Fill Out Your Pa W3R Form

The PA W3R form is an essential document for employers in Pennsylvania, designed to aid in the quarterly reconciliation of income tax withheld from employee wages. This form requires employers to input various identifying details, including the Employer Account ID and the Entity ID, commonly known as the Federal EIN. Additionally, employers must specify the quarter's ending date, as quarterly reporting is a core aspect of compliance. Accurate reporting is crucial; for each reporting period, employers need to provide the total compensation subject to state withholding tax, the total amount of withholding required or actually withheld, and the total deposits made to the Commonwealth. Overpayment and amounts due must also be clearly indicated, ensuring that the correct payments are made to the Pennsylvania Department of Revenue. The form includes sections for both original and amended returns, reinforcing the importance of transparency in reporting tax obligations. To complete the PA W3R form correctly, each line has specific instructions, emphasizing the requirement to report actual tax withheld, rather than deposits remitted. Clear guidelines also instruct employers on where to send the completed form and any payments, which helps streamline the process while ensuring compliance with state tax laws.

Pa W3R Example

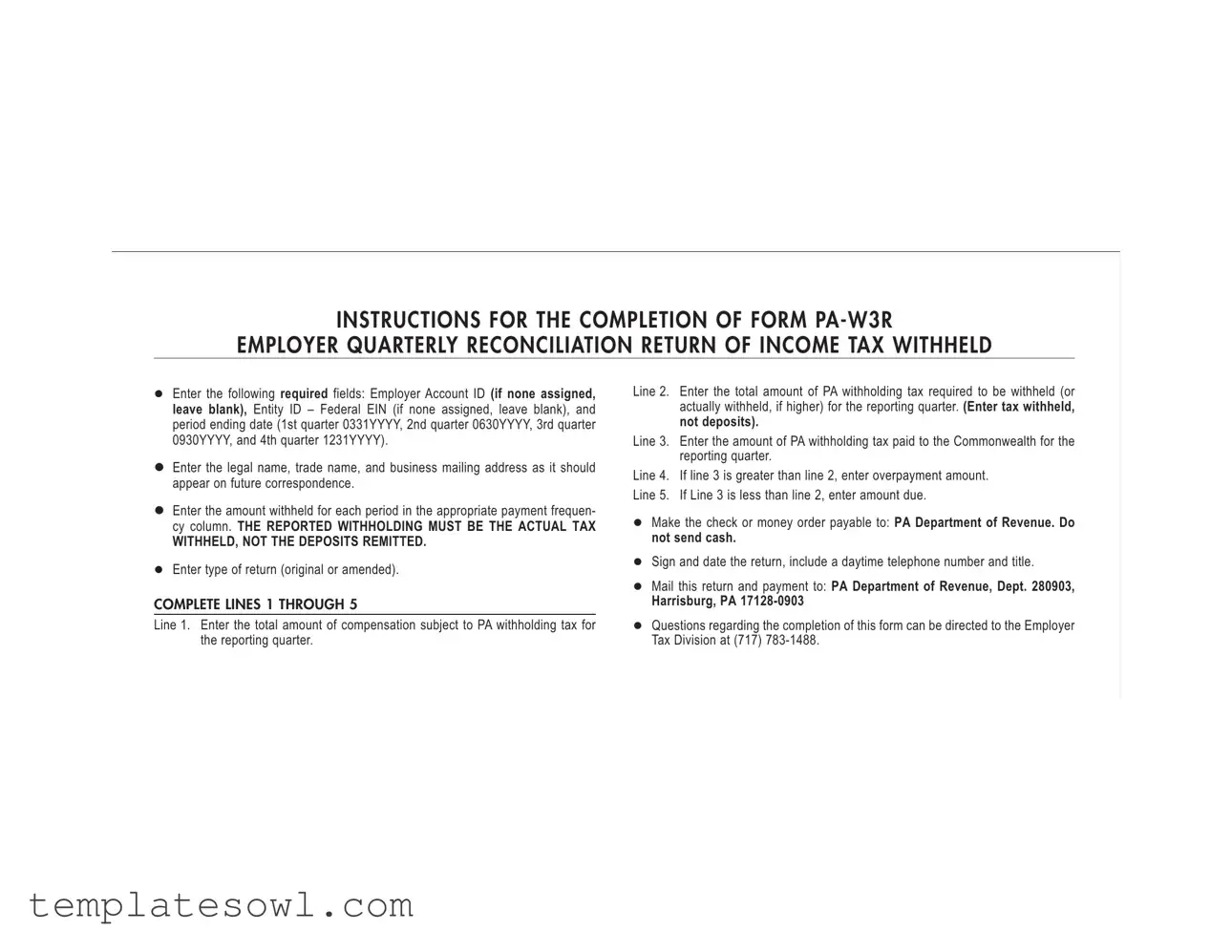

INSTRUCTIONS FOR THE COMPLETION OF FORM

EMPLOYER QUARTERLY RECONCILIATION RETURN OF INCOME TAX WITHHELD

Enter the following required fields: Employer Account ID (if none assigned, leave blank), Entity ID – Federal EIN (if none assigned, leave blank), and period ending date (1st quarter 0331YYYY, 2nd quarter 0630YYYY, 3rd quarter 0930YYYY, and 4th quarter 1231YYYY).

