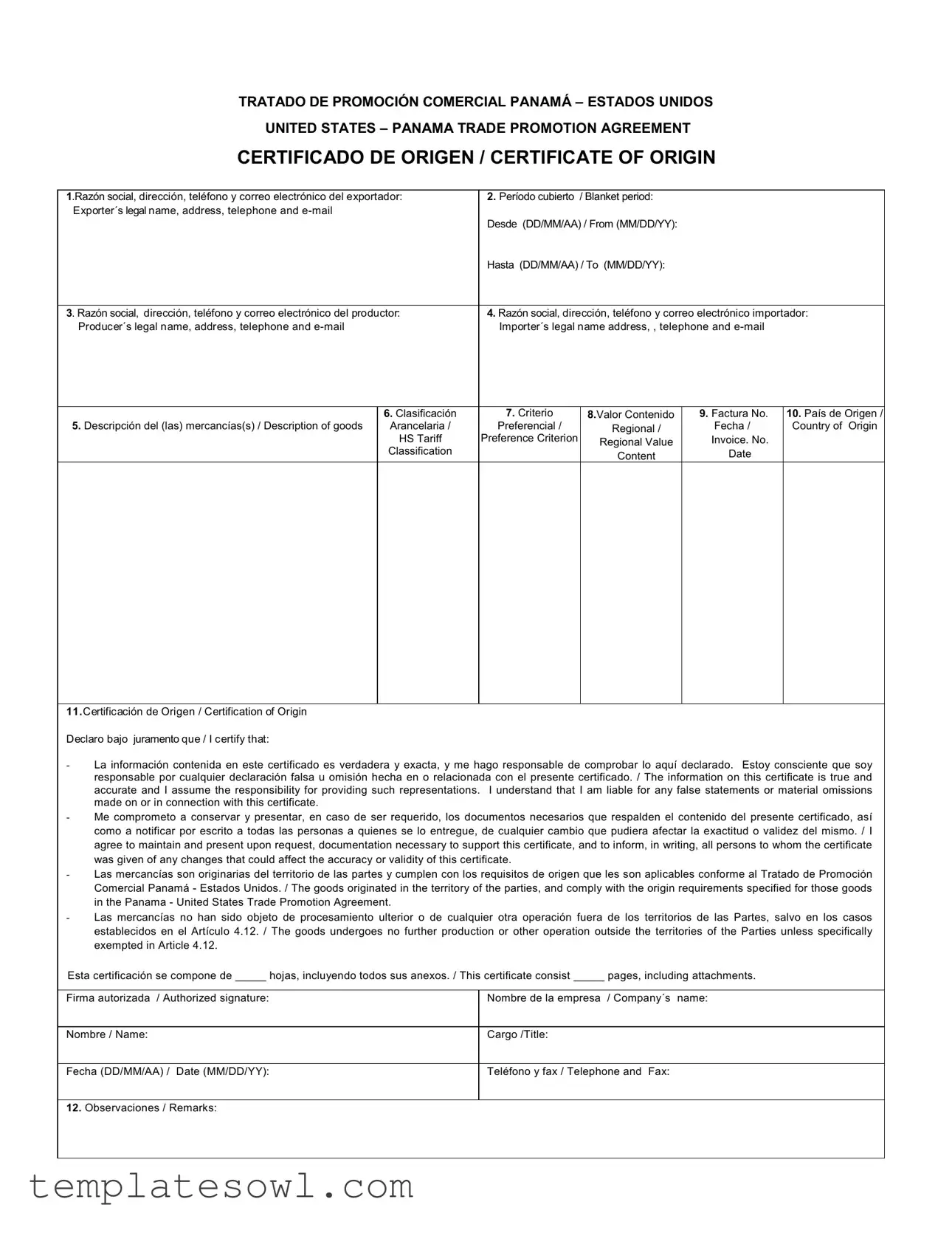

Fill Out Your Panama Certificate Origin Form

The Panama Certificate of Origin is a vital document that plays a significant role in facilitating trade between the United States and Panama under the Trade Promotion Agreement. It serves multiple purposes, enabling exporters to claim preferential tariff treatment for their goods. This certificate requires specific details, such as the legal names, addresses, and contact information of the exporter, producer, and importer. Additionally, it mandates a thorough description of the goods being shipped, including the classification and value for tariff purposes. An important aspect of the certificate is that it attests to the origin of the goods, confirming they meet the necessary requirements outlined in the trade agreement. Furthermore, the certificate ensures that no further processing has occurred outside the territories of the involved parties, except where exemptions apply. Proper completion of the form is essential, as any inaccuracies or omissions could lead to liabilities for the parties involved. Notably, the exporter or relevant party must also certify that the information provided is accurate and agree to maintain supporting documentation, highlighting the importance of transparency in international trade operations.

Panama Certificate Origin Example

TRATADO DE PROMOCIÓN COMERCIAL PANAMÁ – ESTADOS UNIDOS

UNITED STATES – PANAMA TRADE PROMOTION AGREEMENT

CERTIFICADO DE ORIGEN / CERTIFICATE OF ORIGIN

1.Razón social, dirección, teléfono y correo electrónico del exportador: |

2. Período cubierto / Blanket period: |

Exporter´s legal name, address, telephone and |

|

|

Desde (DD/MM/AA) / From (MM/DD/YY): |

|

Hasta (DD/MM/AA) / To (MM/DD/YY): |

|

|

3. Razón social, dirección, teléfono y correo electrónico del productor: |

4. Razón social, dirección, teléfono y correo electrónico importador: |

Producer´s legal name, address, telephone and |

Importer´s legal name address, , telephone and |

5. Descripción del (las) mercancías(s) / Description of goods |

6. Clasificación |

7. Criterio |

8.Valor Contenido |

9. Factura No. |

10. País de Origen / |

Arancelaria / |

Preferencial / |

