Fill Out Your Pa 1000 Instructions Form

The PA-1000 form is an essential tool for residents of Pennsylvania seeking financial relief from property taxes or rent through the state's Property Tax or Rent Rebate Program. This program specifically aims to assist income-eligible seniors, widows, widowers, and individuals with disabilities, providing them with rebates based on the property tax or rent they paid in the previous year. Eligibility requirements are clearly defined, ensuring that only those who meet specific age and income thresholds can apply. For homeowners, the maximum rebate varies based on income brackets ranging from $250 to $650, while renters can receive up to $650, depending on their income. Significant updates to the form for 2020 include new considerations for reporting certain types of income, such as federal stimulus payments, which are not counted towards income eligibility. Additionally, electronic filing has been introduced to streamline the application process, allowing applicants to submit their claims online via the myPATH portal. This digital option enhances efficiency and provides tools to help accurately calculate rebates. Applicants can also conveniently track the status of their claims through the same portal, ensuring transparency in the process. Deadline adherence is crucial, as applications must be submitted by June 30, 2021, to qualify for the rebates that begin distribution in early July 2021. Overall, the PA-1000 form embodies a significant initiative to alleviate financial burdens for some of Pennsylvania's most vulnerable residents.

Pa 1000 Instructions Example

PENNSYLVANIA PROPERTY TAX

or RENT REBATE PROGRAM

2020

HARRISBURG PA

www.revenue.pa.gov

APPLICATION INSIDE

IMPORTANT DATES

Application deadline: JUNE 30, 2021

Rebates begin: EARLY JULY, 2021

NOTE: The department may extend the application deadline if funds are available.

Rebates for eligible seniors, widows, widowers and people with disabilities.

WHAT IS THE PROPERTY TAX/RENT REBATE PROGRAM?

A Pennsylvania program providing rebates on property tax or rent paid the previous year by

AM I ELIGIBLE?

The program benefits

HOMEOWNERS

2020

FORM AND INSTRUCTIONS

CHANGES

Two additional items have been added to the list of income that is not reported for Line 11g. Federal stimulus or economic impact payments received by claimants are not eligibility income by Property Tax or Rent Rebate claimants. STRIVE (Senior Tax Reduction Incentive Volunteer Exchange) Program credits are also not eligibility income by Property Tax Rebate claimants.

A country code field has been added to Section I on

Income

$0 to $8,000 $8,001 to $15,000 $15,001 to $18,000 $18,001 to $35,000

Maximum Rebate

$650 $500 $300 $250

Page 1 of the

RENTERS

Income |

Maximum Rebate |

$0 to $8,000 |

$650 |

$8,001 to $15,000 |

$500 |

NEW FOR 2020

ELECTRONIC PTRR FILING

Starting with the 2020 claim year, Pennsylvanians will be able to electronically submit their Property Tax/Rent Rebate program applications. Visit mypath.pa.gov to access the Department of Revenue’s electronic filing portal. Claimants who submit their applications electronically will have the benefit of automatic calculators and other user- friendly features that are not available when filing a paper application.

myPATH is safe, secure and more efficient. See Page 18 or go to the department's website at www.revenue.pa.gov/mypathinformation to learn more about our electronic services.

CHECK APPLICATION STATUS

Applicants will be able to check the status of their rebates using the myPATH portal (mypath.pa.gov).

Be sure to include a valid phone number on your application to receive updates automatically. The department will make automated phone calls to advise when your claim is received and again when your claim is approved for payment. These calls begin around April.

If you prefer to call to check the status of your appli- cation, you may dial

DIRECT DEPOSIT

Get your rebate faster with direct deposit. See Pages 12 and 13 for details.

2 |

www.revenue.pa.gov |

BEFORE YOU BEGIN

STATE SUPPLEMENTARY PAYMENT RECIPIENTS

The State Supplementary Payment (SSP) is not included on your

SOCIAL SECURITY RECIPIENTS WITH

PA ADDRESSES

If you were a Pennsylvania resident for all of 2020, you do not have to submit proof of your Social Security income including Social Security retirement and Supplemental Security benefits. The Social Security Administration provides Social Security income information to the PA Department of Revenue. The PA Department of Human Services will provide State Supplementary Payment information to the department.

However, you or the person who prepares your claim will need these statements to correctly calculate the amount of your rebate. If none of these documents are available, you or your preparer will need to estimate the amount you received during the year. If the dollar amount you provide is not correct, the department will adjust the amount of your rebate based upon income amounts reported directly to the department by the Social Security Administration or the Department of Human Services.

SOCIAL SECURITY RECIPIENTS WITHOUT PA ADDRESSES

If your address in Social Security Administration records was not a Pennsylvania address for 2020, you must submit a copy of one of the following documents as proof of your 2020 Social Security income: Form

PHILADELPHIA RESIDENTS

Please read the special filing instructions on Page 11.

ELIGIBILITY REQUIREMENTS

You are eligible for a Property Tax/Rent Rebate for claim year 2020, if you meet the requirements in each of the three categories below:

CATEGORY 1 – TYPE OF FILER

a.You were 65 or older as of Dec. 31, 2020;

b.You were not 65, but your spouse who lived with you was 65 or older as of Dec. 31, 2020;

c.You were a widow or widower during all or part of 2020 and were 50 or older as of Dec. 31, 2020; or

d. You were permanently disabled and 18 or older during all or part of 2020, you were unable to work because of your medically determined physical or mental disability, and your disability is expected to continue indefinitely. If you received Supplemental Security Income (SSI) payments, you are eligible for a rebate if you meet all other requirements.

NOTE: If you applied for Social Security disability benefits and the Social Security Administration did not rule in your favor, you are not eligible for a Property Tax/Rent Rebate as a disabled claimant.

CATEGORY 2 – ELIGIBILITY INCOME

When calculating your total eligible annual household income, exclude

a.Property Owners - Your total eligible annual house- hold income, including the income that your spouse earned and received while residing with you, was $35,000 or less in 2020.

b.Renters - Your total eligible annual household income, including the income that your spouse earned and received while residing with you, was $15,000 or less in 2020.

You must report all items of income, except the nonre- portable types of income listed on Pages 8 and 9, whether or not the income is taxable for federal or PA income tax purposes.

NOTE: There may be differences between eligibility income and

CATEGORY 3 – OWNER, RENTER OR

OWNER/RENTER

To file as a property owner, renter, or owner/renter, you must meet all requirements for one of the following categories:

OWNER

a.You owned and occupied your home, as evidenced by a contract of sale, deed, trust, or life estate held by a grantee;

b.You occupied your home (rebates are for your primary residence only); and

c.You or someone on your behalf paid the 2020 property taxes on your home.

