Fill Out Your Pa New Hire Form

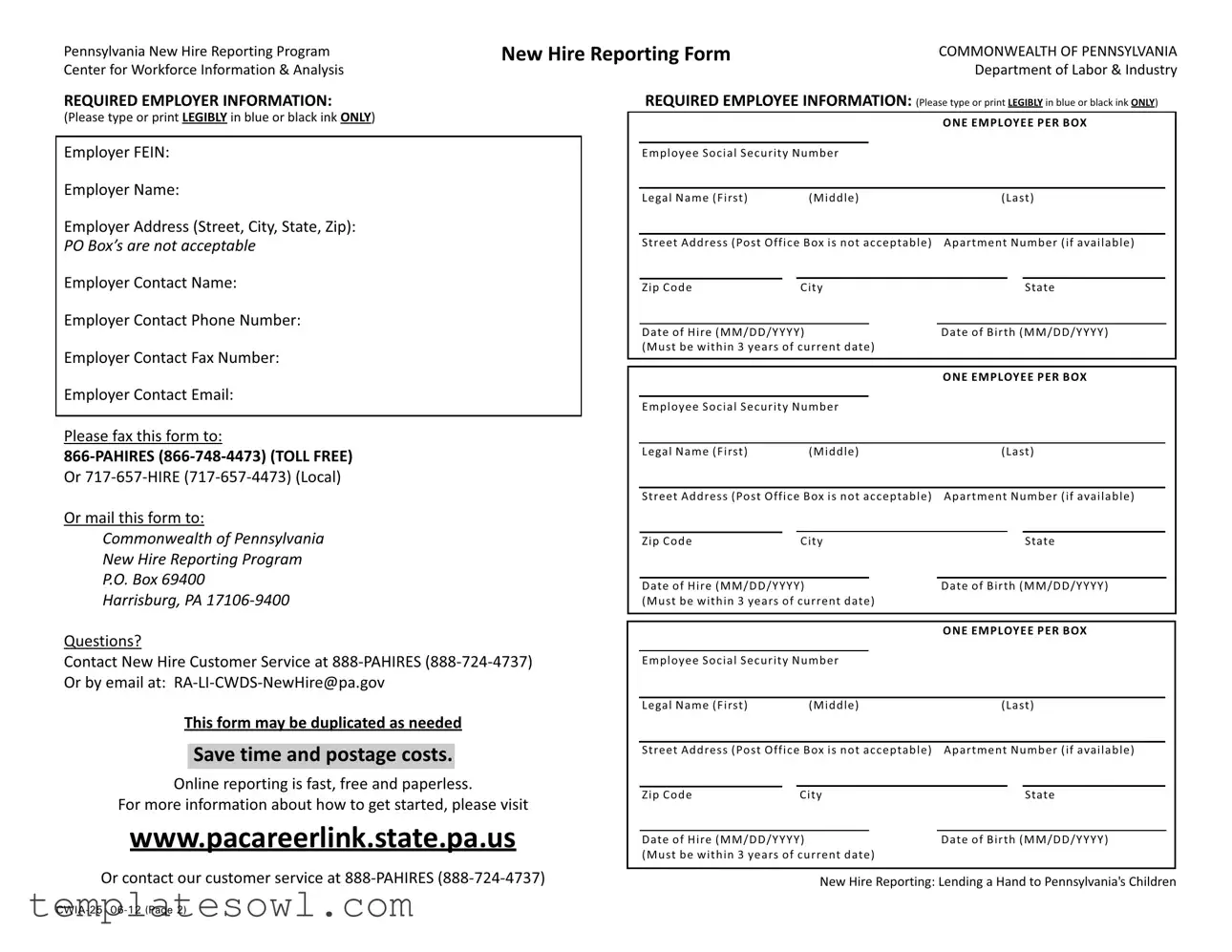

The Pennsylvania New Hire Reporting Form is an essential document for employers to fill out when hiring new employees. This form helps the state track employment and assists in the enforcement of child support obligations, among other purposes. It requires detailed information about both the employer and the employee. Employers must provide their Federal Employer Identification Number (FEIN), contact details, and address. On the employee side, the form requires the social security number, legal name, date of birth, and address—important data that must be completed accurately. It’s critical to note that each employee's information must be submitted on a separate box on the form, ensuring clarity and correctness. Employers have the option to fax or mail the completed form, or even choose a quick and paperless online reporting system. The Pennsylvania government has streamlined the process to make compliance easier; businesses can visit the Pennsylvania CareerLink website for additional guidance. This form not only supports administrative functions but also contributes to the welfare of children across the state by facilitating timely reporting.

