Fill Out Your Pa100 Form

The PA-100 form, also known as the Pennsylvania Enterprise Registration Form, plays a crucial role in the state's business landscape. Designed for enterprises operating in Pennsylvania, it serves multiple purposes, such as registering for various taxes and services overseen by the Pennsylvania Department of Revenue and the Department of Labor & Industry. Enterprises, which include sole proprietorships, partnerships, corporations, and other entities, must accurately complete this form to ensure compliance and avoid penalties. Whether you're a new business just starting out or an established entity looking to add new taxes or services, the PA-100 is essential. It allows you to register, reactivate accounts, and report any changes in business structure or location effectively. Proper completion of the PA-100 facilitates easier interaction with state authorities, allowing enterprises to request important documents like unemployment compensation experience records. Understanding the details required in each section is vital to avoid delays in processing and ensure all necessary information is provided in a clear and legible manner.

Pa100 Example

CommonweAlTh of PennsylvAniA DePARTmenT of Revenue

buReAu of business TRusT funD TAxes Po box 280901

hARRisbuRg, PA

Go Paperless . . .

REGISTER ON THE INTERNET

www.pa100.state.pa.us

P E N N S Y LV A N I A

ENTERPRISE

REGISTRATION

F O R M A N D I N S T R U C T I O N S

AUXILIARY AIDS AND SERVICES ARE AVAILABLE UPON REQUEST TO INDIVIDUALS WITH DISABILITIES.

EQUAL OPPORTUNITY EMPLOYER/PROGRAM.

DETACH AND MAIL COMPLETED REGISTRATION FORM TO:

COMMONWEALTH OF PA • DEPARTMENT OF REVENUE • BUREAU OF BUSINESS TRUST FUND TAXES • PO BOX 280901 • HARRISBURG, PA

PE N NSYLVA NIA E NTERPRISE REGISTRATIO N

The Pennsylvania enterprise Registration form

for registration assistance, contact:

(717)

What is an enterprise?

An enterprise is any individual or organization,

lPays wages to employees

What is an establishment?

An establishment is an economic unit, generally at a single physical location where:

lbusiness is conducted inside PA

lbusiness is conducted outside PA with reporting requirements to PA

lPA residents are employed, inside or outside of PA.

loffers products for sale to others

loffers services for sale to others

lCollects donations

lCollects taxes

lis allocated use of tax dollars

lhas a name which is intended for use and, by that name, is to be recognized as an organization engaged in economic activity.

The enterprise and the establishment may have the same physical location.

Multiple establishments exist if the following apply:

lbusiness is conducted at multiple locations.

lDistinct and separate economic activities involving separate employees are performed at a single location. each activity may be treated as a separate establishment as long as separate reports can be prepared for the number of employees, wages and salaries, or sales and receipts.

How to complete the registration form:

l New registrants must complete every item in sections 1 through 10 and additional sections as indicated.

How to avoid delays in processing:

lReview the registration form and accompanying sections to be sure that every item is complete. The preparer will be contacted

lRegistered enterprises must complete every item in sections 1 through 6 and additional sections as indicated.

lsection 5 has indicators to direct the registrant to additional sections.

lTo determine the registration requirements for a specific tax ser- vice and/or license, see pages 2 and 3.

lType or print legibly using black ink.

lenter all dates in mm/DD/yyyy format (e.g. 01/01/2005).

lRetain a copy of the completed registration form for your records.

to supply information if required sections are not completed.

lenclose payment for license or registration fees, payable to

PA Department of Revenue.

lif a quarterly uC Report/payment is submitted, attach a separate check payable to PA Unemployment Compensation Fund.

lsign the registration form.

lRemove completed pages from the booklet, arrange in sequen- tial order, and mail to the PA Department of Revenue.

It is your responsibility to notify the Bureau of Business Trust Fund Taxes in writing within 30 days of any change to the information provided on the registration form.

Completing this form will NOT fulfill the requirement to register for corporate taxes. Registering corporations must contact the PA Department of State to secure corporate name clearance and register for corporation tax purposes. Contact the PA Depart- ment of State at (717)

TABLE OF

|

|

Form |

Inst. |

|

Section |

Page |

Page |

||

|

mailing Address |

. . . . . . |

front Cover |

|

|

Taxes and services (definitions & requirements) . |

. . . . . . |

||

1 |

Reason for this Registration |

. . . . .4 |

. . . . . |

. .18 |

2 |

enterprise information |

. . . . .4 |

||

3 |

Taxes & services |

. . . . .4 |

. . . . . |

. .19 |

4 |

Authorized signature |

. . . . .4 |

. . . . . |

. .19 |

5 |

business structure |

. . . . .5 |

. . . . . |

. .19 |

6 |

owners, Partners, shareholders, officers, |

. . . . .5 |

. . . . . |

. .19 |

|

Responsible Party information |

|

|

|

6a |

Additional owners, Partners, shareholders, |

. . . .11 . . . . |

. .19 |

|

|

officers, Responsible Party information |

|

|

|

7establishment business Activity

8 establishment sales information . . . . . . . . . . . . .6 . . . . . . .22 9 establishment employment information . . . . . . . .6 . . . . . . .22 10 bulk sale/Transfer information . . . . . . . . . . . . . .6 . . . . . . .22 11 Corporation information . . . . . . . . . . . . . . . . . . . .7 . . . . . . .22 12 Reporting & Payment methods . . . . . . . . . . . . . .7 . . . . . . .22

CO NTE NTS

|

|

Form |

Inst. |

Section |

Page |

Page |

|

13 |

government structure |

. .7 |

. .23 |

14 |

Predecessor/successor information |

. .8 |

. .23 |

15 |

Application for PA uC experience Record & . . |

. .9 |

. .23 |

|

Reserve Account balance of Predecessor |

|

|

16 |

unemployment Compensation Partial |

. .9 |

. .24 |

|

Transfer information |

|

|

17 |

multiple establishment information |

. .24 |

|

18sales use and hotel occupancy Tax

vehicle Rental Tax, Transient vendor

Certificate, Promoter license, or wholesaler Certificate

19 |

Cigarette Dealer’s license |

13 |

. . . . . .25 |

20 |

small games of Chance license/Certificate . . . . |

||

21 |

motor Carrier Registration & Decal/motor |

16 |

|

|

fuels license & Permit |

|

|

22 |

sales Tax exempt status for Charitable and . . . . |

17 |

. . . . . .26 |

|

Religious organizations |

|

|

|

Contact information |

. . . |

|

1

THE FOLLOWING CHART WILL HELP DETERMINE THE SECTIONS OF THIS BOOKLET THAT

SHOULD BE COMPLETED FOR VARIOUS TAX TYPES.

COMPLETE THE SECTIONS THAT APPLY TO YOUR ENTERPRISE.

lnew registrants should complete sections 1 through 10 plus the sections indicated.

lPrevious registrants should complete sections 1 through 6 plus the additional sections indicated.