RENTER

a.You rented and occupied a home, apartment, nursing home, boarding home, or similar residence in Pennsylvania;

b.Your landlord paid property taxes or agreed to make a payment in lieu of property taxes on your rental property for 2020 (see Page 12); and

c.You or someone on your behalf paid the rent on your residence for 2020.

OWNER/RENTER

a.You owned, occupied, and paid property taxes for part of the year and were a renter for part of the year;

b.You owned and occupied your home and paid property taxes and paid rent for the land upon which your home is situated; or

c.You paid rent for the home you occupied, and paid property taxes on the land upon which your home is situated.

CAUTION: As a renter, if you received cash public assis- tance during 2020, you are not eligible for any rebate for those months you received cash public assistance. Please complete a

PROOF DOCUMENTS THAT FIRST

TIME FILERS MUST SUBMIT

IMPORTANT: Please send photocopies, since the depart- ment cannot return original documents. Print your Social Security Number (SSN) on each proof document that you submit with your claim form.

•If you are age 65 or older, provide proof of your age.

•If you are under age 65 and your spouse is age 65 or older, provide proof of your spouse’s age.

•If you are a widow or widower age 50 to 64, provide proof of your age and a photocopy of your spouse’s death certificate.

•If you are permanently disabled, age 18 to 64, you must provide proof of your age and proof of your permanent disability.

PROOF OF AGE

NOTE: If you receive Social Security or SSI benefits and have proven your age with the Social Security Administration, you do not need to submit proof of age.

IMPORTANT: The department accepts photocopies of the following documents as proof of your age. Do not send your original documents since the department cannot return original documents.

•Birth certificate

•Blue Cross or Blue Shield 65 Special Card

•Church baptismal record

•Driver’s license or PA identification card

•Hospital birth record

•Naturalization/immigration paper, if age is shown

•Military discharge paper, if age is shown

•Medicare card

•PACE/PACENET card

•Passport

The department will not accept a Social Security card or hunting or fishing license as proof of age.

If you have questions on other types of acceptable documents, please call the department at

PROOF OF DISABILITY

•For Social Security disability, SSI permanent and total disability, Railroad Retirement permanent and total disability, or Black Lung disability, provide a copy of your award letter.

•For Veterans Administration disability, provide a letter from the Veterans Administration stating that you are 100 percent disabled.

•For Federal Civil Service disability, provide a letter from Civil Service stating that you are 100 percent disabled.

•If you do not qualify under any of the disability programs mentioned above, did not apply for Social Security benefits, or do not have a letter from the Veterans Administration or Civil Service Administration, you must submit a Physician’s Statement of Permanent Disability

IMPORTANT: The Physician’s Statement of Permanent Disability cannot be used if you were denied Social Security disability. The Department of Revenue has the legal authority to require additional evidence that you are permanently disabled and eligible for a rebate.

HOUSEHOLDS WITH MORE THAN

ONE QUALIFIED CLAIMANT

Only one member of your household may file a claim even if more than one person qualifies for a rebate. If someone other than your spouse appears on the deed or the lease, please complete a

DECEASED CLAIMANT

To be eligible for a rebate, the claimant must have lived at least one day of a claim year, owned and occupied and paid taxes or rented and occupied and paid rent for the claim year during the time period the claimant was alive. The property tax paid for a deceased claimant will be prorated based upon the number of days the claimant lived during the claim year. See Schedule A for the calculation of the prorated property tax rebate.

To determine if a deceased claimant is eligible for a rebate, a deceased claimant’s claim form must also include an annualized income amount in the calculation of total household income. See Schedule G, specifically the instructions for Line 11g, for information on the calculation of

4

annualized income to be included in household income. A copy of the death certificate must also be included with the claim form.

A surviving spouse, estate or personal representative may file a claim on behalf of a deceased claimant. A personal representative can also have a previously filed rebate issued in his or her name, instead of the name of the decedent, in certain circumstances. Please see sections entitled SURVIVING SPOUSE, AN ESTATE, and PERSONAL REPRESENTATIVE for details.

SURVIVING SPOUSE

The surviving spouse can file the completed claim and include a copy of the death certificate and a letter stating that he/she was the spouse of the claimant at the time of death. The surviving spouse may sign on the claimant’s signature line.

OR

If the surviving spouse is eligible to file a claim, he/she can file under his/her own name instead of submitting a claim using the deceased individual’s claim form.

The surviving spouse should print his/her name, address, and Social Security Number (SSN) in Section I, and follow the filing instructions. The surviving spouse should furnish proof required for a first time filer. Do not use the label the department sent to the decedent in the booklet. The surviving spouse should enter the deceased spouse’s SSN and name in the spouse information area, and fill in the oval “if Spouse is Deceased”, located in the area next to the Spouse’s SSN on the claim form.

AN ESTATE

The executor or the administrator of the claimant’s estate may file the claim and submit a Short Certificate showing the will was registered or probated. When there is no will and there are assets (an estate), submit a copy of the Letters of Administration. A Short Certificate or Letters of Administration can be obtained from the county courthouse where the death is recorded. The person filing the claim form on behalf of the deceased person may sign on the claimant’s signature line.

PERSONAL REPRESENTATIVE

If a person dies and there is no will, the will has not been reg- istered or probated or there is no estate, then a personal rep- resentative may file a claim on behalf of an eligible decedent. A decedent’s personal representative must submit a copy of the decedent’s death certificate, a

If a person dies after filing a claim and there is no will, or if the will has not been registered or probated, or there is no estate, then a personal representative can also request that the department change the rebate to be issued into his/her name. In cases where the rebate check has been received but cannot be cashed, the check must be

returned with a request to have the rebate issued in the name of the personal representative. The decedent’s per- sonal representative must submit a copy of the decedent’s death certificate, a

The

If you have any questions regarding the filing of a claim on behalf of a deceased claimant, please call the department at

PRIVACY NOTIFICATION

By law, (42 U.S.C. § 405(c)(2)(C)(i); 61 Pa. Code §117.16) the Pennsylvania Department of Revenue has the authority to use the Social Security Number (SSN) to administer the Property Tax or Rent Rebate Program, the Pennsylvania personal income tax and other Commonwealth of Pennsyl- vania tax laws. The department uses the SSN to identify individuals and verify their incomes. The department also uses the SSN to administer a number of

Pennsylvania law prohibits the commonwealth from disclosing information that individuals provide on income tax returns and rebate claims, including the SSN(s), except for official purposes.

PA - 1000 FILING INSTRUCTIONS

SECTION I - SOCIAL SECURITY NUMBER, NAME,

ADDRESS AND RESIDENCE INFORMATION

You must fill in your Social Security Number and enter your county and school district codes even if using the preprinted label. If you are not using software or myPATH to prepare your claim and your label is correct, place your label in Section I. If you or your preparer are using software or myPATH to prepare your claim, or if any information on the preprinted label is incorrect, discard the label. If not using a label, follow the instructions for printing letters and numbers and completing your name and address.