Regional / |

Fecha / |

Country of Origin |

|

|

HS Tariff |

Preference Criterion |

Regional Value |

Invoice. No. |

|

|

Classification |

|

|

|

|

|

|

Content |

Date |

|

|

|

|

|

|

||

|

|

|

|

|

|

11.Certificación de Origen / Certification of Origin Declaro bajo juramento que / I certify that:

-La información contenida en este certificado es verdadera y exacta, y me hago responsable de comprobar lo aquí declarado. Estoy consciente que soy responsable por cualquier declaración falsa u omisión hecha en o relacionada con el presente certificado. / The information on this certificate is true and accurate and I assume the responsibility for providing such representations. I understand that I am liable for any false statements or material omissions made on or in connection with this certificate.

-Me comprometo a conservar y presentar, en caso de ser requerido, los documentos necesarios que respalden el contenido del presente certificado, así como a notificar por escrito a todas las personas a quienes se lo entregue, de cualquier cambio que pudiera afectar la exactitud o validez del mismo. / I agree to maintain and present upon request, documentation necessary to support this certificate, and to inform, in writing, all persons to whom the certificate was given of any changes that could affect the accuracy or validity of this certificate.

-Las mercancías son originarias del territorio de las partes y cumplen con los requisitos de origen que les son aplicables conforme al Tratado de Promoción Comercial Panamá - Estados Unidos. / The goods originated in the territory of the parties, and comply with the origin requirements specified for those goods in the Panama - United States Trade Promotion Agreement.

-Las mercancías no han sido objeto de procesamiento ulterior o de cualquier otra operación fuera de los territorios de las Partes, salvo en los casos establecidos en el Artículo 4.12. / The goods undergoes no further production or other operation outside the territories of the Parties unless specifically exempted in Article 4.12.

Esta certificación se compone de _____ hojas, incluyendo todos sus anexos. / This certificate consist _____ pages, including attachments.