TAXES AND SERVICES |

|

REQUIREMENTS |

|

SECTIONS TO |

|

|

|

COMPLETE |

|||

|

|

|

|

||

|

l |

CigAReTTe DeAleR’s |

l |

seCTion 19 |

|

CIGARETTE TAX is An exCise TAx imPoseD on The sAle oR Possession of |

|

liCense |

|

|

|

CigAReTTes. A DeAleR is Any CigAReTTe sTAmPing AgenT, wholesAleR, |

|

|

|

|

|

oR ReTAileR. |

l |

sAles TAx liCense |

l |

seCTion 18 |

|

|

|

(ReTAileR) |

|

|

|

|

|

|

|

|

|

CORPORATE NET INCOMEAND CAPITAL STOCK FRANCHISE TAXESARe imPoseD |

l |

RegisTRATion wiTh |

|

|

|

|

PA DePARTmenT of sTATe |

|

|

||

on DomesTiC AnD foReign CoRPoRATions, CeRTAin business TRusTs, AnD |

|

|

|

||

|

|

l |

seCTion 11 |

||

limiTeD liAbiliTy ComPAnies whiCh ARe RegisTeReD AnD/oR TRAnsACTing |

l |

foRms musT be obTAineD |

|||

|

|

||||

business wiThin The CommonweAlTh of PennsylvAniA. subJeCTiviTy To |

|

fRom PA DePARTmenT of |

|

|

|

|

sTATe |

|

|

||

sPeCifiC CoRPoRATion TAxes is DeTeRmineD by The TyPe of CoRPoRATe |

|

|

|

||

|

|

|

|

||

oRgAniZATion AnD The ACTiviTy ConDuCTeD. |

|

|

|

|

|

l FINANCIAL INSTITUTIONS TAXES: The bAnK AnD TRusT ComPAny shARes |

|

|

|

|

|

TAx is imPoseD on eveRy bAnK AnD TRusT ComPAny hAving CAPiTAl |

|

|

|

|

|

sToCK AnD ConDuCTing business in PennsylvAniA. DomesTiC TiTle |

l |

RegisTRATion wiTh feDeR- |

|

|

|

insuRAnCe ComPAnies ARe subJeCT To The TiTle insuRAnCe ComPAny |

|

Al oR sTATe AuThoRiTy |

|

|

|

shARes TAx. The muTuAl ThRifT insTiTuTions TAx is imPoseD on sAv- |

|

|

|

||

|

ThAT gRAnTeD ChARTeR |

|

|

||

ings insTiTuTions, sAvings bAnKs, sAvings AnD loAn AssoCiATions, |

|

|

|

||

|

|

|

|

||

AnD builDing AnD loAn AssoCiATions ConDuCTing business in Penn- |

|

|

|

|

|

sylvAniA. CReDiT unions ARe noT subJeCT To TAx. |

|

|

|

|

|

l GROSS PREMIUMS TAX is levieD on DomesTiC AnD foReign insuRAnCe |

l |

RegisTRATion wiTh |

|

|

|

ComPAnies. The yeARly gRoss PRemiums ReCeiveD foRm The TAx |

|

PA DePARTmenT of |

|

|

|

bAse. gRoss PRemiums ARe PRemiums, PRemium DePosiTs, oR |

|

|

|

||

|

insuRAnCe |

|

|

||

AssessmenTs, foR business TRAnsACTeD in PennsylvAniA. |

|

|

|

||

|

|

|

|

||

l GROSS RECEIPTS TAX is levieD on PiPeline, ConDuiT, wATeR nAvigATion |

|

|

|

|

|

AnD TRAnsPoRTATion ComPAnies; TelePhone, TelegRAPh AnD mobile |

l |

RegisTRATion wiTh PA |

|

|

|

TeleCommuniCATions ComPAnies; eleCTRiC lighT, wATeR PoweR AnD |

|

PubliC uTiliTy |

|

|

|

hyDRoeleCTRiC ComPAnies; AnD fReighT AnD oil TRAnsPoRTATion |

|

Commission |

|

|

|

ComPAnies. |

|

|

|

|

|

The TAx is bAseD on gRoss ReCeiPTs fRom PAssengeRs, bAggAge |

|

|

|

|

|

AnD fReighT TRAnsPoRTeD wiThin PennsylvAniA; TelegRAPh AnD |

|

|

|

|

|

TelePhone messAges TRAnsmiTTeD wiThin PennsylvAniA; AnD sAles |

|

|

|

|

|

of eleCTRiCiTy in PennsylvAniA. |

|

|

|

|

|

l PUBLIC UTILITY REALTY TAX is levieD AgAinsT CeRTAin enTiTies fuR- |

|

|

|

|

|

nishing uTiliTy seRviCes. PennsylvAniA imPoses This TAx on PubliC |

l |

RegisTRATion wiTh PA |

|

|

|

uTiliTy ReAlTy in lieu of loCAl ReAl esTATe TAxes AnD DisTRibuTes |

|

PubliC uTiliTy Commission |

|

|

|

The loCAl ReAlTy TAx eQuivAlenT To loCAl TAxing AuThoRiTies. |

|

|

|

|

|

l OTHER CORPORATION TAXES: This gRouP is ComPoseD PRimARily of |

l |

RegisTRATion wiTh PA |

|

|

|

The CoRPoRATe loAns TAx, The CooPeRATive AgRiCulTuRAl AssoCiA- |

|

DePARTmenT of sTATe |

|

|

|

Tion AnD eleCTRiC CooPeRATive CoRPoRATion TAxes. |

|

|

|

||

|

|

|

|

||

|

|

|

|

|

|

EMPLOYER WITHHOLDING is The wiThholDing of PennsylvAniA PeRsonAl |

|

|

|

|

|

inCome TAx by emPloyeRs fRom ComPensATion PAiD To PennsylvAniA |

|

|

l |

seCTion 9 |

|

ResiDenT emPloyees foR woRK PeRfoRmeD insiDe oR ouTsiDe of Penn- |

|

|

|||

|

|

|

|

||

sylvAniA AnD nonResiDenT emPloyees foR woRK PeRfoRmeD insiDe |

|

|

|

|

|

PennsylvAniA. (see unemPloymenT ComPensATion DefiniTion) |

|

|

|

|

|

|

|

|

|

|

|

LIQUID FUELS AND FUELS TAX is An exCise TAx imPoseD on All liQuiD fuels |

|

|

|

|

|

AnD fuels useD oR solD AnD DeliveReD by DisTRibuToRs wiThin Penn- |

|

|

|

|

|

sylvAniA, exCePT Those DeliveReD To exemPT PuRChAseRs. liQuiD fuels |

l |

liQuiD fuels AnD fuels |

l |

seCTion 21 |

|

inCluDe gAsoline, gAsohol, JeT fuel, AnD AviATion gAsoline. fuels |

|

TAx PeRmiT |

|||

inCluDe CleAR Diesel fuel AnD KeRosene. ADDiTionAlly, The liQuiD |

|

|

|

||

|

|

|

|

||

fuels AnD fuels TAx ACT TAxes AlTeRnATive fuels (i.e. highwAy fuels |

|

|

|

|

|

oTheR ThAn liQuiD fuels oR fuels) AT A ReTAil/use TAx level. |

|

|

|

|

|

|

|

|

|

|

|

MOTOR CARRIERS ROAD TAX is imPoseD on moToR CARRieRs engAgeD in |

|

|

|

|

|

oPeRATions on PennsylvAniA highwAys. A moToR CARRieR is Any PeRson |

l |

ifTA liCense AnD |

|

|

|

oR enTeRPRise oPeRATing A QuAlifieD moToR vehiCle useD, DesigneD, |

|

ifTA DeCAls |

|

|

|

oR mAinTAineD foR The TRAnsPoRTATion of PeRsons oR PRoPeRTy |

|

|

|

||

|

|

|

|

||

wheRe (A) The PoweR uniT hAs Two Axles AnD A gRoss oR RegisTeReD |

l |

PA |

l |

seCTion 21 |

|

|

|

||||

gRoss weighT gReATeR ThAn 26,000 PounDs, (b) The PoweR uniT hAs |

|

RegisTRATion AnD PA non- |

|

|

|

ThRee Axles oR moRe RegARDless of weighT, oR (C) vehiCles ARe useD |

|

|

|

||

|

ifTA DeCAls |

|

|

||

in CombinATion AnD The DeClAReD CombinATion weighT exCeeDs 26,000 |

|

|

|

||

|

|

|

|

||

PounDs oR The gRoss weighT of The vehiCles exCeeDs 26,000 PounDs. |

|

|

|

|

|

|

|

|

|

|

2

PROMOTER is Any enTeRPRise engAgeD in RenTing, leAsing, oR gRAnTing PeR- |

|

|

|

|

mission To Any PeRson To use sPACe AT A show foR The DisPlAy oR foR The |

l |

PRomoTeR liCense |

l |

seCTion 18 |

sAle of TAngible PeRsonAl PRoPeRTy oR seRviCes. |

|

|

|

|

|

|

|

|

|

PUBLIC TRANSPORTATION ASSISTANCE FUND TAX is A TAx oR fee imPoseD on eACh |

l |

sAles use AnD hoTel |

|

|

sAle in PennsylvAniA of new TiRes foR highwAy use, on The leAse of moToR |

|

oCCuPAnCy TAx liCense |

|

|

vehiCles, AnD on The RenTAl of moToR vehiCles. The TAx is Also levieD on The |

|

l |

seCTion 18 |

|

|

PubliC TRAnsPoRTATion |

|||

sTATe TAxAble vAlue of uTiliTy ReAlTy of enTeRPRises subJeCT To The PubliC |

l |

|

|

|

uTiliTy ReAlTy TAx AnD on PeTRoleum Revenue of oil ComPAnies. |

|

AssisTAnCe TAx liCense |

|

|

|

|

|

|

|

REPORTING AND PAYMENT METHODS offeR The enTeRPRise The AbiliTy To file |

|

|

|

|

CeRTAin TAx ReTuRns AnD mAKe eleCTRoniC PAymenTs ThRough The eleCTRon- |

|

|

|

|

iC TAx infoRmATion AnD DATA exChAnge sysTem |

|

|

|

|

sysTem. eleCTRoniC PAymenT mAy Also be mADe ThRough eleCTRoniC funDs |

l |

AuThoRiZATion |

l |

seCTion 12 |

TRAnsfeR (efT) oR CReDiT CARD. unemPloymenT ComPensATion (uC) wAges mAy |

|

AgReemenT |

||

|

|

|

||

be RePoRTeD viA A mAgneTiC meDium. in CeRTAin insTAnCes, An enTeRPRise mAy |

|

|

|

|

|

|

|

|

|

eleCT To finAnCe uC CosTs unDeR A ReimbuRsemenT meThoD RATheR ThAn The |

|

|

|

|

ConTRibuToRy meThoD. |

|

|

|

|

|

|

|

|

|

SALES TAX isAn exCise TAx imPoseD on The ReTAil sAle oR leAse of TAxAble, TAn- |

l |

sAles use AnD hoTel |