If your spouse lived in a nursing home the entire year do not include his/her Social Security Number on the claim form. He or she may qualify for a separate rebate on the rent paid to the nursing home.

IMPORTANT TIPS: There are two lines to enter your address. For the First Line of Address, enter the street address. If the address has an apartment number (APT), suite (STE), floor (FL) or rural route number (RR), enter

it after the street address. If the street address and the apartment number, suite, etc. do not fit on the First Line of Address, enter the street address on the Second Line of Address and the apartment number, suite, etc. on the First Line of Address. For the Second Line of Address, enter the post office box, if applicable. If there is no post office box, leave the Second Line of Address blank.

The U.S. Postal Service prefers that the actual delivery address appears on the line immediately above the city, state and ZIP code. Do not include any punctuation such as apostrophes, commas, periods and hyphens.

•Use black ink. Another color such as red ink will delay the processing of your rebate claim.

•Do not use pencil or pens labeled as gel pens or any red ink.

•Print all information on your claim neatly inside the boxes.

•Use upper case (capital) letters. Use a blank box to separate words.

•Print one letter or number in each box when entering your Social Security Number, name, address, dollar amounts, and other information. If your name, address, or city begins with Mc, Van, O’, etc., do not enter a space or a punctuation mark.

•Completely fill in all the appropriate ovals on your claim form.

Sample

|

M |

C |

D |

O |

E |

|

|

|

|

|

|

|

|

|

|

J |

O |

|

H |

N |

|

|

|

|

|

|

|

|

|

|

|

A |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A |

P |

T |

|

4 |

5 |

6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

2 |

3 |

|

A |

N |

Y |

|

S |

T |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

H |

A |

R |

R |

I |

S |

B |

U |

R |

G |

|

|

|

|

|

|

P |

A |

|

1 |

7 |

1 |

2 |

8 |

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

J |

A |

N |

E |

|

|

|

|

|

|

|

A |

|

2 |

2 |

|

|

2 |

2 |

2 |

7 |

5 |

|

U |

S |

A |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As a claimant, you must provide your birth date, telephone number, county code, school district code, and, if applicable, your spouse’s Social Security Number, birth date, and name. If your spouse is deceased, completely fill in the oval “If Spouse is Deceased” in Section I of the form.

COUNTRY CODE

If your current mailing address is in the United States of America, you are not required to enter a country code. The department will automatically include the correct code for you. However, if - you lived at least part of the year in Pennsylvania; you meet the eligibility require- ments for a property tax or rent rebate; and your cur- rent mailing address is in any other country, you must enter the

COUNTY & SCHOOL CODES

You must enter the

school district code for where you lived on Dec. 31, 2020, even if you moved after Dec. 31, 2020. Using incorrect codes may affect your property tax rebate.

IMPORTANT: The lists of county and school district names and the respective codes are on Pages 15, 16 and 17. If you do not know the name of the county or school district where you reside, you can either 1) check the county and school property tax bills used to complete this claim if you are a property owner, or 2) obtain this information from the Online Customer Service Center at www.revenue.pa.gov.

NOTE: Be sure to include your phone number when com- pleting the claim form. The department will make automat- ed phone calls to advise when claims are received and again when they are approved for payment.

SECTION II - FILING STATUS CATEGORIES

Line 1 - Please fill in the oval that shows your correct filing status. Fill in only one oval. Filling in more than one oval may reduce the amount of your rebate.

(P)Property Owners: Fill in this oval if you owned and occupied your home for all or part of 2020 and did not rent for any part of the year. If your deceased spouse’s name is on your deed or tax bills, include the decedent’s Social Security Number and name.

(R)Renters: Fill in this oval if you rented and occupied your residence for all or part of 2020.

(B)Owner/Renter: Fill in this oval if you owned and occu- pied your residence for part of 2020, and also rented and occupied another residence for the rest of 2020, or if you owned your residence and rented the land where your residence is located.

EXAMPLE: John pays property taxes on a mobile home that he owns and occupies. His mobile home is on land that he leases. John may claim a property tax rebate on the mobile home and a rent rebate on the land. See Pages 9, 11 and 12 for documents you must send as proof of property taxes or rents paid.

Line 2 - Certification. Please read each description and select the type of filer that applies best to your situation as of Dec. 31, 2020. A surviving spouse age 50 to 64 is eligible for a rebate as a widow or widower, while a surviving spouse who is 65 or older can file as a claimant. A surviving spouse under 50 may be able to file a claim for a deceased claimant if the deceased was 65 or older. Please complete the claim form using your Social Security Number, name and address, and supply all appropriate documentation.

a.Claimant age 65 or older

b.Claimant under age 65, with a spouse age 65 or older who resided in the same household (You must submit proof of your spouse’s age the first time you file.)

c.Widow or widower, age 50 to 65 (If your most recent marriage ended in divorce, you do not qualify as a widow/widower.)

d.Permanently disabled and age 18 to 64

6

See Page 4 for acceptable proof of age documents. Line 3 - If you are filing on behalf of a decedent (a claimant who died during the claim year who otherwise would have been an eligible claimant under a, b, c or d for Line 2 above), completely fill in the oval. The type of claimant under which the decedent qualifies under Line 2 above must also be included. A copy of the death certificate must be submitted and Schedule G must be completed.

SECTION III - LINES 4 THROUGH 18

You must report the total household income you earned and/or received during 2020 for each category, which includes your spouse’s income earned and/or received while residing with you.

All claimants must submit proof of annual income.

IMPORTANT: The department reserves the right to request additional information or make adjustments to federal data if credits or deductions were taken to reduce income.

CAUTION: Spouses may not offset each other’s income and losses.

The department has the legal authority to require evidence of the income you report on your claim. The following lists the kinds of income you must report and the documents you must submit as proof of the reported income. You must include the income that your spouse received while residing with you. See Pages 8 and 9 for a list of the kinds of income that you do not need to report.

NOTE: Print your Social Security Number on each Proof Document that you submit with your claim form.

Line 4 - Include

Line 5 - Include

CAUTION: The total income from old age benefit programs from other countries, such as Service Canada Old Age Security, must be converted into U.S. dollars and reported on Line 6.

Line 6 - Include the gross amount (not the taxable amount) of pensions, annuities, Individual Retirement Account distributions, Tier 2 Railroad Retirement Benefits, and Civil Service Disability Benefits. Do not include Black Lung Benefits federal veterans’ disability payments, or state veterans’ benefits. State veterans’ benefits include service connected compensation or benefits of any kind provided to a veteran or unmarried surviving spouse paid by a commonwealth agency or authorized under the laws of the commonwealth. Submit photocopies of pension/annuity benefits statements along with other forms 1099 showing income for 2020.