Enter the legal name, trade name, and business mailing address as it should appear on future correspondence.

Enter the amount withheld for each period in the appropriate payment frequen- cy column. THE REPORTED WITHHOLDING MUST BE THE ACTUAL TAX

WITHHELD, NOT THE DEPOSITS REMITTED.

Enter type of return (original or amended).

COMPLETE LINES 1 THROUGH 5

Line 1. Enter the total amount of compensation subject to PA withholding tax for the reporting quarter.

Line 2. Enter the total amount of PA withholding tax required to be withheld (or actually withheld, if higher) for the reporting quarter. (Enter tax withheld, not deposits).

Line 3. Enter the amount of PA withholding tax paid to the Commonwealth for the reporting quarter.

Line 4. If line 3 is greater than line 2, enter overpayment amount. Line 5. If Line 3 is less than line 2, enter amount due.

Make the check or money order payable to: PA Department of Revenue. Do not send cash.

Sign and date the return, include a daytime telephone number and title.

Mail this return and payment to: PA Department of Revenue, Dept. 280903,

Harrisburg, PA

Questions regarding the completion of this form can be directed to the Employer Tax Division at (717)

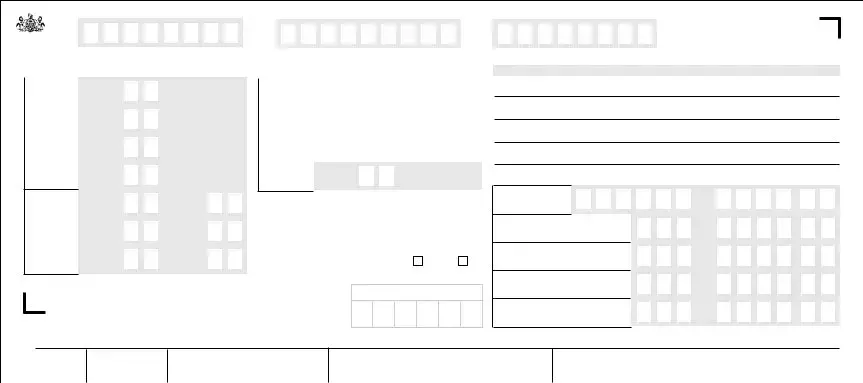

EMPLOYER ACCOUNT ID |

ENTITY ID (EIN) |

PERIOD ENDING DATE |

PA DEPARTMENT

OF REVENUE

PERIOD |

|

|

|

|

SEMI MONTHLY |

|

|

|

|

|

|||

|

|

|

AMOUNTS WITHHELD |

||||||||||

|

|

|

|

||||||||||

1ST HALF |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1ST MONTH |

|

|

|

|

▲ |

|

|

|

● |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2ND HALF |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1ST MONTH |

|

|

|

|

▲ |

|

|

|

● |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1ST HALF |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2ND MONTH |

|

|

|

|

▲ |

|

|

|

● |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2ND HALF |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2ND MONTH |

