Fill Out Your Pa 501 Form

The PA 501 form serves an essential role for employers in Pennsylvania by facilitating the reporting and payment of income tax withheld from employees' wages. Each employer must fill out this form to provide the state with detailed information about wages paid, the amount of Pennsylvania withholding tax collected, and any credits applicable from previous periods. Specifically, employers will need to enter the total compensation subject to withholding, the total withholding tax needed for the designated quarter, any credits to be applied, and interest amount if applicable. This form requires the completion of several lines with precise financial information, including the legal name of the business, its mailing address, and other identifying details, such as the Employer Account ID and Federal EIN. For timely processing, it’s crucial to submit the completed PA 501 form along with the payment to the Pennsylvania Department of Revenue. Additionally, employers must ensure that they file the PA-W3 Reconciliation Return each quarter to maintain compliance with state tax regulations. For any questions, employers are encouraged to reach the Employer Tax Division directly to obtain assistance.

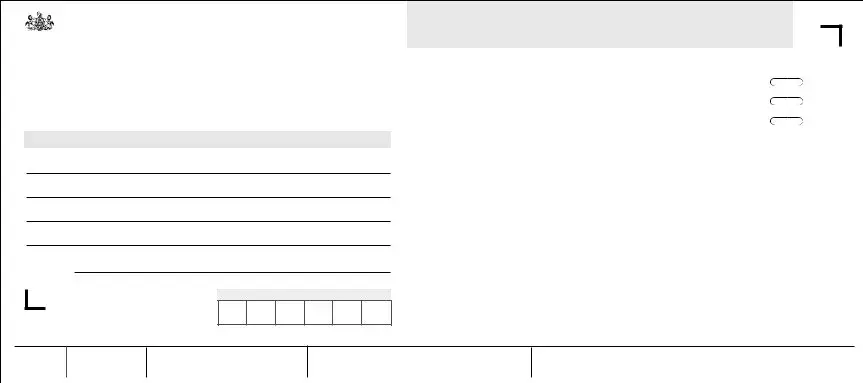

Pa 501 Example

IN STRUCTIO N S FO R THE CO M PLETIO N O F FO RM PA - 5 0 1 R EM PLO YER DEPO SIT STATEM EN T O F IN CO M E TAX W ITHHELD

Enter the quarter (1st quarter YY01, 2nd quarter YY02, 3rd quarter YY03, and 4th quarter YY04), calendar year, the Employer Account ID (if none assigned, leave blank), Entity ID – Federal EIN (if none assigned, leave blank), quarter ending date (1st quarter 0331YYYY, 2nd quarter 0630YYYY, 3rd quarter 0930YYYY and 4th quar- ter 1231YYYY), date wages were first paid and payment frequency.

Enter the legal name, trade name and business mailing address as it should appear on future correspondence.

CO M PLETE LIN ES 1 THRO UGH 4

Line 1. Enter the total amount of compensation subject to PA Withholding Tax for the deposit period.

Line 2. Enter the total amount of PA Withholding Tax required to be withheld (or actually withheld, if greater) for the deposit period. (Enter tax withheld, not deposits)

Line 3. Enter the amount of credit from a previous period which is being applied to the amount withheld for the deposit period.

Line 4. Enter interest due for this payment if remitting after the due date.

Payment. Enter the amount of the payment being remitted for this deposit period.

Sign the document and enter the date, daytime telephone number and title.

Mail the deposit statement and payment to: PA Department of Revenue, Dept. 280401, Harrisburg, PA

Questions regarding the completion of this form can be directed to the Employer Tax Division at (717)

In addition to the

|

|

QUARTER |

|

|

|

YEAR |

|||||||||||||

PA DEPARTMENT OF REVENUE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Y Y Q Q |

|

|

|

|

|

Y Y Y Y |

|||||||||||||||

|

|

|

EMPLOYER ACCOUNT ID |

|

|

ENTITY ID (EIN) |

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BUSINESS NAME AND ADDRESS

LEGAL NAME

TRADE NAME

BUSINESS MAILING ADDRESS

CITY, STATE, ZIP

DATE WAGES FIRST PAID

DEPARTMENT USE ONLY

EM PLO YER DEPO SIT STATEM EN T O F W ITHHO LDIN G TAX

Use Only When Employers Do Not Have Preprinted Coupons.

