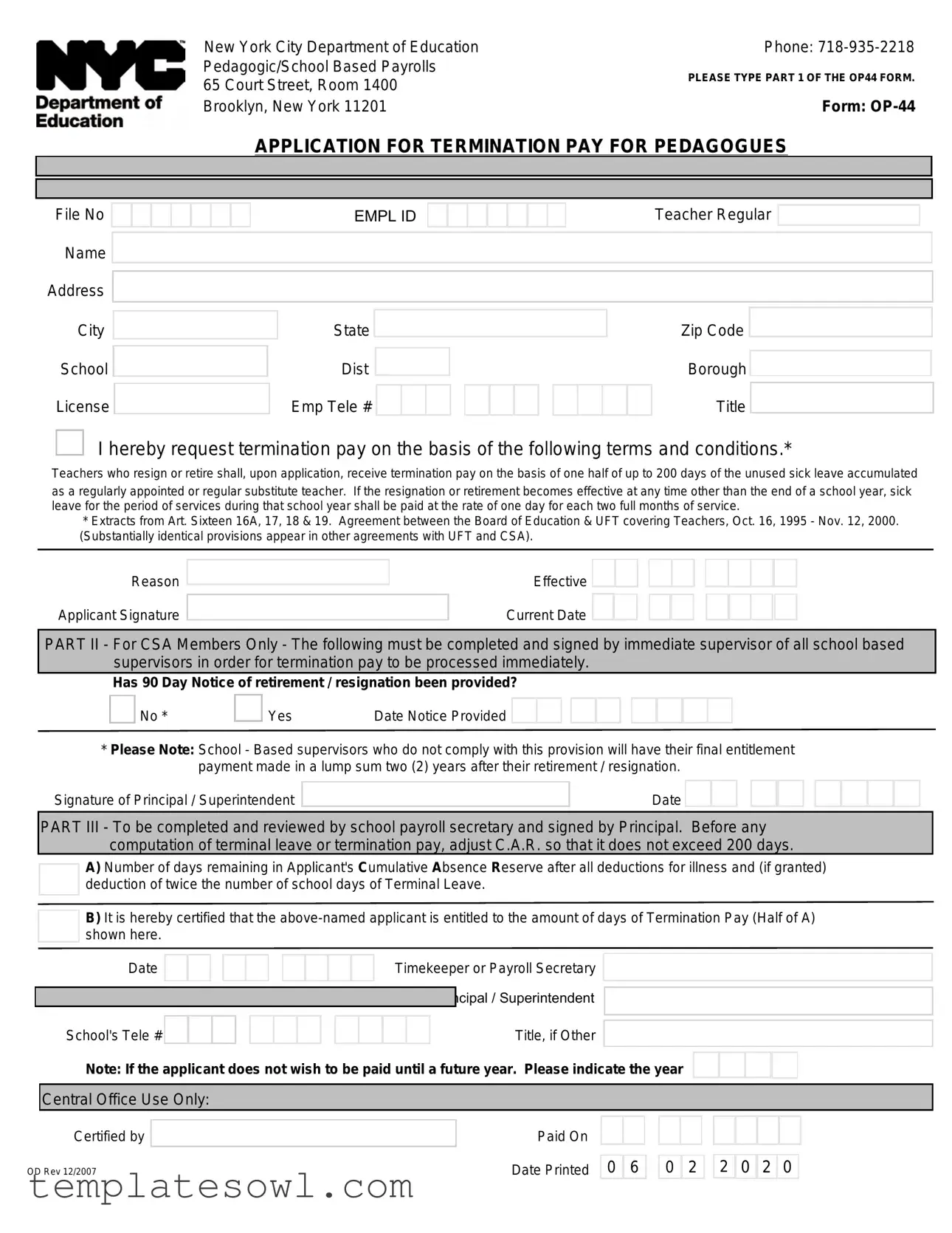

Fill Out Your Op 44 Form

The OP 44 form serves as an important document for educators in New York City seeking termination pay. This form is utilized by pedagogues upon their resignation or retirement, allowing them to request compensation for unused sick leave. Specifically, teachers may be eligible for termination pay based on one-half of up to 200 days of accumulated sick leave. The form is divided into several parts, requiring input from both the applicant and the school payroll secretary. Applicants must provide critical personal information, including their school, license number, and employment details, while also indicating the reason for their request. Part II of the form is designated for members of the Council of School Supervisors and Administrators (CSA) and mandates that their immediate supervisor confirm whether a 90-day notice of resignation has been provided. This step is crucial, as non-compliance may result in a delay of payment. Finally, Part III is completed by the payroll secretary who certifies the applicant's entitlement to termination pay, ensuring that all calculations regarding the applicant's Cumulative Absence Reserve are accurately made. Overall, the OP 44 form aims to streamline the process of securing termination benefits, ensuring that educators receive the compensation they are entitled to upon leaving their positions.

Op 44 Example

New York City Department of Education |

Phone: |

|

Pedagogic/School Based Payrolls |

PLEASE TYPE PART 1 OF THE OP44 FORM. |

|

65 Court Street, Room 1400 |

||

|

||

Brooklyn, New York 11201 |

Form: |

APPLICATION FOR TERMINATION PAY FOR PEDAGOGUES

PART I - To be completed by applicant and submitted to payroll secretary for completion of Part III.

The DOE wants to hear from our employees. Please take the time to complete an anonymous exit survey at:

File No

Name

Address

City

School

License

|

|

|

|

|

|

|

SSNEMPL ID |

|

|

|

|

|

|

|

Teacher Regular |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Zip Code |