|

|

|

|

▲ |

|

|

|

● |

|

|

|

|

PERIOD |

|

|

|

|

|

MONTHLY |

|

|

|

|

|

||||

|

|

|

AMOUNTS WITHHELD |

||||||||||||

|

|

|

|

||||||||||||

1ST |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MONTH |

|

|

|

|

|

▲ |

|

|

|

|

● |

|

|

|

|

2ND |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MONTH |

|

|

|

|

|

▲ |

|

|

|

|

● |

|

|

|

|

3RD |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MONTH |

|

|

|

|

|

▲ |

|

|

|

|

● |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL |

|

|

|

|

|

▲ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

(Enter on Line 2) |

|

|

|

|

|

|

|

|

|

● |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

M M D D Y Y Y Y

BUSINESS NAME AND ADDRESS

LEGAL NAME

TRADE NAME

BUSINESS MAILING ADDRESS

CITY, STATE, ZIP

▼ LINES 1 – 5 MUST BE COMPLETED. ▼

1ST HALF |

|

|

|

|

|

|

|

|

|

|

|

3RD MONTH |

|

|

|

|

▲ |

|

|

|

|

● |

|

|

|

|

|

|

|

|

|

|

|

|

|

2ND HALF |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

3RD MONTH |

|

|

|

|

▲ |

|

|

|

|

● |

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL |

|

|

|

|

▲ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

(Enter on Line 2) |

|

|

|

|

|

|

|

|

● |

||

QUARTERLY AMOUNT WITHHELD. |

||||

ENTER ON LINE 2 ONLY ➡ |

|

|

|

|

|

|

|

|

|

TYPE OF RETURN |

ORIGINAL |

AMENDED |

||

Original or amended. Check block. ➡ |

|

|

|

|

1. TOTAL COMPEN- |

|

SATION SUBJECT |

▲ |

TO PA TAX |

2. TOTAL PA WITHHOLDING TAX |

3. TOTAL DEPOSITS FOR QUARTER |

(Including verified overpayments) |

▲  ▲

▲

▲  ▲

▲

▲  ▲

▲

●

●

●

MAILCOMPLETED

DEPT. 280903 HARRISBURG,

DEPARTMENT USE ONLY

4. OVERPAYMENT |

(If Line 3 is greater than Line 2) |

5. TAX DUE/PAYMENT |

$ |

(If Line 3 is less than Line 2) |

▲  ▲

▲

▲  ▲

▲

●

●

I certify that this return is to the best of my knowledge, information and belief, a full, true and correct disclosure of all tax collected or incurred during the period indicated on this return.

00019

DATE

DAYTIME TELEPHONE # |

EXT. TITLE |

()

SIGNATURE

PA DEPARTMENT OF REVENUE DEPT 280903

HARRISBURG PA

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose | The PA-W3R form is used for employer quarterly reconciliation of income tax withheld. |

| Required Fields | Employers must provide their Employer Account ID, Federal EIN, and the period ending date. |

| Compensation Reporting | Line 1 requires the total compensation subject to PA withholding tax for the reporting quarter. |

| Payment Instructions | Payments should be made to the PA Department of Revenue; cash is not accepted. |

| Governing Law | This form is governed by Pennsylvania state law, specifically regarding income tax withholding. |

Guidelines on Utilizing Pa W3R

Filling out the PA W3R form requires careful attention to detail. Each section must be completed accurately to ensure that your tax information is correctly reported. You will need to input your business information and tax details as specified in the instructions. Follow these steps to complete the form correctly.

- Begin by locating your Employer Account ID and Entity ID (Federal EIN). If you do not have these, you can leave these fields blank.

- Enter the period ending date corresponding to the quarter you are reporting on. This should be formatted as follows: 1st quarter (0331YYYY), 2nd quarter (0630YYYY), 3rd quarter (0930YYYY), and 4th quarter (1231YYYY).

- Fill in your business name, trade name, and business mailing address. Ensure that it is accurate for future correspondence.

- For the quarters being reported, enter the amount withheld for each applicable period. Make sure to report the actual tax withheld, not just what has been deposited.

- Indicate the type of return you are filing by checking either the original or amended box.

- Complete Line 1 by entering the total amount of compensation subject to Pennsylvania withholding tax for the reporting quarter.

- On Line 2, input the total amount of PA withholding tax that should have been withheld (or the actual amount withheld if it is higher).

- For Line 3, enter the total amount of PA withholding tax that you have paid to the Commonwealth for the reporting quarter.

- If Line 3 is greater than Line 2, fill out Line 4 with the overpayment amount.

- If Line 3 is less than Line 2, enter the payment amount due on Line 5.

Make your payment by check or money order payable to the PA Department of Revenue. Cash should not be sent. Sign and date the return, and include a daytime telephone number and your title. Finally, send the completed form along with any payments to the address provided for the PA Department of Revenue.

If you have questions, contact the Employer Tax Division at (717) 783-1488 for assistance.

What You Should Know About This Form

What is the PA W3R form?

The PA W3R form is the Employer Quarterly Reconciliation Return of Income Tax Withheld. Employers use this form to report the total amount of compensation subject to Pennsylvania income tax withholding, the amount of tax withheld, and any payments made during the reporting quarter.

Who needs to fill out the PA W3R form?

Any employer who withholds Pennsylvania state income tax from their employees' wages must complete the PA W3R form. This applies to both businesses and organizations that have employees subject to state withholding tax.

How do I complete the PA W3R form?