l |

seCTion 18 |

gible PeRsonAl PRoPeRTy, AnD on sPeCifieD seRviCes. |

|

oCCuPAnCy TAx liCense |

|

|

|

|

|

|

|

l HOTEL OCCUPANCY TAX is An exCise TAx imPoseD on eveRy hoTel oR moTel |

l |

sAles use AnD hoTel |

|

seCTion 18 |

Room oCCuPAnCy less ThAn 30 ConseCuTive DAys. |

|

oCCuPAnCy TAx liCense |

l |

|

|

|

|

|

|

l LOCALSALES TAX mAy be imPoseD in PhilADelPhiAoRAllegheny CounTies, in |

l |

sAles use AnD hoTel |

|

|

ADDiTion To The sTATe sAles AnD use TAx, on The ReTAil sAle oR use of TAn- |

|

|

||

gible PeRsonAl PRoPeRTy AnD seRviCes AnD on hoTel/moTel oCCuPAnCies. |

|

oCCuPAnCy TAx liCense |

l |

seCTion 18 |

|

|

|

|

|

|

|

|

|

|

SALES TAX EXEMPT STATUS FOR CHARITABLEAND RELIGIOUS ORGANIZATIONS is The |

|

|

|

|

QuAlifiCATion of An insTiTuTion of PuRely PubliC ChARiTy To be exemPT fRom |

l |

CeRTifiCATe of exemPT |

l |

seCTion 22 |

sAles AnD use TAx on The PuRChAse of TAngible PeRsonAl PRoPeRTy oR seR- |

|

sAles TAx sTATus |

||

|

|

|

||

viCes foR use in ChARiTAble ACTiviTy. |

|

|

|

|

|

|

|

|

|

|

l smAll gAmes of ChAnCe |

|

|

|

SMALL GAMES OF CHANCE is The RegulATion of limiTeD gAmes of ChAnCe ThAT |

|

DisTRibuToR liCense |

|

|

QuAlifieD ChARiTAble AnD |

|

AnD/oR |

l |

seCTion 20 |

sylvAniA. |

l |

mAnufACTuReR |

|

|

|

|

|

||

|

|

RegisTRATion CeRTifiCATe |

|

|

|

|

|

|

|

TRANSIENT VENDOR is Any enTeRPRise whose business sTRuCTuRe is sole PRo- |

|

|

|

|

PRieToR oR PARTneRshiP, noT hAving A PeRmAnenT PhysiCAl business loCATion |

l |

TRAnsienT venDoR |

l |

seCTion 18 |

in PennsylvAniA, whiCh sells TAxAble, TAngible PeRsonAl PRoPeRTy oR PeR- |

|

CeRTifiCATe |

||

|

|

|

||

foRms TAxAble seRviCes in PennsylvAniA. |

|

|

|

|

|

|

|

|

|

UNEMPLOYMENT COMPENSATION (UC) PRoviDes A funD fRom whiCh ComPensATion |

|

|

|

|

is PAiD To woRKeRs who hAve beCome unemPloyeD ThRough no fAulT of TheiR |

|

|

|

|

own. ConTRibuTionsARe ReQuiReD To be mADe byAll emPloyeRs who PAy wAges |

|

|

l |

seCTions 7, 9, |

To inDiviDuAls woRKing in PA AnD whose seRviCes ARe CoveReD unDeR The uC |

l |

APPliCATion foR |

|

if APPliCAble |

lAw. This TAx mAy inCluDe emPloyee ConTRibuTions wiThhelD by emPloyeRs |

|

10 AnD 14 |

||

fRom eACh emPloyee’s gRoss wAges. (see emPloyeR wiThholDing DefiniTion) |

|

exPeRienCe ReCoRD AnD |

|

|

|

ReseRve ACCounT |

|

|

|

|

|

l |

seCTions 14, |

|

l APPLICATION FOR PA UC EXPERIENCE RECORD AND RESERVE ACCOUNT BAL- |

|

bAlAnCe of PReDeCessoR |

||

|

|

15. if APPliC- |

||

ANCE enAbles The RegisTeRing enTeRPRise To benefiT fRom A PReDeCes- |

|

|

|

|

|

|

|

Able, 16 |

|

soR’s RePoRTing hisToRy. RefeR To The insTRuCTions To DeTeRmine if This |

|

|

|

|

|

|

|

|

|

is ADvAnTAgeous. |

|

|

|

|

|

|

|

|

|

USE TAX is An exCise TAx imPoseD on PRoPeRTy useD in PennsylvAniA on whiCh |

l |

use TAx ACCounT |

l |

seCTion 18 |

sAles TAx hAs noT been PAiD. |

|

|

|

|

|

|

|

|

|

VEHICLE RENTAL TAX is imPoseD on RenTAl ConTRACTs by enTeRPRises hAving |

l |

sAles use AnD hoTel |

|

|

AvAilAble foR RenTAl: (1) 5 oR moRe moToR vehiCles DesigneD To CARRy 15 oR |

|

oCCuPAnCy TAx liCense |

l |

seCTion 18 |

less PAssengeRs, oR (2) TRuCKs, TRAileRs, oR |

|

|||

|

|

|||

l |

PTA liCense |

|

|

|

PoRTATion of PRoPeRTy. A RenTAl ConTRACT is foR A PeRioD of 29 DAys oR less. |

|

|

||

|

|

|

|

|

WHOLESALER CERTIFICATE PeRmiTs An enTeRPRise solely engAgeD in selling |

|

|

|

|

TAngible PeRsonAl PRoPeRTy AnD/oR seRviCes foR ResAle. To PuRChAse TAngi- |

l |

wholesAleR CeRTifiCATe |

l |

seCTion 18 |

ble PeRsonAl PRoPeRTy oR seRviCes foR ResAle |

|

|

|

|

noRmAl CouRse of The enTeRPRise’s business. |

|

|

|

|

|

|

|

|

|

WORKERS’ COMPENSATION COVERAGE is MANDATORY AnD PRoTeCTs emPloyees |

|

|

|

|

fRom wAge loss benefiTs AnD meDiCAl exPenses inCuRReD As A ResulT of Job |

|

|

|

|

RelATeD inJuRies oR DiseAses. emPloyeRs ThAT mAinTAin woRKeRs’ ComPensA- |

|

|

|

|

Tion CoveRAge ARe immune To lAwsuiTs flowing fRom |

|

|

|

|

oTheR ThAn Those ACTions fileD unDeR The woRKeRs’ ComPensATion ACT. |

|

|

|

|

eveRy emPloyeR liAble unDeR The PA woRKeRs’ ComPensATion ACT shAll |

l |

woRKeRs’ ComPensATion |

l |

seCTion 9 |

insuRe The PAymenT of ComPensATion wiTh The sTATe woRKmen’s insuRAnCe |

|

CoveRAge |

|

|

funD, oR wiTh Any PRivATe insuRAnCe ComPAny, oR muTuAl AssoCiATion oR |

|

|

|

|

ComPAny, AuThoRiZeD To insuRe suCh liAbiliTy in This CommonweAlTh oR by |

|

|

|

|

seCuRing The AuThoRiTy To |

|

|

|

|

fRom The CoveRAge ReQuiRemenTs, AnD fAll inTo one oR moRe of The exemPT |

|

|

|

|

CATegoRies, woRKeRs’ ComPensATion musT be ConTinuAlly mAinTAineD wiTh |

|

|

|

|

no inTeRRuPTion in CoveRAge. |

|

|

|

|

|

|

|

|

|

3

MAIL COMPLETED APPLICATION TO:

DEPARTMENT OF REVENUE

BUREAU OF BUSINESS TRUST FUND TAXES

PO BOX 280901

HARRISBURG, PA

TYPE OR PRINT LEGIBLY, USE BLACK INK

COMMONWEALTH OF PENNSYLVANIA

PA ENTERPRISE

REGISTRATION FORM

DEPARTMENT USE ONLY

RECEIVED DATE

DePARTmenT of Revenue &

DePARTmenT of lAboR AnD inDusTRy

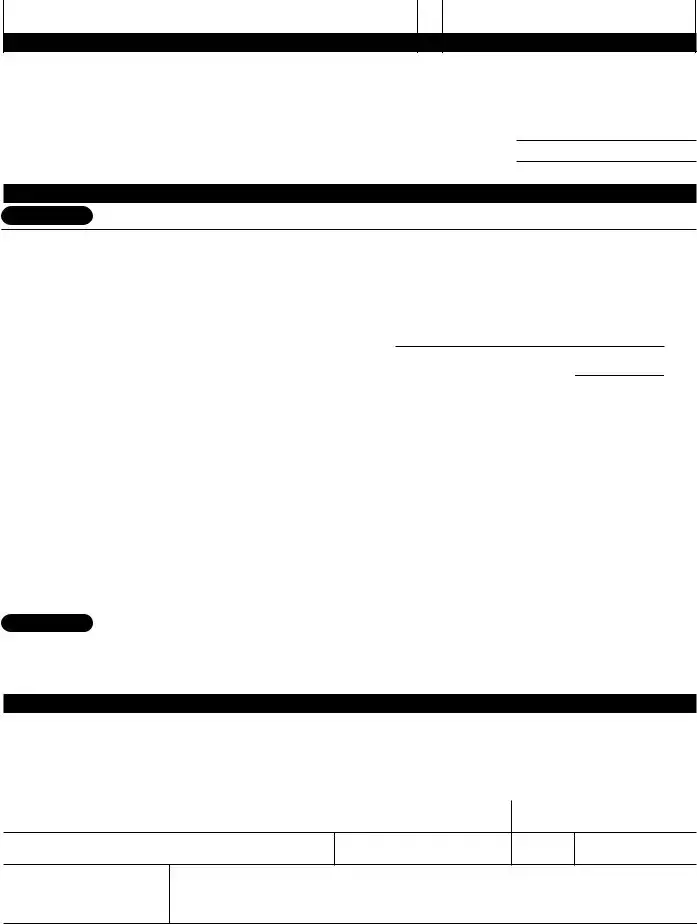

SECTION 1 – REASON FOR THIS REGISTRATION

RefeR To The insTRuCTions (PAge 18) AnD CheCK The APPliCAble box(es) To inDiCATe The ReAson(s) foR This RegisTRATion.

1. |

o new RegisTRATion |

|

2. |

o ADDing TAx(es) & seRviCe(s) |

|

3. |

o ReACTivATing TAx(es) & seRviCe(s) |

|

4. |

o |

ADDing esTAblishmenT(s) |

5. |

o |

infoRmATion uPDATe |

6. DiD This enTeRPRise:

o yes |

o no |

ACQuiRe All oR PART of AnoTheR business? |

o yes |

o no |

ResulT fRom A ChAnge in legAl sTRuCTuRe (foR exAmPle, fRom inDiviDuAl |

|

|

PRoPRieToR To CoRPoRATion, PARTneRshiP To CoRPoRATion, CoRPoRATion |

|

|

To limiTeD liAbiliTy ComPAny, eTC)? |

o yes |

o no |

unDeRgo A meRgeR, ConsoliDATion, DissoluTion, oR oTheR ResTRuCTuRing? |

SECTION 2 – ENTERPRISE INFORMATION

1. DATe of fiRsT oPeRATions |

2. DATe of fiRsT oPeRATions in PA |

3. enTeRPRise fisCAl yeAR enD

4. |

enTeRPRise legAl nAme |

|

|

|

5. |

feDeRAl emPloyeR iDenTifiCATion numbeR (ein) |

||||

|

|

|

|

|

|

|

|

|

|

|

6. |

enTeRPRise TRADe nAme (if different than legal name) |

|

|

|

7. |

enTeRPRise TelePhone numbeR |

|

|||

|

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8. |

enTeRPRise sTReeT ADDRess (do not use PO Box) |

|

CiTy/Town |

|

|

CounTy |

sTATe |

|

ZiP CoDe + 4 |

|

|

|

|

|

|

|

|

|

|

|

|

9. |

enTeRPRise mAiling ADDRess (if different than street address) |

|

|

CiTy/Town |

|

|

|

sTATe |

|

ZiP CoDe + 4 |

|

|

|

|

|

|

|

|

|

|

|

10. |

loCATion of enTeRPRise ReCoRDs (street address) |

|

|

CiTy/Town |

|

|

|

sTATe |

|

ZiP CoDe + 4 |

|

|

|

|

|

|

|

|

|

||

11. |

esTAblishmenT nAme (doing business as) |

12. numbeR of |

13. PA sChool DisTRiCT |

14. PA muniCiPAliTy |

||||||

|

|

|

esTAblishmenTs * |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*ENTERPRISES WITH ONE OR MORE ESTABLISHMENTS WITHIN PA, WHOSE PA ADDRESS WAS NOT ENTERED ABOVE, MUST COMPLETE SECTION 17. (SEE GENERAL INSTRUCTIONS AND SECTION 17 FOR MORE INFORMATION.)