Firma autorizada / Authorized signature:

Nombre de la empresa / Company´s name:

Nombre / Name:

Cargo /Title:

Fecha (DD/MM/AA) / Date (MM/DD/YY):

Teléfono y fax / Telephone and Fax:

12.Observaciones / Remarks:

TRATADO DE PROMOCION COMERCIAL PANAMA - ESTADOS UNIDOS

INSTRUCCIONES RELATIVAS AL CERTIFICADO DE ORIGEN

Para los fines de solicitar un trato arancelario preferencial, este certificado deberá ser llenado completamente y de manera legible por el importador, exportador o productor de la mercancía. A pedido de la autoridad aduanera de la parte importadora el importador deberá presentar el certificado de origen para solicitar tratamiento preferencial para una mercancía importada al territorio de esa parte.

Campo 1: Indique el nombre o Razón Social, la dirección (incluyendo el país) del exportador, si es diferente al productor; así como el su número de teléfono y correo electrónico, si son conocidos.

Campo 2: Si el certificado ampara varios embarques de mercancías(s) idénticas, proporcione el periodo que cubre el certificado (máximo 12 meses). "Desde" es la fecha a partir de la cual el certificado será aplicable respecto de la(s) mercancía(s) amparadas por el certificado. "Hasta" es la fecha en que expira el período que cubre el certificado. La importación de una(s) mercancía(s) para el cual se solicita trato arancelario preferencial con base en este certificado, debe efectuarse entre estas fechas.

Campo 3: Si existe un solo productor, indique el nombre o razón social, la dirección (incluyendo el país) de dicho productor. Si en el certificado se incluye a más de un productor, indique "VARIOS" y adjunte una lista de todos los productores, incluyendo su nombre o razón social, su dirección (incluyendo el país). Si desea que esta información sea confidencial, se acepta anotar "DISPONIBLE A SOLICITUD DE LA ADUANA". Si el productor y el exportador son la misma persona, llene el campo anotando "IGUAL". Si el productor es desconocido, se acepta indicar "DESCONOCIDO".

Campo 4: Indique el nombre o razón social, la dirección (incluyendo el país) así como el número de teléfono y correo electrónico del importador.

Campo 5 Descripción completa de cada mercancía. La descripción deberá ser lo suficientemente detallada para relacionarla con la descripción de la mercancía contenida en la factura y en el Sistema Armonizado (SA).

Campo 6: Para cada mercancía descrita en el Campo 5, identifique la clasificación arancelaria a seis (6) dígitos del Sistema Armonizado como esta especificada para cada mercancía en las reglas de origen.

Campo 7: Para cada mercancía descrita en el Campo 5, indique qué criterio: aplica. Las reglas de origen se encuentran en el Anexo 4.1 Reglas de Origen Específicas del Acuerdo del Capítulo 4. Con el fin de solicitar el trato arancelario preferencial, cada mercancía debe cumplir con alguno de siguientes criterios:

(a)La mercancía es obtenida en su totalidad o producida enteramente en el territorio de una o más de las Partes;

(b)La mercancía es producida enteramente en el territorio de una o más de las Partes; y

i)Cada uno de los materiales no originarios empleados en la producción de la mercancía sufre el correspondiente cambio en la clasificación arancelaria especificado en el Anexo 4.1, , o

ii)La mercancía, de otro modo, satisface cualquier requisito de valor de contenido regional aplicable u otros requisitos especificados en el Anexo 4.1 o

(c)La mercancía es producida enteramente en el territorio de una o más de las Partes, a partir exclusivamente de materiales originarios.

Campo 8: Si la mercancía no está sujeta a un requisito de Valor de Contenido Regional (VCR) para cada mercancía descrita en el Campo 5 indique "NO",. Si la mercancía está sujeta a dicho requisito, identifique el método de cálculo utilizado:

(1)Método de reducción del valor

(2)Método de aumento del valor

(3)Método de costo neto

Campo 9: Si el certificado ampara solo un embarque de mercancías, incluya el número de la factura comercial.

Campo 10: Indique el nombre de país de origen: "PAN" para las mercancías originarias de Panamá y exportadas a los Estados Unidos. "US" para todas las mercancías originarias de los Estados Unidos e importadas a Panamá.

Campo 11: Este campo debe ser completado, firmado y fechado por el emisor del certificado de origen (importador, exportador o productor). La fecha debe ser aquélla en que el Certificado haya sido llenado y firmado.