To complete the PA W3R form, you will need to gather specific information such as your Employer Account ID, Federal EIN, and the period ending date for the quarter. Fill in the legal name, trade name, and mailing address of your business. Enter the appropriate amounts for compensation, withholding, and payments, ensuring accuracy according to the guidelines provided in the form's instructions.

What amounts do I report on lines 1 through 5?

Line 1 is for the total compensation subject to PA withholding tax. Line 2 is the total amount of PA tax that should have been withheld. On Line 3, report the total amount of PA withholding tax you paid. If there’s a difference, Line 4 is for any overpayment, while Line 5 reports any tax due if the payment was less than what was required.

What should I do if I made an overpayment?

If Line 3 shows a greater amount than Line 2, you'll report the overpayment on Line 4. If applicable, this amount can be carried forward to be applied against future tax liabilities or claimed for a refund through the appropriate procedures set by the PA Department of Revenue.

When is the PA W3R form due?

The PA W3R form is due at the end of each quarter. Ensure you submit your completed form by the deadline for each quarter: March 31 for the first quarter, June 30 for the second, September 30 for the third, and December 31 for the fourth quarter.

How do I submit the PA W3R form and payment?

After completing the form, mail it along with any payment due to the PA Department of Revenue at the specified address: Dept. 280903, Harrisburg, PA 17128-0903. Remember to include your check or money order made payable to the PA Department of Revenue. Do not send cash.

Who can I contact for questions about the PA W3R form?

If you have questions or need assistance while filling out the PA W3R form, you can reach the Employer Tax Division at (717) 783-1488 for support and guidance.

Common mistakes

When completing the PA W3R form, many people overlook accurate entries in the required fields. One common mistake is failing to provide the Employer Account ID and the Entity ID (EIN). These identifiers are essential for the Department of Revenue to process the return correctly. If an Employer Account ID has not been assigned, it is important to leave that field blank rather than entering "N/A" or any other notation.

Another frequent error is miscalculating the withheld tax amounts. Taxpayers often confuse the actual amounts withheld with the deposits remitted to the state. It is critical to ensure that the amount reported on Line 2 reflects the actual tax withholdings. Entering the deposit amount instead can result in discrepancies that may require additional follow-up and correction.

Some individuals fail to provide the correct period ending date. The form requires specific formatting based on the quarter, such as 0331YYYY for the first quarter or 1231YYYY for the fourth quarter. Inaccuracies in this date can lead to processing delays and complications in tax filing. Always double-check that the date correlates with the reporting period being completed.

Lastly, many neglect to sign and date the return. Leaving this section incomplete may result in the return being deemed invalid. Additionally, failing to include a daytime telephone number can hinder communication if the tax division has questions. Taking care of these small but significant details can streamline the filing process and promote timely compliance with state tax regulations.

Documents used along the form

The PA W3R form serves as an essential document for employers in Pennsylvania to report income tax withheld from their employees. However, it is often accompanied by several other forms and documents that collectively facilitate tax compliance and reporting. Below are notable documents frequently used alongside the PA W3R form.

- Form PA-40: This is the Pennsylvania personal income tax return. While the PA W3R form is used by employers to report withheld taxes, Form PA-40 is completed by individuals to report their overall income, claim deductions, and calculate their tax liability. Employers may need to provide copies of their PA W3R when their employees file this form.

- Form REV-414: Known as the Employer's Quarterly Withholding Reconciliation Schedule, this form is used to report the total amount of Pennsylvania income tax withheld over a quarter. It serves as a summary to accompany the PA W3R, confirming the amounts reported and ensuring consistency between employer records and tax agency accounts.

- Form 941: This federal tax form, used by employers, reports the total amount of income tax withheld, Social Security tax, and Medicare tax from employees' wages. It is typically submitted on a quarterly basis. The information reported on this form is often cross-referenced with the PA W3R to ensure that withholdings comply with both state and federal tax regulations.

- Form REV-1530: This is the Pennsylvania Employee Withholding Tax Exemption Certificate. Employees may complete this form if they qualify for exemption from withholding due to certain criteria. Employers retain these certificates on file to support their tax withholding practices and ensure they are accurately reflecting employees’ withholding status in their PA W3R filings.

Understanding these documents can streamline the process of compliance for employers. Accurate and timely reporting of tax withholdings is critical for maintaining good standing with the Pennsylvania Department of Revenue and avoiding potential penalties. Each of these forms plays a unique role in the broader picture of tax reporting and compliance.

Similar forms

The PA W3R form serves as an essential document for employers to reconcile their state income tax withholding. Its purpose extends beyond mere compliance, linking various elements of payroll tax management. Similar to the PA W3R form, several other documents fulfill comparable roles in the tax and employment landscape. Here are five such forms, along with explanations of their similarities:

- Form W-2: Employers use the W-2 form to report wages paid and taxes withheld for each employee. Like the PA W3R, it summarizes important tax information, including the amount of federal tax withheld, providing a clear record for both employees and the IRS.