IMPORTANT: Do not include rollovers from Individual Retirement Accounts and employer pensions. However, proof must be provided. Proof includes, but is not limited to, a federal Form

If you have one or more distributions from annuity, life insurance or endowment contracts reported on Form

Line 7 - Report interest and dividends received or credited during the year, whether or not you actually received the cash. If you received dividends and capital gains distributions from mutual funds, report the capital gains distributions portion of the income as dividends, not as gains from the sale or exchange of property. Include interest received from government entities. You must also include all

SUBMIT THE FOLLOWING:

•A copy of your federal Form 1040 Schedule B or your

•A copy of the front page of your PA or federal income tax return verifying the income reported on Line 7.

IMPORTANT: If you received capital gains distributions from a mutual fund, you must use PA Schedule B or the front page of your PA tax return to verify your income. If you have PA

Line 8 - Include gains or losses you realized from the sale of stocks, bonds, and other tangible or intangible property as well as any gains or losses realized as a partner in a partnership or shareholder in a PA S corporation. Do not include capital gains distributions from mutual funds required to be reported on Line 7.

NOTE: The nontaxable gain on the sale of your principal residence must also be reported on this line. If you realized a loss from the sale of your principal residence, this loss may be used to offset any other gains you realized from the sale of tangible or intangible property. However, any net loss reported on this line cannot be deducted from any other income. You may also submit photocopies of each PA Schedule

Submit a copy of your federal Form 1040 Schedule D, a copy of your

Form 1040 Schedule D. You must include a copy of your

If you sold your personal residence during this claim year, submit a statement showing the sale price less selling expenses, minus the sum of the original cost and permanent improvements.

CAUTION: You may only use losses from the sale or exchange of property to offset gains from the sale or exchange of property.

Line 9 - Include net rental, royalty, and copyright income or loss realized during 2020 from property owned and rented to others, oil and gas mineral rights royalties or income received from a copyright as well as any net income or loss realized as a partner in a partnership or shareholder in a PA S corporation.

CAUTION: You may only use rental losses to offset rental income.

IMPORTANT: If you receive income from the rental of a portion of your own home, you must complete and submit a

Line 10 - Include net income or loss from a business, profession, or farm, and net income or loss you realized as a partner in a partnership or a shareholder in a PA S corporation.

CAUTION: You may only use business losses to offset business income.

IMPORTANT: If you operate your business or profession at your residence, you must complete and submit a

Submit a photocopy of each federal Form 1040 Schedule C or F, or

Lines 11a - 11g - Other Income - Complete Lines 11a through 11g to report all other income that you and your spouse earned, received, and realized.

For each category of income on Lines 11a through 11g, you must submit proof, such as photocopies of Forms

Line 11a. - Gross salaries, wages, bonuses, commis- sions, and estate or trust income not included in business, profession, or farm income.

Line 11b. - Gambling and lottery winnings, including PA Lottery, Powerball and Mega Millions winnings, prize winnings, and the value of other prizes and awards. (A

Line 11c. - Value of inheritance, alimony, and spousal support money.

Line 11d. - Cash public assistance/relief, unemployment compensation, and workers’ compensation benefits, except Section 306(c) benefits.

Line 11e. - Gross amount of loss of time insurance benefits, disability insurance benefits,

Line 11f. - Gifts of cash or property totaling more than $300, except gifts between members of a household.

Line 11g. - Miscellaneous income and annualized income amount. Include any income not identified above prior to the calculation of annualized income. If a claimant died during the claim year, an annualized income amount must also be included. To calculate the annualized income amount, complete Schedule G. When adding amounts for Line 3 of Schedule G, do not add any negative amounts reported on Lines 8, 9 or 10.

Do not report the following income:

•Medicare or health insurance reimbursements;

•Food stamps, surplus foods, or other such

•Property Tax/Rent Rebate received in 2020;

•The amount of any damages due to personal injuries or sickness. Damages include Black Lung benefits and benefits granted under Section 306(c) of the Workers’ Compensation Security Fund Act (relating to Schedule of Compensation for disability from permanent injuries of certain classes);

•Payments provided to eligible

•Payments received by home providers of the domiciliary care program administered by the Department of Aging, except those payments in excess of the actual expenses of the care;

•Disability income received by disabled children in the household;

•Federal veterans’ disability payments or state veterans’ benefits received by the veteran or unmarried surviving spouse;

•The difference between the purchase price of your residence and its selling price, if you used the proceeds from the sale to purchase a new residence. This new residence must be your principal residence;

•Federal or state tax refunds;

•Spouse’s income earned or received while not living with you;

•Public Assistance benefits received by children in the household, even though the check is issued in claimant’s name;

8

•Federal stimulus or economic impact payments;

•STRIVE Program credits;

•Child support; and

•Individual Retirement Account and employer pension rollovers (must provide a copy of federal Form

CAUTION: If a claimant had significant income that is not typically received in equal amounts throughout the claim year, or if the

Line 12 - If you and/or your spouse received benefits from the federal Civil Service Retirement System (CSRS) as (a) retired federal civil service employee(s) or as a sur- viving spouse, you may reduce your total eligibility income by 50% of the average retired worker Social Security pay- ment for 2019. The average retired worker Social Security payment for 2019 is $9,514. Enter $9,514 on Line 12 only if you include CSRS benefits in Line 6. If both you and your spouse received CSRS benefits, or if you received your own CSRS benefits and CSRS benefits as a surviving spouse, enter $19,028 on Line 12. Otherwise, enter $0.

Line 13 - Add the positive income figures reported on Lines 4 through 11g, subtract the amount on Line 12 (if applicable) and enter the net result on Line 13 and 23. Do not include losses reported on Lines 8, 9 and/or 10.

IMPORTANT: If you have over $35,000 of income claimed on Line 13, you are not eligible for either Property Tax or Rent Rebate relief under this program.

Line 14 - For Property Owners Only

Before completing Line 14 of the claim form, complete any schedules listed in the instructions for this line. If you must complete more than one schedule, you must complete them in alphabetical order. If one schedule does not apply to you, skip it, and go to the next schedule. You must carry forward, as the total tax paid, the last amount shown on the previous schedule you complete to the next schedule you complete.

Enter the total amount of the property taxes paid for your primary residence, or the amount shown as eligible property taxes paid on the last schedule completed.

IMPORTANT: If you do not enter the amount of all taxes paid on the primary residence, you will limit the department’s ability to determine your eligibility for and amount of a supplemental rebate. See Page 14 for more information on supplemental rebates.