Campo 12: Este campo sólo deberá ser utilizado cuando exista alguna observación en relación con este certificado, entre otros, cuando la(s) mercancía(s) descrita(s) en el campo 5 haya(n) sido objeto de una resolución anticipada o una resolución sobre clasificación o valor de los materiales, indique la autoridad emisora, número de referencia y la fecha de emisión.

Form Characteristics

| Fact Name | Detail |

|---|---|

| Purpose | The Panama Certificate of Origin certifies that goods meet the origin requirements under the United States-Panama Trade Promotion Agreement. |

| Complete Information Required | Exporters, producers, and importers must provide details including legal names, addresses, and contact information for transparency. |

| Validity Period | The certificate can cover a blanket period of up to 12 months for identical goods. Specific start and end dates must be provided. |

| Goods Description | A detailed description of the goods is required. This should align with invoice details and should follow Harmonized System (HS) nomenclature. |

| Tariff Classification | Each item listed on the certificate must include a six-digit HS tariff classification to ensure proper categorization for customs purposes. |

| Certification Responsibility | The signer certifies the truthfulness of the information and bears responsibility for any falsities or omissions, ensuring compliance with applicable regulations. |

| Documentation Retention | Importers must maintain supporting documents and notify relevant parties of any changes affecting the certificate's accuracy or validity. |

Guidelines on Utilizing Panama Certificate Origin

After completing the Panama Certificate of Origin form, ensure that all information provided is accurate and that you retain any supporting documents. You may need to present the certificate upon request by customs authorities. Follow these steps to fill out the form correctly.

- Exporter Information: Enter the legal name, address (including the country), telephone number, and email address of the exporter. If the exporter is the same as the producer, write "IGUAL".

- Blanket Period: Fill in the covered dates. Indicate the start date (Desde) and end date (Hasta). This period should not exceed 12 months.

- Producer Information: If there is one producer, provide their legal name, address, and contact details. For multiple producers, write "VARIOS" and attach a list. For confidentiality, write "DISPONIBLE A SOLICITUD DE LA ADUANA" if needed.

- Importer Information: Provide the legal name, address, telephone number, and email of the importer.

- Description of Goods: Provide a detailed description of each good, ensuring it correlates with the invoice description.

- Classification: Identify the 6-digit HS tariff classification for each good mentioned.

- Criteria: Indicate the applicable origin criteria for each item. Check the specific rules in Annex 4.1 as needed.

- Regional Value Content: State whether the goods are subject to Regional Value Content requirements. If applicable, indicate the calculation method used: (1) Reduced Value Method, (2) Increased Value Method, or (3) Net Cost Method.

- Invoice Number: If the certificate covers one shipment, include the commercial invoice number.

- Country of Origin: State the origin country. Use "PAN" for goods from Panama to the USA, and "US" for goods from the USA to Panama.

- Certification of Origin: This section must be completed, signed, and dated by the issuer of the certificate. The date must match the filling and signing date.

- Remarks: Use this field for any additional observations regarding the certificate, including reference details for any advance rulings related to classification or material value.

What You Should Know About This Form

What is the purpose of the Panama Certificate of Origin form?

The Panama Certificate of Origin form serves to certify that goods imported or exported between Panama and the United States meet certain origin requirements. This certificate is often necessary for securing preferential tariff treatment under the United States-Panama Trade Promotion Agreement. It helps facilitate trade by confirming that the products originate in the specified countries and comply with regional trade regulations.

What information is required to complete the Certificate of Origin?

To correctly complete the Certificate of Origin, several key details must be provided. This includes the legal names, addresses, phone numbers, and email addresses of the exporter, producer, and importer. Additionally, an accurate description of the goods, their classification, and the country of origin must be included. The form also requires a certification statement, indicating that the information is truthful and that all necessary supporting documents will be maintained.

How long is the Certificate of Origin valid?