- Form 941: This form reports the amount of payroll taxes withheld from employees and paid to the IRS on a quarterly basis. It is similar to the PA W3R in that it reconciles withholdings, but it focuses on federal taxes instead of state taxes.

- Form 1040: Though primarily for individual taxpayers, the 1040 incorporates withholding information that reflects what has been taken from wages throughout the year. Its connection to the PA W3R lies in both forms reflecting the relationship between wages earned, taxes withheld, and future potential refunds or payments due.

- Form 1099: This form reports income received by non-employees, such as independent contractors. While it serves a different audience than the W3R, both forms require reporting of taxes and income, albeit in different contexts regarding employment status.

- State Income Tax Return Forms: Each state issues its own income tax return forms, which require similar reconciliations of income and taxes paid. These are akin to the PA W3R as they also document withholding amounts, ensuring compliance with state tax laws.

These forms collectively illustrate the broader landscape of tax reporting, where accuracy and transparency are crucial for both employers and employees. Understanding their interconnections helps in efficient tax management and regulatory compliance.

Dos and Don'ts

Completing the PA W3R form accurately is crucial for ensuring compliance with reporting requirements. Here are some important dos and don'ts to consider.

- Do enter your Employer Account ID and Federal EIN if applicable.

- Do ensure that the legal name and trade name match official documents.

- Do use the correct period ending date format (e.g., 0331YYYY for the first quarter).

- Do report the actual amount withheld, not just the deposits remitted.

- Do sign and date the return before submitting it.

- Don't leave any required fields blank unless specified (like Employer Account ID).

- Don't send cash as payment; use a check or money order instead.

- Don't file an amended return without carefully checking the original submission.

- Don't forget to include a contact number for any follow-up questions.

- Don't mail the form without verifying accuracy; mistakes can lead to penalties.

Misconceptions

Misconceptions about the PA W3R form can lead to confusion and errors. Here are eight common misunderstandings:

- The PA W3R is only for businesses with employees. This form is meant for any entity that withholds PA income tax, not just those with traditional employees. Even contractors or sole proprietors who withhold taxes must file.

- You can report estimated taxes instead of actual withholding. It’s essential to report the exact amount of tax withheld from employees, not the estimated deposits that may have been made throughout the quarter.

- Amended returns are not necessary. If you discover an error after filing, you are required to submit an amended return using the PA W3R. This action ensures that the state records are accurate.

- Only the line 3 deposits need to match what was withheld. All lines should reflect accurate figures. Line 1 must show total compensation, while Line 2 should reflect total withholding for the quarter.

- The PA W3R is submitted annually. The PA W3R is a quarterly return. Each quarter requires its own filing, which helps maintain updated tax records.

- Cash payments can be included with the filing. Cash is not accepted for the PA W3R form. Payments should be made via check or money order only.

- You do not need to include your Employer Account ID if it's not assigned. If you don’t have an Employer Account ID, simply leave that section blank. However, ensure that the EIN is accurate to avoid delays.

- The filing deadline is flexible. There are strict deadlines for submitting the PA W3R. It’s crucial to file on time to avoid penalties and interest on unpaid taxes.

Understanding these misconceptions can help ensure proper compliance with PA tax regulations. Always refer to official resources for the most accurate guidance.

Key takeaways

When filling out the PA W3R form, keep these key points in mind:

- Ensure all required fields are filled: This includes the Employer Account ID, Entity ID (EIN), and the period ending date.

- Enter business details correctly: The legal name, trade name, and business mailing address must be accurate for future correspondence.

- Report actual withholding: The amount of income tax withheld should reflect the actual tax collected, not the deposits made.

- Complete lines 1 through 5: This includes total compensation, total withholding tax required, and amounts paid to the Commonwealth.

- Sign and date the return: Along with your signature, include a daytime telephone number and title for clarity.

- Mail your return and payment: Send completed forms to the specified address, and remember not to send cash.

- Contact for assistance: If questions arise, the Employer Tax Division can provide guidance at the listed phone number.

These steps simplify the process of completing and submitting the form, reducing the likelihood of errors or delays.

Browse Other Templates

What Happens When You Declare Cash at Customs - It's essential to complete and submit this form accurately to avoid penalties.

Church Connect Card - Indicate your membership interest to guide our next steps.

Department of Children and Families Florida - This form facilitates access to food assistance, cash assistance, and medical services.