You must deduct interest or penalty payments, municipal assessments, per capita taxes, or occupation taxes included in your payment. If you paid early and received a discount, you enter the amount you actually paid on Line 14. You must also deduct other charges included in your tax bills. See taxes that are not acceptable on Page 11.

If your name does not appear on the receipted tax bills, you must submit proof of ownership. Examples of proper proof are: a copy of the deed or a copy of the trust agreement, will, or decree of distribution if you inherited your property. If your address is not on your receipted property tax bill or mortgage statement, you also must submit a letter from your tax collector or mortgage company verifying your home address.

NOTE: If your tax bills include a name and/or names other than yours and your spouse’s, you must complete

Include only the property tax on the amount of land that is necessary for your personal use.

As proof of property tax paid, homeowners must provide photocopies of one of the following real estate documents:

•All 2020 real estate tax bills that have been marked “paid” by the tax collector (see the instructions beginning on this page for the proper calculation of the amount on Line 14). If you paid your taxes in quarterly installments, a tax bill must be submitted for each period. For tax bills that are not marked paid by the tax collector, the depart- ment will accept a photocopy of both sides of the cancelled check along with a copy of the tax bill;

•Your

•A letter signed by the tax collector certifying that you paid your 2020 real estate taxes. The letter should also declare the total tax does not include nuisance taxes or penalty; OR

•A receipted copy of your tax billing from your owner’s association or corporation. Resident stockholders of a cooperative housing corporation, such as a condominium, may qualify as property owners based on their pro rata

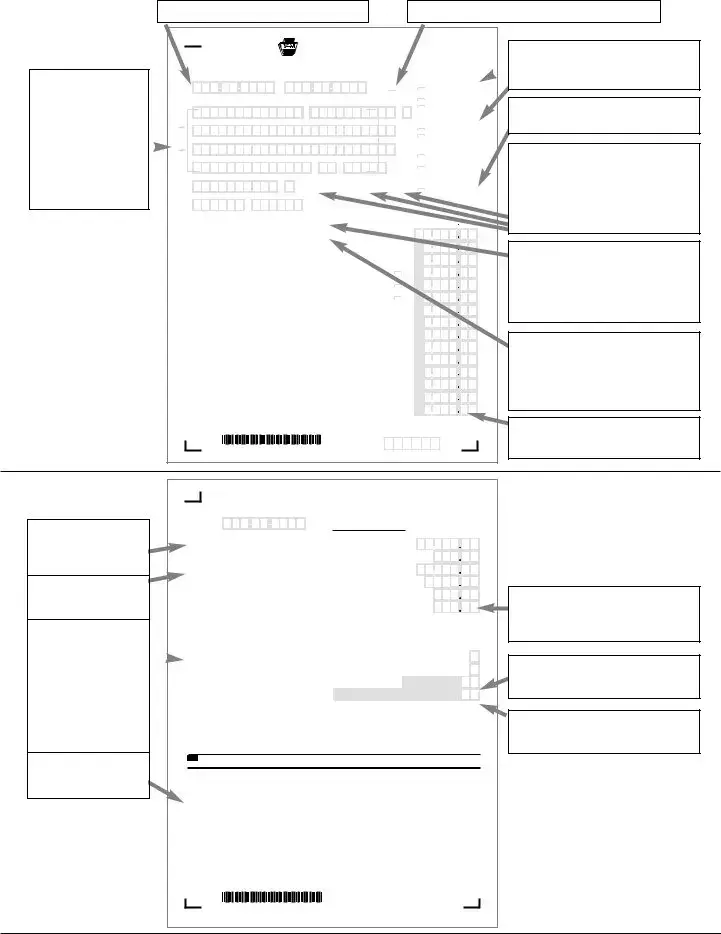

Fill in your Social Security Number.

Fill in this oval if your spouse is deceased.

If your label

is correct,

place it here.

Discard label if  it is not correct

it is not correct

and fill in all data in Section I.

PLACE LABEL HERE

|

|

|

|

|

|

2005010018 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

Property Tax or Rent |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rebate Claim |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PA Department of Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

P.O. Box 280503 |

|

2020 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Harrisburg PA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OFFICIAL USE ONLY |

||||||

I |

Check your label for accuracy. If incorrect, do not use the label. Complete Section I. |

If Spouse |

|

|

II |

Fill in only one oval in each |

||||||||||||||||||||||||

Your Social Security Number |

Spouse’s Social Security Number |

Deceased, fill |

|

|

|

section. |

|

|

|

|||||||||||||||||||||

|

|

1. I am filing for a rebate as a: |

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

in the oval. |

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

P. Property Owner – See |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

PLEASE WRITE IN YOUR SOCIAL SECURITY NUMBER(S) ABOVE |

|

|

|

|

|

|

|

|

instructions |

|

|

|

||||||||||||||||

|

|

|

|

|

MI |

|

R. Renter – See instructions |

|||||||||||||||||||||||

Last Name |

|

|

|

|

First Name |

|

|

|

|

|

|

|

|

|

|

B. Owner/Renter – See |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

instructions |

|

|

|

||

First Line of Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. I Certify that as of Dec. 31, 2020, |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I am (a): |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A. Claimant age 65 or older |

||||||

Second Line of Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

B. Claimant under age 65, |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

with a spouse age 65 or |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

older who resided in the |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

same household |

|||||

City or Post Office |

|

|

|

|

|

|

State |

|

ZIP Code |

|

|

|

|

|

|

|

C. Widow or widower, age |

|||||||||||||

|

|

|

|

|

|

|

|

|

CODES |

|

|

|

|

50 to 64 |

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*REQUIRED |

|

D. Permanently disabled |

||||||||||

Spouse’s First Name |

|

MI County Code School District Code |

Country Code |

|

|

|

|

and age 18 to 64 |

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

* |

|

|

|

|

* |

|

|

|

|

|

|

|

|

|

|

|

|

|

3. |

|

Filing on behalf of a |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Claimant’s Birthdate |

Spouse’s Birthdate |

|

|

|

|

|

Number |

|

|

|

|

|

|

|

|

decedent |

|

|

|

|||||||||||

M M D D Y Y M M D D Y Y |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dollars |

|

Cents |

||||||||||||

III |

TOTAL INCOME received by you and your spouse during 2020 |

|

|

|

|

4. |

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

4. Social Security, SSI and SSP Income (Total benefits $ |

|

|

|

|

|

divided by 2) |

|

|

s |

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

5. Railroad Retirement Tier 1 Benefits (Total benefits $ |

|

|

|

|

|

divided by 2) |

5. |

|

|

s |

|

|

|

|||||||||||||||||

Fill in only one oval for Line 1.  Fill in only one oval for Line 2.

Fill in only one oval for Line 2.

Fill in this oval on behalf

of decedent.

