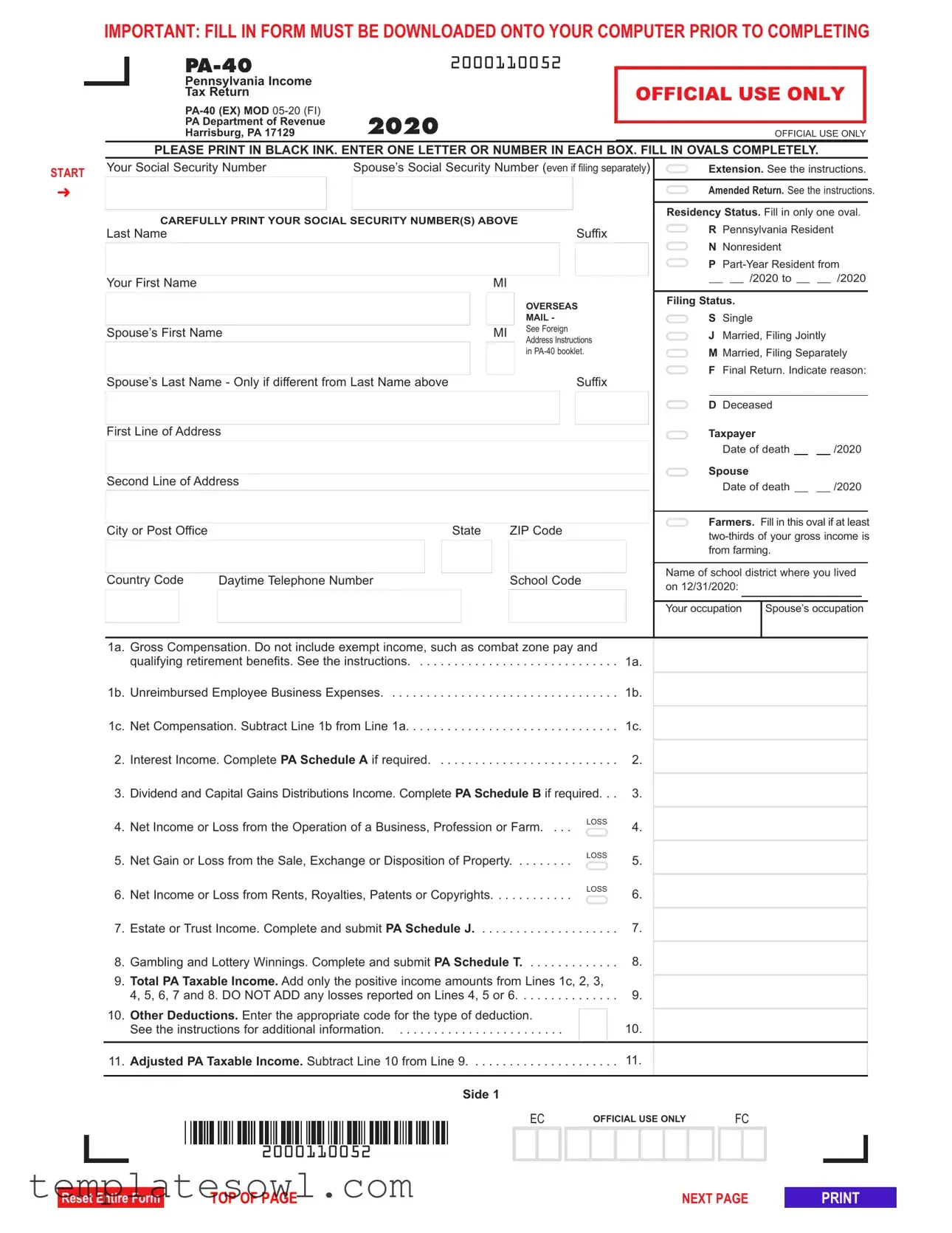

Fill Out Your Pa 40 Tax Form

The PA-40 tax form is a crucial document for individuals reporting their income in Pennsylvania. This form serves residents, nonresidents, and part-year residents who wish to file their Pennsylvania state income tax returns. Completing the PA-40 accurately is essential, as it collects detailed information about the taxpayer's income, deductions, and overall tax liability. The form requires the inclusion of Social Security numbers for both the taxpayer and their spouse, even if they file separately. It further categorizes residency status and filing status, guiding the taxpayer through various income categories such as gross compensation, interest income, and business income. Mandatory fields must be filled in with black ink, and proper calculations are expected, including the application of the state tax rate to determine the tax owed. Taxpayers cannot overlook the importance of disclosing any deductions and credits applicable to their situation. The form also allows for adjustments in the event of overpayments or underpayments. As a comprehensive document, the PA-40 ensures that Pennsylvania residents are compliant with state tax laws and guidelines, paving the way for robust financial reporting and tax management.

Pa 40 Tax Example

IMPORTANT: FILL IN FORM MUST BE DOWNLOADED ONTO YOUR COMPUTER PRIOR TO COMPLETING

|

|

|

2000110052 |

|

|

|

|

|

Pennsylvania Income |

|

|

|

|

|

|

Tax Return |

|

|

OFFICIAL USE ONLY |

|

|

|

2020 |

|

|

|

|

|

|

PA Department of Revenue |

|

|

|

|

|

|

Harrisburg, PA 17129 |

|

OFFICIAL USE ONLY |

||

PLEASE PRINT IN BLACK INK. ENTER ONE LETTER OR NUMBER IN EACH BOX. FILL IN OVALS COMPLETELY.

START

➜

Your Social Security Number |

|

Spouse’s Social Security Number (even if filing separately) |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

CAREFULLY PRINT YOUR SOCIAL SECURITY NUMBER(S) ABOVE |

|||||||||||||||||

Last Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

Suffix |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Your First Name |

|

|

|

|

|

|

|

|

|

MI |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OVERSEAS |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

MAIL - |

||||

Spouse’s First Name |

|

|

|

|

|

|

|

|

MI |

|

See Foreign |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Address Instructions |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

in |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Suffix |

||||