ALL EMPLOYERS MUST FILE A

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PAYMENT FREQUENCY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EXPECTED QUARTERLY WITHHOLDING WILL BE: |

|

|

|

QUARTER ENDING DATE |

QUARTERLY |

||||||||||||||

|

|

|

LESS THAN $300 |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MONTHLY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MORE THAN $300 BUT LESS THAN $1,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

M M D D Y Y Y Y |

|||||||||||||||||

|

$1,000 OR GREATER |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

GROSS COMPENSATION |

|

|

|

|

|

|

▲ |

|

|

|

|

▲ |

|

|

|

|

|

● |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

PA WITHHOLDING TAX |

|

|

|

|

|

|

|

|

|

|

|

|

▲ |

|

|

|

|

|

● |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

3 |

LESS CREDITS |

|

|

|

|

|

|

|

|

|

|

|

|

▲ |

|

|

|

|

|

● |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

4 |

PLUS INTEREST |

|

|

|

|

|

|

|

|

|

|

|

|

▲ |

|

|

|

|

|

● |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

PAYMENT $ |

|

|

|

|

▲ |

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

● |

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

00021

DATE

DAYTIME TELEPHONE #

()

TITLE

SIGNATURE

PA DEPARTMENT OF REVENUE DEPT 280401 HARRISBURG PA

Form Characteristics

| Fact Name | Fact Details |

|---|---|

| Form Purpose | The PA 501 form is used by employers to report income tax withheld from employees' wages in Pennsylvania. |

| Filing Requirements | All employers must file the PA 501 along with a PA-W3 Reconciliation Return for each quarter. |

| Quarter Designation | The form requires entry of the specific quarter being reported: 1st (YY01), 2nd (YY02), 3rd (YY03), or 4th (YY04). |

| Key Dates | Quarter ending dates vary: 1st quarter (0331YYYY), 2nd quarter (0630YYYY), 3rd quarter (0930YYYY), and 4th quarter (1231YYYY). |

| Payment Methods | Payments and the PA 501 form must be mailed to the Pennsylvania Department of Revenue, Harrisburg, PA. |

| Contact Information | For questions, employers can contact the Employer Tax Division at (717) 783-1488. |

Guidelines on Utilizing Pa 501

Filling out the PA 501 form is essential for employers to report and remit income tax withheld from employee wages. After completing the form, it's important to mail it to the designated address along with the payment. Make sure to keep a copy for your records.

- Indicate the quarter by entering "YY01," "YY02," "YY03," or "YY04" for the first, second, third, or fourth quarter, respectively.

- Fill in the calendar year.

- Provide your Employer Account ID. If you do not have one, leave this blank.

- Enter your Entity ID, which is your Federal EIN. Leave this blank if none has been assigned.

- Input the quarter ending date. Use "0331YYYY" for Q1, "0630YYYY" for Q2, "0930YYYY" for Q3, and "1231YYYY" for Q4.

- Record the date wages were first paid and specify the payment frequency.

- Enter your legal name, trade name, and business mailing address as it should appear in future correspondence.

Next, complete lines 1 through 4:

- Line 1: Enter the total amount of compensation subject to PA Withholding Tax for the deposit period.

- Line 2: Provide the total amount of PA Withholding Tax required to be withheld or actually withheld for this deposit period.

- Line 3: Enter the amount of credit from a previous period that you are applying to this deposit period.

- Line 4: Input the interest owed for this payment if you are submitting it after the due date.