Fill in School District Code

(see Pages 16 and 17). Fill in

County Code (see Page 15). Fill

in Country Code if applicable

(see Page 6).

6. |

Total Benefits from Pension, Annuity, IRA Distributions and |

Retirement Tier 2 (Do not |

|

include federal veterans’ disability payments or state veterans’ |

.) |

7. |

Interest and Dividend Income |

. . . . . . . . . . . . . . . . . . . . . . . . |

|

|

|

|

|

|

|

LOSS |

8. |

Gain or Loss on the Sale or Exchange of Property |

If a loss, fill in this oval |

|

||||

|

|

|

|

income |

LOSS |

||

9. |

Net Rental Income or Loss |

. . . . . . . . . . . . . . . . . . . . . |

If a loss, fill |

this oval |

|

||

|

|

|

|

|

|

|

LOSS |

10. |

Net Business Income or Loss . . . . |

. . . . . . . . . . . . . . . . . . . . . |

If a oss, fill |

this oval |

|

||

Other Income. |

|

p |

|

|

|

||

11a. |

Salaries, wages, bonuses, commissions, and estate and trust |

. . . . |

. . . . . . . . . . . . . . . |

. . |

|||

11b. |

Gambling and Lottery winnings, including PA Lotterylwinnings, prize winnings and the value |

|

|||||

|

of other prizes |

. . . . . . . |

. . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . . |

. . . . . . . . . . . . . . . |

. . |

|

11c. |

Value of inheritances, ali |

ony and spousal su |

ort |

. . . . . . . . . . . |

. . . . . . . . . . . . . . . |

. . |

|

11d. |

Cash public assistance/relief. Une |

ploy ent co |

pensation and workers’ compensation, |

|

|||

|

except Section 306(c) benefits. . . . |

. . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . . |

. . . . . . . . . . . . . . . |

. . |

||

11e. |

Gross amount of loss of ti |

e insur |

nce benefits and disability insurance benefits, |

|

|||

|

and life insurance benefits, except the first $5,000 of total death benefit payments |

. . |

|||||

11f. |

Gifts of cash or property tot ling |

than $300, except gifts between |

|

|

|||

|

members of a household. |

.more |

. . . . . . . . . . . |

. . . . . . . . . . . . . . . |

. . |

||

11g. |

Miscellaneous incomeandannualized income amount |

. . . . . . . . . . . |

. . . . . . . . . . . . . . . |

. . |

|||

12. |

Claimants with Federal Civil Service Retirement System Benefits enter $9,514 or $19,028. |

|

|||||

|

See the instructions |

||||||

13. |

TOTALSINCOME. Add only the positive income amounts from Lines 4 through 11g and subtract |

||||||

|

the amount on Line 12. See Page 3 for income limitations. Enter this amount on Line 23 |

||||||

6. s

s

7. s

s

8. s

s

9. s

s

10. s

s

11a.  s

s

11b.  s

s

11c.  s

s

11d.  s

s

11e.  s

s

11f.  s

s

11g.  s

s

12. s

s

13. s

s

Report your total Social

Security, SSI, and SSP benefits here. Divide the total by 2 and enter the result on Line 4.

Report your total Railroad

Retirement Tier 1 benefits here. Divide the total by 2 and enter the result on Line 5.

IMPORTANT: You must submit proof of the income you reported – See the instructions on Pages 7 to 9.

2005010018

Enter the total of Lines 4 through 11g, less Line 12.

Property Owners complete Lines 14 and 15.

Renters complete

Lines 16, 17 and 18.

If you want your  rebate directly

rebate directly

deposited, complete

Lines 20,

21 and 22.

Claimant signs here.

2005120015

Your Social Security Number

Your Name:

PROPERTY OWNERS ONLY

14. |

Total 2020 property tax. Submit copies of receipted tax bills. |

. . . . . . . . . . . . . . . . . . . . . . . . . . . |

14. |

s |

|||

15. |

Property Tax Rebate. Enter the maximum standard rebate |

|

Compare this amount to line 14 and |

|

|

||

|

amount from Table A for your income level here: (_______) |

|

enter the lesser amount to the right. |

15. |

|

||

RENTERS ONLY |

|

|

|

|

|

|

|

16. |

Total 2020 rent paid. Submit PA Rent Certificate and/or rent receipts . . |

. . . . . . . . . . . . |

. . . . . . . . |

16. |

s |

||

17. |

Multiply Line 16 by 20 percent (0.20) |

. |

. . . . . . . . . . |

. . . . . . . . . . . . |

. . . . . . . . |

17. |

|

18. |

Rent Rebate. Enter the maximum rebate amount |

Compare this amount to line 17 and |

|

|

|||

|

from Table B for your income level here: (_______) |

enter the ess r amount to the right. |

18. |

|

|||

OWNER – RENTER ONLY |

|

|

|

|

|

|

|

19. |

Property Tax/Rent Rebate. Enter the maximum |

Com are this amount to |

sum of |

19. |

|

||

|

rebate amount from Table A for your income |

|

|

the |

|

||

|

Lines 15 and 18 and enter the lesser |

|

|

||||

|

level here: (_______) |

|

l |

|

|

|

|

|

amount to the right. |

|

|

|

|||

|

|

p |

|

|

|

||

DIRECT DEPOSIT. Banking rules do not permit direct deposits to bank accounts outside the U.S. If your bank account is outside the U.S.,

do not complete the direct deposit Lines 20, 21 and 22. The de art ent will mail you a paper check. If your rebate will be going to a bank

account within the U.S., you have the option to have your rebate directly deposited. If you want the department to directly deposit your rebate into your checking or savings account, complete Lines 20, 21 and 22.

20. Place an X in one box to authorize the Dep rt ent of Revenue to directly deposit your rebate |

|

|

|

|

|

|

|

Checking |

||||||||||||||||||||||||||||||||

into your: |

. . . . . . . . . . . |

. . . |

. . |

. |

. .m |

. |

. . . |

. . . . . . |

. . . |

. |

. |

. . |

. . . . . . |

. |

20. |

|

|

|

|

Savings |

||||||||||||||||||||

|

|

a |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

21. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

21. Routing number. Enter in boxes to the right |

. . . . . |

. . . |

. . . . . . . . . |

. |

. . |

. . . |

. . . |

. . . . |

. . . |

. |

. . |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

22. Account number. Enter in boxes to the right |

|

. . 22. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

. . . |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

S |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

TABLE A - OWNERS ONLY |

|

|

|

|

TABLE B - RENTERS ONLY |

|||||||||||||||||||||||||||||

23. |

|

|

|

|

|

INCOME LEVEL |

Maximum Standard |

|

|

INCOME LEVEL |

|

|

|

Maximum |

||||||||||||||||||||||||||

|

Enter the amount from Line 13 of |

|

|

|

|

|

|

|

|

|

Rebate |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rebate |

||||||||||||

|

the claim form on this line and circle |

$ |

|

0 |

to |

$ 8,000 |

|

$650 |

|

|

|

|

$ |

0 |

to $ |

8,000 |

$650 |

|||||||||||||||||||||||

|

the corresponding Maximum Rebate |

$ |

|

8,001 |

to |

$15,000 |

|

$500 |

|

|

|

|

$ |

8,001 |

to $ |

15,000 |

$500 |

|||||||||||||||||||||||

|

amount for your income level. |

$ |

15,001 |

to $18,000 |

$300 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

Owners use Table A and Renters |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

use Table B. |

|

|

$ |

18,001 |

to |

$35,000 |

|

$250 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

IV An excessive claim with intent to defraud is a misdemeanor punishable by a maximum fine of $1,000, and/or imprisonment for up to one year upon conviction. The claimant is also subject to a penalty of 25 percent of the entire amount claimed.