Spouse’s Last Name - Only if different from Last Name above |

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First Line of Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Second Line of Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

City or Post Office |

|

|

|

|

|

State |

ZIP Code |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Country Code |

Daytime Telephone Number |

|

|

|

|

|

|

School Code |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Extension. See the instructions.

Amended Return. See the instructions.

Residency Status. Fill in only one oval.  R Pennsylvania Resident

R Pennsylvania Resident  N Nonresident

N Nonresident

P

___ ___/2020 to ___ ___/2020

Filing Status.

S Single

J Married, Filing Jointly

M Married, Filing Separately

F Final Return. Indicate reason:

D Deceased

Taxpayer

Date of death ___ ___/2020

Spouse

Date of death ___ ___/2020

Farmers. Fill in this oval if at least

Name of school district where you lived on 12/31/2020:

Your occupation |

Spouse’s occupation |

|

|

1a. Gross Compensation. Do not include exempt income, such as combat zone pay and qualifying retirement benefits. See the instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1a.

1b. Unreimbursed Employee Business Expenses. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1b.

1c. Net Compensation. Subtract Line 1b from Line 1a. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1c.

2. Interest Income. Complete PA Schedule A if required. . . . . . . . . . . . . . . . . . . . . . . . . . . 2.

3. Dividend and Capital Gains Distributions Income. Complete PA Schedule B if required. . . 3.

4. |

Net Income or Loss from the Operation of a Business, Profession or Farm. . . . |

LOSS |

4. |

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

5. |

Net Gain or Loss from the Sale, Exchange or Disposition of Property |

LOSS |

5. |

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

6. |

Net Income or Loss from Rents, Royalties, Patents or Copyrights |

LOSS |

6. |

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

7. |

Estate or Trust Income. Complete and submit PA Schedule J |

. |

. 7. |

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

. . . . |

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

8. |

Gambling and Lottery Winnings. Complete and submit PA Schedule T |

. |

. 8. |

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

. . . . |

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

9. |

Total PA Taxable Income. Add only the positive income amounts from Lines 1c, 2, 3, |