For the payment section, enter the total amount being remitted for this deposit period.

- Sign the document and include the date, your daytime telephone number, and your title.

- Mail the completed deposit statement and payment to: PA Department of Revenue, Dept. 280401, Harrisburg, PA 17128-0401.

If you have questions while completing the form, contact the Employer Tax Division at (717) 783-1488.

Remember to file a PA-W3 Reconciliation Return as well for each quarter in addition to the PA-501 or PA-501R deposit statement.

What You Should Know About This Form

What is the purpose of the PA-501 form?

The PA-501 form is used by employers in Pennsylvania to report and remit income tax withheld from employee wages for a specific deposit period. It helps ensure that the state receives the correct amount of taxes based on employee earnings throughout the quarter. Proper completion of this form is necessary for compliance with Pennsylvania tax regulations.

How do I fill out the PA-501 form?

To complete the PA-501 form, begin by entering the relevant quarter, year, Employer Account ID, and Federal EIN. Then, provide the quarter ending date and the date wages were first paid. Follow this with a detailed account of earnings and tax withholdings. Specifically, report the total compensation subject to withholding, the amount of tax withheld, any applicable credits, and interest. Finally, sign the form, include a daytime phone number and your title before mailing it to the PA Department of Revenue.

What information is required on the PA-501 form?

Required information includes the quarter and year of the report, Employer Account ID, Federal EIN, and details like legal and trade names, business mailing address, and quarter ending dates. You will also need to provide data on gross compensation, total taxes withheld, any credits, and information regarding interest due if the payment is late.

Where do I send the completed PA-501 form?

The completed PA-501 form, along with any payment, should be mailed to the PA Department of Revenue at the following address: Dept. 280401, Harrisburg, PA 17128-0401. Make sure to send the form well before the due date to avoid penalties.

What happens if I do not file the PA-501 form on time?

If the PA-501 form is filed late, interest and potential penalties may apply. It is essential to submit the form by the due date indicated by the Pennsylvania Department of Revenue to avoid these additional charges. Continuous delays in filing can lead to more significant consequences for your business.

Are there additional forms I need to submit along with the PA-501?

Yes, in addition to the PA-501 form, all employers are required to file a PA-W3 Reconciliation Return for each quarter. If a preprinted coupon is not available, it is vital to submit a PA-W3R return instead. These forms help reconcile total tax withholdings for the entire year and confirm compliance with tax regulations.

Common mistakes

Filling out the PA 501 form can be straightforward, but mistakes can lead to delays or issues with your tax obligations. One common error is failing to enter the correct quarter and calendar year. This information is essential in identifying the deposit period accurately. Double-check the dates to ensure they align with your records.

Another frequent mistake involves the Employer Account ID and Entity ID fields. Some individuals leave these sections blank when they already have assigned numbers. If you have an Employer Account ID, it’s vital to include it. Conversely, if you do not, leaving it blank is appropriate. Keeping these instructions in mind is essential for proper completion.

Many people miscalculate the total amount of compensation subject to PA Withholding Tax on Line 1. Accuracy here is crucial, as any discrepancies can lead to issues with the tax authority. It is always best to cross-check the figures against your payroll records to confirm their accuracy.

Line 2 is another area where mistakes often occur. Entering the total amount of PA Withholding Tax required for the deposit period can be confusing. Ensure that you enter the actual amount withheld, rather than any deposits that may have been made. This distinction is essential for an accurate report.

Also, some filers forget about Line 3, where any credit from a previous period should be applied. Failing to include this credit can result in overpayment or complications down the line. Make sure to gather all necessary documentation regarding past payments.

Another common oversight happens with Line 4. This line asks for interest due if the payment is made after the due date. If there is any interest due, failing to add it here can create problems with your tax records. Always keep track of deadlines to avoid interest charges.

The payment field also requires careful attention. Misreporting the payment amount, whether over or under, can result in regulatory issues. Collect all relevant information and calculate your payment carefully before entering it on the form.

