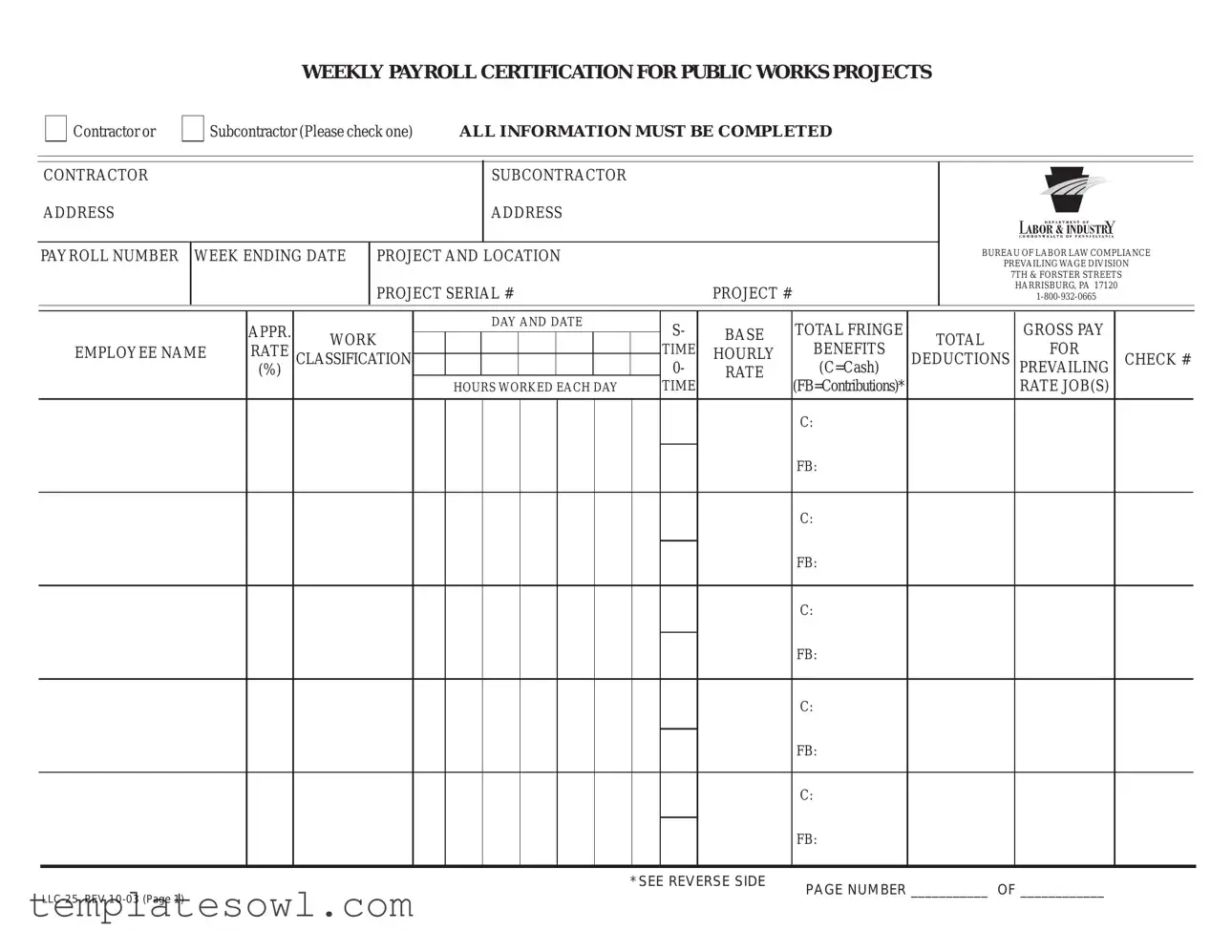

Fill Out Your Pa Payroll Form

The Pennsylvania Payroll form plays a crucial role in ensuring compliance with labor laws for public works projects within the state. Designed for contractors and subcontractors, this form is a certification that details payment practices and prevailing wage rates. Each submission requires complete information including contractor or subcontractor identification, project details, payroll numbers, and hours worked. Salary breakdowns are essential; it itemizes gross pay while clarifying fringe benefits. Additionally, it includes sections for employee names, their classification and rates, as well as necessary deductions. This document not only safeguards workers' rights but also upholds the integrity of labor standards set forth by the Bureau of Labor Law Compliance. Crucially, it functions as a self-certification that contractors must complete in alignment with the prevailing wage requirements. A notarization is mandatory for the first and last submissions, reinforcing the veracity of the information provided. Understanding the intricacies of the Pennsylvania Payroll form empowers all parties involved, fostering transparency and accountability in public contracts.