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

4, 5, 6, 7 and 8. DO NOT ADD any losses reported on Lines 4, 5 or 6 |

. . . . . |

. 9. |

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

10. |

Other Deductions. Enter the appropriate code for the type of deduction. |

|

10. |

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

See the instructions for additional information |

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

11. |

Adjusted PA Taxable Income. Subtract Line 10 from Line 9 |

. . . . . |

. 11. |

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Side 1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EC |

OFFICIAL USE ONLY |

FC |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2000110052

Reset Entire Form

TOP OF PAGE |

NEXT PAGE |

START |

Social Security Number (shown first) |

|

➜

2000210050

Name(s)

OFFICIAL USE ONLY

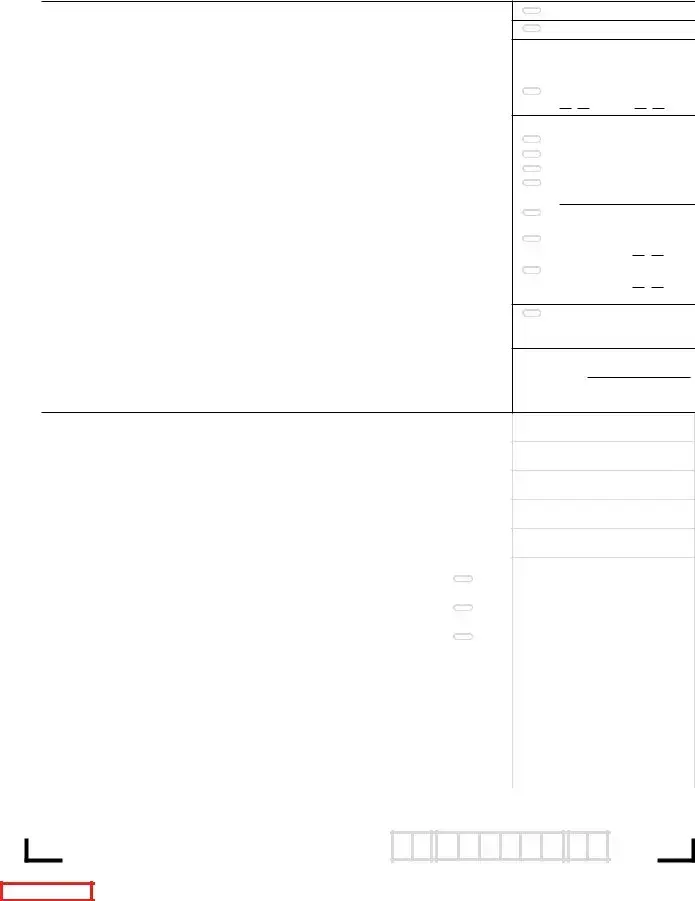

12. |

PA Tax Liability. Multiply Line 11 by 3.07 percent (0.0307) |

12. |

|

|

|

|

|

13. |

Total PA Tax Withheld. See the instructions |

13. |

|

|

|

|

|

|

|

|

|

|

|

|

|

PAID |

|

14. |

Credit from your 2019 PA Income Tax return |

||||||||

|

|||||||||||

15. |

2020 Estimated Installment Payments. Fill in oval if including Form |

||||||||||

TAX |

|||||||||||

|

|

|

|

|

|

|

|

|

|

||

ESTIMATED |

16. |

2020 Extension Payment |

. . . . . . . . . |

. . . . . . . . |

. . . . . . . . . . . . . |

||||||

17. |

Nonresident Tax Withheld from your PA Schedule(s) |

||||||||||

|

|||||||||||

|

|

18. |

Total Estimated Payments and Credits. Add Lines 14, 15, 16 and 17. |

. . . . . . . . . . . . |

|||||||

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

||

|

|

Tax Forgiveness Credit, submit PA Schedule SP |

|

|

|

||||||

|

19a. |

|

Filing Status: |

Unmarried or |

Married |

Deceased |

|||||

|

|

|

|

|

|

|

Separated |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

20. |

Total Eligibility Income from Section III, Line 11, PA Schedule SP. . . |

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

14.