CLAIMANT OATH: I declare that this claim is true, correct and complete to the best of my knowledge and belief, and this is the only claim filed by members of my household. I authorize the PA Department of Revenue access to my federal and state Personal Income Tax records, my PACE records, my Social Security Administration records and/or my Department of Human Services records. This access is for verifying the truth, correctness and completeness of the information reported in this claim.

Claimant’s Signature |

Date |

Witnesses’ Signatures: If the claimant cannot sign, but only makes a mark. |

||||||

|

|

|

1. |

|

|

|

|

|

Spouse’s Signature |

Date |

2. |

|

|

|

|

||

|

|

|

|

|

|

|

||

PREPARER: I declare that I prepared this return, and that it is to the best of my |

Name of claimant’s power of attorney or nearest relative. Please print. |

|||||||

knowledge and belief, true, correct and complete. |

|

|

|

|

|

|

||

Preparer’s Signature, if other than the claimant |

Date |

|

|

|

|

|

||

Telephone number of claimant’s power of attorney or nearest relative. |

||||||||

|

|

|

||||||

|

|

|

( |

) |

|

|

|

|

Preparer’s Name. Please print. |

|

Home address of claimant’s power of attorney or nearest relative. Please print. |

||||||

|

|

|

|

|

|

|||

Preparer’s telephone number |

|

City or Post Office |

State |

ZIP Code |

||||

( |

) |

|

|

|

|

|

|

|

Claim filing deadline – June 30, 2021

You can call

If you were both a Property Owner and a Renter,

complete Lines 14 through 19.

Enter your Routing Number here (direct deposit only).

Enter your Account Number here (direct deposit only).

2005120015 |

2005120015 |

10

Form Characteristics

| Fact Name | Description |

|---|---|

| Eligibility Criteria | Eligible applicants include seniors aged 65 and older, widows and widowers aged 50 and older, and individuals with disabilities aged 18 and older. |

| Rebate Amounts for Homeowners | Homeowners may receive rebates based on income levels, with a maximum rebate of $650 for incomes up to $8,000. |

| Application Deadline | The deadline for submitting applications was June 30, 2021, although this may be extended if funding allows. |

| Electronic Filing | The PA-1000 form can be electronically filed via mypath.pa.gov, providing easier access and automated features for applicants. |

| Income Exclusions | Federal stimulus payments and STRIVE program credits are not considered eligibility income for the rebate program. |

| Checking Application Status | Claimants can check their rebate status online at mypath.pa.gov or by calling 1-888-PA-TAXES. |

Guidelines on Utilizing Pa 1000 Instructions

Filling out the PA-1000 form can seem daunting, but taking it step by step will make the process easier. Once you gather your information and complete the form, you'll be able to submit it for potential rebates on your property taxes or rent payments. Make sure to pay attention to eligibility requirements and deadlines to ensure a smooth application process.

- Gather all necessary documents, including proof of age or disability, and any income statements.

- Visit the official Pennsylvania Department of Revenue website to access the PA-1000 form.

- Fill in Section I with your Social Security Number and your name, making sure to include your county and school district codes.

- Complete Section II, providing information about your income. Carefully follow the instructions about what to include and what to exclude.

- In Section III, indicate whether you are a homeowner, renter, or both. Ensure that all details provided are correct.

- If applicable, complete and attach any required schedules or additional forms, such as the PA-1000 Schedule D, for cash public assistance recipients.

- Double-check all the information for accuracy. Make sure all required documents are included with the form.

- Submit your completed PA-1000 form by the deadline, either electronically via mypath.pa.gov or by mailing a hard copy to the appropriate address.

What You Should Know About This Form

What is the Property Tax/Rent Rebate Program?

The Property Tax/Rent Rebate Program is a Pennsylvania initiative that provides financial relief to eligible seniors and people with disabilities. Rebate payments are issued based on the property tax or rent paid in the previous year. To qualify, applicants must meet specific income requirements and age criteria.

Who is eligible to apply for the PA-1000 rebate?

Eligibility for the rebate extends to Pennsylvanians aged 65 and older, widows and widowers aged 50 and older, and individuals aged 18 and older who are permanently disabled. Additionally, income limits apply. Homeowners must have an annual household income of $35,000 or less, while renters must have an income of $15,000 or less to qualify.

How do I check the status of my application?

You can check the status of your rebate application using the myPATH portal at mypath.pa.gov. Ensure you include a valid phone number on your application to receive automated updates regarding your claim. You may also call 1-888-PA-TAXES to inquire about your application status directly.

What documents do I need to submit with my application?

First-time filers must provide proof of age, which can include a birth certificate or state-issued ID. If you are applying due to a disability, a physician's statement may be necessary. When documenting income, include necessary statements or documents that confirm your income sources for the previous year, such as Social Security benefit statements. It is essential to send copies, as original documents cannot be returned.

Can I submit my application electronically?

Yes, starting with the 2020 claim year, you can submit your application online via the myPATH portal. This electronic filing option is user-friendly and offers benefits such as automatic calculations to assist with your application process.

What should I do if a claimant has passed away?

If the claimant was deceased during the claim year, their eligibility still hinges on the days they lived during that year. A surviving spouse or personal representative may submit a claim on behalf of the deceased. Ensure to include a copy of the death certificate and follow the appropriate guidelines on filing for the rebate on behalf of the deceased claimant.

Common mistakes

When completing the PA 1000 Instructions form, many people make common mistakes that can affect their application. One frequent error is failing to provide complete or accurate income information. Applicants sometimes do not account for all sources of income, mistakenly believe certain income types are exempt, or incorrectly calculate their eligible income. It is essential to review the income categories and exclusions carefully. All relevant income must be reported unless specified otherwise in the instructions.

