Fill Out Your Pa564 Form

The PA564 form is a critical document for individuals seeking assistance from the Pennsylvania Department of Public Welfare. This semiannual reporting case identification form facilitates the review and verification of a household’s eligibility for various benefits, including cash assistance and food stamps. Timely submission is essential. An unsigned form will be deemed incomplete, potentially leading to a disruption of benefits. Essential information required includes details about household members, their income sources, any changes in living situation, and verification of income through necessary documents such as pay stubs or bank statements. Respondents must carefully read the form's instructions, answer all questions, and provide proof of any reported changes. A failure to comply with these directives can result in case closures and loss of support. The importance of accuracy cannot be overstated: the information submitted will directly affect benefit amounts and eligibility. Additionally, specific sections on the form address resources and expenses, accurately capturing the household's financial situation. By adhering to the form's requirements and deadlines, applicants can ensure their ongoing access to vital assistance programs.

Pa564 Example

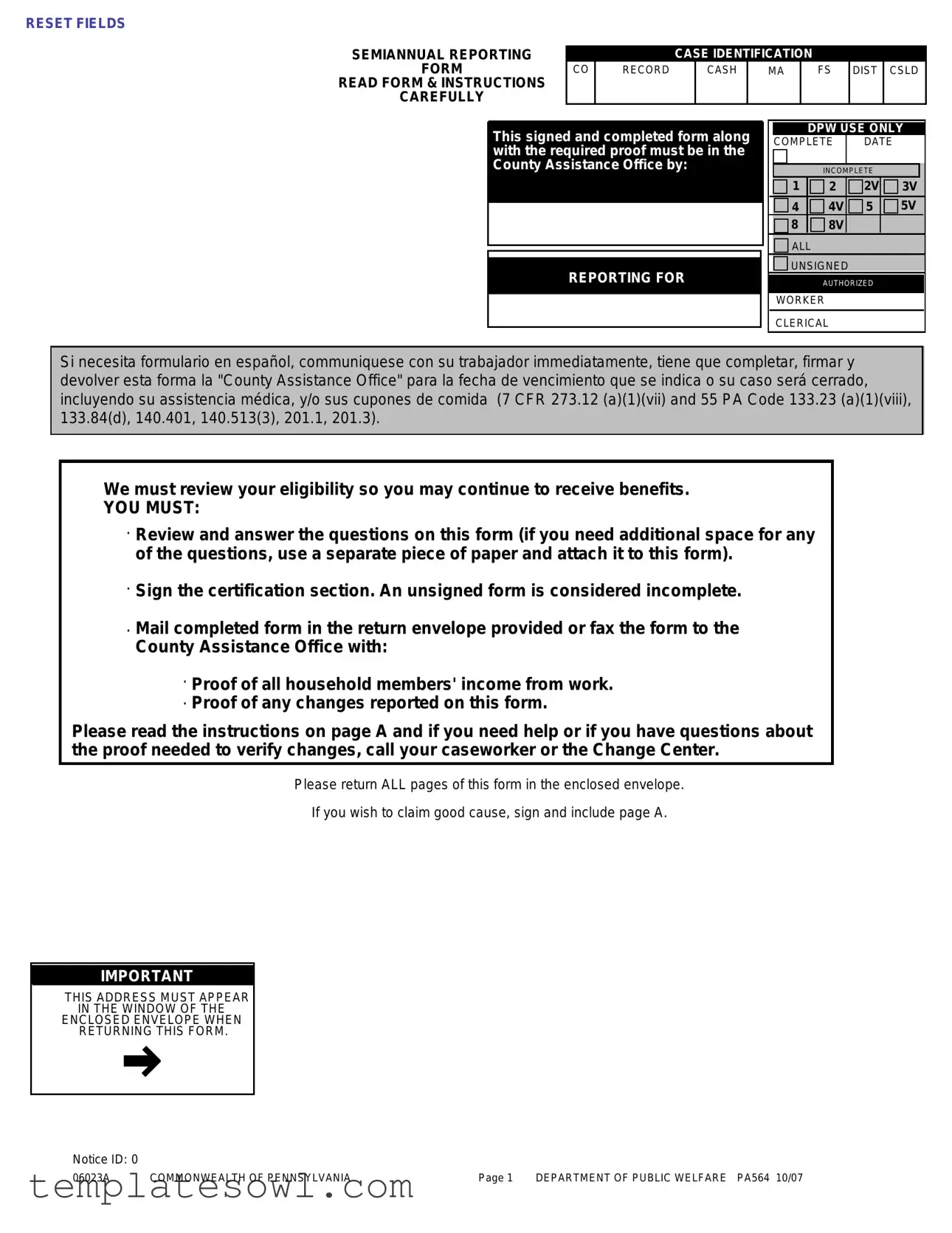

RESET FIELDS

CAO Address

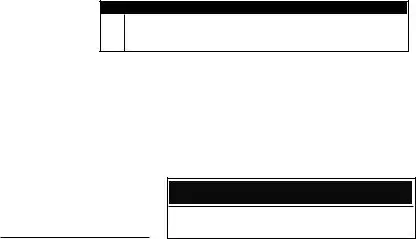

SEMIANNUAL REPORTING |

|

|

CASE IDENTIFICATION |

|

|

|

|||

FORM |

CO |

RECORD |

|

CASH |

MA |

|

FS |

DIST |

CSLD |

READ FORM & INSTRUCTIONS |

|

|

|

|

|

|

|

|

|

CAREFULLY |

|

|

|

|

|

|

|

|

|

Client Address