15.

16.

17.

18.

Dependents, Section II, Line 2,

19b. PA Schedule SP. . . . . . . . . . . .

|

21. |

Tax Forgiveness Credit from Section IV, Line 16, PA Schedule SP |

21. |

|

||

|

|

|

|

|

||

|

22. |

Resident Credit. Submit your PA Schedule(s) |

22. |

|

||

|

23. |

Total Other Credits. Submit your PA Schedule OC |

23. |

|

||

|

24. |

TOTAL PAYMENTS and CREDITS. Add Lines 13, 18, 21, 22 and 23 |

24. |

|

||

|

25. |

USE TAX. Due on internet, mail order or |

25. |

|

||

|

26. |

TAX DUE. If the total of Line 12 and Line 25 is more than Line 24, |

|

|

||

|

|

enter the difference here |

26. |

|

||

|

27. |

Penalties and Interest. See the instructions for additional |

|

|

|

|

|

|

|

|

|||

|

|

information. Fill in oval if including Form |

|

|

27. |

|

|

28. |

TOTAL PAYMENT DUE. See the instructions |

28. |

|

||

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DONATIONS

29. |

OVERPAYMENT. If Line 24 is more than the total of Line 12, Line 25 and Line 27 |

29. |

|

enter the difference here |

|

|

The total of Lines 30 through 36 must equal Line 29. |

|

30. |

Refund – Amount of Line 29 you want as a check mailed to you.. . . . . . . . REFUND |

30. |

31. Credit – Amount of Line 29 you want as a credit to your 2021 estimated account. . . . . 31.

|

|

|

|

|

|

32. |

Refund donation line. Enter the organization code and donation amount. |

|

32. |

||

|

See the instructions |

|

|||

|

|

|

|||

33. |

Refund donation line. Enter the organization code and donation amount. |

|

33. |

||

|

See the instructions |

|

|||

34. |

Refund donation line. Enter the organization code and donation amount. |

|

|

||

|

See the instructions |

|

34. |

||

35. |

Refund donation line. Enter the organization code and donation amount. |

|

|

||

|

|

||||

|

See the instructions |

|

35. |

||

36. |

Refund donation line. Enter the organization code and donation amount. |

|

|

||

|

See the instructions |

|

36. |

||

|

|

|

|

|

|

|

|

|

|

|

|

SIGNATURE(S). Under penalties of perjury, I (we) declare that I (we) have examined this return, including all accompanying schedules and statements, and to the best of my (our) belief, they are true, correct, and complete.

|

Your Signature |

|

|

|

|

|

Date MM/DD/YY |

|

Preparer’s PTIN |

||||||||||||||||||||||||||||||||||||||||||||||||

➜ Please sign after printing. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See the instructions. |

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

Spouse’s Signature, if filing jointly |

|

|

|

|

|

Preparer’s Name and Telephone Number |

|

Firm FEIN |

||||||||||||||||||||||||||||||||||||||||||||||||

Please sign after printing. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

PLEASE DO NOT CALL ABOUT YOUR REFUND UNTIL EIGHT WEEKS AFTER YOU FILE. |

|||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Side 2 |

|

2000210050 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

2000210050 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

PLEASE DO NOT CALL ABOUT YOUR REFUND UNTIL EIGHT WEEKS AFTER YOU FILE.