Pa New Hire Example

Pennsylvania New Hire Reporting Program |

New Hire Reporting Form |

|

|

|

|

COMMONWEALTH OF PENNSYLVANIA |

|||||||||

Center for Workforce Information & Analysis |

|

|

|

|

|

|

|

|

Department of Labor & Industry |

||||||

REQUIRED EMPLOYER INFORMATION: |

|

|

|

REQUIRED EMPLOYEE INFORMATION: (Please type or print LEGIBLY in blue or black ink ONLY) |

|||||||||||

(Please type or print LEGIBLY in blue or black ink ONLY) |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

ONE EMPLOYEE PER BOX |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Employer FEIN: |

|

|

|

Employee Social Security Number |

|

|

|

|

|

||||||

Employer Name: |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

Legal Name (First) |

|

(Middle) |

(Last) |

|||||||||

|

|

|

|

|

|

|

|||||||||

Employer Address (Street, City, State, Zip): |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

PO Box’s are not acceptable |

|

|

|

Street Address (Post Office Box is not acceptable) |

Apartment Number (if available) |

||||||||||

Employer Contact Name: |

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

Zip Code |

|

City |

|

|

State |

|||||||

Employer Contact Phone Number: |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

Date of Hire (MM/DD/YYYY) |

Date of Birth (MM/DD/YYYY) |

|||||||||||

|

|

|

|

|

|

||||||||||

Employer Contact Fax Number: |

|

|

|

(Must be within 3 years of current date) |

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

ONE EMPLOYEE PER BOX |

||||

Employer Contact Email: |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

Employee Social Security Number |

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Please fax this form to: |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

Legal Name (First) |

|

(Middle) |

(Last) |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Or |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

Street Address (Post Office Box is not acceptable) |

Apartment Number (if available) |

||||||||

Or mail this form to: |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Commonwealth of Pennsylvania |

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

Zip Code |

|

City |

|

|

State |

|||||||

New Hire Reporting Program |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

P.O. Box 69400 |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

Date of Hire (MM/DD/YYYY) |

Date of Birth (MM/DD/YYYY) |

|||||||||||

Harrisburg, PA |

|

|

|

||||||||||||

|

|

|

(Must be within 3 years of current date) |

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

||||

Questions? |

|

|

|

|

|

|

|

|

ONE EMPLOYEE PER BOX |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Contact New Hire Customer Service at |

|

Employee Social Security Number |

|

|

|

|

|

||||||||

Or by email at: |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

Legal Name (First) |

|

(Middle) |

(Last) |

|

|||||

This form may be duplicated as needed |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

||||||||

|

Save time and postage costs. |

|

|

|

|

Street Address (Post Office Box is not acceptable) |

Apartment Number (if available) |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Online reporting is fast, free and paperless. |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

Zip Code |

|

City |

|

|

State |

|||||||

For more information about how to get started, please visit |

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||

www.pacareerlink.state.pa.us |

|

|

|

|

|

|

|

|

|

|

|

||||

|

Date of Hire (MM/DD/YYYY) |

Date of Birth (MM/DD/YYYY) |

|||||||||||||

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

(Must be within 3 years of current date) |

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Or contact our customer service at

New Hire Reporting: Lending a Hand to Pennsylvania's Children

Form Characteristics

| Fact Name | Fact Description |

|---|---|

| Purpose | The Pennsylvania New Hire Reporting Form is used to report newly hired employees to the state, helping prevent fraud and ensuring compliance with child support laws. |

| Legal Requirement | This reporting is mandated by Pennsylvania law under the New Hire Reporting Act, which aligns with federal regulations to support child support enforcement. |

| Information Required | Employers must provide specific employee information: legal name, date of birth, Social Security Number, and date of hire, along with employer details such as FEIN and contact information. |

| Submission Options | Employers can submit the form via fax or mail. There is also an option for online reporting, which is free and eliminates paperwork. |

Guidelines on Utilizing Pa New Hire

Once you have your information ready, you will be filling out the Pennsylvania New Hire Reporting Form. This is an essential step in ensuring that your employment records are accurately submitted to the appropriate state agencies. By following these steps, you'll facilitate a smooth process for reporting new hires in Pennsylvania.