This signed and completed form along with the required proof must be in the County Assistance Office by:

REPORTING FOR

DPW USE ONLY

COMPLETE |

DATE |

|

|

|

|

INCOMPLETE

|

|

1 |

2 |

2V |

3V |

|

|

|

|

|

|

|

|

|

|

|

|

4 |

4V |

5 |

5V |

|

|

|

|

8 |

8V |

|

|

|

|

ALL

UNSIGNED

AUTHORIZED

WORKER

CLERICAL

Si necesita formulario en español, communiquese con su trabajador immediatamente, tiene que completar, firmar y devolver esta forma la "County Assistance Office" para la fecha de vencimiento que se indica o su caso será cerrado, incluyendo su assistencia médica, y/o sus cupones de comida (7 CFR 273.12 (a)(1)(vii) and 55 PA Code 133.23 (a)(1)(viii), 133.84(d), 140.401, 140.513(3), 201.1, 201.3).

We must review your eligibility so you may continue to receive benefits.

YOU MUST:

. Review and answer the questions on this form (if you need additional space for any of the questions, use a separate piece of paper and attach it to this form).

. Sign the certification section. An unsigned form is considered incomplete.

. Mail completed form in the return envelope provided or fax the form to the

County Assistance Office with:

. Proof of all household members' income from work.

. Proof of any changes reported on this form.

Please read the instructions on page A and if you need help or if you have questions about the proof needed to verify changes, call your caseworker or the Change Center.

Please return ALL pages of this form in the enclosed envelope.

If you wish to claim good cause, sign and include page A.

IMPORTANT

THIS ADDRESS MUST APPEAR IN THE WINDOW OF THE ENCLOSED ENVELOPE WHEN RETURNING THIS FORM.