Reset Entire Form

RETURN TO PAGE 1 |

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The PA-40 Tax form is used for filing the Pennsylvania Income Tax Return for individuals. |

| Eligibility | Residents, nonresidents, and part-year residents of Pennsylvania may use this form based on their residency status. |

| Filing Method | This form must be downloaded, filled out, and submitted electronically or by mail, ensuring to print in black ink. |

| Governing Law | The form is governed by the Pennsylvania Tax Code of 1971, as amended. |

Guidelines on Utilizing Pa 40 Tax

Completing the PA-40 Tax form is an essential step for filing your Pennsylvania income tax return. The form requires careful attention to detail, particularly regarding your personal information and financial data. Make sure to gather all necessary documents before you start filling it out.

- Download the form onto your computer to ensure it can be filled out electronically.

- Use black ink to fill out the form, entering one letter or number in each box.

- Begin with your Social Security number and your spouse's Social Security number, if applicable, in the designated boxes.

- Fill in your last name, first name, middle initial, and suffix as needed. Do the same for your spouse.

- Provide your address, including the city, state, ZIP code, and country code if applicable.

- Include your daytime telephone number and school code as required.

- Indicate your residency status by filling in the appropriate oval: Pennsylvania Resident, Nonresident, or Part-Year Resident.

- Select your filing status: Single, Married Filing Jointly, Married Filing Separately, or Final Return.

- If applicable, indicate if at least two-thirds of your gross income comes from farming.

- Report your gross compensation in Line 1a and any unreimbursed employee business expenses in Line 1b, then calculate net compensation for Line 1c.

- Complete sections for other income types such as interest, dividends, business income, rents, and gambling winnings.

- Add positive income amounts to determine your total PA taxable income on Line 9.

- Report any deductions on Line 10, subtracting them from your total taxable income to get your adjusted income on Line 11.

- Calculate your PA tax liability by multiplying the adjusted taxable income by 3.07 percent and filling in Line 12.

- Enter any total PA tax withheld amounts and any credits from your previous tax return and estimated payments.

- Calculate total payments and credits and fill in Lines 21 to 24 accordingly.

- Determine tax due or overpayment by comparing total payments against your calculated liabilities.

- Complete the donation lines if you choose to designate funds to organizations.

- Sign and date the form. If filing jointly, include both signatures.

What You Should Know About This Form

What is the PA-40 Tax Form?

The PA-40 Tax Form is Pennsylvania's main income tax return form for individuals. It is used to report your income and calculate the amount of tax you owe or any refund you may be entitled to receive. This form must be filled out accurately and submitted to the Pennsylvania Department of Revenue by the appropriate deadline each year.

Who needs to file a PA-40?

If you are a resident of Pennsylvania or have earned income from Pennsylvania sources, you are required to file a PA-40 Tax Form. This includes full-year residents, non-residents, and part-year residents. Even if you are filing separately from your spouse, you will need to include their Social Security Number on the form.

What information is required on the PA-40?

You’ll need several pieces of information when filling out the PA-40 form. Key details include your Social Security Number, your income from various sources such as employment, interest, and dividends, and your residency status. You will also report any deductions, credits, and your total tax due. Make sure to print in black ink and fill in ovals completely.

How do I submit the PA-40?

The PA-40 Tax Form can be submitted either by mailing a physical copy to the Pennsylvania Department of Revenue or electronically. If you choose to mail it, ensure it is sent to the correct address and postmarked by the deadline. If you prefer to file electronically, various online services can facilitate this. Be sure to keep copies of your submitted form and documents for your records.

What if I made a mistake on my PA-40?

If you discover an error on your PA-40 after submission, you can file an amended return. Use the form designated for amendments and be sure to indicate any necessary changes. It’s important to act quickly to correct any mistakes to avoid potential penalties or increased tax liabilities.

Common mistakes

Filling out the PA-40 Tax Form can feel daunting, especially if it's your first time. Many individuals make mistakes that can lead to delays in processing their returns or errors in tax calculations. To help you avoid common pitfalls, here are four mistakes to watch out for when completing this important form.