SECTION 3 – TAXES AND SERVICES

All RegisTRAnTs musT CheCK The APPliCAble box(es) To inDiCATe The TAx(es) AnD seRviCe(s) ReQuesTeD foR This RegisTRATion AnD ComPleTe The CoRResPonDing seCTions inDiCATeD on PAges 2 AnD 3. if ReACTivATing Any PRevious ACCounT(s), lisT The ACCounT numbeR(s) in The sPACe PRoviDeD.

PREVIOUS |

ACCOUNT NUMBER |

oCigAReTTe DeAleR’s liCense

oCoRPoRATion TAxes

oemPloyeR wiThholDing TAx/1099 misC

ofuels TAx PeRmiT

oliQuiD fuels TAx PeRmiT

omoToR CARRieRs RoAD TAx/ifTA

oPRomoTeR liCense

oPubliC TRAnsPoRTATion AssisTAnCe TAx liCense

osAles TAx exemPT sTATus

SECTION 4 – AUTHORIZED SIGNATURE

o

o o o o o o o

sAles, use, hoTel oCCuPAnCy TAx liCense

smAll gAmes of ChAnCe liC./CeRT.

TRAnsienT venDoR CeRTifiCATe

unemPloymenT ComPensATion

use TAx

vehiCle RenTAl TAx

wholesAleR CeRTifiCATe

woRKeRs’ ComPensATion CoveRAge

i, (we) The unDeRsigneD, DeClARe unDeR The PenAlTies of PeRJuRy ThAT The sTATemenTs ConTAineD heRein ARe TRue, CoRReCT, AnD ComPleTe.

AuThoRiZeD signATuRe (ATTACh PoweR of ATToRney if APPliCAble) |

DAyTime TelePhone numbeR |

TiTle |

||

|

|

( |

) |

|

|

|

|

||

TyPe oR PRinT nAme |

DATe |

|||

|

|

|

|

|

TyPe oR PRinT PRePAReR’s nAme |

|

|

TiTle |

|

|

|

|

||

DAyTime TelePhone numbeR |

DATe |

|||

( |

) |

|

|

|

4

|

DePARTmenT use only |

|

|

|

|

enTeRPRise nAme |

|

|

SECTION 5 – BUSINESS STRUCTURE

CheCK The APPRoPRiATe box foR QuesTions 1, 2 & 3. in ADDiTion To seCTions 1 ThRough 10, ComPleTe The seCTion(s) inDiCATeD.

1. |

o sole PRoPRieToRshiP (inDiviDuAl) |

o geneRAl PARTneRshiP |

o AssoCiATion |

o limiTeD liAbiliTy ComPAny |

||

|

o CoRPoRATion (sec. 11) |

o limiTeD PARTneRshiP |

o business TRusT |

STATE WHERE CHARTERED |

||

|

|

|

||||

|

o goveRnmenT (sec. 13) |

o limiTeD liAbiliTy PARTneRshiP |

o esTATe |

o ResTRiCTeD PRofessionAl ComPAny |

||

|

|

|

o JoinT venTuRe PARTneRshiP |

|

STATE WHERE CHARTERED |

|

|

o PRofiT |

o |

|

|

|

|

2. |

is The enTeRPRise oRgAniZeD foR PRofiT oR |

|

|

|||

3. |

o yes |

o no |

is The enTeRPRise exemPT fRom TAxATion unDeR inTeRnAl Revenue CoDe (iRC) seCTion 501(c)(3)? if yes, |

|||

|

|

|

PRoviDe A CoPy of The enTeRPRise's exemPTion AuThoRiZATion leTTeR fRom The inTeRnAl Revenue seRviCe. |

|||

SECTION 6 – OWNERS, PARTNERS, SHAREHOLDERS, OFFICERS, AND RESPONSIBLE PARTY INFORMATION

PRoviDe The following foR ALL inDiviDuAlAnD/oR enTeRPRise owneRs, PARTneRs, shAReholDeRs, offiCeRs, AnD ResPonsible PARTies. if sToCK is PubliCly TRADeD, PROVIDE THE FOLLOWING FOR ANY SHAREHOLDER WITH AN EQUITY POSITION OF 5% OR MORE. ADDITIONALSPACE ISAVAILABLE IN SECTION 6A, PAGE 11.

1. |

nAme |

|

|

|

2. soCiAl seCuRiTy numbeR |

3. |

DATe of biRTh * |

|

4. |

feDeRAl ein |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5. |

o owneR |

o offiCeR |

6. TiTle |

|

|

|

7. effeCTive DATe |

8. |

PeRCenTAge of |

|

9. |

effeCTive DATe of |

||

|

o PARTneR |

o shAReholDeR |

|

|

|

|

of TiTle |

|

owneRshiP |

|

|

owneRshiP |

||

|

o ResPonsible PARTy |

|

|

|

|

|

|

|

|

|

% |

|

|

|

10. home ADDRess (street) |

|

|

CiTy/Town |

|

|

CounTy |

|

|

sTATe |

|

ZiP CoDe + 4 |

|||

|

|

|

|

|

|

|

|

|

|

|||||

11. This PeRson is ResPonsible To RemiT/mAinTAin: |

o sAles TAx |

o emPloyeR wiThholDing TAx |

o moToR fuel TAxes |

|||||||||||

owoRKeRs’ ComPensATion CoveRAge

* DATe of biRTh ReQuiReD only if APPlying foR A CigAReTTe wholesAle DeAleR’s liCense, A smAll gAmes of ChAnCe DisTRibuToR liCense, oR A smAll gAmes of ChAnCe mAnufACTuReR CeRTifiCATe.

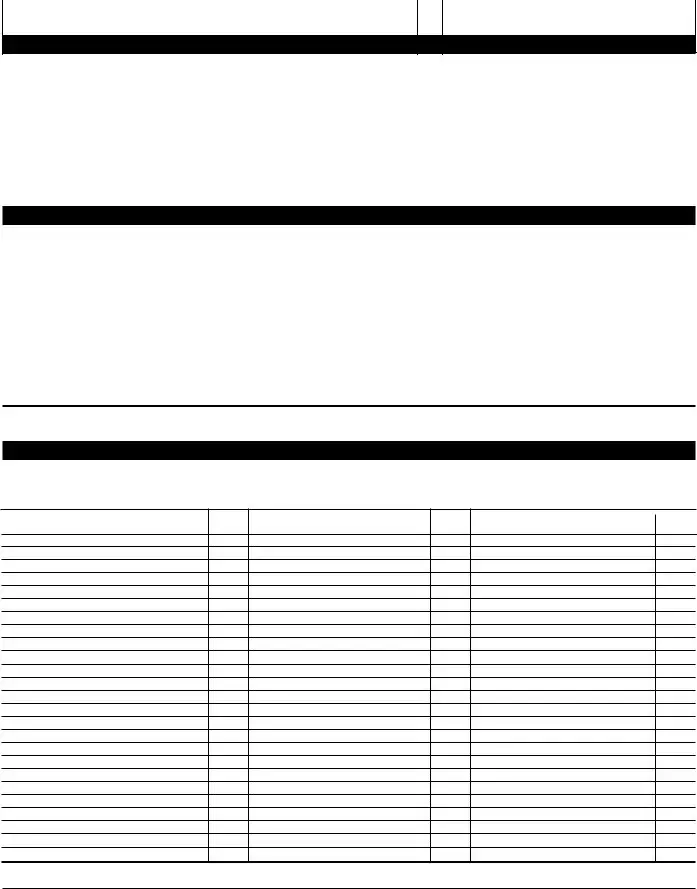

SECTION 7 – ESTABLISHMENT BUSINESS ACTIVITY INFORMATION

REFER TO THE INSTRUCTIONS ON PAGES 20 & 21 TO COMPLETE THIS SECTION. COMPLETE SECTION 17 FOR MULTIPLE ESTABLISHMENTS.

1.enTeR The PeRCenTAge ThAT eACh PABUSINESS ACTIVITY RePResenTs of The ToTAl ReCeiPTs oR Revenues AT THIS esTAblishmenT. lisT PRODUCTS OR SERVICES AssoCiATeD wiTh eACh business ACTiviTy AnD The PeRCenTAge RePResenTing The ToTAl ReCeiPTs oR Revenues.

PA BUSINESS ACTIVITY |

% |

PRODUCTS OR SERVICES |

% |

ADDITIONAL |

% |

|

PRODUCTS OR SERVICES |

||||||

|

|

|

|

Accommodation & food services

Agriculture, forestry, fishing, & hunting

Art, entertainment, & Recreation services

Communications/information

Construction (must complete question 3)

Domestics (Private households)

educational services

finance

health Care services

insurance

management, support & Remediation services

manufacturing |

|

mining, Quarrying, & oil/gas extraction |

|

other services |

|

Professional, scientific, & Technical services |

|

Public Administration |

|

Real estate |

|

Retail Trade |

|

sanitary service |

|

social Assistance services |

|

Transportation |

|

utilities |

|

warehousing |

|

wholesale Trade |

|

ToTAl |

100% |

2.enTeR The PeRCenTAge ThAT THIS ESTABLISHMENT’S ReCeiPTs oR Revenues RePResenT of The TOTAL PAReCeiPTs oR Revenues of The enTeRPRise.

______________ %. single esTAblishmenT enTeRPRises enTeR 100%. mulTiPle esTAblishmenT enTeRPRises enTeR PeRCenTAge of enTeRPRise (see seCTion 17).