CAO BRE Address

Notice ID: 0

06023A |

COMMONWEALTH OF PENNSYLVANIA |

Page 1 DEPARTMENT OF PUBLIC WELFARE PA564 10/07 |

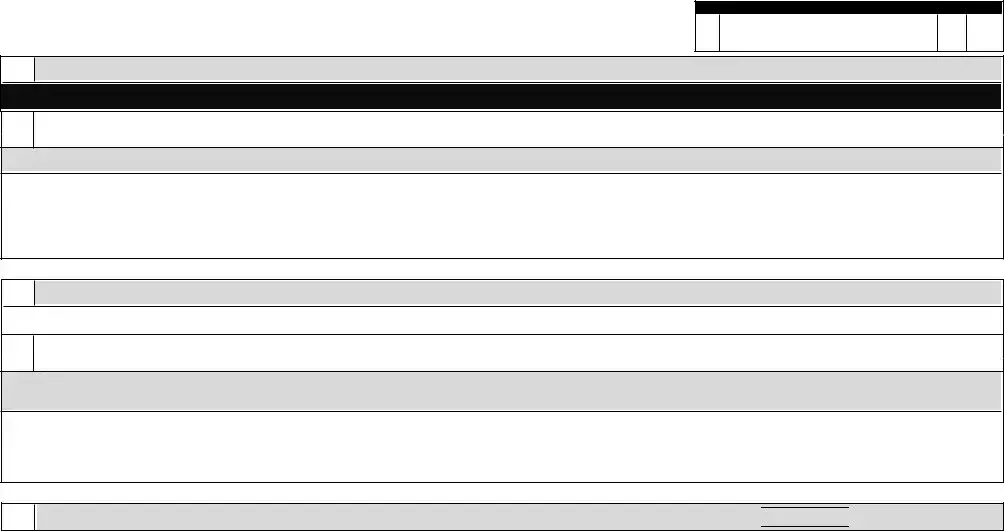

CO

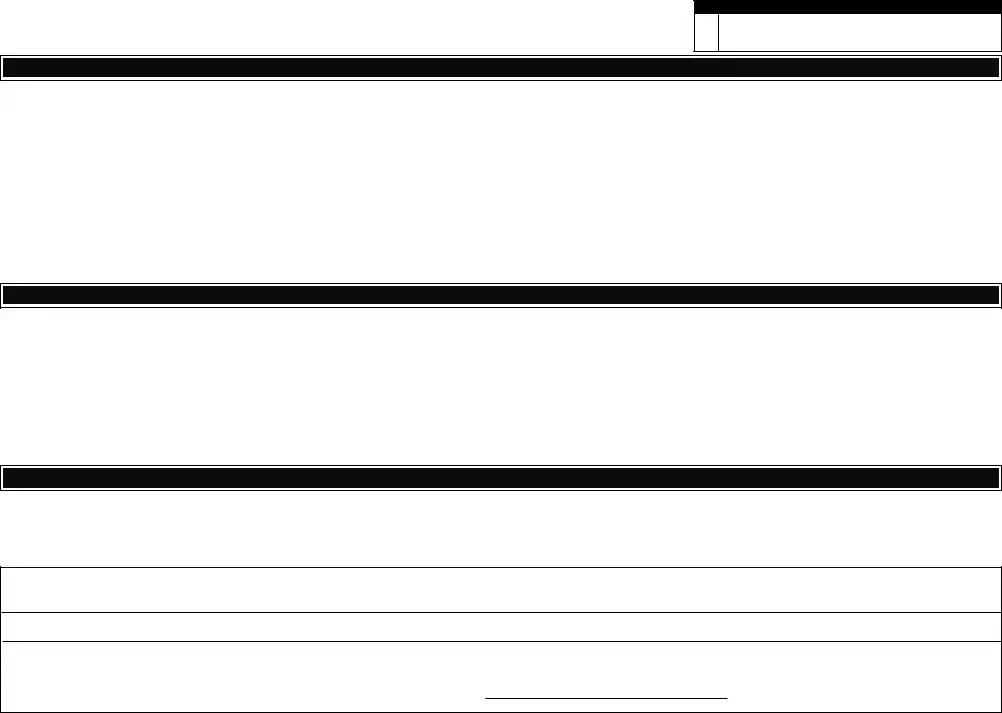

CASE IDENTIFICATION

RECORD |

CASH |

MA |

FS |

|

|

|

|

DIST CSLD

1.

These are the household members you last reported to be in your household.

Last NameFirst NameM.I.Date of Birth

Did anyone move into or out of your household? Yes____ No____ If yes, list who and their relationship to you.

2.

These are the household members you last reported to be working and where they worked.

First Name |

Where Employed |

Date Employment Began |

Did any household member start a new job, change a job, or stop working? Yes ___ No ___ If yes, list any changes, such as job start date, end date, date of first pay, how often paid.) Provide proof (pay stubs, employer statements, etc.)

3.