Pa Payroll Example

WEEKLY PAYROLL CERTIFICATION FOR PUBLIC WORKS PROJECTS

Contractor or

Subcontractor (Please check one) ALL INFORMATION MUST BE COMPLETED

CONTRACTOR |

SUBCONTRACTOR |

ADDRESS |

ADDRESS |

|

PAYROLL NUMBER WEEK ENDING DATE PROJECT AND LOCATION |

|

|

|

BUREAU OF LABOR LAW COMPLIANCE |

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PREVAILING WAGE DIVISION |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7TH & FORSTER STREETS |

|

|

||

|

|

|

PROJECT SERIAL # |

|

PROJECT # |

|

|

|

HARRISBURG, PA 17120 |

|

|

||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

APPR. |

WORK |

|

|

DAY AND DATE |

S- |

BASE |

TOTAL FRINGE |

TOTAL |

|

GROSS PAY |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

EMPLOYEE NAME |

RATE |

CLASSIFICATION |

|

|

|

|

|

|

|

TIME |

HOURLY |

BENEFITS |

DEDUCTIONS |

|

FOR |

|

CHECK # |

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

(%) |

|

|

|

|

|

|

|

0- |

RATE |

(C=Cash) |

|

PREVAILING |

|

|

|||

|

|

|

|

|

HOURS WORKED EACH DAY |

TIME |

|

(FB=Contributions)* |

|

|

RATE JOB(S) |

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

C: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FB: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FB: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FB: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FB: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FB: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*SEE REVERSE SIDE |

PAGE NUMBER ___________ OF ____________ |

|

THE NOTARIZATION MUST BE COMPLETED ON FIRST AND LAST SUBMISSIONS ONLY. ALL OTHER INFORMATION MUST BE COMPLETED WEEKLY.

*FRINGE BENEFITS EXPLANATION (FB): Bona fide benefits contribution, except those required by Federal or State Law (unemployment tax, workers’ compensation, income taxes, etc.)

Please specify the type of benefits provided and contributions per hour:

1)Medical or hospital care __________________________________________________________________________

2)Pension or retirement ____________________________________________________________________________

3)Life insurance _________________________________________________________________________________

4)Disability _____________________________________________________________________________________

5)Vacation, holiday _______________________________________________________________________________

6)Other (please specify) ___________________________________________________________________________

CERTIFIED STATEMENT OF COMPLIANCE

1.The undersigned, having executed a contract with _____________________________________________________

(AWARDING AGENCY, CONTRACTOR OR SUBCONTRACTOR)

______________________________ for the construction of the

(a)The prevailing wage requirements and the predetermined rates are included in the aforesaid contract.

(b)Correction of any infractions of the aforesaid conditions is the contractor’s or subcontractor’s responsibility.

(c)It is the contractor’s responsibility to include the Prevailing Wage requirements and the predetermined rates in any subcontract or lower tier subcontract for this project.

2.The undersigned certifies that:

(a)Neither he nor his firm, nor any firm, corporation or partnership in which he or his firm has an interest is debarred by the Secretary of Labor and Industry pursuant to Section 11(e) of the PA Prevailing Wage Act, Act of August 15, 1961, P.L. 987 as amended, 43 P.S.§

(b)No part of this contract has been or will be subcontracted to any subcontractor if such subcontractor or any firm, corporation or partnership in which such subcontractor has an interest is debarred pursuant to the aforementioned statute.