3.esTAblishmenTs engAgeD in ConsTRuCTion MUST enTeR The PeRCenTAge of ConsTRuCTion ACTiviTy ThAT is new AnD/oR RenovATive AnD The PeRCenT- Age of ConsTRuCTion ACTiviTy ThAT is ResiDenTiAlAnD/oR CommeRCiAl.

|

___________________ % new |

+ |

__________________ % RenovATive |

= |

100% |

|

|

___________________ % ResiDenTiAl |

+ |

__________________ % CommeRCiAl |

= |

100% |

|

|

|

|

|

|

||

4. o yes o no |

Does This enTeRPRise wAnT To beCome A PennsylvAniA loTTeRy ReTAileR? |

|

|

|

||

|

|

|

|

|

|

|

5

|

DePARTmenT use only |

|

|

|

|

enTeRPRise nAme |

|

|

SECTION 8 – ESTABLISHMENT SALES INFORMATION

1. |

o yes |

o no |

is This esTAblishmenT selling TAxAble PRoDuCTs oR offeRing TAxAble seRviCes To ConsumeRs fRom A loCATion |

|

|

|

IN PENNSYLVANIA? if yes, ComPleTe seCTion 18. |

2. |

o yes |

o no |

is This esTAblishmenT selling CigAReTTes IN PENNSYLVANIA? if yes, ComPleTe seCTions 18 AnD 19. |

3. lisT eACh CounTy IN PENNSYLVANIA wheRe This esTAblishmenT is ConDuCTing TAxAble sAles ACTiviTy(ies).

CounTy |

|

CounTy |

|

|

CounTy |

CounTy |

|

CounTy |

|

|

CounTy |

|

|

ATTACH ADDITIONAL 8 1/2 X 11 SHEETS IF NECESSARY. |

|

||

SECTION 9 – ESTABLISHMENT EMPLOYMENT INFORMATION

PART 1

1. o yes o

2. o yes o

no |

Does This esTAblishmenT emPloy inDiviDuAls who WORK IN PENNSYLVANIA? if yes, inDiCATe: |

|

|

|

|

a. |

DATe wAges fiRsT PAID (mm/DD/yyyy) |

. . |

. |

|

b. |

. . . . .DATe wAges ResumeD following A bReAK in emPloymenT |

. . |

. |

|

c. |

. . . . .ToTAl numbeR of emPloyees |

. . |

. |

|

d. |

. . . . .numbeR of emPloyees PRimARily woRKing in new builDing oR infRAsTRuCTuRe |

. . |

. |

|

e. |

. . . . .numbeR of emPloyees PRimARily woRKing in RemoDeling ConsTRuCTion |

. . |

. |

|

f. |

esTimATeD gRoss wAges PeR QuARTeR |

.$ |

.00 |

g.nAme of woRKeRs’ ComPensATion insuRAnCe ComPAny

1. PoliCy numbeR _________________________________effeCTive sTART DATe __________________enD DATe ___________________

2. AgenCy nAme ______________________________________________________DAyTime TelePhone numbeR ( )

mAiling ADDRess _____________________________________CiTy/Town ______________________sTATe _____ZiP CoDe + 4________

3.if This enTeRPRise Does noT hAve woRKeRs’ ComPensATion insuRAnCe, CheCK one:

|

a. |

This esTAblishmenT emPloys only exCluDeD woRKeRs |

o |

||

|

b. |

. . . . . . . . .This esTAblishmenT hAs ZeRo emPloyees |

o |

||

|

c. |

This esTAblishmenT ReCeiveD APPRovAl To |

|

|

|

|

|

woRKeRs’ ComPensATion |

o |

||

|

|

if iTem 3c. is CheCKeD, PRoviDe PA woRKeRs’ ComPensATion buReAu CoDe |

|

|

|

no |

Does This esTAblishmenT emPloy PA ResiDenTs who WORK OUTSIDE OF PENNSYLVANIA? |

|

|

||

|

if yes, inDiCATe: |

|

|

||

|

a. |

DATe wAges fiRsT PAID (mm/DD/yyyy) |

|

|

|

|

b. |

. . . . . . . . . .DATe wAges ResumeD following A bReAK in emPloymenT |

|

|

|

|

c. |

esTimATeD gRoss wAges PeR QuARTeR. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$ |

.00 |

||

3. |

o yes |

o no |

Does This esTAblishmenT PAy RemuneRATion foR seRviCes To PeRsons you Do noT ConsiDeR emPloyees? |

|

|

|||||

|

|

|

|

if yes, exPlAin The seRviCes PeRfoRmeD |

|

|

|

|

|

|

4. |

o yes |

o no |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

PART 2 |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

1. |

o yes |

o no |

is This RegisTRATion A ResulT of A TAxAble DisTRibuTion fRom A benefiT TRusT, DefeRReD PAymenT, oR ReTiRemenT PlAn |

|||||||

|

|

|

|

foR PA ResiDenTs? |

|

|

|

|

|

|

|

|

|

|

if yes, inDiCATe: a. |

DATe benefiTs fiRsT PAID (mm/DD/yyyy) |

|

|

|

|

|

|

|

|

|

b. |

esTimATeD benefiTs PAiD PeR QuARTeR |

$ |

|

.00 |

|

|

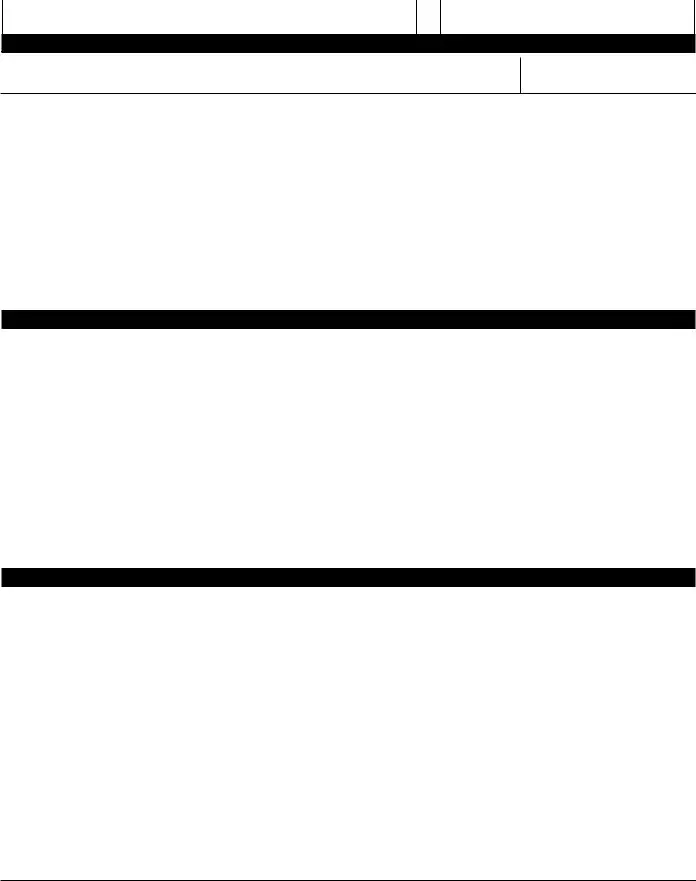

SECTION 10 – BULK SALE/TRANSFER INFORMATION

if AsseTs weRe ACQuiReD in bulK fRom moRe ThAn one enTeRPRise, PhoToCoPy This seCTion AnD PRoviDe The following infoRmATion AbouT eACh selleR/TRAnsfeRoR.

1. |

o yes |

o no |

DiD The enTeRPRise ACQuiRe 51% oR moRe of ANY CLASS of The PA ASSETS of AnoTheR enTeRPRise? see The ClAss of AsseTs |

|

|

|

lisTeD below. |

2. |

o yes |

o no |

DiD The enTeRPRise ACQuiRe 51% oR moRe of The TOTALASSETS of AnoTheR enTeRPRise? |

if The AnsweR To eiTheR QuesTion is yes, PRoviDe The following infoRmATion AbouT The SELLER/TRANSFEROR. |

|||

|

|

|

|

3. |

selleR/TRAnsfeRoR nAme |

4. feDeRAl ein |

|

5. selleR/TRAnsfeRoR sTReeT ADDRess

CiTy/Town

sTATe

ZiP CoDe + 4

6. DATe AsseTs ACQuiReD

7. AsseTs ACQuiReD: |

|

|

|

|

o ACCounTs ReCeivAble |

o eQuiPmenT |

o invenToRy |

o nAme AnD/oR gooDwill |

|

o ConTRACTs |

o fixTuRes |

o leAses |

o ReAl esTATe |

|

o CusTomeRs/ClienTs |

o fuRniTuRe |

o mAChineRy |

o oTheR |

|

IMPORTANT: IF, IN ADDITION TO ACQUIRING ASSETS IN BULK, THE ENTERPRISE ALSO ACQUIRED ALL OR PART OF A PREDECESSOR'S BUSINESS, SECTION 14 MUST BE COMPLETED.

IF THE ENTERPRISE IS ACQUIRING 51% OR MORE OF ANY CLASS OF PA ASSETS AND/OR 51% OF THE TOTAL ASSETS OF ANOTHER ENTERPRISE THE SELLER MUST OBTAIN A BULK SALE CLEARANCE CERTIFICATE. REFER TO INSTRUCTIONS ON PAGE 22.

6

|

DePARTmenT use only |

|

|

|

|

enTeRPRise nAme |

|

|

SECTION 11 – CORPORATION INFORMATION

1. DATe of inCoRPoRATion |

2. sTATe of inCoRPoRATion |

3. CeRTifiCATe of AuThoRiTy DATe |

|

|

|

|

|

|

4. CounTRy of inCoRPoRATion

5. o yes |

o no |

is This CoRPoRATion's sToCK PubliCly TRADeD? |

6. CheCK The APPRoPRiATe box(es) To DesCRibe This CoRPoRATion:

CoRPoRATion: o sToCK |

o PRofessionAl |

bAnK: o sTATe |

muTuAl ThRifT: o sTATe |

insuRAnCe |

o PA |

o |

o CooPeRATive |

o feDeRAl |

o feDeRAl |

ComPAny: |

o |

o mAnAgemenT |

o sTATuToRy Close |

|

|

|

|

7. s CoRPoRATion: o feDeRAl |

inACCoRDAnCe wiThACTno.67 of 2006, A CoRPoRATion wiTh feDeRAl |

||||

|

PoRATion. in oRDeR NOT To be TAxeD As A PA s CoRPoRATion, |

||||

|

WWW.REVENUE.STATE.PA.US, foRms AnD PubliCATions, CoRPoRATion TAx. |

|

|

||

COMPLETING THIS FORM WILL NOT FULFILL THE REQUIREMENT TO REGISTER FOR CORPORATE TAXES. REGISTERING CORPORATIONS MUST CONTACT THE PA DEPART- MENT OF STATE TO SECURE CORPORATE NAME CLEARANCE AND REGISTER FOR CORPORATION TAX PURPOSES. CONTACT THE PA DEPARTMENT OF STATE AT (717) 787- 1057, OR VISIT www.paopenforbusiness.state.pa.us.