Provide proof (pay stubs, employer statements, etc.) of all work income any household member received in the month of:

|

|

Page 2 |

COMMONWEALTH OF PENNSYLVANIA |

DEPARTMENT OF PUBLIC WELFARE |

PA564 |

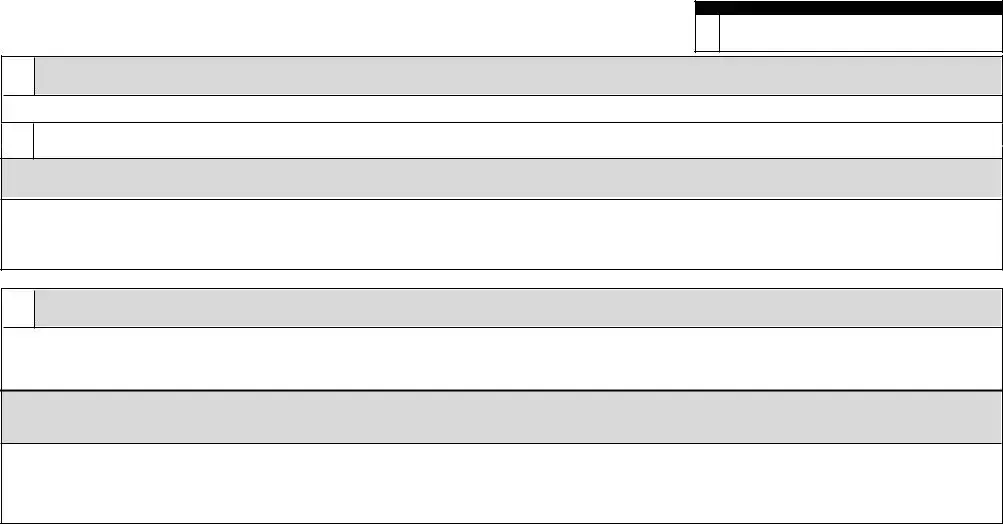

CO

CASE IDENTIFICATION

RECORD |

CASH |

MA |

FS |

DIST |

CSLD |

|

|

|

|

|

|

4.

These are the household members you last reported to have income from a source other than work or public assistance (Examples: child support, Social Security, pension income, etc.)

First Name |

Type of Income |

Amount |

|

|

|

Did any household member lose or start receiving income or have a change in amount? Yes ___ No ___

If yes, list any changes. Provide proof (award letter, support court orders, etc.)

5.

Is the address on this form your current address? Yes ___ No ___

If no, what is your new address? Provide proof. (Examples: Lease, landlord statement, deed, etc.)

If you receive food stamps and you have moved, what are your shelter (rent/mortgage) and utility costs? Do you pay for your own heating and/or air conditioning? Yes ___ No ___

*Answering these questions may help you receive more food stamp benefits.

|

|

Page 3 |

COMMONWEALTH OF PENNSYLVANIA |

DEPARTMENT OF PUBLIC WELFARE |

PA564 |

CO

CASE IDENTIFICATION

RECORD |

CASH |

MA |

FS |

DIST |

CSLD |

|

|

|

|

|

|

6.

This is the last reported amount of child support paid for children outside the household.

Did any household member have a change in the amount he is requested to pay? Yes ___ No ___ If yes, list any changes. Provide copy of support court order or letter and proof of payment.

* You do not have to answer this question or provide proof. Answering this question and providing proof may help you to remain eligible or receive more benefits.

7.

This is the information you last reported about child care or for care of a sick or disabled person.

|

|

Caregiver |

Paid For |

Amount |

|

|

|

|

|

|

|

|

|

|

|

Are there any changes? |

Yes ___ No ___ If yes, list any changes. |

Provide copy of bill or statement from caregiver. |

|

* You do not have to answer this question or provide proof. Answering this question and providing proof may help you to remain eligible or receive more benefits.

8.

These are the household members you last reported to have resources, including vehicles. (Examples: bank accounts, property, etc.)

*If this form is to determine eligibility for medical benefits only and you are pregnant OR under 21 years of age OR living with your dependent child who is under the age of 21, you do not have to answer this question.