Dist |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Borough |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Emp Tele # |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I hereby request termination pay on the basis of the following terms and conditions.*

Teachers who resign or retire shall, upon application, receive termination pay on the basis of one half of up to 200 days of the unused sick leave accumulated

as a regularly appointed or regular substitute teacher. If the resignation or retirement becomes effective at any time other than the end of a school year, sick leave for the period of services during that school year shall be paid at the rate of one day for each two full months of service.

*Extracts from Art. Sixteen 16A, 17, 18 & 19. Agreement between the Board of Education & UFT covering Teachers, Oct. 16, 1995 - Nov. 12, 2000. (Substantially identical provisions appear in other agreements with UFT and CSA).

Reason

Applicant Signature

Effective  Current Date

Current Date

PART II - For CSA Members Only - The following must be completed and signed by immediate supervisor of all school based supervisors in order for termination pay to be processed immediately.

Has 90 Day Notice of retirement / resignation been provided?

No * |

Yes |

Date Notice Provided |

*Please Note: School - Based supervisors who do not comply with this provision will have their final entitlement payment made in a lump sum two (2) years after their retirement / resignation.

Signature of Principal / Superintendent

Date

PART III - To be completed and reviewed by school payroll secretary and signed by Principal. Before any computation of terminal leave or termination pay, adjust C.A.R. so that it does not exceed 200 days.

A)Number of days remaining in Applicant's Cumulative Absence Reserve after all deductions for illness and (if granted) deduction of twice the number of school days of Terminal Leave.

B)It is hereby certified that the

Date

Timekeeper or Payroll Secretary

Signature of Principal / Superintendent

Signature of Pri cipal

School's Tele #

Title, if Other

Note: If the applicant does not wish to be paid until a future year. Please indicate the year

Central Office Use Only:

Certified by

OD Rev 12/2007

Paid On

Date Printed

0  6

6

0  2

2

2

2  0

0  2

2  0

0

Form Characteristics

| Fact Name | Description |

|---|---|

| Governing Authority | The OP-44 form is governed by the collective bargaining agreement between the New York City Department of Education and the United Federation of Teachers (UFT). |

| Purpose of Form | This form is used to apply for termination pay for educators who resign or retire from their positions. |

| Sick Leave Compensation | Teachers can receive termination pay based on one half of the value of up to 200 days of unused sick leave accumulated during their employment. |

| Submission Process | Applicants need to complete Part I and submit it to the payroll secretary to fill out Part III for processing. |

| Notice Requirement | School-based supervisors are required to provide a 90-day notice before retirement or resignation to ensure timely processing of termination pay. |

| Payment Timeline | If the notice is not provided, final payments may be delayed, potentially up to two years after the resignation or retirement date. |

Guidelines on Utilizing Op 44

After gathering the necessary information, you can proceed to fill out the OP 44 form. This form is essential for requesting termination pay. It requires accurate personal and employment details to ensure timely processing.

- Obtain the OP 44 form from the New York City Department of Education.

- Type your information in Part I, including:

- File Number

- Your Name

- Your Address

- City

- Your School

- Your License Number

- Your Social Security Number (SSN)

- Your Employee ID

- Your Position Title

- Indicate your reason for requesting termination pay.

- Sign and date the form where indicated.

- Submit the completed Part I of the form to the payroll secretary.

- Ensure that your payroll secretary completes Part III of the form and obtains the principal’s signature.

- Confirm that your immediate supervisor, if applicable, has filled out Part II for CSA members, including:

- Whether a 90-day notice of resignation or retirement has been provided

- The date notice was provided

- Signature of the Principal or Superintendent

- Date

- Keep a copy of the submitted form for your records.

What You Should Know About This Form

What is the purpose of the OP-44 form?

The OP-44 form is an application used by educators employed by the New York City Department of Education to request termination pay upon resignation or retirement. The form assists applicants in documenting their request and details regarding their unused sick leave. This pay is calculated based on a portion of accrued sick leave days, ensuring that educators can receive compensation for days that they have earned but not utilized during their employment.

Who is eligible to apply for termination pay using the OP-44 form?

Eligibility for termination pay primarily extends to regularly appointed teachers and regular substitute teachers. Individuals planning to resign or retire must ensure that they have accumulated sick leave, as the form allows for payment based on unused days. Importantly, applicants are encouraged to verify their accumulated sick leave balance, as this directly influences the amount of termination pay they may receive.

What steps should I follow to complete and submit the OP-44 form?

To successfully complete the OP-44 form, start by filling out Part I, which includes personal and employment information, the request for termination pay, and the reason for leaving. After completing this part, the form must be submitted to the payroll secretary for completion of Part III. If you are a member of the Council of Supervisors and Administrators (CSA), your immediate supervisor must also complete Part II of the form. This process ensures that all necessary approvals and calculations are made before your request is finalized.

How is the termination pay calculated?

Termination pay is calculated based on the unused sick leave accumulated during one’s tenure. For teachers resigning or retiring, the calculation takes into account one-half of up to 200 days of unused sick leave. In cases where resignation or retirement occurs mid-year, compensation for sick leave is prorated at a rate of one day for every two full months of service during that school year. Understanding this method can help educators anticipate their potential termination pay and establish their financial plans accordingly.

What happens if I do not provide the necessary advance notice of my resignation or retirement?

Failure to submit a 90-day notice of resignation or retirement can have significant implications. For school-based supervisors who do not comply with this requirement, termination pay will be processed in a lump sum, but this payment will be delayed for up to two years post-retirement or resignation. This delay emphasizes the importance of adhering to the notice requirements in order to receive timely compensation for your service.

Common mistakes

Filling out the OP-44 form can be a straightforward process if done carefully. However, there are common mistakes that applicants often make. One major error is not completing all required fields. Missing information, such as the applicant’s name or contact details, can delay processing. Ensure every section is filled out correctly to avoid unnecessary hold-ups.

Another frequent mistake involves providing inaccurate information. This includes the license number or Social Security Number. Double-check these details for accuracy, as even a small typo can cause significant issues in payment processing. Verify your information against official documents to ensure it matches perfectly.