3.The undersigned certifies that:

(a)the legal name and the business address of the contractor or subcontractor are: _________________________

_________________________________________________________________________________________

(b) The undersigned is: |

a single proprietorship |

a corporation organized in the state of ______________ |

|

|

a partnership |

other organization (describe) ____________________________ |

|

(c)The name, title and address of the owner, partners or officers of the contractor/subcontractor are:

NAME

TITLE

ADDRESS

The willful falsification of any of the above statements may subject the contractor to civil or criminal prosecution, provided in the PA Prevailing Wage Act of August 15, 1961, P.L. 987, as amended, August 9, 1963, 43 P.S. § 165.1 through 165.17.

(DATE)

SEAL

(SIGNATURE)

(TITLE)

Taken, sworn and subscribed before me this _________ Day

of ___________________________________ A.D., ___________

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The PA Payroll form is used to certify compliance with prevailing wage requirements for public works projects in Pennsylvania. |

| Governing Law | This form is governed by the Pennsylvania Prevailing Wage Act, specifically Act of August 15, 1961, P.L. 987, as amended. |

| Submission Frequency | Contractors or subcontractors must submit this form weekly for ongoing public works projects. |

| Notarization Requirement | Notarization is required only on the first and last submissions of the project. Other weekly submissions do not require notarization. |

| Penalties for Falsification | Willful falsification of information on the form may lead to civil or criminal prosecution under Pennsylvania law. |

Guidelines on Utilizing Pa Payroll

Completing the PA Payroll form accurately is essential to ensure compliance with state regulations. This process involves recording employee payment details, certifying adherence to prevailing wage laws, and providing necessary signatures. Follow these steps to fill out the form thoroughly and correctly.

- Check whether you are a Contractor or Subcontractor and mark the appropriate box.

- Enter your address in the designated space.

- Fill in the payroll number and the corresponding week ending date.

- Provide the project name and location.

- Obtain the project serial number and project number from your records.

- List each employee’s name, classification, and hourly rate.

- Record the total hours worked each day for each employee.

- Calculate and enter the base pay, fringe benefits, and total gross pay.

- Detail the deductions for each employee, including any fringe benefits and contributions.

- Specify the type of benefits provided and contributions per hour in the designated area.

- Obtain the necessary signatures for the certified statement of compliance.

- If applicable, complete the notarization section for first and last submissions only.

Ensure all sections are completed before submission. Double-check all entries for accuracy to avoid potential fines or compliance issues. Once finalized, submit the form to the appropriate authority according to your project guidelines.

What You Should Know About This Form

What is the purpose of the PA Payroll form?

The PA Payroll form serves as a certification for employees who work on public works projects in Pennsylvania. It ensures that contractors and subcontractors comply with the state's prevailing wage laws. By submitting this form, employers verify that workers are compensated in accordance with established wage rates, thereby promoting fair labor practices.

Who needs to complete the PA Payroll form?

Both contractors and subcontractors involved in public works projects must complete the PA Payroll form. This requirement applies to any entity that oversees labor in the construction context. By ensuring the form is accurately filled out, these parties can confirm compliance with state regulations, which helps maintain a fair workplace.

What specific information is required on the form?

The form requires detailed information such as the name and address of the contractor or subcontractor, payroll number, project and location, employee names, classifications, hours worked, pay rates, deductions, and fringe benefits. Each section serves to document how labor is compensated and the nature of the work performed.

What are fringe benefits and how should they be reported?

Fringe benefits refer to extras provided to employees alongside their wages, such as health insurance, retirement contributions, and paid time off. The PA Payroll form asks employers to specify each type of benefit and the amount contributed per hour. This transparency ensures workers receive full compensation for their labor, in compliance with state law.

When should the PA Payroll form be submitted?

The PA Payroll form should be submitted weekly throughout the project duration. On the first and last submissions, a notarized certification must also be included. Timely submissions help ensure ongoing compliance with state laws and provide accurate records for review by regulatory agencies.

What does the certification statement entail?

The certification statement is a commitment by the contractor or subcontractor attesting to various conditions, including adherence to prevailing wage requirements and disclosure of any debarment status. This part of the form emphasizes accountability and legal compliance, helping protect both workers and employers.