First Name |

Resource Type |

Total Value Amount Owed Resource Description |

|

|

|

Has the information in this section changed? Yes ___ No ___

Does any household member have resources not listed above? Yes ___ No ___

If you answered yes to either question, list any changes. Provide proof (copy of bank statement, vehicle registration, etc.)

|

|

Page 4 |

COMMONWEALTH OF PENNSYLVANIA |

DEPARTMENT OF PUBLIC WELFARE |

PA564 |

CO

CERTIFICATION

CASE IDENTIFICATION

RECORD |

CASH |

MA |

FS |

DIST |

CSLD |

|

|

|

|

|

|

I swear that the information given on this form is complete and correct to the best of my knowledge. I agree to report any changes in circumstances that may affect my eligibility or the amount of cash, Medicaid and/or food stamp benefits. I understand that willful failure to give accurate information or to report changes may result in a fine or imprisonment or both. I understand that changes in income, circumstances, and/or other factors as reported on this form may cause my cash assistance, medicaid and/or food stamp benefits to be increased, decreased or stopped.

|

or |

|

DATE |

Signature of Payment Name |

Authorized Representative for Food Stamps |

||

Daytime Telephone Number

|

|

Page 5 |

COMMONWEALTH OF PENNSYLVANIA |

DEPARTMENT OF PUBLIC WELFARE |

PA564 |

CO

CASE IDENTIFICATION

RECORD |

CASH |

MA |

FS |

DIST |

CSLD |

|

|

|

|

|

|

|

|

Page 6 |

COMMONWEALTH OF PENNSYLVANIA |

DEPARTMENT OF PUBLIC WELFARE |

PA564 |

CO

CASE IDENTIFICATION

RECORD |

CASH |

MA |

FS |

DIST |

CSLD |

|

|

|

|

|

|

INSTRUCTIONS

Your household circumstances require you to report semiannually (every 6 months). The information on the semiannual reporting form is needed to determine your continued eligibility for cash, food stamps, Extended Medical Coverage and/or Medicaid. It is also needed to calculate the amount of your monthly cash and/or food stamp benefits. You must give us information for the reporting month shown on page 1 of the form. You are asked to provide child care information: failure to do so could lead to lower benefits or ineligibility.

Note: You may report changes at any time if the change would increase your benefits (such as if you lose your job or your hours of work decrease).

When answering the questions, you must give us information for all persons included in your cash, food stamps and/or Medicaid benefits. This includes stepparents and information for sponsors of aliens, even if the sponsor does not live in your home. You can use a separate sheet of paper to explain any of your answers or give additional information. A separate sheet of paper must be sent in with the form.

You must complete, sign and return the form to the county assistance office by the date shown on page 1 of the form. IF YOU NEED HELP TO COMPLETE THE.FORM, CALL YOUR CASEWORKER OR CHANGE CENTER.

. NOTICE

.If the form is late or incomplete, you may not receive you cash and/or food stamp benefits on time.

If you DO NOT return the form, action may be taken to close your case. This action may include your cash assistance, food stamps and/or Medicaid (55 Pa Code 133.84(d), 104.401, 140.513(3), 201.1, 201.3 and 7 CFR 273.12 (a)(1)(viii)).

.If you disagree with the decision to reduce or stop your benefit(s), you have the right to appeal. You will be sent a notice to tell you about any proposed reduction or stoppage of your benefits.

If your case is closed, you may have to complete a new application and be otherwise eligible to have benefits restored.

GOOD CAUSE

YOU MAY CLAIM "GOOD CAUSE" if you have good reason for not completing the form or for returning it late. To claim "good cause", you must state your reason(s) in the space below, sign your statement and return this form to the county assistance office as soon as possible, within 30 days from the due date. You may also claim "good cause" orally by contacting your caseworker, but you must also return this form to the county assistance office as soon as possible, within 30 days from the due date.

I AM CLAIMING "GOOD CAUSE" BECAUSE:

CLIENT SIGNATURE:

For DPW use ONLY

Approved |

|

Disapproved |

|

|

|

Page 7 |

COMMONWEALTH OF PENNSYLVANIA |

DEPARTMENT OF PUBLIC WELFARE |

PA564 |

CO

CASE IDENTIFICATION

RECORD |

CASH |

MA |

FS |

DIST |

CSLD |

|

|

|

|

|

|

Important Information

About the Department of Public Welfare's Notice of Privacy Practices.