The Certificate of Origin can be valid for a blanket period covering a maximum of twelve months. This is indicated on the form with a "From" and "To" date. Goods imported under this certificate must be shipped within this specified timeframe to qualify for the preferential tariff treatment. If multiple shipments are covered, the certificate must adequately reflect this period.

What happens if the information on the Certificate of Origin is incorrect?

If any information on the Certificate of Origin is found to be inaccurate or misleading, the certifying party may be held liable for any resulting penalties or tariffs. It is crucial that all declarations are complete and truthful. Furthermore, if changes occur that may affect the validity of the certificate, the certifying person is obligated to notify all relevant parties in writing.

What should I do if I have more than one producer?

In the event there is more than one producer, the form should indicate "VARIOS" and a separate list detailing each producer's name and address must be attached. If confidentiality is necessary, it is permissible to write "DISPONIBLE A SOLICITUD DE LA ADUANA" to signify that the information can be supplied to customs officials upon request. This ensures compliance while protecting sensitive information.

Common mistakes

Filling out the Panama Certificate of Origin form requires careful attention to detail. One common mistake is failing to complete all required fields. Each section, including the exporter's name and address, must be filled out correctly. Omitting any information could lead to processing delays or denials of preferential tariff treatment.

Another frequent error involves incorrect dates in the blanket period section. The "From" and "To" dates must accurately reflect the intended shipping dates for the goods. If the dates do not correspond with actual shipment dates, it can complicate compliance with trade regulations.

Providing vague descriptions of the goods is yet another mistake that can impact the certification process. The description should be detailed enough to match the information on the invoice and align with the Harmonized System (HS) codes. This clarity helps ensure that customs officials understand the nature of the goods being certified.

Many individuals neglect to properly specify the HS tariff classification for the goods. This classification is essential for determining eligibility under the trade agreement. If the classification is incorrect or missing, it can result in significant issues during importation.

Additionally, errors in identifying the country of origin can cause misunderstandings. It is crucial to clearly indicate "PAN" for goods from Panama or "US" for goods from the United States. Misidentifying the country of origin may lead to incorrect tariff applications.

Finally, failing to sign and date the certification could invalidate the entire document. The authorized signature confirms that the individual takes responsibility for the accuracy of the information provided. Without this signature, customs authorities may reject the certificate, causing delays in the importation process.

Documents used along the form

The Panama Certificate of Origin is a crucial document in international trade, especially when benefiting from preferential tariff treatment under the United States-Panama Trade Promotion Agreement. To accompany this certificate, several other forms and documents are often required to facilitate smooth customs clearance and proper record-keeping. Here are seven important documents commonly used alongside the Panama Certificate of Origin:

- Commercial Invoice: This document details the transaction between the seller and the buyer. It includes information such as the goods' description, price, and payment terms. It serves as a basis for customs valuation.

- Packing List: A packing list provides information about the contents of each package being shipped. It specifies quantities, weights, and dimensions, ensuring that customs can verify the shipment's contents against the invoice.

- Bill of Lading: This is a legal document issued by a carrier, acknowledging the receipt of cargo for shipment. It serves as a contract between the shipper and the carrier, outlining the terms of transportation.

- Import Declaration Form: This form is submitted to customs by the importer when goods arrive. It outlines the goods being imported, their classifications, and the applicable duties and taxes.

- Health and Safety Certificates: Depending on the type of goods being imported, health and safety regulations may require certificates proving compliance with necessary standards. This is particularly relevant for food and pharmaceuticals.

- Insurance Certificate: This document proves that goods in transit are insured. It is essential for mitigating risks related to loss or damage during transportation.

- Export License: An export license may be required, depending on the nature of the goods. It ensures that the export complies with legal and regulatory frameworks set by the exporting country.

Proper preparation of these supplementary documents can expedite the customs process and reduce the risk of delays or penalties. Trade compliance is essential for businesses engaged in international commerce, and understanding the required paperwork is a vital step toward successful import and export operations.

Similar forms

The Panama Certificate of Origin form serves an important role in international trade. Here are four documents that share similarities with the Panama Certificate of Origin, highlighting their key aspects:

- NAFTA Certificate of Origin: This document, used under the North American Free Trade Agreement, verifies that goods qualify for preferential tariff treatment. Like the Panama form, it requires detailed information about the exporter, importer, and a description of the goods, along with rules about where the goods were produced.