Another mistake occurs when individuals overlook the necessary documentation. First-time filers, in particular, may forget to include proof of age or disability. If the required documents are not submitted, it can delay the processing of claims. Individuals are advised to send photocopies of documents and ensure their Social Security Number is printed on each one. Original documents cannot be returned, so it is wise to follow this guideline closely.

In addition, some applicants fail to adhere to the filing deadlines. The official deadline for applications is typically June 30 of the following year. However, many may not realize that late applications can be accepted if sufficient funds are available. Keeping track of the application timeline is crucial to ensure eligibility for rebates, which may begin processing as early as July.

Finally, applicants often do not double-check the accuracy of all the information provided. Mistakes in Social Security Numbers, addresses, or other critical fields can lead to application rejections or processing delays. Verifying all entries before submission can help prevent these issues. A thorough review of the completed form can ultimately facilitate a smoother application process.

Documents used along the form

The PA-1000 Instructions form is essential for individuals applying for the Pennsylvania Property Tax or Rent Rebate Program. To facilitate the process, applicants often need to accompany this form with additional documents. Here are some commonly required forms that may be beneficial:

- Form SSA-1099: This document reports the Social Security benefits received during the year. It's crucial for verifying income for those applying based on age or disability.

- Physician’s Statement of Permanent Disability (PA-1000 PS): If claiming disability, this form confirms the nature of the applicant’s permanent disability and must be signed by a physician.

- Death Certificate: Required for surviving spouses or personal representatives when filing on behalf of a deceased claimant. This certificate proves the claimant's death date and allows for the proper processing of the rebate.

- DEX-41: Known as the Application for Refund/Rebate Due the Decedent, this form is necessary if filing a rebate on behalf of someone who has passed away, alongside their death certificate.

- Short Certificate: This document verifies that a will has been probated or registered. It is needed for executors or administrators filing a claim on behalf of a deceased individual.

- Bank Statements: Statements showing deposited Social Security or Supplemental Security Income benefits are critical for applicants without a PA address who need to prove their income for rebate eligibility.

Collecting these documents ahead of time will help streamline the application process for the Property Tax or Rent Rebate Program, ensuring applicants meet all necessary requirements.

Similar forms

- Form SSA-1099: This form reports Social Security income, similar to how the PA-1000 Instructions guide users to provide proof of Social Security income for rebate eligibility. Both documents require verifying income for program qualification.

- IRS Form 1040: Just as the PA-1000 Instructions detail income eligibility guidelines, IRS Form 1040 outlines income tax requirements, indicating various income sources that may affect one's tax responsibilities and eligibility for credits or deductions.

- Supplemental Security Income (SSI) Statement: SSI recipients, as highlighted in the PA-1000 Instructions, must provide proof of income. This requirement parallels the need to submit SSI statements to demonstrate eligibility for benefits.

- Form RRB-1099: Similar to the PA-1000, which clarifies income consideration for rebates, this form reports Railroad Retirement benefits. Individuals must declare this income to determine their eligibility for various programs.

- Pennsylvania Personal Income Tax Form: As with the PA-1000, this form requires detailed income disclosures that inform taxpayers about their eligibility for tax credits and other financial benefits.

- Physician's Statement of Permanent Disability (PA-1000 PS): This document, like the PA-1000 Instructions, verifies eligibility for the Property Tax/Rent Rebate Program based on disability, illustrating the necessity of providing proof to qualify for financial assistance.

Dos and Don'ts

When filling out the PA 1000 Instructions form for the Property Tax or Rent Rebate Program, there are several key points to keep in mind. Here’s a list to help guide you through the process, breaking down what you should and shouldn't do.

- Do: Read the instructions carefully before starting. Understanding the eligibility requirements and necessary documents can save you time and frustration.

- Do: Use the myPATH online portal if possible. Electronic filing is more efficient and allows for features that can help you avoid mistakes.

- Do: Provide accurate information. Ensure that all income levels and personal details are correctly reported to avoid delays in processing your application.

- Do: Keep photocopies of all documents submitted. This will serve as your record in case there are any questions or discrepancies later.

- Don't: Ignore the application deadline. Late submissions may not be accepted unless an extension is granted due to available funds.

- Don't: Forget to include your Social Security Number. This is crucial for processing and identifying your application.

- Don't: Submit original documents. The department cannot return original proofs, so always send copies.

- Don't: Assume you qualify without confirmation. Double-check your eligibility based on age, income, and residency requirements to avoid filing errors.

By following these guidelines, you can approach the form-filling process with confidence. Make sure you prepare your documents ahead of time and are aware of the eligibility criteria. Taking the right steps will make your application process smoother, and help you receive your benefits without unnecessary delays.

Misconceptions

- Misconception 1: The PA-1000 form is only for elderly homeowners.

- Misconception 2: If I missed the application deadline, I cannot apply for a rebate at all.

- Misconception 3: All income counts towards the eligibility limit.

- Misconception 4: I can only file once a year regardless of my living situation.

- Misconception 5: Submitting the application electronically is not secure.

This is not true. The form is also available for renters and includes eligibility for widows, widowers, and individuals with disabilities who meet specific income criteria.

While the application deadline is set for June 30 of the claim year, the department may extend this deadline if funds permit. Therefore, it's always worth checking if an extension has been granted.

This is misleading. Certain types of income, like federal stimulus payments and specific benefits from state programs, do not count towards your eligibility income when filing for the rebate.

This is only partially correct. If you have changed your living arrangement, such as moving from renting to owning, there are specific guidelines on how to file based on your current situation, but in general, only one rebate claim can be submitted each year.

In fact, electronic filing is designed to be safe and secure. The myPATH portal is equipped with measures to protect your personal information, making it a convenient option for many applicants.

Key takeaways

- Eligibility Criteria: To qualify for the Property Tax/Rent Rebate, applicants must be at least 65 years old, or widows/widowers aged 50 and above. People with disabilities aged 18 and older are also eligible.

- Application Deadline: Ensure to submit your application by June 30, 2021. The Department of Revenue might extend this deadline if funds allow.

- Electronic Filing Benefits: The PA-1000 form can now be submitted electronically via myPATH. This method offers helpful features such as automatic calculators, making the process easier and faster.

- Direct Deposit: Opting for direct deposit allows for quicker rebate payments. Details are provided on pages 12 and 13 of the application packet.

- Proof of Eligibility: First-time filers must provide various documents as proof of age and disability. Photocopies are required as original documents cannot be returned.

Browse Other Templates

New York Filing Requirements for Non Residents - Returning payments by check or money order with the IT-370 is mandatory if the taxpayer owes estimated taxes.

Lic 503 Form - The completion of this report is integral to the preliminary hiring process of care professionals.

Steer Clear Program State Farm - Maintaining a good driving record is key to keeping the 3-Star Discount active.