SECTION 12 – REPORTING & PAYMENT METHODS

1.The DePARTmenT of Revenue ReQuiRes ThAT Any enTeRPRise mAKing PAymenTs eQuAl To oR gReATeR ThAn $20,000 RemiT PAymenTs viA one of The fol- lowing eleCTRoniC meThoDs: eleCTRoniC funDs TRAnsfeR (efT); eleCTRoniC TAx infoRmATion AnD DATA exChAnge sysTem

a. o yes |

o |

b. o yes |

o |

2. o yes |

o |

no |

Does This enTeRPRise meeT The DePARTmenT of Revenue’s ReQuiRemenTs foR eleCTRoniC PAymenTs? |

no |

Does This enTeRPRise wAnT To PARTiCiPATe in The DePARTmenT of Revenue’s eleCTRoniC PRogRAms? |

no |

if This enTeRPRise is A |

|

inTeResTeD in ReCeiving infoRmATion AbouT The DePARTmenT of lAboR & inDusTRy’s oPTion of finAnCing uC CosTs |

|

unDeR The ReimbuRsemenT meThoD in lieu of The ConTRibuToRy meThoD? foR moRe DeTAils, RefeR To seCTion 12 |

|

insTRuCTions. |

The DePARTmenT of lAboR & inDusTRy ReQuiRes ThATAny enTeRPRise wiTh 250 oR moRe wAge enTRies PeR QuARTeRly RePoRT, file The wAge infoRmATion viA mAgneTiC meDiA. Any mAgneTiC RePoRTing file musT be submiTTeD foR ComPATibiliTy wiTh The DePARTmenT of lAboR & inDusTRy’s foRmAT. ConTACT The mAg- neTiC meDiA RePoRTing uniT AT (717)

The CommonweAlTh sTRongly ReCommenDs ThAT enTeRPRises use eleCTRoniC filing AnD PAymenT oPTions foR CeRTAin PennsylvAniA TAxes AnD seRviCes. infoRmATion AbouT inTeRneT filing oPTions CAn be founD on The

SECTION 13 – GOVERNMENT STRUCTURE

1. |

is The enTeRPRise A: |

|

|

|

|

o goveRnmenT boDy |

o goveRnmenT owneD enTeRPRise |

o goveRnmenT & PRivATe seCToR |

|

|

|

|

owneD enTeRPRise |

|

2. |

is The goveRnmenT: |

|

|

|

|

o DomesTiC/usA |

o |

o |

|

3. |

if DomesTiC, is The goveRnmenT: |

|

|

|

|

o feDeRAl |

loCAl: o CounTy |

o boRough |

|

|

o sTATe goveRnoR's JuRisDiCTion |

o CiTy |

o sChool DisTRiCT |

|

|

o sTATe |

o Town |

o oTheR |

|

|

|

o TownshiP |

|

|

7

|

DePARTmenT use only |

|

|

|

|

enTeRPRise nAme |

|

|

SECTION 14 – PREDECESSOR/SUCCESSOR INFORMATION

COMPLETE THIS SECTION IF THE REGISTERING ENTERPRISE IS WHOLLY OR PARTIALLY SUCCEEDING A PREDECESSOR.

FOR ASSISTANCE, CONTACT THE NEAREST DEPARTMENT OF LABOR & INDUSTRY FIELD ACCOUNTING SERVICE OFFICE.

if The enTeRPRise hAs moRe ThAn one PReDeCessoR, PhoToCoPy This PAge To PRoviDe The following infoRmATion AbouT eACh.

1. PReDeCessoR legAl nAme |

2. PReDeCessoR PA uC ACCounT numbeR |

3. PReDeCessoR TRADe nAme

4. PReDeCessoR feDeRAl ein

5. PReDeCessoR sTReeT ADDRess

CiTy/Town

sTATe

ZiP CoDe + 4

6. |

sPeCify how The business wAs ACQuiReD: |

o PuRChAse |

o ChAnge in legAl sTRuCTuRe |

||||||

|

o ConsoliDATion |

o gifT |

o meRgeR |

o iRC seC. 338 eleCTion |

o oTheR (sPeCify) |

|

|||

7. |

o ACQuisiTion DATe |

|

|

|

|

|

|

|

|

8. |

PeRCenTAge of The PReDeCessoR's ToTAl business (PAAnD |

% |

|

||||||

9. |

PeRCenTAge of The PReDeCessoR's PA business ACQuiReD |

|

|

|

% |

|

|

||

|

if less ThAn 100%, PRoviDe The nAme(s) AnD ADDRess(es) of The esTAblishmenT(s) ThAT ConDuCTeD oPeRATions in PA oR emPloyeD PA ResiDenTs. |

||||||||

|

ATTACh ADDiTionAl 8 1/2 x 11 sheeTs if neCessARy. |

|

|

|

|

|

|

||

|

|

nAme of esTAblishmenT(s) |

|

|

|

ADDRess(es) |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10.whAT wAs The PReDeCessoR’s business ACTiviTy in The PA business ThAT wAs ACQuiReD?

11. AsseTs ACQuiReD: |

o ACCounTs ReCeivAble |

o eQuiPmenT |

o leAses |

o oTheR (sPeCify) |

|

o ConTRACTs |

o fixTuRes |

o mAChineRy |

|

|

o CusTomeRs/ClienTs |

o fuRniTuRe |

o nAme AnD/oR gooDwill |

|

|

o emPloyees |

o invenToRy |

o ReAl esTATe |

|

12.o yes |

o no |

hAs The PReDeCessoR CeAseD PAying wAges in PA? if yes, enTeR The DATe PA wAges CeAseD, |

|||

|

|

if Known. |

|

|

|

13.o yes |

o no |

hAs The PReDeCessoR CeAseD oPeRATions in PA? if yes, enTeR The DATe PA oPeRATions CeAseD, |

|||

|

|

if Known. |

|

|

|

|

|

if no, DesCRibe The PReDeCessoR's PResenT PA business ACTiviTy, if Known. |

|

||

14. AT The Time of TRAnsfeR fRom The PReDeCessoR enTeRPRise To The RegisTeRing enTeRPRise:

a. o yes |

o no |

weRe Any of The owneRs, shAReholDeRs (5% oR gReATeR), PARTneRs, offiCeRs, oR DiReCToRs of The PReDeCessoR |

|

|

oR of Any AffiliATe, subsiDiARy oR PARenT CoRPoRATion of The PReDeCessoR Also owneRs, shAReholDeRs (5% oR |

|

|

gReATeR), PARTneRs, offiCeRs, oR DiReCToRs of The RegisTeRing enTeRPRise oR of Any AffiliATe, subsiDiARy oR |

|

|

PARenT CoRPoRATion of The RegisTeRing enTeRPRise? |

b. o yes |

o no |

wAs The PReDeCessoR, oR Any AffiliATe, subsiDiARy oR PARenT CoRPoRATion of The PReDeCessoR, An owneR, |

|

|

shAReholDeR (5% oR gReATeR), oR PARTneR in The RegisTeRing enTeRPRise? |

c. o yes |

o no |

wAs The RegisTeRing enTeRPRise, oR Any AffiliATe, subsiDiARy oR PARenT CoRPoRATion of The RegisTeRing |

|

|

enTeRPRise, An owneR, shAReholDeR (5% oR gReATeR), oR PARTneR in The PReDeCessoR? |

if The AnsweR To Any of The QuesTions in 14 is yes, PRoviDe The following infoRmATion. ATTACh ADDiTionAl 8 1/2 x 11 sheeTs if neCessARy.

liDenTify Those PeRsons AnD enTiTies by TheiR full nAme;

lDesCRibe TheiR RelATionshiP To The PReDeCessoR AnD Any AffiliATe, subsiDiARy AnD PARenT CoRPoRATion of The PReDeCessoR; AnD

lDesCRibe TheiR RelATionshiP To The RegisTeRing enTeRPRise AnD Any AffiliATe, subsiDiARy AnD PARenT CoRPoRATion of The RegisTeRing enTeRPRise.

The RegisTeRing enTeRPRise mAy APPly foR A TRAnsfeR in whole oR in PART of The PReDeCessoR's unemPloymenT ComPensATion (uC) exPeRienCe ReCoRD AnD ReseRve ACCounT bAlAnCe, if The RegisTeRing enTeRPRise is ConTinuing essenTiAlly The sAme business ACTiviTy As The PReDeCessoR AnD boTh PRoviDeD PA CoveReD emPloymenT. ComPleTe seCTion 15 AnD, if APPliCAble, seCTion 16.

noTe: A RegisTeRing enTeRPRise mAy APPly The uC TAxAble wAges PAiD by A PReDeCessoR TowARD The RegisTeRing enTeRPRise’s uC TAxAble wAge bAse foR The CAlenDAR yeAR of ACQuisiTion wiThouT TRAnsfeRRing The PReDeCessoR's exPeRienCe ReCoRD AnD ReseRve ACCounT bAlAnCe.

8

|

|

DePARTmenT use only |

|

|

|

|

|

enTeRPRise nAme |

|

|

|

|

|

|

|

SECTION 15 – APPLICATION FOR PA UC EXPERIENCE RECORD |

AND |

RESERVE ACCOUNT |

|

|

BALANCE OF PREDECESSOR |

|

|

|

|

|

|

A RegisTeRing enTeRPRise mAy APPly The unemPloymenT ComPensATion (uC) TAxAble wAges PAiD by A PReDeCessoR TowARD The RegisTeRing enTeRPRise’s uC TAxAble wAge bAse foR The CAlenDAR yeAR of ACQuisiTion wiThouT TRAnsfeRRing The PReDeCessoR's exPeRienCe ReCoRD AnD ReseRve ACCounT bAlAnCe.

RefeR To The insTRuCTions To DeTeRmine if iT is ADvAnTAgeous To APPly foR A PReDeCessoR's uC exPeRienCe ReCoRD AnD ReseRve ACCounT bAlAnCe.