Applicants often overlook the need for their signature. Without it, the form is not valid. Make it a habit to review the entire form before submission to ensure that all necessary signatures are included. A simple review can save time and hassle later on.

Many individuals forget to indicate the effective date of resignation or retirement. This date is crucial for calculating termination pay. Specifying the correct date helps establish eligibility, so remember to highlight it clearly on the form.

Pay attention to deadlines related to submission. Missing the cut-off can lead to a significant delay in receiving pay. Organize your timeline and submit the OP-44 form well in advance of the last working day to ensure smooth processing.

Finally, neglecting to consult a payroll secretary or a supervisor can be detrimental. If unsure about any part of the form, seek assistance. Getting help can clarify doubts and ensure the form is filled out correctly, preventing future complications.

Documents used along the form

The OP-44 form is essential for educators seeking termination pay in New York City's public school system. Along with this form, several other documents are usually required to streamline the application process for termination benefits. Below are nine commonly used forms and documents that may accompany the OP-44:

- Exit Survey Form: This anonymous survey collects feedback from departing employees about their experiences and reasons for leaving the institution.

- Notice of Resignation/Retirement: A formal letter from the employee stating their intent to resign or retire, often required to establish the date of separation.

- Cumulative Absence Reserve (CAR) Statement: A record detailing the employee’s accumulated sick leave, which is necessary for determining the termination pay amount.

- Supervisor's Verification: A document signed by the employee’s immediate supervisor, confirming the 90-day notice of resignation or retirement has been submitted.

- Principal's Certification: A form completed by the school principal certifying the employee’s entitlement to termination pay based on the CAR statement.

- Payroll Processing Form: This form includes relevant information needed by the payroll department to process the final payment upon employee separation.

- Tax Withholding Form: Employees are required to fill out a form indicating how they wish their final paycheck to be taxed, important for ensuring proper tax compliance.

- Direct Deposit Authorization: This document allows for the direct deposit of the employee’s final payment into their bank account, facilitating faster access to funds.

- Benefits Continuation Option Document: A notice outlining available options for continuing benefits after employment ends, including health insurance and retirement plans.

Having these documents ready can help ensure a smooth application process for termination pay. It’s vital for employees to understand each form's requirements and implications regarding their separation from service.

Similar forms

The OP-44 form is an important document within the New York City Department of Education, specifically relating to termination pay for educators. It's similar to several other forms and documents that serve functions related to employment termination and benefits. Here’s a list of documents that share similarities with the OP-44 form:

- W-2 Form: This document provides information about an employee's annual wages and taxes withholding. Like the OP-44, the W-2 is crucial for finalizing the financial aspects of an employment relationship, especially upon termination.

- Exit Interview Checklist: This form is used to gather feedback from departing employees about their experiences. Similar to the OP-44's role in processing termination requests, this checklist ensures that critical information is captured prior to an employee’s exit.

- Final Pay Calculation Sheet: This document details how an employee’s final paycheck is calculated, including any owed amounts for unused sick leave or vacation days. It aligns closely with the OP-44, which also deals with the calculation of termination pay based on accumulated benefits.

- Separation Agreement: Often required when an employee leaves an organization, this document outlines the terms of their departure, including severance pay if applicable. Both the separation agreement and OP-44 ensure that employees understand their rights and compensations upon leaving.

- Retirement Application Form: This form is used by employees to formally apply for retirement and can also address any final benefits due. Much like the OP-44, it captures essential information for the processing of retirement-related payments.

- Rehire Eligibility Form: This document may be utilized to determine if a former employee is eligible for rehire, often after their original employment has ended. This is comparable to the OP-44, which also requires a review of previous employment status before processing termination pay.

- Health Benefits Continuation Form (COBRA): Under COBRA, employees may choose to continue their health insurance after leaving their job. Like the OP-44, this form emphasizes the importance of communicating continued benefits available after employment ends.