- Begin by entering the Employer FEIN (Federal Employer Identification Number).

- Fill in the Employer Name, ensuring accuracy.

- Provide the Employer Address. Make sure to use a street address, as P.O. boxes are not acceptable.

- Include the Employer Contact Name for any inquiries.

- Input the Employer Contact Phone Number for communicating important information.

- Optionally, provide the Employer Contact Fax Number for further correspondence.

- Enter the Employer Contact Email address.

- Now, turn to the employee information section. Start with the Legal Name of the employee: first, middle, and last.

- Fill in the Employee Social Security Number.

- Complete the employee's Date of Hire using the MM/DD/YYYY format.

- Enter the Date of Birth of the employee following the same date format.

- Include the Employee Address, again using a street address.

- Add an optional Apartment Number if applicable.

- Finish with the Zip Code, City, and State for the employee's address.

When the form is completed, you have options for submission. It can be faxed to either the toll-free number or a local number provided on the form, or you can mail it directly to the designated address. Always keep a copy for your records and ensure that the information is accurate to avoid any delays in processing.

What You Should Know About This Form

What is the Pennsylvania New Hire Reporting Form?

The Pennsylvania New Hire Reporting Form is a document required by the state to report newly hired employees. Employers must complete this form to provide essential employee and employer information. This helps the state ensure compliance with various labor regulations and support programs aimed at children and families.

Who needs to fill out the New Hire Reporting Form?

Employers in Pennsylvania are required to fill out this form for every new employee they hire. This obligation applies to all businesses, regardless of size or type. Additionally, it is crucial to ensure the information is accurate and complete to avoid any delays in processing.

What kind of information is needed on the form?

The form requires specific information such as the employer's Federal Employer Identification Number (FEIN), the employee's social security number, names, addresses, and contact information. It also asks for the date of hire and the date of birth of the employee. All entries need to be legible and can only be printed or typed in blue or black ink.

How do I submit the New Hire Reporting Form?

You can submit the form either by faxing it to 866-PAHIRES (866-748-4473) for toll-free submission, or by mailing it to the New Hire Reporting Program at P.O. Box 69400, Harrisburg, PA 17106-9400. Online reporting is also available, which is encouraged as it is fast, free, and eliminates the need for physical paper submissions.

What happens if I don’t submit the New Hire Reporting Form?

Failure to submit the New Hire Reporting Form can lead to penalties for the employer. Additionally, not providing this information may affect your employee's eligibility for certain benefits and support programs, especially those involving child support enforcement.

Can I report multiple new hires on a single form?

Each New Hire Reporting Form can report only one employee per box. However, you may duplicate the form as necessary to report multiple hires efficiently. Ensure that each new employee's information is clearly documented in separate boxes to avoid any confusion.

How soon do I need to submit the New Hire Reporting Form?

The form must be submitted within 20 days of the employee’s hire date. Timeliness is key to ensuring compliance with state regulations and maintaining good standing as an employer in Pennsylvania.

Who can I contact for questions or assistance with the form?

If you have questions about completing the form or need further assistance, you can call the New Hire Customer Service at 888-PAHIRES (888-724-4737) or reach out via email at RA-LI-CWDS-NewHire@pa.gov. They can provide guidance and support throughout the reporting process.

Common mistakes

When completing the Pennsylvania New Hire Reporting Form, individuals often make several common mistakes that can lead to delays or complications. One significant error is providing incorrect personal information. This includes misspellings of names or entering incorrect Social Security numbers. To ensure a smooth process, it’s critical to double-check these details before submission.