IMPORTANT: This APPliCATion CAnnoT be ConsiDeReD unless iT is signeD by An AuThoRiZeD signAToRy of boTh The PReDeCessoR AnD The RegisTeRing enTeRPRise. The TRAnsfeR in whole oR in PART of The exPeRienCe ReCoRD AnD ReseRve ACCounT bAlAnCe is binDing AnD iRRevoCAble onCe iT hAs been APPRoveD by The DePARTmenT of lAboR AnD inDusTRy.

APPliCATion is heReby mADe by The PReDeCessoR AnD The RegisTeRing enTeRPRise foR A TRAnsfeR To The RegisTeRing enTeRPRise of The PennsylvAniA unemPloymenT ComPensATion exPeRienCe ReCoRD AnD ReseRve ACCounT bAlAnCe of The PReDeCessoR wiTh ResPeCT To The TRAnsfeR.

we heReby CeRTify ThAT The TRAnsfeR RefeRenCeD in seCTion 14 hAs oCCuRReD As DesCRibeD TheRein AnD ThAT The RegisTeRing enTeRPRise is ConTinuing essenTiAlly The sAme business ACTiviTy As The PReDeCessoR. we Also heReby CeRTify ThAT The TRAnsfeR RefeRenCeD in seCTion 14 wAs noT unDeRTAKen PRimARily To obTAin A loweR uC TAx RATe, buT hAD A legiTimATe business PuRPose unRelATeD To unemPloymenT ComPensATion TAxes.

ComPleTe This seCTion only if you wAnT To APPly foR The PReDeCessoR’s exPeRienCe ReCoRD AnD ReseRve ACCounT bAlAnCe.

1. PReDeCessoR nAme |

DATe |

AuThoRiZeD signATuRe

TyPe oR PRinT nAme

TiTle

2. RegisTeRing enTeRPRise nAme

DATe

AuThoRiZeD signATuRe

TyPe oR PRinT nAme

TiTle

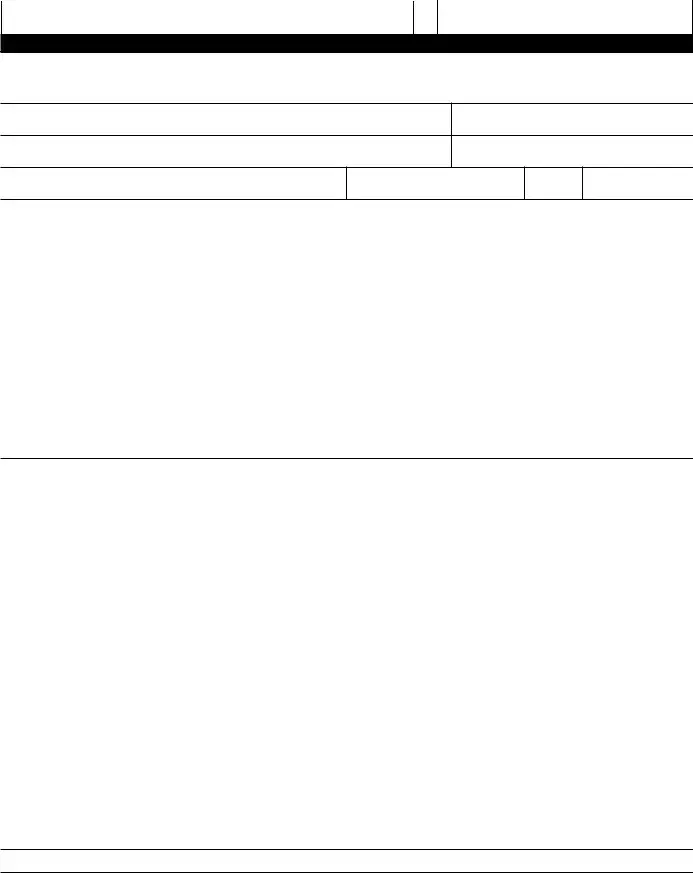

SECTION 16 - UNEMPLOYMENT COMPENSATION PARTIAL TRANSFER INFORMATION

ComPleTe This seCTion if The RegisTeRing enTeRPRiseACQuiReD only PART of The PReDeCessoR's PennsylvAniA(PA) businessAnD is mAKingAPPliCATion foR The TRAnsfeR of A PoRTion of The PReDeCessoR's exPeRienCe ReCoRD AnD ReseRve ACCounT bAlAnCe.

COMPLETE REPLACEMENT

UNEMPLOYMENT COMPENSATION (UC) TAXABLE WAGES ARe Those wAges ThAT Do noT exCeeD The uC TAxAble wAge bAse APPliCAble To A given CAlenDAR yeAR.

1.DATe wAges fiRsT PAiD by PReDeCessoR oR

2.enTeR The numbeR of emPloyees who woRKeD in THE PART OF THE BUSINESS OR WORKFORCE THAT WAS TRANSFERRED foR eACh QuARTeR in The TAble below. if no emPloymenT wAs given in Any QuARTeR, enTeR “0”.

|

yeAR________ |

|

|

yeAR________ |

|

|

yeAR________ |

|

|

yeAR________ |

|

|

yeAR________ |

|

|

yeAR________ |

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

of TRAnsfeR |

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

QuARTeRs |

|

|

|

QuARTeRs |

|

|

|

QuARTeRs |

|

|

|

QuARTeRs |

|

|

|

QuARTeRs |

|

|

|

QuARTeRs |

|

||||||||||||

1 |

|

2 |

3 |

|

4 |

1 |

|

2 |

3 |

|

4 |

1 |

|

2 |

3 |

|

4 |

1 |

|

2 |

3 |

|

4 |

1 |

|

2 |

3 |

|

4 |

1 |

|

2 |

3 |

|

4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3.enTeR The numbeR of emPloyees who woRKeD in THE ENTIRE BUSINESS foR eACh QuARTeR in The TAble below. if no emPloymenT wAs given in Any QuARTeR, enTeR “0”.

|

|

yeAR________ |

|

|

yeAR________ |

|

|

yeAR________ |

|

|

yeAR________ |

|

|

yeAR________ |

|

|

yeAR________ |

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

of TRAnsfeR |

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

QuARTeRs |

|

|

|

QuARTeRs |

|

|

|

QuARTeRs |

|

|

|

QuARTeRs |

|

|

|

QuARTeRs |

|

|

|

QuARTeRs |

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

|

2 |

3 |

|

4 |

1 |

|

2 |

3 |

|

4 |

1 |

|

2 |

3 |

|

4 |

1 |

|

2 |

3 |

|

4 |

1 |

|

2 |

3 |

|

4 |

1 |

|

2 |

3 |

|

4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4.if The PART OF THE BUSINESS OR WORKFORCE THAT WAS TRANSFERRED wAs in exisTenCe foR less ThAn ThRee full CAlenDAR yeARs PRioR To The yeAR of TRAnsfeR, enTeR The following:

A. |

ToTAl numbeR of emPloyees who eARneD TAxAble wAges in The PART OF THE BUSINESS OR WORKFORCE THAT WAS TRANSFERRED DuRing The PeRioD |

||||

|

fRom The fiRsT DAy of The QuARTeR of TRAnsfeR To The DATe of TRAnsfeR |

|

. |

||

b. |

ToTAl numbeR of emPloyees who eARneD TAxAble wAges in The ENTIRE BUSINESS DuRing The PeRioD fRom The fiRsT DAy of The QuARTeR of |

||||

|

TRAnsfeR To The DATe of TRAnsfeR |

|

. |

|

|

5.PReDeCessoR's enTiRe PA uC TAXABLE PAyRoll, foR The PeRioD fRom The fiRsT DAy of The QuARTeR of TRAnsfeR To The DATe of TRAnsfeR ____________________________.

9

Form Characteristics

| Fact Name | Fact Description |

|---|---|

| Form Purpose | The PA-100 form is used to register an enterprise for various taxes and services in Pennsylvania. |

| Applicable Departments | This form is associated with both the Pennsylvania Department of Revenue and the Department of Labor & Industry. |

| Who Must Use It | Any individual or organization that pays wages to employees must complete this registration form. |

| Registration Requirements | New registrants must complete all items in sections 1 through 10 of the form, along with any additional sections as appropriate. |

| Change Notification | Enterprises must notify the Bureau in writing within 30 days about any changes to the provided information. |

| Corporate Tax Registration | Completion of the PA-100 does not register a corporation for corporate taxes, which requires separate action with the Department of State. |

| Payment of Fees | Enterprises must include payment for any applicable license or registration fees when submitting the form. |

| Access and Assistance | Assistance is available by calling (717) 787-1064; services for those with hearing and/or speaking needs are provided through TTY. |

Guidelines on Utilizing Pa100

Completing the PA-100 form is an important step for enterprises wishing to register for various taxes and services in Pennsylvania. Individuals or organizations must gather necessary information and carefully fill out the form to ensure successful registration. Follow these steps to ensure you complete the form accurately.

- Obtain the PA-100 form. You can download the form from the Pennsylvania Department of Revenue website.

- Begin with Section 1 and check the appropriate box to indicate your reason for registration. You may choose from options such as new registration or adding services.

- Proceed to Section 2 to provide detailed enterprise information. Fill in the date of first operations, legal name, federal employer identification number (EIN), and contact details.

- In Section 3, check all applicable taxes and services you wish to register for by marking the corresponding boxes.

- Complete Section 4 by providing an authorized signature. This verifies that the statements made are true and complete.

- Continue to Sections 5 through 10, ensuring that all information is filled in. This includes business structure and employment information.

- Type or print all entries using black ink and legibly for clarity. Dates should be in the format mm/DD/yyyy.

- Review the entire form to ensure every section is completed and correct. Double-check for any missing information.

- Sign the form at the designated area in Section 4 and retain a copy for your records.

- Prepare any necessary payment for license or registration fees as indicated, made out to the PA Department of Revenue.

- Detach the completed pages from the booklet. Ensure they are arranged in order.

- Mail the completed registration form to: Department of Revenue, Bureau of Business Trust Fund Taxes, PO Box 280901, Harrisburg, PA 17128-0901.

Once your registration is submitted, processing will begin. Keep an eye on your correspondence from the Pennsylvania Department of Revenue in case additional information is needed. Be mindful of any changes in your business operations that may require updating your registration.

What You Should Know About This Form

What is the PA-100 form used for?