What are the consequences of submitting false information?

Falsifying any information on the PA Payroll form can lead to serious repercussions, including civil or criminal prosecution. This serves as a reminder for contractors and subcontractors to provide accurate and truthful information. Upholding integrity in reporting not only supports compliance but also fosters trust within the labor community.

How should the form be notarized?

Notarization must be completed on the first and last submissions of the PA Payroll form. This process involves a certified notary public verifying the identity of the signer and witnessing the signing of the form. The presence of a notary adds a layer of authenticity, ensuring that the submitted information is credible and official.

Where can I find assistance if I have questions about the form?

If you have questions about the PA Payroll form, you can contact the Bureau of Labor Law Compliance’s Prevailing Wage Division. They provide resources and assistance to help contractors and subcontractors navigate the requirements of the form. Their guidance is invaluable for ensuring proper completion and compliance with state regulations.

Common mistakes

Completing the Pennsylvania Payroll form accurately is vital for compliance with labor laws. One common mistake is failing to check the appropriate box indicating whether the entity is a contractor or subcontractor. This selection sets the foundation for the entire submission and can lead to confusion or delays in processing if overlooked.

Another frequent error involves improperly listing employee information. Many people do not include all necessary details such as the employee's full name, correct classification, and accurate hourly pay rates. Incomplete or inaccurate information can trigger audits or result in fines, as it is crucial that all payroll data reflects the actual work performed.

In addition, some individuals neglect to provide specific details regarding fringe benefits. The form requires a clear description of benefits offered, along with the corresponding contributions per hour. Omitting this section or providing vague information can lead to questions from regulatory bodies and potential penalties.

Lastly, signing and dating the certification can be overlooked. It’s important to complete the certified statement of compliance, including the signature and title of the individual responsible. Failure to do so may render the entire submission invalid and necessitate resubmission, causing further delays in project timelines.

Documents used along the form

The PA Payroll Form is a crucial document used for reporting payroll information associated with public works projects in Pennsylvania. Along with this form, several other documents often play a role in ensuring compliance and accurate reporting. Here’s a brief overview of some of these essential forms.

- Certified Payroll Report: This report details the wages paid to employees working on public works projects. It includes information on each worker, such as hours worked and wages paid, ensuring that contractors comply with prevailing wage requirements.

- Employee Information Form: This form gathers essential details about each employee, including personal information, tax withholding data, and employment status. It helps employers maintain accurate records for tax and payroll purposes.

- Benefit Contribution Report: This document outlines the various fringe benefits provided to employees, such as health insurance and retirement plans. It ensures that workers receive the benefits required under prevailing wage law.

- Subcontractor Agreement: This agreement outlines the terms and conditions between a contractor and any subcontractors involved in a public works project. It assures all parties understand their roles, responsibilities, and adherence to prevailing wage laws.

- Notarized Affidavit: At times, a notarized statement may be required to confirm the accuracy of submitted payroll information. This affidavit verifies that the provided data is true and can serve as a safeguard against fraud.

- Wage Determination Document: This document provides the specific wage rates required for different types of work. It acts as a guide for contractors to ensure they are paying employees the correct prevailing wages.

Understanding these documents and their role in the payroll process can help ensure compliance with Pennsylvania payroll regulations. Contractors and subcontractors should pay close attention to these forms to maintain proper records and avoid potential legal issues.

Similar forms

The PA Payroll form, particularly designed for public works projects, shares similarities with several other important documents in payroll and labor compliance. Below is a list of these documents, highlighting the key aspects they have in common with the PA Payroll form.

- Certified Payroll Report: This document is used to certify that workers are being paid according to local and federal laws. Like the PA Payroll form, it includes detailed information about employee wages, hours worked, and classifications.

- W-2 Form: Employees receive this yearly statement detailing their earnings and tax withholdings. Similar to the PA Payroll form, it provides a comprehensive account of wages but on an annual basis rather than weekly.

- Employer's Quarterly Federal Tax Return (Form 941): This form informs the IRS about the employee wages, tips, and tax withholdings. Both forms require accurate reporting of wages and compliance with tax obligations.