First, not downloading the form before filling it out is a frequent issue. The instruction clearly states, “FILL IN FORM MUST BE DOWNLOADED ONTO YOUR COMPUTER PRIOR TO COMPLETING PA-40.” If you attempt to fill out the form directly from the website, you risk losing your data or having inputs that aren’t saved correctly. Always make sure to download the form, open it on your device, and fill it out from there. This step ensures that all your information will be preserved and helps avoid any frustrations during submission.

Another common mistake is incorrect Social Security Number entries. It seems simple enough, yet it’s crucial. Both your Social Security Number and that of your spouse (if applicable) must be accurate and clearly printed. Even a small typo can create significant problems with your return processing. Always double-check this information for accuracy before submitting your tax form.

Additionally, many people overlook the importance of selecting the correct residency status. The form requires you to “fill in only one oval” to indicate your residency status: Pennsylvania Resident, Nonresident, or Part-Year Resident. Choosing the wrong option could lead to incorrect tax calculations. If you're unsure about your residency status, take the time to review the definitions in the instructions to ensure you make the right choice.

Lastly, people often confuse the section on deductions. Many mistakenly add losses reported on certain lines to their total taxable income, even though the form instructs you not to do that. Specifically, be mindful of the line that states to add only the positive income amounts from specific lines. Familiarizing yourself with the guidelines on what qualifies as taxable income will help you avoid this error.

By being mindful of these common mistakes—downloading the form beforehand, entering Social Security Numbers accurately, selecting the correct residency status, and understanding the deductions—you’re setting yourself up for a smoother filing process and potentially quicker refunds or resolutions. Remember, accurate and careful completion of your PA-40 can save you time and hassle down the road!

Documents used along the form

The PA-40 Tax form is essential for filing Pennsylvania income taxes. Several other forms and documents often accompany it to provide additional information, claims, or credits that can affect tax liability. Below is a brief overview of some commonly used forms alongside the PA-40 Tax form.

- PA Schedule A: Used to report interest income. If a taxpayer has earned interest during the tax year, this schedule helps identify and quantify that income for state tax purposes.

- PA Schedule B: This form is for reporting dividend and capital gains distributions. Taxpayers who have investments yielding dividends or capital gains must complete this schedule to include that income on the PA-40.

- PA Schedule J: This is for reporting estate or trust income. Individuals who receive income as beneficiaries of an estate or trust will need to complete this schedule to report that income.

- PA Schedule T: This schedule is designed for gambling and lottery winnings. Taxpayers who have won money from these activities must accurately report this income to ensure compliance with state tax laws.

- PA Schedule SP: This form is used for claiming the Tax Forgiveness Credit. Depending on income and family size, taxpayers may be eligible for this credit, which can reduce their overall tax liability.

- REV-1630/REV-1630A: These forms are used to report penalties and interest. Individuals or businesses that have incurred penalties or interest due to late filings or payments will utilize these forms to report and potentially rectify those situations.

Each of these forms serves a distinct purpose and plays an important role in the overall tax filing process for Pennsylvania residents. Completing them accurately ensures that all applicable income and credits are reported, which can impact the amount of tax owed or refunded.

Similar forms

The PA 40 Tax form is an essential document for individuals filing their income tax in Pennsylvania. Several other documents share similar characteristics with the PA 40 in that they are used for reporting tax information, calculating liabilities, and claiming credits or deductions. Below is a list of these similar documents along with explanations of their similarities:

- 1040 Federal Tax Return: Like the PA 40, the 1040 is used for reporting income to the government. Taxpayers report their income, deductions, and tax liability, making it a cornerstone for income tax filings at the federal level.

- W-2 Wage and Tax Statement: The W-2 form provides a summary of an employee's earnings and the taxes withheld. Both the W-2 and the PA 40 require information on gross compensation, highlighting income tax calculations based on earned income.

- Schedule C (Profit or Loss from Business): This document is essential for self-employed individuals, allowing them to report income and expenses from their businesses. Similarly, the PA 40 allows individuals to report income or loss from a business, profession, or farm.