The PA-100 form is utilized primarily to register enterprises for various taxes and services administered by the Pennsylvania Department of Revenue and the Department of Labor & Industry. This form aids both new registrants and those already registered who need to add new taxes or locations, reactivate existing accounts, or update their information. It may also be used to request records related to Unemployment Compensation.

Who qualifies as an enterprise?

An enterprise includes individuals or organizations such as sole proprietorships, partnerships, corporations, government entities, and business trusts that are subject to Pennsylvania laws and perform at least one specific activity, which commonly involves paying wages to employees. If your organization falls within these categories, you will need to complete the PA-100 form for registration.

What defines an establishment?

An establishment is typically defined as an economic unit operating at a specific physical location. That location can either be within Pennsylvania or outside but still obligated to report to Pennsylvania. Establishments are involved in activities such as conducting business, offering services, employing residents, or collecting taxes. A single enterprise can comprise multiple establishments, especially if it operates in various locations or has distinct economic activities at one physical site.

How should one complete the PA-100 registration form?

To complete the PA-100 form, new registrants need to fill out all items in sections 1 through 10, along with any indicated additional sections. Those previously registered should complete sections 1 through 6 and any additional necessary sections. Clear printing in black ink and entering dates in the specified format are essential. Retaining a copy of the completed form for personal records is advisable, as is enclosing payment for any registration fees.

What should be done if information changes after registration?

If there are any changes to the information provided on the PA-100 form, the Bureau of Business Trust Fund Taxes must be notified in writing within 30 days. This could involve updates such as a change in the business address or structure, new ownership, or expansion of business activities. Timely updates ensure compliance with state requirements.

Does completing the PA-100 form substitute for corporate tax registration?

No, filling out the PA-100 does not satisfy the need to register for corporate taxes. If a business is registering as a corporation, separate steps must be taken to register with the Pennsylvania Department of State to secure corporate name clearance and comply with any corporation tax requirements. This often involves a different set of forms and processes.

What is the contact information for assistance with the PA-100?

Individuals seeking assistance while completing the PA-100 form can reach the registration department by calling (717) 787-1064 on weekdays between 8 AM and 4:30 PM EST. For those with special communication needs, a TTY service is available at 1-800-447-3020. Utilizing these resources can help clarify any questions about the registration process.

What happens if the form is incomplete or incorrect?

If there are mistakes or missing information on the PA-100 form, the preparer will be contacted to correct the issues. Incomplete forms can lead to delays in processing, making it essential for businesses to review their submissions carefully before mailing them. Ensuring that all sections are completed accurately will streamline the registration process.

Common mistakes

Filling out the PA-100 form can be a straightforward task, but several common mistakes can lead to delays and complications. One of the most frequent errors involves incomplete sections. For new registrants, it’s essential to complete every item in sections 1 through 10, while previous registrants must fill in sections 1 through 6. Skipping any part of these sections can result in processing delays, as the preparer will need to reach out for missing information.

Another common mistake is using the wrong format for dates. The form specifically requires all dates to be entered in the mm/DD/yyyy format. Failure to follow this guideline can lead to confusion and potential processing errors, making it crucial to adhere strictly to the specified format.

Additionally, many registrants overlook the importance of legibility. The instructions explicitly state that the form must be typed or printed legibly in black ink. Illegible handwriting can make it challenging for reviewers to process applications efficiently. Therefore, taking the time to ensure clarity can significantly impact the speed of the registration process.

Some individuals neglect to retain a copy of the completed form for their records. This can be problematic if there are follow-up questions or issues regarding the submission. Keeping a copy allows for easier reference and response when contacted by the Department of Revenue.

Another frequent oversight involves payment procedures. Registrants should enclose payment for license or registration fees, made payable to the PA Department of Revenue. It’s essential not to forget this step, as applications without proper payment will not be processed.

Some people also fail to sign the registration form. A signature is necessary for the form to be considered valid, and without it, the application cannot proceed. This requirement emphasizes the importance of double-checking the form before submission to ensure that all necessary elements are in place.

Lastly, individuals often forget to update the Bureau of Business Trust Fund Taxes of any changes to the information provided within 30 days. This includes changes to addresses, ownership, or establishment locations. Not keeping this information current can lead to future complications and legal issues that may be easily avoided.

Documents used along the form

The Pennsylvania Enterprise Registration Form (PA-100) is a vital document for businesses operating in the state. Along with the PA-100, several other forms and documents may be necessary to ensure full compliance with Pennsylvania tax laws and business regulations. Understanding these forms can help streamline the registration and operational process.

- PA Corporate Tax Registration - This form is required for corporations to register for corporate taxes with the Pennsylvania Department of Revenue. Failure to register could result in penalties or fines.

- Sales Tax License Application - Businesses selling goods or services subject to sales tax need to complete this application to obtain a sales tax license. This document ensures that the business collects the appropriate tax from customers.

- Employer Withholding Tax Registration - Employers must complete this registration to withhold state income tax from employees’ wages. This tax must be reported and paid to the state on a regular basis.

- Unemployment Compensation Registration - This form registers employers for unemployment compensation insurance. It is mandatory for businesses paying wages and provides benefits to unemployed workers who qualify.

- Workers’ Compensation Insurance Registration - Required for employers in Pennsylvania, this registration ensures that businesses have the necessary coverage for employee injuries. It protects both employer and employee interests.

- Cigarette Dealer’s License - Businesses engaged in the sale of cigarettes must apply for this license. It regulates the distribution and sales to comply with state laws.

- Transient Vendor Certificate - This certificate is necessary for businesses that sell goods or services temporarily at events or places without a permanent location in Pennsylvania.

- Small Games of Chance License - Non-profit organizations that conduct small games of chance, such as raffles or bingo, must obtain this license to ensure compliance with state regulations.

- Vehicle Rental Tax License - Companies renting out vehicles are required to register for this license, which collects tax on rental transactions as mandated by Pennsylvania law.

Each of these forms serves a specific purpose in the business landscape of Pennsylvania. Completing them accurately and timely can help avoid unnecessary complications and ensure smooth operations for any enterprise in the state.

Similar forms

- Form PA-10: Like the PA-100, the PA-10 is designed for tax registration purposes. It serves to formally register a business for various taxation obligations in Pennsylvania, ensuring compliance with state revenue requirements.

- Form 940: The 940 form is used for annual Federal Unemployment Tax Act (FUTA) reporting. Similar to the PA-100, it helps employers report unemployment compensation taxes, though it focuses on federal obligations rather than state-level registrations.

- Form 941: This form, used for reporting quarterly federal payroll taxes, is comparable to the PA-100 in its function of tax compliance. Both require timely updates on employment-related taxes to their respective jurisdictions.

- Form W-2: The W-2 is a report that employers provide to employees, detailing wages and taxes withheld. While it focuses on individual employee earnings, it aligns with the PA-100’s goal of ensuring proper tax reporting for businesses operating within Pennsylvania.

- Form 1065: Used for partnerships, the 1065 form tracks income and deductions, similar to how the PA-100 registers for various tax obligations. Both documents require transparency about business finances to tax authorities.

- Form 1120: This is the corporate tax return form. Like the PA-100, it’s essential for compliance and reporting in the business sector, though it specifically caters to corporations focusing on income tax rather than broader registration.

- Form SS-4: This form is an application for an Employer Identification Number (EIN). Both the SS-4 and the PA-100 initiate the process of business identification and tax tracking, establishing an official record for tax purposes.

- Form PA-500: The PA-500 is the Pennsylvania Business Tax Registration form. It shares the same intent as the PA-100 to register a business for taxes; however, it may be tailored to address specific taxation needs not covered in the PA-100.

Dos and Don'ts

When filling out the PA-100 form, here are five important do's and don'ts to keep in mind:

- Do complete every item in sections 1 through 10 and any additional sections specified.

- Don't leave any fields blank; incomplete forms can lead to processing delays.

- Do use black ink and print legibly to ensure readability.

- Don't submit your registration without signing it; an unsigned form is invalid.

- Do retain a copy of the completed registration form for your records.

Following these simple guidelines can help facilitate a smoother registration process.

Misconceptions

The PA-100 form is a critical document for businesses in Pennsylvania, but several misconceptions can lead to confusion. Below is a list of six common misconceptions and clarifications regarding this form.

- Every business must file a PA-100 form. Not every business is required to file the PA-100. Only those engaging in specific types of activities or requiring certain tax registrations must complete this form.

- The PA-100 form serves as a corporate tax registration. Completing the PA-100 does not register a business for corporate taxes. That process must be handled separately through the PA Department of State.

- Once registered via PA-100, a business is permanently registered. Businesses must update their registration if there are any significant changes, such as establishing new locations or changing ownership.

- Submission of the PA-100 is the only step to activate an unemployment compensation account. The form does not automatically activate an unemployment compensation account; additional steps must be taken to complete this process.

- All sections of the PA-100 must be completed by new registrants. New registrants are only required to complete sections 1 through 10 and any additional sections that apply, not every section.

- The PA-100 can be submitted through any mailing address. PA-100 forms must be mailed specifically to the Bureau of Business Trust Fund Taxes at the designated Harrisburg address.

Understanding these misconceptions can help ensure a smoother registration process and compliance with Pennsylvania's business regulations.

Key takeaways

The PA-100 form is essential for businesses establishing or expanding their operations in Pennsylvania.

This form must be completed to register for various taxes and services, including those managed by the Pennsylvania Department of Revenue and the Department of Labor & Industry.

Use the form to not only register as a new enterprise but also to add additional taxes, reactivate a previous registration, or update business information.

Completing sections 1 through 10 is mandatory for new registrants, while previously registered entities need to complete sections 1 through 6.

Ensure that all dates are entered in the mm/DD/yyyy format for clarity and accuracy.

Legibly type or print using black ink to prevent processing delays.

Retain a copy of the form for your records, as it may be needed for future reference.

It's crucial to notify the Bureau of Business Trust Fund Taxes within 30 days if any information changes after submission.

The registration process does not cover corporate tax obligations—corporations must contact the Pennsylvania Department of State for registration.

For assistance, various support channels are available, such as a dedicated phone line for individuals with hearing or speaking disabilities.

Browse Other Templates

Florida Letters of Administration - Potential conflicts among heirs should be addressed prior to filing the petition.

Cdl Georgia - Those operating in excepted intrastate conditions should mark Option D.