- Labor Condition Application (LCA): Required for certain employment types, particularly for H-1B visas, this form outlines the wages and conditions of employment. Like the PA Payroll form, it emphasizes compliance with wage laws and benefits provided.

- Summary of Benefits and Coverage (SBC): This document outlines health benefit options and costs to employees. It shares the characteristic of detailing benefits provided, a section also covered in the PA Payroll form.

- Employee Pay Stub: Pay stubs provide itemized details of employee earnings during a pay period. Both documents aim to transparently report wages, deductions, and hours worked.

- Prevailing Wage Determination Letter: This letter specifies the wages and benefits required for laborers on public projects. Like the PA Payroll form, it addresses compliance with prevailing wage laws to ensure fair pay for workers.

In summary, these documents not only support the accurate reporting of wages and compliance with labor laws but also establish accountability in the payroll process across various employment settings.

Dos and Don'ts

Filling out the Pennsylvania Payroll form can be straightforward if you follow these guidelines. Here are some dos and don'ts to ensure you complete the form correctly.

- Do complete all sections of the form in full. Incomplete forms can delay processing.

- Do provide accurate employee names and details. Mismatches can lead to complications later.

- Do keep track of work hours carefully. Accurate time reporting is essential for compliance.

- Do confirm the prevailing wage rates applicable to your project. This ensures you meet legal requirements.

- Do maintain records of fringe benefits offered. Provide specifics to meet reporting standards.

- Don't leave the notarization section blank on the first and last submissions. This could invalidate your form.

- Don't overlook the certification statement. Ensure it is properly signed and dated.

- Don't make assumptions about withholding taxes or benefits. Verify whether they apply to your situation.

- Don't forget to keep copies of submitted forms for your records. Documentation is crucial for future reference.

By following these tips, you can help ensure that your Pennsylvania Payroll form is completed correctly and efficiently. Being thorough helps everyone involved in the payroll process.

Misconceptions

- Misconception 1: The form is only needed once per project.

- Misconception 2: Any contractor can submit the form regardless of qualifications.

- Misconception 3: The form is only about tracking payroll.

- Misconception 4: Fringe benefits are optional and do not need to be reported.

- Misconception 5: Only large construction projects require this form.

- Misconception 6: The form can be submitted without notarization for all instances.

Many believe that the PA Payroll form is a one-time requirement for a project. In reality, it must be completed weekly throughout the duration of the public works project to ensure compliance.

Not all contractors or subcontractors can submit this form. Only those not debarred by the Secretary of Labor and Industry are eligible to file. This is a vital part of the compliance process.

While payroll tracking is crucial, the form also ensures that prevailing wage requirements are met. It includes certifications that help confirm compliance with state laws.

Fringe benefits are not optional. If provided, they must be detailed in the form. Reporting these benefits helps ensure that workers receive the proper compensation.

This form is required for all public works projects, regardless of size. No project is too small to necessitate compliance with prevailing wage laws.

Some may think that notarization is not necessary. However, it is required only on the first and last submission for each project. This helps verify the authenticity of the documentation.

Key takeaways

Here are key takeaways about filling out and using the PA Payroll form:

- Complete All Sections: Ensure every part of the form is filled out completely. Incomplete forms can lead to delays or issues with compliance.

- Weekly Submission: Submit the payroll form weekly. Consistent and timely submissions help to maintain compliance with payroll regulations.

- Understand Fringe Benefits: Clearly specify the types of fringe benefits you provide. This includes contributions for medical care, retirement, life insurance, and more.

- Certify Compliance: Acknowledge your understanding of prevailing wage requirements. This certification is a requirement and must be taken seriously to avoid legal repercussions.

- Notarization: Remember that notarization is necessary only on the first and last submissions. This step is vital to validate the form.

Browse Other Templates

Animal Health Certificate for Travel - Confirm that your pet meets all health and vaccination requirements for travel.

Proof of Service California - The server’s fee must be documented if a process server is employed.

Dc Rental Agreement - Landlords can enforce legal remedies in case of tenant defaults, emphasizing the seriousness of compliance with the lease.