Signing the document is a step that some individuals might overlook. Not providing a signature can render the form invalid. Always ensure that your signature, along with the date, daytime telephone number, and title, is clearly written at the end of the document.

Lastly, many fail to include the accompanying payment with their deposit statement when mailing it. The complete package should be sent to the designated address. Take the time to assemble everything required before mailing to ensure compliance.

Being mindful of these common mistakes can make a difference in the accuracy of your PA 501 form submission. A complete and correct filing helps in maintaining good standing with the tax authorities.

Documents used along the form

The PA-501 form is crucial for Pennsylvania employers to report income tax withheld. However, it is not the only document required in the reporting process. Below are other essential forms and documents that frequently accompany the PA-501 to ensure compliance with state tax regulations. Each serves a specific purpose in the overall tax reporting process.

- PA-W3 Reconciliation Return: This form is used to reconcile the total amount of withholding tax reported on the PA-501 forms for the year. Employers must submit this form quarterly.

- PA-W3R Return: If an employer does not have preprinted coupons, this return must be filed instead of the PA-W3. It serves a similar purpose in reconciling withholding tax for the quarter.

- Employer Account ID Registration: This form is required for new employers to register their Employer Account ID, which identifies them in the state's revenue system.

- Payment Coupon: A payment coupon is sometimes necessary to include when mailing payments to ensure that they are applied correctly to the employer's account.

- Federal Form 941: This federal form reports the amount of Federal Income Tax, Social Security, and Medicare taxes withheld from employees and must be filed quarterly as well.

- State Unemployment Tax Form: Employers must also file this form to report unemployment compensation tax obligations to the Pennsylvania Department of Labor & Industry.

- W-2 Forms: These forms summarize an employee's total wages and the taxes withheld during the year and must be distributed to employees and submitted to the IRS and state.

- Schedule A: This form is often included with the PA-W3 to report adjustments made to withholding tax or to provide additional information regarding employee withholdings.

- Business Tax Registration: Businesses may need to register for multiple state taxes, and this form captures all applicable taxes for which the business will be held accountable.

- Request for Extension: If more time is needed to file, employers can submit this form to request an extension for filing their tax returns and related documents.

Collectively, these documents form a comprehensive framework that supports accurate tax reporting and compliance for employers in Pennsylvania. Understanding these forms and submitting them timely is imperative for a smooth reporting process and to avoid potential penalties.

Similar forms

- W-2 Form: Like the PA-501 form, the W-2 form reports wages paid to employees and the taxes withheld. While the PA-501 is used for periodic tax deposits, the W-2 summarizes these amounts at the end of the year.

- W-3 Form: This is the summary form that accompanies the W-2. It provides a total of all W-2s issued by an employer, similar to how the PA-501 outlines totals for a specific deposit period.

- 1099-MISC Form: Similar to the PA-501, this form is used to report various types of income paid to non-employees, including freelancers and independent contractors, along with any tax withheld.

- 941 Form: The IRS Form 941 reports payroll taxes withheld from employees every quarter. It shares the periodic reporting aspect of the PA-501, addressing withholding tax collected within a specific time frame.

- 940 Form: This form is used to report annual Federal Unemployment Tax Act (FUTA) taxes. Like the PA-501, it involves tax reporting but focuses on unemployment tax obligations.

- State Withholding Tax Form: Various states have their own versions of withholding tax forms, similar to the PA-501. They report income taxes withheld from employee wages at different intervals.

- Employer’s Annual Federal Unemployment Tax Return (FUTA): This document, like the PA-501, requires employers to calculate and report their own tax obligations, but it focuses primarily on unemployment taxes rather than income tax withholding.

- Form 1040: This is the individual income tax return filed by employees, which includes details reflecting all income, including earnings subject to withholding covered in the PA-501.

