholding state income tax from employee wages.

- Tax Return Filing Forms: These forms are used to report various tax obligations to the state. Each tax type (e.g., alcohol, cigarette, tobacco) has its own specific return that must be filed regularly.

- Direct Deposit Authorization: This document allows taxpayers to receive refunds directly into their bank accounts. It requires banking information and authorization from the taxpayer for secure transactions.

- Change of Address Form: When an individual or business moves, this form is necessary to update the state about the new address, ensuring they receive important tax correspondence without delay.

- Power of Attorney Form: This legal document allows a designated person to act on behalf of the taxpayer in tax matters, enabling them to manage communications with the Oklahoma Tax Commission.

- Correspondence and Notice Forms: These forms are used to respond to tax notices and inquiries. They facilitate communication with the Oklahoma Tax Commission regarding any discrepancies or questions related to tax filings.

Having these forms readily available can help ensure a smoother interaction with the Oklahoma Tax Commission. Keeping organized and understanding each document's purpose will simplify managing your tax responsibilities.

Similar forms

- Online Tax Filing Systems: Similar to the Oktap form, online tax filing systems provide users the ability to file tax returns electronically. They typically require registration and allow for real-time tracking of submission status and notifications from tax authorities.

- Property Tax Assessment Forms: Like the Oktap form, property tax assessment forms offer a means for property owners to manage their tax obligations. These forms often require detailed information about the property and its valuation, which mimics the informational requirements found in Oktap.

- Business Registration Applications: Business registration forms, similar to Oktap, collect essential information from taxpayers and require users to create a logon. Both processes verify the taxpayer's identity before granting access to sensitive information.

- IRS Form 941: The IRS Form 941, used for reporting employment taxes, shares a similar function with the Oktap form. Both facilitate taxpayers in managing specific tax liabilities and provide a structured format for reporting tax-related data.

- Electronic Payment Authorization Forms: These forms allow taxpayers to authorize electronic payments, akin to Oktap's feature for setting up direct deposits. Authorization is necessary for both, ensuring secure transactions and payment management.

- Annual Tax Returns: Just as the Oktap form helps manage ongoing tax activities, annual tax returns serve a similar purpose for annual reporting. Both require thorough documentation and accurate data entry to avoid potential errors and ensure compliance.

Dos and Don'ts

When filling out the OkTAP form, it's important to get it right to ensure a smooth experience. Here are eight things to keep in mind:

- Do double-check your information before submitting to avoid any errors that could delay processing.

- Don’t use an old user ID or password from QuickTax or other systems; they won’t work with OkTAP.

- Do ensure your password is at least 10 characters long and includes a mix of upper-case, lower-case, and numbers.

- Don’t forget to disable your pop-up blocker, as OkTAP uses pop-ups to navigate effectively.

- Do keep your account number handy; it’s essential for registration and future access.

- Don’t leave your computer unattended while logged in to OkTAP. Always log out and close the browser afterward.

- Do use the resources available, such as the FAQs section, if you have any questions while using the site.

- Don’t ignore color-coded fields; they indicate required actions and can help guide you through the form correctly.

Misconceptions

- OkTAP is only for simple tax inquiries. In reality, OkTAP allows users to manage multiple aspects of their tax accounts, including filing returns and requesting permits, beyond mere inquiries.

- You can use any existing passwords from other OTC services. It is essential to note that the User IDs and passwords from QuickTax or the Business Tax Filing System do not work with OkTAP. Each user must register to set up a new account.

- All tax types are available immediately on OkTAP. For now, OkTAP supports only three tax types: Alcohol, Cigarette, and Tobacco. Additional types will be introduced in the coming years.

- Once I register for OkTAP, I can log in indefinitely. Users should be aware that OkTAP will log off automatically after 15 minutes of inactivity to maintain security and protect personal data.

- OkTAP offers no support for user questions. On the contrary, users can access the Frequently Asked Questions (FAQs) section located on every screen for assistance while navigating the platform.

- Filing returns on OkTAP is difficult. The filing process is designed to be user-friendly. With the right guidance, most taxpayers find it straightforward to submit their returns online.

- Once you register, anyone can manage the OkTAP account. The Master Account Holder, who registers first under a company’s FEIN, holds exclusive management rights over logons and account alterations.

- Pop-up blockers do not affect OkTAP usage. To enhance navigation, users should disable pop-up blockers. This allows OkTAP’s pop-up options to function correctly throughout the interface.

- OkTAP is not secure for personal information. OkTAP uses a secure connection for online messaging, ensuring that communication between taxpayers and the Oklahoma Tax Commission is safe and protected.

Key takeaways

- Access Anytime, Anywhere: By registering for OkTAP, taxpayers gain the ability to manage their tax accounts online, providing flexibility and convenience.

- Secure Messaging: The platform offers a secure messaging feature, allowing you to communicate directly with an Oklahoma Tax Commission representative.

- Account Registration: You must register for OkTAP with an email and specific account information, as credentials from other tax filing systems like QuickTax won’t work.

- Master Account Holder: The first individual who registers for a business under its Federal Employer Identification Number (FEIN) becomes the Master Account Holder, gaining special management rights.

- Color-Coded Forms: Forms within OkTAP use colors to indicate actions required: green is optional, yellow is necessary, red signifies an error, and white indicates calculated fields.

- Quick Logout: To protect personal data, always log out of OkTAP and close the web browser to prevent your information from being stored in cache memory.

Using OkTAP effectively can streamline your tax management experience and improve your interaction with the Oklahoma Tax Commission.

Browse Other Templates

Mvu24 - Amend any incorrect details before submitting the form.

Michigan Dhs Forms - All parties involved must understand their roles regarding representation.