Another frequent mistake is neglecting to use a valid address. The form specifically states that Post Office Boxes are not acceptable. It’s important to provide a physical street address, as failing to do so can result in the rejection of the submission.

Additionally, many people forget to include the date of hire and the employee's date of birth. These dates are essential for record-keeping and compliance. Moreover, if either date is left blank or incorrectly filled out, it could prevent the new hire from being properly entered into the state’s records.

Some filers overlook the requirement that only one employee's information should be included per box. Attempting to provide details for multiple employees in one section can lead to confusion and delays in processing the form. Organizing the form appropriately streamlines the review process.

Individuals also sometimes fail to sign the form, which is a crucial oversight. A lack of a signature can indicate that the information is unverified, delaying processing. Always remember to sign and date the form to validate the information provided.

Errors in the contact information of the employer are another common mistake. Providing incorrect or outdated phone numbers or email addresses can hinder communication, making it difficult for the authorities to reach out if there are questions or issues regarding the submission.

Finally, many individuals do not take advantage of online reporting options. While the form can be mailed or faxed, using online resources is often faster and more efficient. Submitting the form electronically helps to eliminate potential mailing delays and ensures quicker processing.

Documents used along the form

The Pennsylvania New Hire Reporting Form plays a crucial role in the employment process within the state. It is often accompanied by several other forms and documents that assist in the collection of important employee and employer information. Below is a list of additional forms frequently used alongside the New Hire form.

- W-4 Form: Employees use this form to indicate their tax withholding preferences. It determines the amount of federal income tax withheld from paychecks based on the employee's filing status and personal allowances.

- I-9 Form: This document verifies the identity and employment eligibility of individuals hired for employment in the United States. Employees must present valid identification and complete this form within three days of starting work.

- Direct Deposit Authorization Form: Employees complete this form to authorize their employer to deposit their paychecks directly into their bank accounts, providing convenience and ensuring timely payments.

- Employee Handbook Acknowledgment: This form indicates that the employee has received, read, and understands the company’s policies and procedures outlined in the employee handbook.

- Health Insurance Enrollment Form: New employees may use this form to enroll in the company’s health insurance plan. It typically includes information on coverage options and dependent details.

- Emergency Contact Form: Employees fill this form with information regarding persons to contact in case of an emergency. It ensures that relevant individuals can be reached quickly in unforeseen situations.

- Confidentiality Agreement: This document establishes the employee’s commitment to protect sensitive company information and trade secrets during and after their employment.

- Background Check Consent Form: This consent form allows the employer to conduct a background check on the employee. It typically covers criminal history and may include credit checks, depending on the employer's policies.

- Training Acknowledgment Form: Employees use this form to confirm participation in any mandatory training sessions or programs. It serves as a record of compliance with required training.

- Benefits Enrollment Form: This document allows new employees to choose and enroll in various benefits offered by the employer, such as retirement plans, disability insurance, and life insurance.

These additional forms and documents play significant roles in facilitating the hiring process and ensuring compliance with legal and organizational requirements. Employers often require these forms to maintain accurate records for each employee.

Similar forms

W-4 Form: Similar to the PA New Hire form, the W-4 is also used for employment records. It allows employers to withhold the correct amount of federal income tax from employees' paychecks. Both require personal information like social security number and date of hire.

I-9 Form: This form verifies an employee's identity and eligibility to work in the U.S. Like the PA New Hire form, it involves providing personal information and is essential for compliance with employment laws.

State Tax Withholding Form: This document allows employees to indicate their state tax withholding preferences. It shares similarities with the PA New Hire form in that both deal with tax-related information and require preliminary employee details.

Employee Handbook Acknowledgment: While different in purpose, this form confirms that an employee has received and understood the company's policies. Both documents require the employee's legal name and can indicate the start of employment.

Direct Deposit Authorization Form: Employees use this form to set up direct deposit for paychecks. It collects similar personal details as the PA New Hire form, including bank account information to ensure accurate payment processing.