If you need a free translation of this information, contact your County Assistance Office.

YOU MAY REQUEST A COPY OF THE DEPARTMENT'S

NOTICE OF PRIVACY PRACTICES

The Department of Public Welfare's Notice of Privacy Practices explains how information about you is used and

disclosed. This Notice is available at any time through your County Assistance Office and online at

www.dpw.state.pa.us. If you would like us to send you a copy of the Notice of Privacy Practices, please contact your caseworker. You may also request a copy in person at your County Assistance Office.

USTED PUEDE SOLICITAR UNA COPIA DEL AVISO DE LAS

NORMAS DE PRIVACIDAD DEL DEPARTAMENTO

EI Aviso de las Normas de Privacidad del Departamento de Bienestar publico explica como se utiliza y divulga

información sobre usted. EI Aviso esta disponible en cualquier momento en la Oficina de Asistencia del Condado o en linea en www.dpw.state.pa.us. Si desea que nosotros le enviemos una copia del Aviso de las

Normas de Privacidad, comuníquese con su asistenete social. Tambíen puede solicitar una copia un persona en

También puede solicitar una copia un persona en la Oficina de Asistencia del Condado.

|

|

Page 8 |

COMMONWEALTH OF PENNSYLVANIA |

DEPARTMENT OF PUBLIC WELFARE |

PA564 |

Form Characteristics

| Fact Name | Detail |

|---|---|

| Form Title | PA564 Semiannual Reporting Case Identification Form |

| Governing Law | 7 CFR 273.12 (a)(1)(vii) and 55 PA Code 133.23 (a)(1)(viii), 133.84(d), 140.401, 140.513(3), 201.1, 201.3 |

| Submission Deadline | The completed PA564 must be submitted to the County Assistance Office by a specified due date to avoid case closure. |

| Proof of Income | All household members' income proof from work must be included when submitting the form. |

| Form Completeness | An unsigned form is considered incomplete. Ensure all sections are filled out appropriately before submission. |

| Language Assistance | The form is available in Spanish. Contact your caseworker for assistance with completing it. |

| Important Instructions | Write the address in the window of the enclosed envelope before returning the form to ensure it reaches the correct destination. |

| Eligibility Review | Eligibility for benefits will be reviewed based on information provided on this form. |

| Resource Disclosure | All resources, such as bank accounts and vehicles, must be reported, unless exempt due to specific conditions. |

Guidelines on Utilizing Pa564

Once you receive the PA564 form, it is important to complete it accurately and submit it by the due date to avoid any disruption in your assistance. Follow these steps for a smooth completion process.

- Begin by entering your CAO Address and Client Address at the top of the form.

- Provide the names and birthdates of all household members in Section 1. Indicate if anyone has moved in or out of your household.

- In Section 2, list all household members who are employed, along with their job details. Report any job changes, including starting or stopping work.

- Section 3 requires proof of all income earned by household members for the specified month. Attach relevant documents like pay stubs.

- For Section 4, identify any other sources of income, such as child support or Social Security. Provide details on any changes in this income.

- In Section 5, confirm that your address is current. If it has changed, provide your new address and proof of residency.

- Answer the questions regarding shelter costs and utilities, especially if you receive food stamps, as this information may affect your benefits.

- Section 6 addresses any child support obligations. If there have been changes in payments, list them and provide the necessary documentation.

- In Section 7, report on any childcare costs. Indicate if there are changes and provide associated proof.

- Section 8 deals with household resources. Complete this section only if necessary and report any changes or additional resources held by household members.

- Finally, sign and date the certification section at the end of the form. Your form will be considered incomplete without a signature.

- Mail the completed form in the provided envelope or fax it to the County Assistance Office along with the necessary proof of income and any reported changes.

Ensure that all pages of the form are returned together, as all information is required to evaluate your eligibility accurately. Following these instructions carefully will help maintain your assistance without interruption.