- EU Certificate of Origin: In the European Union, this document certifies that goods are of a particular origin. It includes similar information regarding the parties involved and supports preferential tariff rates. Both certificates emphasize the importance of accurate documentation to prevent duties and tariffs.

- ASEAN Certificate of Origin: The Association of Southeast Asian Nations (ASEAN) uses this form to provide proof of origin for goods traded among member countries. Much like the Panama Certificate, it includes information about the exporter, importer, and the customs duties applicable based on the origin of the goods.

- Customs Declaration: While not a certificate of origin, the customs declaration is a crucial document in international shipping. It provides detailed information about the imported goods, including their origin, value, and classification. Both the customs declaration and the Panama Certificate seek to facilitate smooth trade by ensuring compliance with regulations and accurate reporting.

Dos and Don'ts

When filling out the Panama Certificate of Origin form, there are several important guidelines to follow to ensure accurate and effective completion. Below is a list of dos and don’ts to consider:

- Do provide complete and accurate information for each field.

- Do maintain legibility to avoid any misinterpretations by customs authorities.

- Do specify the blanket period accurately, using the correct date formats.

- Do include detailed descriptions of the goods to match the invoice.

- Do classify goods using the correct six-digit HS code as required.

- Don’t leave any fields blank unless specifically instructed, as this may delay processing.

- Don’t provide inaccurate or vague information that could lead to misunderstanding.

- Don’t use abbreviations that could confuse customs officials; clarity is critical.

- Don’t submit the form without a proper signature and date from the authorized individual.

- Don’t forget to keep copies of the certificate and any supporting documents for your records.

Misconceptions

Misconceptions about the Panama Certificate of Origin form can lead to confusion and potential errors. Here is a list of seven common misunderstandings:

- It is optional to complete the form. Many believe that submitting the Certificate of Origin is not mandatory. However, it is required for obtaining preferential tariff treatment when importing goods.

- Only exporters need to fill it out. Some think only exporters are responsible for this form. In reality, both importers and producers may need to provide information, depending on the circumstances.

- The information does not need to be accurate. People often assume that inaccuracies on the form are acceptable. This is false. All information must be true and accurate, as you assume responsibility for any inaccuracies.

- It covers any period without limits. There’s a misconception that the certificate can cover any time frame. It actually has a maximum coverage period of 12 months.

- You can ignore multiple producers. Some individuals think that if there are multiple producers, they can skip mentioning them. This is incorrect; all producers must be listed or marked as "VARIOS" with an attachment.

- The form can be completed at any time. Many believe that timing is flexible. However, the form should be completed at the time of export, and proper dates must be filled in correctly.

- Language is not important. Some assume it does not matter which language the form is completed in. While it can be in Spanish or English, ensuring clarity and understanding for all parties involved is essential.

Understanding these points can help ensure that the Certificate of Origin is completed correctly, minimizing the risk of complications during importation. Doing so can streamline the process and foster smoother trade relations.

Key takeaways

Filling out and using the Panama Certificate of Origin form requires attention to detail and accuracy. Here are key takeaways to ensure compliance:

- Complete Information: Ensure that all fields are filled out accurately. This includes the legal names, addresses, and contact details of the exporter, producer, and importer.

- Document Period: Specify the blanket period for multiple shipments. This period should not exceed 12 months, and the merchandise must be imported within this timeframe.

- Classification and Criteria: Provide the correct tariff classification for each item along with the applicable origin criteria. Refer to the relevant annexes for guidance on specific requirements.

- Certification Accuracy: The signer of the certificate is responsible for the truthfulness of the information. Documentation must be retained to support the claims made in the certificate.

Browse Other Templates

Downloadable Baby Dedication Certificate - This heartfelt document signifies the collective support of a community in nurturing a child's spiritual life.

Dcnr Login - Permit applications are categorized based on the proposed type of tree work.