Understanding these documents and their similarities to the OP-44 can help employees navigate the complexities of employment termination smoothly.

Dos and Don'ts

Filling out the OP-44 form can be straightforward if you keep a few important points in mind. Here are nine essential dos and don'ts to guide you through the process.

- Do: Type all entries clearly in the OP-44 form to ensure readability.

- Do: Confirm that you have completed Part I before submitting it to the payroll secretary.

- Do: Provide accurate and current contact information, including your phone number and address.

- Do: Review your accumulation of sick leave days to maximize your termination pay.

- Do: Keep a copy of the submitted OP-44 form for your records.

- Don't: Leave any fields blank unless they are marked as optional; incomplete forms may cause delays.

- Don't: Wait until the last minute to submit your form; allow time for processing.

- Don't: Forget to check the applicable notice periods for resignation or retirement.

- Don't: Assume that the payroll secretary will know about your past sick leave; it's your responsibility to provide this information.

By following this list, you can help ensure that your experience with the OP-44 form is as smooth and efficient as possible.

Misconceptions

There are several misconceptions surrounding the OP-44 form, commonly used for termination pay in New York City's Department of Education. Here’s a list that clarifies these myths:

- Everyone is automatically entitled to termination pay. This is not true. Only teachers who resign or retire under specific conditions may qualify for payment.

- All unused sick leave days are paid out. In reality, the form covers one half of up to 200 days of accumulated sick leave.

- The OP-44 form must be submitted only at the end of the school year. This is incorrect; it can be submitted at any time, but conditions may change based on when the resignation or retirement takes effect.

- If I do not submit the OP-44 form, I will lose all my sick leave benefits. While you may not receive termination pay, your unused sick leave does not disappear; you may still apply under different circumstances later.

- Every teacher's situation is handled the same way. Each case is unique, and factors such as service duration affect eligibility and payout computations.

- Part II of the form is optional. For CSA members, completing Part II is mandatory for ensuring timely payment of termination benefits.

- A lump sum payment is guaranteed for all resignations. If proper notice isn't given, some may have to wait up to two years for their payment.

- The payroll secretary completes all sections of the OP-44 form. The applicant must fill out Part I before submission for further processing.

- The OP-44 form can be handwritten. This is a misconception; the form must be typed to ensure clarity and proper processing.

- All communication regarding termination pay must go through the principal. While the principal plays a vital role, applicants can also directly contact the payroll secretary for inquiries.

Understanding these points will help to clear confusion about the OP-44 form and its processes. It’s always best to ask questions when in doubt, so as to ensure clarity around your rights and responsibilities.

Key takeaways

When filling out and using the OP-44 form for termination pay, keep the following key points in mind:

- Complete the Form Accurately: Ensure that all required fields are filled in, including personal details like name, address, and employee ID.

- Submit Part I Promptly: Submit the completed Part I of the OP-44 form to the payroll secretary for the processing of Part III. Delays in submission may affect the processing time.

- Understand Sick Leave Entitlement: Teachers may receive termination pay based on one-half of up to 200 days of unused sick leave. Familiarize yourself with how this calculation works.

- Notice Requirements: If applicable, make sure that the required 90-day notice of retirement or resignation has been submitted to avoid delays in payment.

- Check for Adjustments: The school payroll secretary must adjust the Cumulative Absence Reserve (C.A.R.) to ensure it does not exceed 200 days before calculating any termination pay.

- Future Payments Consideration: If you prefer not to receive termination pay in the current year, clearly indicate your preference on the form.

Following these guidelines can help streamline the process of obtaining termination pay and ensure that all necessary paperwork is completed correctly.

Browse Other Templates

Us Bankruptcy Court Forms - Its use is mandated when a security interest involves the debtor's primary residence.

The Cornell Method of Note Taking - Exploring multiple questions can enrich the overall understanding of a topic.

Incident Form in Hospital - This report must be signed by the Child Care Facility Director or Administrator for official documentation.