Benefits Enrollment Form: This document is filled out during new hire orientation to enroll in company benefits. It, like the PA New Hire form, gathers personal and employment information but focuses on health and welfare benefits.

Non-Disclosure Agreement (NDA): This form protects company information and requires employee details. Both forms are essential for legal compliance and employee protection, but they serve different purposes within the employment process.

Performance Evaluation Form: Although typically used later in the employment process, this document evaluates an employee’s performance. It contains personal and employment-related information, similar to the PA New Hire form, helping to track employee development.

Dos and Don'ts

When filling out the Pennsylvania New Hire form, it’s important to be precise and thorough. Follow these guidelines to ensure accurate reporting.

- Use blue or black ink. Always fill out the form legibly.

- Provide one employee per box. Do not combine multiple employees on one form.

- Include complete employer and employee information. Ensure all required fields are filled in.

- Verify social security numbers. Ensure the numbers are accurate and legible.

- Check the dates. Dates of hire and birth must be correct and within the required timeframe.

- Send the form to the correct destination. Choose either faxing or mailing based on your preference.

- Use a proper street address. Do not use a PO Box; it is not accepted.

- Do not leave any required fields blank.

- Do not use red ink or any other color than blue or black.

- Avoid using abbreviations in addresses.

- Do not forget to double-check your entries before submission.

- Refrain from sending forms for more than one employee at a time.

- Do not overlook the submission deadlines.

- Avoid failing to keep a copy for your records.

Misconceptions

There are several misconceptions about the Pennsylvania New Hire form. Understanding the truth behind these can help streamline the hiring process.

- Myth 1: Only large employers need to submit the New Hire form.

- Myth 2: The New Hire form is only necessary for full-time employees.

- Myth 3: Submitting the form is optional for employers.

- Myth 4: The New Hire form can be completed in any format.

- Myth 5: There is no deadline for submitting the New Hire form.

- Myth 6: Employers can use a Post Office Box for their address.

This is not true. All employers, regardless of size, are required to report new hires to the appropriate state agency.

In reality, the form must be completed for both full-time and part-time employees. Any new hire must be reported.

This misconception is inaccurate. Reporting new hires is mandatory under both state and federal law. Failure to do so can result in penalties.

This is misleading. The Pennsylvania New Hire form must be filled out legibly, using blue or black ink, and follow the required structure.

In fact, the form must be submitted within 20 days of the employee's hire date. Timeliness is crucial to avoid fines.

This is incorrect. The form requires a physical street address. PO Boxes are not acceptable for employer address submission.

Key takeaways

The Pennsylvania New Hire Form serves an essential role in connecting employers with the state's workforce management systems. When filling out this form, it's crucial to ensure accuracy and completeness. Here are seven key takeaways to consider:

- Use Proper Ink: Fill out the form using blue or black ink only, ensuring that all information is legible. This helps prevent any processing delays.

- One Employee Per Box: It is mandatory to submit one form per employee. Each employee's information should be entered in its designated box, maintaining clarity in records.

- Avoid PO Boxes: Do not use a Post Office Box for the employer's address. Only physical street addresses are accepted, ensuring that correspondence reaches the right location.

- Timely Submission: The form must be submitted within three years of the employee's date of hire. This requirement allows the state to maintain up-to-date employment records.

- Easy Contact Options: Employers can fax or mail the completed forms. The fax numbers and mailing address are provided clearly for ease of access.

- Online Reporting: Consider using the online reporting system, which is fast, free, and saves on postage costs. This paperless option simplifies the reporting process.

- Customer Support: For questions or assistance, contact New Hire Customer Service via phone or email. They provide valuable support for navigating the form and its requirements.

By following these key points, employers can effectively manage their new hire reporting responsibilities while ensuring compliance with state regulations.

Browse Other Templates

Long-Term Care Facility Medicare/Medicaid Application,SNF/NF Certification Application,Health Facility Regulatory Compliance Form,Medicare and Medicaid Provider Form,Nursing Facility Participation Application,Extended Survey Long-Term Care Applicatio - It supports facilities in showcasing their commitment to providing quality long-term care.

Pcs Real Estate - Understanding the DD 2762's instructions increases compliance and efficiency.