Dos and Don'ts

When filling out the PA 501 form, it's essential to approach the process with care and attention. Below are five things you should and shouldn’t do to ensure your form is completed accurately and efficiently.

- Do: Carefully enter the correct quarter and calendar year at the top of the form.

- Do: Provide your Employer Account ID and Entity ID, or leave them blank if none has been assigned.

- Do: Fill in all required amounts on lines 1 through 4 accurately to reflect the compensation and taxes withheld.

- Do: Include your legal name, trade name, and business mailing address as they should appear in official correspondence.

- Do: Sign and date the document, ensuring you include your daytime telephone number and title.

- Don't: Skip entering the necessary details about wages paid, as this information is vital for accurate reporting.

- Don't: Enter an amount for tax withheld that does not reflect the actual figures; report the correct total required for the period.

- Don't: Ignore the due date; submitting payments late can result in interest charges.

- Don't: Forget to file a PA-W3 Reconciliation Return if you are an employer, as this is mandatory for each quarter.

- Don't: Leave any required fields blank after entering your information; make sure all entries are complete before submission.

Misconceptions

There are several misconceptions about the PA 501 form that can lead to confusion. Clarifying these myths helps ensure compliance and proper filing. Here’s a closer look at nine common misconceptions:

- The PA 501 form is optional for employers. Many think this form isn’t necessary. In reality, it is required for employers to report income tax withheld.

- Only large employers need to file the PA 501. It doesn't matter the size of your business. All employers must submit this form if they withhold Pennsylvania income tax.

- Filing the PA 501 alone is sufficient. Employers must also submit the PA-W3 Reconciliation Return each quarter. Not filing both can lead to penalties.

- The form is the same for all quarters. While the PA 501 can look similar each quarter, the figures you enter will differ based on your withholdings for that period.

- There’s no deadline for filing. This isn’t true. The PA 501 has specific deadlines based on the quarter ending dates. Late filings can incur interest and penalties.

- Credits from past periods are automatically applied. You must manually enter any credits from previous periods on the form. They won’t just carry over.

- Mailing the form is the only way to file. While mailing is one option, employers may also have electronic filing options available, depending on their circumstances.

- The PA 501 form is complicated and hard to understand. It may seem daunting, but the instructions are straightforward. Following them step by step can simplify the process.

- I don’t need to provide any contact information on the form. You must include your daytime telephone number and title for communication purposes. This helps the Department of Revenue reach you if there are questions.

Understanding these misconceptions can make a big difference when managing your tax responsibilities. Properly completing the PA 501 form keeps you compliant and helps avoid future headaches.

Key takeaways

Here are some key takeaways about filling out and using the PA 501 form:

- Important Dates: Clearly indicate the quarter, year, and the quarter ending date. Each quarter has specific dates, and accuracy is essential.

- Accurate Compensation Reporting: Ensure you report the total compensation subject to Pennsylvania withholding tax on Line 1. This is crucial for the correct calculation of tax owed.

- Withholding Tax Calculation: On Line 2, enter the total amount of PA withholding tax that needs to be withheld. If more tax was withheld than necessary, report the higher amount.

- Credit Application: If you have credits from a prior period, report these on Line 3. This can reduce the amount you're required to pay for the current period.

- Timeliness and Contact: Submit the form along with any payment to the specified address promptly. If you have questions, contact the Employer Tax Division at the provided phone number for assistance.

Browse Other Templates

Nj Real Estate Contract - Deposits are held in a non-interest-bearing escrow account until closing.

Bargain Sale Agreement,Statutory Transfer Deed,Oregon Real Estate Conveyance,Deed of Sale Form,Real Property Transfer Document,Bargain and Sale Instrument,Property Conveyance Declaration,Statutory Property Deed,Oregon Transfer of Title Form,Real Esta - Including all necessary parties is essential for the deed's enforceability.

30 Ceus for Dialysis Technicians - Engaging with accredited continuing education providers enhances your skills and helps fulfill recertification requirements.