What You Should Know About This Form

What is the purpose of the PA564 form?

The PA564 form is a Semianual Reporting Case Identification Form required by the Commonwealth of Pennsylvania. It is used to report the status of household members, their income, and any changes in circumstances that may affect eligibility for benefits such as cash assistance, Medicaid, and food stamps. Timely submission of this form is critical to continuing these benefits.

What happens if I do not submit the PA564 form on time?

If the completed PA564 form is not submitted to the County Assistance Office by the specified deadline, your case may be closed. This includes loss of medical assistance and/or food benefits. It is essential to ensure all required sections are filled out and that the form is signed to avoid any disruption in benefits.

What information do I need to provide on this form?

You will need to provide information regarding all household members, their employment status, and any changes in income or circumstances since the last reporting period. You must submit proof of income and any other relevant documentation that supports any changes, such as pay stubs or court orders for child support. Ensure that you also confirm your current address.

Can I fill out the form in Spanish?

Yes. If you need the form in Spanish, contact your caseworker immediately. It’s vital to understand all questions and provide accurate information. Completing, signing, and returning the form by the deadline is necessary, regardless of the language you use.

What should I do if I have questions while completing the form?

If you have questions or need help while filling out the PA564 form, call your caseworker or the Change Center. They can assist you with understanding the information required, verifying changes, and ensuring that your submission is complete.

Common mistakes

Completing the PA564 form accurately is crucial for maintaining eligibility for benefits. However, many people make common mistakes that can result in delays or even the denial of assistance. One significant mistake is failing to sign the form. An unsigned form is deemed incomplete, which means that applicants face potential delays in processing or may even have their case closed. It's essential to ensure the certification section is signed before submission.

Another common error involves not providing complete and accurate information about household members. The form requires detailed information about individuals residing in the home, their employment status, and any income sources. Omitting this critical information can lead to questions about eligibility, requiring additional follow-up and documentation, which disrupts the benefits process.

Many applicants also neglect to attach proof of income for all household members. The form explicitly states that proof, such as pay stubs or employer statements, is necessary to verify reported income. Without this documentation, the application may be returned or processed incorrectly, affecting the applicant's ability to receive aid.

Additionally, individuals may overlook providing proof of address changes if they have moved. The form asks if the address provided is current. If the answer is 'no,' it requires documentation of the new address, like a lease or utility bill. Failing to supply this proof complicates the application process, potentially leading to complications in benefits distribution.

Finally, not using the return envelope provided with the form is another frequent oversight. The instructions specify that the address must appear in the window of the envelope, ensuring that the completed form reaches the intended County Assistance Office. Failing to comply with this simple instruction can result in lost documents, causing further delays and stress.

Documents used along the form

The PA564 form is an important document used in Pennsylvania for reporting case information related to public assistance programs like cash benefits, Medicaid, and food stamps. When completing the PA564, you may also need several other forms and documents to ensure everything is accurate and complete. Below is a list of commonly used forms that often accompany the PA564.

- Proof of Income: This document verifies the income of all household members. It could include pay stubs, tax returns, or other income statements. Providing this proof is crucial for determining eligibility for assistance programs.

- Change of Address Form: If your address has changed, this form must be filled out to update your records with the County Assistance Office. It's essential to keep your information current to avoid any interruptions in your benefits.

- Child Support Documentation: If you receive or pay child support, you might need to submit court orders or recent payment records. This information helps assess any changes that may affect your benefits.

- Employment Verification Form: This form is used to confirm employment status and income for all working household members. It might require a signature from an employer to verify job details.

- Medical Expenses Documentation: If you have medical expenses that could affect your eligibility, collecting receipts or invoices can be helpful. Usually, costs related to ongoing medical treatments qualify for consideration.

- Household Resources Report: This form lists any assets or resources, such as bank accounts or properties, owned by household members. It assists in assessing total financial health and eligibility.

- Authorization to Release Information: If you want someone else to handle your case or receive information related to your application, you may need this form. It allows your caseworker to communicate with your authorized representative.