- Form 1099-MISC: For freelancers and contractors, this form documents income received outside traditional employment. The purpose is akin to the PA 40, where all sources of income must be reported to determine overall tax liability.

- PA Schedule SP (Special Tax Forgiveness): This schedule is specifically for Pennsylvania taxpayers seeking tax forgiveness credits. It complements the PA 40 by detailing adjustments based on income levels and various credits, directly impacting the final tax liability.

- Form REV-1630 (PA Tax Credit Refund): This form is filed when individuals seek a refund on specific tax credits. Just like the PA 40, it serves to reconcile the amount of tax owed with the credits available, informing taxpayers about possible refunds or payments owed.

Understanding these documents helps taxpayers navigate their responsibilities and ensure compliance with tax obligations. Each form plays a unique role in the overall tax filing process, creating a comprehensive system for accounting for personal income.

Dos and Don'ts

- DO: Download and save the PA-40 form onto your computer before filling it out.

- DO: Use black ink and clearly print each letter or number in the designated boxes.

- DO: Ensure that you fill in the appropriate ovals completely to indicate your residency status and filing status.

- DO: Double-check all entered information for accuracy before submitting your form.

- DON'T: Include exempt income, such as combat zone pay, in your gross compensation.

- DON'T: Leave any required fields blank; each section must have the necessary information filled out.

- DON'T: Forget to sign and date the form to validate your submission.

- DON'T: Call about your refund status until at least eight weeks after filing your return.

Misconceptions

Here are six common misconceptions about the PA-40 tax form. Understanding these can help ensure your tax return is accurate and filed on time.

- It's only for Pennsylvania residents. Many believe that the PA-40 is applicable only to full-year residents. However, nonresidents and part-year residents can also use this form to report income earned in Pennsylvania.

- You must file even if you owe no tax. Some people think that if they do not owe taxes, they do not need to file. This isn't true; Pennsylvania law requires certain individuals to file a return, even if no tax is due.

- Only wage income counts. A misconception exists that only wages count as taxable income. In reality, the PA-40 form also accounts for various income sources, such as rental income, dividends, and capital gains.

- Filing electronically isn’t an option. Some taxpayers are unaware that they can electronically file the PA-40. Various software programs and professionals can assist with e-filing, which may streamline the process.

- All deductions are the same as federal deductions. It’s a common belief that all deductions applicable at the federal level apply to the state level as well. However, Pennsylvania has its own rules about what deductions are allowed, which may differ from federal guidelines.

- You only need to report income from Pennsylvania sources. Some individuals mistakenly think that they only need to report income earned in Pennsylvania. If you are a resident, you are required to report all income sources, regardless of where earned.

Clearing up these misconceptions can help taxpayers navigate the complexities of the PA-40 form more effectively. Understanding what is required can lead to a smoother filing process.

Key takeaways

Filling out the PA 40 Tax Form requires careful attention to detail. Here are some key takeaways to keep in mind:

- Ensure to download the form before starting. Completing the form directly in a web browser may lead to data loss.

- Fill in all fields using black ink and print clearly. This ensures readability and prevents errors in processing.

- List both your and your spouse's Social Security numbers at the top of the form. This information is required even if filing separately.

- Indicate your residency status by filling in the corresponding oval. Choose from Pennsylvania Resident, Nonresident, or Part-Year Resident.

- Calculate your total PA taxable income accurately by adding only the positive amounts. Do not include any losses from specified lines.

- Remember to sign and date the form before submission. This confirms that you believe the information provided is correct and complete.

Following these guidelines will help you complete the PA 40 Tax Form efficiently and correctly.

Browse Other Templates

Medicaid North Carolina - Fill out personal and family information clearly on this form.

Imm5710e Guide - Interpreter information must be documented if applicable.

How Long Does It Take to Get Unemployment in Pa - Clear instructions are provided on the back of the UC-1208 form to assist in its completion.