Collecting and submitting these forms along with your PA564 will help the County Assistance Office accurately assess your needs. It ensures that you can access the benefits for which you qualify without delay. Being prepared and thorough can make the process smoother and less stressful.

Similar forms

- Form 1040 - Individual Income Tax Return: Both documents require detailed reporting of income information to assess financial eligibility for benefits, though Form 1040 is for federal taxes while PA564 focuses on benefits eligibility.

- W-2 Form - Wage and Tax Statement: Similar in that both documents require proof of income. The W-2 provides annual wage data, while PA564 collects ongoing household income information.

- Social Security Administration - Application for Benefits: Both forms collect personal information and require verification of household income to determine eligibility for benefits.

- Medicaid Application Form: Each document assesses financial circumstances to establish eligibility for government assistance programs, specifically medical coverage in the case of Medicaid.

- Food Stamp Application (SNAP): This application requests detailed information on income and household members just like the PA564, as it helps determine eligibility for food assistance.

- Child Support Order Modification Request: Both documents require disclosure of current income and changes in financial circumstances to assess ongoing support obligations and eligibility.

- Housing Assistance Application: Each document requires proof of income and information about household members to establish eligibility for financial assistance programs.

- Unemployment Benefits Application: Both forms ask for verification of income, employment status, and household composition for determining qualification for benefits.

- State Benefit Verification Form: This form is similar as it collects household income and resource information to verify eligibility for various state assistance programs.

- Income Reporting Form for Temporary Assistance: Like the PA564, this form helps state agencies gather ongoing income information necessary for determining aid eligibility.

Dos and Don'ts

When completing the PA564 form, it is essential to follow specific guidelines to ensure successful processing. Here are seven do's and don'ts to consider:

- Do read all instructions carefully before starting to fill out the form.

- Do provide proof of income and any changes reported on the form.

- Do sign the certification section; an unsigned form will be deemed incomplete.

- Do return all pages of the form in the enclosed envelope.

- Don't forget to include any additional information on a separate piece of paper if required.

- Don't submit the form late; ensure it is in the County Assistance Office by the deadline.

- Don't leave any questions unanswered; all sections must be completed to avoid delays.

Misconceptions

Misconceptions about the PA564 form can lead to confusion and potential issues with benefits. Here are four common misunderstandings:

- The PA564 form is optional. Some believe that completing this form is not mandatory. In reality, submission is required to maintain eligibility for cash assistance, medical benefits, and food stamps. Failure to submit it by the due date might result in the closure of your benefits.

- Signing the form is not necessary if I provide all the information. There is a common idea that providing complete information suffices, even without a signature. However, an unsigned form is deemed incomplete, which may lead to delays or denial of benefits.

- I do not need to provide proof of income if my situation hasn’t changed. Many believe that they are exempt from submitting proof of income if there are no changes. It is important to understand that proof of all household members' income must be submitted, even if the income level remains the same.

- Any errors on the form can be corrected later. Some individuals think they can correct mistakes after submission. While amendments can sometimes be made, it is best to ensure all information is accurate upon submission to avoid complications in receiving benefits.

Key takeaways

When dealing with the PA564 form, there are several important points to keep in mind:

- The form must be completed accurately and submitted to the County Assistance Office by the specified due date to avoid case closure.

- All household members' income must be documented, and proof like pay stubs or award letters is required to support any claims made.

- Unsigned forms are considered incomplete; ensure to sign the certification section before submitting.

- Changes in household composition, income, or address must be reported clearly, as these can affect your eligibility for benefits.

- Use the provided return envelope for mailing, and ensure your address is visible in the window of the envelope.

- If additional space is needed while answering questions, feel free to attach a separate piece of paper.

These tips will help ensure the form is filled out correctly and submitted on time, maintaining your eligibility for the benefits you need.

Browse Other Templates

Local Access Pass Registration,Navy Base Access Form,DoD Population ID Card,Marine Corps Access Application,Physical Security Identification Document,Navy Installation Access Request,Visitor Identification Registration Form,Base Entry Credential Form - Final access determination is made by the Base Commanding Officer.

Form 35 Income Tax - You may need to show this cancellation to future lenders or buyers of the vehicle.